Markets live on fads.

Once a certain investment theme takes hold, the imitators start coming out of the woodwork in droves.

In 1989, all of the largest Japanese banks stampeded issuing naked short put options on the Nikkei Average by the billions of dollars when the index was at an all-time high. The Nikkei then fell by 85% causing tens of billions worth of losses.

I remember signing the paperwork on a $3 billion deal for the Industrial Bank of Japan on behalf of Morgan Stanley. It’s been 35 years, and I’m still waiting for those investors to come after me.

Then there was the peak of the Dotcom Bubble in 2000 and no less than five online pet food delivery companies raised billions. (remember Webvan and those cute sock puppets?) Every one of them went under.

So, what has been one of the biggest fads of 2024?

That would be electric vehicles.

You no longer have to wear Birkenstocks, grow your hair long, and smoke pot to drive an electric car. They have become a major part of the American economy. According to Adam Jonas at Morgan Stanley, EVs account for 8% of the total car market today and will grow to 10% by 2025 and 25% by 2030.

I have been involved with Tesla (TSLA) since its earliest days way back in 2003. Then it was one rich man’s hobby, with technology that was a reach at best, and unlikely to ever see the light of day as a public company. There it remained for seven years.

Then Tesla brought out the Model S in 2010, which I snapped up as fast as I could, picking up chassis no. 125 at the Fremont factory. My signature is still on the wall there as are those for all of the first 125 buyers. Every time I pick up a new Tesla I check if it is still there.

If the Model S worked it had the potential to be a real car. If it didn’t, I would wind up with $100,000 worth of inert aluminum, steel, silicon, rubber, lithium, and copper with only scrap metal value.

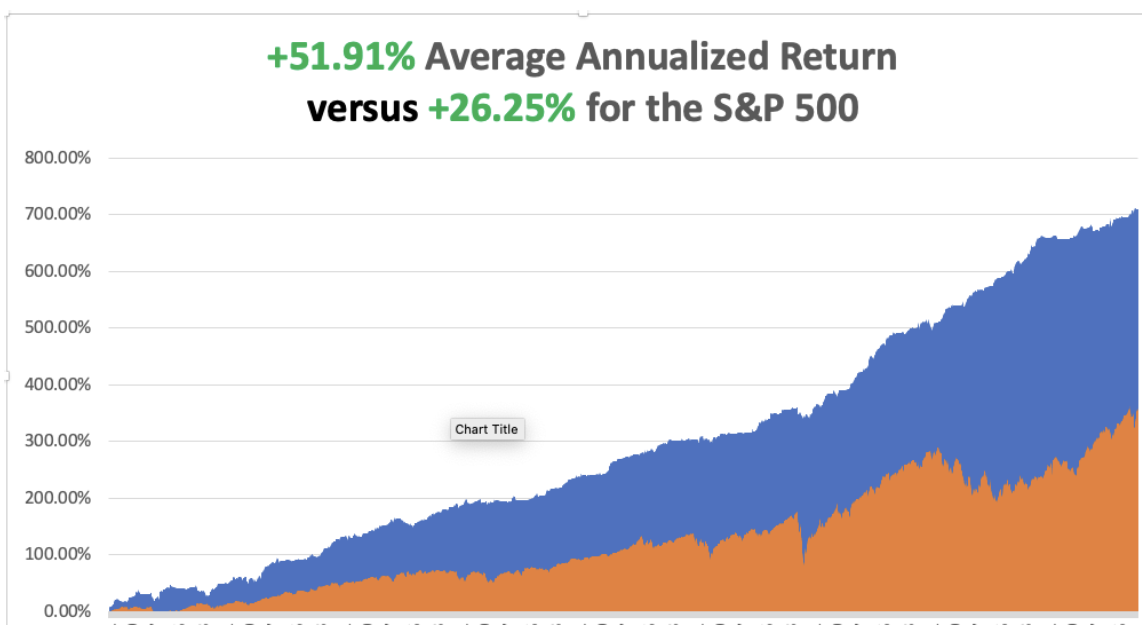

The trials were then only just beginning for Musk. He faced nervous breakdowns, sleeping in factories, and SEC prosecutions. After a decade of abuse, suddenly everything clicked. Total Tesla production is now running at a 1.7 million vehicle annual rate. The shares leaped 180-fold to a split-adjusted $425 from their post-IPO low of $2.40. That move financed a lot of retirements among my readers.

I remember what Steve Jobs once told me; “Like many overnight successes, this one took decades to pull off.”

Suddenly, making electric cars looked easy. Raising money to finance them looked even easier.

The problem is that all the new EV entrants now have a hyper-aggressive Tesla to compete against. Tesla has already locked up long-term supplies of crucial commodities essential for EV production, like copper, lithium, and chromium for stainless steel.

It has a 66% market share. It was a lock on experienced EV engineering talent. It has a near monopoly with a 48,000-strong national charging network which Ford (F) had no choice but to sign up for.

The best competitors can hope for is to peel off experienced employees from Tesla at inflated salaries, and then get sued by Tesla.

Enter the hoards, which I list below, a roll call of the shameless:

Nikola Badger (NKLA) – Has a hydrogen fuel cell power source that hasn’t a hope in hell of ever becoming economic. As I never tire of explaining to investors, while electric power is digital and infinitely scalable, hydrogen is analog and isn’t. Maybe that’s why the stock has been a disaster. Too many unbelievable promises and no actual functioning model. Gravity was their only actual power source. It just announced a recall of its electric trucks because of a coolant leak in the battery that caused fires.

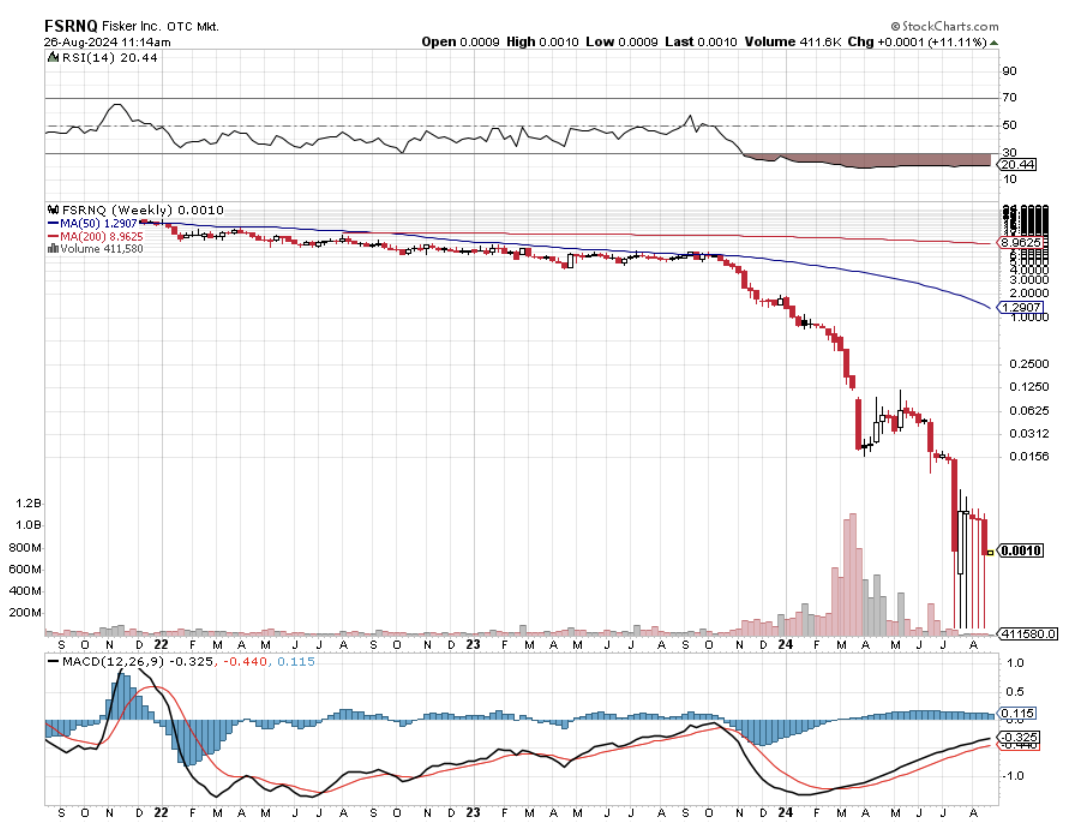

Fisker (F-SRNQ) – If at first, you don’t succeed, why not fail again? This VEHICLE had double the number of parts of a conventional international combustion engine. Its chief claim to fame was that it got a free factory from the government in Joe Biden’s home state and the fact that Justin Bieber drove one. More flailing at the wind. It recently went bankrupt….again.

Aspark Owl – A $3.2 niche supercar with an appeal to maybe three car-collecting Saudi princes.

Bollinger B1 – Is a $125,000 SUV expected from a Michigan startup with only a 200-mile range. Why not pay nearly double the cost of a Tesla Model X and get half the performance?

The Byton M-Byte – Is a $45,000 crossover car from a Chinese start-up. China has actually been building electric cars longer than Tesla, but they have a tendency to break down or catch on fire. Quality and safety problems have until now kept them out of the US, and probably always will.

Genesis Essentia – A Croatian-based start-up with a major investment from South Korea’s Hyundai. It will most likely never get off the drawing board. The last time Croatia built cars was for the Austria-Hungarian Empire during WWI.

Rivian R1T (RIVN) – A start-up with a reasonably priced truck and up to 400 miles of range that will only make it because they have a 100,000-unit order from the largest shareholder, Amazon (AMZN). It’s perfect for local deliveries. The cars are beautiful and there is a two-year waiting list for the $80,000 list price vehicles. (RIVN) is the only alternative EV maker that will probably make it.

By now, virtually every major car manufacturer has or is about to roll out its entry in the electric car race. I list them below, skipping those that are more than two years out over the horizon. Notice the profusion of the letter “e” in the names. In fact, there are an astonishing 527 EVs either on, or about to hit the market.

They include the Porsche Taycan, Audi eTron, Jaguar I-Pace, Austin Mini Electric, Fiat 500e, Kia Niro EV, BMW i3, Chevy Bolt EV, Hyundai Kona Electric, and the Hyundai Ioniq Electric, Ford F-150 Electric, Ford Mustang Mach-E, and Nissan Ariya.

Not one of these comes even close to the price/performance and battery density of the Tesla cars. Tesla is a decade ahead of the competition and is accelerating its lead. At best, they will sell a few electric cars to those who are intensely loyal to their brands and lose money doing it.

In the meantime, Tesla hasn’t been sitting on its hands. Elon Musk plans to bring out a $25,000 model in two years that will bar entry to the field from any other competitor. It has its own $250,000 supercar, the Tesla Plaid, which will go zero to 60 MPH in 1.9 seconds and has a 600-mile range. The Tesla Cyber Truck at $60,000 has the specs to take on the enormous US pickup market. Did I mention that the company is on the verge of developing technology that will improve battery performance by a staggering 20-fold?

So Tesla is branching out to suck up every profit in every branch of the entire global auto industry.

And this is what most traders, especially the short sellers, got wrong about Tesla. The data is worth more than the car. The miles driven provide a springboard from which the company can offer very high value-added and profitable services, like autonomous driving. Not even Alphabet (GOOGL) can replicate this.

When I bought my first Tesla more than a decade ago, I knew I was betting on the company. The big risk was that General Motors (GM) would step in with their own cheap electric car and drive Tesla out of business.

In the end (GM) did that, but too little, too late. Its Chevy Bolt EV didn’t hit the market until the end of 2016. Today it offers a boring design, lacks autonomous driving, possesses only a 259-mile range for $36,620, and is subject to recall, thanks to recurring battery fires (click here for the link).

The quality is, well, Chevy quality. The company has already announced it will discontinue production.

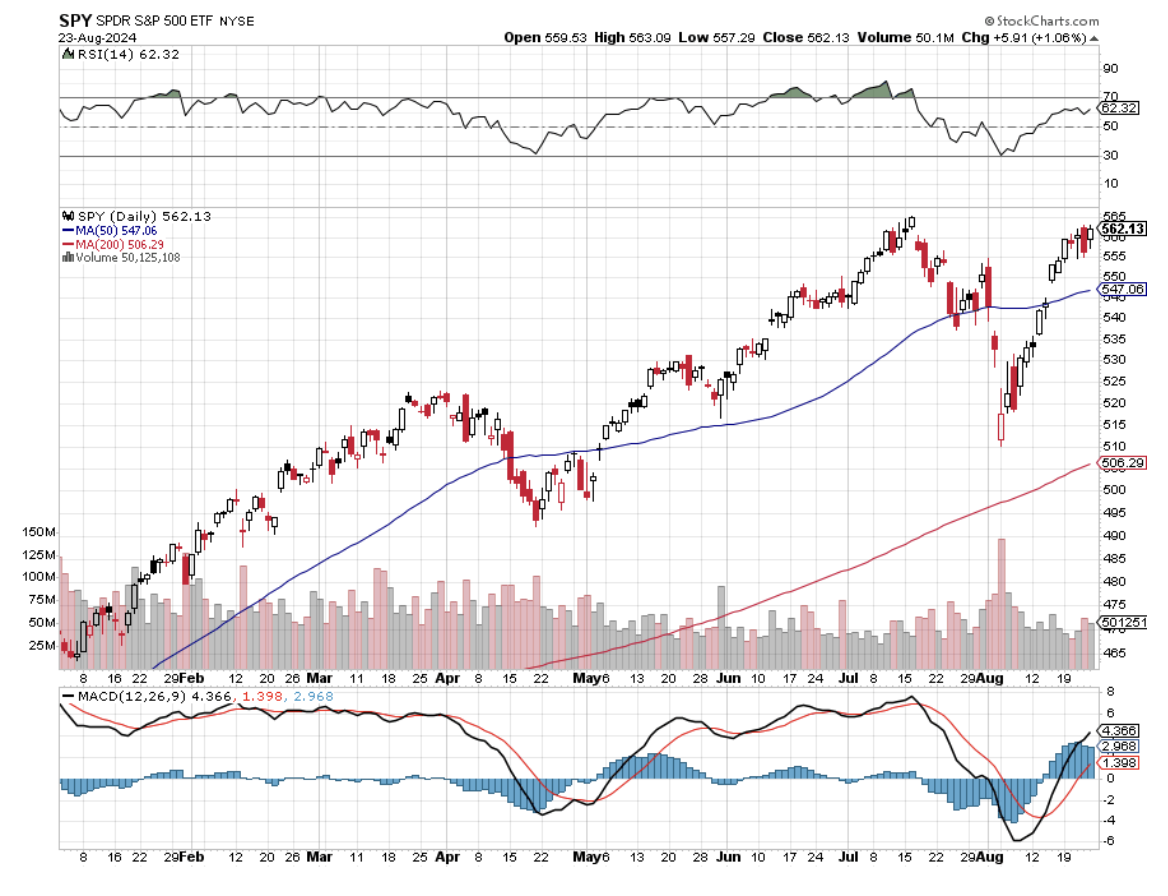

Tesla is approaching 2 million. It’s too late to close the barn door after the horse has “bolted,” as GM is earning. Over the past decade, Tesla shares were up 180 times at the high. GM shares are nearly unchanged during the greatest bull market of all time.

It is competing against Teslas that are 20 years from the future, are fully autonomous, go to street-autonomous driving next year, and upgrade itself once or twice a month.

Make mine Tesla, please, which will soon become the world’s first trillion-dollar car company. Don’t waste your time or money on the others, either as a driver or investor.

I’ll Go with Tesla