Below please find subscribers’ Q&A for the February 7 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Silicon Valley, CA.

Q: Have you ever flown an ME-262?

A: There's only nine of the original German jet fighters left from WWII in museums. One hangs from the ceiling in the Deutsches Museum in Munich (click here for the link), I have been there and seen it and it is truly a thing of beauty. You would have to be out of your mind to fly that plane, because the engines only had a 10 hour life. That's because during WWII, the Germans couldn't get titanium to make jet engine blades and used steel instead, and those fell apart almost as soon as they took off. So, of the 1,443 ME-262’s made there’s only nine left. The Allies were so terrified of this plane, which could outfly our own Mustangs by 100 miles per hour, that they burned every one they found. That’s also why there are no Japanese Zeros.

Q: Thoughts on Palantir (PLTR) long term?

A: I love it, it’s a great data and security play. Right now, markets are revaluing all data plays, whatever they are. But it is also overvalued having almost doubled in a week.

Q: What do you make of all these layoffs in Silicon Valley? What does this mean for tech stocks?

A: It means tech stocks go up. The tech stocks for a long time have practiced over-employment. They were growing so fast, they always kept a reserve of about 10% of extra staff so they could be put them to work immediately when the demand came. Now they are switching to a new business model: fire everybody unless you absolutely have to have them right now, and make everybody you have work twice as hard. That greatly increases the profitability of these companies, as we saw with META (META), which had its profits triple—and that seems to be the new Silicon Valley business model. If you're one of the few 100,000 that have been laid off in Silicon Valley, eventually the economy will grow back to where they can absorb you. That's how it's going to play out. In the meantime, go take a vacation somewhere, because you're not going to get any vacations once you get a new job.

Q: I have had shares of Alibaba (BABA) since 2020 and the stock has been in free fall since. Should I take the 80% loss or hold?

A: Well, number one, you need to learn about risk control. Number two, you need to learn about stop losses. I stop out when things go 10% against me; that's a good level. At 80%, you might as well keep the stock. You've already taken the loss and who knows, China may recover someday. It's not recovering now because no foreigners want to invest in China with all the political risk and invasion risk of Taiwan. After all, look at what happened to Russia when they invaded Ukraine—that didn't work out so well for them.

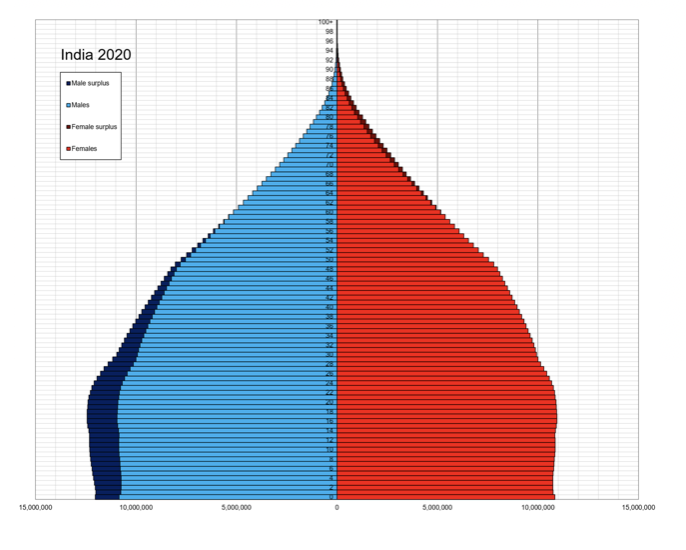

Q: On the Chinese economy (FXI), is the poorer performance due to the decision to move to a war economy? The move in the economic front was described in Xi's speech to the CCP in January of 2023.

A: The real reason, which no one is talking about except me, is the one child policy, which China practiced for 40 years. What it has meant is you now have 40 years of missing consumers that were never born. And there is no solution to that, at least no short-term solution. They're trying to get Chinese people to have more kids now, and you're seeing three and four child families for the first time in 40 years in China. But there is no short-term fix. When you mess with demographics, you mess with economic growth. We warned the Chinese this would happen at the time, and they ignored us. They said if they hadn't done the one child policy, the population of China today would be 1.8 billion instead of 1.2 billion. Well, they’re kind of damned no matter what they do so there was no good solution for them. Of course, threatening to invade your neighbors is never good for attracting foreign investment for sure. Nobody here wants to touch China with a 10-foot pole until there’s a new leader who is more pacifist.

Q: What do you think of Eli Lilly (LLY)?

A: I absolutely love it. If there's a never-ending bull market in fat Americans, which is will go on forever, they're one of two companies that have the cure at $1,000 a month. On the other hand, the stock has tripled in the last 18 months, so it’s kind of late in the game to get in.

Q: Are there any stocks that become an attractive short in the event of a Taiwan invasion, such as Taiwan Semiconductor (TSM)?

A: All stocks become attractive shorts in the event of another war in China. You don't want to be anywhere near stocks and the semis will have the greatest downside beta as they always do. You don't want to be anywhere near bonds either, because the Chinese still own about a trillion dollars’ worth of our bonds. Cash and T-bills suddenly looks great in the event of a third war on top of the two that we already have in Gaza and Ukraine.

Q: What do you think about the prospects of the Japanese stock market now?

A: I think the big move is done; it finally hit a new high after a 34-year wait. The next big move in Japan is when the Yen gets stronger, and that is bad for Japanese stocks, so I would be a little cautious here unless you have some great single name plays like Warren Buffett does with Mitsubishi Corp. (MSBHF). So that's my view on Japan—I'm not chasing it after being out for 34 years. Why return? The companies in the US are better anyway.

Q: What is the deal with Supermicro Computer (SMCI)? It went up 23 times in a year to $669 after not clear $30 for a decade.

A: The answer is artificial intelligence. It is basically creating immense demand for the entire chip ecosystem, including high end servers, which Supermicro makes. It also has the benefit of being a small company with a small float, hence the ballistic move. It was too small to show up on my radar. I’ll catch the next one. There are literally thousands of companies like (SMCI) in Silicon Valley.

Q: Will JP Morgan (JPM) bank shares keep rising, or will they fall when the Fed cuts rates?

A: (JPM) will keep rising because recovering economies create more loan demand, allow wider margins, and cause default rates to go down. It becomes a sort of best case scenario for banks, and JP Morgan is the best of the breed in the banking sector. It also benefits the most from the concentration of the US banking sector, which is on its way from 4,000 banks to 6 with help from the US government.

Q: Is India a good long-term play? Which of the two ETFs I recommend are the better ones?

A: Yes, India is a good long-term play. You buy both iShares India 50 (INDY) and the iShares MSCI India (INDA), which I helped create yonks ago. India is the new China, and the old China is going nowhere. So, yes, India definitely is a play, especially if the dollar starts to weaken.

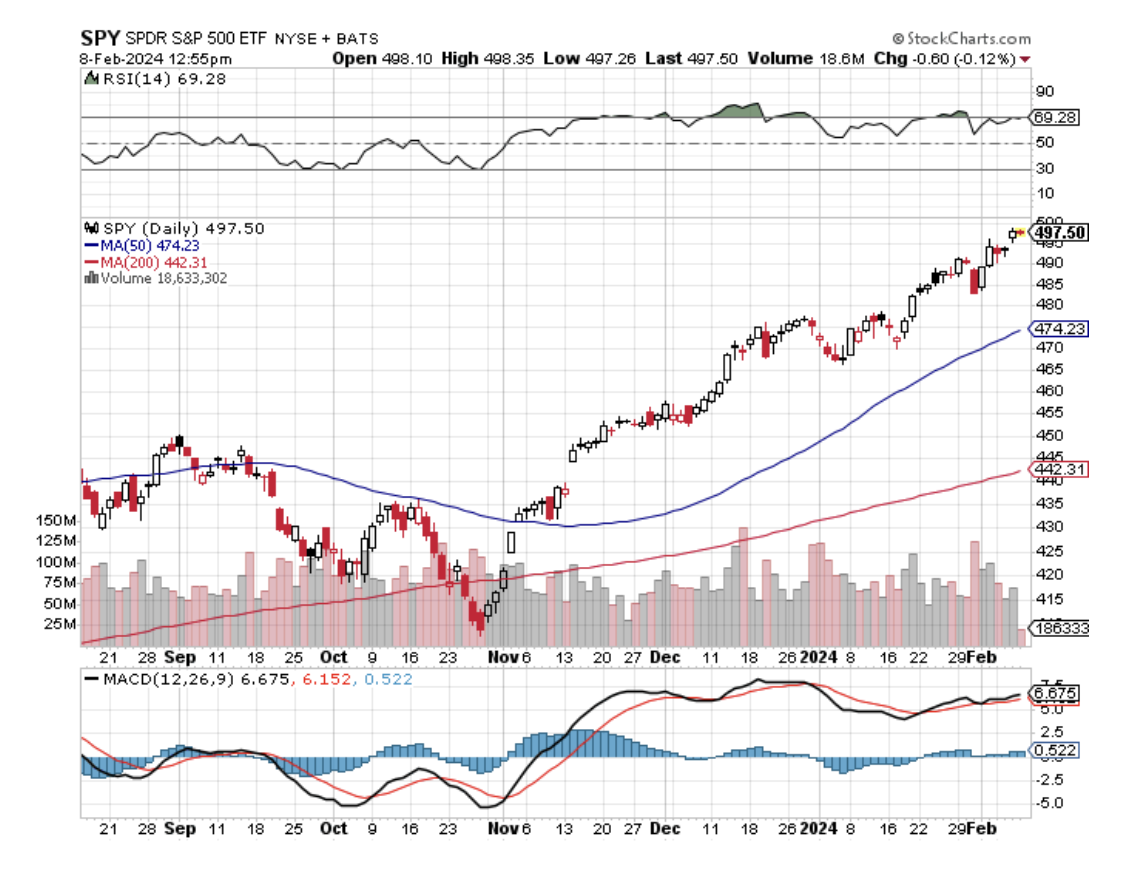

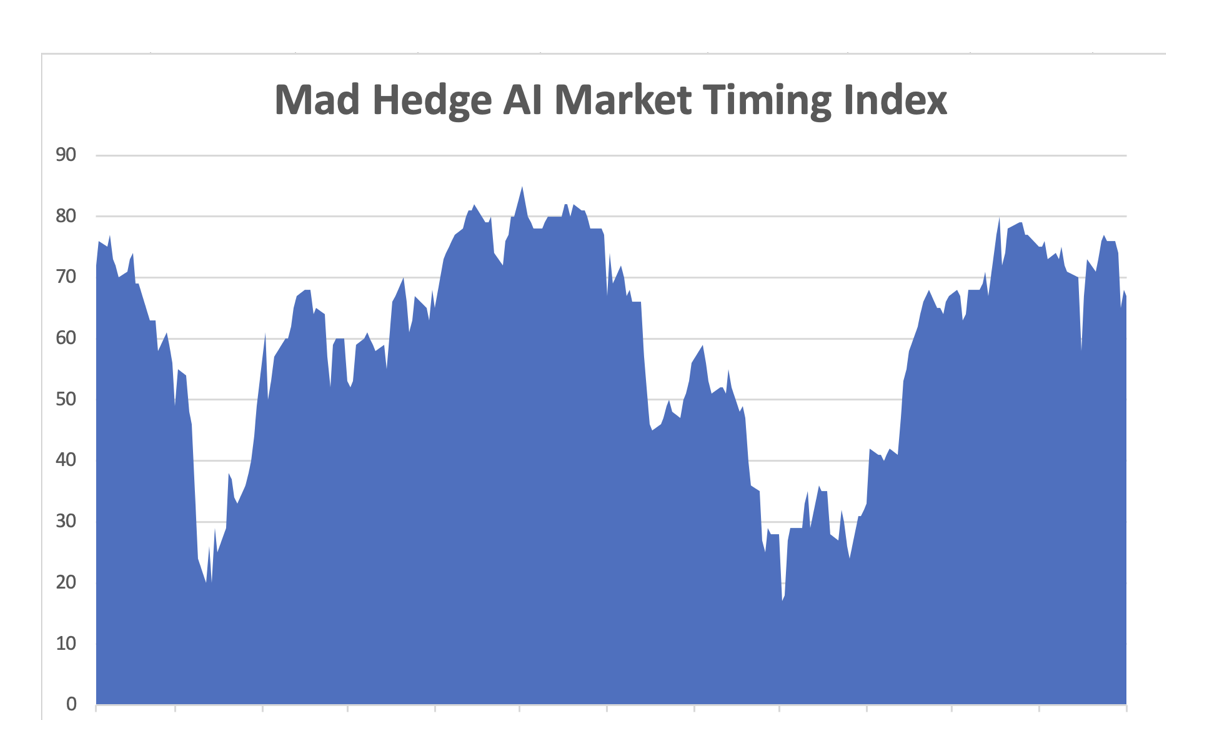

Q: Do you expect to pull back in your market timing index?

A: Yes, probably this month. Have I ever seen it go sideways at the top for an extended period? No, I haven't. On the other hand, we’ve never had a new thing like artificial intelligence hit the market, nor have we seen five stocks dominate the entire market like we're seeing now. So, there are a lot of unprecedented factors in the market now which no one has ever seen before, therefore they don't know what to do. That is the difficulty.

Q: Does India have an in-country built EV, and what is their favorite EV in India?

A: No, but Tesla (TSLA) is talking about building a factory there. And I would have to say BYD Motors (BYDDF) because they have the world’s cheapest EV’s. There is essentially no car regulation in India except on imports. Car regulation and safety requirements is what keeps the BYDs out of the United States, and it's kept them out for the last 15 years. So that is the issue there.

Q: What do you think about META as a dividend play?

A: I think META will go higher, but like the rest of the AI 5, it is desperately in need of a pull back and a refresh to allow new traders to come in.

Q: Why does Netflix (NFLX) keep going up? I thought streaming was saturated—what gives?

A: Netflix won the streaming wars. They have the best content and the best business strategy; and they banned sharing of passwords, which hit my family big time since it seemed like the whole world was using my Netflix password. And no, I'm not going tell you what my password is. I’ve already paid for Griselda enough times. Seems there is a lot of demand for strong women in my family. Netflix they seem to be enjoying a near monopoly now on profits.

Q: Has the NASDAQ come too far too fast, and does it have more to run?

A: Well it does have more to run, but needs a pull back first. I'm thinking we'll get one this month, but I'm definitely not shorting it in the meantime.

Q: Have you ordered your Tesla (TSLA) Cybertruck?

A: I actually ordered it two years ago and it may be another two year wait; with my luck the order will come through when I'm in Europe and I'll miss it. Some of my friends have already gotten deliveries because they ordered on day one. They love it.

Q: What happened to United States Natural Gas (UNG)?

A: A super cold spell hit the Midwest, froze all the pipes, and nobody could deliver natural gas just when the power companies were screaming for more gas. That created the double in the price which you should have sold into! Usually, people don't need to be told to take a profit when something doubles in 2 weeks, but apparently there are some out there as I've been here getting emails from them. Further confusing matters further is that (UNG) did a 4:1 reverse split right at this time. They have to do this every few years or the 35% a year contango takes the price below $1.00 and shares can’t trade below $1.00 on the New York Stock Exchange.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader