October 27, 2009

October 27, 2009

Featured Trades: (CIA), (TBT), (DBA), (FCX), (USO), (TM), (CVX), (XTO), (RSX), (GOOG), (BIDU)

2) That unappreciated source of great investment ideas, National Geographic magazine, has a short piece on the infrastructure that will be needed to support the coming electric car boom in its November issue (click here for the full story at http://ngm.nationalgeographic.com/). Dozens of different plug-in hybrid and?? electric cars are about to hit the market, most of which run out of juice in 40 miles, needing a vast recharging network which doesn?t yet exist. If the main fuse on my house blows whenever my daughter uses her hairdryer, how am I supposed to top up my plug-in Toyota Prius, which will need an eight hour charge? California always lives perilously close to brown outs. What happens when you throw a million electric cars into the mix? The answer will be unique to each family, depending on their own personal transportation needs. Those driving cars from Better Place in the San Francisco area from next year will simply drive though a car wash type facility, where a new battery is swapped while the driver is sipping a fresh latte. Home ?smart meters? will take advantage of variable electricity pricing that will charge cars only at night when power is cheaper. The 240 volt outlet that you already have to run your dryer or hot tub will halve the charging time. Gas stations along major interstates will soon start offering hefty 480 volt ?quick charge? plugs where a recharge can be had in as little as 20 minutes. Alternative energy naysayers rightly complain that electric car enthusiasts are blind to these complex realities. But in 1908 you had to go to a drug store to buy a one gallon tin of gasoline to power your model T, yet 17 years later there were 25,000 gas stations across the US, and that?s when most had to be built using a horse and wagon.

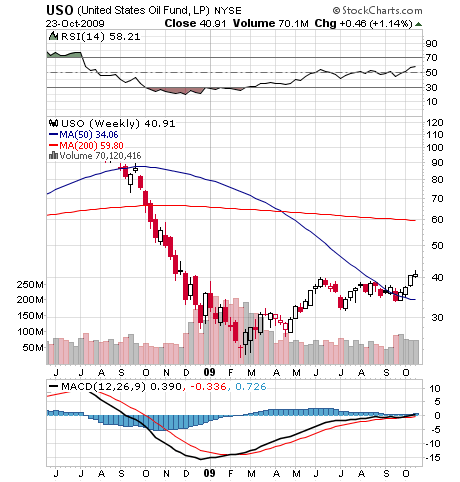

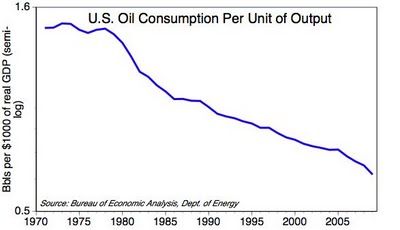

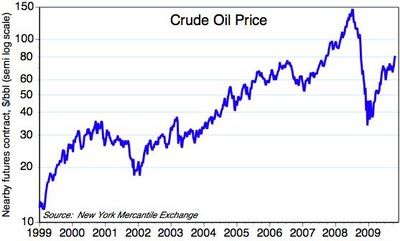

3)If you think oil is expensive here at $80, look again. The Department Energy chart below of US oil consumption per unit of output shows that, in fact, we are at a 40 year low in the price of crude. In other words, it takes half as much oil to produce a unit of GDP than it did in the late sixties, when 12 miles per gallon was considered reasonable, and only Lincoln Continentals got abused because they consumed a gluttonous six miles per gallon. This is the why current lofty prices are having a negligeable effect on a reviving economy. The other chart shows the price of oil in inflation adjusted terms. Again, we are at the high end of the range, but nowhere near the top. What?s the lesson in all of this? If the price of oil is not hurting now, then it will move a lot higher to where it does hurt big time. When the US gets back on track, and the emerging markets return to firing on all 12 cylinders, triple digit oil is a gimme, and new highs will easily be attainable. Then you can expect the current perfect correlation between rising stock and crude prices to shatter. Make sure you maintain exposure to the oil patch, either through majors like Chevron (CVX) (click here ), oil service companies like XTO Energy (XTO) (click here ), the Russian market ETF (RSX) (click here), or just the plain vanilla Oil Trust ETF (USO). If noting else, these names will help immunize your portfolio against the certainty of higher fuel prices. If you are wondering where the ?W? recession might come from, this is it.

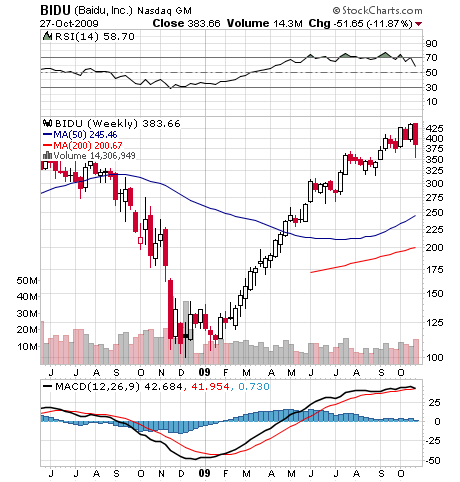

4) If you think Google (GOOG) has a great future (click here for my recent update), then you?ll love Baidu (BIDU), which is Google on Viagra. With economic growth for China exploding a sizzling 8.9% in the recent quarter, it can mean only one thing for the Chinese Internet provider. The business for banner ads is booming, and with that comes expanding margins as economies of scale kick in. I have been pounding the table, trying to get readers to buy Baidu since December, when it bounced off $100 (click here for my recommendation). Since then the stock has rocketed to $438. It is not exactly cheap here, but what multiple do you put on a hyper growing company in the world?s hottest economy? If you do play, I would suggest a limited risk vehicle in case someone soon stuffs some smelling salts up the noses of the global equity markets. Outright call options are too expensive for this bad boy, so cut your cost with a 1:1 call spread involving a long near money call against a short out of the money call. Use the surprise 20% pullback today to become a Baiduphile.

QUOTE OF THE DAY

?The next Pearl Harbor will be a cyber attack,? Said Leon Panetta, Director o the CIA.