October 29, 2009

Global Market Comments

October 29, 2009

Featured Trades: (GOLD), (DOW), (BRAZIL), (EWZ)

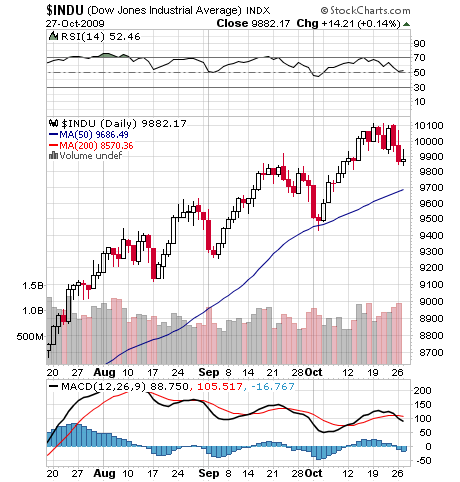

1) A few years ago, I went to a charity fund raiser at San Francisco's priciest jewelry store, Shreve & Co., where the well heeled men bid for dinner with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area's premier hotties, who shall remain nameless. Suffice to say, she has a sports stadium named after her. The bids soared to $6,000, $7,000, $8,000. After all, it was for a good cause. But when it hit $10,000, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer's remorse came to me and offered his date back to me for $9,000.?? I said 'no thanks.' $8,000, $7,000, $6,000? I passed. The current altitude of the stock market reminds me of that evening. I have just had one of the best years of my career, and have cashed out of most of my positions so I can greedily await payment of my year end performance bonus. If you rode gold from $800 to $1,050, oil from $35 to $80, and the FXI from $20 to $40, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: 'There is a time to fish, and a time to hang your nets out to dry.' At least then I'll have plenty of dry powder for when the window of opportunity reopens for business. One of the headaches in writing a letter like this is that while I publish 1,500 words a day for 250 days a year, generating about half the length of War and Peace annually, you really need to tinker with your portfolio on only a dozen or so of those days. So while I'm mending my nets, I'll be building new lists of trades for you to strap on when the sun, moon, and stars align once again. And no, I never did find out what happened to that date.

2) With the media going gaga over the imagined economic recovery, it's time to take another look at Ben Bernanke's exit strategy, or the lack of one. There is no doubt that a large part of our current financial stability is owed to massive Fed support of?? the entire spectrum of the debt markets and the forced recapitalization of the banks. If Ben vacates too soon, we'll descend back into the depths of Hell. If he hangs around too long, he'll be doling out massive dollops of hyperinflation. It's like having an annoying dinner party guest who you can't ditch because you need him to pay the bill. Fed watchers say the dilemma is as challenging as threading a needle in the dark while wearing pruning gloves. There are also the two 800 pound gorillas swept under the carpet named Fannie Mae and Freddie Mac, which are still major sources of home loans for the catatonic housing market. I'm glad it's his headache and not mine.

3) I've got to comment on Brazil's (EWZ) idiotic move last week to impose a 2% tax on real stock and bond purchases to scare off foreign investors. It's like firing off an emergency flare in the night and saying 'Come and get me.' If any portfolio manager was living in a cave for the past ten years and somehow missed the attractions of investing in an emerging market that exports food and energy, has an appreciating currency, and an almost perfect demographic profile, they can see it now, clear as day. This lunacy reminds me of Malaysia prime minster Mohamad Mahathir's rantings and ravings about George Soros's selling of his country's markets during the Asian financial crisis, when in fact, George was buying. I sympathize with Brazil's dilemma, similar to those of the Swiss during the eighties and nineties, when the whole world wanted to buy their currency, forcing the government in Berne to drive interest rates to zero, pushing domestic prices through the roof. But this is the price of economic success. Everyone wishes they had Brazil's problems. Better to just let things be.

4) The gold rush is back on in California. On my way back from Lake Tahoe last weekend I saw that every bend of the American river was dotted with hopeful miners, looking to make a windfall fortune. Weekend hobbyists were there panning away from the banks, while the hardcore pros stood in hip waders balancing portable pumps on truck inner tubes, pouring sand into sluice boxes. A sharp eyed veteran can take in $2,000 worth of gold dust a day. The new 2009'ers were driven by a record price of gold at $1,066 and the attendant headlines, but also by unemployment, and recent heavy rains that flushes new quantities of the yellow metal out of the Sierras. They were no doubt inspired by the chance discovery of an 8.7 ounce nugget in May near Bakersfield, worth an impressive $9,200. Local folklore says that The Sierra's have given up only 20% of their gold, and the remaining 80% is still up there awaiting discovery. Out of work construction workers are taking their heavy equipment up to the mountains and using it to reopen mines that have been abandoned since the 19th century. The US Bureau of Land Management says that mining permits in the Golden State this year have shot up from 15,606 to 23,974. Unfortunately, the big money here is being made by the sellers of supplies and services to the new miners, much as Levi Strauss and Wells Fargo did in the original 1849 gold rush. Gee, do you think Wall Street is familiar with this concept?

'We get 150,000 job applications a year, and more when a James Bond movie comes out,' said Leon Panetta, Director of the CIA.