Oil: Is It Different This Time?

A reader emailed me yesterday to tell me that while visiting his daughter at a college in North Carolina, he refilled his rental car with gas for $1.39 a gallon.

So I got the idea that something really big is going on here that no one is yet seeing. I processed the possibilities in my snowshoe up to the 10,000-foot level above Lake Tahoe last night.

By the way, the view of the snow covered High Sierras under the moonlight was incredible.

For decades, I have dismissed the hopes of my environmentalist friends that alternatives will soon replace oil (USO) as our principal source of energy.

I have long agreed with the views of my fracking buddies in the Texas Barnett Shale that it will be decades before wind, solar, and biodiesel make any appreciable dent in our energy makeup.

It took 150 years to build our energy infrastructure, and you don?t replace that overnight. The current weakness in oil prices is a simple repeat of a predictable cycle that has continued for a century and a half. In a couple years, Texas tea will be posting triple digits once again.

I always thought that oil had one more super spike left in it. After that, it will fade into history, reduced to limited applications, like making plastics and asphalt, probably sometime in the 2030?s.

The price for a barrel of oil should then vaporize to $5.

But given the price action for energy and all other commodities I?m starting to wonder if this time I?m wrong.

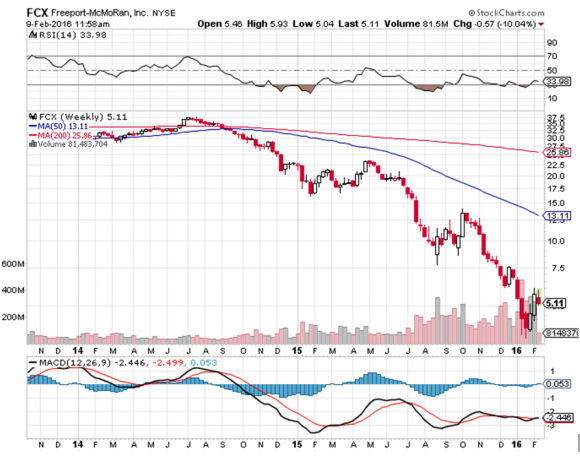

I have watched with utter amazement while Freeport McMoRan (FCX) plunged from $38 to $3. I was gob smacked to see Linn Energy (LINE), admittedly a leveraged play, crater from $32 to 30 cents.

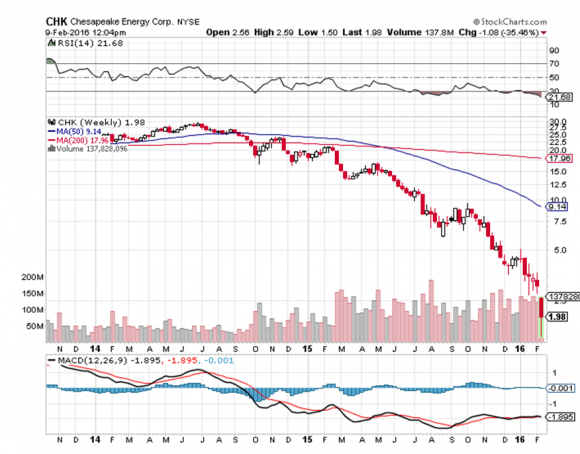

And I was totally befuddled to see gas major Chesapeake Energy (CHK) implode from $65 to $1.

Has the world gone mad?

When the data don?t match your view, it?s time to change your view.

Maybe there won?t be another spike in oil prices. Could its disappearance from the modern industrialized economy have already begun?

That would certainly explain a lot of the recent eye-popping price action in the markets. In five short years oil has dropped 82%. It did this while global GDP grew by 20% and auto sales, and therefore gasoline demand, has been booming.

Of course, you could just call all of this a big giant reversion to the mean.

Over the past 150 years, the average, inflation adjusted price of oil has been $35 a barrel. The price for gasoline has been $2.25 a gallon, exactly where it was in 1932, and where it now is in much of the country.

I know all of these numbers because I once did a study to see if oil prices are rigged (conclusion: they are). How can the price of a commodity stay the same for 150 years?

Wait, the naysayers announce. Things don?t happen that fast.

But they do, my friends, they do, especially in energy.

Until 1849, my ancestors were the largest producers of whale oil on Nantucket Island. (Our family name,? Coffin, was mentioned in ?Moby Dick? seven times, and was a focus of the just released film, ?In the Heart of the Sea.?)

Then this stuff called petroleum came along, wrested from the ground with new technology by men like Drake and Rockefeller. The whale oil market crashed, dropping in price by 90%, and virtually disappeared in two years.

My relatives were wiped out and moved to San Francisco, which they already knew from their whaling days, and where gold had just been found.

A half-century later, this thing called an ?automobile? came along meant to replace the ubiquitous horse and buggy. People laughed. It was loud, noisy, smelly, inefficient, and expensive. Only the rich could afford them.

You had to go to a drug store to buy high priced fuel in one-gallon tins. And it scared the horses. England passed a national automobile speed limit of 5 miles per hour, as cars were considered dangerous.

Then huge oil discoveries were made in Texas and California (watch ?There Will Be Blood?), the Hughes drill bit came along, and gasoline prices fell sharply. Suddenly cars were everywhere. The horse population declined from 100 million to only 1 million today.

All of this is a long-winded, history packed way of saving ?This time it may be different?.

I have on my desktop a Trade Alert already written up to buy the (USO) May, 2016 $9 calls. Today, they traded at $1.00. I?m just waiting for another melt down in oil to take a low risk punt on the long side.

If we rocket back up to $100, as many are predicting, these calls will be worth a fortune. But you know what, oil may only peak out at $44 this time. The trade will still make money, but not as much as in past cycles.

So, you better think hard about loading up on too many oil stocks at these distressed levels. Look what has already happened to the coal industry (KOL), which has essentially gone bankrupt.

You could well be buying into the buggy whip industry circa 1900.