While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

December 26, 2013

Fiat Lux

Featured Trade:

(INDIA IS CATCHING UP WITH CHINA),

(PIN), (FXI),

(WHO SAYS HEDGE FUNDS AREN?T ADDING VALUE?)

(PETER F. DRUCKER ON MANAGEMENT)

PowerShares India (PIN)

iShares China Large-Cap (FXI)

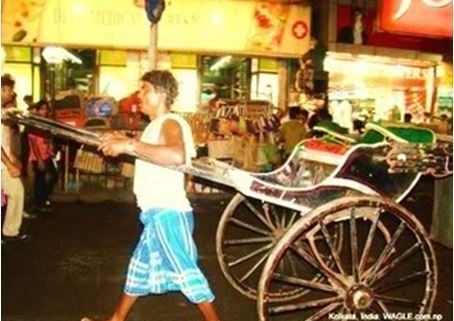

When I first visited Calcutta in 1976, more than 800,000 people were sleeping on the sidewalks, I was hauled everywhere by a very lean, barefoot rickshaw driver, and drinking the water out of a tap was tantamount to committing suicide.

Some 36 years later, and the subcontinent is poised to overtake China's white hot growth rate.

My friends at the International Monetary Fund just put out a report predicting that India will grow by 8.5% this year. While the country's total GDP is only a quarter of China's $5 trillion, its growth could exceed that in the Middle Kingdom as early as 2013. Many hedge funds believe that India will be the top growing major emerging market for the next 25 years, and are positioning themselves accordingly.

India certainly has a lot of catching up to do. According to the World Bank, its per capita income is $3,275, compared to $6,800 in China and $46,400 in the US. This is with the two populations close in size, at 1.3 billion for China and 1.2 billion for India.

But India has a number of advantages that China lacks. To paraphrase hockey great, Wayne Gretzky, you want to aim not where the puck is, but where it's going to be. The massive infrastructure projects that have powered much of Chinese growth for the past three decades, such as the Three Gorges Dam, are missing in India. But financing and construction for huge transportation, power generation, water, and pollution control projects are underway.

A large network of private schools is boosting education levels, enabling the country to capitalize on its English language advantage. When planning the expansion of my own business, I was presented with the choice of hiring a website designer here for $60,000 a year, or in India for $5,000. That's why booking a ticket on United Airlines or calling technical support at Dell Computer gets you someone in Bangalore.

India is also a huge winner on the demographic front, with one of the lowest ratios of social service demanding retirees in the world. China's 30-year-old 'one child' policy is going to drive it into a wall in ten years, when the number of retirees starts to outnumber their children.

There is one more issue out there that few are talking about. The reform of the Chinese electoral process at the People's Congress in 2013 could lead to posturing and political instability, which the markets could find unsettling. India is the world's largest democracy, and much of its current prosperity can be traced to wide ranging deregulation and modernization that took place 20 years ago.

I have been a big fan of India for a long time, and not just because they constantly help me fix my computers, make my travel reservations, and tell me how to work my new altimeter watch. In August, I recommended Tata Motors (TTM), and it has gone up in a straight line since, instantly making it one of my top picks of the year. On the next decent dip take a look at the Indian ETF's (INP), (PIN), and (EPI).

![India 2010 Population]() Better to Own This Pyramid

Better to Own This Pyramid

![China 2010 Population]() Than This Pyramid

Than This Pyramid

![Rickshaw]() Taxi! Taxi!

Taxi! Taxi!

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

December 24, 2013

Fiat Lux

Featured Trades:

(A CHRISTMAS STORY),

(THE U-HAUL INDICATOR)

It is the end of the school year at the University of California at Berkeley, and the unenviable task of moving my son, a senior, out of his hovel for the holidays fell to me.

When I arrived, I was stunned to find nothing less than a war zone. Both sides of every street were lined with mountains of trash, the unwanted flotsam and jetsam cast aside by departing students. Computer desk, stained mattresses, broken lava lamps, and an assortment of heavily worn Ikea furniture were there for the taking. Newly arriving students were sifting through the piles looking for that reusable gem. Diminutive Chinese teenagers were seen pushing massive suitcases on wheels down the sidewalk on their way back to Shanghai, Beijing, and Hong Kong. The university attempted to bring order to the chaos by strategically placing dumpsters on every block, but they were rapidly filled to overflowing.

It was all worth it because of the insight it gave me into one of my favorite, least known leading economic indicators. When I picked up the truck at U-HAUL, the lot was absolutely packed with returned vehicles, and there were more parked on both sides of the streets. The booking agent told me there is a massive influx of people moving into California from the Midwest and the Northwest, with the result that lots all over the San Francisco Bay Area are filled to capacity.

I love this company because in addition to providing a great service, they get the first indication of any changes to the migratory habits of Americans. The last time I saw this happen was after the dotcom bust, when thousands of tech savvy newly unemployed pulled up stakes in the foggy city and moved to Lake Tahoe to work in ?the cloud.? Bottom line: California is enjoying a resurgence of hiring and new economic growth. This is what the stock market is seeing that you and I can?t.

![lava lamps]() Want a Great Deal on a Used Lava Lamp?

Want a Great Deal on a Used Lava Lamp?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.