As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

November 8, 2013

Fiat Lux

Featured Trade:

(THE RISING RISK OF A MARKET MELT UP)

(FXE), (FXY), (YCS), (FXA), (SPY), (USO),

(THE PARTY IS JUST GETTING STARTED WITH THE JAPANESE YEN),

(FXY), (YCS), (DXJ)

CurrencyShares Euro Trust (FXE)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

CurrencyShares Australian Dollar Trust (FXA)

SPDR S&P 500 (SPY)

United States Oil (USO)

ProShares UltraShort Yen (YCS)

WisdomTree Japan Hedged Equity (DXJ)

The risk of a major market melt up just took a quantum leap upward with the European Central Bank?s surprise 25 basis points in interest rates a few minutes ago. The move had not been expected from normally sleepy and moribund European monetary authorities for a few more months.

The ECB?s action has major positive implications for the world economy. It gives a shot of adrenalin to a global synchronized economic recovery, which was already in the cards for 2014. The effect on all asset classes will be huge.

Of course, the Euro ETF (FXE) crashed by $1.70, as one would expect, one of the largest moves of the year in the foreign exchange markets. We already took profits on a short position we strapped on in the Euro the last time it ran up to $1.38, which turned out to be the peak of a multi month move. But it has also spilled over into the other currencies, expanding into a much broader move into the US dollar.

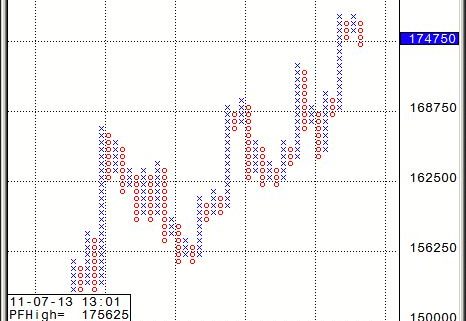

The Japanese yen (FXY), (YCS) has just puked up 60 basis points, where we have a major short position and were looking to add. As a result, we have already gained 58% of the potential profit for a position that we added only two days ago. The Australian dollar (FXA), where I am also attempting to go long on a bigger dip, has lost 50 cents. Gold took it on the nose, again.

The other blockbuster event, which transpired this morning, was the release of the early read of US Q3 GDP, coming in at a red hot 2.8%. This was much higher than expected, with many estimates hovering around the 2.0% level. This means that the 0.5% we lost in the Washington shut down will turn out to be just a speed bump. We should make it all back, and much more, in the run up to Q1, 2014.

But wait! There?s more!! The price of oil has plunged by $20 in six weeks, thanks to the massive oversupply coming out of US fracking fields, and the movement of US-Syrian hostilities to a back burner. Even an Israeli attack on a Russian resupply of missiles at a Syrian port failed to generate any interest in Texas tea. Two months ago, this would have been worth a one day, $5 spike.

The US Energy Information Agency calculates that a $20 cut in the price of oil adds 0.4% to US GDP, and cuts unemployment by 0.1%. Newly enriched consumers spend more money and corporations with lower costs earn more profits. In other words, it cancels out the negative effects of the Washington shutdown in one fell swoop.

The University of California argues that ten out of the last 11 recessions were triggered by oil price spikes. The inverse is true as well. Collapsing oil prices create economic booms. Guess which way we are headed?

US Q3 earnings reports are generating extremely favorable comparisons, up about 10% YOY in aggregate. We have an extremely favorable calendar right now, as November and December are traditionally strong months for risk markets. Maybe it?s also that holiday grog. We also have the 2014 ?Great Reallocation? out of stocks and into bonds to look forward to, which has probably already started.

It all adds up to a first class market melt up, which could start at any time. Indeed, given the torrid market performance since the summer, and its Teflon like behavior during the October Washington shutdown, some strategists are claiming that a melt up has already started. The net net of all of this is that the world looks like a much friendlier place, and I am much more inclined to add risk than I was only a few minute ago when I dragged my sorry ass out of bed.

Below, please find the posture you should take in the markets listed by asset class.

*Stocks - ?buy the dips, running to a new yearend highs, especially in technology,? industrials, health care, and consumer cyclical

*Bonds - ?sell rallies, heading to the top of the 2.50%-3% 10 year yield range

*Commodities - start scaling in on dips in copper, iron ore

*Currencies - sell yen on any rallies, buy the Australian dollar on a China recovery

*Precious Metals - stay away, the world wants? paper assets

*Volatility - stand aside, will bounce along bottom

*The Ags - stay away until next year, great weather is killing prices, but too late to sell short

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.