As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Take a look at the 30 year chart of the S&P 500 below, and it?s clear that the market is approaching a critical juncture. With the closely watched index closing at 1,460 today, we are a mere 140 points from the iron ceiling that has been unassailable for the past 13 years.

The chart is a roll call of past disasters for American investors. The 2000 peak was the apex of the Dotcom Bubble. The 2006 high water market defined the end of the Housing Bubble. Since March 9, 2009, a scant 15 days after president Obama took office, the index has soared by a record breaking 119%.

Something tells me this won?t go down in history as the ?Great Obama Bull Market?. Maybe it will become known as the ?Quantitative Easing Bubble? or the ?Bernanke Bubble?. Only future armchair economic historians will know for sure.

The chart clearly defines the last lost decade for stocks, as well as the second missing decade we are currently in. If the US economy were growing at a nice 3% annual clip, I would say that we are taking a run at the 13 year high, will breakout to the upside, and quickly tack on 10%-20% from there.

Unfortunately, that is not the world we live in. In fact, we are growing at half that rate on a good day, and are facing major challenges ahead. Bernanke?s announcement of QE3 last week (although he never used that precise term), will give markets the juice to take a serious run at 1,600 in the coming six months. But then, I think the fundamentals will cause it to fail once again.

Even the best case scenario for the resolution of the fiscal cliff at year-end takes a minimum of 3.5% out of GDP growth next year. The economies of Europe, China, and Japan remain in free-fall. U.S. corporations may be about to deliver their first YOY zero earnings growth in three years.

All of this sets up a recession in 2013 that will be tough to avoid. This is why U.S. companies are loathe to hire, have crimped capital spending at half of their historic levels at $2 trillion, and are sitting on cash mountains. They are obviously running scared.

The shock of the magnitude of this QE3 will get digested and fully priced in by the markets by Q1, 2013, right around the time the (SPX) is peaking short of 1,600. Then, one of the greatest shorting opportunities of the century will set up. I hate to sound like a broken record, but ?Sell in May and go away? is likely to work for the fourth year in a row. Except this time, you might not want to come back until August of 2014.

Is This a SELL Signal?

?It?s all artificial stimulation. The market wouldn?t be here without quantitative easing,? said a NYSE floor trader.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Sometimes market moves call for options, and I?ve used a lot of them recently. Can options be profitable? The proof is in the pudding as my strategies have paid off handsomely. However, I do get a lot of questions about option strategies and how best to place trades. In an effort to help my readers improve their profits I have scheduled an options training seminar for the first week in November ? and I?ve gone one better.

This options training session will be a half-day session run by the folks at TradeMONSTER, and will be part of a 2-day economic symposium run by the HS Dent group of Harry Dent fame. I?ve been a guest speaker at this event in the past and will be part of their lineup at a later session as well. The combined program is a two-day information and education feast. The options training will be the second half of the second day of the symposium.

TradeMONSTER is the trading platform run by my friends, the Najarian brothers, the guys on CNBC with ponytails that report from the old exchange in Chicago. Their representative will discuss options in general then get into the nitty gritty of strategies like the ones I use, although I don?t often use the official names, like bull put spread, bear call spread, verticals, and even Iron Condors. Don?t get lost in the vernacular; just know that they will help you sort this out so that you better understand how to take advantage of my research. I?ll be there at the end of the options session to answer questions and share a cocktail.

The economic symposium put on by HS Dent, which they call Demographics School, gives you the lay of the land in our economy. It will outline how the economy works and what most likely lies ahead based on how consumers spend money. Here?s a hint ? old people buy less toys and spend more on healthcare, which sounds simple but has profound implications for our country and the world. These trends unfold over a long time period and if you pay attention you can make a lot of money. Short term moves can be very profitable, but you have to keep in mind how the world is shaping up in the background. If you lose sight of the long term, you risk having it run you over.

So here?s the scoop. The 2-day event will be held on Wednesday and Thursday, November 7th and 8th, 2012, in Tampa, FL at the Renaissance Hotel. The cost of the event is typically $1,995, but through my relationship with these two organizations I am able to get my subscribers in for just $895. This includes the symposium, the options training, breakfast and lunch on both days, as well as a cocktail hour. Harry Dent will be on hand Wednesday afternoon and I understand he also sticks around to share a drink. So come to learn as well as share stories and ideas with Harry and me.

To register for the event, click on this link http://www.hsdent.com/madhedge_demospecial.pdf

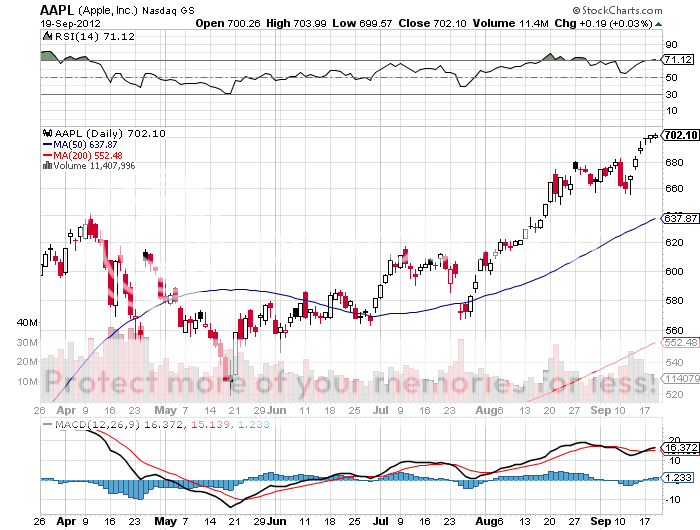

I went into my local Apple store last week to buy an iPhone 5 to replace my aging iPhone 4s. The sales girl looked at me like I was out of my mind. She gave me a website address where I could pre-order and said good luck. I found out later that the company sold a stunning 2 million units in pre-orders in 24 hours. That?s nearly a billion dollars in revenue. Wow!

I went back into the store yesterday and talked to the manager. I asked when iPhones would be physically available in the store. He said this Friday, but there will be lines around the block. I asked when I could just come in and just buy one without a long wait. He answered mid-week in the afternoon sometime at the end of October. Double wow! It is clear to me that the only limitation on the sales of this incredible product for the rest of the year is the number of units they can physically get out the door.

The stock is now up 75% year-to-date. Any money manager found missing Apple from their portfolio at year end will get fired. So a gigantic performance chase has begun, with thousands of institutions throwing in the towel and paying up at these lofty levels just to get the name on their books.

The truly bizarre thing is that the higher Apple shares go, the cheaper they get on an earnings multiple basis, because the market can?t keep up with surging profit growth. This is proof, yet again, that if you live long enough, you get to see everything.

There is one stock that is certainly not going to announce an earnings disappointment in the coming quarterly cycle, and that is Apple. The roll out of the iPhone 5 is occurring much faster than previous models. It will be offered for sale in 100 countries by yearend compared to only 53 for the iPhone 4s during the same period.

So unit sales could reach 8 million by the end of Q3 and a staggering 50 million by Q4. This will create an unprecedented surge in Apple?s reported quarterly earnings. Those waiting to buy on the next big dip could end up missing one of the most impressive multi-decade growth stories in history.

CEO Tim Cook is not finished with us with the iPhone 5 launch. My sources in the company tell me that other generational changing products will be released in the months to come which could trigger another leg up in the stock. I think it is possible for the share price to tack on another $100 by year end.

For additional research on why you should buy shares in this amazing company, please go to my website at www.madhedgefundtrader.com and do a search for ?Apple?. There you will find a zillion pieces begging you to buy the stock from $250 on up. Last week, I raised my final target for the shares to $1,600, which we could see in a couple of years. I will continue to drink from this well as long as the water is fresh and sweet.

Last week Apple?s legendary product designer, Sir Johnny Ive, bought a $17 million, 7,279 square foot mansion on San Francisco?s tony Gold Coast in Pacific Heights, an abode first built by a famous gold miner. He?s the guy who came up with the look of the iPhone, iPad, and iPhone to Steve?s Jobs? exacting standards. I want a piece of that action.

Johnny's New Kitchen

?The reality is that the iPhone 5 is going to do more for the economy than QE3,? said Kevin Warsh, a former Federal Reserve governor.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Since Ben Bernanke?s announcement of QE3 last week, new forecasts for gold have been popping up like acne at a high school prom. They range from the conservative to the absurd, from $1,900 to $55,000. But they all have one thing in common: higher. Before you head down to the local coin store to load up on bags of one ounce American gold eagles, let me go through the simplest of the many bull arguments.

The most positive interpretation of QE3 is that it will expand the Federal Reserve?s balance sheet from $2.7 trillion to $5 trillion over the next two years. This is up from only $800 billion in 2008. QE1&2 took the Fed balance sheet up by $2 trillion, but the money supply (M0) increased by only $300 billion. Where did the rest of the money go?

The answer is that it went into the reserves of private banks, where it still sits today. When these funds are released, everyone will rush out and buy stuff, and the inflationary implications will be awesome. This is bad news for the dollar. As gold is priced in dollars, it will be the first to feel the impact. Witness the 18% rise we have seen off of the July bottom.

How far does it have to run? The correlation between the price of gold and the broader money supply M1, a measure of the currency in circulation plus demand deposits or checking account balances at banks, is almost 1:1. In 2008, M1 doubled from $800 billion to $1.6 trillion, and so did the yellow metal, from $500 to $1,000. The Fed?s balance sheet is roughly equivalent to M1. So a near doubling of the balance sheet to $5 trillion should take gold up a similar amount. Using $1,720 as the base level before the Fed?s announcement, that takes the barbarous relic up to $3,440 over the next two years.

Spoiler alert! Gold tends to front run the growth of M1. So while we may see a disciplined straight-line rise in the Fed balance sheet as it diligently buys $40 billion a month in mortgage-backed securities, gold won?t be so patient. It could go parabolic at any time. My first target: the old inflation adjusted high of $2,300, which we could see some time in 2013.

The instruments to entertain here are the gold ETF?s (GLD) and (IAU), gold miners like Barrick Gold (ABX), and the gold miners ETF (GDX). If you are hyper aggressive, you might look into 100 ounce gold futures contracts traded on the COMEX. They offer leverage of 19:1, with an initial margin requirement of $9,113. ?If my $3,440 target is achieved, the value of one contract would rocket to $166,800, an increase of 17,300%. But this is only for those who wish to play at the deep end of the pool and are authorized for futures trading.

And then there are those one-ounce American gold eagles, now retailing for $2,300.

Growth of M1 to 2014

One Ounce American Gold Eagle

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.