An Easy Way to Militarize Your Tech Portfolio

With funding from the CIA’s non-profit venture capital arm In-Q-Tel, Palantir (PLTR) is named after mystical orbs in J.R.R. Tolkien’s “The Lord of the Rings” universe that can see both the past and present and allow users to communicate over vast distances.

Palantir is effectively a secretive big-data firm co-founded by billionaire venture capitalist Peter Thiel that will make its stock market debut via a direct listing on Sept. 30 with a valuation of $22 billion.

It’s the gold standard of data mining stocks and I recommend investors consider buying and holding if you’re currently eyeing new opportunities.

The foundations beneath it could not be more rock solid with the CIA affording the company major access to recurring government revenue.

Not even a pandemic would be able to knock off this business model from the perch it sits on.

Up until now, what Palantir does and how it uses its troves of data is somewhat lost to all but the industry analysts and government officials, but that is all about to change with quarterly earnings reports.

In a nutshell, Palantir provides customized software to clients analyzing large tranches of data for reasons ranging from finding suspected criminals to improving companies’ manufacturing capabilities.

Summarizing their strategic operational zone even further, Palantir’s data platform is the go-to platform for U.S. intelligence agencies.

In the media, they have attracted significant controversy due to its work with government agencies, including Immigration and Customs Enforcement (ICE).

Palantir has yet to spin a profit, losing $580 million in 2018 and $579 million in 2019, but does that even matter when their products are so deeply embedded in the U.S. intelligence agencies’ everyday work?

As long as they are trending towards margin improvement, investors are most likely willing to give them a free pass.

Palantir's claim to fame is that its technology reportedly helped locate Osama bin Laden while zeroing in on terrorists in Afghanistan and Iraq.

The company acknowledges that government customers use its technology to kill people so investors not comfortable with the deeper meaning behind the technology should avoid this one and go with the softball versions of big tech.

Palantir gets both criticism and praise for the powerful nature of its data analytics software. For example, critics allege Palantir's profiling tools used by intelligence and immigration agencies sometimes operate under a cloak of secrecy with zero oversight.

Palantir’s tools are not just for killing bad guys, they have also signed up companies from sectors that include healthcare, energy, and manufacturing.

Another noteworthy development is the stranglehold on company decisions that the co-creators will have no matter what.

The Palantir IPO established three classes of stock, meaning the stock structure guarantees control of the company stays in the hands of creators Thiel, Karp, and Cohen.

The company’s financials are still behaving like a growth asset leading up to the IPO.

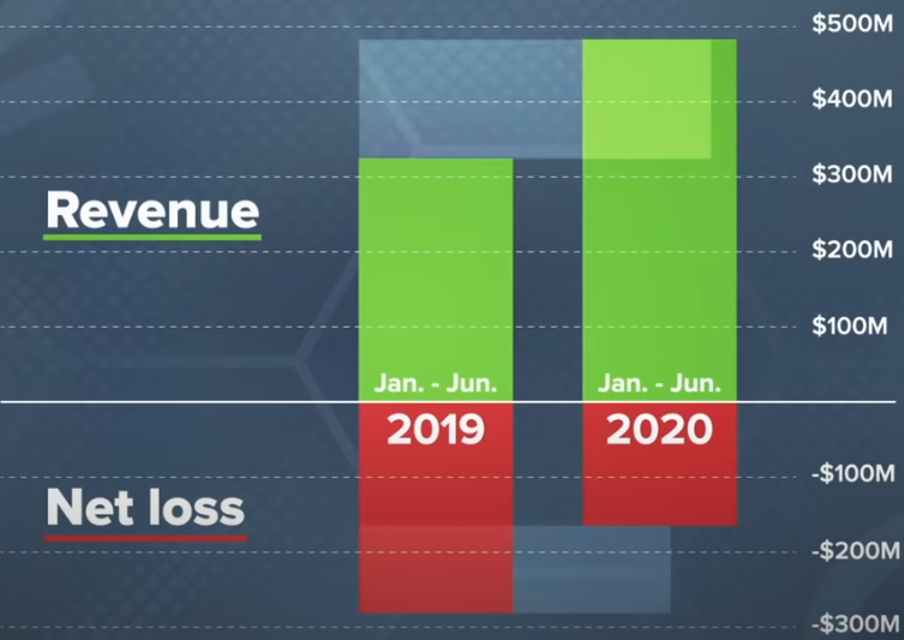

For the first half of 2020, Palantir reported revenue of $481.2 million, up 49% from a year ago. Also, it reported a net loss of $164.7 million, vs. a loss of $280.5 million year-over-year.

Palantir expects revenue to rise by about 47%, to around $278 million to $280 million for the rest of the year. For 2020, it expects revenue of about $1 billion, up 42%.

Palantir has two main services that analyze data: Palantir Gotham and Palantir Foundry.

A customized option, Palantir Gotham is used by companies, government agencies, and law enforcement to combine information to decipher previously unseen patterns and identify relationships between sets of data ranging from social media posts and addresses to license plate numbers and personal relationships.

The algorithm then summarizes content together to make broader conclusions from the data.

Meanwhile, Foundry is a ready-made solution focusing on clients ranging from pharmaceutical and automotive businesses to aviation companies like Airbus and is meant to cut down on the costs associated with Gotham, such as the need for multiple on-site engineers.

Who is the CEO?

Alex Karp.

A graduate of Stanford Law School.

Karp has been explicit in his belief for the need for Silicon Valley companies to work with the U.S. government and law enforcement agencies precisely because they are American companies.

Palantir refers to effective applications of its software such as combatting Ponzi conman Bernie Madoff to disaster recovery to thwarting cyberattacks and fighting child exploitation.

Not only that, Palantir’s software was deployed in the aftermath of Hurricane Florence in 2018 alongside Team Rubicon, an organization of military veterans that responds to disaster areas. With Palantir’s Gotham Operations module, the group identified and responded to neighborhoods in the greatest need of assistance.

Palantir also assisted the Center for Public Integrity and Georgetown University’s Journalism Program for an investigation into the death of Wall Street Journal reporter Daniel Pearl by militants in Pakistan in 2007.

The company says the software helped identify 27 individuals who took part in the kidnapping and killing of Pearl, tracking relationships and offering answers to questions surrounding his death.

How does the software directly help real-time U.S. soldiers in the field?

The firm also claims its software helped the U.S. military track insurgents in Afghanistan planting improvised explosive devices (IEDs) by finding correlations between weather patterns, command wire IED attacks, and biometric information found on explosive devices.

Palantir has also sold its software to the Salt Lake City Police Department, helping officers reduce the time it takes to perform complex investigations by 95%.

Predictive policing models that base conclusions on historical data can sometimes not work, meaning that there is the chance of a slipup or wrongfully identifying a problem that isn’t a problem.

Reading about Palantir’s business model, it’s easy to see how they could put themselves in a political mess with the software being used to “find people in the U.S. who are undocumented.”

Granted, this tech company is not for everyone which is why many global brands such as Hershey’s, Coca-Cola, Home Depot, and American Express have terminated relationships.

Lastly, there is word that their services are not exactly cheap, but that is the cost of doing business in 2020 where data analysis is the new oil.

With a roadmap of constant 40% revenue growth for the foreseeable future and a death grip on recurring revenue provided by the CIA, it’s hard to ignore the robustness of their plan moving forward.

If you thoroughly believe in the U.S. military and are okay supporting a data firm that offers software services to it, then I would suggest buying every dip in Palantir from now to eternity.

There are worse investments out there.