Renomination Boosts Big Tech

U.S. President Joe Biden is doing all he can do to make sure that the US Central Bank stays accommodative to big tech investors.

He let the doves back in the driving seat which is highly positive for corporate America and terrible for penny-pinching savers.

Biden’s decision to re-elect incumbent Fed Chair Jerome Powell was cheered by the market locking in his ultra-low interest rate policies for yet another term.

Even more brazen was the appointment of Vice Chair, an even more pronounced dove Dr. Lael Brainard.

The second in command often helps signal Fed policy and gives it a dovish twist and clears the way for all systems go in 2022.

Any inclination that interest rates would rise faster than expected is now a non-starter, and the Fed will push its "lower for longer" mantra in the face of surging inflation for as long as they can make excuses for it.

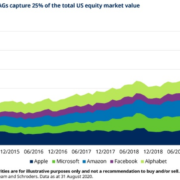

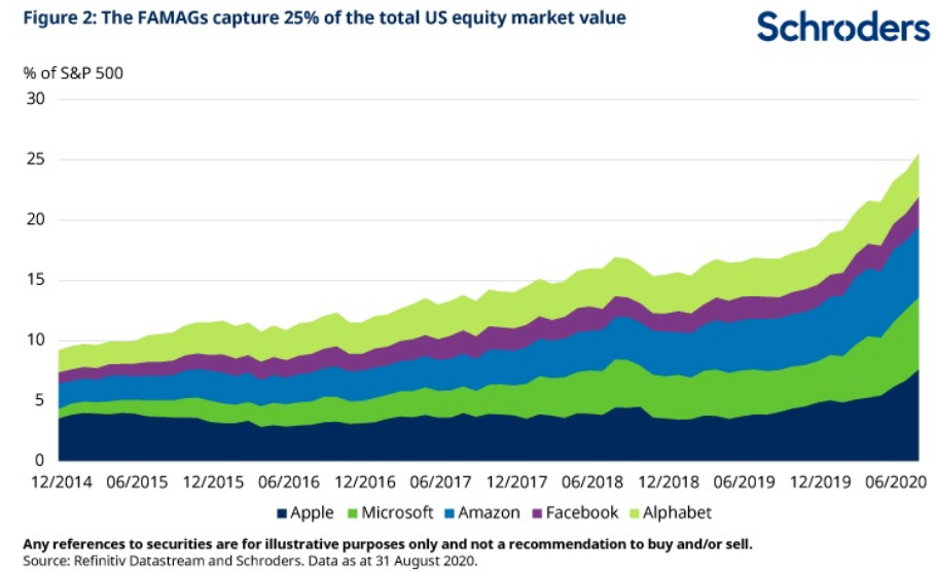

Ostensibly, the path of easiest conjecture leads me to say that the five biggest stocks in the S&P 500 – Facebook, Apple, Amazon, Microsoft, and Google, which are around 30% of the market and growing, will do well in 2022.

Long-term, they have comprised an average of about 14% of the entire stock market, and 2022 should be the year they knock on the 35% threshold.

This essentially means that the stock market is techs to win or lose and everyone else is just a footnote.

And yeah I know…it’s been like that for quite a while now; but it’s more prevalent than ever.

We are rolling into a year where big tech will weaponize their cash horde to issue low-interest corporate bonds of their own company debt and then spin those cash harvests into higher rate corporate bonds that cheapen their cost of doing business because they pocket the higher interest payments as profits.

Industry leaders are able to borrow more cheaply and in greater quantities, and the size of their balance sheets also offers incredible optionality.

This also means they can buy back more shares and also leverage up their balance sheets.

Preferential access to cheap money also cheapens the process of expansion, or in buying rivals, more easily. In effect, lower rates give leading companies an unfair set of tools to accelerate their dominance and which no regulator dares to prevent.

What does this mean in practice for investors? If falling rates have spiced up valuations of the biggest tech stocks on the way up, it implies they may struggle if rates rise, particularly as this would mean investors place less of a premium on future earnings.

But since the expectations are lower for longer, the market will be comfortable with the nominal rate even in the face of surging inflation, meaning it’s a net positive for tech stocks in 2022.

Powell and Baird will move as slow as needed and anything faster than that will shock the tech market and we will get a 5% drop which will be a golden buying opportunity.

I have read many experts’ take on tech preaching that regulation is here and coming fast to take down big tech.

However, I am in the camp that Congress will do hardly anything, and any investigation will end with a slap on the wrist which is fine.

I don’t subscribe to this ridiculous idea that superstars eventually tend to fall to earth.

I believe the current climate has set up big tech to gain an even bigger market share, crush the little guy faster, and trigger EPS to grow uncontrollably.

That’s what I am seeing on the ground with my own eyes, as opposed to baseless claims that big tech will revert back to the mean.

This sets the stage for big tech to benefit from such elevated rates of profitability next year, they will be happy to overpay for smaller companies to whom they will give an ultimatum to either sell up or get killed by them.

Numerous signs point to a devastatingly profitable and comically successful 2022 for the most recognizable and biggest tech firms who will refine their tech and harness their balance sheets in a systematically lethal way.

Unprofitable startups have a mountain climb as it relates to competing in their industries and they can thank President Joe Biden for that; they will be unduly penalized as a group that will result in lower share prices that force them to crawl on their knees to venture capitalists for capital injections.