?Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful.?

That is one of my favorite quotes from Oracle of Omaha, Warren Buffet, and it was never more true than during the past 30 trading days.

It turns out that the lowest risk day to buy stocks in 2014 was October 15, when we saw a giant, capitulation, spike low in the S&P 500 (SPY) down to $182.

That was the most fearful day I can recall over the last three years. You wouldn?t believe how many people I begged not to sell out entire portfolios that day!

So where are we now with the markets? Go back to the beginning of that legendary quote, and the word ?fearful? really stands out.

That means traders are stuck right back in the uncomfortable position in which they have spent most of this year.

Do I try to play catch up here and chase the market for a few extra basis points of performance, even at the risk of enduring another calamitous selloff? Or do I sit here in cash and earn precisely zero and get fired at the end of the year?

It is a choice that would truly vex Salomon. But as a king, at least he had job security.

We are now entering the tag ends of 2014, with only 36 trading days left, including three half days. I think it is safe to say that the trends that have predominated since January 1 will continue. Expect markets to continue to over reward risk takers and over punish risk avoiders.

That means there are only three trades in the world to execute:

1) Buy the US Dollar

A yield advantage for the greenback is sucking in capital from all over the world. Concerns about principal risk is a further driver, creating a ?flight to safety? of prodigious proportions. Thanks to the collapse in energy prices and a ramp up in US domestic production, dollar outflows from America are at decade lows.

This can only mean that we are at the beginning of a multi year bull market in the buck. Sell short the Japanese yen (FXY) and the Euro (FXE), and buy the 2X short yen ETF (YCS), and the 2X short Euro ETF (EUO).

2) Buy US Stocks

The majority of US portfolio managers are still underweight stocks and are desperately trying to get in. Now that the 10% correction is finally behind us, they can afford the luxury of being more aggressive loading up on the dips.

The midterm elections, which saw the Republicans take control of the Senate with a seven seat gain, is a new turbocharger for equities. Congress is now seen as pro business. Since the stock market tripled and corporate profits rocketed with an anti business elected body, imagine how well they will do with a friendly one!

I was hoping for the Senate results to get tied up in runoffs and the courts for a couple of months, triggering a 5% market correction and an opportunity to load the boat once more. It was not to be. What is left for us now is to see the (SPX) grind up to close the year at a 2100 all time high.

Who will be the sector leaders? The usual suspects who have led the charge all year, technology, health care, and financials.

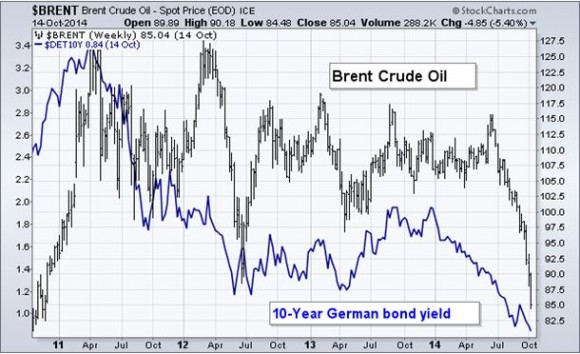

3) Sell Short All Commodities

It is truly impressive to see the entire commodity space collapse all at the same time. This includes oil, natural gas, gold, silver, copper, corn, wheat, soybeans, and the commodity producing currencies of the Australian and Canadian dollars.

They have all been hard hit with a perfect storm; overwhelming supply of product, a strong dollar, and weak demand caused by a slowing global economy. The story is the same everywhere.

Commodity collapses always last longer and deeper than you imagine possible because you cannot turn off production by simply flipping a switch, as you can with the paper assets of stocks and bonds. Cutting off supplies means freezing capital spending worth hundreds of billions of dollars spread over decades, no easy task.

So, before you purchase a hard asset of any kind, lie down and take a long nap first. And please stop emailing me asking if this is the bottom for all of the above. It isn?t.

4) Sell All Bonds

There is a fourth secular trend that began exactly on October 15, right after the market opening. The ten year Treasury bond (TLT) hit a yield of 1.86%. This is a secondary low in yields, high in prices, after the 1.39% yield we saw in 2012. This means we are now two years into a 30-year bear market for all fixed income securities.

However, don?t expect a crash like we saw during the 1970?s, when yields soared up to 13%. Expect a slow grind up in interest rates, often spending 3-6 months in tedious, narrow, sleep inducing ranges.

This makes your entry points on the short side important. Only buy the short Treasury bond ETF (TBT) on substantial dips, lest hair starts growing on the position.

There is one other alternative if you have been following the Trade Alerts of the Mad Hedge Fund Trader all year.

Quit trading and take the rest of the year off. Start your Christmas shopping early. Contribute to retail sales and the national GDP. You earned it. The 42% profit you have earned so far is of heroic proportions.

Let?s hope for more of the same in 2015!