The Race to the Bottom

Gone are the days of brokers shouting from the trading pits, a bygone era where pimple-faced traders cut their teeth rubbing shoulders with the journeymen of yore.

The stock brokerage industry is at an inflection point, with the revolutionary online stock brokerage Robinhood shaking up an industry that has needed shaking up for years.

A common thread revisited by this newsletter is the phenomenon of broker apps being low-quality tech.

A broker ultimately serves little or no value to the real players among the deal, usually extracting huge commissions.

Technology and now blockchain technology vie to completely remove this exorbitant layer from the business process.

Well, for the stock brokerage industry, that time is now.

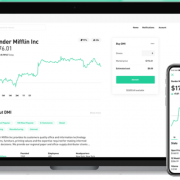

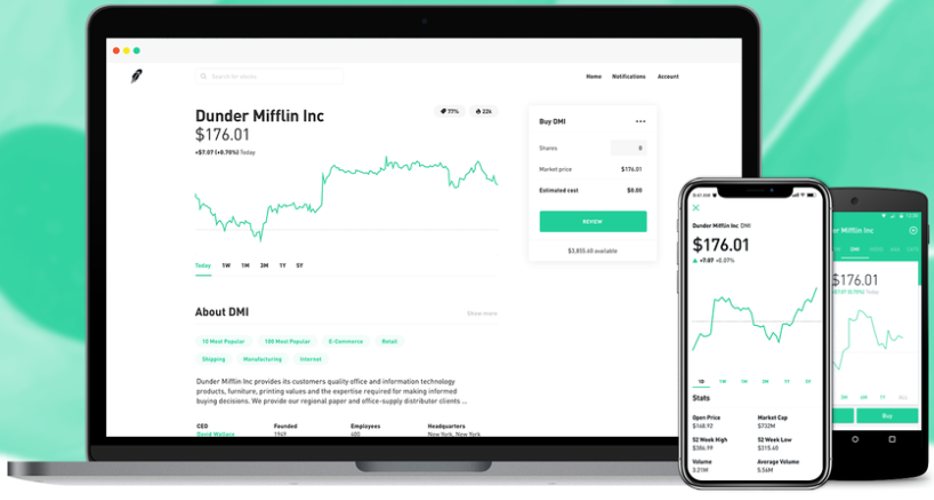

Robinhood is an online stock brokerage company based in Menlo Park, Calif., trading an assortment of asset classes including equities, options, and cryptocurrencies.

So, what's the catch?

Robinhood does not charge commission and they single-handedly broke the internet broker model with this move.

That's right, you can invest up until the $500,000 threshold protected by the Securities Investor Protection Corporation (SIPC) and you can go along with your merry day trading for free.

The online brokerage industry has been getting away with murder for years.

They got comfortable and stopped innovating - the death knell of any company in 2020 and even more so because of the global health crisis.

Effectively, high execution costs reaping massive profits were the norm for brokers, and nobody questioned this philosophy until Robinhood exposed the ugly truth - unreasonably high rates.

Peeking at a monthly chart of brokerage costs will make your stomach churn.

For instance, a trader frequently executing trades with an account of $100,000 would hand over $1836 in commission in 2017 if their account was with Fidelity.

On the cheaper side, Interactive Brokers would charge $854 for its brokerage services to habitual traders per month.

These two internet brokers have finally bitten the bullet and slashed fees on equities and ETFs down to 0.

The outlier was Tradier, a start-up brokerage founded in 2014 using the powerful tool of an Application Programming Interface (API) which charged $213 per month to trade frequently.

An API is described as a software intermediary allowing two applications to communicate with each other.

This model helped cut costs for the online brokerage because Tradier did not have to focus its funds on the trading platform that was delegated to various third-party platforms.

Tradier is largely responsible for the aggregation of data and charts thus employing an army of developers to meet their end of the business.

This model is truly the democratization of the online brokerage industry, which has been coming for years.

Costs were cut to a minimum with equity trades at Tradier costing investors $3.49 per order and options contracts costing $0.35 per contract with a $9 options assignment and exercise fee.

Now Tradier has done the full monty by going to $0 commissions on stock and ETF executions

Technology has defeated the traditionalist again.

More than 80% of Robinhood's accounts are owned by millennials – as expected.

Trading cryptocurrencies acts as a gateway asset to springboard into other asset classes such as equities and derivative contracts.

Vlad Tenev, co-CEO of Robinhood, indicated that Robinhood will have to modify its radical business model to monetize more of the business in the future, but he is comfortable with the current business model for the time being.

But Tenev has already seen fruit borne with the likes of Robinhood applying fierce pressure to the legacy brokerages' pricing models.

The traditionalists are locked in a vicious pricing war with each other slashing their commission rates to stay competitive.

It was only in 2018 when Charles Schwab (SCHW) felt it necessary to charge $4.95, down from the January 2017 cost of $8.95, and now they have gone down to zero in 2020 along with the rest of the pack.

Charles Schwab has more than 10 million accounts, only double the number of Robinhood, after being founded in 1971.

The 42-year head start over Robinhood has not produced the desired effect, and it is ill-prepared to battle these tech companies that enter the fray.

Robinhood has been able to add a million new accounts per year. If Charles Schwab relatively performed at the same rate, it would have 60 million accounts open today.

It doesn't and that is a problem because the company can be caught up to.

The age of specialization is upon us with full force, and customer demand requires care and diligence that never existed before which will set up a massive wave of consolidation in the industry.

It’s never been better to be a trader.

Sign me up!