September 15, 2011 - Selling Oil Again for a Hedge

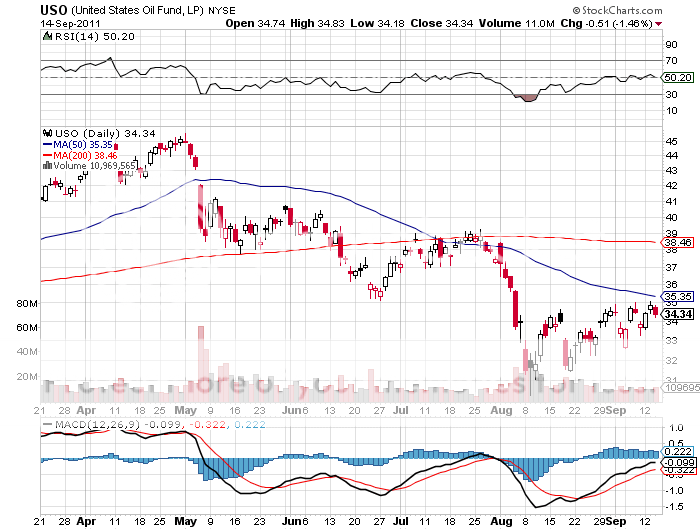

Featured Trades: (SELLING OIL AGAIN FOR A HEDGE), (USO)

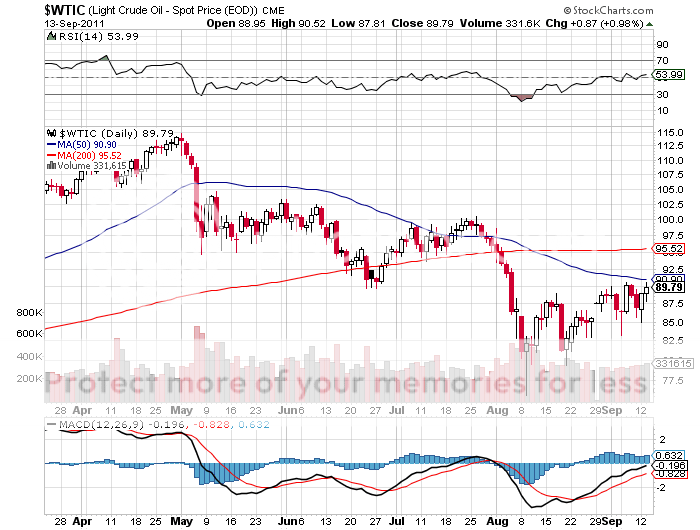

2) Selling Oil Again for a Hedge. With oil having bounced $5.50 over the last couple of days, I am going to flip back to the short side for several reasons, not all of which have to do with Texas tea.

The trigger was oil's failure to rally in the wake of a surprisingly large draw down in inventories this week, some 6.7 million barrels. This comes off the back of a large build in gasoline inventories of 2 million barrels, which has been a great leading indicator for crude.

For a start, I have run out of 'RISK OFF' positions, having covered them all during the last big dip in risk assets, quite profitably I might add. We have seen a nice rallyette in the (TBT), and I want to hedge these gains by going short oil. The 'RISK OFF' (USO) puts can also be used to hedge any additional 'RISK ON' positions I may want to add in the near future.

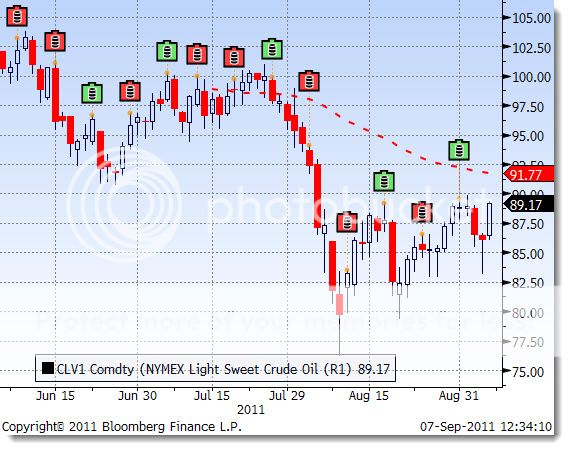

Finally, this is just an outright punt. Looking at the charts, we are clearly at the upper end of a rising channel. There should be a chance to capture a $3-$4 break in oil, even if we continue in the uptrend. This could be worth a quickie 50% gain in the puts. This is a flyer I can afford to take, as my book is now small, and I am up 37% year to date. If it doesn't work, I can always stop out when oil hits $93. Notice, also, that I am rolling out to the November expiration on this trade to duck the accelerated time decay.

It gives us some downside participation if the financial markets choose to have one more puke-out before the fall rally begins. It is also a great put on the next bombshell coming out of Europe, which could occur as early as this weekend.

-

-

-

Is There One More Puke Out Left in the Markets?