September 21, 2009

September 21, 2009

Featured Trades: (EQUINOX), (INDIA),

($BSE), (HOG), (EPI), (PIN), (GENERAL MOTORS)

1) The autumnal equinox is tomorrow. That is the day when the sun crosses the equator headed South, and daylight equals darkness. I know this because I am so old that celestial navigation with a sextant was a requirement to get a commercial pilot?s license. That means that I can shoot an angle off of the North Star and tell you your latitude, the same method used by Christopher Columbus to first cross the Atlantic. Now that?s old! Moving on to navigation of the financial sort, many long in the tooth, grizzled old veterans insist the movement of the sun, moon, and stars, as well as sun spots, have a major impact on the markets. History is certainly replete with financial disasters this time of year, most recently in 2008 when Lehman went under, almost dragging the entire banking system with it. These were easily explainable a century ago when 50% of our GDP came from agriculture, and the harvesting of the fall crop placed huge trains on a then nascent financial system. But today, less than 2% of the economy comes from Green Acres. So maybe history is not repeating itself, but rhyming, or reverberating. Certainly everything good, from currencies and commodities, to energy, emerging markets, and private and public debt, need a rest and are overdue for a pull back. The short term risk/reward for everything is not good here. Watch the run up to end Q3, when the fireworks may begin.

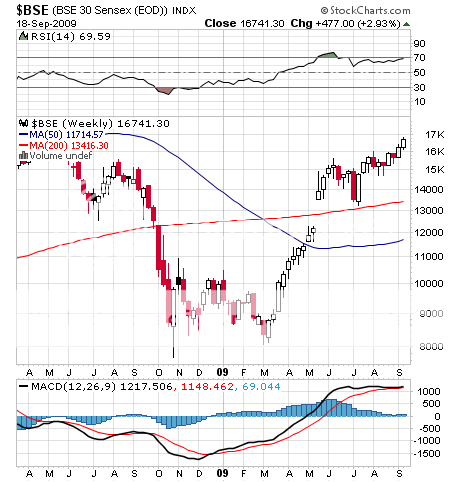

2) India has been one of my stellar picks this year, the ?I? in BRIC, rocketing 112% from the March lows (click here for my initial report ).? Although it appears overheated for the short term, I believe it has much further to run over the long haul. You want to buy countries that have yet to build infrastructure and a middle class, and China has already done that. India?s per capita GDP came in at a sparse $1,016 last year, compared to $6,100 for the Middle Kingdom. China?s economy today is about on the same level that Japan experienced during the late fifties, while India is still in the late twenties, with large parts effectively mired in the 16th century. India?s recent election of a more pro-business government was the trigger for improved growth, which is expected to exceed 6% for the rest of the year. India?s economy is entirely domestic, and is so far outside the world economic system that the global financial crisis was barely felt there. While we were melting down with a minus 6% GDP rate, India continued to bask in a plus 5.8% growth rate. No subprime debt, toxic portfolios, foreclosure crisis, government bailouts, or AIG, GM, or Chrysler. With 1.2 billion consumers, some 70% of GDP there accounted for by consumer spending, so retail figures large in the country?s future. Even Harley Davidson (HOG) has big expansion plans in the world?s largest user of motorcycles.? For those of the ETF persuasion, look at Wisdom tree?s earnings based offering (EPI) or the one from PowerShares (PIN). Better start checking your share prices in rupees.

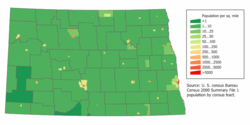

3) With the collapse in employment, it is all about ?location, location, location.? No surprise then that Michigan leads the country with a 15.2% jobless rate caused by the implosion of the auto industry. Detroit is suffering a horrific 17.3% rate. Nevada came next at 13.2%, blasted by both barrels of a shotgun by simultaneous layoffs in housing and hotels. Rhode Island at 12.8% took big hits in health care services and tourism. My home state of the ?Land of Fruits and Nuts,? California, now has a 12.2% jobless rate, the worst in 70 years. Housing was the grim reaper here, and now 20,000 teachers have started collecting unemployment checks, thanks to our bankrupt state government. Who has the lowest unemployment rate in the nation? Sunny North Dakota at 4.3 %, where healthy agriculture and energy industries kept people in work, and ranking 48th in population, have almost no people to fire anyway. It also helps that the ?Roughrider State? was completely bypassed by the subprime boom, and for many years was the cheapest place in the country in which to own a home. To get unemployment back to a normal 5% rate, Obama has to create 20 million jobs by the next election in 1012, one tall order.

?If you have been playing poker for a half an hour, and you don?t know who the patsy is, it?s you,? said Warren Buffet.