September 6, 2010 - Is the UNG Going Under?

Featured Trades: (NATURAL GAS), (UNG), (CHK), (DVN), (XTO)

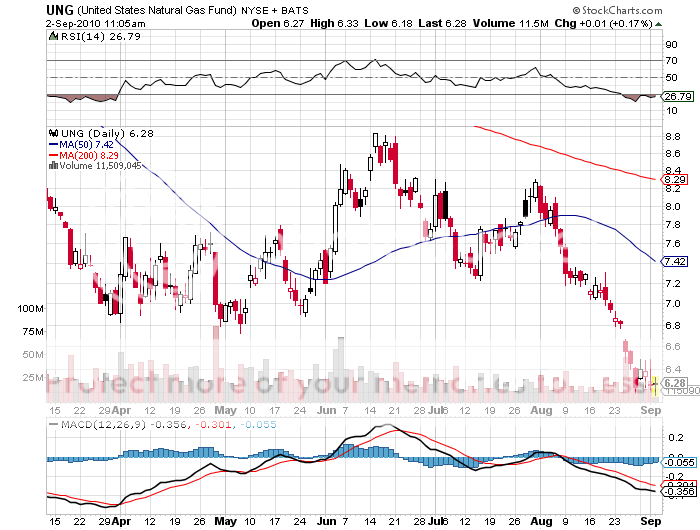

1) Is the UNG Going Under? The poster boy for everything that can go wrong with an ETF is undoubtedly the United States Natural Gas Fund (UNG). If you had studiously done all of your homework a year ago, and concluded that natural gas was severely oversold and about to go up 40%, you would have been dead right. If you then went out and bought the UNG you would have then lost 40%. You would think at first glance that this is a chart for an inverse gas ETF that would only profit from falling gas prices. However, such an instrument doesn't exist.

This dreadful state of affairs was brought about by the intricacies of contango, where far month contracts in the futures markets are trading at premiums to the front month. As each month expired, the managers of UNG bought fantastically rich forward contracts, and then rode them all the way down to spot, as they were mandated to do by their prospectus. They then repeated this exercise every month.

If the contango continues indefinitely, the UNG will eventually approach zero. Moral of the story: don't just punch in a symbol and hit enter. Read the damn prospectus first.

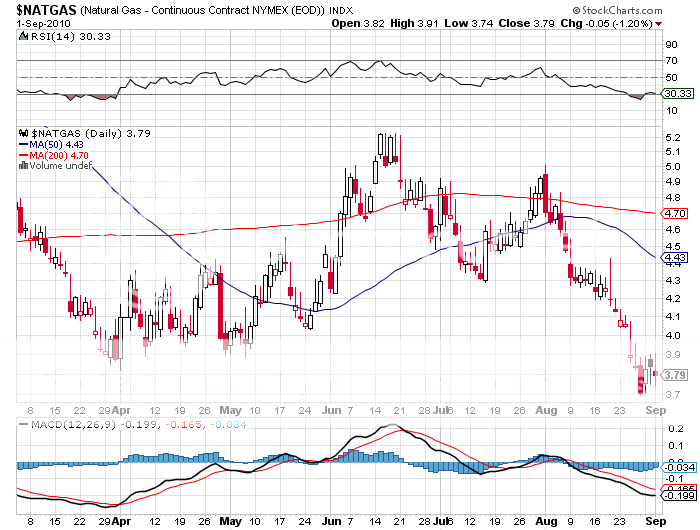

Since we are discussing CH4, I have to tell you that the outlook does not look great. We are just coming out of one of the hottest summers in history, and NG only managed a rally from the $4.30/MCF low to $5.00 . Gas in storage is about to rise again, and gas producers, like Chesapeake Energy (CHK), XTO Energy (XTO),? and Devon Energy (DVN), are racing to out-produce each other in the hope of offsetting falling prices with increased volumes. The price collapse is prompting a Darwinian consolidation of the entire industry. The spot price for NG has already suffered a free fall down to $3.70. It's sad to see such a great molecule fall on such hard times. Pitiful, really.

This is all happening thanks to the new miracle fracting technology, which has suddenly and unexpectedly been used to discover a 100 year supply of natural gas. The Marcellus shale in Pennsylvania, and other fields in Ohio, New York, and West Virginia could power the entire East Coast for decades. The Haynesville shale in Louisiana, Texas, and Arkansas could knock oil out of the box for power generation in the South. Huge fields in North Dakota are yet to be fully developed. All this makes the construction of a gas pipeline from Alaska pointless, once a pet project of former governor Sarah Palin.

It seems that now only need poke a straw in their backyard to obtain a lifetime supply of relatively clean burning energy. Gas majors are now jockeying to exploit untapped shale fields in Europe, with Poland and Germany leading the charge in deploying fracting technology. They must be sweating bullets in Qatar, which just invested $50 billion in facilities intended to export NG to the US and Europe. Looks like they'll have to flare it instead.

The problem is that ETF's have become a great money spinner for Wall Street, replacing earlier income generators, like CDO's, that died in the crash. By the beginning of this year, some 900 ETF's had been created worth $1trillion, generating massive management fees and trading commissions for the industry.

The big question is, when one of these marquee ETF's goes under, will it sour investors on the entire asset class? UNG has already cratered from $8.30 in July to $6.24 today, costing investors millions. Imagine how a leveraged ETF would have fared. Will this be the ETF that kills the goose that laid the golden egg?

Is Natural Gas Going to Burn Investors Once More?