Softbank's Epic Comeback

I haven’t touched on the Softbank Vision Fund since pre-pandemic times, but it is time to take a barometer of the state of their fund because they also represent a snapshot of the state of emerging technology.

The Fund reported a massive loss of $18 billion during the nadir of the tech correction in 2020, and its clout in the tech world fell by epic proportions to almost pariah status.

Those were perilous times for Softbank Founder and CEO Masayoshi Son who held the distinction of losing the most wealth in the world before making it all back.

The ensuing flood of liquidity, accessible at the tech lows, catapulted most of Softbank’s investments in the U.S. tech market and they recently reported the highest-ever profit for a Japanese company.

Softbank Group reported profits of $48 billion for the fourth quarter, while Softbank Vision Fund, which invests in startups, reported a profit of $37 billion.

After massive weakness in assets including Airbnb, Oyo, and WeWork, we saw the value in these startups dip to an all-time low, then they were essentially bailed out by the Fed.

During that recapitalization process, Softbank Vision Fund fired 10% of its employees to cut costs.

When you combine that with big up moves from South Korean e-commerce company Coupang (CPNG) and ride-hailing firm Grab planning to go public via an SPAC, betting all his chips in emerging tech was the right thing to do and Son was handsomely rewarded for this outsized risk.

Son is quite famous for some of his speculative energy that he has channeled towards China’s Alibaba (BABA) before Alibaba became famous.

More than a decade later, that investment is worth $130 billion, becoming one of the most successful startup bets in history. He then aggressively invested in several startups around the world, including Snapdeal, Oyo, Ola, and Paytm in India.

For as many lemons in his basket, he’s had his fair share of 10-baggers and 433-baggers like Alibaba that validated his aggressive tech strategy.

Son got into many investments before venture capitalists in tech started being copied around the world and before the Arab sovereign funds and Chinese could get their house in order to partake as well.

He wasn’t the first, but the first group mover advantage made these deals possible, and by borrowing heavily against his Softbank equity, he was able to bet the ranch on many emerging techs by acquiring the proper financing and leverage.

However, the Softbank Vision Fund is a harbinger for what’s to come in tech and Son laughing all the way to the bank could also be loosely translated as the low hanging fruit in tech and its harvest has been plucked dry.

Venture capitalists are having a harder time in 2021 finding those 433-baggers or even 3-baggers.

An ominous sign that bodes ill for emerging tech is the financing hawks that have started to highlight the extreme risks involved in investing big in little-known business models with the propensity to fail.

Credit Suisse (CS) has put Son recently on notice by dissolving a longstanding personal lending relationship as the bank clamps down on transactions with his company, according to regulatory filings and people familiar with the situation.

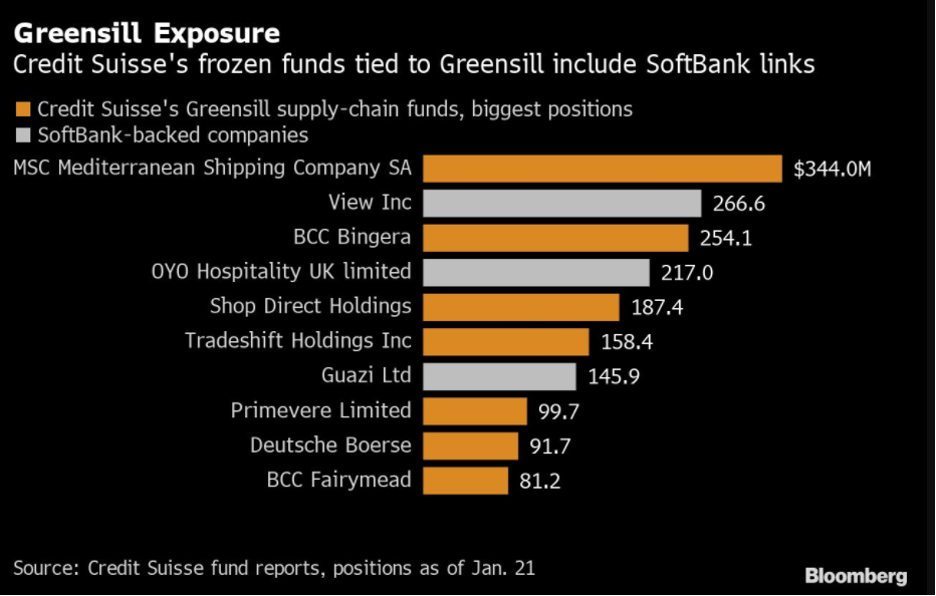

The moves came after the collapse of SoftBank-backed Greensill Capital that caused turmoil for Credit Suisse forcing them to book a massive loss.

That was on the heels of Credit Suisse’s $5.5 billion loss originating from trading by family office Archegos Capital Management.

The bank is now avoiding business with big tech investors who are likely to reach further up the risk barometer and inflict heavy damage.

Does this mean the era of subsidized tech business models is over?

No, but it will become more difficult to originate financing from traditional methods like European banks to invest in these types of exotic tech projects.

Mr. Son had long used Credit Suisse and other banks to borrow money against the value of his substantial holdings in SoftBank.

As recently as February, Mr. Son had around $3 billion of his shares in the company pledged as collateral with Credit Suisse, one of the biggest amounts of any bank, according to Japanese securities filings.

The share pledge loan relationship stretched back almost 20 years. By May, that lending had gone to zero.

Bloomberg News reported in May that Credit Suisse refuses to do any new business with SoftBank, but the silver lining is that Softbank has $48 billion in new profits to theoretically spin into some new projects it likes.

Of course, it’s always easier when you use other people’s money, but these are then new rules of the game.

Its bounty from the liquidity surge will help them advance into this new post-pandemic tech ecosystem with substantial gunpowder.

So I can’t say it’s been all bad for everyone at the individual level because this pandemic divided the masses into tech winners and losers.

Notice that many Bay Area tech investors were taking profits from the tech pandemic stock surge and rolled the capital into $3-5 million Lake Tahoe Mountain chalets as a summer house or dinner party house.

And if they didn’t do that, they were rolling these profits into Hawaiian beachfront properties with views of Diamond Head in Oahu or even dabbling in villas on the Kauai Island.

This could partially explain why Apple (AAPL) has gone sideways for the past 11 months.

This year has instigated a tech reset and in the short term, the Nasdaq has been overwhelmed by external headlines like of perceived inflation fears, chip shortage, and a built-in assumption that earnings will be perfect.

These sky-high earnings expectations have created a “buy the rumor and sell the news” type of price action with only a handful of companies able to top these insane expectations like Google (GOOGL).