How Softbank Got Globalization All Wrong

Softbank’s Vision Fund, a technology-biased venture capitalist fund, is basically a leveraged massive bet on synchronized bullish behavior on the future earnings of global tech companies.

It assumes that technology is one of the critical underpinnings to global business and it's more or less a wager on an increased rate of harmonic globalization.

I get what they are trying to do, but in 2021, globalization is far from harmonic, and there are many in the camp that the world is wrought by a current phase of deglobalization.

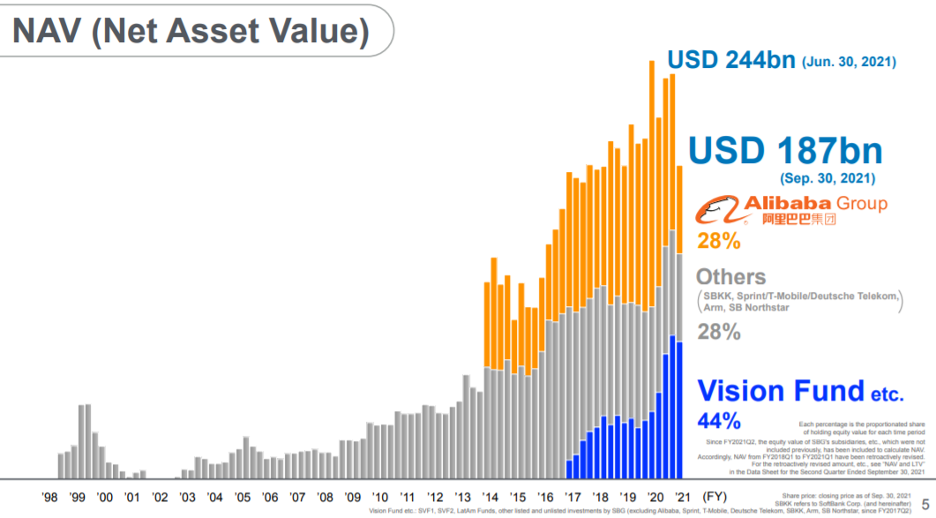

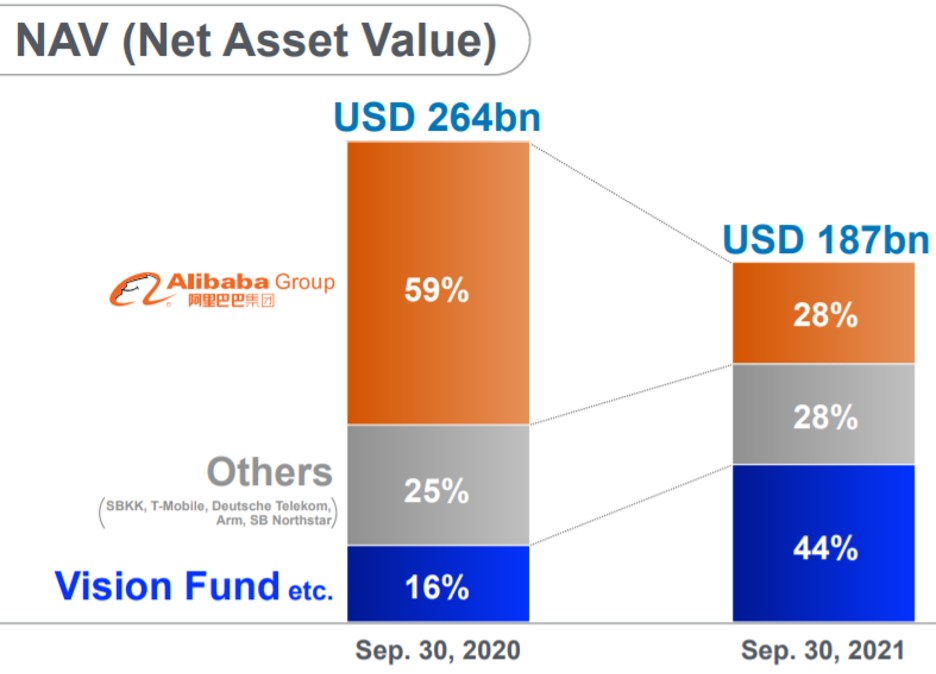

This past quarter, Softbank presided over a precipitous drop in the Net Asset Value of their technology investments from $244 billion to $187 billion.

The -24.6% return and the pain from it were mainly induced from Softbank’s vast array of Chinese investments specifically dreadful performance from its bellwether leader Alibaba (BABA) whose stock has halved since the crackdown started.

CEO of Softbank Masayoshi Son, an ethnic Korean with a Japanese passport, described its current predicament as being “right in the middle of a storm.”

The problem with that is not being in a storm per se, but the timeline into transitioning into sunnier climate because just 1-2 quarters out from now, prospects appear bleak.

If one might remember, DiDi Global Inc. (DIDI), the Chinese ride-sharing platform, was the big shebang going public at a valuation that pegged the company at $68 billion.

Since then, not much has gone right as it was later found out that (DIDI) went public without the tacit approval of the Chinese Communist Party.

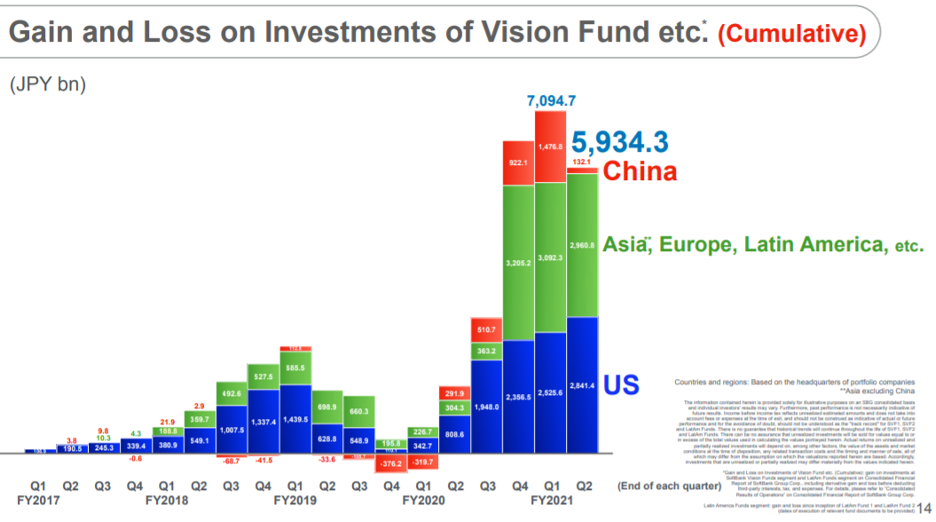

Falling out with the good graces of their overlords has meant a halving of the stock and Softbank has taken a loss of $6.1 billion on DiDi.

Even worse for the firm, there appears to be no savior or “next DiDi” IPO to save their Net Asset Value in the upcoming quarters.

That means we could be staring at the high-water mark which occurred 2 quarters ago.

Thank God for the outperformance in Europe and the United States that, in effect, accomplished some damage control for the bottom line.

And their recent short-term track record has been overwhelmingly poor.

Let’s take a glimpse into the other investments that have been chop blocked at the knees.

The losses keep rolling off the tongue with Uber-like trucking startup Full Truck Alliance Co. down $1.2 billion.

KE Holdings Inc., which runs the Beike online property service, lost $2.2 billion of value — the stock is down more than 70% from its peak and is trading below the IPO price.

And the failings weren’t just in China, take a stock that I have extensively bashed on — the biggest ecommerce company in South Kora — Coupang (CPANG).

Their poor past quarter’s performance meant that Softbank booked a quarter performance of a horrific -$6.7 billion.

I told readers to stay away from this one not because it is a bad company.

It was crystal clear in the underlying data that its business was saturated in Seoul, and there are no other big cities in South Korea, and I couldn’t see where the next phase of incremental growth would come from.

The idea was to grow abroad but everywhere else in Asia has been monopolized by local or brand-named ecommerce companies.

That was the bad news, and the silver lining is that ex-China, particularly the United States, they have been doing well and are highly profitable.

Slippage from this Vision Fund is quite notorious, from its misallocation of funds of shared office space company WeWork to overpaying for many other companies with a vanilla idea that technology will overcome any obstacle.

I would say that at a management level, not a lot is well thought out at Softbank.

I would like to remind readers that many of these new China investments by Softbank have just plain out ignored the geopolitical tensions.

They have nobody to blame but themselves because they certainly had time to divest from China and take profits which would have been the right move to do at that time.

Softbank’s parent company’s stock is basically half of what it was in March 2020 thanks to China and the Vision Fund will need to rely on its ex-China investments to pull itself out of this “storm.”

Another big plus is that the China losses are unrealized, but China has offered zero indication that their monumental crackdown on private business is over, and no amount of kowtowing will sway them from their lofty perch.

This could just be the start of their reign of terror over private business and that’s a scary thought right there.

Honestly, I opt for the more conservative stance of never buying Chinese stocks.

Why invest in Chinese tech when United States tech is so much better?

Not enough growth for you?

Then use options.

Softbank should and could have just poured all their investments into Silicon Valley, or just one company like Google, or even the digital gold of Bitcoin.

Good thing there is no ETF that tracks the performance of Softbank!

Invest at your own peril.