The Paper Regulator in Washington

It’s a misnomer that this proposed stock buyback tax has teeth.

It offers easy loopholes to make it largely ineffective.

If management is smart enough – it’ll be a 0.

This is more or less a slam dunk for tech firms.

The Federal government is already too cozy with big tech to actually do anything that harms them, otherwise they would have removed Section 230, the law that doesn’t make corporations liable for content posted on their platform, a long time ago.

In fact, I would argue that the stock buyback tax in its current form will be good for tech companies because it offers the veneer of regulation without actually regulating big tech.

I’m referring to the new 1% excise tax on share repurchases that went into effect on Jan. 1, 2023.

This tax has caused some concern in some corners of Wall Street, based on the notion that buybacks were the biggest tailwinds supporting the past decade’s bull market — and anything weakening that advantage could lead to lower valuations.

Even more anti-stock market is the possibility that Ukrainian Supporter Joe Biden wants to ratchet up and quadruple federal taxes on US buybacks to 4%.

It’s all bark and no bite for Biden as usual.

This proposal is considered dead on arrival in Congress so it is convenient to just throw it out there to sound like he’s actually regulating when this thing has no chance of passing into law.

Virtue signaling has been a popular behavioral trait for US politicians for quite some time now.

So what is the loophole?

Foundationally, the new excise tax — whether 1% or 4% — is applied to NET buybacks — the key word being NET.

These are repurchases in excess of how many shares the corporation may have issued.

As has been widely reported for years, the shares that many companies are buying back often are barely enough to compensate for the new shares they issue as part of their compensation to company executives and top talent.

As a result, net repurchases — on which the new tax will be levied — are extremely less than gross repurchases.

There is much irony in the excise tax’s application to net repurchases.

Close your eyes when talking about some tech companies like data company Palantir (PLTR) who issue new stock as if it is going out of fashion.

There is so much new gross stock issued at PLTR that the stock is constantly mired in single digits.

Much of the stock issuance in the past has been diverted to the founders and executive management like Alex Carp and Peter Thiel who use this financial engineering tactic as their personal piggy banks.

In fact, a buyback tax based on a low stock price will incentivize founders and upper management to issue loads of new stock to cash out since they will need a higher volume of nominal stock to achieve whatever nominal amount is desired.

This leads to a situation where the stock buyback tax for net repurchases will never be applicable and will effectively always be 0%.

It’s precisely when share repurchases equal share issuance that the tax would not apply and if there is ever a remote possibility of happening, I can easily see management issuing whatever amount of stock to make sure the stock buyback tax always stays at 0.

Yet, that’s not all, I believe the stock buyback tax will promote higher dividends.

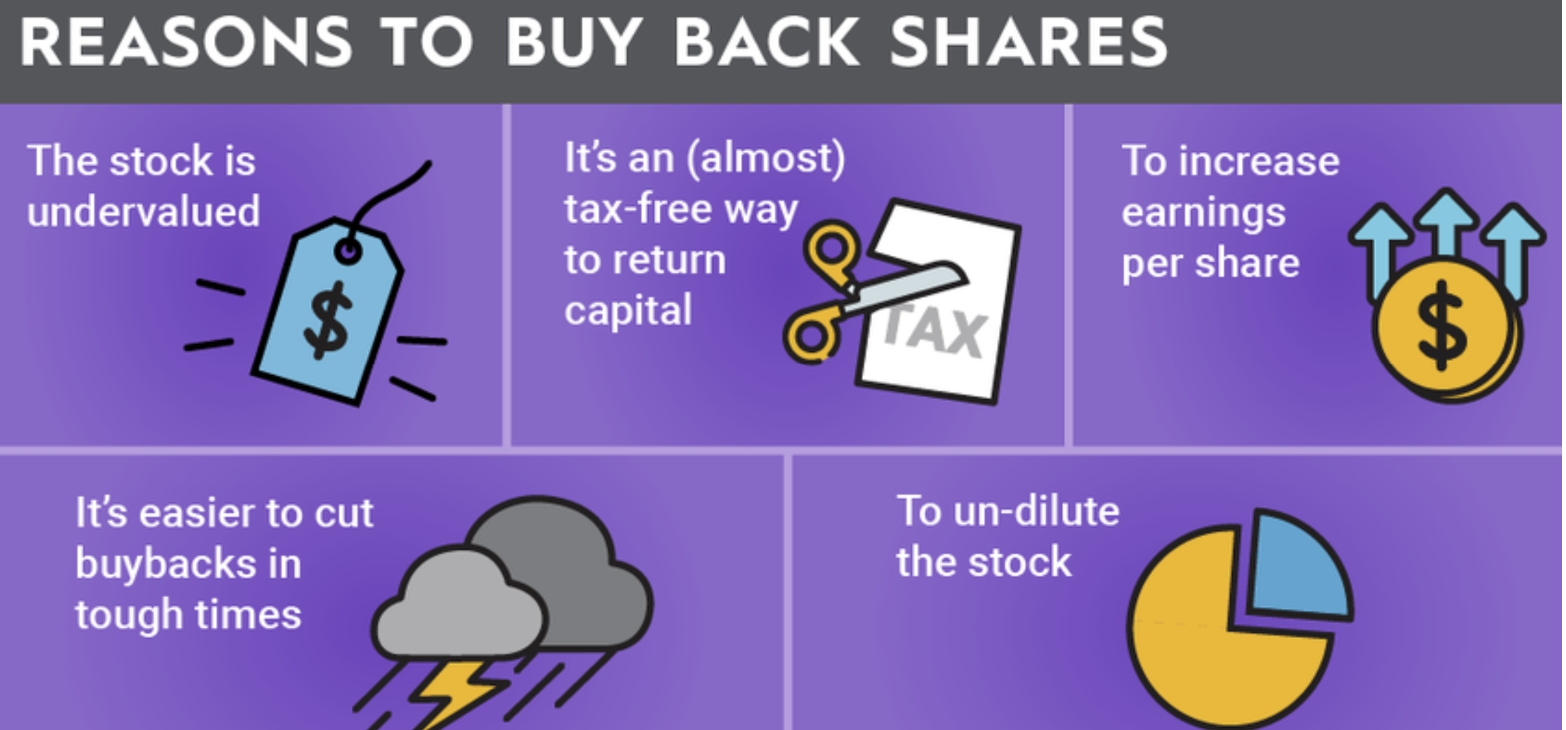

Up until now, the tax code provided an incentive for firms to repurchase shares rather than pay dividends when they wanted to return cash to shareholders.

Tech firms could absolutely return to delivering higher dividends to shareholders if share buybacks become too politically toxic.

This would be good news because, dollar for dollar, a higher dividend yield has more bullish consequences than a higher buyback yield.

In a largely copycat industry where if one strategy works, all notable companies pile into the same trend, we could see a renaissance of increasing dividend yields in tech companies.

Tech employees are also interested in these developments because many possess stock options.

The value of these stock options is tied to the price of the stock and recently, many of these employees are upset that once their stock options vest, they are cashing out with only half the amount compared to the peak of the Nasdaq index in November 2021.

Tech continues to be the least regulated industry in the US and as tech investors, let’s hope it stays that way.

This stock buyback tax plan has more holes in it than a piece of Swiss cheese, which is why it has done nothing to slow down share repurchases in the first 3 months of 2023.

It’s just more of the Federal government being a paper regulator and not a real one.