Students Poised to Dump on Tech Stocks

The straw that breaks the camel's back for not only the broader market, but tech stocks, could be the $2 trillion in student debt loans that could be canceled by U.S. President Joe Biden’s current administration.

About $1.6 trillion of the $2 trillion in loans that's owed to the U.S. federal government, as opposed to private loans, went into forbearance at the beginning of the pandemic.

The U.S. government already owes over $30 trillion in debt with another handout of $40 billion going to Ukraine yesterday and today another $100 million planned in weapons earmarked for Ukraine.

If we do a basic calculation, $2 trillion of possible forgiven student debt represents around 7% of total federal debt; and this will add additional pressure to the federal government, as they will absorb the debt and gaudy interest payments that will make their debt repayments even more arduous.

To be more precise, the federal government is about to give up $25 billion per year in interest payments from these loans, and that is $25 billion they won’t have to pay back of their own interest-based debt repayments.

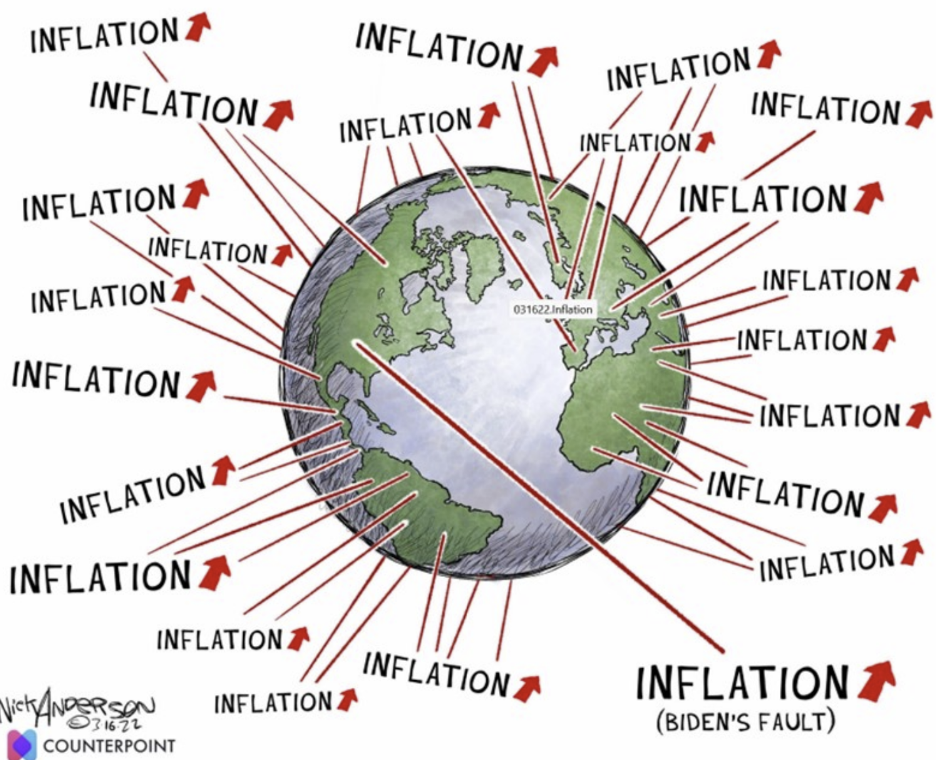

These current pro-inflation policies are on borrowed time for not only the people on the ground dealing with them, but some of these politicians.

Senator Mitt Romney and four Republican senators introduced the Student Loan Accountability Act, which would: prohibit the Biden administration from enacting wide-scale student loan cancellation to forgive all, or some, student loans for borrowers; and include exemptions for existing targeted federal student loan forgiveness, student loan cancellation, or student loan repayment programs, such as public service loan forgiveness and teacher loan forgiveness.

Desperate times make for desperate measures.

What does this mean for technology stocks?

In general, it means lower price per share.

Another explosion of high inflation would force the Fed to become even more hawkish about raising interest rates.

Although I don’t want to beat a dead horse, the macro elements have completely consumed everything and anything going on in risk markets.

It’s almost not about the tech stocks anymore, even though they are guiding weakly.

Much of the fallout stems from the extremity of the exogenous events as the world barrels towards a food shortage in 2023 because many countries have banned food exports and Ukrainian ports shut down.

Much like the price of Bitcoin, technology stocks don’t perform well in a hyperinflationary environment.

Money is allocated to other needs, which is why we saw BlackRock's $10 billion momentum ETF dumping technology for energy starting next week.

Energy stocks are not in a bubble compared to non-profit tech companies in a high inflation environment. You have to ask yourself: what companies benefit more from higher inflation prices? Definitely the energy sector.

Russia’s current account surplus more than tripled in the first four months of the year to $95.8 billion.

Last week, the International Energy Agency said Russian oil export revenue is up 50% since the start of 2022 with the Kremlin generating close to $20 billion per month in sales.

Additional incremental capital allocation pouring into energy sets the stage once the student debt gets canceled, this money will be used to pay for even higher energy prices which in turn be used to return to shareholders via buybacks and dividends.

Energy prices will certainly be higher since the current administration enacted price controls by The U.S. House passing a bill on Thursday that allows the U.S. president to issue an energy emergency declaration, making it unlawful for companies to excessively increase gasoline and home fuel prices.

This will destroy more supply as smaller gas companies shudder in fear of being prosecuted, leaving only the big players and decreased capacity.

The money saved on not paying student loans will not go into technology stocks in the short-term, especially since the rising rates put a cap on price appreciation.

We are in the midst of extreme shareholder capitalism in the United States, anyone who can double or triple prices can and will.

This means that every industry needs to package itself the shiniest to get a sliver of the incremental capital.

Technology stocks are failing at this, and it was only just recently they were considered the darlings of the economy.

The shelter-at-home economy is long gone and same for the revenue that was pulled forward with it.

Revenue is now being pushed further back and the tech industry is panicking under the new rules of the global economy.