Mad Hedge Technology Letter

May 10, 2018

Fiat Lux

Featured Trade:

(WHO'S TRYING TO BREAK INTO YOUR HOME NOW?),

(GRUB), (DPZ), (AMZN), (BABA), (YUM), (YELP), (MS)

Mad Hedge Technology Letter

May 10, 2018

Fiat Lux

Featured Trade:

(WHO'S TRYING TO BREAK INTO YOUR HOME NOW?),

(GRUB), (DPZ), (AMZN), (BABA), (YUM), (YELP), (MS)

Penetrating the home is the holy grail for tech companies, and soon the smart home will be full of gizmos and gadgets that will accompany Alexa.

Not so fast.

Before we enter the abode, there is a war taking place right before our eyes.

The last mile.

This industry focuses on monetizing the transportation route to people's doorsteps whether its food delivery, ride-shares, or a dog-walking app.

The intense obsession with this last mile stems from the shift in consumers' behavior because of online commerce.

People just aren't going out and buying stuff anymore like they used to do.

Particularly, Millennials have a pension for binge-watching Netflix while gorging on food deliveries.

In the current climate, brick-and-mortar's future prospects look bleak as foot traffic disappears and mega-malls shutter at an accelerating rate.

As a last resort, companies have no choice but to evolve, reinvent themselves, and execute a digital strategy based on fast fulfillment through a smartphone app to attract new transactions.

Enter the food delivery industry.

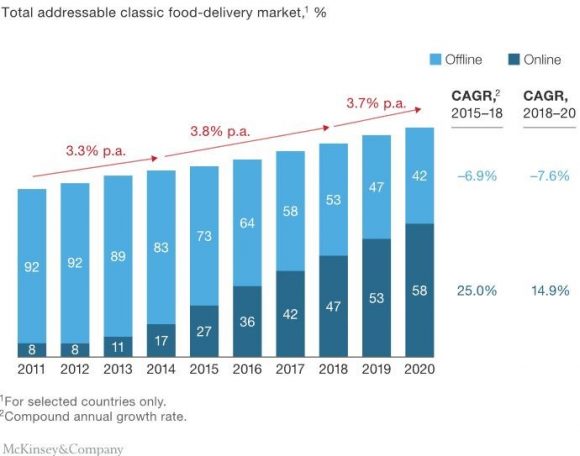

China's food delivery industry has matured faster than America's food delivery industry. And precious pearls of wisdom can be gleaned by the developments in China.

The Chinese food delivery industry is a $32 billion industry compared to a $5 billion industry in America.

Consolidation ran rampant in the early days while the migration to mobile was more pronounced in China. The multiple players burning cash faster than Elon Musk were subsidized by private funds.

Then Tencent and Alibaba (BABA) snapped up the last two remaining combatants resulting in a blossoming of a new duopoly.

Alibaba's Ele.me commands about half the market share in China while Tencent's Meituan-Dianping has a 43% share.

Meituan-Dianping is valued at $30 billion at the last stage of fundraising making it the fourth biggest unicorn in the world.

The food delivery industry could gradually mirror the situation in China, but America is still in its nascent stage, and the industry still offers viable growth chances for the participants.

The industry leader is Grubhub and it has been able to avoid the insane cash burn with which Chinese food deliverers grappled.

Shockingly, Grubhub turns a profit showing how last mile delivery in China has been reduced to a data grab.

The margins are juicier stateside.

On March 1, 2017, Grubhub's shares were trading at $33. Fast-forward to today and the shares are doing extraordinarily well, topping $102 giving investors more than a 300% return on capital in more than a year.

Grubhub was able to perform this feat in the face of harsh downgrades caused by Amazon's epic rise as the No. 4 player.

Numerous Amazon induced sell-offs could not hold back the stock with each stock dump being an attractive entry point.

Morgan Stanley's (MS) Brian Nowak went neutral on the stock in June 2017 and issued a price target between a range of $43 and $47 because of enhanced competition.

The analysts were all wrong again.

Grubhub has secured 34% of the market share followed by Uber Eats at 20% and Amazon at 11%. The third player was Eat24, which was recently acquired by Grubhub bolstering its market position an additional 16% to 50%.

The key metric for Grubhub is DAG - Daily Active Grubs.

This number was up 35% YOY to 437,000. Management has highlighted Tier 2 and Tier 3 cities as noticeable growth levers, and the Tier 1 cities such as New York and Chicago remain solid.

The rampant growth resulted in $233 million for the quarter, which is up 49% YOY. The integration of Eat24 will result in cost efficiencies and synergies across its operation.

Grubhub also entered into a partnership with online restaurant review platform Yelp (YELP) integrating the Grubhub platform onto the Yelp platform.

Actions speak volumes and aggressive tactics securing further market share gains are required to stave off Amazon whose rapid ascent has management's nerves hanging by a thread.

Despite being defensive in nature, the Yelp and Eat24 deals should give Grubhub a wider digital footprint stimulating business.

Grubhub also agreed to a deal with Yum! Brands (YUM) to lure premium restaurant assets such as KFC and Taco Bell into the Grubhub ecosphere.

The company has many irons in the fire and will not rest on its laurels.

After last quarter, Grubhub tallied up 15.1 million active diners, which is up 72% YOY. Annual guidance came in at between $930 million to $965 million.

To put the diminutive size in perspective, Grubhub liaises with 80,000 restaurants while Ele.me in China served 1.2 million restaurants.

Rough estimates show that 11% of Americans will use food delivery apps by 2020.

The nascent industry in America has a long runway ahead as the American consumer has been slower than the Chinese to adopt a thoroughly digital life.

This will all change.

Amazon is swiftly ramping up its food delivery business in conjunction with food ordering platform Olo based in New York. Outsourcing back-end support and partnering with Olo is a sign that Amazon sees this as a side job.

Amazon is still in the process of blending in Whole Foods within the existing framework of the company. Last mile food delivery is not a pure Amazon type of business.

Any potential business Amazon hopes to disrupt is leveraged by advantages in execution of volume (using state-of-the-art fulfillment centers) and low margins.

Thus, groceries fit these criteria to a T. However, value-added food meals delivered to the home cannot take advantage of the expensive fulfillment centers because the products' main point of transport is the restaurant's kitchen.

The analysts' bearish calls revolve around the grim margin prospects.

They could be correct, but the timing of the call is too early.

Yes, the opportunity to ruin margins is there for the taking in this industry.

Grubhub earned $99 million off of a miniscule $683 million of revenue in 2017, and technological innovations will devour margins to the bone.

After the mythical run-up in the face of the Amazon threat, the stock is expensive, but the company is still healthy and expects another record year.

Any sniff of margin headwinds will cripple the stock trajectory. It's not a matter of if but when.

Any big data play is ripe for competition because of the appreciation of the value of the data itself. Buy low and sell high.

At the height of competition in China, consumers were eating for free along with free deliveries because of the massive subsidies with companies seeking to gain market share any way possible.

Any similar repeat would put Grubhub's stock in the doldrums.

There are alternatives in the last mile food space.

Domino's Pizza (DPZ) is not a food delivery business nor is it a tech company.

However, it is a restaurant that fuels growth with one of the best digital strategies in the food business.

Domino's Pizza is an A.I. play.

The stock's epic rise is directly correlated with a smorgasbord of tech enhancements.

In 2014, Domino's launched DOM, a virtual ordering assistant created by A.I. voice recognition technology.

The heavy investments into the tech side have borne fruit with 65% of Domino's sales resulting from a myriad of digital platforms.

CEO J. Patrick Doyle has chimed in promulgating the desire for 100% digital sales.

Doyle believes voice is the future and implementing voice into Domino's structure will free up workers' time to focus on producing the pizzas instead of manning the phone lines thus reducing operating costs.

Domino's has been investing in its A.I. capabilities for the past five years and would be a better way to play the food space with a few extra degrees of separation with Amazon than Grubhub.

The digital strategy is about five years in, and during that time, Domino's has seen its stock rise from $46.57 to $245 today and most analysts attribute the success to its excellent digital strategy.

Would I take a flyer on Grubhub? Yes.

Would I rather buy Microsoft? Yes.

_________________________________________________________________________________________________

Quote of the Day

" 'User' is the word used by the computer professional when they mean 'idiot.' " - said Pulitzer Prize-winning American author Dave Barry.

Mad Hedge Technology Letter

May 9, 2018

Fiat Lux

Featured Trade:

(HERE'S THE TOP STOCK IN THE MARKET TO BUY TODAY),

(MSFT), (AMZN), (AAPL), (APTV), (QCOM), (FB)

When the CEO of Microsoft, Satya Nadella, sits down for a candid interview, I move mountains then cross heaven and hell to listen to him, and you should, too.

Microsoft is at the top of my list as a conviction buy.

Nadella is one of the great CEOs of our time and was able to complete Microsoft's makeover after Steve Ballmer's insipid tenure at the helm.

Microsoft's Build conference is the perfect platform for Nadella to share his wisdom about the company, industry, and changes going forward.

In an age where tech CEOs thrive off of smoke and mirrors, Nadella was succinct conveying the concept of trust as the secret sauce that will help tech's digital footprint expand into new territories.

Trust infused products through the cloud and A.I. will be the perfect archetype of future tech that will encourage accelerated adoption rates.

A.I. was the message of the day at the Build conference. Nadella used the term A.I. 14 times and the word cloud four times when interviewed.

It was fitting that Microsoft wowed the audience with a sparkly, new-fangled demo.

The demo put on by Microsoft in conjunction with Amazon's (AMZN) Alexa showed smart-assistants working in collaboration.

Microsoft showed how it is possible to use a PC Windows desktop to order an Uber car through Amazon's Alexa.

This technology is very powerful and is a work-around for the "walled garden" problem where big companies are closing off their systems only to proprietary software and products limiting upside potential.

The ability to collaborate with multiple A.I. smart systems will generate a whole new layer of business catering toward the communication and business developments among A.I. systems.

Nadella also offered extended examples of A.I. applications, for instance, the capability of detecting cracks in an oil pipeline and running recognition software through a drone using a Qualcomm (QCOM) manufactured camera to monitor the state of containers.

Trusting A.I. will expedite the usage of A.I. business applications, and the companies diverting capital into A.I. enhancement will reap from what they sow.

The knock-on effect is that university A.I. staff members are being poached faster than a breakfast egg. There is a bidding war going on as we speak from both sides of the Pacific.

Facebook is opening new A.I. research centers in Seattle and Pittsburgh.

Previously, A.I. was a buzzword and companies would trot out a visually stimulating display with pizzazz. But that is all changing with A.I. swiftly moving into the backbone of all business operations.

Ottomatika, a company that develops software for autonomous cars acquired by Aptiv (APTV), was entirely a Carnegie Mellon University (CMU) in-house project that was picked up by Aptiv for commercial applications.

In one fell swoop, (CMU) lost a whole team of leading A.I. researchers.

Microsoft is a premium stock because it straddles both sides of the fence.

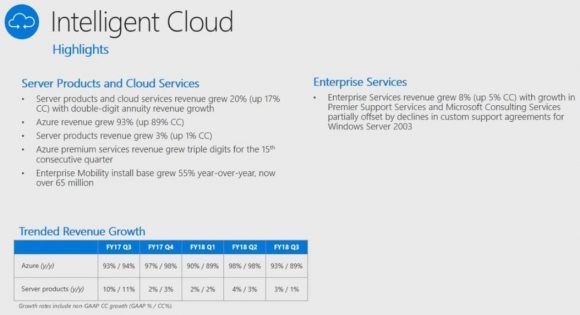

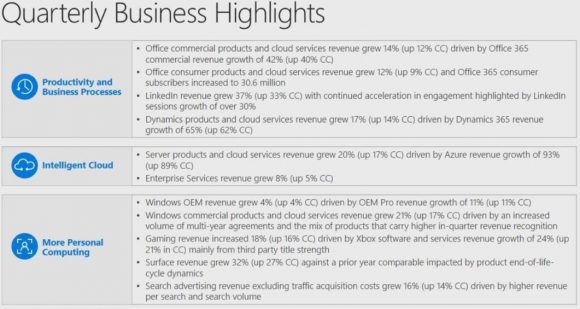

On one side, it's an uber growth company with Microsoft Azure growing 93% YOY satisfying investors requirement for insatiable growth.

On the other hand, Microsoft is robustly lucrative profiting $21.20 billion in 2017, and would be a Warren Buffett-type of cash flow reliant stock even though he has smothered any inkling of buying Microsoft shares because of his close relationship with co-founder Bill Gates.

Even Microsoft's legacy product Microsoft Office 365 is a gangbuster segment swelling 42% YOY.

This contrasts with other legacy companies that are attempting to wean themselves from their own outdated products.

Office 365 products are still embedded in daily life, and I am using it now to type this story.

On the technical side of it, Microsoft is beefing up its developer tools.

Microsoft will integrate Kubernetes, an open-source system for automating deployment, into the Azure as well as upping its Azure Bot Service adding 100 new features.

There are more than 300,000 developers who operate the Azure Bot Service alone.

The slew of upgrades for developers will enhance the power of Microsoft's software and ecosystem.

The overarching theme to the Build conference is the integration of A.I. into real life business applications and the importance of the cloud.

Now the Cloud.

Nadella reaffirmed Microsoft's position in the cloud wars characterizing the current environment as a duo of Amazon and Microsoft with Google trailing behind.

Microsoft has the potential to nick Amazon's position as the industry's cloud leader because of the unique set of products it can combine with the cloud.

Most of the world utilizes a mix of PC-based hardware, using Microsoft's software and operating system, supplemented by an Android-based smartphone.

As expected, Microsoft, Alphabet (GOOGL), and Amazon are spending a pretty penny advancing their cloud business.

Microsoft spends more than $1 billion per month on Azure cloud data centers.

This number now surpasses the entire annual Microsoft R&D budget.

In the interview, Nadella cited that Microsoft now has 50 domestic data centers.

Amazon habitually holds between 50,000 to 80,000 servers at each data center. Extrapolate the lower range of the number with 50 data centers and Microsoft could have at least 2.5 million servers working for its data needs.

The barriers of entry have never been higher in the cloud industry because the costs are spiraling out of control.

Few people have billions upon billions to make this business work at the appropriate scale.

Tom Keane, head of Global Infrastructure at Microsoft Azure, recently said that Azure meets 58 compliance requirements set forth by the federal government, industry, and local players.

Azure is the first cloud that satisfies the Defense Federal Acquisition Regulation Supplement criteria for contractors to handle Department of Defense work.

Regulation has emerged as one of the controversial issues of 2018, and this did not get lost in the shuffle.

The trust comment was clearly a thinly veiled swipe against Facebook's (FB) much frowned upon business model, making it commonplace these days for prominent CEOs to distance themselves from Mark Zuckerberg's creation.

Protecting a company's image and reputation is paramount in the new rigid era of big data.

Nadella's anti-Facebook rhetoric continued by noting the auction-based pricing standards are "funky," explaining the model is counterintuitive. His reason was that as demand increases, the price should drop and not rise.

Apple (AAPL) CEO Tim Cook has largely been negative about Facebook's tactics. The fury is justified when you consider Apple and Microsoft hustle industriously to develop software and hardware products while Facebook manipulates user data to profit from collected data. A nice shortcut if there ever was one.

It's clear that Apple and Microsoft have no interest in giving third parties access to personal data because the leadership understands it is a slippery slope to go down and unsustainable.

Nadella's emphasis on tech ethics is a breath of fresh air and the data Microsoft accumulates is used to improve the cloud and software products rather than pedal to mercenaries.

The companies that have staying power create proprietary products that cannot be replicated.

Microsoft's assortment of software products acts as the perfect gateway into the cloud and is a moat widening tool.

A.I. and the cloud are all you need to know, and Microsoft is at the heart of this revolutionary movement.

Any weakness of Microsoft's shares into the low-90s is a screaming buy.

_________________________________________________________________________________________________

Quote of the Day

"Innovation has nothing to do with how many R&D dollars you have. When Apple came up with the Mac, IBM was spending at least 100 times more on R&D. It's not about money. It's about the people you have, how you're led, and how much you get it." - said Apple cofounder Steve Jobs.

Mad Hedge Technology Letter

May 8, 2018

Fiat Lux

Featured Trade:

(BUFFETT GOES ALL IN WITH APPLE),

(SNAP), (WDC), (GOOGL), (AMZN),

(CRM), (RHT), (HPQ), (FB), (AAPL)

Not every stock comes with Warren Buffett's confession that he would like to own 100% of it. But, of course that stock would have to be a tech stock.

As it stands, the Oracle of Omaha owns 5% of Apple (AAPL), and his confession is still a bold statement for someone who seldom forays outside his comfort zone.

Buffett also continues to concede that he "missed" Google (GOOGL) and Amazon (AMZN).

What a revelation!

The outflow of superlatives invading the airwaves is indicative of the strength technology has assumed in the bull market.

The tech sector has been coping with obstacles such as higher interest rates, trade wars, data regulation, IP chaos, and the globalization backlash.

However, the tech companies have come through unscathed and hungry for more.

Their power is not contained to one industry, and techs' capabilities have been spilling over into other sectors digitizing legacy industries.

Every CEO is cognizant that enhancing a product means blending the right amount of tech to suit its needs.

It is not halcyon times in all of tech land either.

There have been some companies that have faltered or were naturally cannibalized by other tech companies that disrupt business.

Times are ruthless and this is just the beginning.

There will be winners and losers as with most other secular paradigm shifts.

Particularly, there are two types of losers that investors need to avoid like the plague.

The first is the prototypical tech company hawking legacy products such as Western Digital Corp. (WDC) that I have been banging on the table telling investors not to buy the stock.

The lion's share of revenue is still in the antiquated hard drive business that has a one-way ticket to obsolescence.

Yes, they are turning around product mixes to factor in its pivot to solid state drives (SSD), but they are late to the game and deservedly punished for it.

Compare WDC to companies that have completed the transition from legacy reliance to the cloud, and it is simple to understand that companies such as Microsoft, which struggled for years to turn around with CEO Satya Nadella, finally can claim victory.

The problem with WDC is the stock's price action performs miserably because the company is tagged as an ongoing turnaround story.

On the other hand, headliner cloud plays experience breathtaking gaps up due to the strength of the cloud such as Amazon (AMZN), Red Hat (RHT), and Salesforce (CRM), just to name a few.

To pour fuel on the fire, speculative reports citing NAND chip price "softening" beat down the stock into submission.

Effectively, legacy companies become sell the rallies type of stocks.

Transforming a legacy company into a high-octane cloud company is perilous to say the least. Jeff Bezos recently gloated that Amazon Web Service's (AWS) seven-year head start is all investors need to know about the cloud. There is some merit to his statement.

Examples are rife with bad executive decisions by legacy companies such as HP Inc. (HPQ), another legacy tech company that makes computers and hardware. It ventured out to buy Palm for $1.2 billion plus debt after a bidding war with legacy competitor Dell in 2010.

In 1996, the Palm PDA (Personal Digital Assistant) was the first smart phone on the market that predated BlackBerry's smart phone with the full keyboard made by RIM (Research in Motion).

The demise of Palm emerged from a hodgepodge of mismanagement, failed spin-offs, misplaced mergers, and resource wastefulness even with the preeminent technology of its time.

(HPQ)'s stab at the smartphone market resulted in purchasing Palm. However, after heavy selling pressure in its shares, HP shut down this division and sold off the remaining technology to Chinese electronics company TCL Corporation.

The sad truth is many transformations fail at step one, and there is no guarantee a newly absorbed business will perform as expected.

RIM, now changed to BlackBerry (BB), soon found out how it felt to be Palm when Steve Jobs dropped the first iPhone on the market, and the world has never been the same.

(BB) gradually morphed into an autonomous vehicle technology company after the writing was on the wall.

The other types of losers are companies with inferior business models such as Snapchat (SNAP), which I have written about extensively from the bearish side.

In an age where disruptors are being disrupted by other disruptors, CEOs must live in fear that their business will get undercut and hijacked at any time.

Instagram, a subsidiary of Facebook (FB), has permanently borrowed numerous features from Snapchat. Its Instagram "stories" feature is now used by more than 300 million daily users.

Snapchat is serving as Instagram's guinea pig while CEO Evan Spiegel finds an alternative way to survive against Facebook's unlimited resources.

Both are in the game of selling ads and nobody does it better than Facebook and Alphabet or has the degree of scale.

The recent redesign was met with a chorus of universal boos. The 60 minutes I spent testing the new design reconfirmed my fears that the new design was an unmitigated washout.

In short, Snap's redesign seemed like a different app and became incredibly difficult to use.

Compounding the deteriorating situation, Snapchat laid off 120 engineers due to sub-par performance and withheld last year's performance bonuses even though co-founder Evan Spiegel received $637 million in 2017.

The latest earnings report was a catastrophe.

Daily active user (DAU) growth, the most sought out metric for Snapchat, failed to deliver the goods. The street expected 194.2 million DAU and Snap reported 191 million. A miss of 3.2 million users and a deceleration of growth QOQ.

Remember that Snapchat is substantially smaller than Instagram and should have no problems surpassing expectations on a smaller scale, thus investors voted with their feet and bailed on the stock after the catatonic performance last quarter.

Instagram is six times larger with more than 800 million users as of the end of 2017.

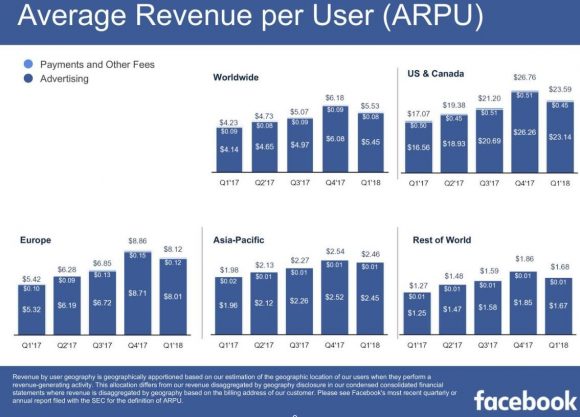

Top line fell short of expectations and average revenue per user (ARPU) dropped to $1.21, far less than the expected $1.27.

The less than stellar redesign faced a rebellion from long-term Snapchat disciples. More than 1.2 million Snap diehards signed a petition hoping to revert back to the old interface, and its updated ratings in Apple's app store has fallen to 1.6 stars out of 5.

Then the perpetual question of why would advertisers want to pay for Snapchat digital ads when they earn more by buying Instagram ads?

This remains unsolved and appears unsolvable.

Snapchat is befuddled by the pecking order and the company is on a train to nowhere.

To hammer the nail in the coffin, Snapchat announced to investors that it expects revenue to "decelerate substantially" next quarter.

In an era where technology companies will lead the economy and stock market, and has an outsized influence in politics and culture, not all tech companies are one-foot tap-ins.

Investors need to separate the wheat from the chaff or risk losing their shirt.

_________________________________________________________________________________________________

Quote of the Day

"We have to stop optimizing for programmers and start optimizing for users." - said American software developer Jeff Atwood

Mad Hedge Technology Letter

May 2, 2018

Fiat Lux

Featured Trade:

(FACEBOOK GOES FROM STRENGTH TO STRENGTH),

(FB), (AMZN), (GOOGL), (NFLX)

Everyone and their mother was waiting for Facebook (FB) to fluff their lines, but they defied the odds by posting solid performance.

The data police can go back to eating doughnuts because it is obvious that regulation won't fizzle out the precious growth drivers that Mark Zuckerberg relies on to please investors.

I even begged readers to buy the regulatory dip, and I was proved correct with Facebook shares rebounding from $155 to $173.

The dip buying was proof that investors have faith in Facebook's business model.

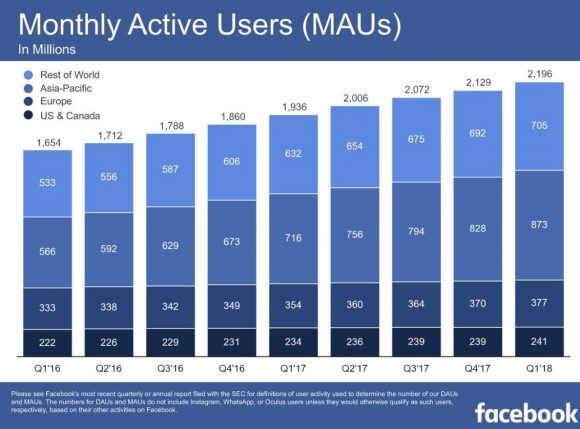

The Cambridge Analytica scandal threatened to tear apart the quarterly numbers and place Facebook in the tech doghouse, but stabilization in Monthly Active Users (MAU) and bumper digital ad revenue growth was the perfect elixir to an eagerly anticipated earnings report.

Facebook showed resilience by growing (MAU) to 2.2 billion, up 13% at a time when attrition could have reared its ugly head.

The market breathed a huge sigh of relief as the Facebook beat came to light.

The battering that Facebook received in the press effectively lowered the bar and Facebook delivered in spades.

The unfaltering migration to mobile continues throughout the industry with mobile digital ad revenue making up 91% of ad revenue, which is a nice bump from the 85% last quarter.

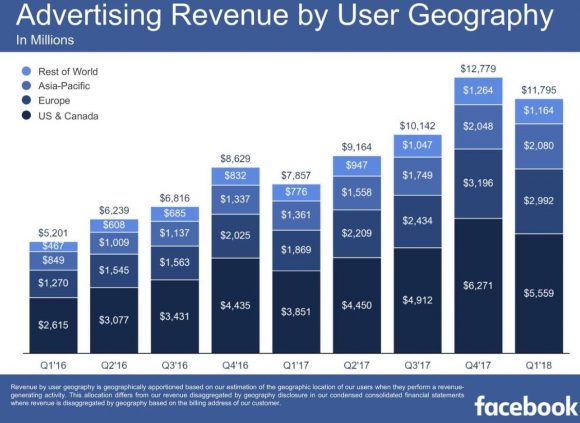

Overall, Facebook grew revenues 49% YOY to $11.97 billion.

There is no getting around that Facebook is a highly profitable business due to the lack of costs. I should be so lucky.

Remember at Facebook, the user is the product.

Instead of paying for rising TAC (Traffic Acquisition Costs) as does Google (GOOGL) or the $8 billion outlay for Netflix's (NFLX) annual content budget, Facebook pours its money into improving its digital platform and advancing its ad tech capabilities.

However, moving forward, Facebook will have to cope with extra regulatory costs.

Facebook recently hired a legion of content supervisors at minimum wage to root out the toxic content roaming around on its platform.

Site operators have doubled to 14,000. This number gives you a taste why the large cap tech names are best positioned to combat the new era of regulation.

Doubling the staff of any business would be a tough cost pill to swallow.

Many companies would go under, but Facebook has the cash to mitigate the additional cost of doing business.

This defensive initiative casts Facebook in a better light than before like a superhero rooting out the evil villain.

Facebook and its co-founder Mark Zuckerberg need to hire a better public relations team to ensure that Mark Zuckerberg isn't pigeonholed in mainstream media as the monster of tech.

The Amazon-effect is infiltrating every possible industry, and even the bigger tech names are coping with the Amazon (AMZN) spillage onto competitors' turf.

A risk down the line is Amazon's booming digital ad business nibbling away at Facebook's own digital ad model.

ARPU (Average Revenue Per User) remains robust with Facebook earning $23.59 per North American user, which is the most lucrative geographic location.

Artificial Intelligence (A.I.) is a tool that Facebook has implemented into its platform and monitoring apparatus.

Removing damaging content preemptively is the order of the day instead of being blamed for harboring nefarious content.

One example of this use case has been targeting ISIS- and Al Qaeda-related terror content with 99% of inappropriate content removed before being flagged by a human.

Heavy investments in A.I. will make Facebook a safer place to share content.

Big events exemplify the strength of Facebook.

During the Super Bowl in February, around 95% of national TV advertisers were simultaneously posting ads on Facebook because of the viral effect commercials and posts have during massive events.

Tourism Australia is another firm that bought ads on Instagram and Facebook platforms during the Super Bowl.

The campaign was hugely successful with half the leads for Tourism Australia coming directly from Facebook.

Facebook acts as the go-to provider for quality digital marketing and this will not change for the foreseeable future.

Investors can feel comfortable that there was no advertiser revolt after the big data chaos.

Facebook is improving its ad tech, and new ad products will be introduced to the 2.2 billion MAUs.

For instance, Facebook developed a carousel of rotating ads on Instagram Stories, and advertisers will be able to share up to three video or photos now instead of one. If the user swipes up, the swipe will take them directly to the advertisers' websites.

The shopping experience is more personalized now with an updated news feed that will show a full-screen catalog to help the user find whatever is in their search.

Facebook will only get better at placing suitable ads that mesh with the users' interests or hobbies.

Investors must be cautious to not let macro-headwinds sabotage existing positions.

Facebook's underlying growth drivers remain intact, but the stock is vulnerable to regulation headline risk that caps its short-term upside.

There is also the possibility that another Cambridge Analytica is just around the corner, which would result in a swift 10% correction.

Next earnings report should be interesting because it will reflect the first quarter that Facebook has operated with higher security expenses and will go a long way to validating its business model in a new era of rigid regulation.

If Facebook does not fill in the moat around the business, then Facebook is braced to grow top and bottom line with minimal resistance.

The cherry on top was the additional $9 billion of buybacks giving the stock price further support.

Facebook is a long-term hold but a risky short-term trade.

_________________________________________________________________________________________________

Quote of the Day

"Never trust a computer you can't throw out a window." - said Apple cofounder Steve Wozniak.

Mad Hedge Technology Letter

May 1, 2018

Fiat Lux

Featured Trade:

(AMAZON KILLS IT AGAIN),

(AMZN), (WMT), (FB), (TGT), (GOOGL)

Jeff Bezos is a god.

Well, not quite but he is turning into one after Amazon delivered a mythical earnings report that left Amazon haters in awe.

The Amazon bears patiently waiting for the day of reckoning will have to wait longer as Amazon smashed earnings expectations by a magnitude of two or three.

Amazon had a lot riding on the most recent earnings report after racing to new highs in mid-March.

The brief macro-correction then gave investors yet another entry point into one of the best companies of our generation that is still up more than 30% this year.

Amazon Web Services (AWS) revenue reaccelerated from its 42% growth last year to a high octane 49% YOY and made up a disproportionate 73% of Amazon's operating income.

Amazon is heavily reliant on the AWS segment to carry it through feast or famine.

According to Jeff Bezos, its critically acclaimed cloud segments' outstanding results originate from the "seven-year head start before like-minded competition."

This reaffirms the benefit of first-mover advantage with which large cap tech is obsessed.

There is room for other companies in the cloud space, with the cloud industry expanding 20% in 2018 to $186 billion.

Therefore, expanding by 20% is the bare bones minimum to be considered relevant.

Amazon has positioned itself to funnel in the most dollars that migrate toward the cloud as the industries pioneer and best of breed.

After the latest earnings report, Amazon is in pole position to become the first publicly traded $1 trillion company.

This latest quarter wrapped up its 62nd consecutive quarter of 20% plus growth.

And the commentary coming out of the earnings reports makes it almost certain that Amazon will capture more market share.

There were a few bombshells dropped that were unequivocal positives for investors.

First, Amazon has become the third player in digital ad industry with the duopoly of Google search and Facebook.

Amazon revved up its digital ad revenue by 139% QOQ to a substantial $2.03 billion per quarter business.

This business is particularly appetizing because of its high margins and will help alleviate tight margins on the e-commerce side.

Amazon's digital ad business is by far the fastest growth lever in its portfolio. It will ramp up this side of the business whose main function is to match consumers with suitable products that consumers otherwise would miss out on in a standard Amazon search.

The extraordinary numbers support the notion that the hoopla of Washington regulation is all bark and no bite.

Facebook also delivered a prodigious quarter for the ages amid testimony and public backlash that resulted in immaterial damage to top- and bottom-line numbers.

The second bombshell announced was the change in pricing to prime members. Amazon upped its annual prime membership to $119 from $99.

This additional $20 price hike, or 20% on 100 million prime members, will swell revenue by an extra $2 billion of incremental revenue.

In total, Amazon will accrue a bonus of 4% of revenue by this price change.

Amazon has a high fixed-cost business, and slightly tweaking prices will create a huge windfall with the revenue almost entirely flowing down to the bottom line in the form of pure profit.

Many industry analysts claim that Amazon has the best management team in the industry and explicate this company as an "Internet staple."

More than 100 million products are delivered with free shipping for Amazon prime customers. This is starkly higher than the 20 million products shipped for free in 2014.

Amazon does everything in its power to offer a unique and efficient experience for customers.

The customer satisfaction reveals itself by the rock-bottom churn rate.

Amazon prime at an annual cost of $119 is such a value that no analysts even dared to ask Amazon CFO Brian Olsavsky if consumers would take issue with the rise in price.

Investors and strangers alike assume that broad-based reoccurring revenue from annual prime membership is a given.

In an era of mass-scrutinization, Amazon's earnings call seemed like a celebration of the mythical achievements that are changing consumer behavior by the day.

The lack of inquiry was justifiable this time because the one major shortcoming suddenly remedied itself.

Amazon's doubters frequently attack the lack of margin growth because its business model is first and foremost a land grab for market share ignoring any remnants of margin stability.

Now that Amazon's digital ad business has sprouted up, the margin story, starting from a miniscule base, will go from weakness to an unrelenting success.

Amazon started with its ultra-thin margin e-commerce business that made an operating loss of $160 billion in 2017.

Cranking up a shiny, high margin business will be hard for the other FANGs to compete with as they gyrate toward other businesses that have lower margins than Amazon's digital ad segment.

This is a horrible time to start fighting Amazon in price wars as the paradigm shift to quantitative tightening has made the cost of capital demonstrably pricier.

Operating margins almost doubled from 2% to 3.8% on $51 billion of quarterly sales.

This is a huge deal.

Amazon has been continuously harangued for "not making money." Well, that era is over.

Profits, and not only revenue, will start accelerating and Amazon will become the closest thing to a perfect company.

The years and years of plowing cheap capital back into fulfillment center and e-commerce activity gave Amazon a stained reputation for years.

However, as Amazon turns the screws and uses its foundational leverage to capture additional profits, the other FANGs will be forced down the same path ruining operating margins for the other big players.

Amazon telegraphed its quest for market share strategy to investors years ago, and investors understand they are paying for growth and growth only.

That will change now that profits have become a real part of its arsenal.

There is no doubt that Amazon will deploy its profits back into expanding its company because Jeff Bezos knows that if he can grow Amazon's top-line number, investors will follow suit.

Also, spending means improving the products, and Amazon has never hesitated to spend big.

The move into digital ad growth is a warning shot to Facebook and Google. Amazon will mobilize its workforce to take on other business, and anything that is high margin is fair game.

The future looks bleak for retail competitors Walmart and Target, as the contents of the earnings report reaffirms Amazon's unrelenting assault on the retail sector, which is systematically being dissected by Amazon for fun.

Google search and Facebook are in Amazon's crosshairs. Staving off this monster will be hard to do in the long run.

Amazon has a clear path to further market gains, and operating margins are almost at a tipping point.

Revenue is poised to re-accelerate because of the reignition of AWS to a higher growth trajectory.

Shoring up operating margins through a burgeoning digital ad division will only be a boon to earnings in the future.

Amazon is one of the best companies in the world, and any weakness in the stock should be bought and held forever.

_________________________________________________________________________________________________

Quote of the Day

"I do not fear computers. I fear a lack of them," - said writer Isaac Asimov.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.