Although late to the party, giant biopharmaceutical company AbbVie (ABBV) is now going all-out on its coronavirus disease (COVID-19) treatment program.

The Illinois-based company, which has a market capitalization of $162.95 billion, aims to come up with a treatment that can block the SARS-CoV-2 coronavirus that causes COVID-19. The drug is currently dubbed 47D11.

AbbVie is working on this cure alongside Netherlands’ Erasmus Medical Center and Utrecht University as well as China’s bio-therapeutics developer Harbour BioMed.

It’s worth noting that AbbVie isn’t the first company to use this approach.

Earlier this year, Regeneron (REGN) announced a similar strategy to beat COVID-19. Its experimental cure, called REGN-COV2, is an antibody cocktail composed of two to three proteins working together to fight off the virus. The company plans to start clinical trials sometime this month.

Aside from AbbVie and Regeneron, Eli Lilly (LLY) is also utilizing the same technology.

In fact, the Indiana-based biotechnology leader already started dosing actual patients with COVID-19 with its experimental treatment, LY-CoV555.

Eli Lilly’s drug was actually developed using the antibodies collected from one of the first patients in the US to recover from the disease.

Using the same approach to find a COVID-19 cure isn’t the only thing Regeneron and AbbVie have in common, though.

To bulk up its oncology pipeline, AbbVie forged a partnership with Danish biotechnology company Genmab (GMAB) earlier this month.

Interestingly, Genmab is the same company behind the clinical progress of the bispecific antibody treatments of both Regeneron and Roche Holding (RHHBY).

AbbVie and Genmab agreed to collaborate on bispecific antibody development to come up with treatments that can target cancer cells and strengthen immune cells. The three drugs included in the deal are epcoritamab (DuoBody-CD3xCD20), DuoHexaBody-CD37, and DuoBody-CD3x5T4.

Aside from the three candidates already lined up, the two companies are also ironing out details on four additional cancer treatments.

The deal is estimated to be worth almost $4 billion, with AbbVie paying $750 million upfront.

On top of that, Genmab will also be entitled to get potential payments of up to $3.15 billion in milestone payments. The four potential cancer treatments could also entitle Genmab with an additional $2 billion.

Since bispecific antibodies are hailed as the “next-generation cancer therapy,” this market continues to attract big names in the industry.

So far, the list of companies working on bispecific antibodies includes Amgen (AMGN), Johnson & Johnson (JNJ), Novartis (NVS), GlaxoSmithKline (GSK), Merck (MRK), AstraZeneca (AZN), and Sanofi (SNY).

Aside from improving its oncology lineup, Abbvie has shown more creativity in diversifying its products.

Throughout the years, AbbVie had been considered as a strictly pharmaceutical company in the past. However, its recent purchase of Allergan set off a series of decisions that showcased the company’s plan to expand its portfolio.

With AbbVie’s revenue reaching $33.3 billion in 2019, several experts disagreed with the company’s decision to buy Allergan (AGN).

However, the move is estimated to add roughly $50 billion to the company’s annual revenue and help AbbVie’s bottom line.

One of the biggest products added to AbbVie’s portfolio is Botox, which has been long-regarded as Allergan’s prized cash cow.

In fact, this widely popular injectible raked in $1.02 billion in sales for Allergan in the fourth quarter of 2019 alone. Another promising product is the dermal filler Juvederm, which brought in $347.3 million in the same period.

Despite the excitement from the newly formed partnerships, a lot of investors remain apprehensive over AbbVie’s future.

These fears are rooted in the doomsday countdown for the company’s blockbuster rheumatoid arthritis drug Humira — and for good reason.

In its 2020 first quarter report, AbbVie recorded $8.6 billion in revenue, indicating a 10.1% jump year over year.

From this, Humira contributed nearly 58% despite the growing number of biosimilar rivals in Europe. In fact, Humira sales reached $4.7 billion, showing a 14.5% climb from the same period last year.

In 2019, experts predicted that Humira is poised to overtake Pfizer’s (PFE) Lipitor as the top-selling drug of all time by 2024.

AbbVie’s rheumatoid arthritis drug is estimated to reach a whopping $240 billion in sales in the next four years.

As expected, biosimilar competition, led by Amgen, has been licking their chops to get a piece of the action for years now, and they would do everything to dethrone AbbVie from its top spot in the autoimmune diseases sector.

Hence, AbbVie implemented two strategies to address this issue.

The first is forestalling the inevitable. In a recent court victory, AbbVie secured patent exclusivity for Humira until 2023.

Although this only leaves AbbVie with three short years to deal with the problem, it’s sufficient period for the company to execute its second plan: “Humira on steroids.”

Since Humira’s patent exclusivity has been a sore issue for AbbVie for years, the company decided to solve it by creating a stronger version of the drug.

The new antibody treatment, called ABBV-3373, is said to be more effective than Humira.

If all goes well in its clinical trials, then this “new Humira” can very well be AbbVie’s next megablockbuster and main moneymaker after 2023.

Humira isn’t the only big seller in AbbVie’s lineup.

Other blockbusters include cancer drug Imbruvica, which recorded $1.2 billion in revenue in the first quarter, up by 20.6% compared to the same period last year. Another cancer drug, Venclexta, is also performing well, bringing in $317 million in net revenue.

AbbVie has been boosting its next-generation treatments as well.

So far, two more Humira-like drugs stand out --severe plaque psoriasis medication Skyrizi and rheumatoid arthritis treatment Rinvoq.

Skyrizi’s annual sales are projected to grow from $1 billion to hit $4.4 billion by 2025, with the numbers going higher than $7.4 billion in the following years.

Rinvoq is expected to bring in $3.7 billion in sales by 2025 and increasing to reach $5.9 billion after that.

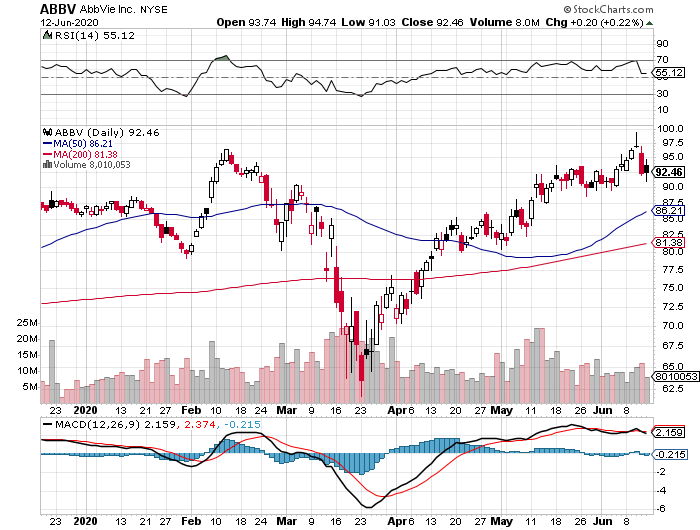

Right now, AbbVie appears to be oddly cheap as its shares are trading at only 9 times its expected earnings this year. This is possibly due to the anxiety over the loss of Humira’s patent exclusivity by 2023.

As AbbVie has shown in the past months, it has solid plans on how to deal with the impending loss. Its acquisition of Allergan, partnership with Genmab, and development of the “next Humira” all prove that claim.