Below please find subscribers’ Q&A for the May 4 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: How confident are you to jump into stocks right now?

A: Not confident at all. If you look at all of my positions, they’re very deep in the money and fully hedged—I have longs offsetting my shorts—and everything I own expires in 12 days. So, I’m expecting a little rally still here—maybe 1,000 points after the Fed announcement, and then we could go back to new lows.

Q: Would you scale into ProShares Ultra Technology ETF (ROM) if you’ve been holding it for several years?

A: I would—in the $40s, the (ROM) is very tempting. On like a 5-year view, you could probably go from the $40s to $150 or $200. But don’t expect to sleep very much at night if you take this position, because this is volatile as all get out. It's not exactly clear whether we have bottomed out in tech or not, especially small tech, which the (ROM) owns a lot of.

Q: Is it time to buy the Ark Innovation ETF (ARKK) with the 5-year view?

A: Yes. I mentioned the math on that a couple of days ago in my hot tips. Out of 10 positions, you only need one to go up ten times to make the whole thing worth it, and you can write off everything else. Again, we’re looking at venture capital type math on these leverage tech plays, and that makes them very attractive; however I’m always trying to get the best possible price, so I haven’t done it yet.

Q: We’ve been hit hard with the tech trade alerts since March. Any thoughts?

A: Yes, we’re getting close to a bottom here. The short squeeze on the Chinese tech trade alerts that we had out was a one-day thing. However, when you get these ferocious short covering rallies at the bottom—we certainly got one on Monday in the S&P 500 (SPY) —it means we’re close to a bottom. So, we may go down maybe 4%-6% and test a couple more times and have 500- or 1000-point rallies right after that, which is a sign of a bottom. There’s a 50% chance the bottom was at $407 on Monday, and 50% chance we go down $27 more points to $380.

Q: Is the Roaring 20s hypothesis still on?

A: Yes absolutely; technology is still hyper-accelerating, and that is the driver of all of this. And while tech stocks may get cheap, the actual technology underlying the stocks is still increasing at an unbelievable rate. You just have to be here in Silicon Valley to see it happening.

Q: Do you like defense stocks?

A: Yes, because companies like Lockheed Martin (LMT) and Raytheon (RTN) operate on very long-term contracts that never go away—they basically have guaranteed income from the government—meeting the supply of F35 fighters for example, for 20 years. Certainly, the war in Ukraine has increased defense spending; not just the US but every country in the world that has a military. So all of a sudden, everybody is buying everything—especially the javelin missiles which are made in Florida, Georgia and Arizona. The Peace Dividend is over and all defense companies will benefit from that.

Q: Is Buffet wrong to go into energy right now? How will Berkshire Hathaway Inc. (BRK.B) perform if energy tanks?

A: Well first of all, energy is only a small part of his portfolio. Any losses in energy would be counterbalanced by big gains in his banking holdings, which are among his largest holdings, and in Apple (AAPL). Buffet does what I do, he cross-hedges positions and always has something that’s going up. I think Berkshire is still a buy. And he's not buying oil, per say; he is buying the energy producing companies which right now have record margins. Even if oil goes back down to $50 a barrel, these companies will still keep making money. However, he can wait 5 years for things to work for him and I can’t; I need them to work in 5 minutes.

Q: You must have suffered big oil (USO) losses in the past, right?

A: Actually I have not, but I have seen other people go bankrupt on faulty assumptions of what energy prices are going to do. In the 1990s Gulf War, someone made an enormous bet that oil would go up when the actual shooting started. But of course, it didn’t, it was a “buy the rumor, sell the news” situation. Energy prices collapsed and this hedge fund had a 100% loss in one day. That is what keeps me from going long energy at the top. And the other evidence that the energy companies themselves believe this is true is that they’re refusing to invest in their own businesses, they won’t expand capacity even though the government is begging them to do so.

Q: Why should we stay short the iShares 20 Plus Year Treasury Bond ETF (TLT) instead of selling out for a profit or holding on due to your statement that the TLT will go down to $105/$110?

A; If you have the December LEAPS, which most of you do, there’s still a 10% profit in that position running it seven more months. In this day and age, 7% is worth going for because there isn’t anything else to buy right now, except very aggressive, very short term, front month options, which I've been doing. So, the only reason to sell the TLT now and take a profit—even though it’s probably the biggest profit of your life—is that you found something better; and I doubt you're finding anything better to do right now than running your short Treasuries.

Q: Are you still short the TLT?

A: Yes, the front months, the Mays, expire in 8 days and I’m running them into expiration.

Q: What will Bitcoin do?

A: It will continue to bounce along a bottom, or maybe go lower as long as liquidity in the financial system is shrinking, which it is now at roughly a $90 billion/month rate. That’s not good for Bitcoin.

Q: Is now the time for Nvidia Corporation (NVDA)?

A: Yes, it’s definitely time to nibble here. It’s one of the best companies in the world that’s dropped more than 50%. I think we’d have a final bottom, and then we’re entering a new long term bull market where we’d go into 1-2 year LEAPS.

Q: What do you think of buying the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) junk bond fund here for 6% dividend?

A: If you’re happy with that, I would go for it. But I think junk is going to have a higher dividend yet still. This thing had a dividend in the teens during the financial crisis; I don’t think we’ll get to the teens this time because we don’t have a financial crisis, but 7% or 8% are definitely doable. And then you want to look at the 2x long junk bond special ETFs, because you’re going to get a 16% return on a very boring junk bond fund to own.

Q: What do you think about Amazon (AMZN) at this level?

A: I think it’s too early and it goes lower. Not a good stock to own during recession worries. At some point it’ll be a good buy, but not yet.

Q: Energy is the best sector this year—how long can it keep going?

A: Until we get a recession. By the way, if you want evidence that we’re not in a recession, look at $100/barrel oil. When you get real recessions, oil goes down to 420 or $30….or negative $37 as it did in 2020. There’s a lot of conflicting data out in the market these days and a lot of conflicting price reactions so you have to learn which ones to ignore.

Q: Should we stay short the (TLT)?

A: Yes, we should. I’m looking for a 3.50% yield this year that should take us down to $105.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

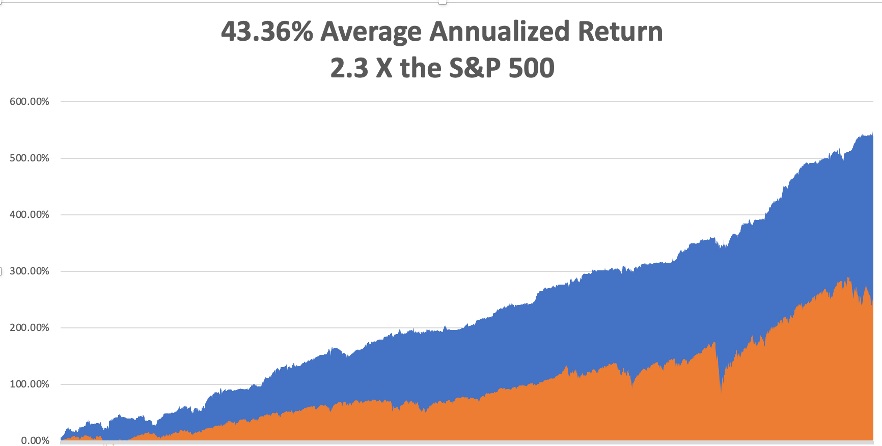

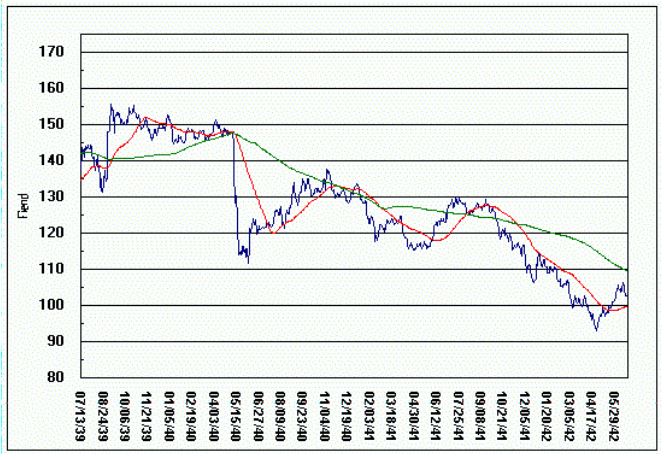

Dow Average 1939-1942

Dow Average 1939-1942