September is notorious as the worst month of the year for the market. Boy, did it deliver, down a gut busting 9.7%!

As for the Mad Hedge Fund Trader, September was one of the best trading months of my 54-year career. But then I knew what was coming.

So did you.

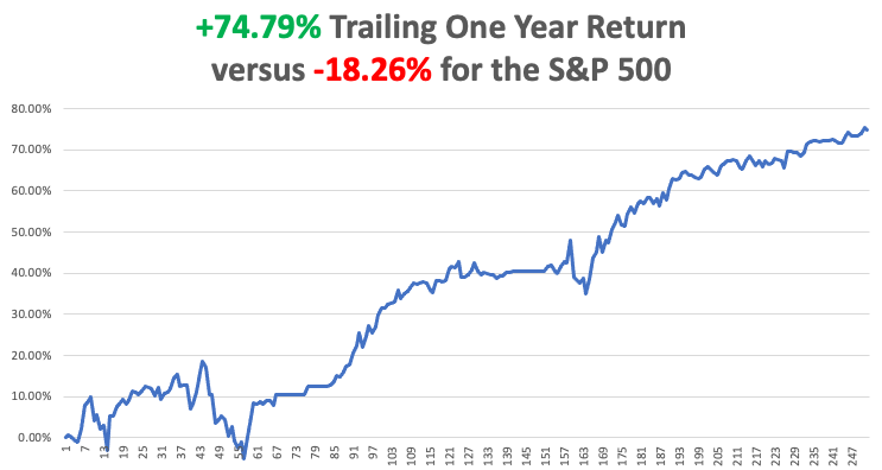

With some of the greatest market volatility in market history, my September month-to-date performance exploded to exactly +9.72%.

I used last week’s extreme volatility and move to a Volatility Index (VIX) of $34 to add longs in Freeport McMoRan (FCX), S&P 500 (SPY), NVIDIA (NVDA), and Berkshire Hathaway (BRKB). I added shorts in the (SPY) and the (TLT). That takes me to 70% long, 20% short, and 10% cash. I am holding back my cash for any kind of rally to sell into.

My 2022 year-to-date performance ballooned to +69.68%, a new high. The Dow Average is down -23.44% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky high +80.08%.

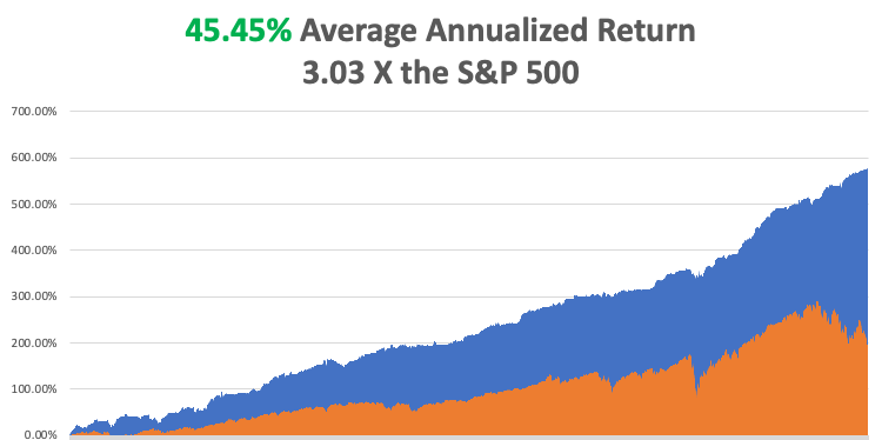

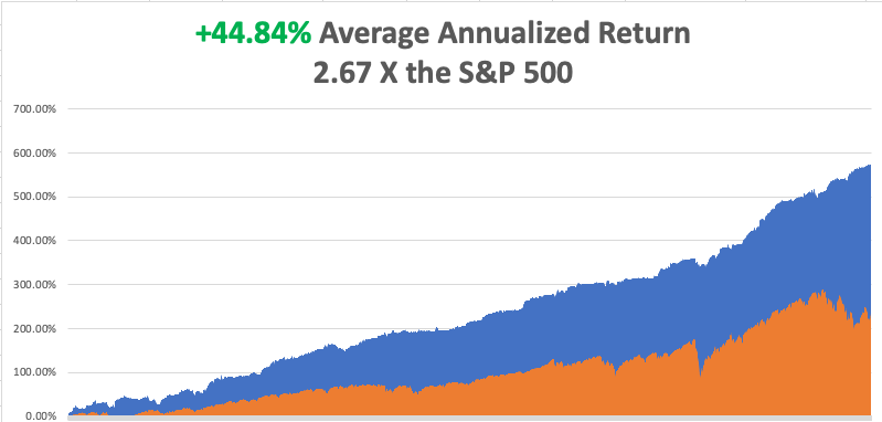

That brings my 14-year total return to +582.24%, some 3.03 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +45.45%, easily the highest in the industry.

It was in May of 2020 when 34 of my clients became millionaires through buying TESLA at precisely the right time…

Well, the stars have aligned once again!!!!

In my TESLA free report, I list 10 reasons I’d tell my grandmother to mortgage her house and go all in.

Go to MADHEDGERADIO.com and download my “Tesla takes over the world” free report…that’s

madhedgeradio.com.

At the end of the month, the market was down six days in a row. That has only happened 20 times since 1950.

However, bet the ranch time is approaching. It’s time to start scaling in in a small way into your favorite long term names where the value is the greatest.

The Fed has taken away the free put that the stock market has enjoyed for the last 13 years. Now, it’s the bond market that has the free put. Hint: always own the market where the Fed is giving you free, unlimited downside protection.

People often ask what I do for a living. I always answer, “Talking people out of selling stocks at the bottom.” Here is the cycle I see repeating endlessly. They tell me they are long term investors. Then the markets take a sudden dive, like to (SPX) $3,300, a geopolitical event takes place, and the TV networks only run nonstop Armageddon gurus. They sell everything.

Then the market turns sharply, and they helplessly watch stocks soar. When they get frustrated enough, they buy, usually near a market top.

Sell low, buy high, they are perfect money destruction machines. And they wonder why they never make money in the stock market!

If any of this sounds familiar you have a problem and need to read more Mad Hedge newsletters. The people who ignore me I never hear from again. Those who follow me stick with me for decades.

Don’t make the mistake here of only looking at real GDP growth which, in recessions, is always negative. Nominal GDP is growing like a bat out of hell, 12% in 2021 and 8% in 2022. That’s 20% in two years, nothing to be sneezed at.

The problem is that all economic data has been rendered useless by the pandemic, even for legitimate and accomplished Wall Street analysts. The US economy was put through a massive restructuring practically overnight, the long-term consequences of which nobody will understand for years. Typical is the recently released Consumer Price Index, which said that real estate prices are rocketing, when in fact they are crashing.

A lot of people have asked me about the comments from my old friend, hedge fund legend Paul Tudor Jones, that the Dow Average would show a zero return for the next decade.

For Paul to be right, technological innovation would have to completely cease for the next decade. Sitting here in the middle of Silicon Valley, I can tell you that is absolutely not happening. In fact, I’m seeing the opposite. Innovation is accelerating at an exponential rate. For goodness sakes, Apple just brought out a satellite phone with its iPhone 14 pro for a $100 upgrade!

Remember, Paul got famous, and rich, from the trades he did 40 years ago with me, not because of anything he did recently. Paul has in fact been bearish for at least five years.

Still, we have a long way to go on earnings multiples. The trailing S&P 500 market multiple is now at 19. The historic low is at 15. Current earnings are $245 per (SPX) share. The 3,000 target the bears are shouting from the rooftops assumes that a severe recession takes earnings down to $200 a share ($3,000/$200 = 15X).

I don’t think earnings will get that bad. Big chunks of the economy are still growing nicely. Companies are commanding premium prices for practically everything. There is no unemployment because the jobs market is booming.

That suggests to me a final low in this market of $3,000-$3,300. That means you can buy 15%-20% deep in-the-money vertical bull call spreads RIGHT HERE and make a killing, as Mad Hedge has done all year.

Let me plant a thought in your mind.

After easing for too long, then tightening for too long, what does the Fed do next? It eases for too long….again. You definitely want to be long stocks when that happens, which will probably start some time next year.

Let me give you one more data point. The (SPY) has been down 7% or more in September only seven times since 1950. In six of the Octobers that followed, the market was up 8% or more.

Sounds like it’s time to bet the ranch to me.

Capitulation Indicators are Starting to Flash. Cash levels at mutual funds are at all-time highs. The Bank of America Investors Survey shows the high number of managers expecting a recession since the 2020 pandemic low, the last great buying opportunity. Commercial hedgers are showing the largest short positions since 2020. And of course, my old favorite, the Volatility Index (VIX) hit $34.00 on Tuesday. The risks of NOT being invested are rising.

Bank of England Moves to Support a Crashing Pound (FXB), by flipping from a seller to a buyer in the long-dated bond market, thus dropping interest rates. The move is designed to offset the new Truss government’s plan to cut taxes and boost deficit spending. The BOE also indicated that interest rate hikes are coming. The bond vigilantes are back.

Here’s the Next Financial Crisis, massive unrealized losses in the bond market. The (TLT) alone has lost 43% in 2 ½ years. Apply that to a global $150 trillion bond market and it adds up to a lot of money. Anybody who used leverage is now gone. How many investors without swimsuits will be discovered when the tide goes out?

Will the Strong Dollar (UUP) Do the Fed’s Work, forestalling a 75-basis point rate rise? It will if the buck continues to appreciate at the current rate, up a record five cents against the British pound, taking it to a record low of $1.03. Such is the deflationary impact of weak foreign currencies, which are seriously eating into US multination earnings.

Weekly Jobless Claims Hit Five-Month Low at 195,000, far below expectations. If the Fed is waiting for the job market to roll over before it quits raising interest rates, it could be a long wait.

EV Sales to Hit New All-Time High in 2022, to 13% of global new vehicle sales, up from 9% last year. The IEA expects this figure to reach 50% by 2030. That works out to 6.6 million EVs in 2021, 9.5 million in 2022, and 36 million by 2030. Buy (TSLA), the world’s largest EV seller, and (RIVN), the fastest grower in percentage terms, on dips.

EVs Take 25% of China New Vehicle Sales, and Tesla’s Shanghai factory is a major participant. Tesla just double production there. Some 403,000 EVs were sold in China in May alone. China is also ramping up its own EV production, up 183% YOY. China is much more dependent on imported oil than other large nations, most of which goes to transportation. Global EV production is expected to soar from 8 to 60 million vehicles in five years and Tesla is the overwhelming leader. Buy (TSLA) on dips again.

Oil (USO) Hits New 2022 Low at $78 a Barrel, cheaper than pre–Ukraine War prices, thanks to exploding recession fears. Is Jay Powell the most effective weapon against Russia with his most rapid interest rate rises in history?

Consumer Sentiment Hits Record Low at 59.1 according to the University of Michigan. That’s worse than the pandemic low and the 2009 Great Recession low. It could be that politics has ruined this data source making everyone permanently negative about the future. Inflation at a 40-year high isn’t helping either, nor is the prospect of nuclear war.

Case Shiller Delivers a Shocking Fall, down from 18.7% to 16.1% in June. The other shoe is falling with the sharpest drop in this data series in history. Tampa was up (31.8%), Miami (31.7%), and Dallas (24.7%). Many more declines to come.

30-Year Fixed Rate Mortgage Hits 7.08%, up from 2.75% a year ago. You can kiss those retirement dreams goodbye. It has been the sharpest rise in mortgage rates in history. Real estate has just become an all-cash market. That screeching juddering sound you hear is the existing home market shutting down.

Pending Home Sales Drop, down 2.0% in August on a signed contract basis. Sales are down for the third month in a row and are off 24% YOY. Only the west gained. Mortgage interest rates are now at 20-year highs. Buyers catching recession fears are breaking contracts and walking away from deposits.

Stock Crash Wipes Out $9 Trillion in Personal Wealth, which is the fall in equity holdings and mutual funds as of the end of June. The drop has been from $42 to $33 trillion. The bad news: it’s still going down, putting a dent in consumer spending.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil in a sharp downtrend and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 3 at 8:30 AM, the ISM Manufacturing PMI for September is released.

On Tuesday, October 4 at 7:00 AM, the JOLTS Report for private job openings for September is out.

On Wednesday, October 5 at 7:00 AM, ADP Private Employment Report for September is published.

On Thursday, October 6 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, October at 8.30 AM, the Nonfarm Payroll Report for September is disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, while working for The Economist magazine in London, I was invited to interview some pretty amazing people: Margaret Thatcher, Ronald Reagan, Yasir Arafat, Zhou Enlai.

But one stands out as an all time favorite.

In 1982, I was working out of the magazine’s New York Bureau off on Third Avenue and 47th Street, just seven blocks from my home on Sutton Place, when a surprise call came in from the editor in London, Andrew Knight. International calls were very expensive then, so it had to be important.

Did anyone in the company happen to have a US top secret clearance?

I answer that it just so happened that I did, a holdover from my days at the the Nuclear Test Site in Nevada. “What’s the deal,” I asked?

A person they had been pursuing for decades had just retired and finally agreed to an interview, but only with someone who had clearance. Who was it? He couldn’t say now. I was ordered to fly to Los Angeles and await further instructions.

Intrigued, I boarded the next flight to LA wondering what this was all about. What I remember about that flight is that sitting next to me in first class was the Hollywood director Oliver Stone, a Vietnam veteran who made the movie Platoon. When Stone learned I was from The Economist, he spent the entire six hours grilling me on every conspiracy theory under the sun, which I shot down one right after the other.

Once in LA, I checked into my favorite haunt, the Beverly Hills Hotel, requesting the suite that Marilyn Monroe used to live in. The call came in the middle of the night. Rent a four-wheel drive asap and head out to a remote ranch in the mountains 20 miles east of Santa Barbara. And who was I interviewing?

Kelly Johnson from Lockheed Aircraft (LMT).

Suddenly, everything became clear.

Kelly Johnson was a legend in the aviation community. He grew up on a farm in Michigan and obtained one of the first masters degrees in Aeronautical Engineering in 1933 at the University of Michigan.

He cold called Lockheed Aircraft in Los Angeles begging for a job, then on the verge of bankruptcy in the depths of the Great Depression. Lockheed hired him for $80 a month. What was one of his early projects? Assisting Amelia Earhart with customization of her Lockheed Electra for her coming around-the-world trip, from which she never returned.

Impressed with his performance, Lockheed assigned him to the company’s most secret project, the twin engine P-38 Lightning, the first American fighter to top 400 miles per hour. With counter rotating props, the plane was so advanced that it killed a quarter of the pilots who trained on it. But it allowed the US do dominate the air war in the Pacific early on.

Kelley’s next big job was the Lockheed Constellation (the “Connie” to us veterans), the plane that entered civil aviation after WWII. It was the first pressurized civilian plane that could fly over the weather and carried an astonishing 44 passengers. Howard Hughes bought 50 just off of the plans to found Trans World Airlines. Every airline eventually had to fly Connie’s or go out of business.

The Cold War was a golden age for Lockheed. Johnson created the famed “Skunkworks” at Edwards Air Force base in the Mojave Desert where America’s most secret aircraft were developed. He launched the C-130 Hercules, which I flew in Desert Storm, the F-104 Starfighter, and the high altitude U-2 spy plane.

The highlight of his career was the SR-71 Blackbird spy plane where every known technology was pushed to the limit. It could fly at Mach 3.0 at 100,000 feet. The Russians hated it because they couldn’t shoot it down. It was eventually put out of business by low earth satellites. The closest I ever got to the SR-71 was the National Air & Space Museum in Washington DC at Dulles airport where I spent an hour grilling a retired Blackbird pilot.

Johnson greeted me warmly and complimented me on my ability to find the place. I replied, “I’m an Eagle Scout.” He didn’t mind chatting as long as I accompanied him on his morning chores. No problem. We moved a herd of cattle from one field to another, milked a few cows, and fertilized the vegetables.

When I confessed to growing up on a ranch, he really opened up. It didn’t hurt that I was also an engineer and a scientist, so we spoke the same language. He proudly showed off his barn, probably the most technologically advanced one ever built. It looked like a Lockheed R&D lab with every imageable power tool. Clearly Kelley took work home on weekends.

Johnson recited one amazing story after the other. In 1943, the British had managed to construct two Whittle jet engines and asked Kelly to build the first jet fighter. The country that could build jet fighters first would win the war. It was the world’s most valuable machine.

Johnson clamped the engine down to a test bench and fired it up surrounded by fascinated engineers. The engine immediately sucked in a lab coat and blew up. Johnson got on the phone to England and said “Send the other one.”

The Royal Air Force placed their sole remaining jet engine on a plane which flew directly to Burbank airport. It arrived on a Sunday, so the scientist charged with the delivery took the day off and rode a taxi into Hollywood to sightsee.

There, the Los Angeles police arrested him for jaywalking. In the middle of WWII with no passport, no ID, a foreign accent, and no uniform, they hauled him straight off to jail.

It took two days for Lockheed to find him. Johnson eventually attached the jet engine to a P-51 Mustang, creating the P-80, and eventually the F-80 Shooting Star (Lockheed always uses astronomical names). Only four made it to England before the war ended. They were only allowed to fly over England because the Allies were afraid the Germans would shoot one down and gain the technology.

But the Germans did have one thing on their side. The Los Angeles Police Department delayed the development of America’s first jet fighter by two days.

Germany did eventually build 1,000 Messerschmitt Me 262 jet fighters, but too late. Over half were destroyed on the ground and the engines, made of steel and not the necessary titanium, only had a ten hour life.

That evening, I enjoyed a fabulous steak dinner from a freshly slaughtered steer before I made my way home. I even helped Kelly slaughter the animal, just like I used to do on our ranch in Montana. Steaks are always better when the meat is fresh and we picked the best cuts. I went back to the hotel and wrote a story for the ages.

It was never published.

One of the preconditions of the interview was to obtain prior clearance from the National Security Agency. They were horrified with what Johnson had told me. He had gotten so old he couldn’t remember what was declassified and what was still secret.

The NSC already knew me well from our previous encounters, but MI-6 showed up at The Economist office in London and seized all papers related to the interview. That certainly amused my editor.

Johnson died at age 80 in 1990. As for me, it was just another day in my unbelievable life.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

SR-71 Blackbird

My Former Employer