Global Market Comments

July 18, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES

THE FULL EMPLOYMENT RECESSION),

(TSLA), (SPY), (TLT), (NVDA), (MSFT), (BRKB), (FCX)

Global Market Comments

July 18, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES

THE FULL EMPLOYMENT RECESSION),

(TSLA), (SPY), (TLT), (NVDA), (MSFT), (BRKB), (FCX)

I am writing this from the balcony of my chalet high in Zermatt, Switzerland watching the sun set on the last bit of snow at the Matterhorn summit. There is a roaring Alpine River 100 feet below me as the melting of the glaciers accelerates. Mountain larks are diving and looping through the trees.

I have just had my third top-up on the schnapps and the cheese plate in front of me is to die for.

Life is good!

I have something else to celebrate as well. The performance of the Mad Hedge Fund Trader is off the charts and the best in its 14-year history. It seems the worse market conditions get, the better our numbers. We are up 3.81% so far in July, 54.66% year-to-date, and are averaging 45.01% a year. It doesn’t get any better than that.

Or maybe it does.

Where is the recession? If you work in the imploding Bitcoin universe or the suffering mortgage origination business, you are definitely in a recession. But if you work in any other industry, you are not.

Sure, things are slowing down in interest rate-related sectors, like new home construction. But that does not make a recession.

If we are in a recession, we are in a full employment one, with the headline Unemployment Rate at a near record low of 3.6%. No one has ever seen one of those before. And if no one is losing their job in this recession, who cares?

In the meantime, the Fed is slowly and unobtrusively winning its war against inflation. Soaring interest rates have caused the housing market to grind to a halt. Used car prices have rolled over and repossessions are climbing.

It may take a couple of months to see this in the official inflation numbers, but the next Fed shocker could be a hint that the pace of interest rate rises may be slowed or stopped. Stocks would go through the roof on this because the falling inflation trade will have begun.

By the time you realize that we are in a recession, it will be over, and the next decade-long bull market will have begun.

This is one of those rare times when the long-term investor is actually rewarded versus his shorter-term trading colleagues. If you bought stocks during every postwar recession over the last 80 years, stocks were ALWAYS up on a three-year view, and they always DOUBLE on a five-year view.

That doesn’t sound bad to me.

The rollover in the price of oil is a crucial part of this view. Of course, it is recession fears that are driving the price of crude down, now off 29% from its wartime $132 high. That cuts the price of gasoline, the major inflation driver this year. Falling inflation means fewer interest rate rises, making stocks more valuable.

You see, it’s all connected.

And before I sign off, I want to update you on the NATO piece I sent out on Friday.

I just spoke with the chairman of the British Chiefs of Staff Committee, their Joint Chiefs of Staff, and the one organization with the best read on Russian losses in the Ukraine War so far.

Russia has lost an incredible 2,000 tanks out of their initial 2,800 operational ones, and a further 4,000 armored vehicles. Russia has lost one-third of its army since February through deaths or injury, some 50,000 men.

Russia is now unable to defend itself from an attack from the West. Putin is assuming that we are nicer people than we actually are, which is always a fatal mistake.

I can’t tell you why I know this, only that I do. All I can say is that the Internet, advanced hardware, encryption, and artificial intelligence are amazing things.

London’s Heathrow Airport asks airlines to cap passengers at 100,000 a day, meaning many will cancel their least profitable flights. I was there yesterday, and it was a complete madhouse on the verge of a riot. You need to arrive three hours early to have any chance of making your flight. It’s all the result of three years of pent-up travel demand unleashing over a single problem. It makes America’s problems pale in comparison.

Musk Cancels Twitter Deal, saying there was no “there” there. Much of the business was bogus. Sure, it means five years of litigation, but why should the richest man in the world care. It’s good news for Tesla because it means less diversion of management time, although the news took the stock down $50. Buy (TSLA) on dips and avoid (TWTR) like Covid.

Crypto Hedge Fund Founders Go Missing, as the bankruptcy proceedings of 3AC go missing, leaving $12 billion in losses in their wake. It could be a death blow to emerging crypto infrastructure. Avoid crypto at all costs. There are too many better fish to fry, with the best quality stocks selling at big discounts.

Home Purchase Cancellations reach 15%, the highest since the pandemic began. Many deals are falling out of escrow because of failed financing at decade-high interest rates. Price cuts of 10% across the board are happening on the homes I have been watching. 30-year fixed rate mortgages at 5.75% are proving a major impediment. Homebuilders are also seeing shocking levels of cancellations.

Is There Now a Chip Glut? There is, says TechiInsight, a research firm. Extreme shortages have flipped to oversupply as a new Covid wave, and the Ukraine War cut back spending on new cell phones and PCs. The Crypto blow-up and contagion have completely eliminated high-end chip demand from new miners. That’s why the Philadelphia Semiconductor Index (SOX) is off 35% this year. Micron Technology has already cut back production of low-end chips by 20%. If a selloff ensues, buy (NVDA), (MU), and (AMD). They will lead any recovery.

The Euro Breaks Parity Against the US Dollar, a decades low, and the Swiss franc may be next. Soaring US interest rates are the reason, while recessionary Europe is still keeping theirs at negative numbers. The dollar will remain strong for another year, or as long as the US is raising and the continent is frozen.

CPI Comes in at 9.1%, much hotter than expected, forcing the Fed to maintain an aggressive rate hike posture. That’s up an eye-popping 1.3% from May. It’s not what the Biden administration wanted to hear. A big part of that was oil price rises which have already gone away. Rents were up 0.8%, the most since 1986, and pressure from labor costs is rising. It puts on the table new lows for the Dow Average, but not by much.

Bonds Invert Big Time, posting the biggest 2/10 spread in 22 years, strongly suggesting a recession. That means short term interest rates are higher than long term ones, or the 2-year paper is yielding 20 basis points more than ten-year bonds. Oil is also holding its crushing $8.00 loss. Bonds are already suffering their worst year since 1865 when it had to shoulder the enormous cost of winning the civil war.

Doctor Copper Says the Recession is Here, dropping by 39% since February. Covid caused a slowdown in demand from China, the world’s largest consumer. It looks like we may get another chance to buy Freeport McMoRan at bargain basement prices.

Weekly Jobless Claims jump to 244,000, the highest since Thanksgiving week in November. New York led, with Google and Microsoft adding to the numbers. Let the mini-recession begin!

JP Morgan (JPM) Earnings Dive 28%. CEO Jamie Diamond says that growth, spending, and jobs remain good, but Covid, inflation, rising interest rates, and the geopolitical outlook are a drag. This is an opportunity to buy the best-run bank in America at a deep discount.

Morgan Stanley (MS) takes a hit, with Q2 earnings down 11.3% YOY at $13.13 billion. Return on equity dropped from 13.8% to 10.1%. Equity and bond trading were strong while investment banking in the falling market was weak. Money continues to pour into asset management, which I helped found 40 years ago. Buy (MS) on the dip.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my July month-to-date performance exploded to +3.81%.

My 2022 year-to-date performance ballooned to 54.66%, a new high. The Dow Average is down -18.91% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 74.56%.

That brings my 14-year total return to 567.22%, some 2.70 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to an eye-popping 45.01%, easily the highest in the industry.

With the July options expiration having gone spectacularly in our favor, we are now 80% in cash. The remaining 20% is in a Tesla (TSLA) August $500-$900 short strangle. If you don’t know what that is, please read your trade alerts.

We need to keep an eye on the number of US Coronavirus cases at 89.6 million, up 500,000 in a week and deaths topping 1,023,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, July 18 at 8:30 AM, NAHB Housing Market Index for July is released.

On Tuesday, July 19 at 7:00 AM, the US Housing Starts and Building Permits for June are out.

On Wednesday, July 20 at 7:00 AM, Existing Home Sales for June are published.

On Thursday, July 21 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, July 22 at 7:00 AM, the S&P Global Flash PMI for July is disclosed. At 2:00, the Baker Hughes Oil Rig Count is out.

As for me, I am constantly asked why I do what I do, what motivates me, and why I keep taking such insane risks.

I have thought about this topic quite a lot over the years while piloting planes on long flights, crossing oceans, and sitting on mountain tops.

From a very early age, I have had an immense sense of curiosity, wanted to know what was over the next hill, and what the next country and people were like.

When I was five, my parents gave me an old fashioned alarm clock. I smashed it on the floor to see how it worked and spent a month putting it back together.

When I was eight, the local public library held a contest to see who could read the most books over the summer vacation. By the time September rolled along, the number three contestant had read 5, number two had read 10, and I had finished 365. I read the entire travel section of the library.

I vowed to visit every one of those countries and I almost did. So far, I have been to 125, and they keep inventing new ones all the time.

It helped a lot that I won the lottery with my parents. Dad was a tough Marine Corps sergeant who never withdrew from a fight and endlessly tinkered with every kind of machine. He was a heavyweight boxer with hands the size of hams. Dad went to the University of Southern California on the GI Bill to study business.

When I was 15, I bought a green 1957 Volkswagen bug for $200 that consumed a quart of oil every 20 miles. I tore the engine apart trying to fix it but couldn’t put it back together. So, I brought in dad. He got about half the engine done and hit a wall.

So, we piled all the parts into a cardboard box and took them down to a local garage run by a man who had been a mechanic for the German Army during the war, was taken prisoner, and opted to stay in the US when WWII ended. Even he ended up with four leftover parts that he couldn’t quite place, but the car ran.

Mom was brilliant, earned a 4.0 average in high school and a full scholarship to USC. They met in 1949 on the fraternity steps when she was selling tickets to a dance. She eventually worked her way up to a senior level at the CIA as a Russian translator of technical journals. I was called often to explain what these were about. For years, that gave me access to one of the CIA’s primary sources. When the Cold War ended, the first place my parents went to was Moscow. Their marriage lasted 52 years.

I was very fortunate that some of the world’s greatest organizations accepted me as a member. The Boy Scouts taught me self-sufficiency and survival skills. At the karate dojo in Tokyo, I learned self-confidence, utter fearlessness, and the ability to defend myself.

The Economist magazine is where I learned how to write and perform deep economic research. That got me into the White House where I observed politics and how governments worked. The US Marine Corps taught me how to fly, leadership, and the value of courage.

Morgan Stanley instructed me on the art of making money in the stock market, the concept of risk versus reward, and how to manage a division of a Fortune 500 company.

Being such a risk taker, it was inevitable that I ended up in the stock market. A math degree from UCLA gave me an edge over all my competitors when it counted. This was back when the Black-Scholes option pricing model was a closely guarded secret and was understood by only a handful of traders.

In the early 80s, I took a tip on a technology stock from a broker at Merrill Lynch and lost my wife’s entire salary for a year on a single options trade. I’ll never make that mistake again. I spent a month sleeping on the sofa.

I figured out that if you do a lot of research and preparation, big risks are worth taking and usually pay off.

I have met a lot of enormously successful, famous, and wealthy people over the years. They are incredibly hard workers, inveterate networkers, and opportunists. But they will all agree on one thing, that luck has played a major part in their success. Being in the right place at the right time is crucial. So is recognizing opportunity when it is staring you in the face, grabbing it by both lapels, and shaking it for all it’s worth.

If I hadn’t worked my ass off in college and graduated Magna Cum Laude, I never would have gotten into Mensa Japan. If I hadn’t joined Mensa, I never would have delivered a lecture in Tokyo on the psychoactive effects of tetrahydrocannabinol (THC), which the Tokyo police department and the famous Australian journalist Murray Sayle found immensely interesting.

Without Murray, I never would have made it into the Foreign Correspondents Club of Japan and journalism. If a 50-caliber bullet had veered an inch to the right, I never would have made it out of Cambodia.

You know the rest of the story.

I am an incredibly competitive person. Maybe it’s the result of being the oldest of seven children. Maybe it’s because I spent a lifetime around highly competitive people. That also means being the funniest person in the room, something of immense value in the fonts of all humor, the Marine Corps, The Economist, and a Morgan Stanley trading floor. If you can’t laugh in the face of enormous challenges, you haven’t a chance.

I have also learned that retirement means death and has befallen many dear old friends. It is the true grim reaper. Most people slow down when they hit my age. I am speeding up. I just have to climb one more mountain, fly one more airplane, write one more story, and send out one more trade alert before time runs out.

So, you’re going to have to pry my cold dead fingers off this keyboard before I give up on the Mad Hedge Fund Trader.

I hope this helps.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 27, 2022

Fiat Lux

Featured Trade:

(HERE IS YOUR NEXT DECADE LONG PLAY),

(CAT), ($COPPER), (FCX), (BHP), (RIO),

(TESTIMONIAL)

As I expected, the markets have continued their march to “cheap”, with the price-earnings multiple plunging in a week from 19X to 17X. This has occurred both through rising earnings and falling share prices.

“Cheap,” is now within range, a mere 10% drop in the (SPX) to $3,800 only 10% away, taking us to a 15X multiple. With the Volatility Index (VIX) at a sky-high $34, in another week we could be there.

The long-term smart money isn’t bothering to wait and has already started to scale into the best names. For now, they are overwhelmed by sellers panicking to sell the next market bottom, as they usually do. That won’t last.

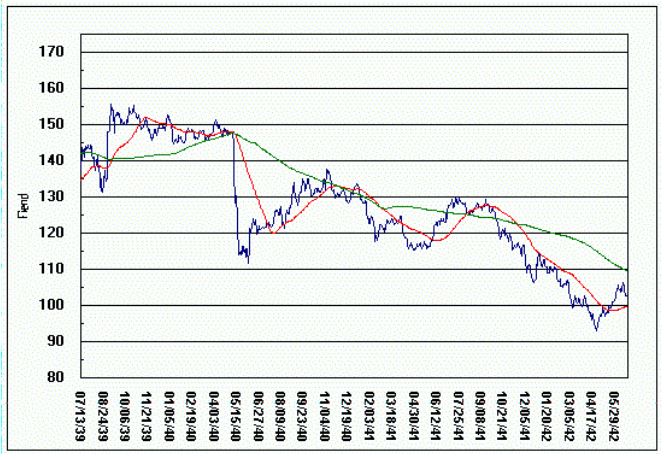

Stocks have seen their worst start to a year since 1942, right after the crushing Japanese attack on Pearl Harbor attack. They didn’t bottom until the US won the Battle of Midway in May, seven months later, even though the public didn’t learn about the strategic victory until months later.

That took the Dow Average down exactly 20%, from $115 to $92. Thereafter, the market began one of the greatest bull moves of all time, exploding from $92 to $240, up 161%.

That is how long and how much we may have to wait for a recovery this time as well with the same long-term outcome.

Those of you who have traditional 60/40 portfolios (60% stocks and 40% bonds), which are most of you, even though I advised against it, have suffered their worst start to a year since 1981, 40 years ago. Both bonds AND stocks have gone down huge.

NASDAQ, the red-headed stepchild of the day, delivered the worst monthly performance since October 2008. Playing from the short side has been like shooting fish in a barrel. The Mae Wests which have floated this market for years have been found to be full of holes.

Consumer discretionary stock delivered a horrific performance. The discretion of consumers right now is to flee stocks and own cash.

I prefer Oracle of Omaha Warren Buffet’s approach. For the first time in years, he is pouring money into stocks, some $51 billion in Q1. That includes $26 billion into California energy major Chevron (CVX), followed by a big bet on Occidental Petroleum (OXY) (click here for my piece at https://www.madhedgefundtrader.com/take-a-look-at-occidental-petroleum-oxy-4/ ).

These are clearly a bet that oil will remain high for at least five more years. That has whittled his cash position down from $147 billion to only $106 billion. Buffet likes to keep a spare $100 billion on hand so he can take over a big cap at any time.

Warren clearly eats his own cooking, buying $26 billion worth of his own stock in 2021. If you can’t afford the lofty $4,773 price for the “A” shares, try the “B” shares at $322.83, which also offer listed options on NASDAQ and in which Mad Hedge Fund Trader currently has a long position.

Rather than fleeing what you already own, because it’s too late, you’re better off building lists of what to buy at the bottom. And the farther the market falls, the more volatility I am looking for.

Investors are salivating at the demise of Cathy Wood’s Ark Innovation ETF (ARKK), which has collapsed by 72% in 14 months. In the meantime, the short Ark ETF (SARK) rose by 50% in April Alone.

You can scale into (ARKK) on the next Armageddon Day. Better yet, you can pick up their ten largest holdings. Those include:

Tesla (TSLA)

Zoom (ZM)

Roku (ROKU)

Coinbase (COIN)

Block (BLOK)

Exact Sciences (EXAS)

Unity Software (U)

Teladoc (TDOC)

Unity

UiPath (PATH)

Over five years, you can expect two of these to go bust, three to do nothing, two to get taken over at a 50% premium, one to double, one to go up ten times, and one to go up 50 times. If you do the math on this, it’s pretty attractive. Guess which one I think is going up ten times?

After listening to endless talking heads postulating about what Bitcoin is, I have finally come up with a definition. It is a small-cap non-earning stock. For that is the asset close showing the closest correlation in the current meltdown. That is not good because I expect small-cap non-earning stocks to go nowhere for the foreseeable future. Don’t hold your breath, but when they turn, you can expect a 2X-10X return on investment, as we did before.

My Ten Year View

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My April month-to-date performance added a decent 3.33%. My 2022 year-to-date performance ended at a chest-beating 30.18%. The Dow Average is down -13.5% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 62.56%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 542.74%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.71%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 81.4 million, up only 300,000 in a week, and deaths topping 993,000 and have only increased by 5,000 in the past week. Wow, we only lost the equivalent of 12 Boeing 747 crashes in a week! Great news indeed. You can find the data here at https://coronavirus.jhu.edu.

The coming week is a big one for the jobs reports.

On Monday, May 2 at 7:00 AM EST, the ISM Manufacturing PMI is published. NXP Semiconductors (NXPI) reports.

On Tuesday, May 3 at 7:00 AM, the JOLTS Job Openings report is announced. Skyworks Solutions Reports (SWKS).

On Wednesday, May 4 at 8:30 AM, ADP Private Sector Employment Change is printed. At 11:00 AM the Federal Reserve announced its interest rate decision. Jay Powell’s press conference follows at 11:30. Moderna (MRNA) reports.

On Thursday, May 5 at 8:30 AM, Weekly Jobless Claims are disclosed. Conoco Phillips (COP) reports.

On Friday, May 6 at 8:30 AM, the Nonfarm Payroll Report for April is released.

At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, I spent a decade flying planes without a license in various remote war zones because nobody cared.

So, when I finally obtained my British Private Pilot’s License at the Elstree Aerodrome, home of the WWII Mosquito twin-engine bomber, in 1987, it was cause for celebration.

I decided to take on a great challenge to test my newly acquired skills. So, I looked at an aviation chart of Europe, researched the availability of 100LL aviation gasoline, and concluded that the farthest I could go was the island nation of Malta.

Caution: new pilots with only 50 hours of flying time are the most dangerous people in the world!

Malta looms large in the history of aviation. At the onset of the second world war, Malta was the only place that could interfere with the resupply of Rommel’s Africa Corps, situated halfway between Sicily and Tunisia. It was also crucial for the British defense of the Suez Canal.

So, Malta was mercilessly bombed, at first by Mussolini’s Regia Aeronautica, and later by the Luftwaffe. By April 1942, the port at Valletta became the single most bombed place on earth.

Initially, Malta had only three obsolete 1934 Gloster Gladiator biplanes to mount a defense, still in their original packing crates. Flown by volunteer pilots, they came to be known as “Faith, Hope, and Charity.”

The three planes held the Italians at bay, shooting down the slower bombers in droves. As my Italian grandmother constantly reminded me, “Italians are better lovers than fighters.” By the time the Germans showed up, the RAF had been able to resupply Malta with as many as 50 infinitely more powerful Spitfires a month, and the battle was won.

So Malta it was.

The flight school only had one plane they could lend me for ten days, a clapped-out, underpowered single-engine Grumman Tiger, which offered a cruising speed of only 160 miles per hour. I paid extra for an inflatable life raft.

Flying over the length of France in good weather at 500 feet was a piece of cake, taking in endless views of castles, vineyards, and bright yellow rapeseed fields. Italy was a little trickier because only four airports offered avgas, Milan, Rome, Naples, and Palermo. Since Italy had lost the war, they never experienced a postwar aviation boom as we did.

I figured that if I filled up in Naples, I could make it all the way to Malta nonstop, a distance of 450 miles, and still have a modest reserve.

Flying the entire length of Italy at 500 feet along the east coast was grand. Genoa, Cinque Terra, the Vatican, and Mount Vesuvius gently passed by. There was a 1,000-foot-high cable connecting Sicily with the mainland that could have been a problem, as it wasn’t marked on the charts. But my US Air Force charts were pretty old, printed just after WWII. But I spotted them in time and flew over.

When I passed Cape Passero, the southeast corner of Sicily, I should have been able to see Malta, but I didn’t. I flew on, figuring a heading of 190 degrees would eventually get me there.

It didn’t.

My fuel was showing only quarter tanks left and my concern was rising. There was now no avgas anywhere within range. I tried triangulating VORs (very high-frequency omnidirectional radar ranging).

No luck.

I tried dead reckoning. No luck there either.

Then I remembered my WWII history. I recalled that returning American bombers with their instruments shot out used to tune into the BBC AM frequency to find their way back to London. Picking up the Andrews Sisters was confirmation they had the right frequency.

It just so happened that buried in my pilot’s case was a handbook of all European broadcast frequencies. I look up Malta, and sure enough, there was a high-powered BBC repeater station broadcasting on AM.

I excitedly tuned in to my Automatic Direction Finder.

Nothing. And now my fuel was down to one-eighth tanks and it was getting dark!

In an act of desperation, I kept playing with the ADF dial and eventually picked up a faint signal.

As I got closer, the signal got louder, and I recognized that old familiar clipped English accent. It was the BBC (I did work there for ten years as their Tokyo correspondent).

But the only thing I could see were the shadows of clouds on the Mediterranean below. Eventually, I noticed that one of the shadows wasn’t moving.

It was Malta.

As I was flying at 10,000 feet to extend my range, I cut my engines to conserve fuel and coasted the rest of the way. I landed right as the sunset over Africa.

While on the island, I set myself up in the historic Excelsior Grand Hotel. Malta is bone dry and has almost no beaches. It is surrounded by 100-foot cliffs. I paid homage to Faith, the last of the three historic biplanes, in the National War Museum in Valetta.

The other thing I remember about Malta is that CIA agents were everywhere. Muammar Khadafy’s Libya was a major investor in Malta, recycling their oil riches, and by the late 1980’s owned practically everything. How do you spot a CIA agent? Crewcut and pressed creased blue jeans. It’s like a uniform. What they were doing in Malta I can only imagine.

Before heading back to London, I had to refuel the plane. A truck from air services drove up, dropped a 50-gallon drum of avgas on the tarmac along with a pump then they drove off. It took me an hour to hand pump the plane full.

My route home took me directly to Palermo, Sicily to visit my ancestral origins. On takeoff to Sardinia wind shear flipped my plane over, caused me to crash, and I lost a disk in my back.

But that is a story for another day.

Who says history doesn’t pay!

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Faith”

The Andrews Sisters

Spitfire

Grumman Tiger

Global Market Comments

April 25, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE ESCALATOR UP AND THE WINDOW DOWN)

($INDU), (SPY), (TLT), (WFC), (JPM),

(TSLA), (TWTR), (FCX), (NFLX), (GLD)

On Friday, we saw the worst day in the market since October 2020. And it won’t be the last such meltdown day.

The big question for the market now is how far it can fall without actually having a recession. The answer is 20%, and we are down 8.6% so far.

The economy is as strong as ever and everyone that is predicting a recession is using outdated, useless models. If I have to wait nine months for the delivery of my sofa demand is still off the charts.

Spoiler Alert!

I have to do some math here to explain the current situation. So, don’t run down the street screaming with your hair on fire. Math is your friend, not your enemy.

With an average estimated $227.33 forecast earnings for the S&P 500, we are currently trading at a multiple of 19.29X ($4,386 divided by $227.33). At the November high, we were trading at 24X. At the 2009 Financial Crisis low, we saw 9.5X for a few nanoseconds. There’s our range, 9.5X to 24X.

So, stocks are still historically expensive. They won’t start to approach cheap until we drop to 15X, a level we haven’t seen in nearly a decade. That is another 4.29 multiple points lower, or down 22.23%.

How do we get to cheap?

Since November, the S&P 500 has earned another $60, or 1.36X multiple points. We’ll probably pick up another $55, or 1.25X multiple points in Q2. That gets us halfway there.

The (SPX) is down 8.6% so far in 2022, or $414. If Q2 earnings come in as expected, then the (SPX) only has to fall by another 1.68X multiple points, or 8.72% to $4,004 to get to our 15X downside target.

I hasten to remind you that this was exactly 10% below my downside forecast of an H1 loss of 10% in my 2022 Annual Asset Class Review (click here)for the link.

The Ukraine War and the third oil shock, neither of which I, or anybody else, predicted, account for the second 10% loss.

How long will it take to reach these new, enhanced downside targets? My guess is by the summer.

And you wondered why I was still 100% in cash….until Thursday?

So what does the Federal Reserve make of all this? Even though they say they don’t care about the stock market, it really does, especially when it is crash-prone.

Some 2.50% in expected interest rate hikes are already discounted by the futures market. The market has already done the Fed’s work, and we were short all the way, via the (TLT). We will likely get aggressive half-point rate hikes through April to June, especially if inflation goes double-digit, which it might.

At that point, the Fed may be ahead of the curve. If we get the slightest backtrack in inflation, even just for one month, the Fed may well back off a bit on its tightening strategy and skip a meeting, igniting a monster stock market rally in the second half.

Poof! Your inflation fears have gone away.

Jay Powell Thrust a Dagger into the heart of the Stock Market, sending the Dow down 1,000. At this point, the only question is whether we get two back-to-back 50 basis point rate hikes coming, or two back-to-back 75 basis point rate hikes. 75 basis points is becoming the new 25 basis points.

TINA is dead (there is no alternative to stocks) with virtually all fixed income securities offering a 3.00% yield and junk bonds paying 6%. These kinds of yields have started sucking money out of stocks into bonds, which is why I am long bonds.

There is one other sparkly asset class that is worthy of attention here. Gold, the yellow metal, the barbarous relic (GLD), may have just entered a long-term structural bull market. By evicting Russia from the global financial system, we have driven it out of dollars and into gold and Bitcoin for good. Take a look at the Gold Miners ETF (GDX).

And Russia is not alone in pouring its revenues into gold, which can’t be seized by foreign governments, so is every other country that might be subject to future sanctions, like China. This adds up to a heck of a lot of new gold buying and could take the barbarous relic to my old long-term target of $3,000 an ounce.

Bonds Crash Again, with ten-year US Treasury bond yields topping 3.02% overnight, a three-year high. Those who took my advice to buy the (TBT) in November are now up 44%. The market is now oversold in the extreme and could rally $5-$10 at any time. This could happen right around the next Fed meeting on April 28.

Tesla Earnings Soar by 87% YOY, taking the stock up $90. Musk is still predicting that 50% YOY growth in sales will continue as far as the eye can see and could reach 2 million this year if they can get the lithium. There is a one-year wait for a Tesla now. With gasoline at $6.00 a gallon everyone who bought a Tesla in the last 12 years is looking like a genius. $10,000 a share here we come! Keep buying (TSLA) on dips, as I have been begging you do to for the last 12 years.

Netflix Gets Destroyed, on horrific earnings and falling subscribers. Disney and Amazon are clearly eating their lunch. Hedge fund manager Bill Ackman dumped his position with a $400 million loss. At this point, (NFLX) is a high risk, high return trade than may take years to play out, not my cup of tea.

Corn Hits Nine-Year High, above $8 a bushel. Russia’s invasion of Ukraine may take one-third of the global wheat supply off the market and cause Africa to starve. Who is the world’s largest food importer? China, which may be why the yuan has seen a rare selloff.

Weekly Jobless Claims Fall to 184,000, why the unemployed hit a 52-year low. No need for stimulus here. It’s clear that fear of interest rate rises is not scaring off companies from hiring. Fifty basis points here we come. The unemployment rate may hit an all-time low with the April report on May 6.

Twitter Adopts Poison Pill, to fight off Elon Musk’s takeover attempt. Musk’s offer is a generous 20% higher than the Friday close. If the poison pill is successful then Musk will dump his 9.9% holding, cratering the stock. The battle of the century is on! Incredibly, the stock is up today. (TWTR) holders should take the money and run.

Investor Optimism Hits 30-Year Low, according to the Association of Individual Investors. Now only 15.8% of investors are bullish, down 9% in a week. A lot of pros are starting to see this as a “BUY” signal.

World Bank Cuts Global Growth Outlook on Russian War, from 4.1% in January to 3.2%. This compares to 5.7% in 2021. Europe and central Asia are taking the big hits.

Natural Gas Hits 13-Year High, to $7.80 per MM BTU, up 100% YTD. American exports are rushing to fill the gap in Europe. With the war showing no end in sight, prices will go higher before they go lower.

Copper is Facing a Giant Short Squeeze, and the world rushes into alternative energy, says Freeport McMoRan (FCX) CEO Richard Adkerson. World copper output will have to triple just to accommodate Tesla’s long-term target of 20 million vehicles a year. Buy (FCX) on dips, like this one.

US Housing Starts Hit 15 Year High, up 0.3% in March to 1.79 million. Applications to build top 1.87 million. The US has a structural shortage of 10 million homes caused by the large number of small builders that went under during the financial crisis and never came back.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My March month-to-date performance retreated to a modest 2.58%. My 2022 year-to-date performance ended at a chest-beating 29.28%. The Dow Average is down -6.8% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 71.86%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 541.94%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.6 million, up only 300,000 in a week, and deaths topping 988,000 and have only increased by 3,000 in the past week. Wow, we only lost the equivalent of eight Boeing 747 crashes in a week! Great news indeed. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

The coming week is a big one for tech earnings.

On Monday, April 25 at 8:30 AM EST, the Chicago Fed National Activity Index for March is out. Activision Blizzard Reports (ATVI).

On Tuesday, April 26 at 8:30 AM, US Durable Goods for March are printed. At 9:00 AM the S&P Case Shiller National Price Index is announced. Alphabet (GOOGL) and Microsoft (MSFT) report.

On Wednesday, April 27 at 8:30 AM, the Pending Homes Sales for March are released. Qualcomm and Meta (FB) report.

On Thursday, April 28 at 8:30 AM, the Weekly Jobless Claims are printed. We also get the first look at Q1 GDP. Apple (AAPL), Amazon (AMZN) and Intel (INTC) report.

On Friday, April 29 at 8:30 AM, the Personal Income and Spending for March are disclosed.At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, when you are a guest of the KGB in Russia, you get treated like visiting royalty par excellence, no extravagance spared. That was the setup I walked into when I was sent by NASA to test fly the MiG 25 in 1993.

Far a start, I was met at Moscow’s Sheremetyevo Airport by Major Anastasia Ivanova, who was to be my escort and guide for the week. She had a magic key that would open any door in Russia and gave me a tour worthy of a visiting head of state.

Anastasia was drop-dead gorgeous. She topped 5’11” with light blonde hair, and was statuesque with chiseled high cheekbones and deep blue eyes. She could easily have taken a side job as a Playboy centerfold. But I could tell from her hands she was no stranger to martial arts and was not to be taken lightly. And wherever we went people immediately tensed up. They knew.

For a start, I was met on the tarmac by a black Volga limo. No need for customs or immigration here. Anastasia simply stamped my passport and welcomed me to Russia, whisking me off to the country’s top Intourist hotel.

The next morning, I was given a VIP tour of the Kremlin and its thousand-year history. I was shown a magnificent yellow silk 18th century ball gown worn by Catherine the Great. I asked her if the story about the horse was true, and she grimaced and said yes.

In a side room were displayed the dress uniforms of Adolph Hitler. I asked what happened to the rest of him and she said he was buried under a parking lot in Magdeburg, East Germany.

Out front, I was taken to the head of the line to see Lenin’s Tomb, which looked like he was made of wax. I think he has since been buried. In front of the Kremlin Armory, I found the Tsar Cannon, a gigantic weapon meant to fire a one-ton ball.

There was only one decent restaurant in Moscow in those days and Anastasia took me out to dinner both nights. Suffice it to say that the Beluga caviar and Stolichnaya vodka were flowing hot and heavy. The service was excellent. We were never presented with a bill. I guess it just went on the company account.

After my day in the capital, I was whisked away 200 miles north to the top secret Zhukovky Airbase to fly the MiG 25. A week later, Anastasia was there in her limo to take me back to Moscow.

The next morning Anastasia was knocking on my door. “Get dressed,” she said. “There’s something you want to see.”

She drove me out to a construction site on the southwestern outskirts of the city. As Moscow was slowly westernizing, suburbs were springing up to accommodate a rising middle class. One section was taped off and surrounded by the Moscow Police. That’s where we headed.

While digging the foundation for a new home, the builders had broken into a bunker left from WWII. Moscow had grown to reach the front lines of the 1942 Battle of Moscow. In Berlin during the 1960s, I worked with a couple of survivors of this exact battle. I was handed a flashlight and we ventured inside.

There were at least 30 German bodies inside in full uniform, except that only the skeletons were left. They still wore their issued steel helmets, medals, belt buckles, and binoculars. There were also dozens of K-98 8 mm rifles, an abundance of live ammunition and potato mashers (hand grenades), and several MG-42’s (yes, I know my machines guns).

The air was dank and musty. My guess was that the bunker had taken a direct hit from a Soviet artillery shell and had remained buried ever since. As a cave in threatened, we got the hell out of there in a few minutes.

Then Anastasia continued with our planned day. Since it was Sunday, she took me to the Moscow Flea Market. Russia was suffering from hyperinflation at the time, and retirees on fixed incomes were selling whatever they had in order to eat.

Everything from the Russian military was for sale for practically nothing, including hats, uniforms, medals, and night vision glasses. I walked away with a pair of very high-powered long-range artillery binoculars for $5. I paused for a moment at an 18th century German bible printed in archaic fraktur. But then Anastasia said I might get hung up by Russia’s antique export ban on my departure.

Anastasia and I kept in touch over the years. I sent him some pressed High Sierra wildflowers, which impressed her to no end. She said such a gesture wouldn’t even occur to a Russian man.

We gradually lost contact over the years, given all the turmoil in Russia that followed. But Anastasia left me with memories I will never forget. And I still have those binoculars to use at the Cal football games.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 22, 2022

Fiat Lux

Featured Trade:

(APRIL 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPX), (TSLA), (TBT), (TLT), (BAC), (JPM), (MS),

(BABA), (TWTR), (PYPL), (SHOP), (DOCU),

(ZM), (PTON), (NFLX), (BRKB), (FCX), (CPER)

Below please find subscribers’ Q&A for the April 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: Should I take profits on the ProShares UltraShort 20+ Year Treasury ETF (TBT), or will it go lower?

A: Well, you’ve just made a 45% profit in 4 months; no one ever gets fired for taking a profit. And yes, it will go lower, but I think we’re due for a 5 -10% rally in the (TBT) and we’re seeing some of that today.

Q: Do you think the bottom is in now for the S&P 500 Index (SPX)?

A: No, I think the 50 basis point rate hikes will put the fear of God into the market and prompt another round of profit-taking in stocks. So will another ramp up or expansion in the Ukraine War, and so could another spike in Covid cases. And interest rates are getting high enough, with a ten-year US Treasury (TLT) at 2.95% and junk at 6.00% that they will start to bleed off money from stocks.

So there are plenty of risks in this market that I don’t need to chase thousand point rallies that fail the following week.

Q: What would cause a rally in the iShares 20 Plus Year Treasury Bond ETF (TLT)?

A: Everyone in the world is short, for a start. And secondly, we’ve had a $36 point drop in the market in 4 ½ months—that is absolutely screaming for a short-covering rally. It would be typical of the market to get everybody in the world short one thing, and then ramp it right back up. You can bet hedge funds are just gunning for that trade. So those are two big reasons. Another big reason is getting a slowdown in the economy. Fear of interest rate rises and yield curve inversions are certainly going to scare people into thinking that.

Q: Where to buy Tesla (TSLA)?

A: We had a $1,200 all-time high at the end of last year, then sold off to $700—that was your ideal entry point, on that one day when the market was down $1,000 and they were throwing out Tesla stock like there was no tomorrow. We have since rallied back to the 1100s, so I'd say at this point, anything you could get under just above the $200-day moving average at $900 would be a gift because the sales are happening and they’re making tons of money. They’re so far ahead of the rest of the world on EV technology that no one will ever be able to catch up. A lot of the biggest companies like Ford (F) and (GM) are still unable to mass produce electric cars, even though they’re all talking about these wonderful models they're bringing out in 2024 and 2025. So, I think Tesla is just so far ahead in the market that no one will catch them. And the stock will have to reflect that by trading at a higher premium.

Q: I Bought the ProShares UltraShort 20+ Year Treasury ETF (TBT) at your advice at $14, it’s now at 425. Time to take the money and run?

A: Yes, so that you’re in position to rebuy the (TBT) at $22, or even $20.

Q: I bought some bank LEAPS such as Bank of America (BAC), JP Morgan (JPM), and Morgan Stanley (MS) just before earnings; they’re doing well so far.

A: That will definitely be one of my target sectors on any recovery; because the only reason the stock market recovers is because recession fears have been put away, and the only reason the banks have been going down is because of recession fears. Certainly, the yield curve inversion has been helping them lot, as are absolute higher interest rates. So yes, zero in on the banks, I’m holding back waiting for better entry points, but for those who are aggressive, there’s no problem with scaling in here.

Q: If Putin uses a tactical nuclear weapon in the Ukraine, what would be the outcome?

A: Well, I don't think he will, because you don’t want to use nukes on your neighbors because the wind tends to blow the radiation back into your own country. It also depends on when he does this; if Ukraine joins NATO, joins the EC, and NATO troops enter Ukraine, and then they use tactical nukes, France and England also have their own nuclear weapons. So, attacking a nuclear foe and risking bringing in the US, who could wipe out the whole country in minutes, would not be a good idea.

Q: Would you get into Chinese stocks here?

A: Not really; China seems to have changed its business model permanently by abandoning capitalism. The Mad Hedge Technology Letter is currently running a short position in Alibaba (BABA) which has proved highly successful. Although these things are stupidly cheap, they could get cheaper before they turn around. Also, there’s the threat of delisting on the stock exchanges facing them in a year or two, and the trade tensions which continue with China. China doesn’t seem friendly anymore or is interested in capitalism. You don't want to own stocks anywhere in that situation. And by the way, Russia has also banned all foreign stock listings. China could do the same—not good if you’re an owner of those stocks.

Q: How would you play Twitter (TWTR) now?

A: I think it’s a screaming short, myself. If the board doesn’t accept Elon’s offer, which seems to be the case with their poison pill adoption, there are no other buyers of Twitter; and Elon has already said he’s not going to pay up. So you take Elon Musk’s shareholding out of the picture, and you’re looking at about a 30% drop.

Q: Many of the biggest Covid beneficiaries are near or below their March 2020 lows, such as PayPal (PYPL), Shopify (SHOP), DocuSign (DOCU), Zoom (ZM), Peloton (PTON), Netflix (NFLX), etc. Are these buys soon or are there other new names joining them?

A: I think this will continue to be a laggard sector. I think any recovery will be led by big tech, and once big tech peaks out after a 6-month run, then you may get the smaller ones catching up—especially if they're still down 80% or 90%. So that’s a no-touch for me; too many better fish to fry.

Q: Do you think inflation is transitory or are we headed toward double digits over the long term?

A: The transitory argument got thrown out the window the day Russia invaded Ukraine; they are one of the world’s largest producers of both energy and wheat. So that definitely set those markets on fire and really could end up adding an extra 5% in our inflation numbers before we peak out. I think we will see the highs sometime this year, could be as low as 4% by the end of this year. But we may have a double-digit print before we top out, and that could be next month. So, if you’re looking for another reason for stocks to sell out, that would be a good one.

Q: If the EU could limit oil purchases from Russia, then the war would be over in a month since Russia has no borrowing power or reserves.

A: The problem is whether they actually could limit oil purchases, which they can’t do immediately. If you could limit them in a year or cut them down by like 80%, we could come up with the other 20%, that is possible. Then, the war would end and Russia would starve; but Russia may starve anyway. Even with all the rubles in the world, they can’t buy anything overseas. Basically, Russia makes nothing, they only sell commodities and use those proceeds to buy consumer goods from abroad, which have all been completely cut off. They’re in for an economic disaster no matter what happens, and they have no way of avoiding it.

Q: What are your thoughts on supply chain problems?

A: I actually think they’re getting better; I watch the number of ships at anchor in San Francisco Bay, and it’s actually down by about half over the last 3 months. People are slowly starting to get things that they ordered nine months ago, used car prices are starting to roll over…so yes, it’s going to be a very slow process. It took one week to shut down the global economy, it’ll take three years to get it fully reopened. And of course, that’s extended by the Ukraine War. Plus, as long as there are supply chain problems and huge prices being paid for parts and labor, you’re not going to have a recession, it’s impossible.

Q: What’s your outlook on tech stocks?

A: I see them bottoming in the current quarter, and then going on to new all-time highs in the second half.

Q: What about covered calls?

A: It’s a really good idea, allowing you to get long a stock here, and reduce your average cost every month by writing calls against your position until they eventually get called away. Not too long ago, I wrote a piece on covered calls, so I could rerun that again to get people familiar with the concept.

Q: If Warren Buffet retires, what happens to Berkshire Hathaway (BRKB) stock?

A: It drops about 5% one day, then goes on to new highs. The concept of a 90-year-old passing away in his sleep one night is not exactly revolutionary or new. Replacements for Buffet have been lined up for so long that now the replacements are retiring. I think that’s pretty much baked in the price.

Q: Any plans to update the long-term portfolio?

A: Yes it’s on my list.

Q: Too late to buy Freeport McMoRan (FCX)?

A: Yes I’m afraid so. We’ve had a near double since September when it started moving. However, I would hold it if you already own it and add on any substantial selloff. Freeport McMoRan announced fabulous earnings today, and the stock promptly sold off 9%. It was a classic “buy the rumor, sell the news” type move. This is despite the fact that the United States Copper Fund ETF (CPER), in which (FCX) is a major holding, is up on the day. Please remember that I told you earlier that each Tesla needs 200 pounds of copper, that Tesla sales could double to 2 million this year, and that they could sell 4 million if they could make them. It sounds like a bullish argument of me, of which (FCX) is the world’s largest producer.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 25, 2022

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(MARCH 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (TSLA), (BA), (DEER), (CAT),

(AAPL), (SLV), (FCX), (TLT), (TBT)

Below please find subscribers’ Q&A for the March 23 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: What is the best way to keep your money in cash?

A: That’s quite a complicated answer. If you leave cash in your brokerage account, they will give you nothing. If you move it to your bank account they will, again, give you nothing. But, if you keep the money in your brokerage account and then buy 2-year US Treasury bills, those are yielding 2.2% right now, and will probably be yielding over 3% in two years, so we’re actually being paid for cash for the first time in over ten years. And, as long as it’s in your brokerage account, you can then sell those Treasury bonds when you’re ready to go back into the market and buy your stock, same day, without having to perform any complicated wire transfers, which take a week to clear. Also, if your broker goes bankrupt and you hold Treasury bills, they are required by law to give you the Treasury bills. If you have your cash in a brokerage cash account, you lose all of it or at least the part above the SIPC-insured $250,000 per account. And believe me, I learned that the hard way when Bearings went bankrupt in the 1990s. People who had the Bearings securities lost everything, people who owned Treasury bills got their cashback in weeks.

Q: Is the pain over for growth stocks?

A: Probably yes, for the smaller ones; but they may flatline for a long time until a real earnings story returns for them. As for the banks, I think the pain is over and now it’s a question of just when we can get back in.

Q: Why did you initiate shorts on the Invesco QQQ Trust Series (QQQ) and SPDR S&P 500 ETF Trust (SPY) this week, instead of continuing with the iShares 20 Plus Year Treasury Bond ETF (TLT) shorts?

A: We are down 27 points in 10 weeks on the (TLT); that is the most in history. And every other country in the world is seeing the same thing. That is not shorting territory—you should have been shorting above $150 in the (TLT) when I was falling down on my knees and begging you to do so. Now it’s too late. If we get a 5-point rally, which we could get any time, that’s another story. It is so oversold that a bounce of some sort is inevitable. I’d rather be in cash going into that.

Q: Do you think Tesla (TSLA) has put in a bottom, or do you still see more downside? Is it time to buy?

A: The time to buy is not when it is up 50% in 3 weeks, which it has just done. The time to buy is when I sent out the last trade alert to buy it at $700. This was a complete layup as a long three weeks ago because I knew the German production was coming onstream very shortly; and that opens up a whole new continent, right when energy prices are going through the roof—the best-case scenario for Tesla. And the same is happening in the US—it’s a one-year wait now to get a new Model X in the US. In fact, I can sell my existing model X for the same price I paid for it 3 years ago, if I were happy to wait another year to get a replacement car.

Q: Will the Boeing (BA) crash in China damage the short-term prospects? And as a pilot, what do you think actually happened?

A: Boeing has been beat-up for so long that a mere crash in one of its safest planes isn’t going to do much. It could have been a maintenance issue in China, but the fact that there was no “mayday” call means only two or three possibilities. One is a bomb, which would explain there being no mayday call—the pilots were already dead when it went into freefall. Number two would be a complete structural failure, which is hard to believe because I’ve been flying Boeings my entire life, and these things are made out of steel girders—you can’t break them. And number three is a pilot suicide—there have been a couple of those over the years. The Malaysia flight that disappeared over the south Indian Ocean was almost certainly a pilot suicide, and there was another one in Germany and another in Japan about 20 years ago. So, if they come up with no answer, that's the answer. It’s not a Boeing issue, whatever it is.

Q: Is John Deer (DEER) or Caterpillar (CAT) a better trade right now?

A: It’s kind of six of one, half a dozen of the other. Caterpillar I’ve been following for 50 years, so I’m kind of partial to CAT, and Caterpillar has a much bigger international presence, but that could be a negative these days in a deglobalizing world.

Q: Apple (AAPL) has really caught fire past $170. Should I chase it here or wait until it’s too overbought?

A: I never liked chasing. Even a small dip, like we’re having today, is worth getting into. So always buy on the dips.

Q: Is Silver (SLV) still a good long-term play?

A: Yes, because we do expect EV production to ramp up as fast as they can possibly do it. Too bad the American companies don’t know how to make electric cars—they just haven’t been able to get their volumes up because of production problems that Tesla solved 12 years ago. So, long term, I think it will do better, but right now the risk-on move is definitely negative for the precious metals.

Q: How low will the iShares 20 Plus Year Treasury Bond ETF (TLT) go in April before the next Fed meeting?

A: I think we’re bottoming for the short term right around here. That’s why I had on that $127-$130 call spread in the (TLT) that I got stopped out of. And I may well end up being right, but with these call spreads, once you break your upper strike, the math goes against you dramatically. You go from like a 1-1 risk profile to like a 10-1 against you. So, you have to get out of those things when you break your upper strike, otherwise, you risk writing off the entire position with 100% loss. As long as Jay Powell keeps talking about successive half-point rate cuts, we will get lower lows, and my 2023 target for the TLT is $105, or about $20.00 points below here.

Q: Do you think we retest the bottoms?

A: Absolutely, yes; it just depends on where the test is successful—with a double bottom or with a retrace of half the recent moves. Keep in mind that stocks go up 80% of the time over the last 120 years, and that includes the Great Depression when they hardly went up at all for 10 years, so selling short is a professional’s game, and I wouldn’t attempt it unless you had somebody like me helping you. You're betting against the long-term trend with every short position. That said, if you’re quick you can make decent money. Most of the money we’ve made this year has been in short positions, both in stocks and in bonds.

Q: Where can we find this webinar?

A: The recording for this webinar will be posted on the website in about two hours. Just log into your account and you’ll find them all listed.

Q: When should I sell my tradable ProShares UltraShort 20+ Year Treasury ETF (TBT)?

A: You don’t have an options expiration to worry about, so I would just keep in until we hit $105 in the (TLT). If you do want to trade, I’d take a little bit off here and then try to re-buy it a couple of points lower, maybe 10% lower.

Q: What do you think of a Freeport McMoRan (FCX) $55-$60 vertical bull call spread?

A: The market has had such a massive move, that I’m reluctant to do out of the money call spreads from here unless we get a major dip. So, don’t reach for the marginal trade—that’s where you get your head handed to you.

Q: Will yield curve inversions matter this time and foretell a recession?

A: I think no, because corporate earnings are still growing, and by the summer, we probably will have a yield curve inversion.

Q: There seems to be some huge breakthrough in battery technology where batteries could be recharged within four minutes. I believe it’s the Chinese who have the tech, if so how will that impact on Tesla?

A: Every day of the year someone presents Tesla with a revolutionary new battery technology. It either doesn’t work, can’t be mass-produced, or is wildly uneconomical. So, I’ll confine my bet that Tesla will be able to eventually mass produce solid state batteries and get their 95% cost reduction that way.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.