Global Market Comments

April 23, 2019

Fiat Lux

Featured Trade:

(LAS VEGAS MAY 9 GLOBAL STRAGEGY LUNCHEON)

(APRIL 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (RWM), (IWM), (VXXB), (VIX), (QCOM), (AAPL), (GM), (TSLA), (FCX), (COPX), (GLD), (NFLX), (AMZN), (DIS)

Tag Archive for: (GLD)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 17 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What will the market do after the Muller report is out?

A: Absolutely nothing—this has been a total nonmarket event from the very beginning. Even if Trump gets impeached, Pence will continue with the same kinds of policies.

Q: If we are so close to the peak, when do we go short?

A: It’s simple: markets can remain irrational longer than you can remain liquid. Those shorts are expensive. As long as global excess liquidity continues pouring into the U.S., you’ll not want to short anything. I think what we’ll see is a market that slowly grinds upward until it’s extremely overbought.

Q: China (FXI) is showing some economic strength. Will this last?

A: Probably, yes. China was first to stimulate their economy and to stimulate it the most. The delayed effect is kicking in now. If we do get a resolution of the trade war, you want to buy China, not the U.S.

Q: Are commodities expected to be strong?

A: Yes, China stimulating their economy and they are the world’s largest consumer commodities.

Q: When is the ProShares Short Russell 2000 ETF (RWM) actionable?

A: Probably very soon. You really do see the double top forming in the Russell 2000 (IWM), and if we don’t get any movement in the next day or two, it will also start to roll over. The Russell 2000 is the canary in the coal mine for the main market. Even if the main market continues to grind up on small volume the (IWM) will go nowhere.

Q: Why do you recommend buying the iPath Series B S&P 500 VIX Short Term Futures ETN (VXXB) instead of the Volatility Index (VIX)?

A: The VIX doesn’t have an actual ETF behind it, so you have to buy either options on the futures or a derivative ETF. The (VXXB), which has recently been renamed, is an actual ETF which does have a huge amount of time decay built into it, so it’s easier for people to trade. You don’t need an option for futures qualification on your brokerage account to buy the (VXXB) which most people don’t have—it’s just a straight ETF.

Q: So much of the market cap is based on revenues outside the U.S., or GDP making things look more expensive than they actually are. What are your thoughts on this?

A: That is true; the U.S. GDP is somewhat out of date and we as stock traders don’t buy the GDP, we buy individual stocks. Mad Hedge Fund Trader in particular only focuses on the 5% or so—stocks that are absolutely leading the market—and the rest of the 95% is absolutely irrelevant. That 95% is what makes up most of the GDP. A lot of people have actually been caught in the GDP trap this year, expecting a terrible GDP number in Q1 and staying out of the market because of that when, in fact, their individual stocks have been going up 50%. So, that’s something to be careful of.

Q: Is it time to jump into Qualcomm (QCOM)?

A: Probably, yes, on the dip. It’s already had a nice 46% pop so it’s a little late now. The battle with Apple (AAPL) was overhanging that stock for years.

Q: Will Trump next slap tariffs on German autos and what will that do to American shares? Should I buy General Motors (GM)?

A: Absolutely not; if we do slap tariffs on German autos, Europe will retaliate against every U.S. carmaker and that would be disastrous for us. We already know that trade wars are bad news for stocks. Industry-specific trade wars are pure poison. So, you don't want to buy the U.S. car industry on a European trade war. In fact, you don’t want to buy anything. The European trade war might be the cause of the summer correction. Destroying the economies of your largest customers is always bad for business.

Q: How much debt can the global economy keep taking on before a crash?

A: Apparently, it’s a lot more with interest rates at these ridiculously low levels. We’re in uncharted territory now. We really don't know how much more it can take, but we know it’s more because interest rates are so low. With every new borrowing, the global economy is making itself increasingly sensitive to any interest rate increases. This is a policy you should enact only at bear market bottoms, not bull market tops. It is borrowing economic growth from futures year which we may not have.

Q: Is the worst over for Tesla (TSLA) or do you think car sales will get worse?

A: I think car sales will get better, but it may take several months to see the actual production numbers. In the meantime, the burden of proof is on Tesla. Any other surprises on that stock could see us break to a new 2 year low—that's why I don’t want to touch it. They’ve lately been adopting policies that one normally associates with imminent recessions, like closing most of their store and getting rid of customer support staff.

Q: Is 2019 a “sell in May and go away” type year?

A: It’s really looking like a great “Sell in May” is setting up. What’s helping is that we’ve gone up in a straight line practically every day this year. Also, in the first 4 months of the year, your allocations for equities are done. We have about 6 months of dead territory to cover from May onward— narrow trading ranges or severe drops. That, by the way, is also the perfect environment for deep-in-the-money put spreads, which we plan to be setting up soon.

Q: Is it time to buy Freeport McMoRan (FCX) in to play both oil and copper?

A: Yes. They’re both being driven by the same thing: China demand. China is the world’s largest new buyer of both of these resources. But you’re late in the cycle, so use dips and choose your entry points cautiously. (FCX) is not an oil play. It is only a copper (COPX) and gold (GLD) play.

Q: Are you still against Bitcoin?

A: There are simply too many better trading and investment options to focus on than Bitcoin. Bitcoin is like buying a lottery ticket—you’re 10 times more likely to get struck by lightning than you are to win.

Q: Are there any LEAPS put to buy right now?

A: You never buy a Long-Term Equity Appreciation Securities (LEAPS) at market tops. You only buy these long-term bull option plays at really severe market selloffs like we had in November/December. Otherwise, you’ll get your head handed to you.

Q: What is your outlook on U.S. dollar and gold?

A: U.S. dollar should be decreasing on its lower interest rates but everyone else is lowering their rates faster than us, so that's why it’s staying high. Eventually, I expect it to go down but not yet. Gold will be weak as long as we’re on a global “RISK ON” environment, which could last another month.

Q: Is Netflix (NFLX) a buy here, after the earnings report?

A: Yes, but don't buy on the pop, buy on the dip. They have a huge head start over rivals Amazon (AMZN) and Walt Disney (DIS) and the overall market is growing fast enough to accommodate everyone.

Q: Will wages keep going up in 2019?

A: Yes, but technology is destroying jobs faster than inflation can raise wages so they won’t increase much—pennies rather than dollars.

Q: How about buying a big pullback?

A: If we get one, it would be in the spring or summer. I would buy a big pullback as long as the U.S. is hyper-stimulating its economy and flooding the world with excess liquidity. You wouldn't want to bet against that. We may not see the beginning of the true bear market for another year. Any pullbacks before that will just be corrections in a broader bull market.

Good Luck and Good Trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Well, that was some week!

After moving up in a straight line for ten weeks, markets are now doing their best impression of a Q4 repeat.

The transports Index (XTN), the most important leading indicator for markets, has been down for 11 straight days, the worst run in 40 years.

And now for the bad news.

Look at a long term chart for the S&P 500 (SPY) and the head and shoulder top practically leaps at you and grabs you by the lapels (that is, if you are one of the few who still wears a suit).

It makes you want to slit your wrist, jump off the nearest bridge, or binge watch all nine seasons of The Walking Dead. It neatly has the next bear market starting around say May 10 at 4:00 PM EST, a rollover point I put out two years ago.

However, hold that move! As long as we have a free Fed put under the market in the form of Jay Powell’s “patience’ policy, we are not going to have a major crash any time soon. That is 2021 business.

It's more likely we trade in a long sideways range until the economy finally rolls over and dies. So when we hit my first (SPY) downside target at the 50-day moving average at $269, which is a very convenient 5% down from the recent top, could well bounce hard and I might add some longs in the best quality names. It all sets of my dreaded flatline of death scenario for the rest of 2019.

Last week saw an unremitting onslaught of bad news from the economy.

The February Nonfarm Payroll report came in at a horrific 200,000 when 210,000 was expected, sending traders to man the lifeboats. The headline Unemployment Rate dropped 0.2% to 3.8%. Average Hourly Earnings spiked 11 cents to $27.66, a 3.4% YOY gain and the biggest pop since 2009.

Construction lost 31,000 jobs, while leisure and Hospitality added no jobs at all. The stunner is that the U6 long term structural “discouraged worker” unemployment rate dropped an amazing 0.8% to 7.4%, the sharpest drop on record. Fewer jobs, but at higher wages is the takeaway here, the exact opposite of what markets want to hear.

US Construction Spending fell off a cliff, down 0.6% in December. It seems that nobody wants to invest ahead of a recession.

The dollar soared (UUP), and gold (GLD) got hammered. You can blame the slightly stronger GDP print on Thursday the week before, which came in at 2.2% instead of 1.8%. As long as Jay doesn’t raise interest rates this is just a brief short covering rally for the buck.

China cut its growth forecast from 6.5% to 6.0% GDP growth for 2019. The trade war with the US and the stimulus hasn’t kicked in yet. The last time they did this, the market fell 1,000 points. Buy (FXI) on the dip.

US Trade Deficit hit ten-year high at $59.8 billion for December, and a staggering $419 billion for the year. It’s funny how foreigners stop buying your goods when you declare war on them. Even Teslas (TSLA) are being stopped at the border in China. Who knew?

New trade tariffs hit US consumers the hardest adding $69 billion to their annual bill. Falling real earnings and rising costs is hardly a sustainable model. Will someone please tell the president?

US growth is fading, says the Fed Beige Book, slowing to a “slight to moderate rate”. The government shutdown is the cause. With Europe already in recession, I’ll be using rallies to increase my shorts. Sell (SPY) and (IWM).

The European Central Bank axed its growth forecast sharply, from 1.7% to 1.1%. Stimulus to renew on all front, including more quantitative easing. It’s just a matter of time before their recession pulls the US down. Sell the Euro (FXE).

You lost $3.7 trillion in Q4, or so says the Fed about the decline of national personal net worth during the stock market crash, the sharpest decline in a decade. You’re now only worth $104.3 trillion.

The Mad Hedge Fund Trader actually gained ground last week, thanks to profits on our short positions rising more than our offsetting losses on our longs.

I have doubled up my overall positions, finally taking advantage of the rollover in all risk assets from a historic ten-week run to the upside. I added shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) against a very deep in-the-money long in Freeport McMoRan (FCX) the world’s largest copper producer.

The thinking here is that with China the only economy in the world that is stimulating its economy and the planet’s largest copper consumer, copper makes a nice long side hedge against my short positions.

The Mad Hedge Technology Letter is happily running a short position is Apple (AAPL) which is now almost at its maximum profit point. We only have four days to run to expiration when the position we bought for $4.60 will be worth $5.00.

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started out negative, down -0.84%, thanks to a wicked stop loss on Gold (GLD). We had 80% of the maximum potential profit at one point but left the money on the table at the highs.

My 2019 year to date return ratcheted up to +12.84%, a new all-time high and boosting my trailing one-year return back up to +29.92%.

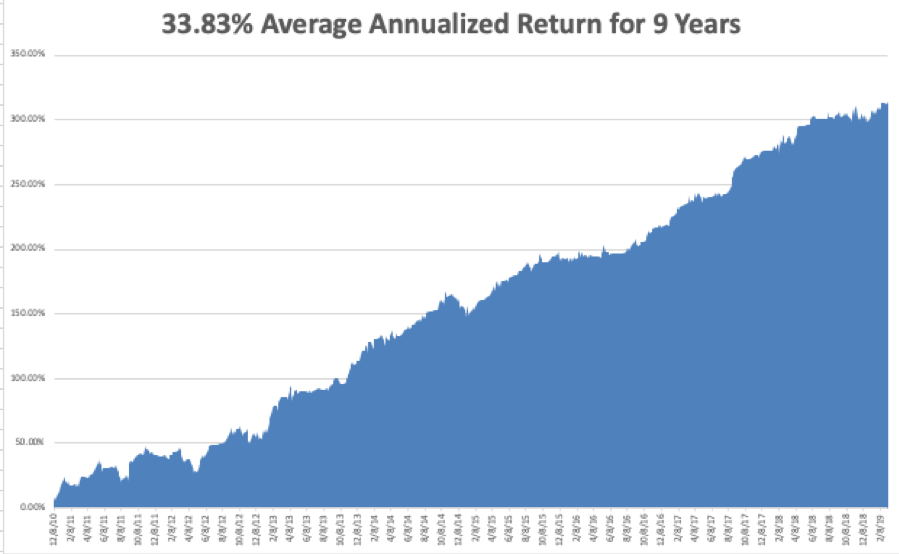

My nine-year return clawed its way up to +312.94%, another new high. The average annualized return appreciated to +33.83%.

I am now 50% in cash, 20% long Freeport McMoRan (FCX), and 10% short bonds (TLT), 10% short the S&P 500, and 10% short the Russell 2000.

We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 11, at 8:30 AM EST, January Retail Sales is ut.

On Tuesday, March 12, 8:30 AM EST, the February Consumer Price Index is published.

On Wednesday, March 13 at 8:30 AM EST, the February Durable Goods is updated.

On Thursday, March 14 at 8:30 AM EST, we get Weekly Jobless Claims. These are followed by January New Home Sales.

On Friday, March 15 at 9:15 AM EST, February Industrial Production comes out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be headed to the De Young Museum of fine art in San Francisco to catch the twin exhibitions for Monet and Gaugin. When it rains every day of the week, there isn’t much to do but go cultural.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Good Trades are Getting Harder to Find

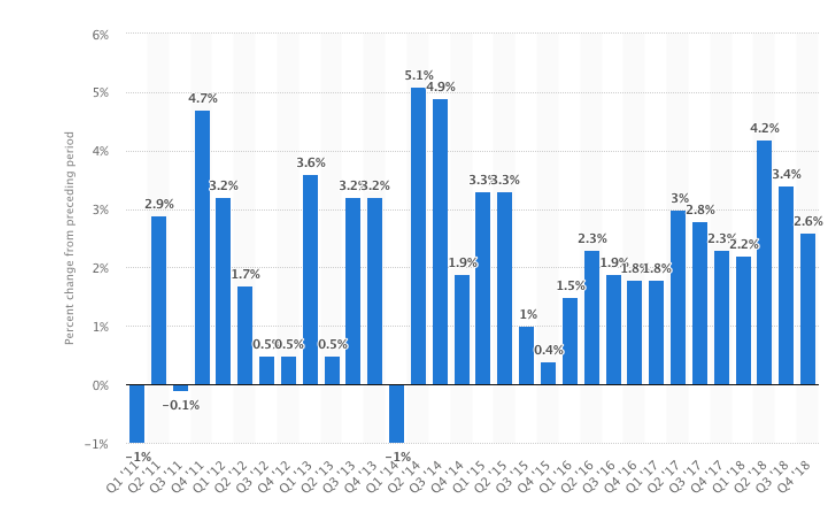

I hate to be the one to fart in church here, but the long-feared recession has already started.

It’s not a conventional recession defined by two back to back quarters of negative GDP growth, although you have a tough time convincing anyone in the besieged auto, real estate, or agricultural sectors of that.

No, this is more of a growth recession. US GDP growth peaked at a 4.4% annualized rate during the second quarter of 2018. The third quarter came in at 3.4% and the four quarter at only 2.6%. Consensus forecasts for Q1 2019 are well below 1%, thanks to the government shutdown.

That means the growth rate has fallen by an eye-popping 76% in nine months! By the way, the government has told us that economic growth has been rising this entire time. But want the stimulus from the 2017 tax bill were spent, there were no more bullets left.

If it were just the GDP data that was falling off a cliff, I wouldn’t be so worried. However, the weakness is confirmed by a raft of other data. The ten year US Treasury bond (TLT) remains stuck around 2.75%, an incredibly low figure given that we are ten years into an economic recovery.

Corporate earnings growth forecasts going forward are now at zero. To see a market multiple of 18X for stocks with no growth and prices that are just short of all-time highs defies belief. This will all lead us to a REAL recession sometime in the near future.

What we are left with is a market of very low return, high-risk trades, not the kind you want to pursue, let alone bet the ranch on.

I believe that when the BIG ONE finally arrives, it won’t be all that bad. I’m looking for a short, sharp recession of maybe six months in duration. There really isn’t that much leverage in the system that can blow up. It might even not be worth selling out all your stocks to avoid it, especially if it results in a giant tax bill.

You would also be selling in front of my coming Golden Age for the United States when a huge demographic tailwind brings a new era of prosperity. If you are smart enough to get out at the top now, will you also be clever enough to get back in at the bottom? Or will you sell more instead, like you did in December?

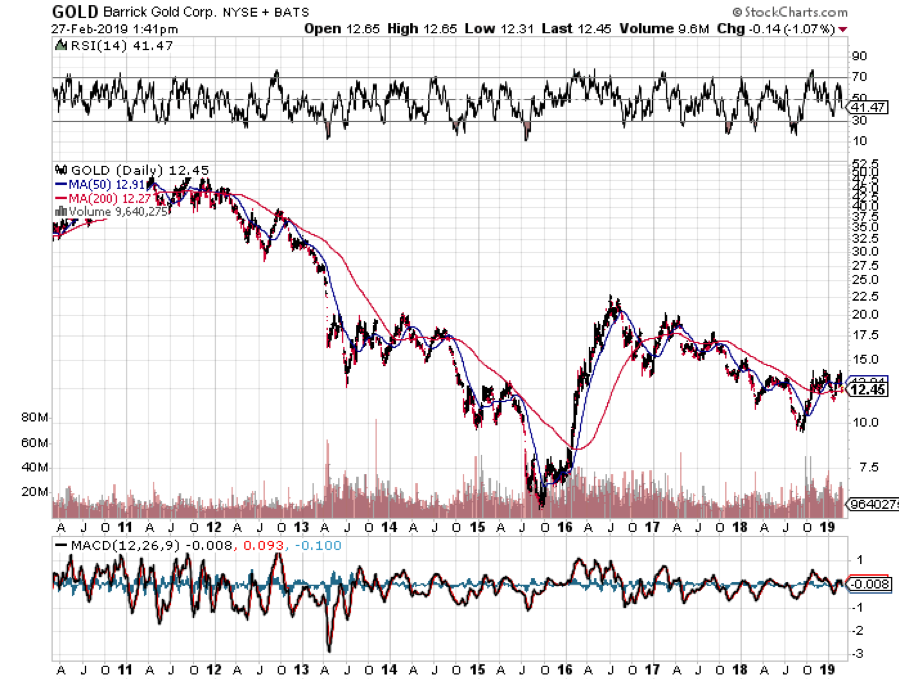

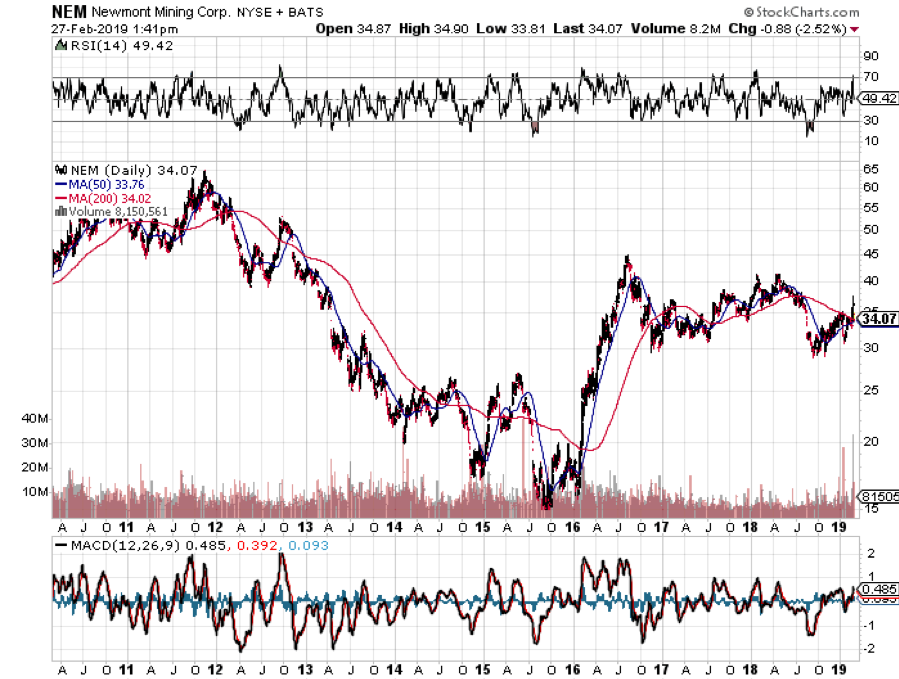

Merger fever hit the gold industry with Barrick Gold (GOLD) taking a run at Newmont Mining (NEM), the world’s first and second largest producers. It’s all about efficiencies of scale. Take this as a long-term bottom in gold prices.

The China tariff hike was postponed indefinitely, and Chinese stocks love it. Import duties will stay at 10%, instead of rising by 25% starting last Friday. We knew it was never going to happen.

Some 95% of the China trade deal is now already priced into the market. If a deal DOESN’T get done and goes the way of the North Korean negotiations, the market will very quickly back out that 95%.

Poor economic data was to be found everywhere you looked. Wholesale Inventories rose sharply, up 1.1% in another recession indicator. US Factory Orders came in incredibly weak at 0.1% in December when 0.6% was expected. Recession indicator number one million. Limit your risk.

Our friend Jay stayed dovish again, but markets yawned this time. How much mileage can you get from the same vague assertion? Shorts are about to swarm the market. Take profits on all longs.

The US Dollar hit a three-week low. The Fed’s dovish leanings are hammering the buck. Keep loading the boat with weak dollar plays, like emerging markets (EEM).

Bonds got crushed delivering their worst week in five months, down three points as the great “crowding out” begins. Massive corporate borrowing can’t compete with government borrowing, so rates are rising sharply. This is the beginning of the end. Sell short the (TLT).

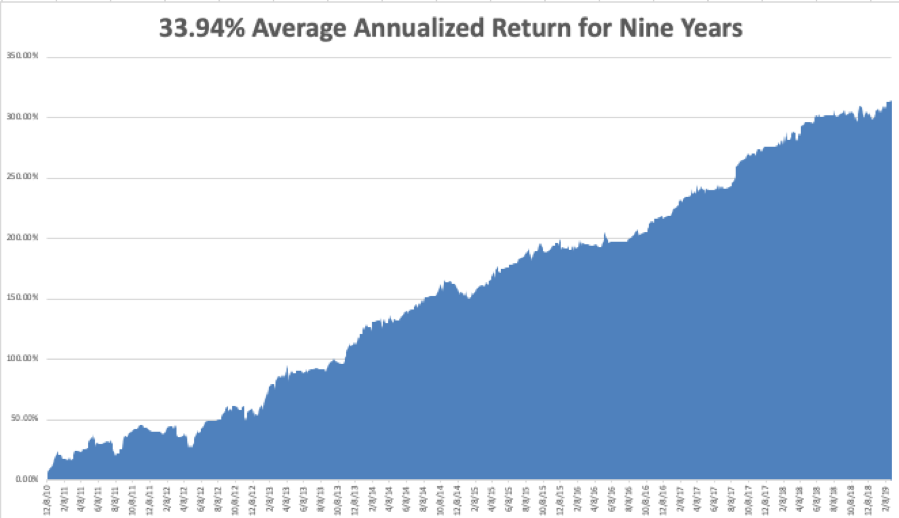

February came in at a hot +4.16% for the Mad Hedge Fund Trader. My 2019 year-to-date return ratcheted up to +13.64%, a new all-time high and boosting my trailing one-year return back up to +31.90%.

My nine-year return clawed its way up to +313.78%, another new high. The average annualized return appreciated to +33.94%.

I am now 80% in cash, 10% long gold (GLD), and 10% short bonds (TLT). We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be all about jobs, jobs, jobs.

On Monday, March 4, at 10:00 AM EST, December Construction Spending is published.

On Tuesday, March 5, 10:00 AM EST, December New Home Sales are out.

On Wednesday, March 6 at 10:00 AM EST, the February ADP Employment Report is out, a measure of private sector hiring.

Thursday, March 7 at 8:30 AM EST, we get Weekly Jobless Claims.

On Friday, March 8 at 8:30 AM EST, we get the February Nonfarm Payroll Report is released. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’m taking the kids to see Hello Dolly in San Francisco. This was one of my parents’ favorite Broadway musicals, and they used to sing the songs around the house all day long. However, it won’t be the same without the late Carol Channing.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 1, 2019

Fiat Lux

SPECIAL FRIDAY TECH EDITION

Featured Trade:

(ABOUT THE TRADE ALERT DROUGHT),

(SPY), (GLD), (TLT), (MSFT),

Long term subscribers are well aware that I sent out a flurry of Trade Alerts at the beginning of the year, almost all of which turned out to be profitable.

Unfortunately, if you came in any time after January 17 you watched us merrily take profits on position after position, whetting your appetite for more.

However, there was nary a new Trade Alert to be had, nothing, nada, and even bupkiss. This has been particularly true with particular in technology stocks.

There is a method to my madness.

I was willing to bet big that the Christmas Eve massacre on December 24 was the final capitulation bottom of the whole Q4 move down, and might even comprise the grand finale for an entire bear market.

So when the calendar turned the page, I went super aggressive, piling into a 60% leverage long positions in technology stocks. My theory was that the stocks that had the biggest falls would lead the recovery with the largest rises. That is exactly how things turned out.

As the market rose, I steadily fed my long positions into it. As of today we are 80% cash and are up a ballistic 13.51% in 2019. My only remaining positions are a long in gold (GLD) and a short in US Treasury bonds (TLT), both of which are making money.

So, you’re asking yourself, “Where’s my freakin' Trade Alert?

To quote my late friend, Chinese premier Deng Xiaoping, “There is a time to fish, and there is time to mend the nets.” This is now time to mend the nets.

Stocks have just enjoyed one of their most prolific straight line moves in history, up some 20% in nine weeks. Indexes are now more overbought than at any time in history. We have gone from the best time on record to buy shares to the worst time in little more than two months.

My own Mad Hedge Market Timing Index is now reading a nosebleed 72. Not to put too fine a point on it, but you would be out of your mind to buy stocks here. It would be trading malpractice and professional negligent to rush you into stocks at these high priced level.

Yes, I know the competition is pounding you with trade alerts every day. If they work, it is by accident as these are entirely generated by young marketing people. Notice that none of them publish their performance, let alone on a daily basis like I do.

You can’t sell short either because the “I’s” have not yet been dotted nor the “T’s” crossed on the China trade deal. It is impossible to quantify greed in rising markets, nor to measure the limit of the insanity of buyers.

When I sold you this service I promised to show you the “sweet spots” for market entry points. Sweet spots don’t occur every day, and there are certainly none now. If you get a couple dozen a year, you are lucky.

What do you buy at market highs? Cheap stuff. That would include all the weak dollar plays, including commodities, oil, gold, silver, copper, platinum, emerging markets, and yes, China, all of which are just coming out of seven-year BEAR markets.

After all, you have to trade the market you have in front of you, not the one you wish you had.

So, now is the time to engage in deep research on countries, sectors, and individual names so when a sweet spot doesn’t arrive, you can jump in with confidence and size. In other words, mend your net.

Sweet spots come and sweet spots go. Suffice it to say that there are plenty ahead of us. But if you lose all your money first chasing margin trades, you won’t be able to participate.

By the way, if you did buy my service recently, you received an immediate Trade Alert to by Microsoft (MSFT). Let’s see how those did.

In December, you received a Trade Alert to buy the Microsoft (MSFT) January 2019 $90-$95 in-the-money vertical BULL CALL spread at $4.40 or best.

That expired at a maximum profit point of $1,380. If you bought the stock it rose by 10%.

In January, you received a Trade Alert to buy the Microsoft (MSFT) February 2019 $85-$90 in-the-money vertical BULL CALL spread at $4.00 or best.

That expired last week at a maximum profit point of $1,380. If you bought the stock it rose by 12%.

So, as promised, you made enough on your first Trade Alert to cover the entire cost of your one-year subscription ON THE FIRST TRADE!

The most important thing you can do now is to maintain discipline. Preventing people from doing the wrong thing is often more valuable than encouraging them to do the right thing.

That is what I am attempting to accomplish today with this letter.

Global Market Comments

February 28, 2019

Fiat Lux

Featured Trade:

(GOLD IS BREAKING OUT ALL OVER),

(GLD), (GDX), (NEM),

(THE STEM CELLS IN YOUR INVESTMENT FUTURE)

(CELG), (TMO), (REGN)

Longtime readers of this letter are well aware that I have been bullish on gold since August. However, this week, the barbarous relic really got the bit between its teeth and is now poised to break out to a new five year high.

All of a sudden, the sun, moon, and stars have aligned in favor of a new leg of the bull market for gold. We could even see a bitcoin-style melt up over the next 18 months to its previous all-time high of $1,927 an ounce.

Gold is not seeing this in isolation. With the primary focus of all financial markets now exploding US deficits, inflation plays everywhere have found new vigor. These would include, other precious metals, commodities, energy, and any security that shorts the bond market.

The really great news here is that your investment life has suddenly gotten very easy. We are probably only months into a megatrend that could last for another decade.

If you look carefully at the long-term charts you will see that gold has in fact been in a new bull market for three years now. But the rate of appreciation was at a snail’s pace, with the yellow metal averaging only 14% a year since then.

For a while, bitcoin and other cryptocurrencies were stealing gold’s thunder and sucking up gold’s volatility. Inflation, the traditional driver of gold prices, was nowhere to be seen.

It is no accident that the recent strength in gold has been matched with the decimation of Bitcoin, down 80% from its high. Investors are finally seeing the light of day.

Other factors have been assisting in gold’s resurgence. Chinese dumping of US treasury bonds is freeing up lots of cash in the middle Kingdom to buy gold.

The run-up to the Chinese New Year on February 16, when Chinese traditionally settle debts with gold coin purchases, has thrown some exploding firecrackers on the move.

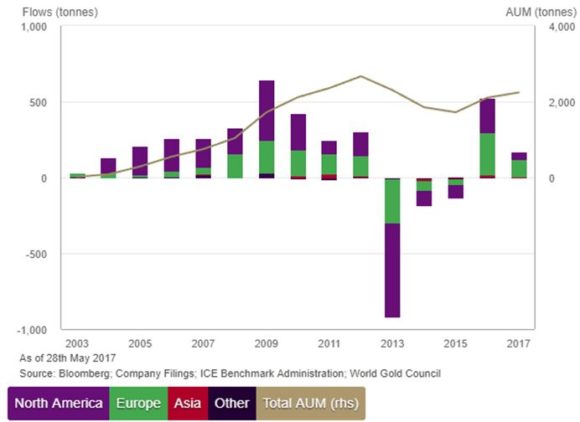

The Europeans saw the inflation boogeyman before we did. Look at the chart below showing global gold ETF purchases, which helped market the 2015 bottom. Some 75% of global flows into gold ETF’s were for Europe based funds.

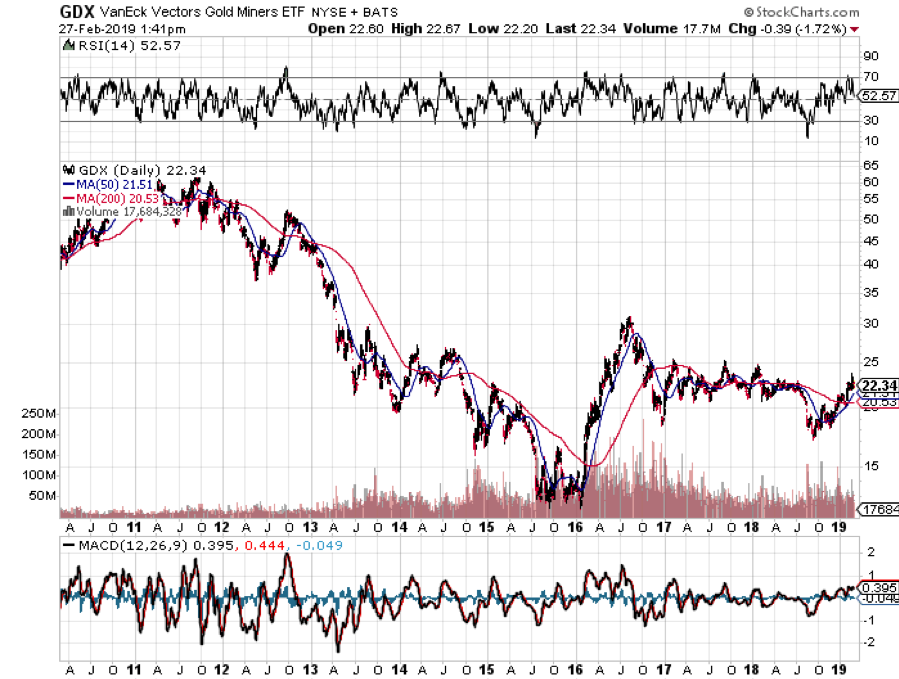

The buying has spread into the entire precious metals space. The Van Eck Vectors Gold Miners ETF (GDX) is off to the races. So is Newmont Mining (NEM), Canada’s largest miner and one of my long-time favorites. (NEM) by the way, is considering a takeover offer from Barrick Gold (GOLD).

Look to buy dips in gold whenever you get them. Remember those black swans? They are still out there in a holding pattern awaiting landing instructions.

When they finally return, you’ll be happy you have a nice position in gold to hedge your other risk positions.

All That Glitters

Global Market Comments

February 27, 2019

Fiat Lux

Featured Trade:

(WHY CHINA’S US TREASURY DUMP WILL CRUSH THE BOND MARKET),

(TLT), (TBT), ($TNX), (FCX), (FXE), (FXY), (FXA),

(USO), (OXY), (ITB), (LEN), (HD), (GLD), (SLV), (CU),

(THE 13 NEW TRADING RULES FOR 2019)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.