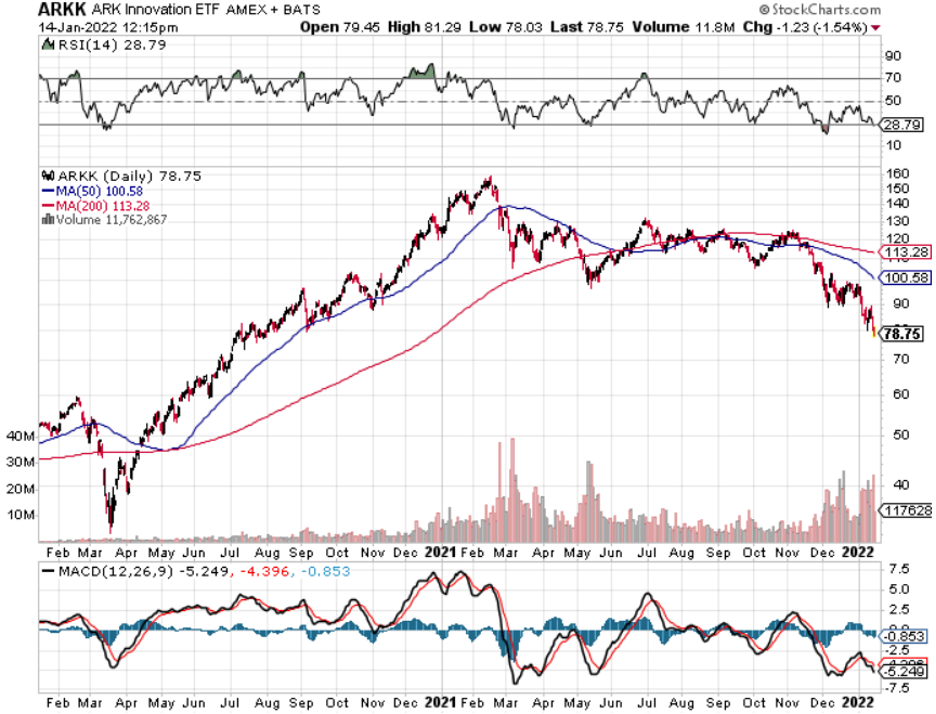

I was a little taken aback by the content and attitude of boutique investment fund CEO and CIO of Ark Invest Cathie Woods as I watched her podcast -- set in a palatial estate with vaulted ceilings.

The line that stuck out to me was when she began to explain that the ARK Innovation ETF (ARKK) is made up of “real companies with real revenue.”

Well, so is the liquor store down the street and that doesn’t mean we should all bandy together with each other, sing kumbaya and bet the ranch on this ETF fund that dabbles in ultra-high growth tech stocks.

She continued to praise her strategy by comparing ARKKs relative success with the dot com crash where companies were based on thin air and accrued massive valuations for nothing.

That’s a bad comparison because it was a different era and time, and just because that market then was frothy, it has nothing to do with a higher ARKK stock price in the short term.

She then explains to us viewers that she has never been so convinced by companies like Teledoc (TDOC) and this is a company that has experienced about a 400% drop in share price in the past 365 days.

The reason she gives support for TDOC is because they do $2 billion in annual revenue and then she followed that up by saying how great Zoom Video (ZM) is because their revenue has gone up “4-fold during the coronavirus” but fails to mention that their stock is down about 400% since October 2020.

She laments that these stocks have recently been treated as “stay at home” stocks and I believe that giving such an excuse to why these stocks have been performing poorly lately makes her look like she doesn’t know what she is doing.

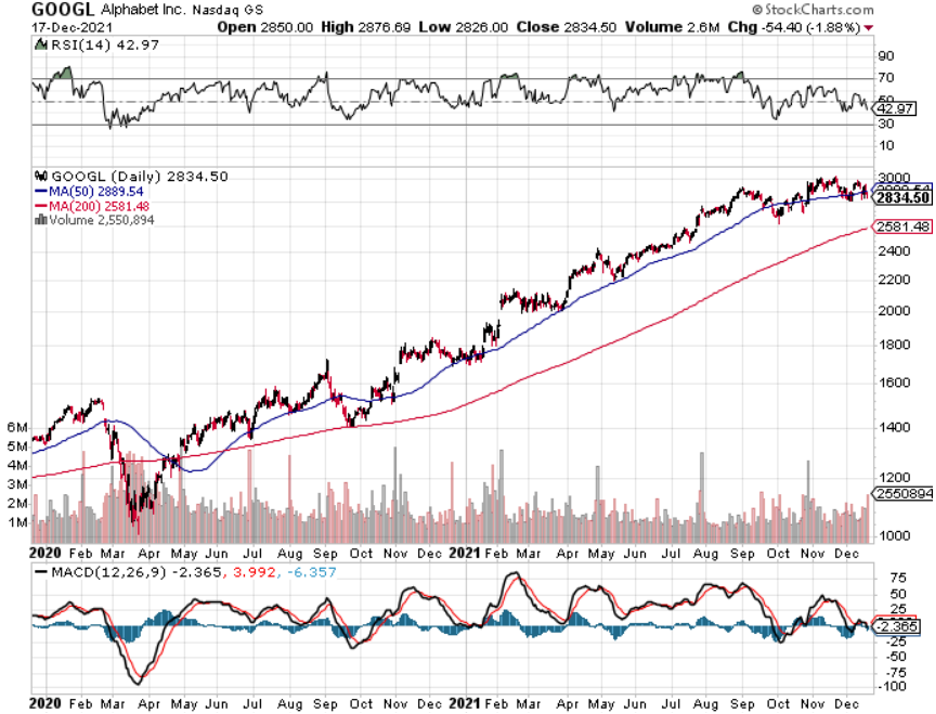

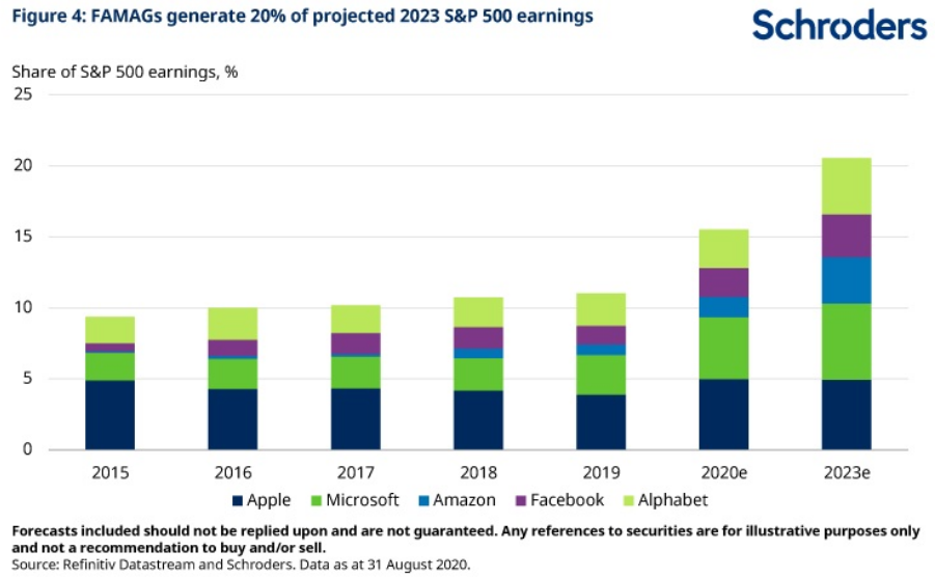

If she champions TDOC for doing $2 billion in annual revenue, then why not invest in Alphabet (GOOGL) which does $180 billion of revenue per year. According to her math, GOOGL is a 90X better investment than TDOC.

In her video interview, she starts to explain the inflationary monster which of course, she has an incentive to downplay. Low rates mean a better environment for growth stocks to operate in.

She continues to explain that used car prices are up 60% but that “bubble has burst” because sales are down 4 recently.

Again, she is grasping for straws here because she has an incentive to.

Another data point she tries to spin off as anti-inflationary is the increase in average wages and explains that a 0.6% increase is the “lower end of the guidance” so that certainly will trend down.

Again, nominal wages have exploded in all industries, and this is again proof she likes to reverse engineer stats to fit her own interests.

During this interview or fireside chat, Woods appears to be an expert at cherry-picking data points that are in her best interest.

She fails to acknowledge that her timing of equity purchases is just as important as the type of stocks bought, and her recent timing has been terrible.

Her response to the underperformance was to blame the market and pontificate that the “dismissal (of her ARKK fund ETF) is misplaced” and “analysts and investors aren’t doing their homework.”

Her attempt to shift blame on the market is comical and the real traders in the room know that the market decides the prices of assets and not anyone or any organization can dictate the market to the market.

Showing a little humility might do her a little good as Ark Innovation ETF suffered an outflow of $352 million Wednesday, the biggest one-day drop since March.

She explains the Fed policy towards higher rates as just “jawboning” and begins to explain how she is seeing some anti-inflationary data coming down the pipeline imminently.

I will tell Woods that this “jawboning” isn’t just that, it’s real. The Fed is poised to react to combat inflation and not raising interest rates as fast as she thought doesn’t mean the narrative immediately evolves into something even close to anti-inflationary.

We are so far from that sentiment and her reaction is to dismiss anything that is a threat to her fund.

Sadly enough, she wants things how it was in 2020, massive amounts of quantitative easing for that capital to flow into her ARKK fund.

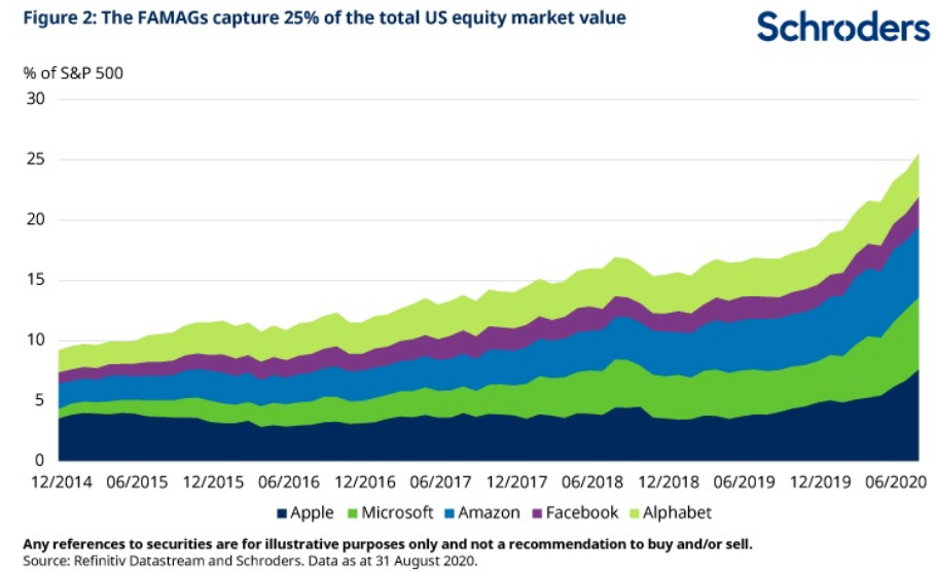

I am not saying that won’t ever happen again, but the zeitgeist must overcome the higher rates narrative that has completely consumed the broader market which is why tech growth has been hammered lately.

Her failure to act has meant her investors are down 50% in the last 13 months. Buying at tops are dangerous and even more important, she doesn’t describe the current market and describes only what she wants to happen in the future as it relates to higher ARKK prices.

I wouldn’t call that breaching her fiduciary responsibilities, but she is playing a snake oil saleswoman at her finest.

This could be a case of her thinking that she is playing with houses’ money, a longer time frame shows that ARKK is still up more than 300% since 2017.

If you ever feel like getting into high tech growth, avoid this fund, just buy the stocks you like outright.

This is an example of how ETFs will not work in today’s climate, as ETFs only function properly if they go up every year.

The markets could spend the first third of the year grappling with higher rates, and there will be another time to buy tech growth. For Woods to completely ignore her failure of timing the tech growth market, it shows she isn’t looking out for your best interest as an investor.

Avoid tech growth today until we get through the short-term challenges.