I have long advocated a long cruise as the best of all long-term investment strategies. After all, over the past 100 years, stocks have gone up 80% of the time, including the last Great Depression and WWII. Almost all news is negative, so ignoring should boost your investment returns immensely.

The last six months offer the most recent example. If you had departed on February 14 and return on Friday, August 14, the index return would have been absolutely zero, but you would have collected 1% in dividends. If you had been overweight in technology and biotech stocks, as I have been advocating for the past decade, you would have been up 20-30%.

Of course, this year, cruising presented its own risks, not from a sinking ship, pirates, or the norovirus, but from Covid-19. Many guests departed in the best of spirits to return DOA in the ship’s overcrowded meat locker.

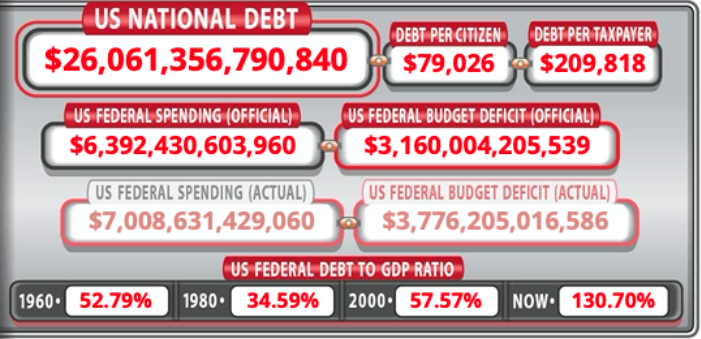

The stock markets are offering more than the usual amount of risks as well. Think of an irresistible force, massive liquidity, meeting the immovable object, record-high valuations.

Only action in Washington could break this stalemate to the upside, a deal between the House and the White House that brings yet another stimulus package. Most of whatever money gets approved will head straight for the stock market, either directly or indirectly. Until then, we will be trapped in a narrow range.

These conditions could last into September, or until after the election. Nobody knows. That’s why eight of my nine positions expire on Friday, in four trading days.

Trump took executive action to help the economy but offers not a penny in funding. He expects states running record deficits to pay for a big chunk. It’s a symbolic act that will have no impact on the economy. The bottom line is no more stimulus for the economy. Stocks will hate it. Trump fiddles while America burns.

A bond market collapse is imminent, with record new issuance in the coming week and a strong July Nonfarm Payroll Report last Friday. Expect ten-year Treasury yields to go back to 0.95% and prices to collapse. Inflation is ticking up, with Consumer prices rising to 1.6% YOY. Fed buying of $80 billion a month is already in the price. I am selling short the (TLT).

Warren Buffet was a major buyer of His own stock, picking up a record $5.1 billion worth of Berkshire Hathaway (BRK/B). With $146.6 billion in cash on hand, what else is he going to do? Berkshire Class A shares were down 7.4% for the year through Friday’s close, compared with the 3.7% gain in the S&P 500. It’s his way of betting on the long-term future of industrial America at a discount.

Russia claimed Covid-19 Vaccine, causing stocks to pop. The rotation trade continues with a vengeance, with tech (I’m short), bonds (I’m short), and gold down big and “recovery” stocks like cruise lines, hotels, restaurants, and banks (I’m long) on a tear. Some $5 trillion in cash is pouring in from the sidelines, so there is only “UP” and “UP BIG”. (SPY) hit a new all-time high.

Tesla announced 5:1 stock split on August 21, which is the options expiration day. Long expected, it is just the latest in a series of Elon Musk attacks against the shorts, of which I am now one. The shares are up only 7% on the announcement. The impact won’t be so great, as it only takes the shares back to where they were in March.

Biden picked Kamela Harris as VP. It is the safe choice, not that California was ever in doubt in the electoral college. A moderate choice clearly takes aim at the conservative Midwest. Markets will rally because she is not Elisabeth Warren, who would have pilloried the banks and big tech and is essentially anti-capitalist.

College Football is postponed for 2020-2012, delivering a $4 billion hit to sponsoring colleges and another drag on GDP. No more free Corvettes for USC players. It's another example of local government taking the lead on Corona measures where the federal government is totally absent.

Van Eck targets $3,400 for gold. One of the original players in gold mutual funds who I know from the big bull market during the 1970s sees a 72% increase in the barbarous relic coming. With the government running the printing presses 24/7 to end the Great Depression collapsing the US dollar, it’s a no-brainer.

Consumer Prices unexpectedly jump, up 0.6% in July and 1.6% YOY. It’s a legitimate “green shoot” and provided yet another reason for the recovery trade. Rebounding inflation is always a great time to be short the US Treasury bond market (TLT). Keep selling every rally in the (TLT).

Retail Sales jump 1.2% in July, despite rising Corona cases, taking it back above pre-pandemic levels. Industrial Production picked up 3%. A lot was bought on credit. The problem is that all of those stimulus and unemployment dollars are now gone. In the meantime, further aid is frozen in Washington. No shopping, no growth.

Weekly Jobless Claims drop below one million for the first time since March. It’s still terrible, but it’s progress. Take what you can get. However, the rate of decline is flagging, and the next report could well bring an upturn.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

Nothing refreshes and clears the mind like a vacation.

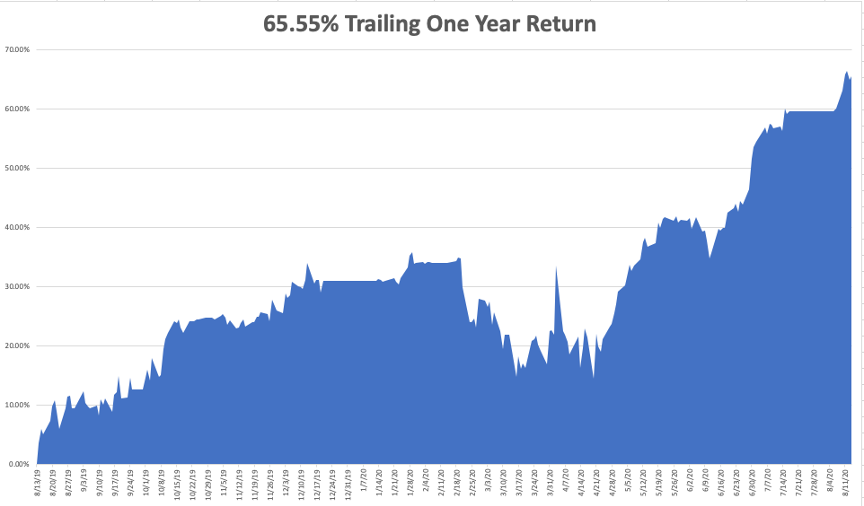

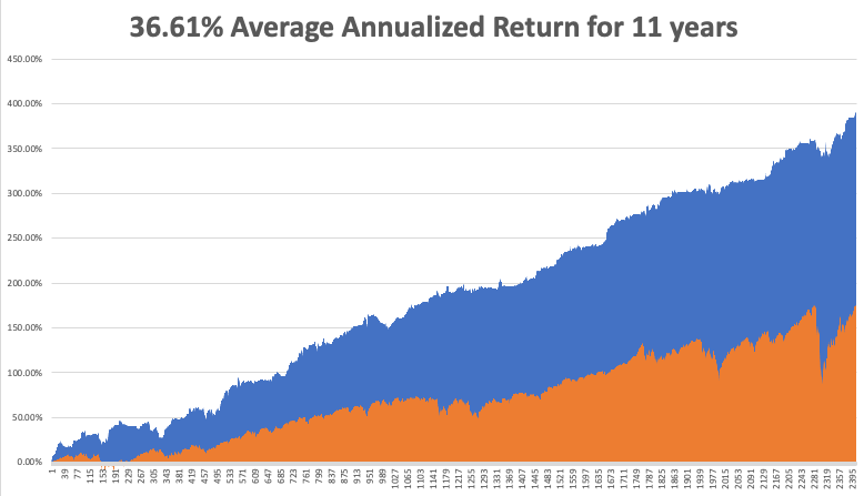

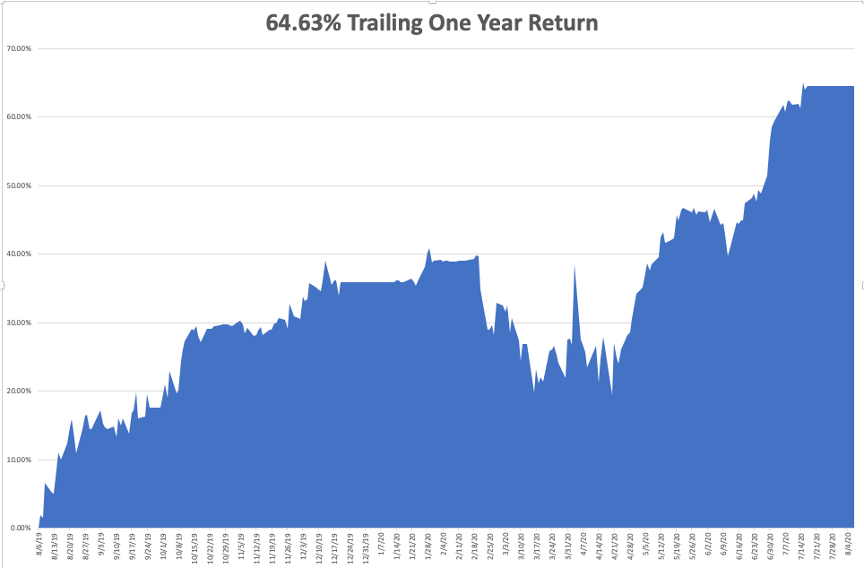

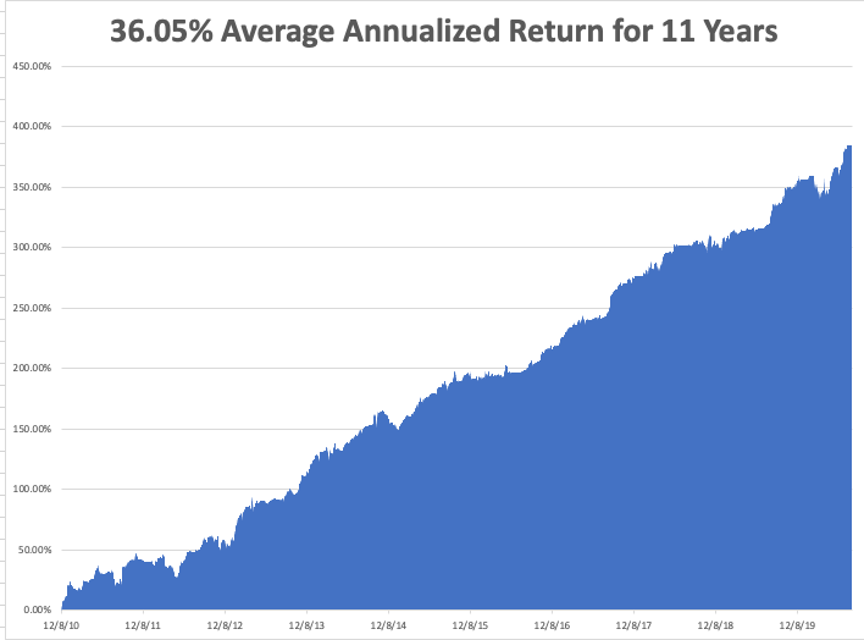

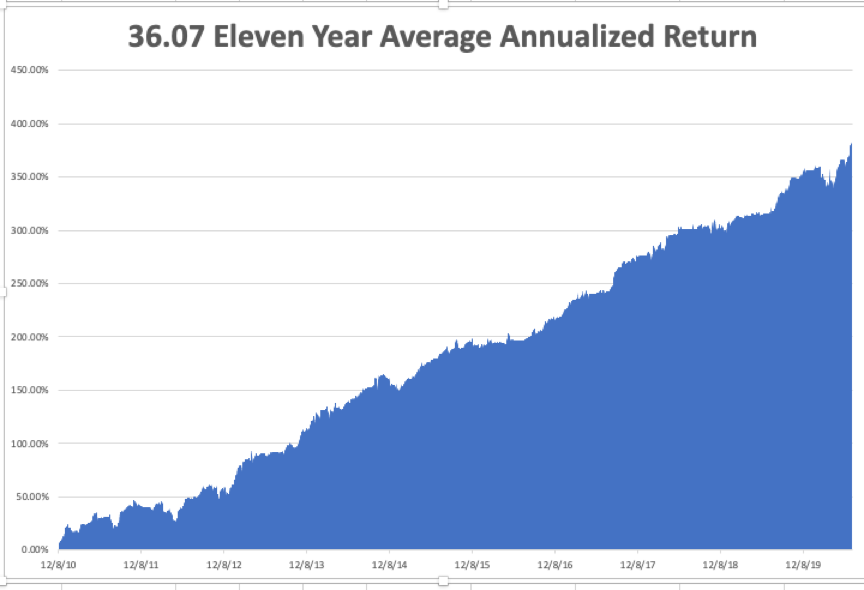

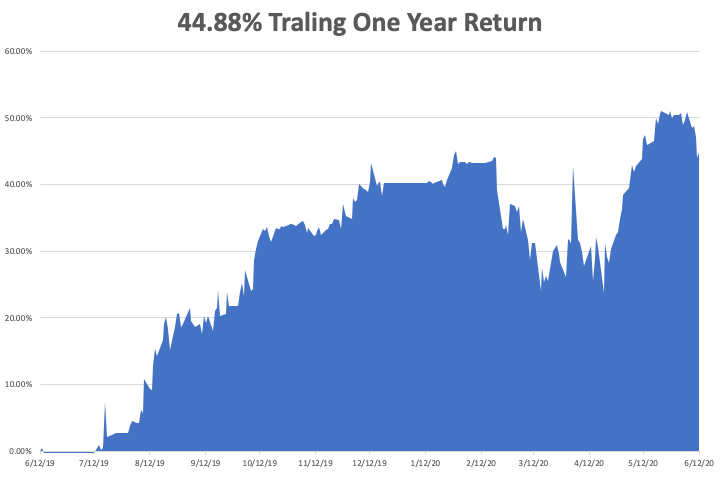

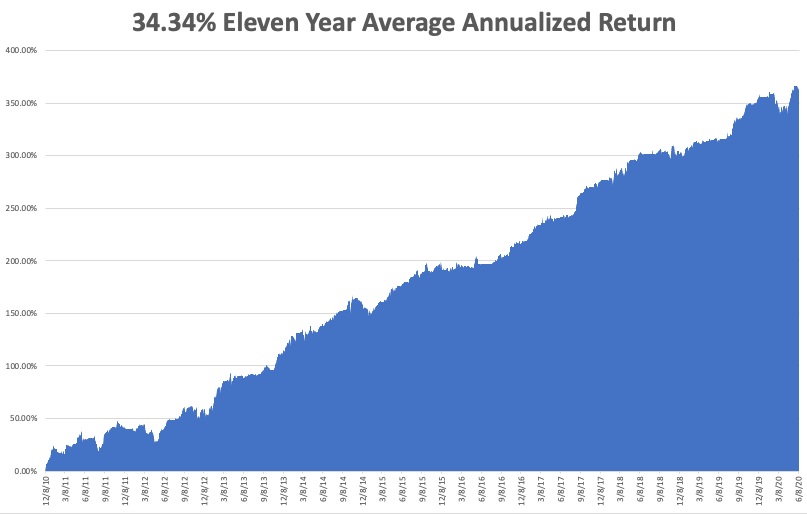

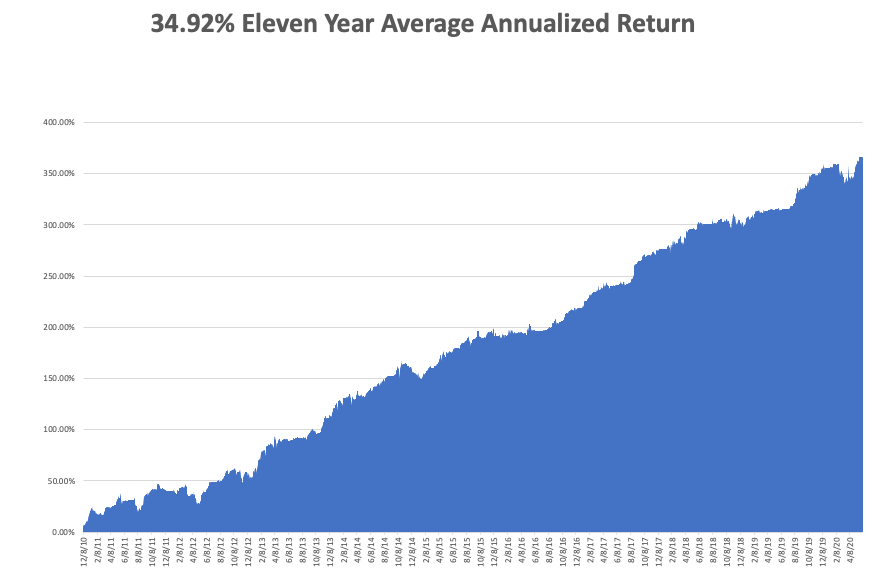

As a result, my Global Trading Dispatch blasted through to a substantial new all-time high. August is running at a blistering 6.03%, delivering a 2020 year to date of 34.66%, versus -2.00% for the Dow Average. That takes my eleven-year average annualized performance to a new all-time high of 36.61%. My 11-year total return has rocketed to 390.57%.

It certainly helped being short big tech (AAPL), (AMZN), (FB), short US Treasury bonds (TLT), (TBT), long banks (JPM), (BAC), and long gold (GLD).

The only numbers that count for the market are the number of US Corona virus cases and deaths, which you can find here.

On Monday, August 17 at 8:30 AM EST, the August New York Empire State Manufacturing Index is published.

On Tuesday, August 18 at 8:30 AM EST, Housing Starts for July are released.

On Wednesday, August 19 at 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, August 20 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, August 14, at 10:00 AM EST, Existing Home Sales for July are printed. At 2:00 PM The Bakers Hughes Rig Count is released.

As for me, with six days of 100-degree temperatures forecast, I attempted to go to the beach. A car crash on the Richmond Bridge trapped me in traffic for an hour. By the time I made it to the coast, the beaches were unreachable, thanks to unprecedented crowding.

With the local real unemployment rate at 25%, people have a lot of free time on their hands these days. It’s all part of the times we live in.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader