Global Market Comments

April 10, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE APRIL 11 GLOBAL STRATEGY WEBINAR),

(IT'S ALL ABOUT WHAT HAPPENS NEXT),

($INDU), (GOOGL),

(HOW AMERICA'S PLUNGING EDUCATION SURPLUS WILL DAMAGE YOUR PORTFOLIO), (UUP)

Tag Archive for: ($INDU)

Stock markets are only in the business of discounting what happens next. I spend so much time anticipating the coming moves in shares that I can't even remember what I had for breakfast.

This is why technical analysis is such a bust as an investment strategy, except on an intraday basis only, as it is entirely founded on historical data. It is 100% backward looking.

So, I'll take you through the same thought experiments that convinced me to adopt a much more aggressive stance toward the markets after spending two months hiding in the weeds.

What happens after stocks hit new highs? They hit new lows, as they did on April 1, when the Dow Average plunged to 23,600.

What happens after markets hit new lows? They hit new highs again, supported by the strongest earning reports in history, which begin on Friday, April 13.

What happens after the inflation scare we received in the January Nonfarm Payroll Report with the surprise pop in average hourly earnings?

Inflation non-events, which unfolded with average hourly wages that came in subdued with the February and March Nonfarm Payroll Reports.

What follows a trade war? Trade peace, which is yet to come, but will arrive eventually nevertheless.

All of this points to stock markets that are in the process of putting in the lows for 2018. That means it is time to start ramping up your risk, as I did with three rapid Trade Alerts yesterday.

What does this look like on the charts? Alphabet (GOOGL) is a perfect example, which is in the process of putting in a very convincing triple bottom around the $1,000 level, right around the 200-day moving average.

What if I'm wrong?

After all the trade war continues to inflame by the day, the algorithms are still running amok, and the president still has a Twitter account.

What did it today? The Congressional Budget Office forecast of $1 trillion deficits running indefinitely? Or the FBI raids on the offices of the president's personal lawyer?

Then markets will edge down to the next support levels, about 4% lower than the most recently visited bottom, or about 22,600 in the Dow Average.

So, it would seem that the really smart thing to do here is to build options positions that can take that 4% hit, and STILL expire at their maximum profit points.

And this is exactly what I have been doing for the past two weeks: piling on long positions in the best technology stocks, and adding to short positions in bonds.

For fans of LEAPS, long dated out-of-the-money option call spreads one year or more out, this is the best time this year to get involved.

I'll give you an example.

BUY one June 21, 2019 $1,000 call at $145.00

SELL one June 21, 2019 $1,050 call at $120.00

NET COST = $25.00

In the event that (GOOGL) closes over $1,050 on June 21, 2019, or up 3% from today's closing level, the profit on this position would amount to $25.00 from an initial cost of $25.00, or a 100% gain in 14 months.

The only catch is that if the recession comes sooner than expected, the value of this position falls to zero in 14 months.

If you go deeper out-of-the-money with your strike prices, the potential profit rises by a multiple.

You can generate this kind of astronomical return with any of the FANGs assuming no real movement of the stock in a year.

It looks pretty good to me.

You heard it here first.

Winter Is Ending

I have a feeling that you are going to really need to know how to trade a crash in the coming weeks.

Due to our recent blockbuster performance, up 39% last year alone, we have also taken in a large number of new subscribers. They should read this piece carefully and commit it to memory, and have the key points tattooed on their forearm.

There won?t be time to look for these words to the wise, once the market?s wheels really fall off.

In my half-century of trading stocks, I have been through quite a few crashes.

When the Nifty Fifty collapsed in 1973, everyone thought it was the end of the world. The Dow Average fell to 650. President Nixon resigned shortly afterwards.

The 1987 crash certainly left its scars. My equity department at Morgan Stanley lost $75 million in one day, then a staggering amount. We had to pedal triple time to make it all back by the end of the month. I remember that George Soros puked right at the very low.

The 1998 emerging market debacle certainly put our wits to the test. That little affair ultimately led to the Russian debt default and the blow up of Long Term Capital Management, Nobel Prize winners and all.

The 2000 Dotcom Crash was one to remember. At least the parties leading up to the peak made it all worth it. But a lot of friends lost their careers and their homes over that one.

2008-09? That one sent us all back to our history books searching for comparisons with the Great Depression.

It turns out that we were only in for a Great Recession instead and a 52% market decline instead of a 90% one. Not a single person alive thought markets would triple over the next six years, as they have done.

The 2010 Flash Crash, the last time we were down 1,000 points in a single day? Seems like it was only yesterday, just water off your back.

So given my long history of surviving market melt downs, I have to tell you that the August swoon doesn?t even rank in the top ten.

But then again, it?s not over yet either.

So trading crashes is a skill set that every long-term investor is going to need. It is an ability that may save your wealth, if not your life.

I have listed below my twelve rules for trading crashes that I have compiled off the back of decades of hard earned experience.

TWELVE RULES FOR TRADING A CRASH

1) Shrink your trading book to a single position so it?s easier to watch.

2) Shrink your size so it?s small enough for you to sleep at night?even during a crash.

3) Watch the (VIX) as a leading indicator. This time, junk bonds (HYG) and the Russell 200 (IWM) are functioning as pathfinders as well.

4) Don?t be afraid to trade, since now is when risk is the lowest and the rewards the highest. Don?t give up, throw up your hands in despair, and go into hiding like everyone else is.

5) You wanted to buy on a dip? This is a dip. Be careful what you wish for.

6) Time is compressed during a crash. Share price movements that normally take months occur in minutes. Be prepared to do a lot of trading.

7) Liquidity disappears and spreads widen dramatically. Basically, the market wants you to go away. Some of the lesser ETF?s take the biggest hits, as no one wants to touch them.

8) Expect system breakdowns everywhere as they are hyper stressed. Trading platforms can seize up, computers freeze, and the Internet noticeably slows down.

9) If you have any kind of leverage, now is when your brokers will come after you. Margin requirements can double or quadruple overnight with no notice. If you can?t cough up the extra money they will execute a forced liquidation of your account at terrible prices.

10) When you buy single names, focus on quality. It is a rare chance to buy Cadillacs at a discount. Be careful, because fundamentals mean nothing during a crash. Cash is King.

11) Don?t even think about calling your broker. You?re on your own. They?ll just put you on perpetual hold or throw the handset down on the floor and burst into tears, as happened to me during the 1987 crash when I tried to buy.

12) Maintain discipline, exercise strict risk control, and let the other people panic. Now is when you define yourself as a trader. Anyone can trade a bull market. But only a few can handle the bear version.

HAVING SAID ALL THAT, GOOD LUCK AND GOOD TRADING!

How to Keep Your Head Above Water in a Crash

How to Keep Your Head Above Water in a Crash

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950?s, and which I still remember fondly.

This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The implications for your investment portfolio will be huge.

What I call ?intergenerational arbitrage? will be the principal impetus. The main reason that we are now enduring two ?lost decades? of economic growth is that 80 million baby boomers are retiring to be followed by only 65 million ?Gen Xer?s?.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and ?RISK ON? assets like equities, and more buyers of assisted living facilities, health care, and ?RISK OFF? assets like bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward six years when the reverse happens and the baby boomers are out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home. That is when you have 65 million Gen Xer?s being chased by 85 million of the ?millennial? generation trying to buy their assets.

By then we will not have built new homes in appreciable numbers for 20 years and a severe scarcity of housing hits. Residential real estate prices will soar. Labor shortages will force wage hikes. The middle class standard of living will reverse a then 40-year decline. Annual GDP growth will return from the current subdued 2% rate to near the torrid 4% seen during the 1990?s.

The stock market rockets in this scenario. Share prices may rise very gradually for the rest of the teens as long as tepid 2% growth persists. A 5% annual gain takes the Dow to 20,000 by 2020. After that, we could see the same fourfold return we saw during the Clinton administration, taking the Dow to 100,000 by 2030. If I?m wrong, it will hit 200,000 instead. Emerging stock markets (EEM) with much higher growth rates do far better.

This is not just a demographic story. The next 20 years should bring a fundamental restructuring of our energy infrastructure as well. The 100-year supply of natural gas (UNG) we have recently discovered through the new ?fracking? technology will finally make it to end users, replacing coal (KOL) and oil (USO). Fracking applied to oilfields is also unlocking vast new supplies.

Since 1995, the US Geological Survey estimate of recoverable reserves has ballooned from 150 million barrels to 8 billion. OPEC?s share of global reserves is collapsing. This is all happening while automobile efficiencies are rapidly improving and the use of public transportation soars.? Mileage for the average US car has jumped from 23 to 24.7 miles per gallon in the last couple of years, and the administration is targeting 50 mpg by 2025. Total gasoline consumption is now at a five year low.

Alternative energy technologies will also contribute in an important way in states like California, accounting for 30% of total electric power generation by 2020. I now have an all-electric garage, with a Nissan Leaf (NSANY) for local errands and a Tesla Model S-1 (TSLA) for longer trips, allowing me to disappear from the gasoline market completely. Millions will follow. The net result of all of this is lower energy prices for everyone.

It will also flip the US from a net importer to an exporter of energy, with hugely positive implications for America?s balance of payments. Eliminating our largest import and adding an important export is very dollar bullish for the long term. That sets up a multiyear short for the world?s big energy consuming currencies, especially the Japanese yen (FXY) and the Euro (FXE). A strong greenback further reinforces the bull case for stocks.

Accelerating technology will bring another continuing positive. Of course, it?s great to have new toys to play with on the weekends, send out Facebook photos to the family, and edit your own home videos. But at the enterprise level this is enabling speedy improvements in productivity that is filtering down to every business in the US, lower costs everywhere.

This is why corporate earnings have been outperforming the economy as a whole by a large margin. Profit margins are at an all time high. Living near booming Silicon Valley, I can tell you that there are thousands of new technologies and business models that you have never heard of under development. When the winners emerge they will have a big cross-leveraged effect on economy.

New health care breakthroughs will make serious disease a thing of the past, which are also being spearheaded in the San Francisco Bay area. This is because the Golden State thumbed its nose at the federal government ten years ago when the stem cell research ban was implemented. It raised $3 billion through a bond issue to fund its own research, even though it couldn?t afford it.

I tell my kids they will never be afflicted by my maladies. When they get cancer in 20 years they will just go down to Wal-Mart and buy a bottle of cancer pills for $5, and it will be gone by Friday. What is this worth to the global economy? Oh, about $2 trillion a year, or 4% of GDP. Who is overwhelmingly in the driver?s seat on these innovations? The USA.

There is a political element to the new Golden Age as well. Gridlock in Washington can?t last forever. Eventually, one side or another will prevail with a clear majority.?

This will allow the government to push through needed long-term structural reforms, the solution of which everyone agrees on now, but nobody wants to be blamed for. That means raising the retirement age from 66 to 70 where it belongs, and means-testing recipients. Billionaires don?t need the maximum $30,156 annual supplement. Nor do I.

The ending of our foreign wars and the elimination of extravagant unneeded weapons systems cuts defense spending from $800 billion a year to $400 billion, or back to the 2000, pre-9/11 level. Guess what happens when we cut defense spending? So does everyone else.

I can tell you from personal experience that staying friendly with someone is far cheaper than blowing them up. A Pax Americana would ensue. That means China will have to defend its own oil supply, instead of relying on us to do it for them. That?s why they have recently bought a second used aircraft carrier. The Middle East is now their headache.

The national debt then comes under control, and we don?t end up like Greece. The long awaited Treasury bond (TLT) crash never happens. Fed governor Janet Yellen has already told us as much by indicating that the Federal Reserve may never unwind its massive $3.9 trillion in bond holdings, but run them to maturity instead.

Sure, this is all very long-term, over the horizon stuff. You can expect the financial markets to start discounting a few years hence, even though the main drivers won?t kick in for another decade. But some individual industries and companies will start to discount this rosy scenario now.

Perhaps this is what the nonstop rally in stocks since 2009 has been trying to tell us.

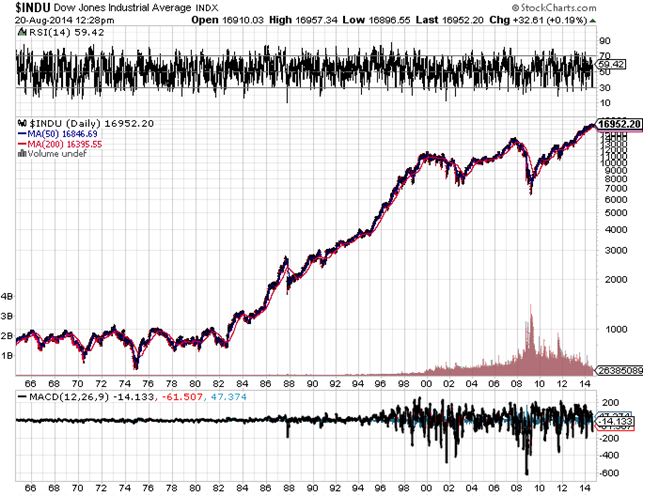

Dow Average 1900-2015

Dow Average 1900-2015

A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5.

Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, whom shall remain nameless. Suffice to say, she is now married to a tech titan and has a sports stadium named after her.

Obviously, I didn?t work hard enough.

The bids soared to $15,000, $16,000, $17,000.

After all, it was for a good cause. But when it hit $17,750, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his date back to me for $17,000.? I said ?no thanks.? $16,500, $16,000, $16,250?

I passed.

The altitude of the stock market right now reminds me of that evening.

If you rode the S&P 500 (SPX) from 700 to 2,100 and the Dow Average (INDU) from 7,000 to 17,750, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it did then?

I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands.

But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? If you followed my Trade Alerts this year and are up now 38%, you don?t have to chase every trade.

At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

Time to Mend the Nets

Time to Mend the Nets

Her red Tesla is parked in the driveway, her potted plants are back on the balcony, and the closet is once again filled with designer shoes.

Goldilocks is back!

It?s not like she was ever going to be gone for long. Once a woman of a certain maturity gets accustomed to the lifestyle of the rich and famous, it?s hard to give up the better things in life.

However, there were some doubts.

When the Dow Average opened down 400 points on October 15, a gigantic capitulation move saw $70 billion worth of stock sold at market at the absolute low of 15,850, and a spectacular 315 million shares of the S&P 500 ETF (SPY) were unloaded.

One might have thought that Goldilocks had changed her name and moved into a nunnery for good.

It was not to be.

The rally that ensued off of that print was one of the most ferocious in history. After having cleaned out hedge fund trader longs on the downside, the market then ripped their faces off on the upside.

It has not been a good year for hedge funds. It has been a fantastic year for high frequency traders, with September the most profitable month in the history of this arcane, computer trading strategy.

As for me, I never had any doubt that Goldilocks was coming back. As I miraculously pound into my followers on a daily basis, it?s all about the numbers. It?s always about the numbers.

The strength of the economy is such that the sudden 10% swoon we witnessed was in no way justified. All that was really required was that an extreme overbought condition in stocks we say six weeks ago be remedied. Now that is done, it is up, up, and away.

Corporate earnings obliged, with an eye-popping 80% delivering upside surprises. Corporate earnings are now growing at a robust year on year 11% annual rate.

Instead of focusing in on Ebola, Russia and ISIS, traders are now looking at improving Purchasing Managers Indexes in both Europe and China. The Middle East has gone quiet. There were even rumors, later quashed, of an extended quantitative easing for the US.

The European Central Bank announced the results of its bank stress test, and guess what? Almost everyone passed! Only 12 banks need to raise $12 billion in new capital.

Of course, this was never more than a window dressing exercise designed to make us all feel warm and fuzzy about the beleaguered continent.

It worked!

Capital spending also remains robust for the first time in eight years. But I think most analysts are missing the reason why this is happening. It is too late for companies to add capacity for this economic cycle.

They are instead building factories now to accommodate demand for the next economic and financial boom in the early 2020?s, when the stiff demographic headwind created by the baby boomers flips to a brisk tailwind provided by the Gen Xer?s.

The true 800-pound gorilla on the trading landscape these days is the price of oil, which broke the $80 handle yesterday morning. As with every move by every financial instrument everywhere, the more it goes down, the more dire the forecasts become. The savings in energy costs at this level amount to $12,000 per family per year. Do the math.

$10 a barrel? Really?

I think it is safe to say, like interest rates, energy prices will stay lower for longer than anyone imagines possible. So add another 1% to US GDP growth this year, next year and the one after that.

When the stock market figures this out, new highs will follow, probably before year end.

Has Goldilocks Moved Back in For Good?

Has Goldilocks Moved Back in For Good?

I don?t double up short positions very often. I am too old to lose all my money and go back to work as an entry-level analyst at Morgan Stanley. Besides, they probably wouldn?t have me back anyway. It is a different company than it was 30 years ago, a lot different.

However, the dead cat, short covering bounce we got off this morning?s Hong Kong dump does allow me to get back into the short side of the (SPY) one more time.

We managed to gain 20 (SPX) points, or 2 entire (SPY) handles from the Monday morning capitulation, puke on your shoes low. Except this time, we are a weekend closer to expiration, only 14 trading days until October 15.

And waiting all the way until Friday for the September nonfarm payroll buys us a free week.

Does anyone really care what?s going on in Hong Kong, China, or anywhere else in the world, for that matter? Not really. It appears only day traders do, and those of us who have family members there, like me.

The beginning of October is usually the scariest two weeks of the year. So a bet that the (SPY) doesn?t blast up to new all time highs during this period looks like a pretty good idea.

Buying the S&P 500 (SPY) October, 2014 $202-$205 vertical in-the-money bear put spread with the volatility index (VIX) just short of the $17 handle, the highest print in six months, is also getting us the best short term spread prices this year. It?s almost like the good old days.

If the prospect of executing this trade causes the hair on the back of your neck to stand up, take a look at the charts below.

The Russell 2000 (IWM) broke through to a new low this morning, proving that a solid, three-month downtrend in the small caps is still alive and well.

The chart looks even worse for the iShares iBoxx High Yield Corporate Bond ETF (HYG), which has become a very important lead security for traders to keep a laser like focus on.

NASDAQ (QQQ) and the Dow Jones Average ($INDU) are sitting bang on crucial support lines. Alibaba is still sucking all the oxygen out of the technology sector, with major institutions selling everything else to take instant 5% stakes in the new issue. This is great news for the sector for the long term, but not so great for the short term.

Finally, I asked my ace Mad Day Trader, Jim Parker, his thoughtful take here. He believes that short term, markets are oversold and due for a rallyette. He wouldn?t be shorting stocks here with My money! But is the (SPY) going to a new all time high in 14 trading days? Absolutely no way!

There is another factor to consider here. We have recently clocked substantial profits with our short positions in the Euro (FXE) and the Russell 2000 (IWM).

So we can afford the luxury of getting aggressive here when everyone else is running and hiding. We are essentially now playing with the house?s money. The only question is whether we will next post a larger gain, or a smaller one. That is a position of strength, and a great place to trade from.

So I think the net net of all of this is that best case, the risk markets all keep trending downward, worse case, they flat line sideways, at least for the next 14 trading days. Either way, it is a win-win for me. That makes the S&P 500 (SPY) October, 2014 $202-$205 in-the-money bear put spread a winner in my book.

You can buy this spread anywhere in a $2.60-$2.75 range and have a reasonable expectation of making money on this trade.

This is a rare instance where there is no outright stock or ETF equivalent to this trade. If you sell short the stock market here, such as through purchasing the ProShares Ultra Short S&P 500 ETF (SDS), we could rally all the way up to, but just short of the all time high, and you would get your head handed to you.

If this happens with the S&P 500 (SPY) October, 2014 $202-$205 in-the-money bear put spread, you make your maximum profit of 1.30% of your total portfolio. This is why I play in the options market. So non options players are better to stand aside on this trade and just watch it for educational purposes.

Many commentators are warning of a top, a bubble and Armageddon to come in the stock market. There has not been a 10% correction in the indexes since the debt ceiling crisis three years ago.

But I think that we are just getting started.

Share prices have the rocket fuel for the Dow average to make it to 18,000 by the end of 2014, and possibly 100,000 by 2025. To understand why, you have to focus on major long-term structural changes occurring in the global economy which at this point only a handful for strategists can see, and then, only faintly.

The evidence couldn?t be more undeniable. The major stock indexes have repeatedly broken out to new all time highs in 2014. The more volatile and economically sensitive Russell 2000 small cap index has left it in the big caps dust.

Inflows to equity mutual funds have been the most prolific since 2008. It all paints a picture of a run up (SPX) to and of 2,100 by year-end, which by the way, has been my own forecast all year. Perma bears be damned!

Betting on the Federal Reserve?s fears of a replay of 1937, when premature tightening tipped the US economy into the second leg of the Great Depression, has been a huge winner for me for years now. It means that it is willing to err on the side of over stimulation, by a lot.

With wages growth stagnant for decades, and many commodity prices and precious metals down 30% or more year to date, the Fed certainly has a free pass on the inflation front to do so. Corporate earnings are also helping, consistently surprising to the upside.

However, I think the market is trying to tell us infinitely more than what appeared in yesterday?s headlines, or what flew by in the last tweet or text. There is something deeper going on here beyond the noise of the daily data releases. Asset prices are acting like there is a major structural change underway in the world economy, which so far has remained invisible to all except the market.

Yes, there are a few professionals out there who can see imminent momentous change within their own narrow industries. But no one has yet aggregated all these changes together, so I?ll take a whack at it.

Here are ten theories for you to contemplate.

1) There is more Peace Dividend to Pay - Is it possible that the markets have not yet fully discounted America?s victory in the Cold War? That the payout was interrupted by the dotcom and housing crashes, and that it is now resuming?

Yes, we priced in a chunk with the run up in the Dow average from 2,500 to 11,000 during the 1990?s. But could there be more to go? After all, 22 years since the fall of the Soviet Union and the US still faces no industrial strength enemy, and there are none on the horizon either.

At the very least, this reality should be enough to chop our current defense spending by half, and eliminate most of our budget deficit. Much of the defense establishment agrees with me. They?d rather be spending money on inexpensive, high value, targeted programs, like cyber warfare and drones, rather than the costly, politically inspired, heavy metal weapons systems of old.

2) Obama Care Works ? With the House of Representatives voting to repeal the President?s health care plan for the 50th time, and closing down the government for 16 days in protest, conservative antipathy towards Obamacare couldn?t be more clear. But what if, instead of doubling health care costs as the right has claimed, it drops them by half? What if the plan does add 0.5% to annual GDP and creates 2 million jobs?

This, after all, was the original plan. Health care is expensive in the US because of the lack of competition, and Obamacare delivers that in spades for the first time. Of course there were going to be teething problems. After all, the government is trying to create 50 Amazons overnight at once. It took 20 years for my former Morgan Stanley colleague, Jeff Bezos, to create just one.

The early evidence shows that the competitive health insurance exchanges the plan sets up are delivering price reductions of 30% to 50% in New York and California. I walked into Costco the other day and was offered a plan for $235 a month with an $8,000 deductable, just so I could avoid the penalties for the uninsured. The best offer I previously received from Blue Cross of California was $3,500 a month, typical for an elderly white male like myself.

If this, in turn, solves the health care and Social Security crisis, it will do a lot to wipe out that ?uncertainty? you hear so much about. The predictions of the eventual insolvency of the United States, a perennial Internet conspiracy favorite, also go down the drain.

3) Another Technology Revolution ? Are we on the verge of another great technology breakthrough like the one we saw during the dotcom boom, when PC?s, the Internet, and the World Wide Web simultaneously came together to supercharge corporate earnings for a decade? What if the cost of treating cancer drops from $100,000 to $200, as my friend, Dr. Michio Kaku, believes. What if new Apples and Googles (GOOG) continue to appear out of nowhere?

If you lived in San Francisco and were barraged by venture capital pitches on a daily basis, as I am, you would think this new Golden Age is going to start any minute. There are a thousand innovations percolating out there.

The only question is whether the lead industry will be communications, health care, energy, or all three. Ride your bike south of Market Street someday and see how much research capacity is being built now, the size of a small city. It is awe-inspiring.

4) The Real Cost of Energy Collapses ? We all know about the new 100-year supply of natural gas discovered under our feet that will turn us into Saudi America. But there are 100 additional ways that energy supply is improving and demand is falling.

Conservation will be huge, as will grid and utility modernization. What if Tesla?s (TSLA) Elon Musk is able to deliver a $40,000 electric car with a 300-mile range in three years, as he has promised? This will be a game changer. His track record so far is pretty good.

This is the man so brimming with confidence that he just bought James Bond?s submarine car for $1 million (see the cool modified Lotus in The Spy Who Loved Me). Falling energy costs mean that the profitability of virtually every listed company goes through the roof.

It is likely that if Iran ever does make good on its threat to close the Straights of Hormuz, no one will care. Some 80% of that oil, and soon to be 100%, goes to China, and that will be their problem, not ours.

5) Productivity Accelerates ? By relentlessly introducing new technologies and cutting costs, corporate profitability has soared for the past 30 years. Pessimists now say things can?t get any better. But what if they do?

As I tell guests at my strategy luncheons, this is not a mean reverting data series. Having invested in the machine that took your labor force from 1,000 to 100, what if the next one brings it to 10? Guess which country is about to lose millions of jobs from offshoring and new technology? China. Just talk to any European CEO about their new ?American Strategy.?

6) Interest Rates Stay Low for Another Decade ? If wages stay in check, oil prices fall, and commodity places stay low, then the Fed has absolutely no reason to substantially raise interest rates for another ten years, no matter what the economy does. The next demographic push that creates a worker shortage and higher wages doesn?t start until the early 2020?s.

Sure, the Fed will probably normalize overnight rates back to 2% by next year, as the safety net for the economy is no longer needed. But rates could remain historically very low for quite a long time. This savings immediately drops to the bottom line of any borrower, be they individual, corporate, or government.

In fact, looking at the main causes of the recessions for the last 50 years?a spike in interest rates or a sudden cut off in oil supplies, and absolutely none are visible on the horizon, for now.

7) Shinzo Abe Saves Japan ? The conventional wisdom is that the new government in Japan is resorting to a last desperate act to save their economy that will fail, and that a complete collapse of their over leveraged financial system will result.

But what if Abe gets his necessary reforms through and the country regains its powerhouse status. If Japan?s $6 trillion economy, the world?s third largest, bounces back from a 1% to a 4% GDP growth rate, there will be positive implications for all of us.

8) Europe Gets Its Act Together ? It seems that all we ever hear about from the continent is debt crisis and stagnation and a political system so fragmented that no one can do anything about it. But what if new leadership emerges and takes the initiative to coalesce and solidify Europe?

That would involve creating a single Ministry of Finance, issuing pan Euro bonds, and a European Central Bank with teeth and courage. Their economic problems would disappear and growth would double. As part of my consulting arrangements with governments there, I have been recommending these measures for years, and everyone agrees. All that is missing is the political will to carry them out.

9) The Dollar Stays Strong ? With America?s debt to GDP now over 100% and rising, many analysts believe it is just a matter of time before we see a major crash in the dollar. This is only the continuation of a 220-year-old trend.

What if it goes up instead? Energy independence means we will no longer ship $250 billion a year to the Middle East to pay for oil imports. CEO?s in Europe and Asia are stumbling over each other to find ways to get capital into the US to take advantage of a stronger economy. Higher growth rates mean the feared American deficits start shrinking on their own, with no action from congress whatsoever. This is all long-term dollar positive.

10) Multiples Keep Expanding ? Most strategists believe that the S&P 500 is fairly valued at 1,983 with a price earnings multiple of 15 times, dead in the middle of its historic 9-22 range. But if any of my theories above unfold, then much higher multiples are justified. If they all unfold, then investors wouldn?t hesitate to pay a 25 multiple for American stocks, as their future outlook is so unremittingly positive.

You may say this sounds crazy, and you?d be right. But remember, twice in the last 25 years we have seen market multiples skyrocket to 100. Japanese share valuations reached that nosebleed summit in 1989, and American Dotcom stocks did so in 2000. And they reached those numbers with fundamentals far less substantial than we are facing now. Just take multiples on today?s market up from 15X to 20X, and the Dow should be worth 26,000.

Sure, all of the above represents a pie in the sky best-case scenario. Some, or none, of them may actually play out in the real world. But the ones that do occur will have a super-leveraged effect on each other. The net impact will be US GDP growth easily leaps back from today?s feeble 2% to the virile 4% or more that we grew comfortable with during the fifties, sixties, and eighties.

That growth rate will solve America?s Social Security, Medicare, and deficit problems in fairly short order, without any action by the government.

Needless to say, all of the above is hugely positive for the stock market. It brings forecasts for a Dow 18,000 by the end of 2014, and 100,000 by 2025 out of the realm of fantasy. It kind of makes today?s stock prices look dirt-cheap.

Maybe that?s what the market is trying to tell us, if we only had the patience and the foresight to listen.

This doesn?t mean that you need to rush out and buy more stocks today. Some of these trends will take a decade or more to play out. Better entry points will no doubt present themselves. But the writing is on the wall for higher equity prices, not just in the US, but globally.

I can tell you from the vast expanse of my own 45 years in the prediction business, I have learned one thing. All that is forecast never happens, and all that happens was never forecast.

I?m still waiting for my flying car, although the Tesla S-1 comes close.

My Tesla S-1

My Tesla S-1

I often see one stock index outperform another, as different segments of the economy speed up, slow down, or go nowhere. Sometimes the reasons for this are fundamental, technical, or completely arbitrary.

Many analysts have been scratching their heads this year over why the S&P 500 has been moving from strength to strength for the past year, while the Dow Average has gone virtually nowhere. Since January, the (SPX) has tacked on a reasonable 7.9%, while the Dow has managed only a paltry 3.4% increase.

What gives?

The problem is particularly vexing for hedge fund managers, who have to choose carefully which index they use to hedge other positions. Do you use the broad based measure of 500 large caps or a much more narrow and stodgy 30?

What?s a poor risk analyst to do?

The Dow Jones Industrial Average was first calculated by founder Charles Dow in 1896, later of Dow Jones & Company, which also publishes the Wall Street Journal. When Dow died in 1902, the firm was taken over by Clarence Barron and stayed within family control for 105 years.

In 2007, on the eve of the financial crisis, it was sold to News Corporation for $5 billion. News Corp. is owned by my former boss, Rupert Murdoch, once an Australian, and now a naturalized US citizen. News then spun off its index business to the CME Corp., formerly the Chicago Mercantile Exchange, in 2010.

Much of the recent divergence can be traced to a reconstitution of the Dow Average on September 20, 2013, when it underwent some major plastic surgery.

It took three near-do-wells out, Bank of America (BAC), Hewlett Packard, (HPQ), and Alcoa (AA). In their place were added three more robust and virile companies, Goldman Sachs (GS), Visa (V), and Nike (NKE).

Call it a nose job, a neck lift, and a tummy tuck all combined into one (Not that I?ve been looking for myself!).

And therein lies the problem. Like many attempts at cosmetic surgery, the procedure rendered the subject uglier than it was before.

Since these changes, the new names have been boring and listless, while the old ones have gone off to the races. Hence, the differing performance.

This is not a new problem. Dow Jones has been terrible at making market calls over its century and a half existence. As a result, these rebalancings have probably subtracted several thousand points over the life of the Dow.

They are, in effect, selling lows and buying highs, much like individual retail investors do. It is almost by definition the perfect anti-performance index. When in doubt, always measure your own performance against the Dow.

Dow Jones takes companies out of its index for many reasons. Some companies go bankrupt, whereas others suffer precipitous declines in prices and trading volumes. (BAC) was removed because, at one point, its shares took a 95% hit from its highs and no longer accurately reflected a relevant weighting of its industry. Citigroup (C) suffered the same fate a few years ago.

Look at the Dow Average of 1900 and you wouldn?t recognize it today. In fact, there is only one firm that has stayed in the index since then, Thomas Edison?s General Electric (GE). Buying a Dow stock is almost a guarantee that it will eventually do poorly.

This is why most hedge funds rely on the (SPX) as a hedging vehicle and how its futures contracts, options and ETF?s, like the (SPY), get the lion?s share of the volume.

Mind you, the (SPX) has its own problems. Apple (AAPL) has far and away the largest weighting there and is also subject to regular rebalancings, wreaking its own havoc.

Because of this, an entire sub industry of hedge fund managers has sprung up over the decades to play this game. Their goal is to buy likely new additions to the index and sell short the outgoing ones.

Get your picks right and you are certain to make money. Every rebalancing generates massive buying and selling in single names by the country?s largest institutional investors, which in reality are just closet indexers, despite the hefty fees they charge you.

Given their gargantuan size these days, there is little else they can do. Rebalancings also give brokerage salesmen talking points on otherwise slow days and generate new and much needed market turnover.

What has made 2014 challenging for so many managers is that so much of the action in the Dow has been concentrated in just a handful of stocks.

Caterpillar (CAT), the happy subject of one of my recent Trade Alerts, accounts for 35.3% of the Index gain this year. Walt Disney (DIS) speaks for 24.2% and Intel (INTC) 23.4%.

Miss these three and you are probably trolling for a new job on Craig?s? List by now, if you?re not already driving a taxi for Uber.

It truly is a stock picker?s market; a market of stocks and not a stock market.

Believe it or not, there are people that are far worse at this game than Dow Jones. The best example I can think of are the folks over at Nihon Keizai Shimbun in Tokyo (or Japan Economic Daily for most of you), who manage the calculation of the 225 stocks in the Nikkei Average (once known as the Nikkei Dow).

In May, 2000, out of the blue, they announced a rebalancing of 50% of the constituent names in their index. Their goal was to make the index more like the American NASDAQ, the flavor of the day. So they dumped a lot of old, traditional industrial names and replaced them with technology highfliers.

Unfortunately, they did this literally weeks after the US Dotcom bubble busted. The move turbocharged the collapse of the Nikkei, probably causing it to fall an extra 8,000 points or more than it should have.

Without such a brilliant move as this, the Nikkei bear market would have bottomed at 15,000 instead of the 7,000 we eventually got. The additional loss of stock collateral and capital probably cost Japan an extra lost decade of economic growth.

So for those of you who bemoan the Dow rebalancings, you should really be giving thanks for small graces.

Rebalancing? Yikes!

Rebalancing? Yikes!

Miss This One, And You?re Toast

Miss This One, And You?re Toast

It Truly is a Stock Picker?s Market

It Truly is a Stock Picker?s Market

The Key to Your 2014 Performance

The Key to Your 2014 Performance

This is a bet that the S&P 500 does not rocket to a new all time high by the May 16, 2014 expiration.

The news flow this morning is giving us an opportunity to re enter the short positions that I covered on Friday. Half of the opening 80-point pop in the Dow came from Citibank (C), which surprised to the upside with its Q1 earnings report.

We also got March retail sales +1.1%, better than expected.

We are down only 4.1% in this pullback, not even matching the 6% January dump, and we have clearly not suffered enough for our IPO sins. An eroding quantitative easing from Janet Yellen?s Federal Reserve is clearly taking a toll.

This rally could continue for a day or two more. But it has been so difficult to get short positions off in this correction that I don?t mind erring on the side of being a little early. The reversals ambush you at openings you can?t trade, and take no prisoners. We will probably get our reward on Friday in the next weekend flight to safety.

It is only because implied volatilities are so elevated that I can get this position so far out of the money off so richly, with only 23 trading days left until the May 16 expiration. The spring swoon has sent put prices through the roof, as panicking institutions rush to buy downside insurance a little too late.

Charts and technical analysis are far more useful and important in falling markets than rising one, as the downside crowd is far more dependent on this dismal science.

The fact that these charts are breaking down across markets on increasing volume is terrible news.

A sector rotation out of aggressive technology (XLK), financial (XLF), and discretionary stocks (XLY) into defensive consumer staples (XLP) and utilities (XLU) is a further complicating factor that is making matters worse.

During economic slowdowns, consumers postpone purchases of new iPhones and cars. They don?t for toilet paper and electricity.

Ten year Treasury yields approaching a five-month low is another nail in the coffin. Banks are falling because of the rocketing bond market, which is flattening the yield curve to the topography of Kansas, hurting profits.

All that is needed is a match to ignite a broader, more vicious selloff and Russian Prime Minister Vladimir Putin has a whole box of them!

1,760 in the S&P 500, here we come, the 200-day moving average!

Keep in mind that fast markets, such as the one we have, I can get you only ballpark prices at best. It?s every man for himself. Praise the Lord, and pass the ammunition.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.