The wall of money continues.

According to the legendary economist John Maynard Keynes: “Markets can remain irrational longer than you can remain liquid.”

Keynes should know. After making a fortune trading foreign currency, he was almost wiped out by the 1929 crash when markets fell 90%.

I keep that quote taped to my monitor to instill humility, discipline, self-control, and to avoid hubris. It works most of the time. It is the father of my aggressive stop-loss strategy.

However large the wall of money was before; it is getting bigger. People are making more money, their home values have soared, more are working, the Fed’s quantitative easing continues unabated, and Washington deficit spending is breaking all records, and federal benefits continue to pour through the system.

A very large part of this new money has gone into the stock market, and it will continue to do so. August usually presents the best buying opportunity of the year with a frightful, gut-churning selloff. It’s not happening this time, baby.

If we get another hot payroll report for August, then happy days are here again and it’s off to the races for the rest of 2021. A 100% trading profit for the year comes into range for me, as well as you.

It gets better.

The delta variant has taken new Covid cases from 15,000 a day to 100,000, pushing back the reopening and slowing the economy. ALL of that growth gets pushed back into 2022, making it another hot year. We won’t see the current historic 12% growth rate, but 5% could be doable. Stocks will love it.

Could 2022 be another 100% return year? Maybe.

One thing is for sure. The market could care less about Covid, closing at an all-time high on Friday. Covid is now a known quantity. A year ago, it looked like the end of the world.

If you are vaccinated, it’s now just an inconvenience. It’s currently only killing unvaccinated Republicans and sadly, children.

The next big thing to happen will be for new cases to peak out and begin a sharp decline, causing stocks to rocket. That’s how traders are positioning themselves now.

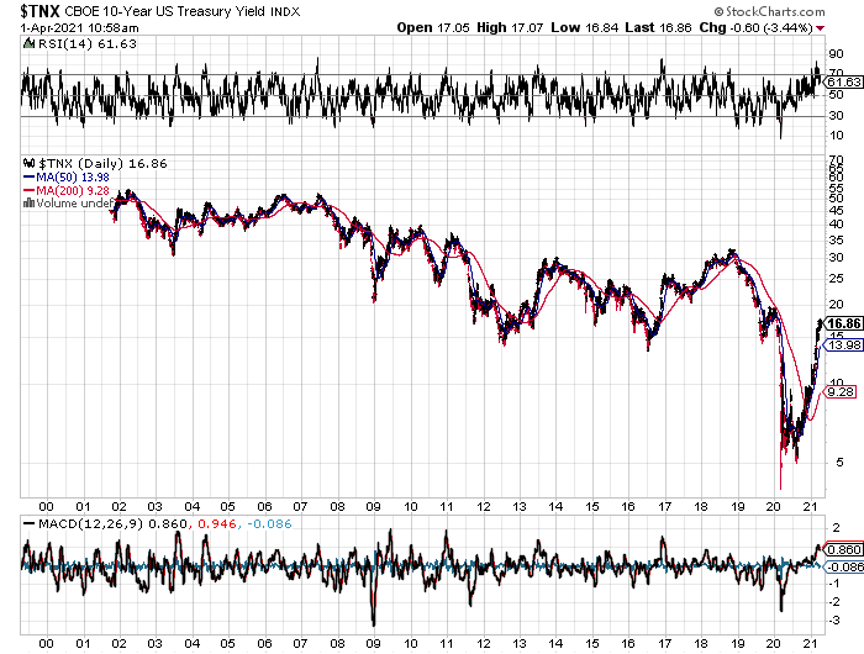

July Nonfarm Payroll Report explodes to 943,000, taking the Headline Unemployment Rate down an amazing half-point to 5.4%. Leisure & Hospitality was up a staggering 380,000. Bonds (TLT) were crushed, down two full points and yields up 19 basis points from the low to 1.29%, gold (GLD) was destroyed, and the US dollar (UUP) popped. The hot number could bring forward a Fed tapper and interest rate rise. Certainly, makes this month’s Jackson Hole meeting interesting.

New Covid Cases hit 100,000 daily, 86% of which are the delta variant, 1,000 times more powerful than the original strain. That’s still a fraction of the 2.5 million cases a day seen in January. The vaccines seem powerless against the onslaught, although they eliminate the possibility of death. The unvaccinated are the walking dead. Companies like Wells Fargo, Amazon, and JP Morgan have delayed reopening. We’re all helpless until a new booster shot comes out in months.

Infrastructure Deal to be signed, at $550 billion worth of road, bridge, water, and power projects. It should generate 2.75 million jobs, if you can find the workers. Expect your local freeways to start getting tied up in a few months when the projects begin in all 50 states. Per capital, Alaska and Hawaii will get the most money.

Copper Unions Vote to strike in Chile, cutting off 33% of the global supply. This is just when the green economy, especially electric cars, is driving demand through the roof. Great news for Freeport McMoRan, which predominantly mines in the US. By (FCX) on dips.

US Treasury to sell $126 billion in bonds this week. It also sees rising demand for Treasury Inflation-Protected Securities (TIPS). Am I the only one seeing the contradiction? Fed governor Clarida said the taper could start in November. Don’t buy bonds here on pain of death.

ADP disappoints in its monthly read of private job openings, coming in at only 330,000 instead of an expected 690,000. Leisure & Hospitality saw the biggest decline, with only 139,000. Could Friday’s July Nonfarm Payroll report be a bust?

Weekly Jobless Claims come in at 385,000, taking another run at post-pandemic lows. This number should really collapse once kids go back to school for the first time in 17 months. Most large companies are now requiring proof of vaccination to return to the office. The same will soon be true for airlines.

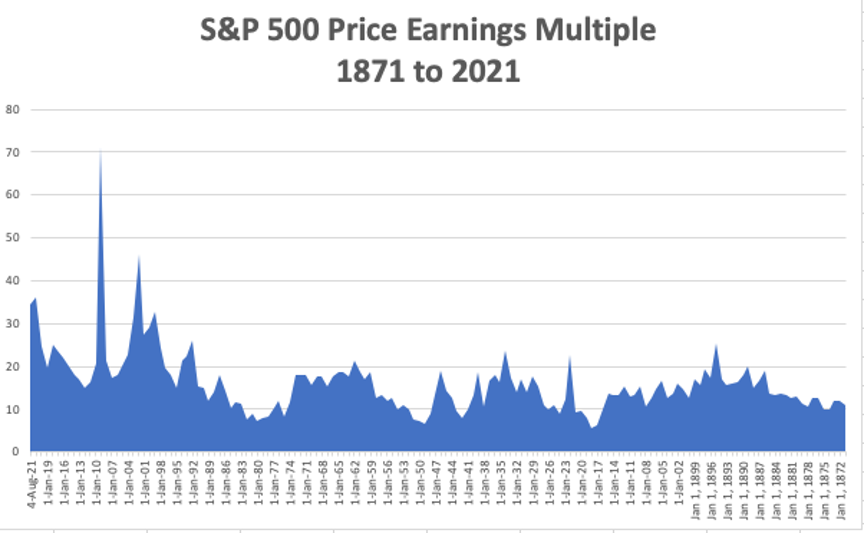

Think the market is expensive now? After the last pandemic ended in 1919, price earnings multiple for the S&P 500 soared 3.09 times from 5.74X to 17.77X. So, today’s 34.39X looks rich indeed but is only half of the 70.91 peak seen at the bottom of the 2009 Great Recession, back when investors were throwing stocks out the window with both hands. The Index started at a lowly 11.1X back when America was still an emerging market. Could we get the 3X move up seen in the last pandemic? One can only hope.

My Ten Year View

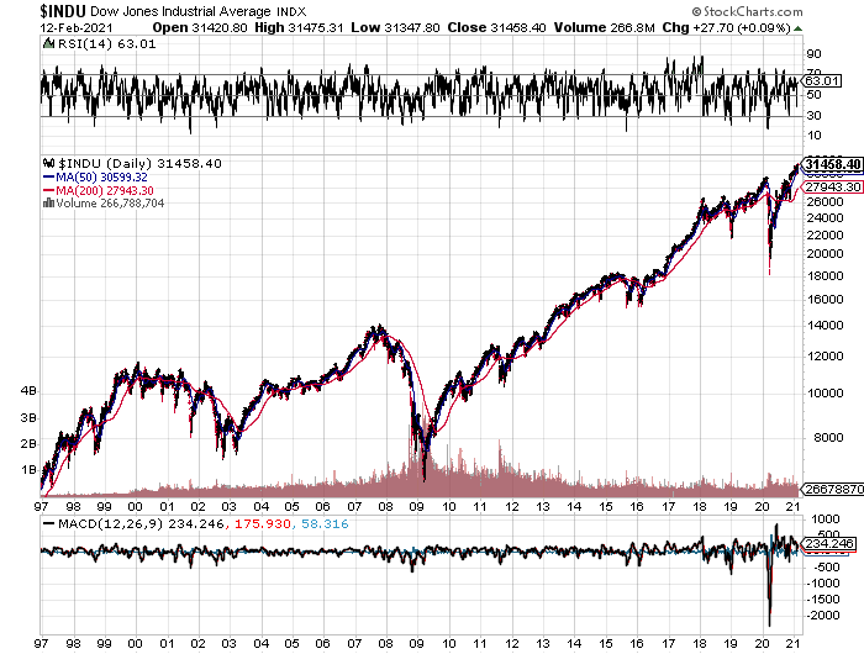

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a healthy gain of +3.36% so far in August. My 2021 year-to-date performance appreciated to 72.57%. The Dow Average is up 15.06% so far in 2021.

I stuck with my four positions, a long in (JPM) and a short in the (TLT) and a short in the (SPY). Since stocks refused to go down, I added longs in Goldman Sachs (GS) and Visa (V). I doubled up my short in the (TLT) after it spiked to a 1.10% yield. The market surge off the back of the July Nonfarm Payroll report also forced me to stop out of my second (SPY) short for a loss.

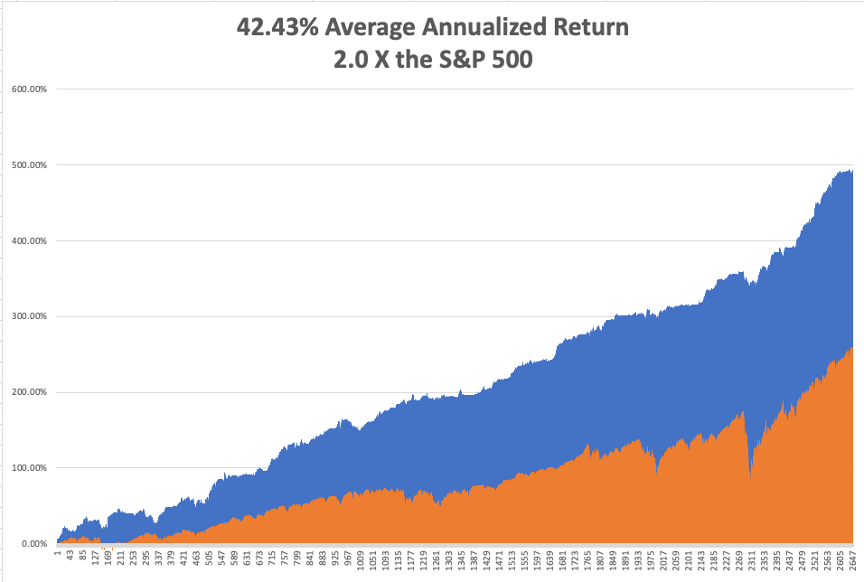

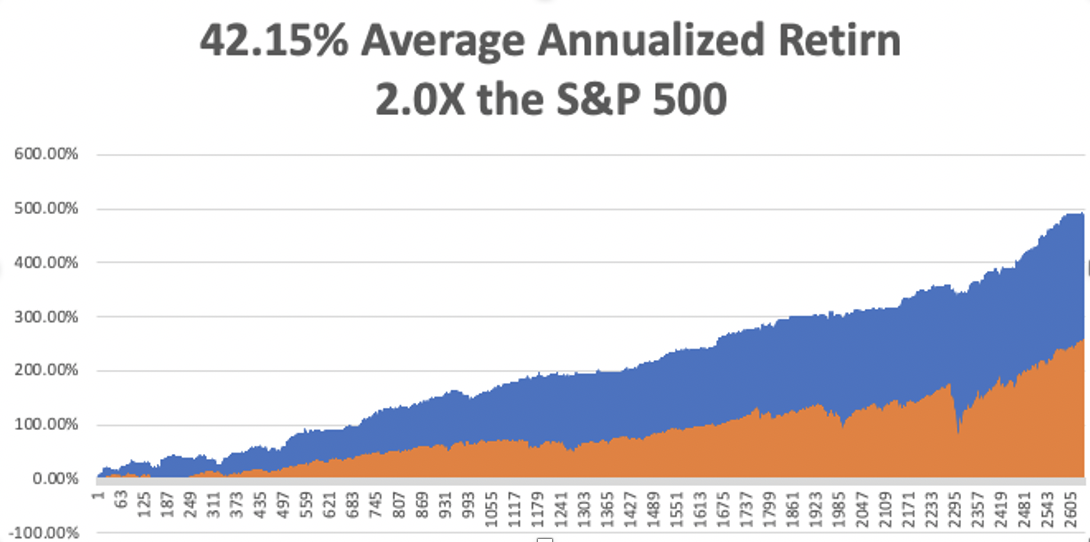

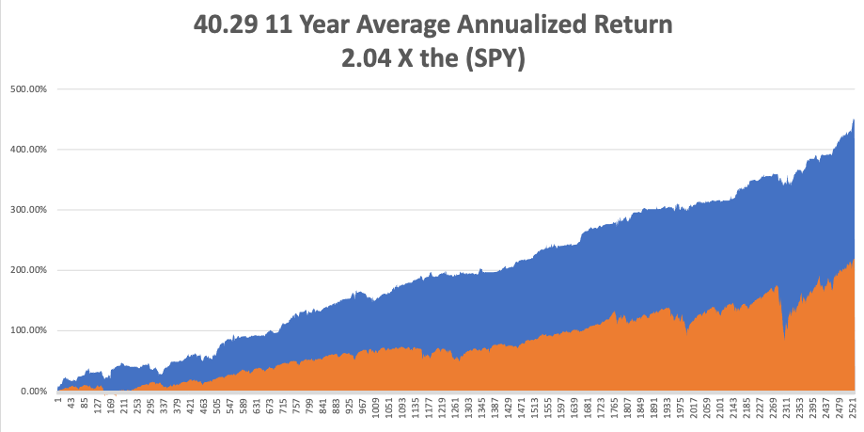

That brings my 11-year total return to 495.12%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.43%, easily the highest in the industry.

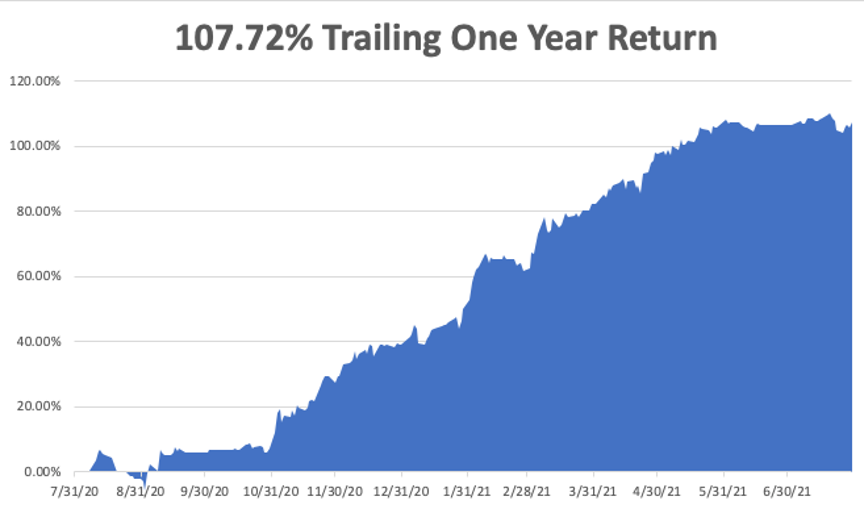

My trailing one-year return retreated to positively eye-popping 110.12%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 35.8 million and rising quickly and deaths topping 617,000, which you can find here.

The coming week will be slow one on the data front.

On Monday, August 9 at 8:00 AM, US Consumer Inflation Expectations are out. AMC (AMC) reports.

On Tuesday, August 10 at 7:30 AM, the NFIB Business Optimism Index for July is printed. Coinbase (COIN) and Softbank (SFTBY) report.

On Wednesday, August 11 at 5:30 AM, the US Core Inflation Rate is released. eBay (EBAY) reports.

On Thursday, August 12 at 8:30 AM, Weekly Jobless Claims are announced. Disney (DIS) and Airbnb (ABNB) report.

On Friday, August 13 at 7:00 AM, we get the University of Michigan Consumer Expectations.

As for me, with the 34th anniversary of the 1987 crash coming up, when shares dove 20% in one day, I thought I’d part with a few memories.

I was in Paris visiting Morgan Stanley’s top banking clients, who then were making a major splash in Japanese equity warrants, my particular area of expertise.

When we walked into our last appointment, I casually asked how the market was doing (Paris is six hours ahead of New York). We were told the Dow Average was down a record 300 points. Stunned, I immediately asked for a private conference room so I could call the equity trading desk in New York to buy some stock.

A woman answered the phone, and when I said I wanted to buy, she burst into tears and threw the handset down on the floor. Redialing found all transatlantic lines jammed.

I never bought my stock, nor found out who picked up the phone. I grabbed a taxi to Charles de Gaulle airport and flew my twin Cessna as fast as the turbocharged engines take me back to London, breaking every known air traffic control rule.

By the time I got back, the Dow had closed down 512 points. Then I learned that George Soros asked us to bid on a $250 million blind portfolio of US stocks after the close. He said he had also solicited bids from Goldman Sachs, Merrill Lynch, JP Morgan, and Solomon Brothers, and would call us back if we won.

We bid 10% below the final closing prices for the lot. Ten minutes later, he called us back and told us we won the auction. How much did the others bid? He told us that we were the only ones who bid at all!

Then you heard that great sucking sound. Oops!

What has never been disclosed to the public is that after the close, Morgan Stanley received a margin call from the exchange for $100 million, as volatility had gone through the roof, as did every firm on Wall Street. We ordered JP Morgan to send the money from our account immediately. Then they lost it! After some harsh words at the top, it was found. That’s when I discovered the wonderful world of Fed wire numbers.

The next morning, the Dow continued its plunge but, after an hour, managed a U-turn and launched on a monster rally that lasted for the rest of the year. We made $75 million on that one trade from Soros.

It was the worst investment decision I have seen in the markets in 53 years, executed by its most brilliant player. Go figure. Maybe it was George’s risk control discipline kicking in?

At the end of the month, we then took a $75 million hit on our share of the British Petroleum privatization, because Prime Minister Margaret Thatcher refused to postpone the issue, believing that the banks had already made too much money. That gave Morgan Stanley’s equity division a break-even P&L for the month of October 1987, the worst in market history. Even now, I refuse to gas up at a BP station on the very rare occasions I am driving an internal combustion engine.

Good Luck and Good Trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader