So far in 2015 the Indian stock market has handily beaten that of the US, by 10.6% compared to 5.3%.

?The India election result is the biggest development to affect emerging markets over the last 30 years.? That is what retired chairman of Goldman Sachs Asset Management and originator of the ?BRIC? term, Jim O?Neal, told me last week.

Indeed, the stunning news has sent long term country specialists scampering. In my long term strategy lectures I have been titillating listeners for years with predictions that India was about to become the next China.

With half the per capita income of the Middle Kingdom, India was lacking the infrastructure needed to compete in the global marketplace. All that was needed was the trigger.

This is the trigger.

With a new party taking control of the government for the first time in 50 years, the way is now clear to carry out desperately needed sweeping political and economic reforms. At the top of the list is a clean sweep of corruption, long endemic to the subcontinent. I once spent four months traveling around India on the Indian railway system, and the demand for ?bakshish? was ever present.

A reviving and reborn India has massive implications for the global economy, which could see growth accelerate as much at 0.50% a year for the next 30 years. This will be great news for stocks everywhere. It will help offset flagging demand for commodities from China, like coal (KOL), iron ore (BHP), and the base metals (CU).

Demand for oil (USO) grows, as energy starved India is one of the world?s largest importers.

A strengthening Rupee, higher standards of living, and relaxed import duties should give a much needed boost for gold (GLD). India has always been the world?s largest buyer.

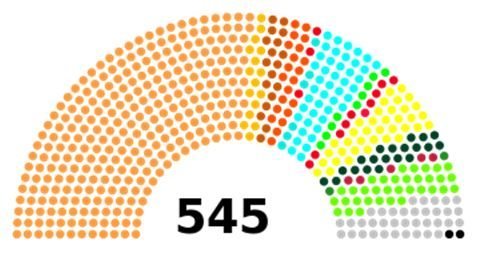

The world?s largest democracy certainly delivers the most unusual of elections, a blend of practices from today?.and a thousand years ago. It was carried out over five weeks, and a stunning 541 million voted, out of an eligible 815 million, a turnout of 66.4%. That is far higher than elections seen here in the United States.

Of the 552 members in the Lok Sabha, the lower house (or their House of Representatives), a specific number of seats are reserved for scheduled castes, scheduled tribes, and women. Gee, I wonder which one of these I would fit in?

Important issues during the campaign included rising prices, the economy, security, and infrastructure such as roads, electricity and water. About 14% of voters cited corruption as the main issue.

Some 12 political parties ran candidates. The winner was Hindu Nationalist Narendra Modi of the Bharatiya Janata Party (BJP), who led a diverse collection of lesser parties to take an overwhelming majority. For more details on this fascinating election, please click here at http://www.ndtv.com/elections.

It is still early days for the Bombay stock market, which has already rocketed by a stunning 20% since the election results became obvious last week.

This could be the beginning of a ten-bagger move over coming decades. Managers are hurriedly pawing through stacks of research on the subcontinent they have been ignoring for the past four years, the last time emerging markets peaked.

In the meantime, the action has spilled over into other emerging markets (EEM), their currencies (CEW), and their bonds (ELD), which have all punched through to new highs for the year.

I?ll be knocking out research o specific names when I find them. Until then, use any dip to pick up the Indian ETF?s (INP), (PIN), and (EPI).