Going against the market consensus has been working pretty well lately.

When the world prayed for a Santa Claus rally, I piled on the shorts. When traders expected a New Year January crash, I filled my boots with longs.

That’s how you earn an eye-popping 19.83% profit in a mere nine trading says, or 2.20% a day.

The other day, someone asked me how it is possible to get mind-blowing results like these. It’s very simple. Get insanely aggressive when everyone else is terrified, which I did on January 3. I also knew that with the Volatility Index (VIX) falling to $18, pickings would quickly get extremely thin. It was make money now, or never.

To quote my favorite market strategist, Yankees manager Yogi Berra, “No one goes to that restaurant anymore because it’s too crowded.”

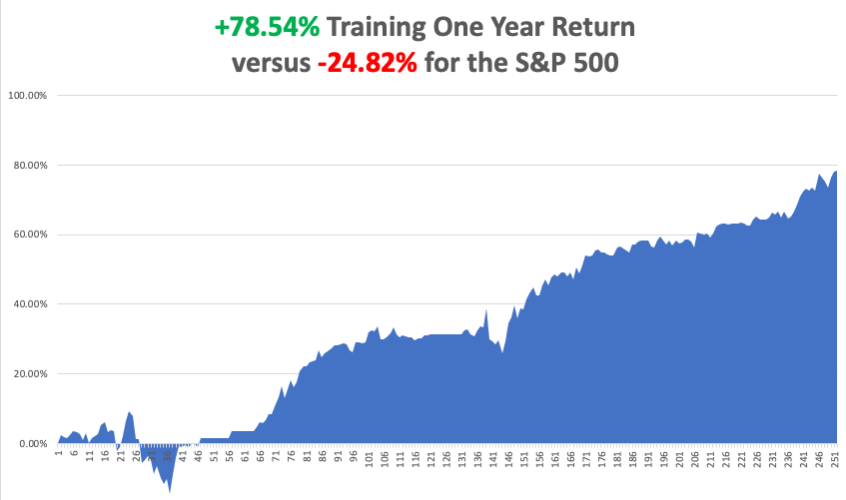

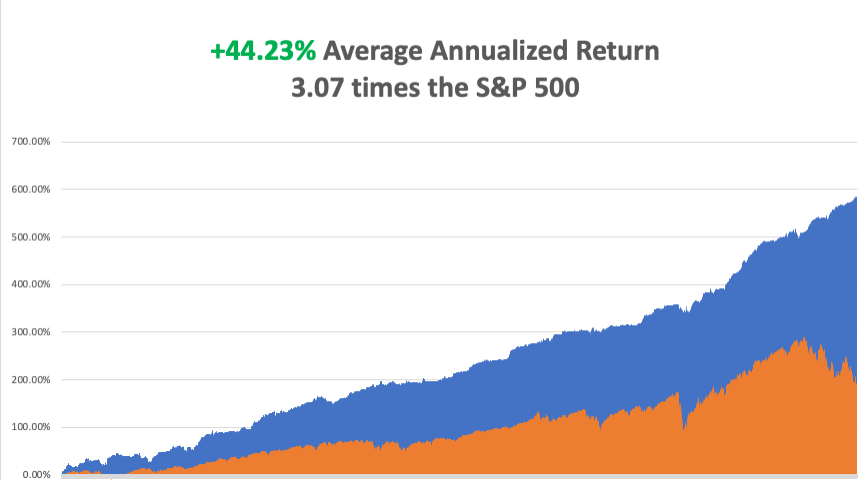

My performance in January has so far tacked on a welcome +19.83%. Therefore, my 2023 year-to-date performance is also +19.83%, a spectacular new high. The S&P 500 (SPY) is up +3.78% so far in 2023.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 15 years ago. My trailing one-year return maintains a sky-high +103.30%.

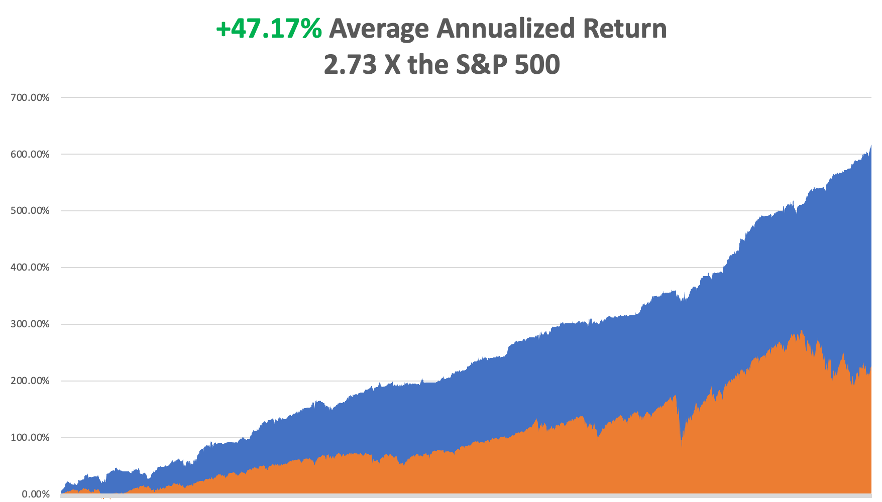

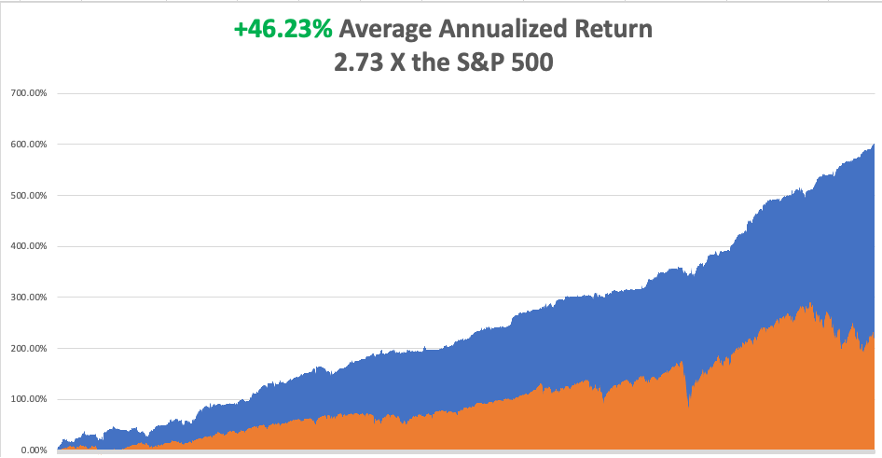

That brings my 15-year total return to +617.03%, some 2.73 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +47.17%, easily the highest in the industry.

I took profits in my February bonds last week (TLT), taking advantage of a $5 pop in the market. All my remaining positions are profitable, including longs in (GOLD), (WPM), (TSLA), (BRK/B), and (TLT), with 30% in cash for a 10% net long position.

Since my New Year forecasts have worked out so well, I will repeat the high points just in case you were out playing golf or bailing out from a flood when they were published.

Buy Falling Interest Rate Plays, as I expect the yield on the ten-year US Treasury yield to fall from 3.50% to 2.50% by yearend. That means Hoovering up any kind of bond, like (TLT), (MUB), (JNK), and (HYG). Falling interest rates also shine a great spotlight on precious metals like (GLD), (SLV), (GOLD), and (WPM).

The US Dollar Will Continue to Fall. Commodities love this scenario, including (FCX), (BHP), and emerging markets (EEM).

Inflation Will Decline All Year and should go below 4% by the end of 2023. In fact, we have had real deflation for the past six months. Financials do well here, like (MS), (GS), (JPM), (BAC), (C), and (BRK/B).

Which creates another headache for you, if not an opportunity. We may have a situation where the main indexes, (SPY), (QQQ), and (IWM) go nowhere, while individual stocks and sectors skyrocket. That creates a chance to outperform benchmarks…and everyone else.

There has been a lot of discussion among traders lately about the collapse of the Volatility Index ($VIX) to $18, a two-year low and what it means.

They are distressed because a ($VIX) this low greatly shrinks the availability of low risk/high return trading opportunities. A ($VIX) this low is basically shouting at you to “STAY AWAY!”

Does it mean that an explosion of volatility is following? Or are markets going to be exceptionally boring for the next six months?

Beats me. I’ll wait for the market to tell me, as I always do.

Current Positions

Risk On

(TSLA) 1/$75-$80 call spread 10.00%

(GOLD) 1/$15.50-$16.50 call spread. 10.00%

(WPM) 1/$$36-$39 call spread. 10.00%

(BRKB) 1/$290-$300 call spread 10.00%

Risk Off

(TLT) 1/$96-$99 call spread - 10.00%

(TLT) 1/$95-$98 call spread -20.00%

Total Net Position 10.00%

Total Aggregate Position 70.00%

Consumer Price Index Falls 0.1% in December, continuing a trend that started in June. Stocks popped and bonds rallied. YOY inflation has fallen to 6.5%. “RISK ON” continues. Now we have to wait another month to get a new inflation number. The economy has now seen de facto deflation for six months. Gas prices led the decline, now 9.4%. We might get away with only a 0.25% interest rate hike at the February 1 Fed meeting.

Bond Default Risk Rises, as well as a government shutdown, as radicals gain control of the House. This is the group that lost the most seats in the November election. Bonds are the only asset class not performing today, and paper with summer maturities is trading at deep discounts. It certainly casts a shadow over my 50% long bond position. However, I don’t expect it to last more than a month and my longest bond maturity is in February.

The US Consumer is in Good Shape, according to JP Morgan’s Jamie Diamond. Spending is now 10% greater than pre covid, and balance sheets are healthy. No sign of an impending deep recession here.

Boeing Deliveries Soar from 340 to 480 in 2022, and 479 new orders. A sudden aircraft shortage couldn’t have happened to a nicer bunch of people. The 737 MAX has shaken off all its design problems after two crashes four years ago. Cost-cutting here can be fatal. Europe’s Airbus is still tops, with 663 deliveries last year. Don’t chase the stock up here, up 79% from the October lows, but buy (BA) on dips.

Small Business Optimism Hits Six-Month Low to from 91.9 to 89.8, adding to the onslaught of negative sentiment indicators, so says the National Federation of Independent Business (NFIB).

Copper Prices Set to Soar Further with the post-Covid reopening of China, according to research firm Alliance Bernstein. After a three-year shutdown, there is massive pent-up demand. Copper prices are at seven-month highs. Keep buying (FCX) on dips.

Australian Metals Exports Soar, as the new supercycle in commodities gains steam. Shipments topped $9 billion in November, 20% higher than the most optimistic forecasts. Keep buying copper (FCX), aluminium (AA), iron ore (BHP), gold (GLD) and silver (SLV) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, January 16, markets are closed for Martin Luther King Day.

On Tuesday, January 17 at 8:30 AM EST, the New York Empire State Manufacturing Index is out

On Wednesday, January 18 at 11:00 AM, the Producer Price Index is announced, giving us another inflation read.

On Thursday, January 19 at 8:30 AM, the Weekly Jobless Claims are announced. US Housing Starts and Building Permits are printed.

On Friday, January 20 at 7:00 AM, the Existing Home Sales are disclosed. At 2:00, the Baker Hughes Oil Rig Count is out.

As for me, the University of Southern California has a student jobs board that is positively legendary. It is where the actor John Wayne picked up a gig working as a stagehand for John Ford which eventually made him a movie star.

As a beneficiary of a federal work/study program in 1970, I was entitled to pick any job I wanted for the princely sum of $1.00 an hour, then the minimum wage. I noticed that the Biology Department was looking for a lab assistant to identify and sort Arctic plankton.

I thought, “What the heck is Arctic plankton?” I decided to apply to find out.

I was hired by a Japanese woman professor whose name I long ago forgot. She had figured out that Russians were far ahead of the US in Arctic plankton research, thus creating a “plankton gap.” “Gaps” were a big deal during the Cold War, so that made her a layup to obtain a generous grant from the Defense Department to close the “plankton gap.”

It turns out that I was the only one who applied for the job, as postwar anti-Japanese sentiment then was still high on the West Coast. I was given my own lab bench and a microscope and told to get to work.

It turns out that there is a vast ecosystem of plankton under 20 feet of ice in the Arctic consisting of thousands of animal and plant varieties. The whole system is powered by sunlight that filters through the ice. The thinner the ice, such as at the edge of the Arctic ice sheet, the more plankton. In no time, I became adept at identifying copepods, euphasia, and calanus hyperboreaus, which all feed on diatoms.

We discovered that there was enough plankton in the Arctic to feed the entire human race if a food shortage ever arose, then a major concern. There was plenty of plant material and protein there. Just add a little flavoring and you had an endless food supply.

The high point of the job came when my professor traveled to the North Pole, the first woman ever to do so. She was a guest of the US Navy, which was overseeing the collection hole in the ice. We were thinking the hole might be a foot wide. When she got there, she discovered it was in fact 50 feet wide. I thought this might be to keep it from freezing over but thought nothing of it.

My freshman year passed. The following year, the USC jobs board delivered up a far more interesting job, picking up dead bodies for the Los Angeles Counter Coroner, Thomas Noguchi, the “Coroner to the Stars.” This was not long after Charles Manson was locked up, and his bodies were everywhere. The pay was better too, and I got to know the LA freeway system like the back of my hand.

It wasn’t until years later when I had obtained a high-security clearance from the Defense Department that I learned of the true military interest in plankton by both the US and the Soviet Union.

It turns out that the hole was not really for collecting plankton. Plankton was just the cover. It was there so a US submarine could surface, fire nuclear missiles at the Soviet Union, then submarine again under the protection of the ice.

So, not only have you been reading the work of a stock market wizard these many years, you have also been in touch with one of the world’s leading experts on Artic plankton.

Live and learn.

CLICK HERE to download today's position sheet.

1981 On Peleliu Island in the South Pacific