Global Market Comments

May 10, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SUSHI HITS THE FAN),

(SPY), (TLT), (TBT), (V), (UNP), (DAL), (MSFT), (GS), (JPM), (FCX)

Global Market Comments

May 10, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SUSHI HITS THE FAN),

(SPY), (TLT), (TBT), (V), (UNP), (DAL), (MSFT), (GS), (JPM), (FCX)

During my senior year in High School, I had the good fortune to date the daughter of Richard Knerr, the founder of Wham-O, the inventor of Hula Hoops, Silly Putty, Super Balls, Frisbee’s, and Slip & Slides (click here).

At six feet, she was the tallest girl in the school, and at 6’4” I was an obvious choice.

After the senior prom and wearing my tux, I took her to the Los Angeles opening night of the new musical Hair. In the second act, the entire cast dropped their clothes onto the stage and stood there stark naked. The audience was stunned, shocked, embarrassed, and even gob-smacked.

Those were the reactions I saw on Friday, when the April Nonfarm Payroll Report was released showing a gain of only 266,000 jobs. A million had been expected.

So, how does that work? Red hot ADP private jobs and a year low in Weekly Jobless Claims, but a horrific monthly Payroll report?

They say economic data can be “noisy”. This time it was positively cacophonous. The fact is that these data points were never created to handle times like this, the most disruptive in history.

When the data are useless, all you have to do is take a walk down Main Street. There are “Help Wanted” signs at virtually every business.

The data dissonance created a wild day in the markets on Friday. Bonds soared, causing ten-year yields to dive to 1.48%. Then they rallied all the way back up to 1.58%.

That was seen as the end of the two-month long rally in bonds, so stock took off like a rocket. Essentially everything went up, both cyclicals, banks, AND tech.

All those bond shorts you have been nursing since March? They are about to explode to the upside. The next leg down in the year-old bear market in bonds is about to begin.

And what about that 266,000-payroll report? If you didn’t get a million jobs print in April, then you’ll almost certainly get it in May. Stocks could well keep rally until then. That’s how traders are seeing it.

Just another reason to buy.

By the way, I learned one of the great untold business stories from Richard Knerr. When the Hula Hoop was first launched in 1957, sales went ballistic. Some 25 million were sold in the first four months.

The Hula Hoop was made of a plastic tube stapled together with an oak cork made in England. Since demand seemed infinite, Wham-O ordered 50 million corks. Then the republican party claimed the toy was a communist conspiracy to destroy the youth of America as the swiveling of hips was deemed obscene. This was at the tail end of the McCarthy period.

Sales of Hula Hoops collapsed.

They cancelled the order for 50 million oak corks, which were thrown overboard mid-Atlantic. They are still floating out there somewhere today. Wham-O almost went bankrupt from the experience but was eventually saved by the Frisbee.

Richard Knerr died in 2008 at the age of 82. Wham-O was taken over by Mattel in 1995. For his obituary, please click here.

April Nonfarm Payroll Report is a huge disappointment, at 266,000 when up to one million was expected. April’s hiring boom goes bust. March was revised down massively, from 916,000 to 770,000. The headline Unemployment Rate rose to 6.1%. It was one of the most confusing reports in recent memory. Bonds rocketed, interest rates crashed, and tech stocks took off like a scalded chimp. Inflation expectations have been shattered. Leisure & Hospitality kicked in at 331,000. But Professional & Business Services collapsed by 111,000. The two million businesses that went under last year aren’t hiring. Much of the return to work has been by people who already have jobs.

Weekly Jobless Claims plunged to 488,000, one of the sharpest drops on record at 100,000. Go down any Main Street today and instead of a sea of plywood, it is plastered with “Help Wanted” signs. Productivity is soaring, while average labor costs are actually falling.

ADP Private Employment Report soars, up by 742,000 in April, the biggest gain since September. It makes the coming Friday Nonfarm Payroll Report look outstanding. The jobs market is booming, but competition for the top jobs is also fierce.

Europe’s Q1 GDP falls by 0.6%. That’s better than expected, but disastrous when compared to America’s spectacular 6.4% print. Blame the bumbled slow-motion vaccine rollout. European governments wasted time negotiating on price like it was just another government program, while the US poured billions into vaccine makers, no questions asked. European vaccines, like Astra Zeneca’s, were flawed. It’s amazing that a big government continent can’t perform a big government task, even when millions of lives depend on it.

US Factory Orders gain, up 1.1% in March, providing more evidence that stimulus is working. Most economists are expecting double-digit growth in Q2. Driving up to Lake Tahoe, the number of trucks on the road has doubled in the last month.

Personal Income Explodes, up 21.1% in March, the most since 1945 according to the Bureau of Economic Analysis. What the heck happened in 1945? $1,400 stimulus checks are clearly burning holes in the pockets of consumers. Expect all numbers to hit lifetime highs in the coming months. The sun, moon, and stars are all lining up and standard of living is soaring.

Chicago PMI rockets to a 40-year high, up to 72.1 versus an expected 65. It seems everyone is already trying to buy what I am trying to buy. My bet is that the stock market is wildly underestimating the coming onslaught of economic numbers and will go to new highs once it figures out the game.

Lumber Prices are becoming a big deal, soaring 70% in two months and a staggering 340% in a year, igniting inflation fears. It’s only a tiny fraction of our tiny spending but is adding $36,000 to the cost of a new home. Someone in four homes sold today are newly built, the highest ratio ever. Punitive Trump lumber tariffs against Canada years ago shut down a lot of production and now that we need it, it isn’t there.

IBM brings out the 2-Nanometer Chip, taking semiconductor technology to the next evolutionary level. Any smaller and electrons will be too big to squeeze through the gates. The current battle is over 7 nm technology. It promises to bring much faster computing at a lower price and will act as a temporary bridge to lightening quantum computing.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 2.38% gain during the first week of May on the heels of a spectacular 15.67% profit in April.

I took profits in my long in Goldman Sachs (GS) and my short in the United States Treasury Bond Fund (TLT). I then plowed the cash into a new June short position in the (TLT) and a new short in the S&P 500 (SPY). That gave me a heart attack on my bond shorts when bond prices soared and then an immediate rebirth when they collapsed two points in the afternoon.

That leaves me 100% invested, as I have been for the last six months.

My 2021 year-to-date performance soared to 62.14%. The Dow Average is up 14.45% so far in 2021.

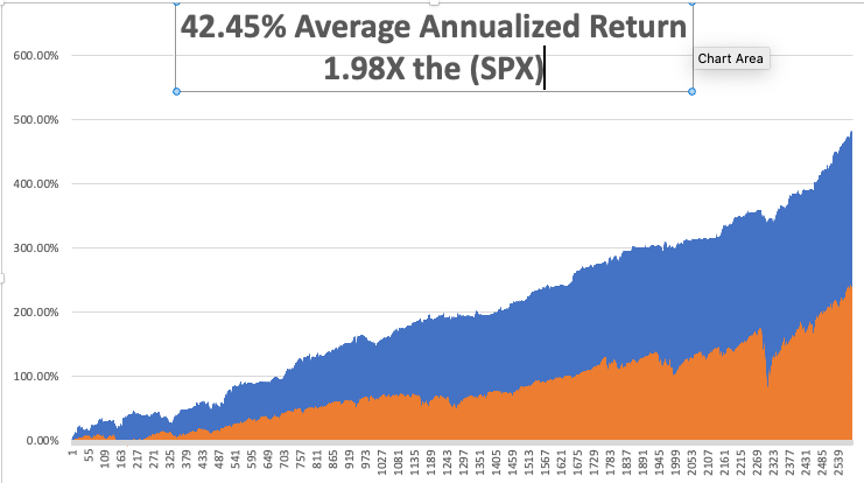

That brings my 11-year total return to 484.89%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.45%, easily the highest in the industry.

My trailing one-year return exploded to positively eye-popping 127.09%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 32.7 million and deaths topping 581,000, which you can find here. New cases are in free fall, with only 12 here in Washoe County Nevada out of a population of 500,000. We could approach zero by the summer.

The coming week will be weak on the data front.

On Monday, May 10, at 9:45 AM, the April ISM New York Index is out. Roblox (RBLX) and BioNTech (BNTX) report earnings.

On Tuesday, May 11, at 10:00 AM, the NFIB Small Business Optimism Index for April is released. Palantir reports results (PLTR).

On Wednesday, May 12 at 2:00 PM, the US Core Inflation Rate for April is published. Softbank (SFTBY) reports results.

On Thursday, May 13 at 8:30 AM, the Weekly Jobless Claims are published. Walt Disney (DIS), Airbnb (ABNB), and Alibaba (BABA) report results.

On Friday, May 14 at 8:30 AM, Retail Sales for April are indicated. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I’ve found a new series on Amazon Prime called Yellowstone. It is definitely NOT PG-rated, nor is it for the faint of heart. But it does remind me of my own cowboy days.

When General Custer was slaugherted during his last stand in Montana at the Little Big Horn in 1876, my ancestors spotted a great buying opportunity. They used the ensuing panic to pick up 50,000 acres near the Wyoming border for ten cents an acre.

Growing up as the oldest of seven kids, my parents never missed an opportunity to farm me out with relatives. That’s how I ended up with my cousins near Broadus, Montana for the summer of 1967.

When I got off the Greyhound bus in nearby Sheridan, I went into a bar to call my uncle. The bartender asked his name and when I told him “Carlat” he gave me a strange look.

It turned out that My uncle killed someone in a gunfight in the street out front a few months earlier, which was later ruled self-defense. It was the last public gunfight seen in the state, and my uncle hadn’t been seen in town since.

I was later picked up in a beat-up Ford truck and driven for two hours down a dirt road to a log cabin. There was no electricity, just kerosene lanterns and a propane-powered refrigerator.

Welcome to the 19th century!

I was hired on as a cowboy, lived in a bunkhouse with the rest of the ranch hands, and was paid the princely sum of a dollar an hour. I became popular by reading the other cowboys' newspapers and their mail since they were all illiterate. Every three days, we slaughtered a cow to feed everyone on the ranch. I ate steak for breakfast, lunch, and dinner.

On weekends, my cousins and I searched for Indian arrowheads on horseback, which we found by the shoebox full. Occasionally, we got lucky finding an old rusted Winchester or Colt revolver just lying out on the range, a remnant of the famous battle 90 years before. I carried my own six-shooter to help reduce the local rattlesnake population.

I really learned the meaning of work and had callouses on my hands in no time. I had to rescue cows trapped in the mud (stick a burr under their tail), round up lost ones, and saw miles of fence posts. When it came time to artificially inseminate the cows with superior semen from Scotland, it was my job to hold them still. It was all heady stuff for a 16-year-old.

The highlight of the summer was participating in the Sheridan Rodeo. With my uncle, one of the largest cattle owners in the area, I had my pick of events. So, I ended up racing a chariot made from an old oil drum, team roping (I had to pull the cow down to the ground), and riding a Brahma bull. I still have a scar on my left elbow from where a bull slashed me, the horn pigment clearly visible.

I hated to leave when I had to go home and back to school. But I did hear that the winter in Montana is pretty tough.

It was later discovered that the entire 50,000 acres was sitting on a giant coal seam 50 feet thick. You just knocked off the topsoil and backed up the truck. My cousins became millionaires. They built a modern four-bedroom house closer to town with every amenity, even a big screen TV. My cousin built a massive vintage car collection.

During the 2000s, their well water was poisoned by a neighbor’s fracking for natural gas, and water had to be hauled in by truck at great expense. In the end, my cousin was killed when the engine of the classic car he was restoring fell on top of him when the rafter above him snapped.

It all did give me a window into a lifestyle that was then fading fast. It’s an experience I’ll never forget.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 22, 2021

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

Global Market Comments

April 19, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or LIE BACK AND THINK OF ENGLAND)

(JPM), (BAC), (AAPL), (FXI), (TLT), (VIX), (TSLA)

If you have to ask what this classic phrase from Britain’s colonial past means, you are too young to know.

The stock market equivalent is that there is nothing to do. Just sit back and relax, watching the value of your stocks go up every day. Let the greatest monetary and fiscal stimulus work its inevitable magic.

When I said last week that stocks might go up every day in April, I wasn’t kidding. NASDAQ (QQQ) has gone up every day this month except one. The S&P 500 has seen only two down days when it was virtually unchanged.

And the best may be yet to come.

The mere prospect of a $2.3 infrastructure trillion budget is enough to keep stocks powering upward for the foreseeable future. Biden may have to negotiate the total down to get it through congress and that may be the cause of the next correction…in about three months.

What really had the phones buzzing on Thursday was the bizarre move in the bond market. After seeing spectacularly positive data, the Weekly Jobless Claims plunging by 200,000 and Retail Sales coming in at a prolific 9.8%, bonds should have crashed.

Instead, the (TLT) jumped by $2.60. That took interest rate and inflation fears packing and sent the indexes soaring to all-time highs once again.

It’s proof yet again that inflation is the boogie man that will never show. Despite the incredible strength of the economy, any time anyone tries to raise prices, another company comes along with a better product or service at half the price. Such is the relentless tide of technology.

In the meantime, Goldilocks has moved in, unpacked her bags, gotten comfortable, and has settled in for the duration. I have been so aggressive in trading the market for the last six months it is wearing me out.

So, I took a rare Saturday off, weeding the garden, setting up a new computer, and generally fixing things that I haven’t had time to attend to since last year. I lived almost normally….for a day.

One of the best Earnings Seasons in history started last week, with 25% growth expected at 81% beating forecasts. JP Morgan (JPM) and Bank of America (BAC) kicks off on Wednesday, with the big kahuna, Apple (AAPL) reporting on April 28. Expect stocks to rally until then. It may give us the first hint of the massive stimulus on the economy to come. Q2 and Q3 will be the monster quarters.

Equity Funds pick up a half trillion dollars in five months, more than they attracted over the last 12 years. It’s all rocket fuel for the ongoing market melt-up. With the Volatility Index (VIX) at a one-year low at $17, the best may be yet to come. Equity investors are the most bullish in years.

Tesla is upgraded to $1,071 per share by research firm Canaccord Genuity. The company is transitioning from low-volume high-priced cars to high-volume low-priced cars, as seen in the 47% leaps in sales during Q1. The stationary battery business is booming, thanks to a new generation of technology. Tesla is developing an Apple-type brand value in the energy market, which is worth a big premium, which competitors can’t match. Tesla has brought a machine gun to a knife fight. Global chip shortages are a risk. The stock jumped $25 on the news.

Consumer Price Index comes in muted at 0.6% in April and 2.6% YOY. The market had been fearing worse, sparking another leg up in technology stocks. Much of the gain was from a jump in gasoline prices, which are now falling. Food prices are also rising.

JP Morgan pops on upside earnings surprise, with Q1 profits soaring from $2.9 billion a year ago to an eye-popping $14.5 billion. Revenues were up 14% to $33.1 billion. Loan demand is weakening because so many people are getting government money for free. Credit card debts are being paid down.

Retail Sales explode in March, up a staggering 9.8%. New spending at bars and restaurants was a major factor, and we haven’t even started yet! Stocks soar to new highs, and the bond market takes off like a scalded chimp, taking ten-year US Treasury yields below 1.57%. It confirms my thesis that when we see actual real numbers of an unprecedented recovery, we get another new leg in the bull market.

Weekly Jobless Claims collapse to 576,000, the lowest of 2021. That's down a massive 193,000 jobs from the previous week. Herd immunity is here! Keep getting those shots!

China’s (FXI) GDP grew by a staggering record of 18.3% in Q1 at an annualized rate YOY. Strong industrial production and exports were the leaders. It presages a similar explosive growth rate for the US in Q2. We won’t know until the end of July. Having your largest customers breaking growth records is great for your business too. Buy everything on dips.

Hedge funds nailed the Bond Crash, selling short some $100 billion in paper since January. It will be more than enough to cover their losses in equity shorts.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 7.17% gain during the first half of April on the heels of a spectacular 20.60% profit in March.

It was a very busy week for trade alerts, with five positions expiring at their maximum profit points in (TSLA) and the (TLT). It’s been so long since I’ve had a loss, I forgot what they looked like.

I used a puzzling $2.60 spike in the (TLT) to add to my already substantial short position in bonds (TLT) with a distant May expiration. Ten-year US Treasury yields fell all the way to 1.51%.

My 2021 year-to-date performance soared to 51.26%. The Dow Average is up 12.9% so far in 2021.

That brings my 11-year total return to 473.81%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 40.81%, the highest in the industry.

My trailing one-year return exploded to positively eye-popping 129.19%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives. Every time I think these numbers can’t be topped, they increase by another 10% during the following two weeks.

We need to keep an eye on the number of US Corona virus cases at 31.6 million and deaths topping 567,000, which you can find here.

The coming week will be dull on the data front.

On Monday, April 19 at 11:00 AM, earnings for (IBM), Coka-Cola (KO), and United Airlines (UAL) are released.

On Tuesday, April 20, at 4:30 PM, API Crude Stocks are published. We also get earnings for Johnson & John (JNJ) and Netflix (NFLX).

On Wednesday, April 21 at 1:00 PM, there is a big 20-year US Treasury bond auction. Chipotle (CMG) and Verizon (VZ) earnings are out.

On Thursday, April 22 at 8:30 AM, the Weekly Jobless Claims are printed. At 10:00 AM Existing Home Sales for March are announced. Snap (SNAP) and Intel (INTC) announce earnings.

On Friday, April 23 at 10:00 AM, we get the New Home Sales for March. American Express (AXP) and Honeywell (HON) release earnings. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, someone commented that I walk kind of funny the other day, and the memories flooded back.

In 1975, The Economist magazine in London heard rumors that a large part of the population was getting slaughtered in Cambodia. We expected this to happen after the fall of Vietnam, but not in the Land of the Khmers. So my editor, Peter Martin, sent me to check it out.

Hooking up with a right-wing guerrilla group financed by the CIA was the easy part. Humping 100 miles in 100-degree heat wasn’t.

We eventually came to a large village that was completely deserted. Then my guide said, “Over here.” He took me to a nearby cave containing the bodies of over 1,000 women, children, and old men that had been there for months.

I’ll never forget that smell.

With the evidence and plenty of pictures in hand, we started the trek back. Suddenly, there was a large explosion and the man 20 yards in front of me disappeared. He had stepped on a land mine. Then the machine-gun fire opened up. It was an ambush.

I picked up an M-16 to return fire, but it was bent, bloody, and unusable. I picked up a second rifle and fired until it was empty. Then everything suddenly went black.

I woke up days chained to a palm tree, covered in shrapnel wounds, a prisoner of the Khmer Rouge. Maggots infested my wounds, but I remembered from my Tropical Diseases class at UCLA that I should leave them alone because they only ate dead flesh and would prevent gang green. That class saved my life. Good thing I got an “A”.

I was given a bowl of rice a day to eat, which I had to gum because it was full of small pebbles and might break my teeth. Farmers loaded their crops with these so the greater weight could increase their income. I spent my time pulling shrapnel out of my legs with a crude pair of plyers.

Two weeks later, the American who set up the trip for me showed up with cases of claymore mines, rifles, ammunition, and antibiotics. My chains we cut and I began the long walk back to Thailand.

It’s nice to learn your true value.

Back in Bangkok, I saw a doctor who attended to the 50 caliber bullet that grazed my right hip. It was too old to sew up so he decided to clean it instead. “This won’t hurt a bit,” he said as he poured in hydrogen peroxide and scrubbed it with a stiff plastic brush.

It was the greatest pain of my life. Tears rolled down my face.

But you know what? The Economist got their story and the world found out about the Great Cambodian Genocide, where 3 million died. There is a museum in Phnom Penh devoted to it today.

So, if you want to know why I walk funny, be prepared for a long story. I still set off metal detectors.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 16, 2021

Fiat Lux

Featured Trade:

(APRIL 14 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (JPM), (ROM), (AAPL), (MSFT), (FB) (CRSP), (TLT), (VIX), (DIS), (NVDA), (MU), (AMD), (AMAT) (PLTR), (WYNN), (MGM)

Below please find subscribers’ Q&A for the April 14 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA.

Q: How do you choose your buy areas?

A: It’s very simple; I read the Diary of a Mad Hedge Fund Trader. Beyond that, there are two main themes in the market right now: domestic recovery and tech; and I try to own both of those 50/50. It's impossible to know which one will be active and which one will be dead, and some of that rotation will happen on a day-by-day basis. As for single names, I tend to pick the ones I have been following the longest.

Q: In my 401k, should I continue placing my money in growth or move to something like emerging markets or value?

A: It depends on your age. The younger you are, the more aggressive you should be and the more tech stocks you should own. Because if you’re young, you still have time to earn the money back if you lose it. If you’re old like me, you basically only want to be in value stocks because if you lose all the money or we have a recession, there's not enough time to go earn the money back; you’re in spending mode. That is classic financial advisor advice.

Q: When you say “Buy on dips”, what percentage do you mean? 5% or 10%

A: It depends on the volatility of the stock. For highly volatile stocks, 10% is a piece of cake. Some of the more boring ones with lower volatility you may have to buy after only a 2% correction; a classic example of that is the banks, like JP Morgan (JPM).

Q: Even though you’re not a fan of cryptocurrency, what do you think of Coinbase?

A: It’ll come out vastly overvalued because of the IPO push. Eventually, it may fall to a lower level. And Coinbase isn’t necessarily a business model dependent on bitcoin; it is a business model based on other people believing in bitcoin, and as long as there’s enough of those creating two-way transactions, they will make money. But all of these things these days are coming out super hyped; and you never want to touch an IPO—wait for it to drop 50%, as I once did with Tesla (TSLA).

Q: Please explain the barbell portfolio.

A: The barbell works when you have half tech, half domestic recovery. That way you always have something going up, because the market tends to rotate back and forth between the two sectors. But over the long term everything goes up, and that is exactly what has been happening.

Q: Is the ProShares Ultra Technology Fund (ROM) an ETF?

A: Yes, it is an ETF issuer with $53 billion worth of funds based in Bethesda, MD. (ROM) is a 2x long technology ETF, and their largest holdings include all the biggest tech stocks like Apple (AAPL), Microsoft (MSFT), Facebook (FB), and so on.

Q: Will all this government spending affect the market?

A: Yes, it will make it go up. All we’re waiting to see now is how fast the government can spend the money.

Q: What is the target for ROM?

A: $150 this year, and a lot more on the bull call spread. The only shortcoming of (ROM) is you can only go out six months on the expiration. Even then, you have a good shot at making a 500% return on the farthest out of the money LEAPS, the November $130-$135 vertical bull call spread. That's because market makers just don’t want to take the risk being short technology two years out. It’s just too difficult to hedge.

Q: There have been many comments about hyperinflation around the corner. Will we be seeing hyperinflation?

A: No, the people who have been predicting hyperinflation have been predicting it for at least 20 years, and instead we got deflation, so don’t pay attention to those people. My view is that technology is accelerating so fast, thanks to the pandemic, that we will see either zero inflation or we will see deflation. That has been the pattern for the last 40 years and I like betting on 40-year trends.

Q: When we get called away on our short options, is it easier to close the trade than to exercise your option?

A: No, any action you take in the market costs money, costs commissions, costs dealing spreads. And it's much easier just to exercise the option if you have to cover your short, which is either free or will cost you $15.

Q: Are you worried about overspending?

A: No, the proof in that is we have a 1.53% ten-year US Treasury yield, and $20 trillion in QE and government spending is already known, it’s already baked in the price. So don’t listen to me, listen to Mr. Market; and it says we haven't come close to reaching the limit yet on borrowing. Look at the markets, they're the ones who have the knowledge.

Q: My Walt Disney (DIS) LEAPs are getting killed. I don't understand why my LEAPS go down even on green days for the stock.

A: The answer is that the Volatility Index (VIX) has been going down as well. Remember, if you’re long volatility through LEAPS, and volatility goes down, you take a hit. That said, we’re getting close to the lows of the year for volatility here, so any further stock gains and your LEAPS should really take off. And remember when you buy LEAPS, you’re doing multiple bets; one is that volatility stays high and goes higher, and one is that your stock is high and goes higher. If both those things don’t happen, and you can lose money.

Q: How do you best short the (TLT)?

A: If you can do the futures market, Treasury bonds are always your best short there because you have 10 to 1 leverage.

Q: How would you do a spread on Crisper Technology (CRSP)?

A: We have a recommendation in the Mad Hedge Biotech & Healthcare service to be long the two-year LEAP on Crisper, the $160-$170 vertical bull call spread.

Q: When do you see the largest dip this year?

A: Probably over the summer, but it likely won’t be over 10%. Too much cash in the market, too much government spending, too much QE. People will be in “buy the dips” mode for years.

Q: Is the SPAC mania running out of steam?

A: Yes, you can only get so many SPACS promising to buy the same theme at a discount. I think eventually, 80% of these SPACS go out of business or return the money to investors uninvested because they are promising to buy things at great bargains in one of the most expensive markets in history, which can’t be done.

Q: What do you think about Joe Biden’s attempt to tame the semiconductor chip shortage?

A: Most people don't know that all chips for military weapons systems are already made in the US by chip factories owned by the military. And the pandemic showed that a just-in-time model is high risk because all of a sudden when the planes stop flying, you couldn't get chips from China anymore. Instead, they had to come by ship which takes six weeks, or never. So a lot of companies are moving production back to the US anyway because it is a good risk control measure. And of course, doing that in the midst of the worst semiconductor shortage in history shows the importance of this. Even Tesla has had to delay their semi truck because of chip shortages. Keep buying NVIDIA (NVDA), Micron Technology (MU), Advanced Micro Devices (AMD), and Applied Materials (AMAT) on dips.

Q: Do you see a sell the news type of event for upcoming earnings?

A: Yes, but not by much. We got that in the first quarter, and stocks sold off a little bit after they announced great earnings, and then raced back up to new highs. You could get a repeat of that, as people are just sitting on monster profits these days and you can’t blame them for wanting to pull out a little bit of money to spend on their summer vacation.

Q: Has the stock market gotten complacent about COVID risk?

A: No, I would say COVID is actually disappearing. Some 100 million Americans have been vaccinated, 5 million more a day getting vaccinated, this thing does actually go away by June. So after that, you only have to worry about the anti-vaxxers infecting the rest of the population before they die.

Q: Do you see any imminent foreign policy disasters in Asia, the Middle East, or Europe that could derail the stock market?

A: I don’t, but then you never see these things coming. They always come out of the blue, they're always black swans, and for the last 40 years, they have been buying opportunities. So pray for a geopolitical disaster of some sort, take the 5-10% selloff and buy because at the end of the day, American stockholders really don't care what’s going on in the rest of the world. They do care, however, about increasing their positions in long-term bull markets. I don't worry about politics at all; I don’t say that lightly because it’s taking 50 years of my own geopolitical experience and throwing it down the toilet because nobody cares.

Q: Would you buy Coinbase?

A: Absolutely not, not even with your money. These things always come out overpriced. If you do want to get in, wait for the 50% selloff first.

Q: Is Canada a play on the dollar?

A: Absolutely yes. If they get a weaker dollar, it increases Canadian pricing power and is good for their economy. Canada is also a great commodities play.

Q: The IRS is using Palantir (PLTR) software to find US citizens avoiding taxes with Bitcoin.

A: Yes, absolutely they are. Anybody who thinks this is tax-free money is delusional. And this is one reason to buy Palantir; they’re involved in all sorts of these government black ops type things and we have a very strong buy recommendation on Palantir and their 2-year LEAPS.

Q: Are NFTs, or Non-Fundable Tokens, another Ponzi scheme?

A: Absolutely, if you want to pay millions of dollars for Paris Hilton’s music collection, go ahead; I'd rather buy more Tesla.

Q: When do you think you can go to Guadalcanal again?

A: Well, I’m kind of thinking next winter. Guadalcanal is one of the only places you can go and get more diseases than you can here in the US. Last year, I went there and picked up a bunch of dog tags from marines who died in the 1942 battle there, sent them back to Washington DC, and had them traced and returned to the families. And I happen to know where there are literally hundreds of more dog tags I can do this with. It’s not an easy place to visit and it’s very far away though. Watch out for malaria. My dad got it there.

Q: Walt Disney is already above the pre-pandemic price. Do you suggest any other hotel company name at this time?

A: Go with the Las Vegas casinos, Wynn (WYNN) and MGM (MGM) would be really good ones. Las Vegas is absolutely exploding right now, and we haven't seen that yet in the earnings yet, so buy Las Vegas for sure.

Q: Is the upcoming Roaring Twenties priced into the stock market already?

A: Absolutely not. You didn't want to sell the last Roaring Twenties in 1921 as it still had another eight years to go. You could easily have eight years on this bull market as well. We have historic amounts of money set up to spend, but none of it has been actually spent yet. That didn’t exist in 1921. I think that when they do start hitting the economy with that money, that we get multiple legs up in stock prices.

To watch a replay of this webinar just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 23, 2021

Fiat Lux

Featured Trade:

(NOW THE FAT LADY IS REALLY SINGING FOR THE BOND MARKET),

(JPM), (BAC), (C), (FCX), (TLT), (UBER)

Global Market Comments

March 22, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or ENTERING TERRA INCOGNITA),

(TLT), (TSLA), (JPM), (VIX), (QQQ), (IWM), (BAC), (C), (SPY)

During the Middle Ages, when explorers sought new lands and their rich treasures, large sections of their navigational charts were marked with the term “terra incognita.”

That meant what lays beyond was unknown and that they should enter only at their own risk. Often there was a picture of a dragon or a sea monster to mark the spot.

There was also often a warning that you might even sail off of the edge of the earth.

Financial markets have entered a “terra incognita” of their own recently.

Here is the big unknown: How high can ten-year US Treasury bond yields soar when the Federal Reserve is promising to keep overnight interest pegged at 25 basis points until 2024 in the face of essentially unlimited monetary and fiscal stimulus?

So far, the answer is: more.

That is a really big question because we’ve never really been here before.

In fact, some Cassandras from the right are even predicting such a policy will cause us to sail off of the edge of the earth. The modern-day equivalent of running into dragons is inviting runaway inflation.

I can tell you from my own vast, almost immeasurable navigational experience (I am licensed by the US government) that “terra incognita” does not invite inordinate risk-taking or betting of ranches by traders or investors. Instead, they tend to sit on their hands, work on their golf swing, or update their Facebook pages.

That is what the Volatility Index (VIX) last week is essentially screaming at us by touching the $19 handle for the first time in a year.

Almost everyone I know has made more money in the markets than at any time in their lives. That is what a near doubling of the stock market in a year gets you.

And the new wealth was not attained because their intelligence and market insight have suddenly doubled, although a strong case for such can be made for readers of Mad Hedge Fund Trader.

So I used the Friday, March 19 option expiration to go into a rare 100% cash position. I really have gotten away with too much lately.

Then feeling guilty, I slapped on a single long in Tesla (TSLA), that old reliable money-maker. It’s worked for me since it was $3.50 a share. After all, a gigantic green energy infrastructure bill is about to pass in Congress. What better to own than the world’s largest EV car maker.

And what a tear it has been.

After bringing in a ballistic 66.64% profit in 2020, I reeled in another 40.38% gain in the first 2 ½ months of 2021. I did this via 40 trades which generated 38 wins and only two losses. That’s a success rate of an incredible 95%. I have to pinch myself when I read these numbers.

I am concerned because numbers any higher than this will look fake. It’s a rule of thumb in the investment business that when managers claim a 100% success rate, they are either high-frequency traders back by super-fast mainframe computers or running a scam.

So, I have been advising clients to pare back their biggest positions that became massively overweight purely through capital appreciation. Financials come to mind. JP Morgan (JPM) up 81% in three months? Sounds like a Ponzi Scheme.

So let me give you some upside targets in the bond market. We doubled bottomed in 2012 and 2016 at a 1.37% yield in the ten-year Treasury bond yield. We have already surpassed that level like a hot knife through butter.

At the depths of the 2008-2009 Great Recession, rates bottomed at 2.0% yield, which now seems within easy reach. The lowest yield we saw after the 2003 Dotcom Crash was a 3.0%.

When the upside targets in interest rates in this cycle are the lows of the previous economic cycles, that augurs pretty well for the future of stock prices. That is the guaranteed outcome of the tidal wave of cash now sweeping the global financial system.

The permabears are warning that the “Roaring Twenties” have already happened. I argued that they are only just getting started and that the indexes have another 4X of upside in them over the rest of the decade. When the last “Roaring Twenties” occurred, you didn’t sell in 1921.

It also reminds me of the huge “rip your face off” rally we saw from March 2009 to 2010. A lot of market gurus said then that was the peak. They were wrong. Today, they are driving for Uber and Lyft.

So when a talking head warns you that higher interest rates will cause the stock market to crash, just turn off the boob tube and go back to practicing your golf swing.

The Mad Hedge Summit Videos are Up, from the March 9,10, and 11 confab. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. The product discounts offered last week are still valid. Start, stop, and pause the videos at your leisure. Best of all, access to the videos is FREE. Access them all by clicking here at www.madhedge.com, click on CURRENT SUMMIT REPLAYS in the upper right-hand corner, and then choose the speaker of your choice.

Ten Year Bond Yields (TLT) soar to a 1.75%, setting financials on fire and demolishing tech (QQQ). We are rapidly approaching a 2.00% yield, which could trigger a huge round of profit-taking on bond shorts, a domestic stock selloff, and a tech rally. The next great rotation may be just ahead of us.

Oil (USO) dives 8% on fears of an imminent Saudi production increase and a worsening Covid-19 outlook in Europe. Are we next with all these early reopening’s? Gone 100% cash at the close with the March quadruple witching option expiration.

A Tax Hike is next on the menu. Corporate tax rates are returning from 21% to 28% for the small proportion of companies that actually PAY tax. Raising taxes on earnings of more than $400,000. Pass through entities to get a haircut. Increasing estate taxes. You better die soon if you want your kids to stay rich. Increase in capital gains taxes over $1 million. I want my SALT deduction back! The grand negotiation begins on who needs bridges, rail lines, and subway extensions. Hint: for some reason, there have been no new federal projects started in California for the past four years and all the existing ones were cut back.

Value Stocks (IWM) are beating growth ones, reversing a decade-long trend. The Russell Value Index is up 11% this year, while growth is unchanged. It’s a total flip from last year when growth was tech-led. This could continue for years, or until the tech becomes the new value stocks. Big winners include Boeing (BA), JP Morgan (JPM), and Morgan Stanley (MS), all Mad Hedge moneymakers.

Bitcoin tops 61,000. Nothing else to say but that because there are no fundamentals. It’s up 80% in 2021 and 540% YOY. But it is becoming a good risk-taking indicator thought, and right now it is shouting a loud and clear “Risk On.”

It’s going to be All About Stock Picking for the Rest of 2021, says Morgan Stanley strategist Mike Wilson. Dragging on the index from here on will be the prospects of rising rates, tax hikes, and inflation. Mike especially dislikes small caps (IWM) which have already had a terrific run, with a 19% YTD gain. Stock picking? Boy, did you come to the right place!

Fed to hold off on rates hikes through 2023, said Governor Jay Powell after the open Market Committee Meeting. Bonds rallied a full half-point on the news and then crashed again, taking yields to a new 1.70% high. It sees inflation reaching a positively stratospheric 2.0% sometime this year, after which it will die, so nothing to do here. This is what a 100% dovish FOMC gets you. Let the games begin!

New Housing Starts Collapse, from an expected +2.5% to -10.3%, as high lumber, land, labor, and interest rates take their toll. This will only drive new home prices high at a faster rate and the little remaining supply dries up. Millennials need some place to live.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

It’s amazing how well patience can help your performance. My Mad Hedge Global Trading Dispatch profit reached a super-hot 16.89% during the first half of March on the heels of a spectacular 13.28% profit in February.

It was a tough week in the market, so I held fire and ran my seven remaining profitable positions into the March 19 options expiration. I took advantage of a meltdown in Tesla (TSLA) shares to put on my only new position of the week with a very deep-in-the-money long. That leaves me with 90% cash and a barrel full of dry powder.

This is my fifth double-digit month in a row. My 2021 year-to-date performance soared to 40.38%. The Dow Average is up a miniscule 7.7% so far in 2021.

That brings my 11-year total return to 462.93%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.14%.

My trailing one-year return exploded to 121.60%, the highest in the 13-year history of the Mad Hedge Fund Trader. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 29.8 million and deaths topping 542,000, which you can find here. Thankfully, death rates have slowed dramatically, but Obituaries are still the largest sector in the newspaper.

The coming week will be a boring one on the data front.

On Monday, March 22, at 9:00 AM, Existing Home Sales for February are released.

On Tuesday, March 23, at 9:00 AM, New Home Sales are published.

On Wednesday, March 24 at 8:30 AM, we learn US Durable Goods for February are printed.

On Thursday, March 25 at 8:30 AM, Weekly Jobless Claims are out. We also get the final read of US Q4 GDP.

On Friday, March 26 at 8:30 AM, US Personal Income & Spending for February are released. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I have been doing a lot of high altitude winter mountain climbing lately, and with the warm spring weather, the risk of avalanches is ever present. It takes me back to the American Bicentennial Everest Expedition, which I joined in 1976.

It was led by my old friend, instructor, and climbing mentor Jim Whitaker, who pulled an ice ax out of my nose on Mt. Rainer in 1967 (you can still see the scar). Jim was the first American to summit the world’s highest mountain. I tried to break a high-speed fall and an ice ax kicked back and hit me square in the face. If I hadn’t been wearing goggles I would have been blinded.

I made it up to 22,000 feet on Everest, to Base Camp II without oxygen because there were only a limited number of canisters reserved for those planning to summit. At that altitude, you take two steps, and then break to catch your breath.

There is a surreal thing about that trip that I remember. One day, a block of ice the size of a skyscraper shifted on the Khumbu Ice Fall and out of the bottom popped a body. It was a man who went missing on the 1962 American expedition. Everyone recognized him as he hadn’t aged a day in 15 years, since he was frozen solid.

I boiled my drinking water, but at that altitude, water can’t get hot enough to purify it. So I walked 100 miles back to Katmandu with amoebic dysentery. By the time I got there, I’d lost 50 pounds, taking my weight to 120 pounds.

Jim was an Eagle Scout, the first full-time employee of Recreational Equipment Inc. (REI), and last climbed Everest when he was 61. Today, he is 92 and lives in Seattle, WA.

Jim reaffirms my belief that daily mountain climbing is a great life extension strategy, if not an aphrodisiac.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.