Six months into the quarantine, I feel like I’ve been under house arrest with no visiting privileges. And if I go outside for even a few minutes, I have to inhale the equivalent of a pack of cigarettes as I am surrounded by three monster fires.

All I can say is that I’m getting a heck of a lot of work done.

We are in the middle of a 20-year move in the Dow Average from 6,500 to 120,000. We have just completed a fourfold move off the 2009 bottom. All that remains is to complete a second fourfold gain by 2030.

The move is being driven by hyper-accelerating technology on all fronts. The first half of this move was wrought with constant fear and disbelief. The second half will be viewed as a new “Golden Age” and a second “Roaring Twenties.” The euphoria of July and August were just a foretaste.

And here is the dilemma for all investors.

The Dow has just pulled back 6.1% from the all-time high of 29,300 to 27,500. Should you be buying here, keeping the eventual 120,000 target in mind? Or should you hold back and wait for 26,000, 25,000, or 24,000?

The risk is that if you lean out too far to grab the brass ring, you’ll fall off your horse. By getting too smart attempting to buy the bottom, you might miss the next 93,000 points.

And now, I’ll make your choice more complicated.

The president has recently whittled away at his deficit in the polls, however slightly, typical of the run-up to the November elections. That increases the uncertainty of the election outcome and increases market volatility (VIX). Ironically, the better Trump does, the lower stocks will fall. So, if you do hang out for the lower numbers you might actually get them, and then more.

That puts the 200-day moving averages in play, not only for the major indexes but for single stocks as well. That could take Apple (AAPL) from a high of $137 to $80, a Tesla down from a meteoric $500 to $300.

Hey, if this were easy, your cleaning lady would be doing this for a tiny fraction of the pay.

Did I just tell you the market may go up, down, or sideways? I sound like a broker.

The 200-day moving averages are definitely in play. The 200-day moving average for the Dow Average is 26,298, down an even 10% from the high for the year. The technology-heavy S&P 500 could fall as much as 14% to its 200-day at 3,097.

Don’t bet against the Fed as Tuesday’s 700-point rally in the Dow Average sharply reminded traders. Don’t bet against the global scientific community either. That’s why I am fully invested and within spitting distance of a new all-time high. After a pre-election low, the market will soar to new highs. Even if Trump loses the election, quantitative easing and fiscal stimulus will continue as far as the eye can see.

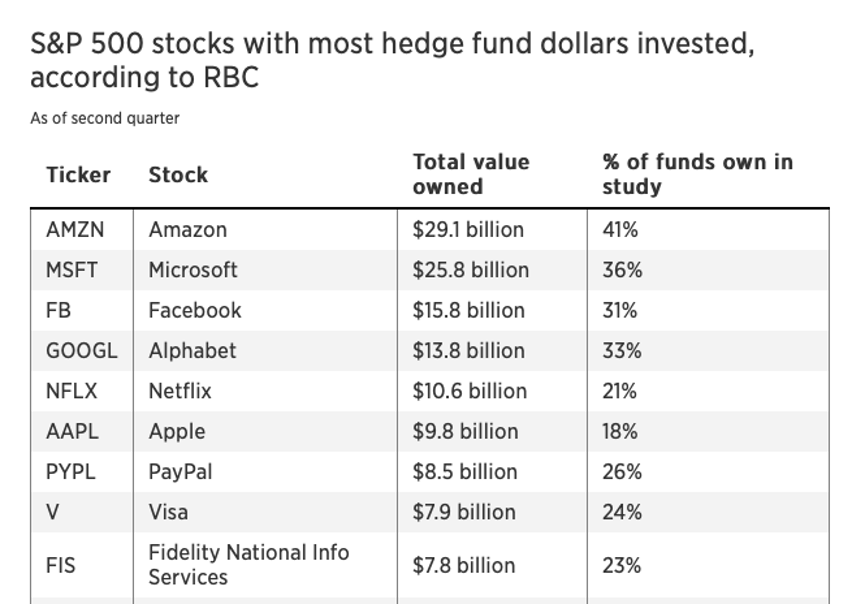

The elephant unwinds. Softbank dumped $718 million worth of technology call options deleveraging in a hurry. (NFLX), (FB), and (ADBE) were the targets according to market makers. They still own $1.66 billion worth of long positions in call options. Softbank’s position has grown so large that even my cleaning lady and gardener know about them.

The Tesla bubble popped, down a record 22% in one day after traders learned it would NOT be added to the S&P 500. Tesla approached my medium-term downside target of down 40%, or $300 a share. It seems too much of its earnings were coming from non-recurring EV subsidies from the Detroit carmakers. With a peak market cap for an eye-popping $450 billion, it’s probably the largest company ever turned down from the Index.

Google ditched Irish office space, putting on ice a plan to rent additional office space for up to 2,000 people in Dublin. The retreat from global office space continues. The company was close to taking 202,000 sq ft (18,766sq m) of space at the Sorting Office building before the virus hit.

AstraZeneca halted their vaccine trial after a patient fell ill. It’s not clear if the vaccine killed off the phase 3 trial volunteer, a preexisting condition felled them, or an unrelated illness hit. The company was developing the “Oxford” vaccine, which had been the best hope for developing Covid-19 immunity. It definitely creates a pause for the headline rush to develop a vaccine. Notice the tests are being held in South Africa where patients have little legal recourse. Keep buying (AZN) on dips.

“Skinny” failed, tanking the Dow Average by 450 points. A Republican Senate failed to provide even $500 billion to support a COVID-19-ravaged economy. There will be no more stimulus until a new administration takes office. Until then, unemployment will remain in the high single digits, tens of thousands of small businesses will fail, and home foreclosures will explode. The stock market cares about none of this, as it is dominated by large, heavily subsidized companies.

Nikola crashed, down 33%, in response to a damning report from a noted short-seller. They don’t have a truck, they lack a claimed hydrogen fuel source, and the founder is milking the company for every penny he can. It’s all hype, thanks to endless quantitative easing. None of the Tesla wannabees are going anywhere. General Motors (GM), which just bought 11% of the company, has egg on its face. With a market cap of $20 billion, Nikola is this year’s Enron. Sell short (NKLA) on rallies.

US inflation jumped, with the Consumer Price Index up 1.3% YOY in August, compared to only 1% in July. Soaring used car prices accounted for the bulk of the gain. More proof that the economy lives. Is this the beginning of the end or the end of the beginning?

Goldman Sachs moved global stocks to “overweight”. They’re preparing for the post-pandemic world. Cyclical “recovery” stocks like banks will take the lead. It fits in nicely with my view of a monster post-election rally and a Dow 120,000 by 2030.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch clocked its second blockbuster week in a row, thanks to aggressively loading up on stocks at the previous week’s bottom (JPM), (C), (AMZN). My long in gold (GLD) looked shinier than ever. I bet the ranch again on a massive short in the US Treasury bond market (TLT) which paid off big time. My short position in the (SPY) is looking sweet.

My only hickey was an ill-fated long in Apple (AAPL), which I stopped out of at close to cost. Notice that I am shifting my longs away from tech and toward domestic recovery plays.

You only need 50 years of practice to know when to bet the ranch.

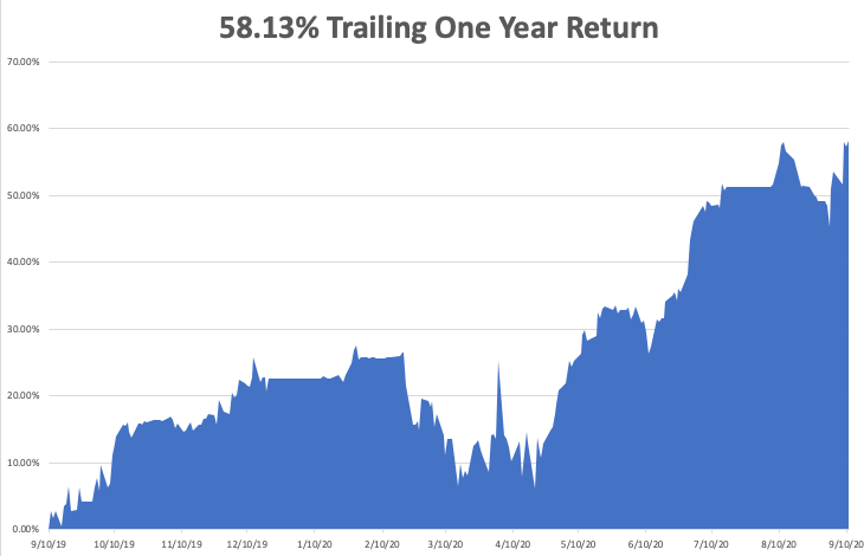

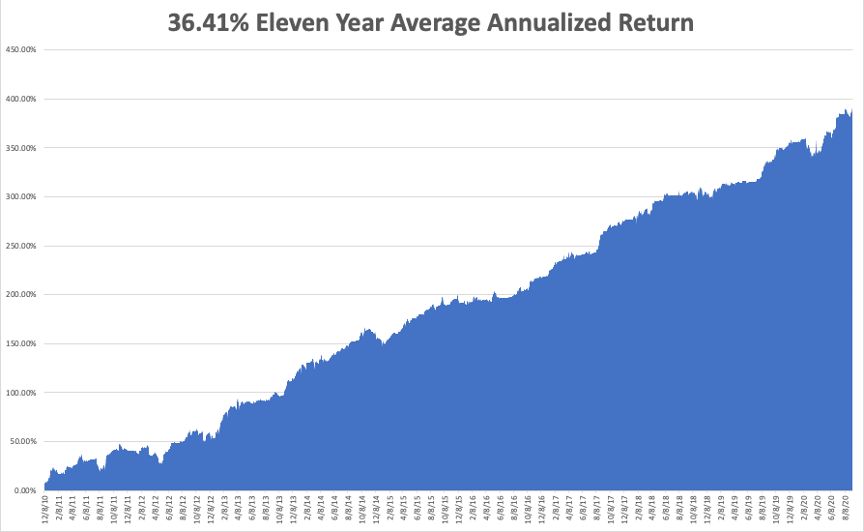

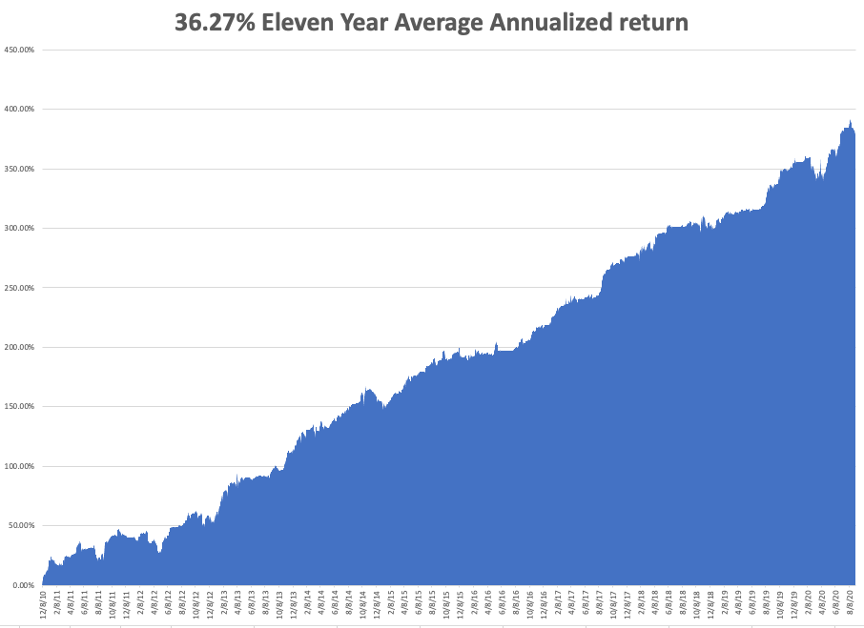

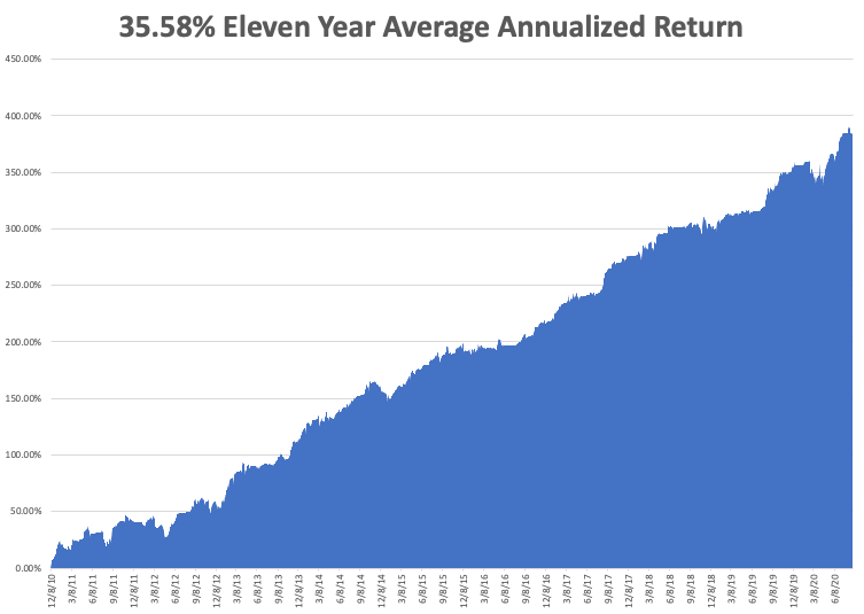

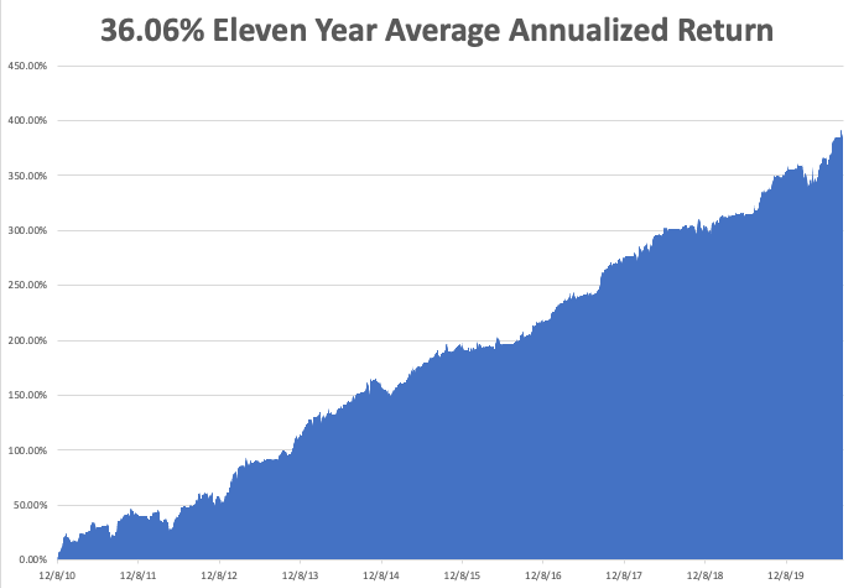

That takes our 2020 year-to-date back up to a blistering 35.51%, versus -2.93% for the Dow Average. September stands at a robust 8.96%. That takes my 11-year average annualized performance back to 36.41%. My 11-year total return has reached to another new all-time high at 391.42%. My trailing one year return popped back up to 58.13%.

It will be a dull week on the data front, with only the Federal Reserve Open Market Committee Meeting drawing any attention.

The only numbers that really count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, September 14 at 11:00 AM US Inflation Expectations are released.

On Tuesday, September 15 at 8:30 AM EST, the New York Empire State Manufacturing Index for September is published. A two-day meeting at the Federal Reserve begins.

On Wednesday, September 16, at 8:30 AM EST, September Retails Sales are printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out. At 2:00 the Fed announces its interest rate decision, which will probably bring no change.

On Thursday, September 17 at 8:30 AM EST, the Weekly Jobless Claims are announced. Housing Starts for August are also out.

On Friday, September 18, at 8:30 AM EST, the University of Michigan Consumer Sentiment is announced. At 2:00 PM The Bakers Hughes Rig Count is released.

As for me, the Boy Scout camporee I was expected to judge and supervise this weekend was cancelled, not because of Covid-19, but smoke. This will certainly go down in history as the year from hell.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader