Here I am holed up in a mountaintop retreat.

I have six months of canned food, one month of water, and a year supply of ammo. There is an AR-15 and 12 gauge shotgun at the front door. There is a 45 caliber Colt Peacemaker and a Browning 45 at the backdoor. I sleep with a 9mm Glock 17 under my pillow and a baseball bat next to the bed. There are empty tin cans strung from the shrubbery to sound the alarm for any unexpected intruders.

Let the election begin!

Actually, I think the big surprise will be how little violence takes place. The violence threatened by one political party will fail to show. It was all talk, no substance, and just one big con. That alone should be worth a thousand-point rally in the Dow Average.

Of course, the passing of the election isn’t going to end the uncertainty for the stock market. All we are really doing is trading one kind of uncertainty for another. If Harris wins, will she be able to govern from the middle and how much will she be able to keep her party’s left wing at bay?

If Trump is elected, how many of his threats will be carried out, or was it all just talk? And how much will the courts allow him to carry out extreme policies? Then, there is the issue of who has control of the House and the Senate.

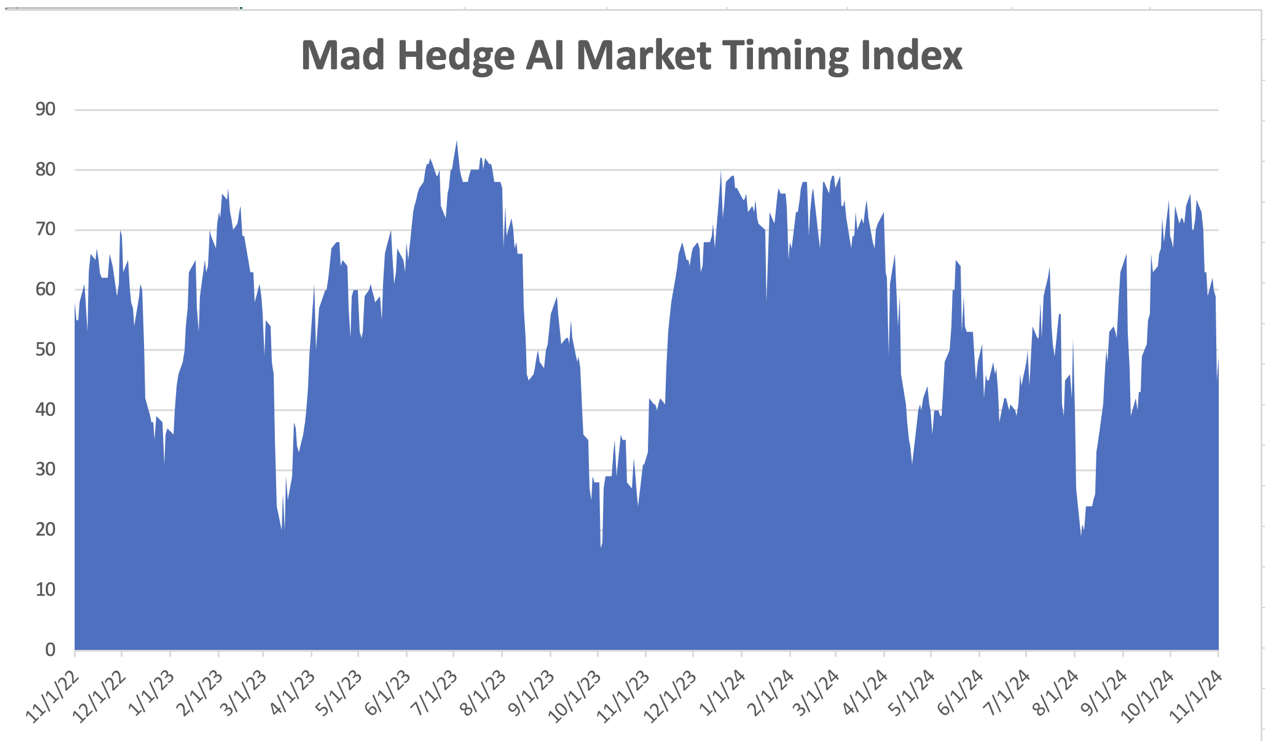

It will all add up to increased market volatility, which I love as a trader. Volatile markets yield much higher returns.

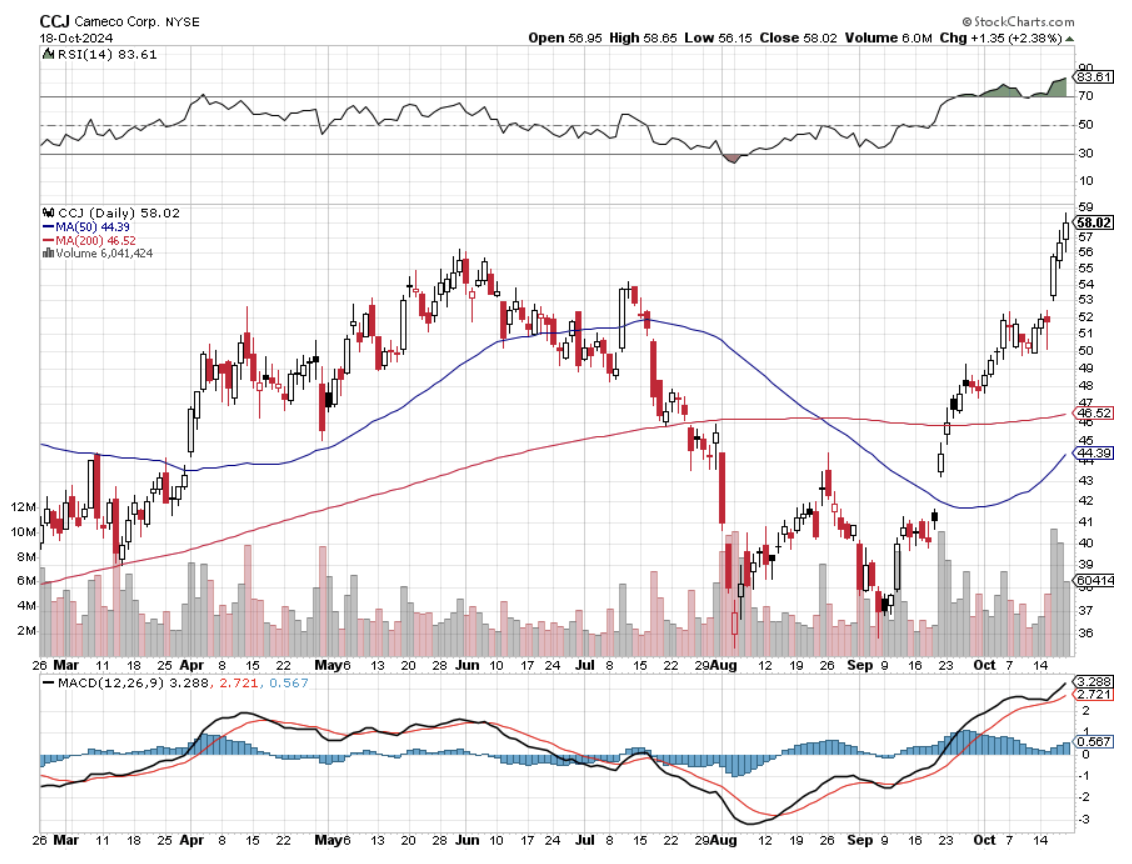

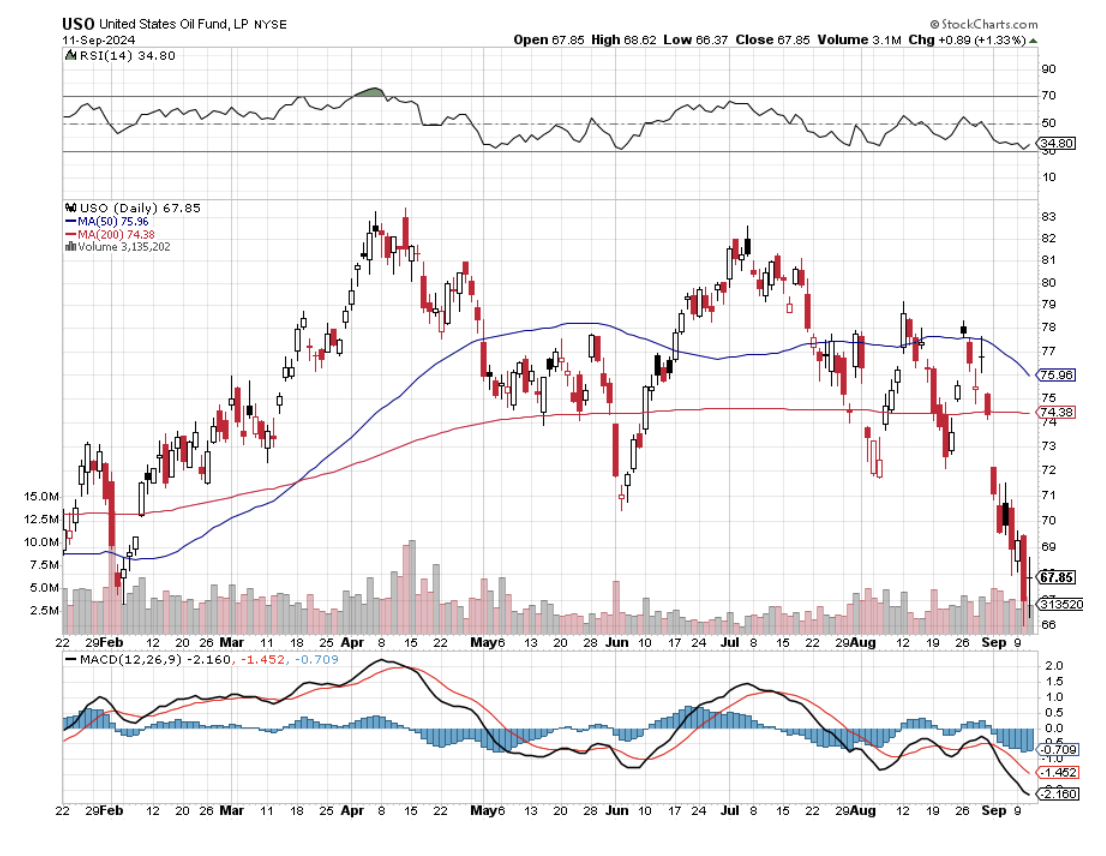

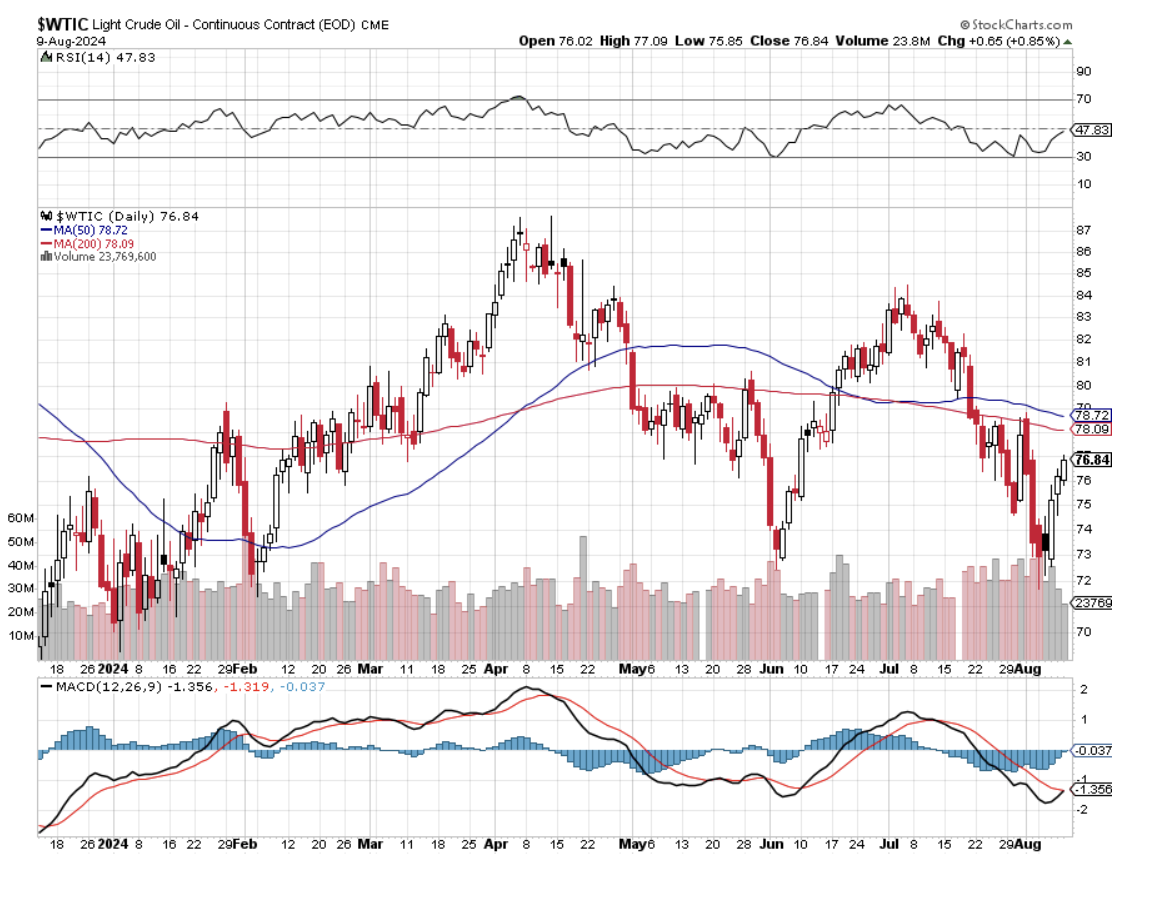

Buy this year’s winners and sell the losers. That is what every professional money manager will be doing on Wednesday morning. They want to window dress their holdings for yearend and harvest tax losses, mostly in energy. That makes the post-election rally really very easy to play.

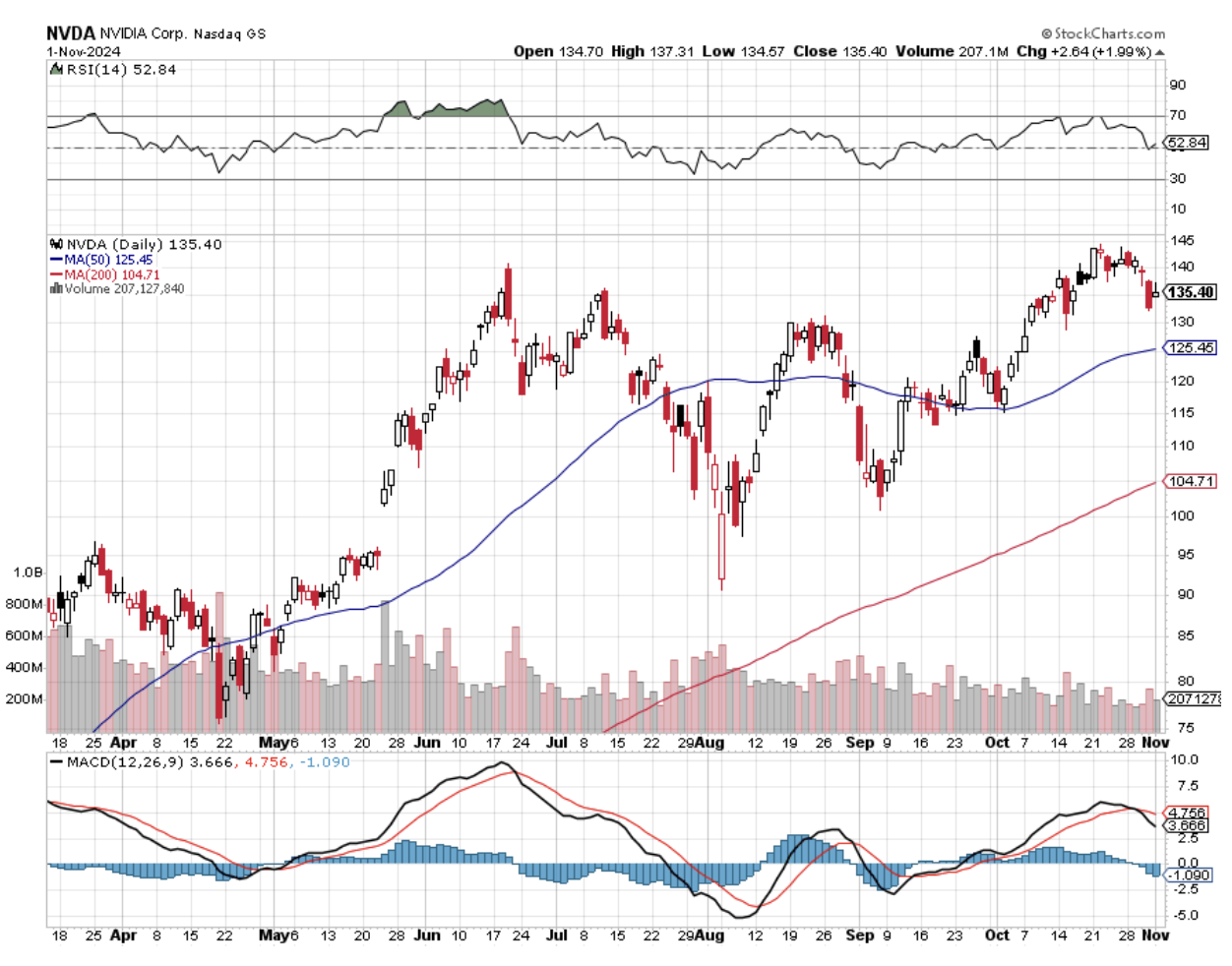

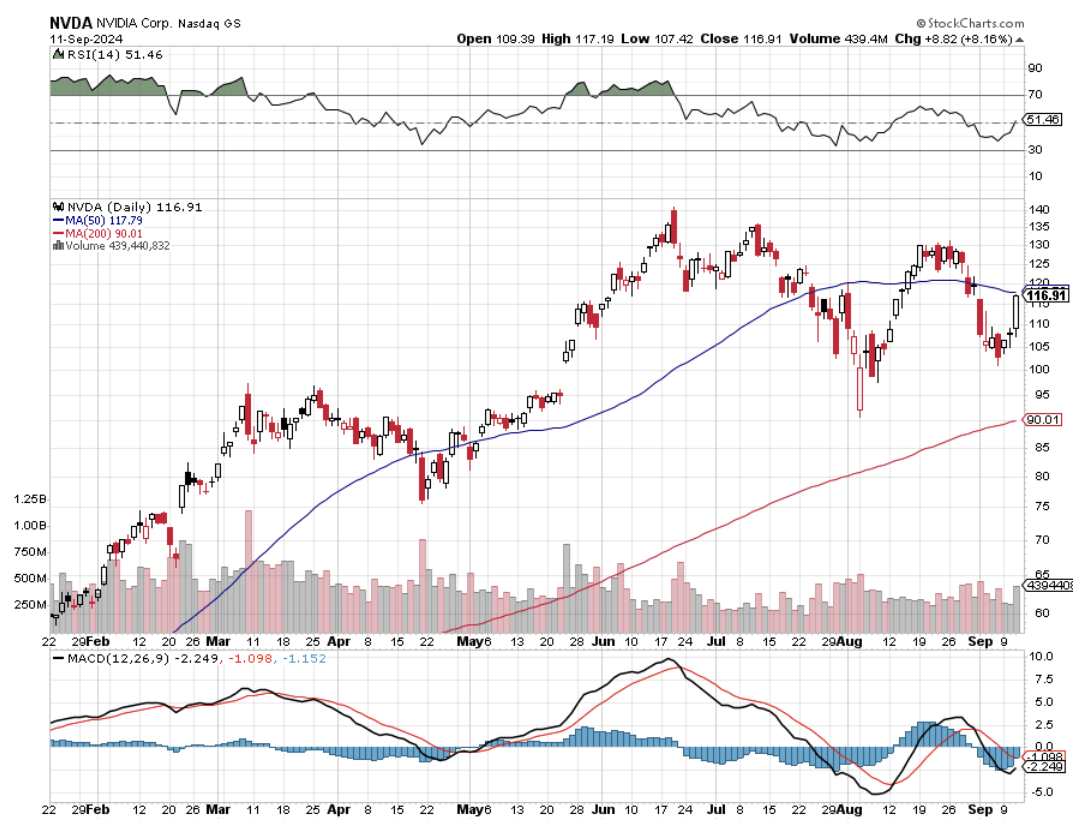

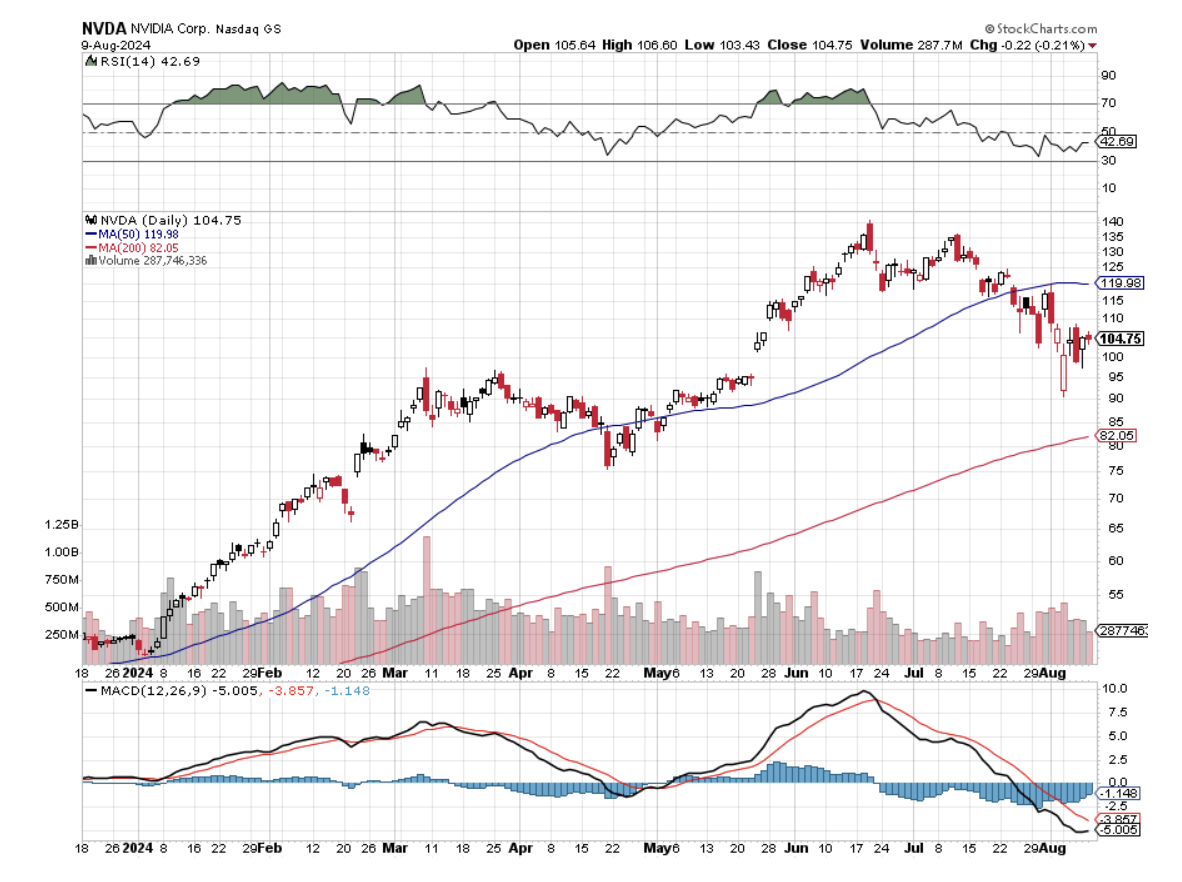

In one of the most curious market timings in history, Dow Jones announced that it is adding Nvidia (NVDA) to their 30-strong stock market average on Friday, November 8, just three days after the presidential election, and possibly when the outcome is not yet known.

The Dow Jones Industrial Average was the only major US equity benchmark that didn't hold Nvidia. Intel (INTC) will be taken out to the woodshed, which just announced a massive $16 billion loss and has shrunk to a mere $100 billion in market cap. (INTC) is a mere shadow of its former self with a caricature of a CEO.

The normal reaction by the market is a 5-10% pop in the new Dow entrants and a similar 5-10% decline in the shares of the banished company. This is good news for followers of the Mad Hedge Fund Trader because virtually everyone now has (NVDA) as their largest holding, either by selection or capital appreciation.

The 19th century Dow has been playing catchup in gaining exposure to the largest technology companies. The Dow became 30 stocks in 1928. The DJIA was originally created by Charles Dow in 1896 and contained just 12 stocks. The number of stocks in the DJIA increased to 20 in 1916.

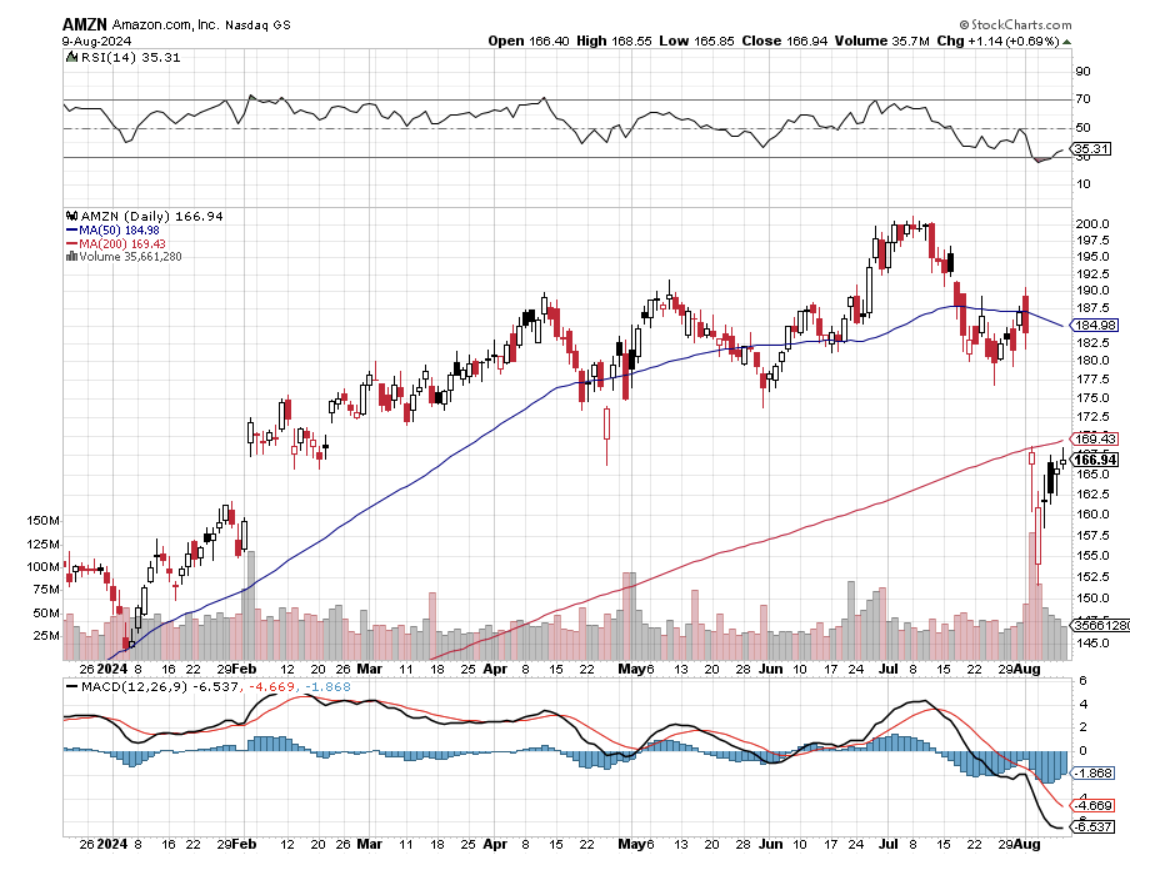

The move will increase the volatility of the Dow by adding a stock that is up 170% this year while removing one that has fallen 50%. It will lead to higher highs and then lower lows. Remember, (NVDA) fell 40% in July. It also continues to technology drift of the Dow to keep up with its main competitor, NASDAQ. The last company to join the Dow was Amazon.

When you do the hard work and perform your research well, all surprises tend to be happy ones.

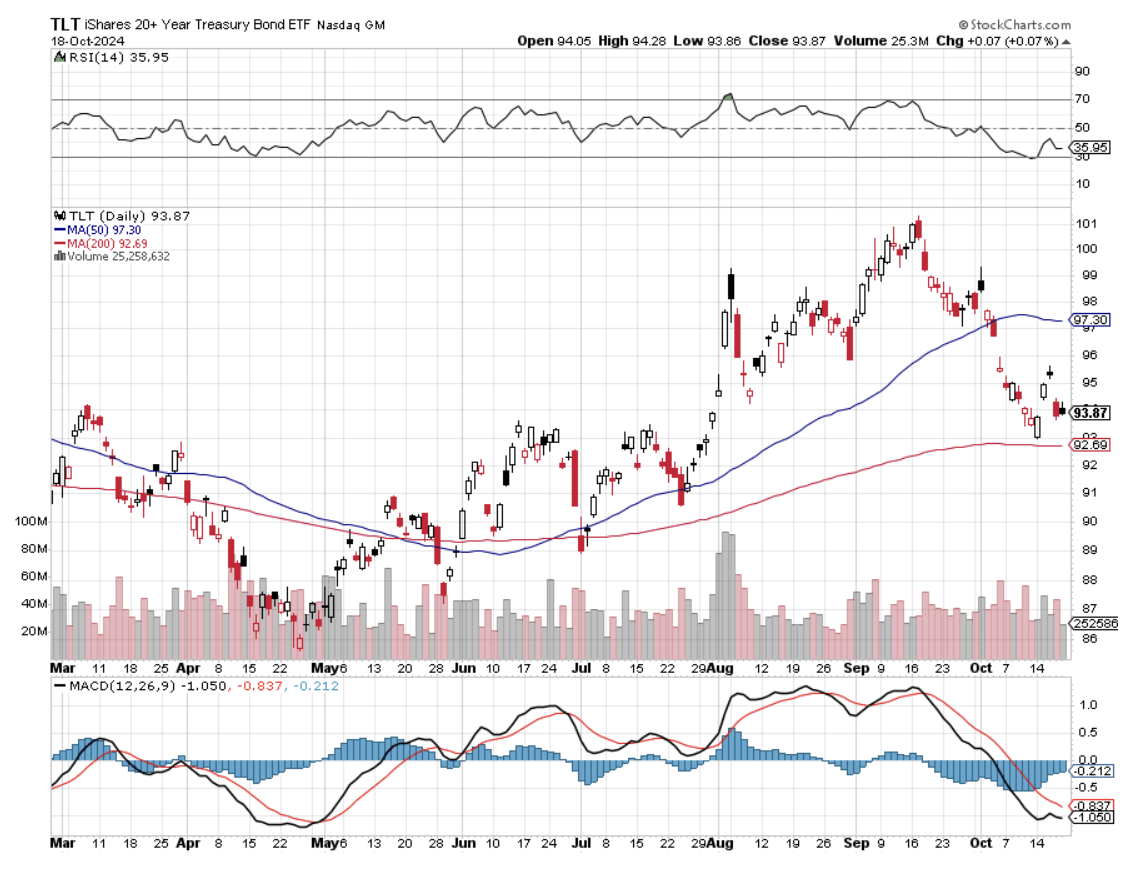

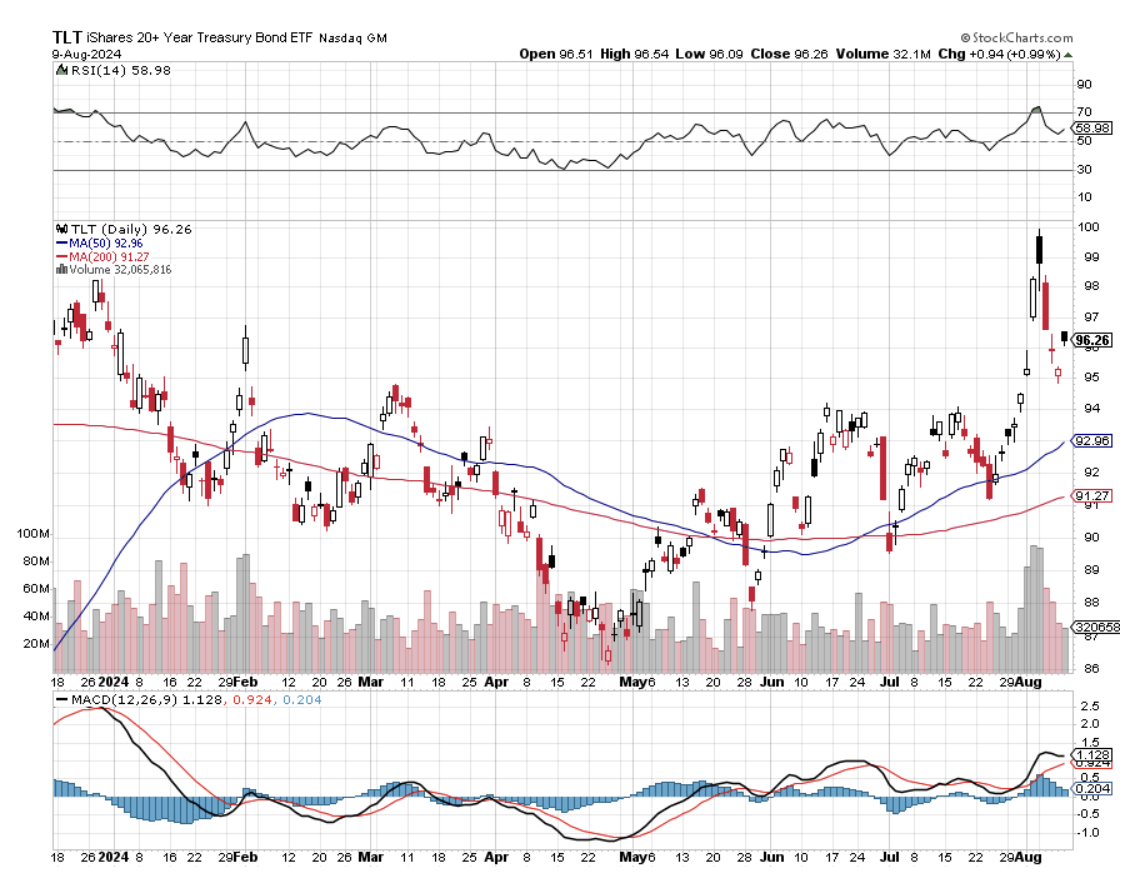

A number of readers have expressed concern over DH Horton’s (DHI) disappointing results. But if anything, the bull case for the industry is stronger than ever. An imminent post-election rally in the bond market and drop in interest rates is about to cause the industry to explode to the upside.

The US new homes market is massively underbuilt. We are short anywhere from 10-20 million homes. Normal inventory is 6 months, and we are currently at 3 months. We went into the pandemic short of homes and then demand exploded. The average home price is now $420,000 against an average income of $75,000, requiring $130,000 in annual income to qualify for a conventional 30-year fixed rate loan.

If you want to live in San Jose, CA you need to earn $463,000 a year. Half of the new homes built this year are in only ten cities, with four in Texas as Americans continue a century-long trend of moving from north to south and from the coasts to the southwest. Building permits are actually falling, down 7% this year.

Concentration of the industry, and therefore the elimination competition, has continued at an incredible pace. Only ten firms control 50% to 80% of new home construction, making it difficult for new entrants. That’s up from only 10% 30 years ago. As a result, the number of floor plan options has shrunk dramatically.

Vice President Harris is proposing a $25,000 tax credit for first-time buyers if elected. She has also suggested subsidies to build 3 million affordable housing units. You always buy a sector that is about to see a big inflow of government largess. Buy (LEN), (KBH), (PHM), (TOL), and (DHI) on dips.

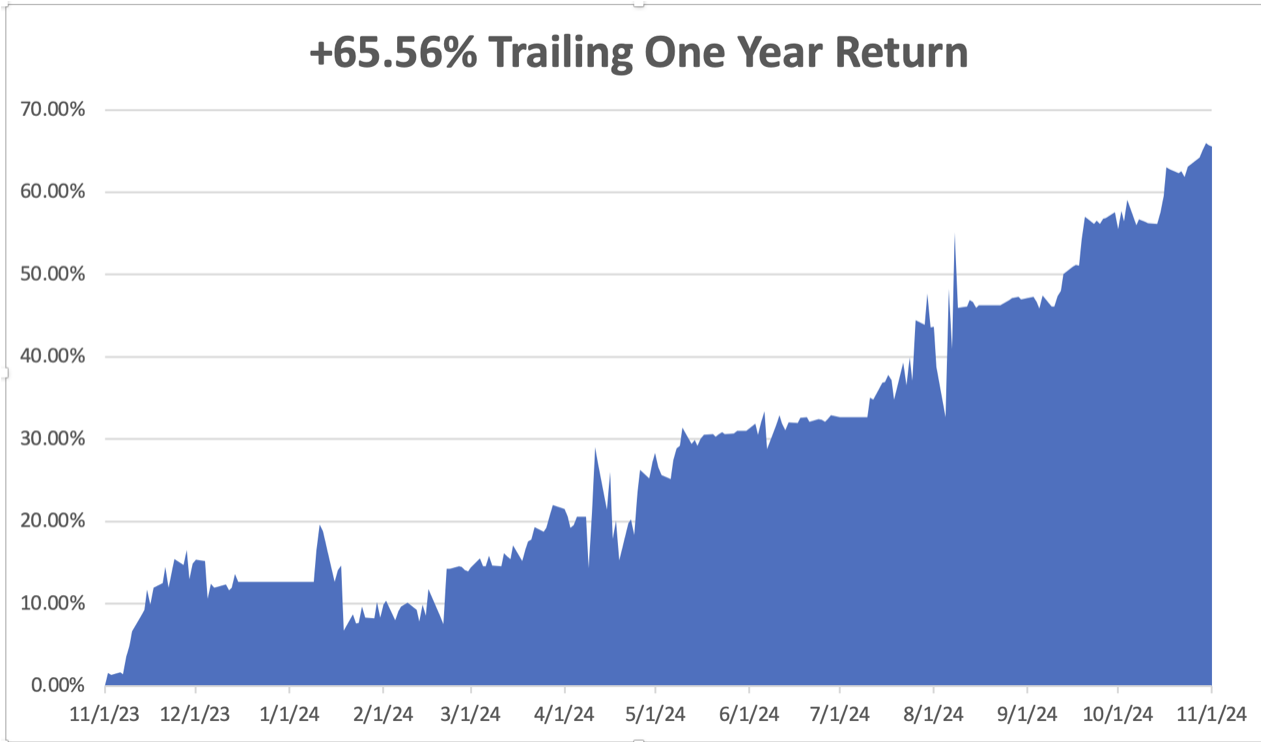

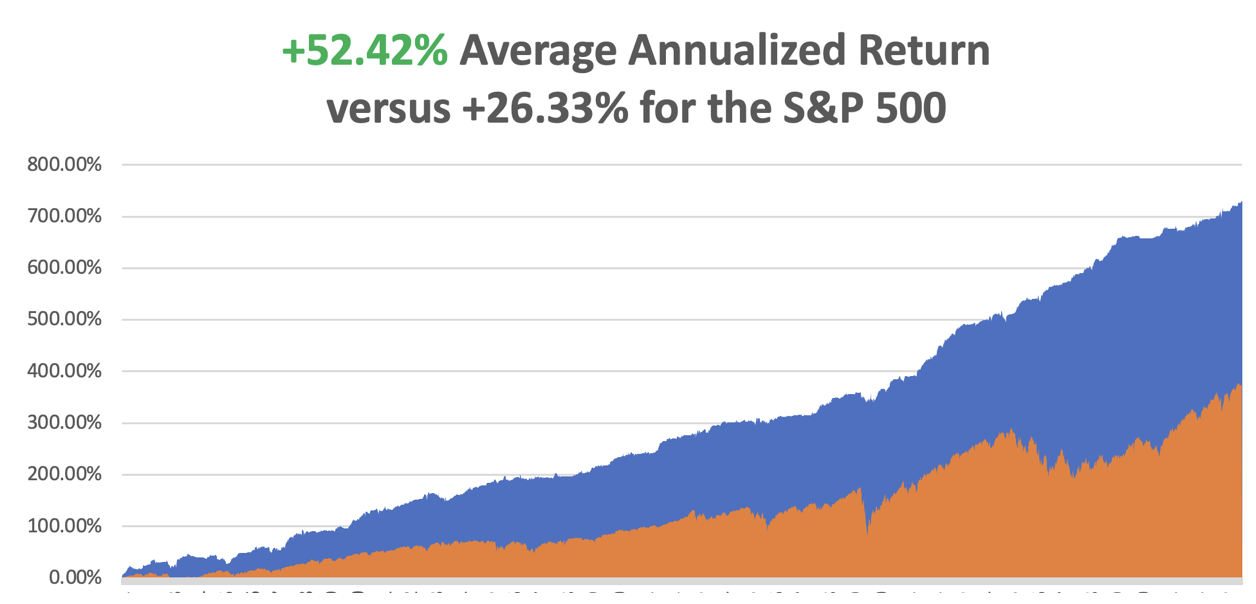

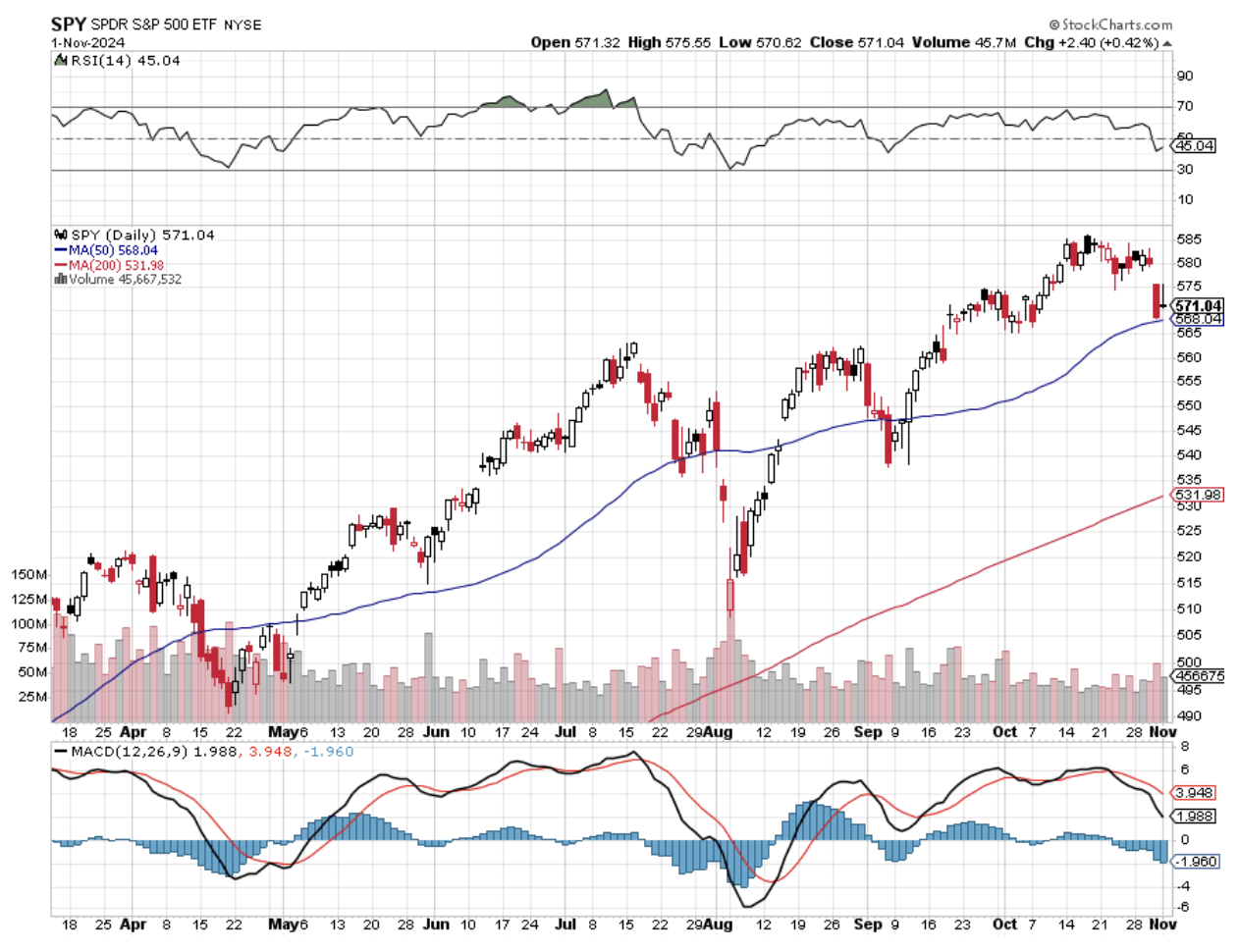

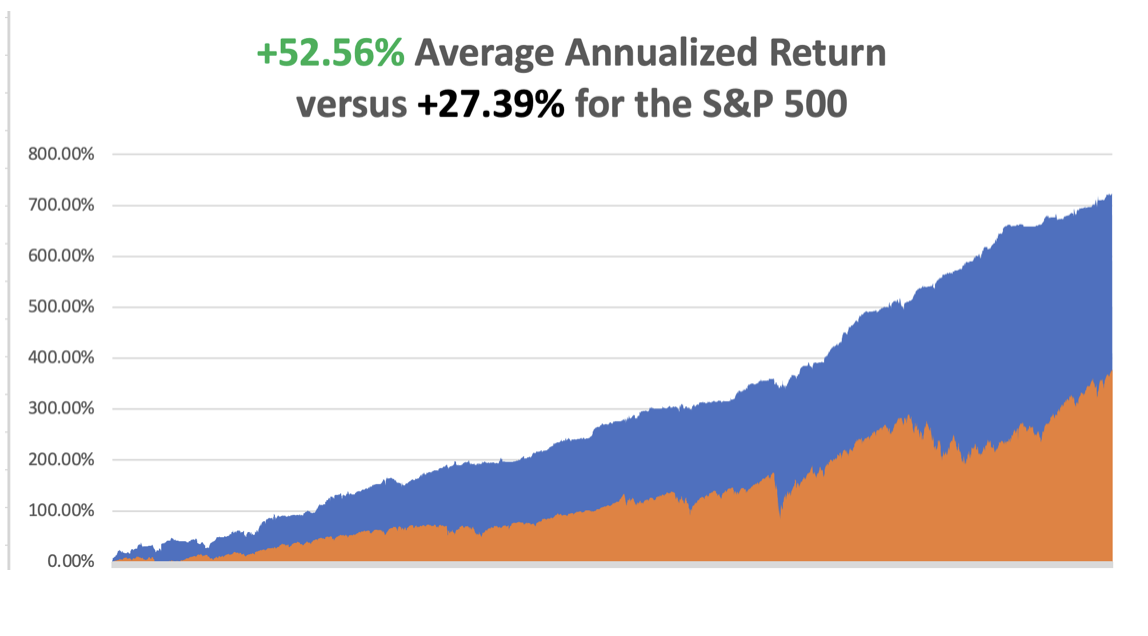

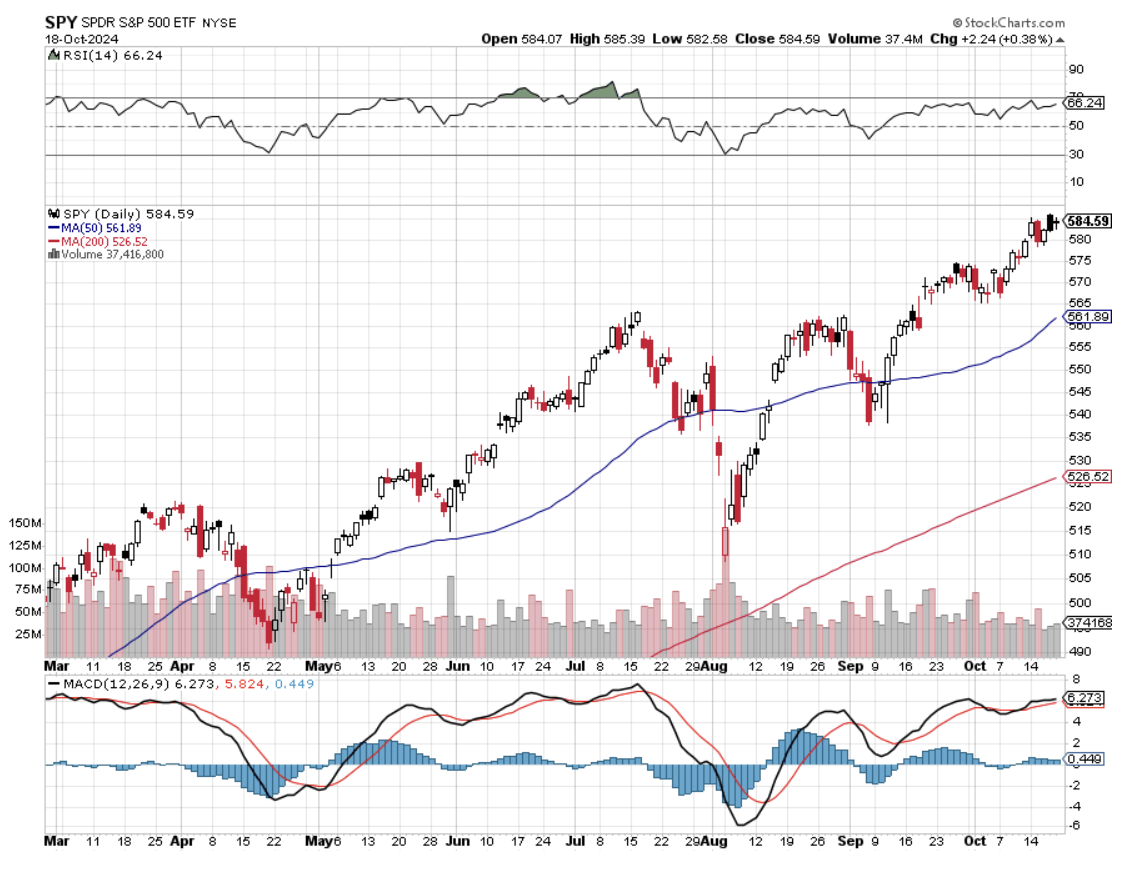

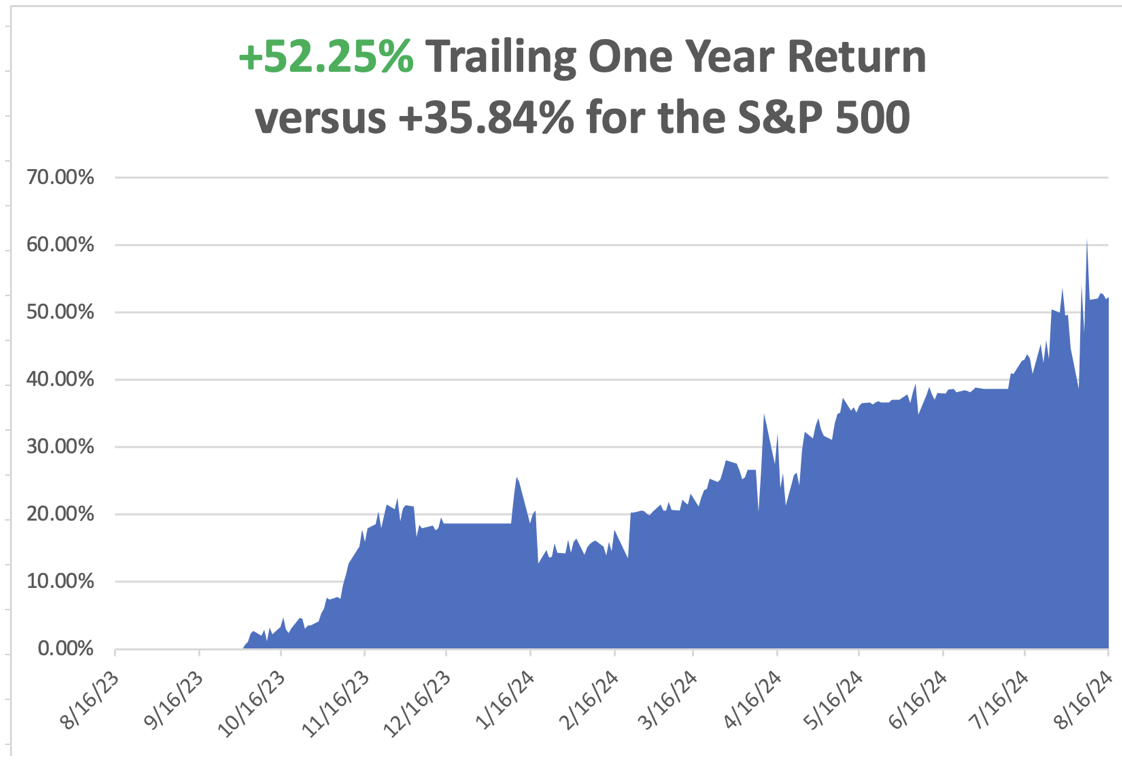

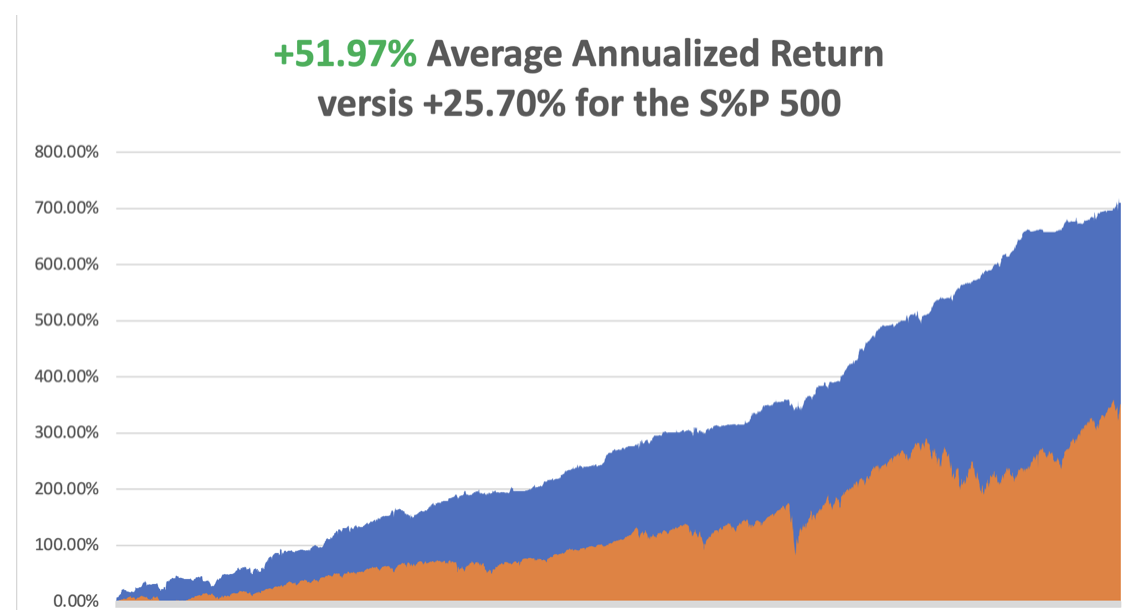

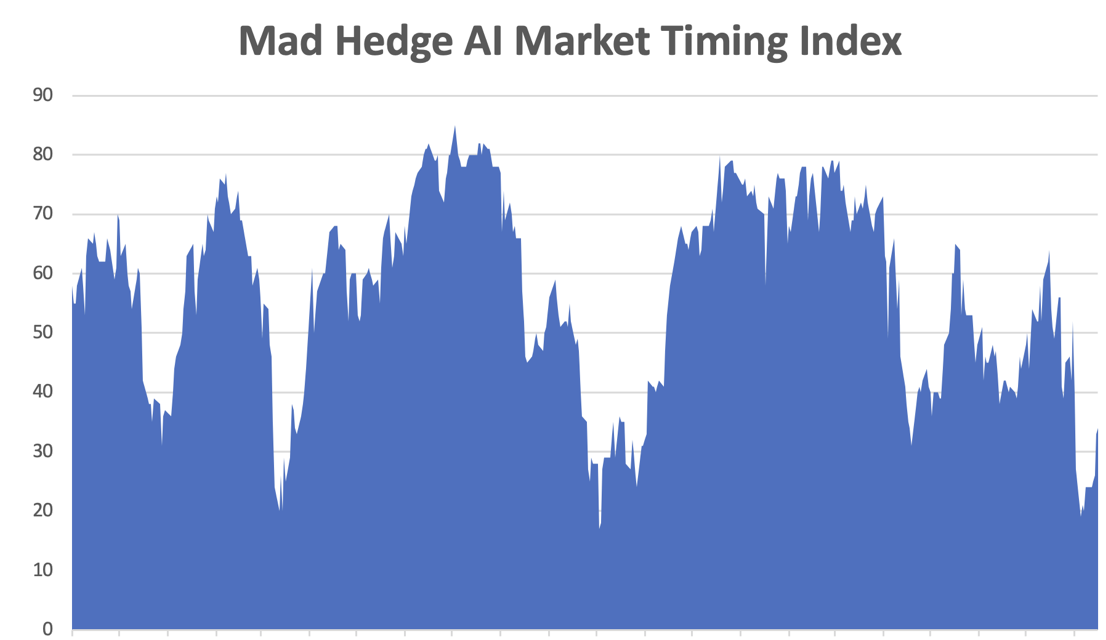

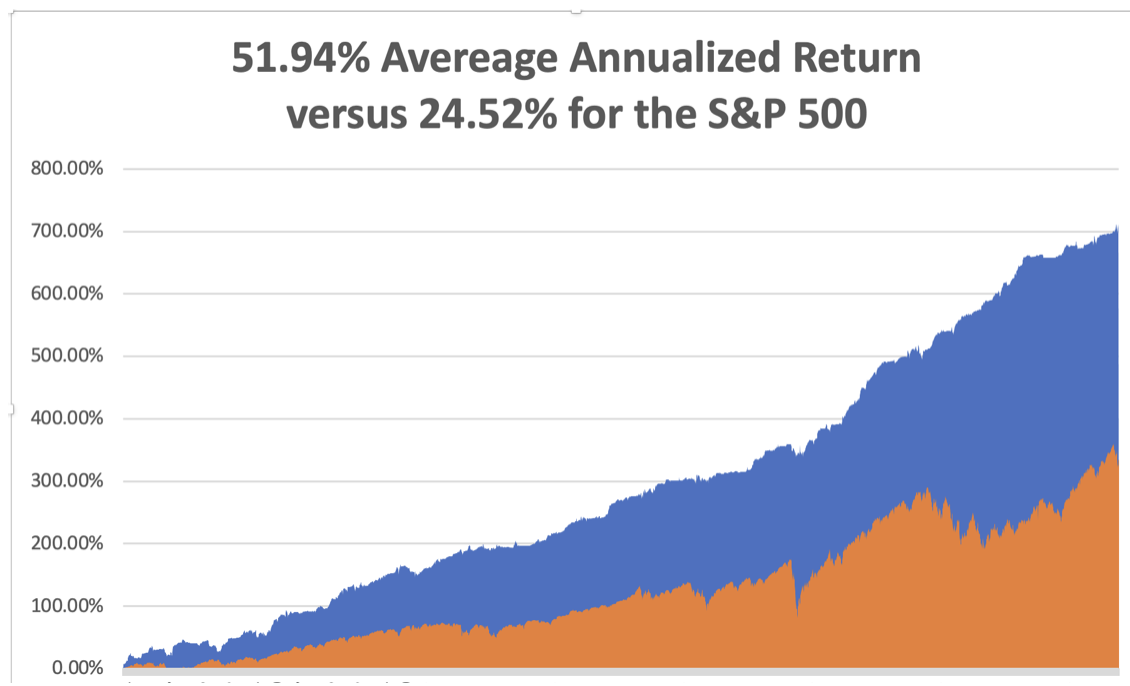

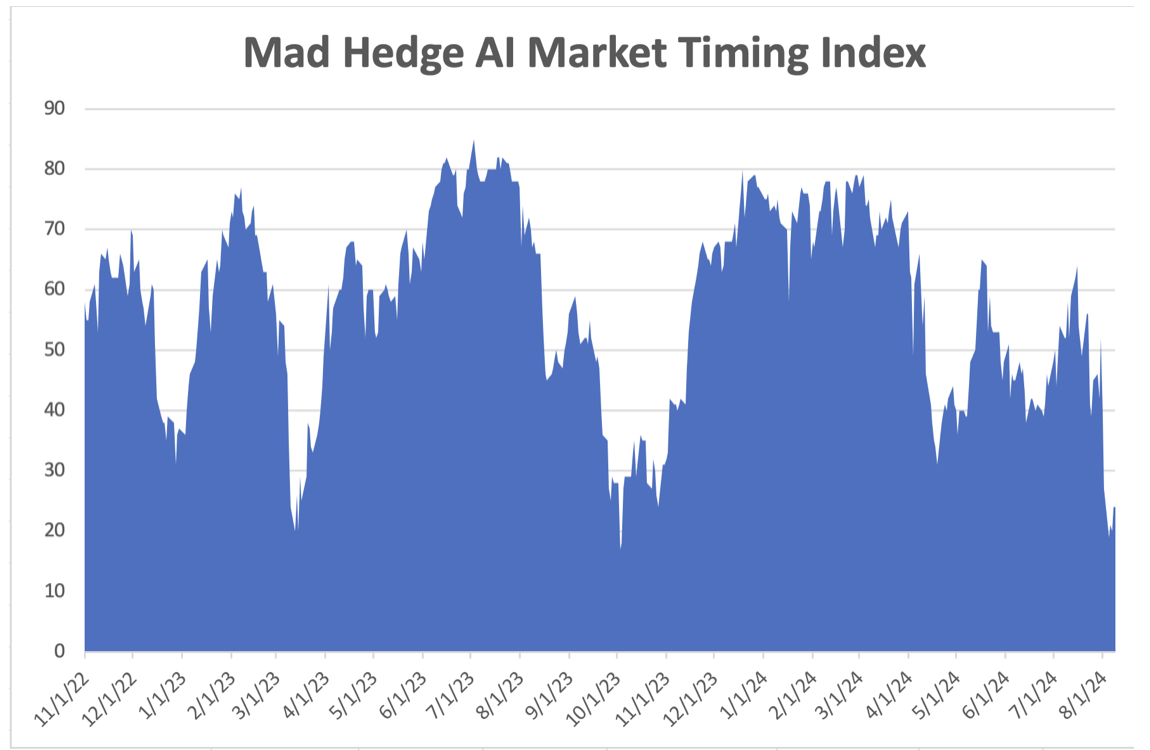

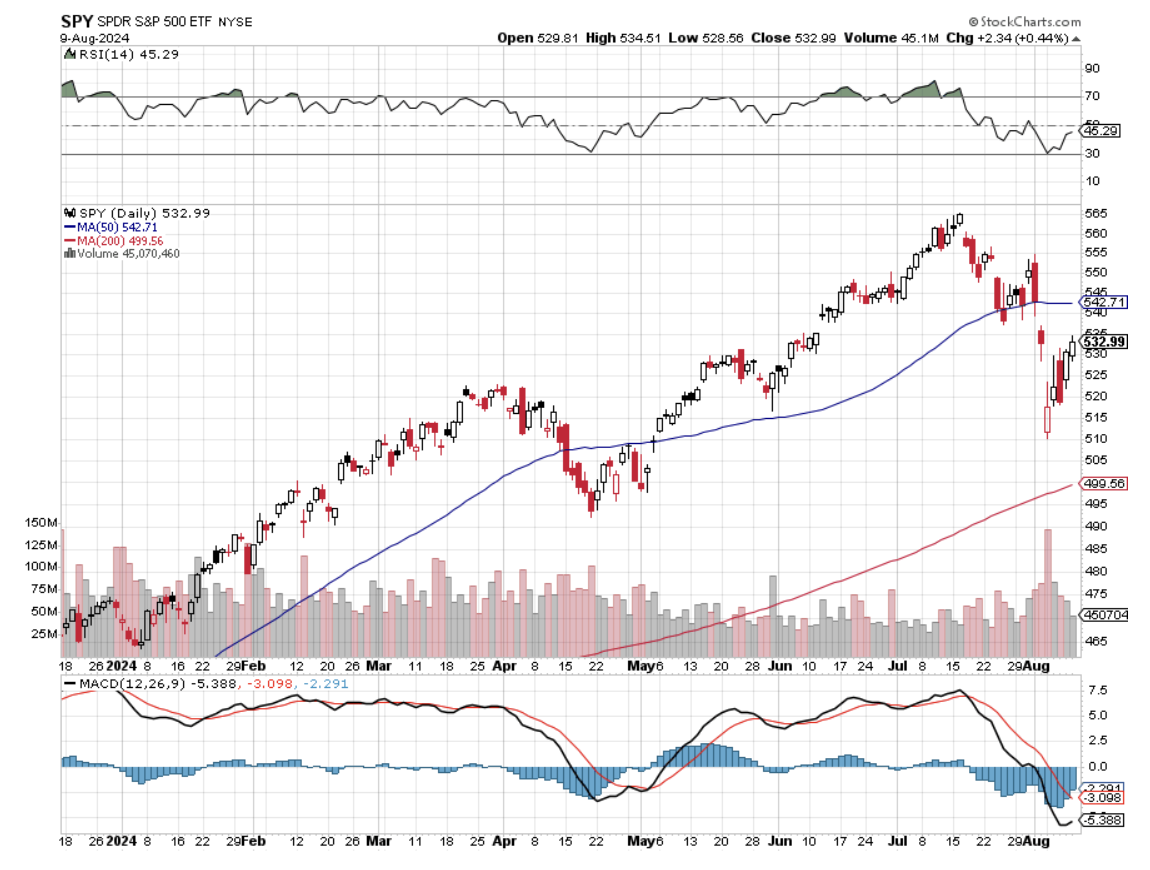

In October, we have gained a breathtaking +7.68%. My 2024 year-to-date performance is at an amazing +52.92%. The S&P 500 (SPY) is up +19.92% so far in 2024. My trailing one-year return reached a nosebleed +65.56. That brings my 16-year total return to +729.55%. My average annualized return has recovered to +52.42%.

I am going into the election as cautious as possible, with 80% in cash and 20% long. When you’re up this much you don’t take chances. I maintained two longs in (DHI) and (JPM) that are well in the money.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 63 of 82 trades have been profitable so far in 2024, and several of those losses were really break-even. Some 22 out of the last 23 trade alerts were profitable. That is a success rate of +76.82%.

Try beating that anywhere.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 4 at 8:30 AM EST, the US Factory Orders are published.

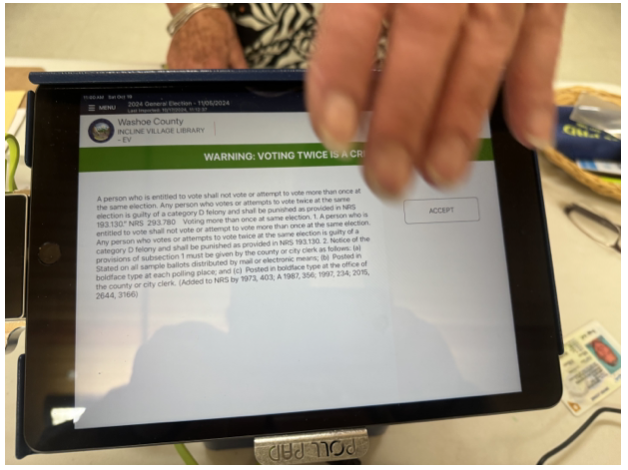

On Tuesday, November 5 at 6:00 AM, the US Presidential Elections take place. The last polls close in Hawaii at 1:00 AM EST.

On Wednesday, November 6 at 11:00 AM, the MBA Mortgage rate is printed.

On Thursday, November 7 at 11:00 AM, the Federal Reserve announces its interest rates decision. A 25-basis point cut is in the bag. A press conference follows at 11:30 AM.

On Friday, November 8 at 8:30 AM, the University of Michigan Consumer Sentiment is announced. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, as the son of a Marine who served on Guadalcanal in 1942, I had an unusual childhood. The memories all came flooding back to me as the HBO program, The Pacific, which aired once again over last Memorial Day weekend.

Every scene in the ten-hour series I had already heard about around campfires, at veteran’s reunions, or in officers clubs around the world. At five, I learned how to open a coconut by tapping around the three eyes with a bayonet. At ten, I could shinny up a palm tree with a belt wrapped around my ankles.

I learned that you can shoot down a Japanese zero fighter by leading with four hand widths and aiming high. A tank can be disabled by ramming a log into its tracks. There was the survival training; practicing how to find water in the desert, setting a snare trap to catch small animals to eat, and starting a fire with only flint and steel. All the sniper training was fun but was fortunately never put to use.

I can still thrill the kids by hitting a quarter taped to a tree 50 feet away with a Winchester lever action 30-30. We outfitted ourselves with surplus WWII equipment from the “Supply Sergeant” for camping trips, which you could buy for a couple of dollars. Now, you only find these things in museums. We ate leftover C-rations.

Perhaps it was dad’s explanation of how to make highly alcoholic hooch out of canned peaches that led to my degree in biochemistry. In the end, I had my own Marine career as a combat pilot in Desert Storm, and many tasks that followed. There you learn the true meaning of “gung ho.”

At 73, I stay in boot camp shape. In my free time, I hike 100 miles in the High Sierras over 8,000 feet in eight days. I am carrying a 50-pound pack, and living on only 500 calories a day entirely composed of fruit and nuts. I love every minute of it.

Watching the series, I was reminded how feeble and meaningless my profession is, toiling away all year just to create a spreadsheet full of numbers, and how the men of eight decades ago were made of sterner stuff. Buying a dip on a bad day just doesn’t equate to “taking out that machine gun.”

How times have changed. Fall down on your knees and give thanks for your simple life.

You can buy the Hugh Ambrose book the series was based on by clicking here. You can purchase the DVD by clicking here.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader