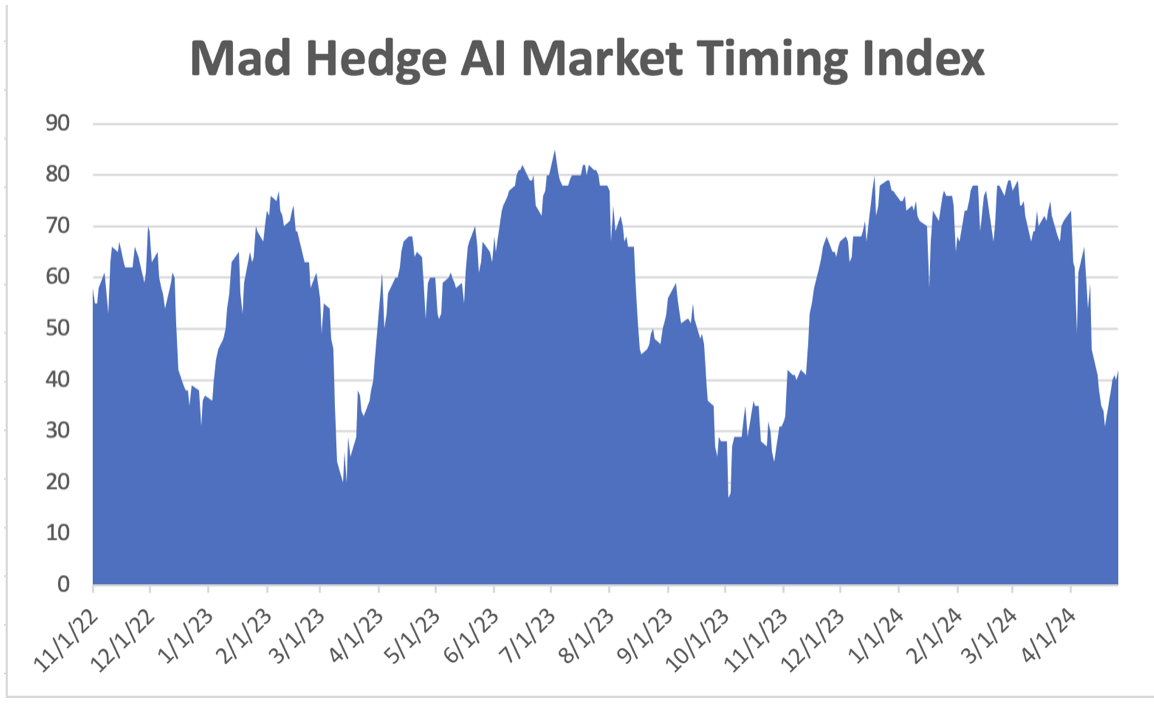

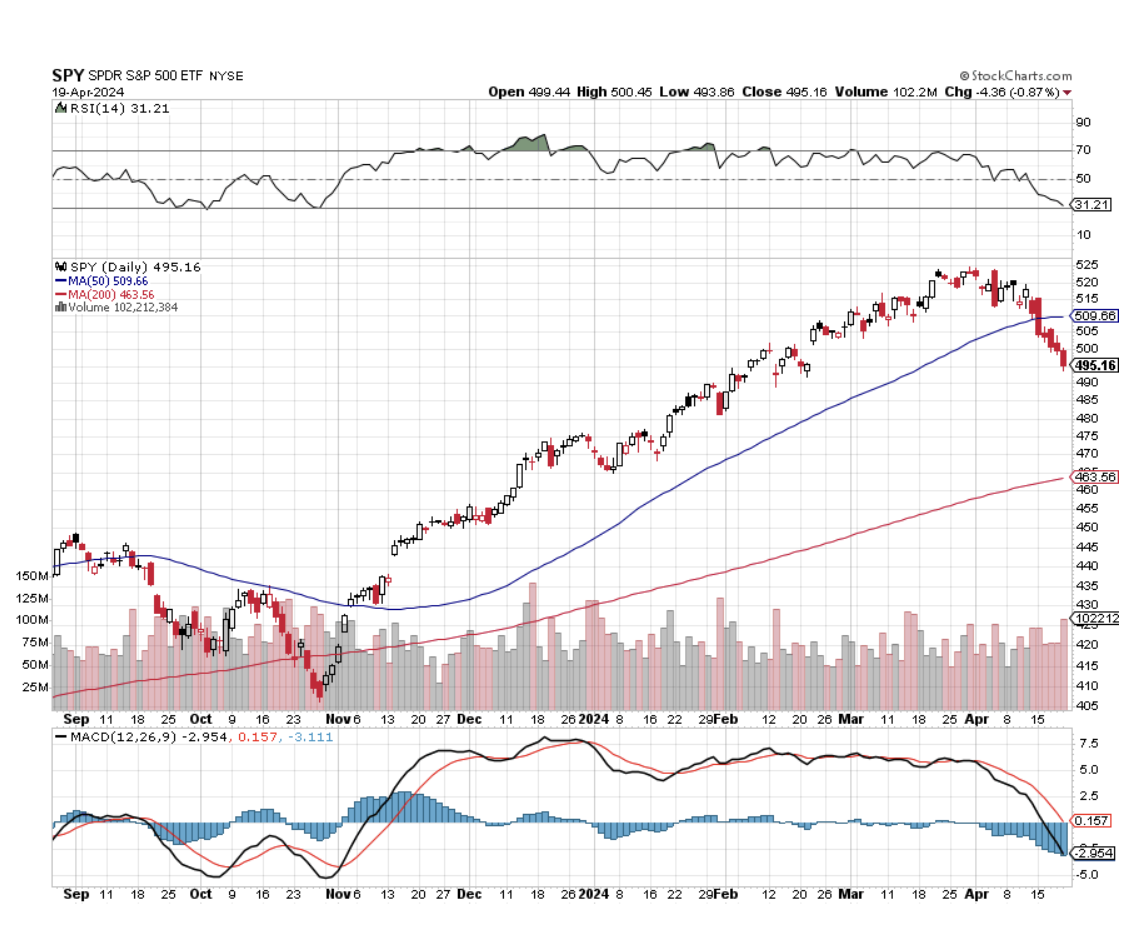

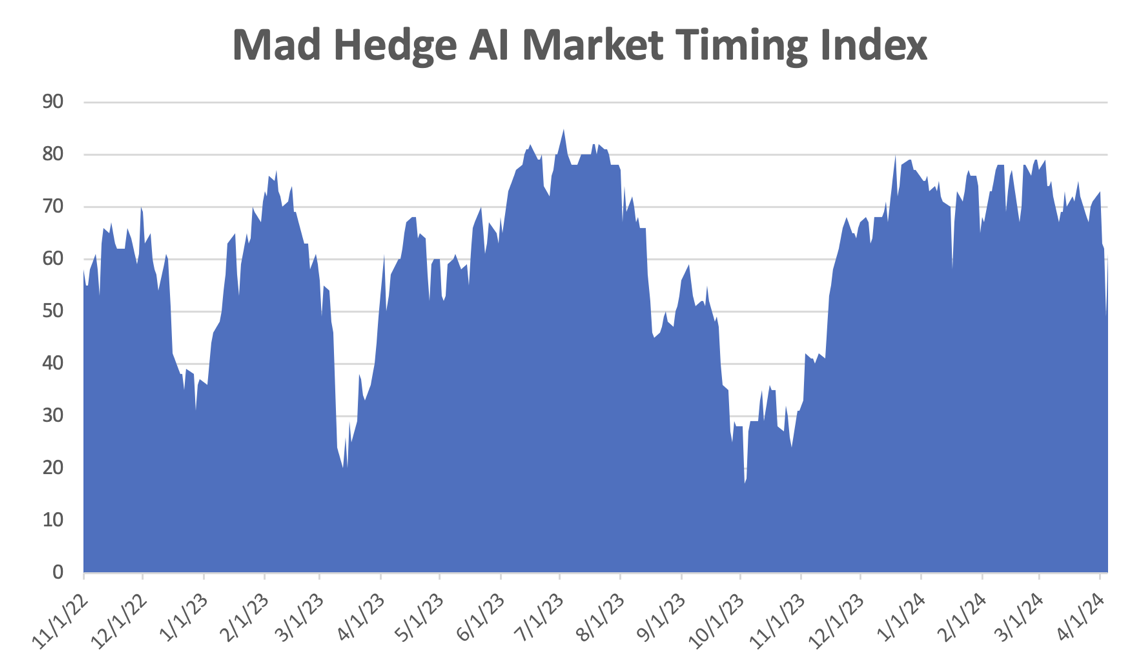

Before you even ask, I’ll give you the answer you’ve all been waiting for: It’s too late to sell and too early to buy.

Stocks may still have some digesting to do having soared by 27% in six months. Nobody wants to look like an idiot by buying a market top. As I have learned over the decades, investors fear looking stupid more than they fear losing money, especially if they are professionals.

Everyone knows the market is eventually going higher so they are not selling in any meaningful way unless they are short-term, algos, or day traders.

This means we may have a whole lot of nothing going on in the coming weeks or months.

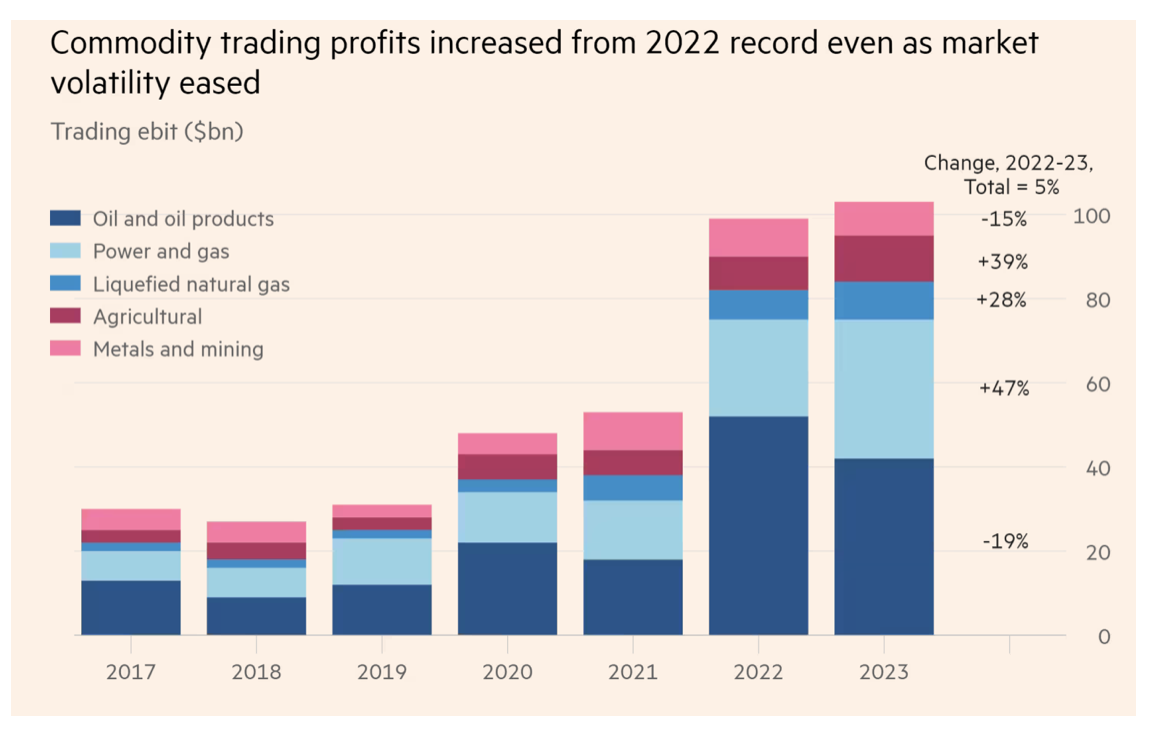

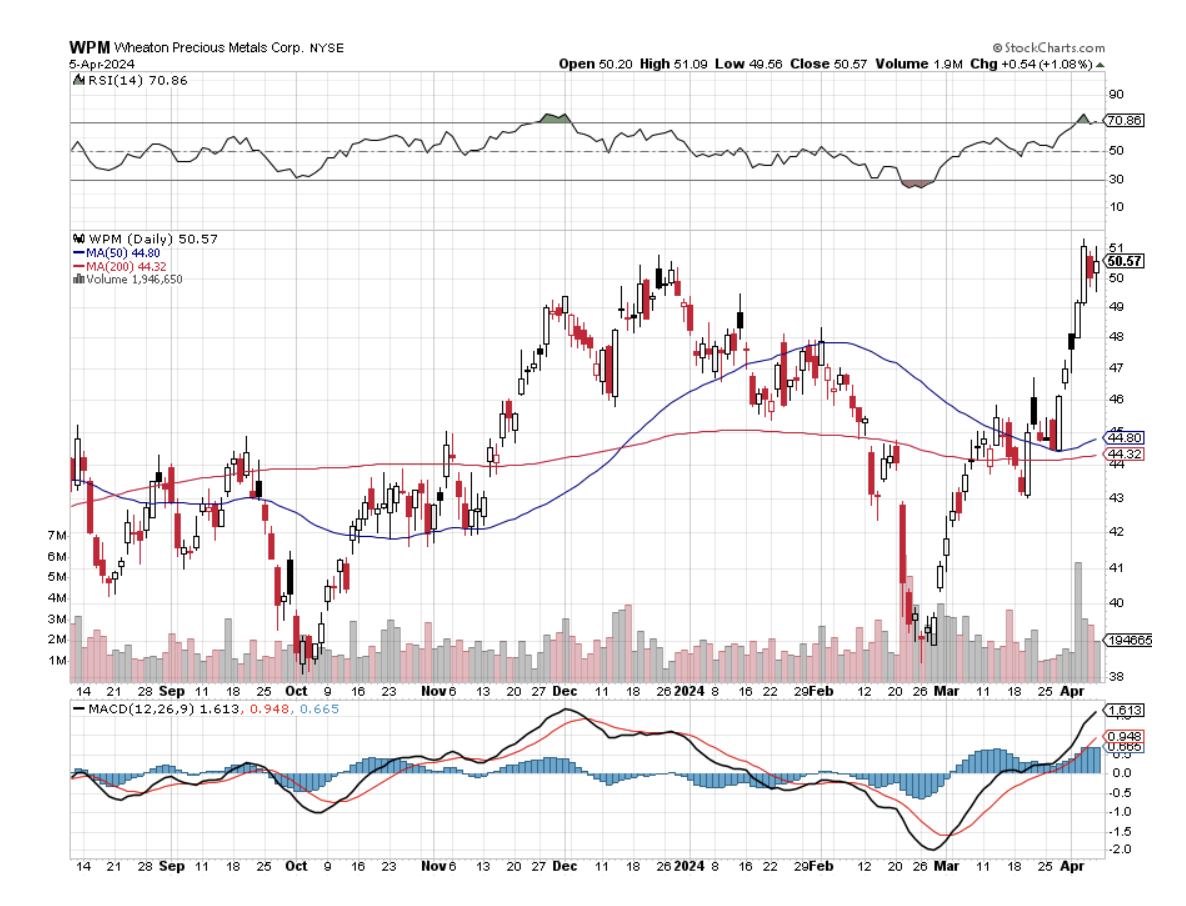

That leaves us time to examine the most interesting trends going on in the markets right now, especially the new bull market in commodities. Believe it or not, we are still unwinding the long-term effects of Covid 19 and commodities have only recently come to the fore.

Remember Covid?

Since October, copper prices have risen by 22%, oil by 23%, gold by 34%, and uranium by a gobsmacking 83%. What’s causing this sudden new interest? It’s not a recovering Chinese economy, that’s for sure. Investors have been waiting for a bounce back in the Middle Kingdom seemingly forever. But China remains hobbled by the bitter fruit of a 40-year one-child policy and an ineffective government. History tells us that the United States does not make a great enemy.

So what’s driving the new demand? Remember Covid? Believe it or not, we are still unwinding the long-term effects of Covid 19 and commodities have only recently started to play catch up.

Commodities are unique in that they have such a long lead time to add new supply. It can take 5-10 years, to map out new sites, get government approvals, deliver heavy equipment, and mine, process, refine, and ship the final product.

In the meantime, enormous new demand has arisen. There have been 10 million EVs manufactured in recent years and each one needs 200 pounds of copper. AI means the electric power grid has to double in size quickly. Commodity markets are unable to meet the supply. Therefore, prices can only go up.

That enabled Freeport McMoRan (FCX), the world’s largest copper producer, to handily beat its earnings expectations, helped by higher production and easing costs. The mining giant said its quarterly production of copper rose to 1.1 billion pounds from 965 million pounds a year earlier, helped by a 49% jump in output from its Indonesia operations. (FCX) said it was working with the Indonesian government, which has put a ban on raw material exports, to obtain approvals to continue shipping copper concentrates and anode slimes. Its current license is set to expire in May. Buy (FCX) and (COPX) on dips.

Corporate raiders have taken notice.

Activist Elliot is taking a Run at Mining Giant Anglo American, accumulating a $1 billion stake. BHP, the largest iron ore miner, is also making a takeover bid here on the coattails of which Elliot is trying to ride. It just highlights the global interest in mining shares.

Anglo American plc is a British multinational mining company that is the world's largest producer of platinum, with around 40% of world output, as well as being a major producer of diamonds, copper, nickel, iron ore, polyhalite, and steelmaking coal. On a side note, copper hit a two-year high above $10,000 per metric tonne in the London Market last week.

Needless to say, the commodity boom could continue for another decade.

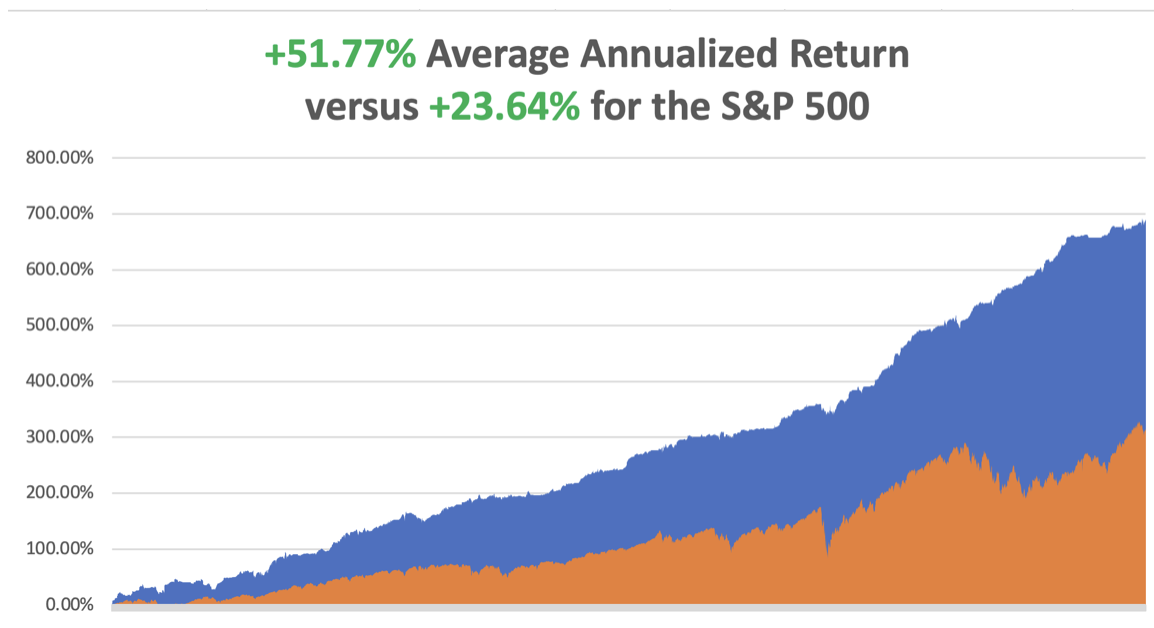

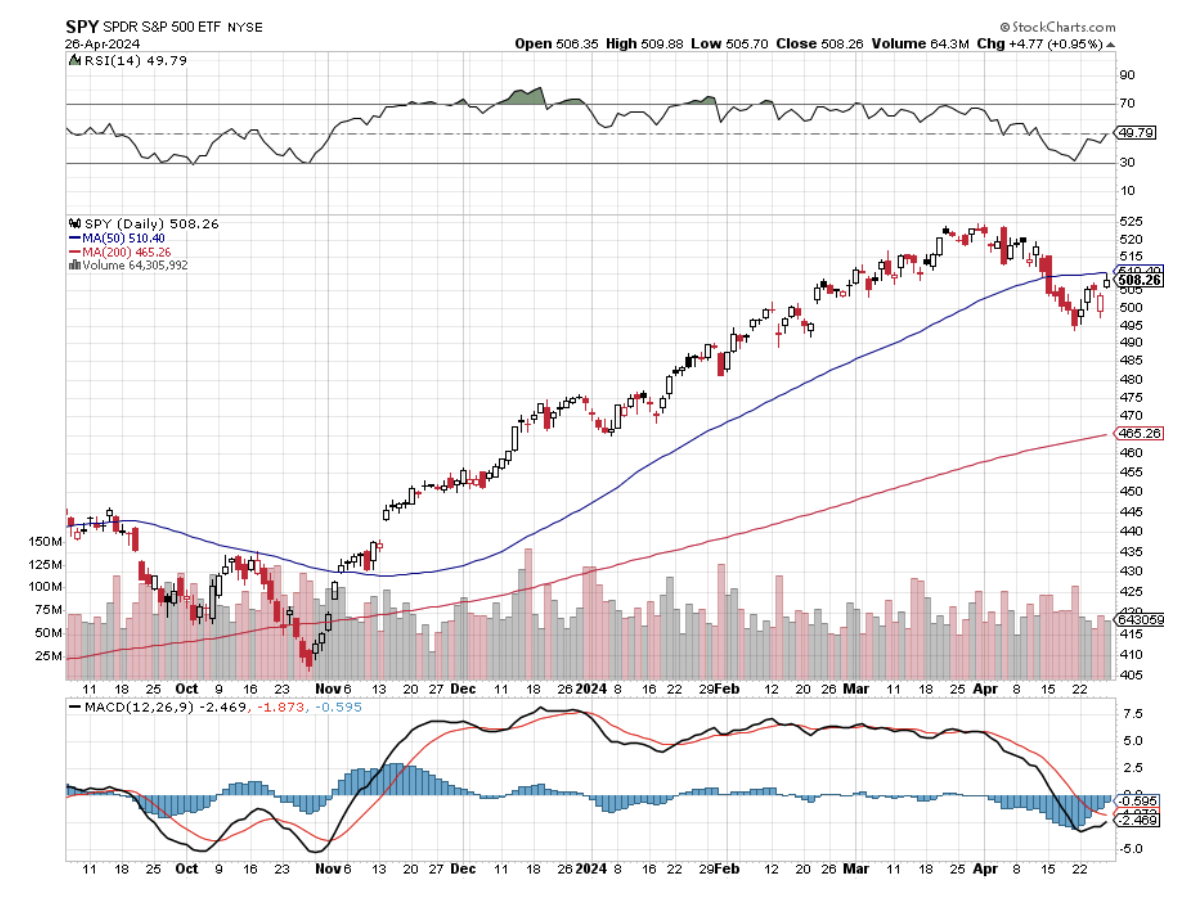

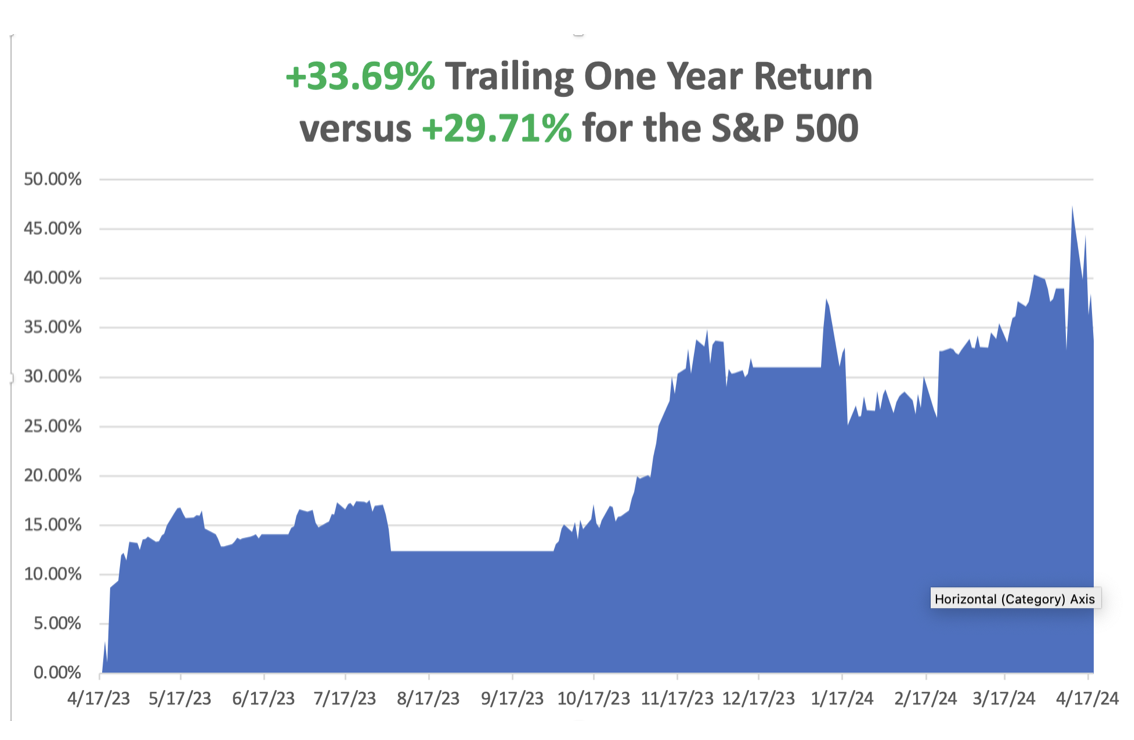

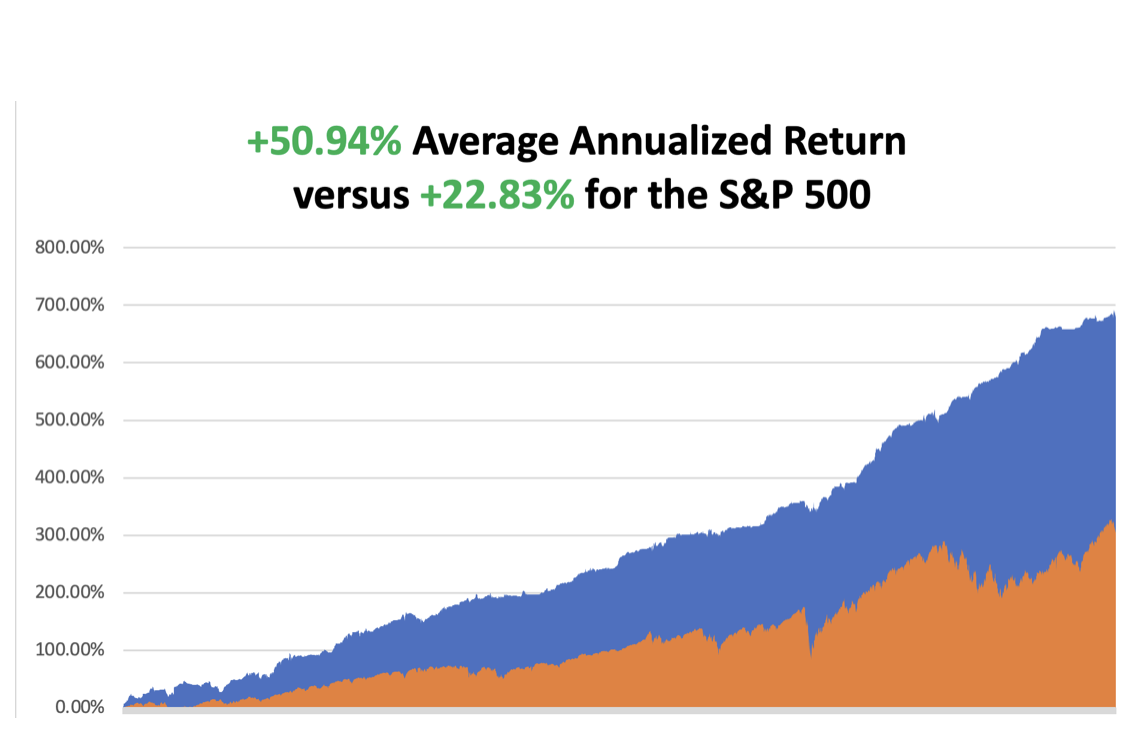

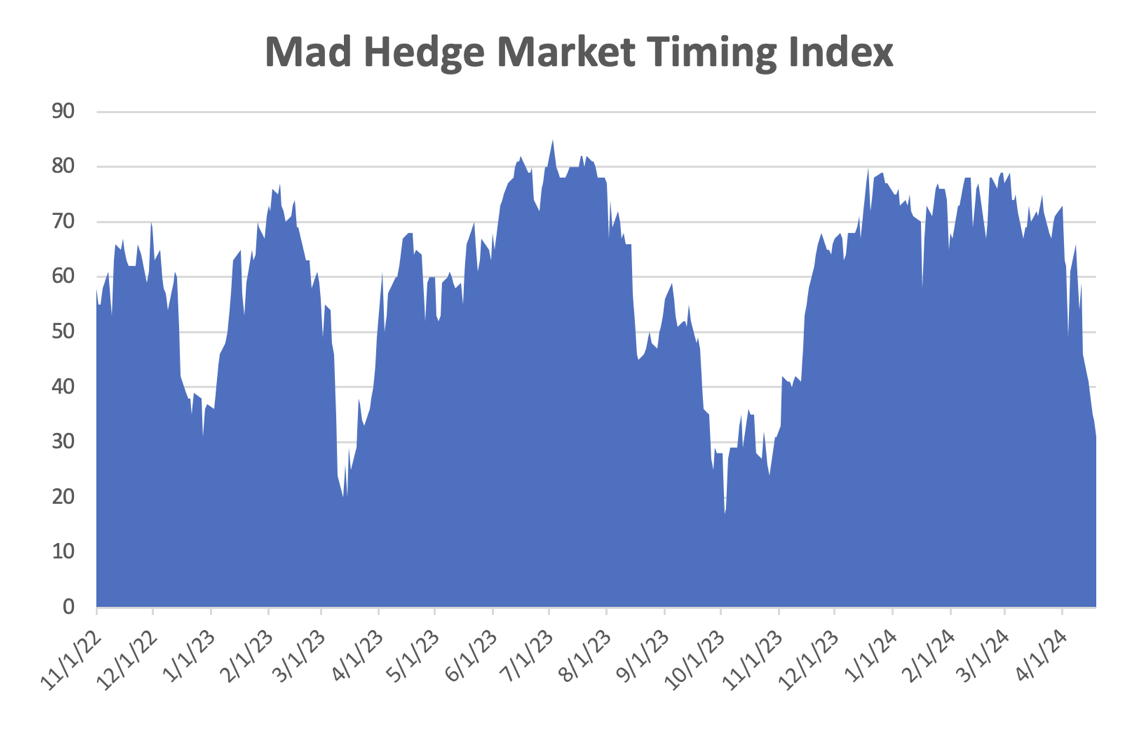

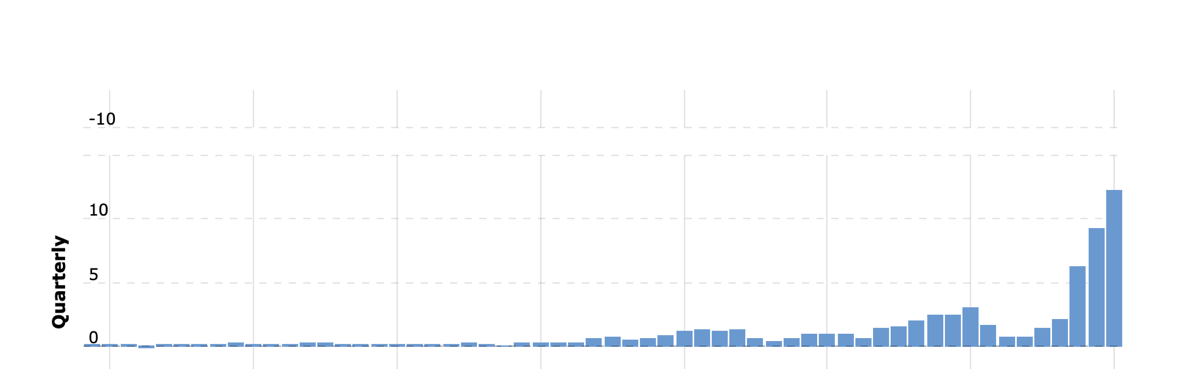

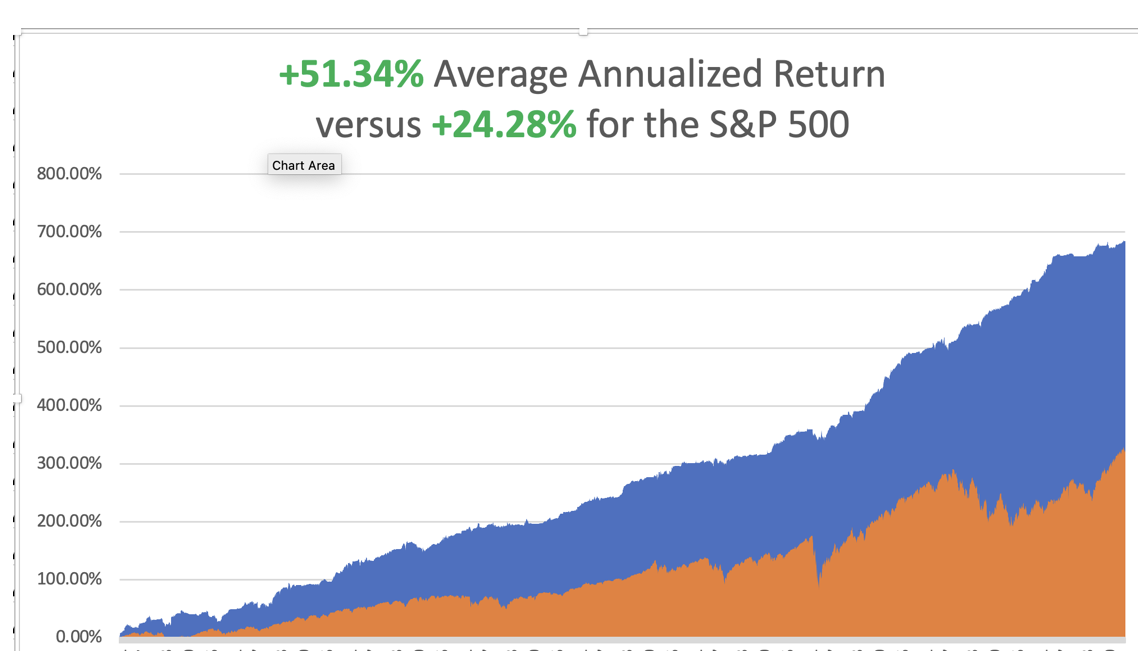

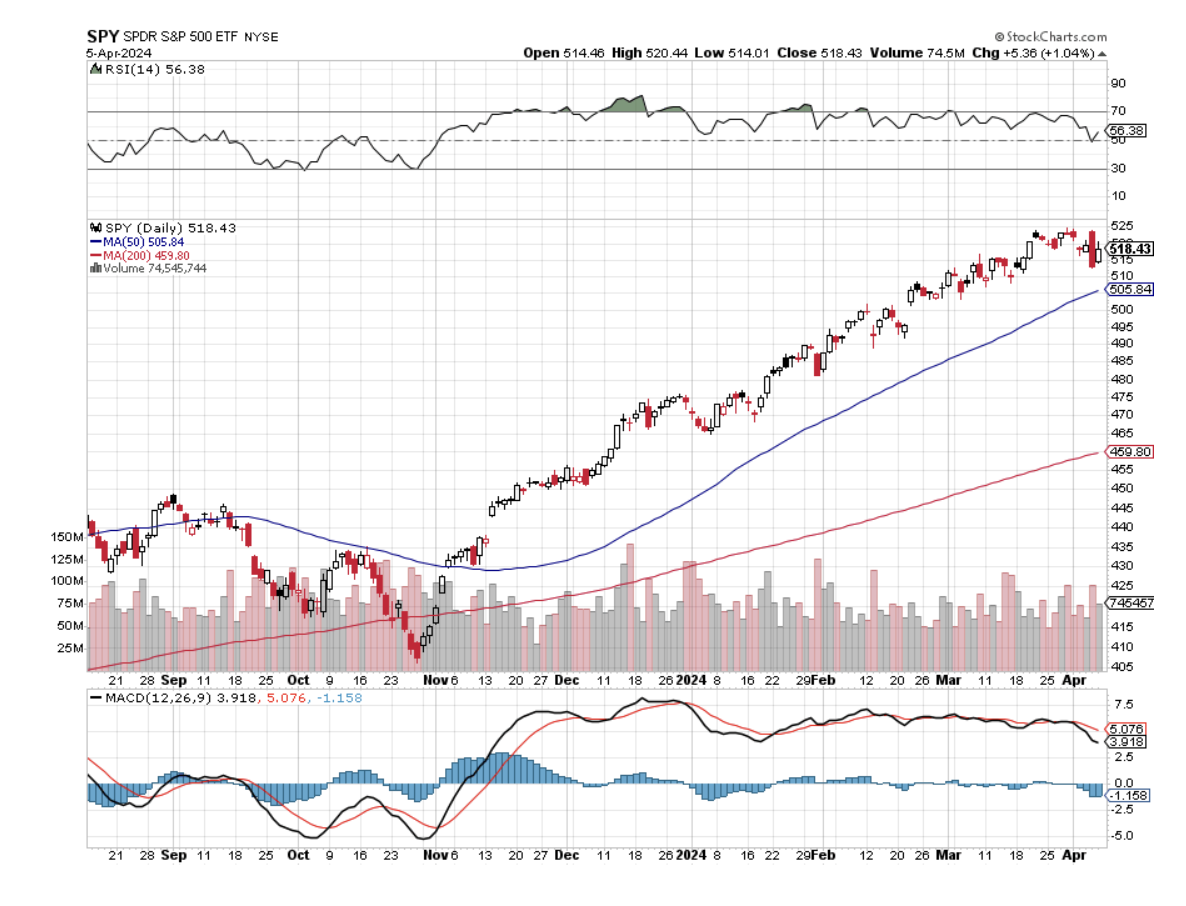

So far in April, we are up +4.24%. My 2024 year-to-date performance is at +13.61%. The S&P 500 (SPY) is up +6.50% so far in 2024. My trailing one-year return reached +32.40% versus +23.14% for the S&P 500.

That brings my 16-year total return to +690.24%. My average annualized return has recovered to +51.77%.

Some 63 of my 70 round trips were profitable in 2023. Some 25 of 33 trades have been profitable so far in 2024.

Tesla Delivers Worst Earnings in 12 Years, with a 9% revenue drop, but the stock rallies big as the disappointment was well telegraphed. Revenue declined from $23.33 billion a year earlier and from $25.17 billion in the fourth quarter. Net income dropped 55% to $1.13 billion, or 34 cents a share, from $2.51 billion, or 73 cents a share, a year ago. The drop in sales was even steeper than the company’s last decline in 2020, which was due to disrupted production during the Covid-19 pandemic. Tesla’s automotive revenue declined 13% year over year to $17.38 billion in the first three months of 2024. I’ll watch (TSLA) from the sidelines from now.

Personal Consumption Expenditures (PCE) Comes in Warm for March, up 2.8% YOY, the same as for February. Service prices led. But the numbers were not as hot as feared so both bonds and stocks rose.

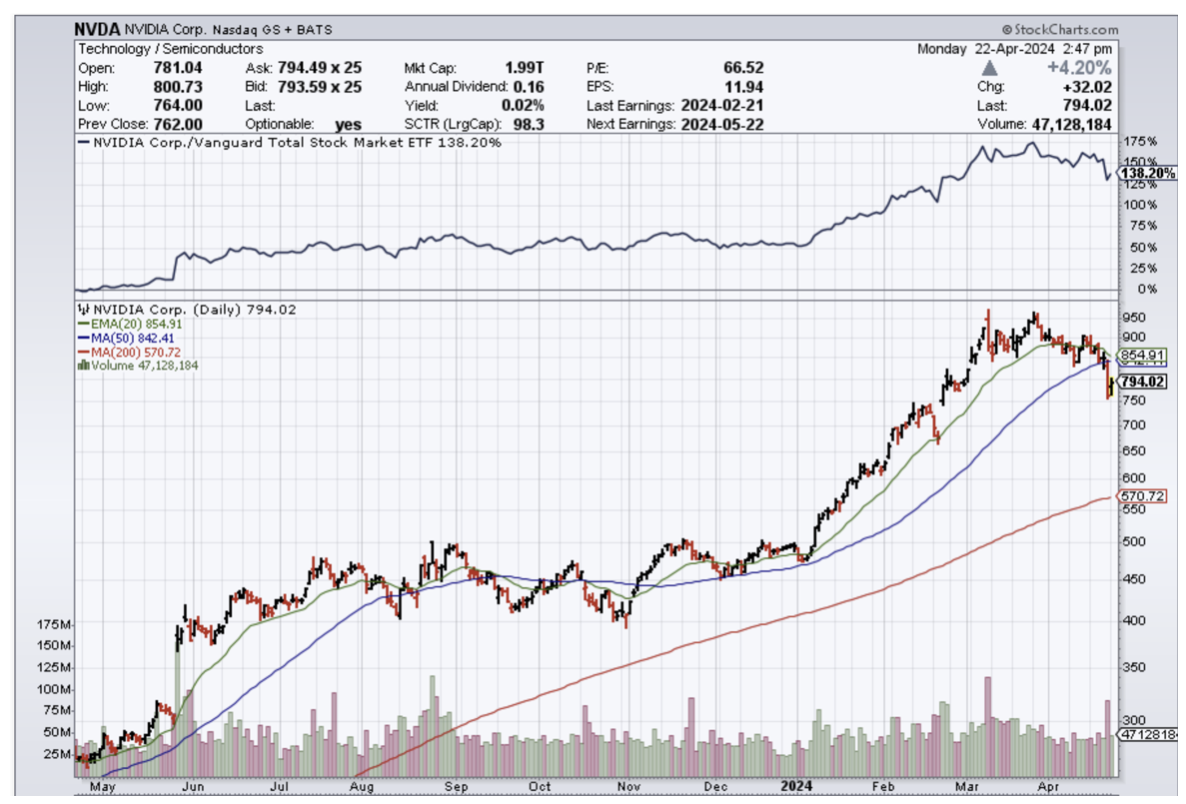

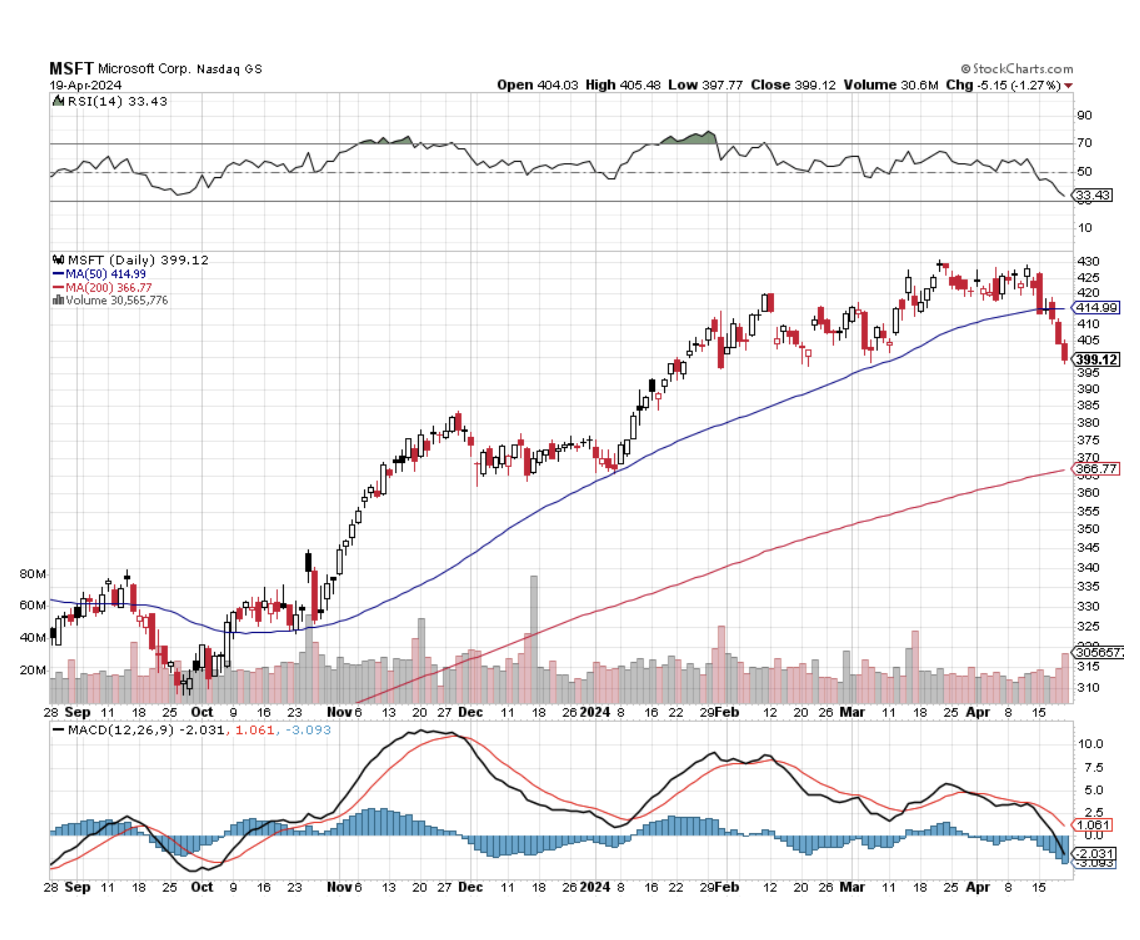

Big Tech Crashes, with all of the Magnificent Seven breaking 50-day moving averages. (NVDA) alone gave up 10% on Friday. The next stop is the 200-day moving averages, which are far, far away. If those hold this is just a correction. If they don’t the bear market is back.

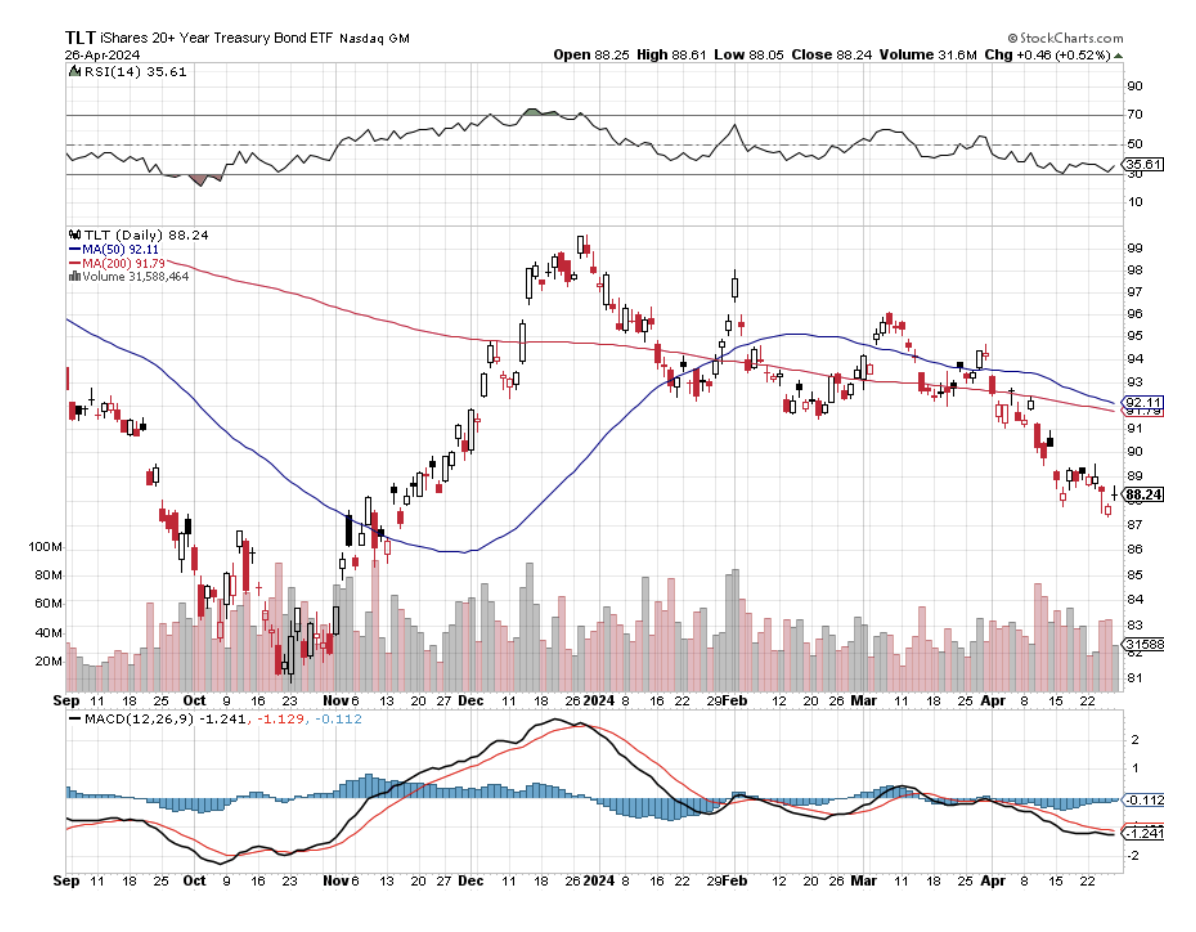

Biggest Treasury Bill Auction in History is a Huge Success, at $69 billion for a two-year paper with a 4.898% yield. That is almost a risk-free government-guaranteed 10% yield in two years. Another $70 billion of five-year notes go on sale today. Half of this is going to foreign investors and central banks. Faith in America and the US dollar remains strong. Who else’s bonds would you rather buy? Passage of the Ukraine aid bill was probably a help. Wait for (TLT) to bottom.

Visa Pops on Earnings Beat, continuing as the powerhouse that it has been for years. Reported at $4.7 billion, showing a 10% increase year-over-year, slightly above the estimate of $4.943 billion. Visa is a call option on the growth of the Internet. Buy (V) on dips.

Apple China Sales Dive, by 19% as Chinese switch to cheaper Huawei phones for nationalism reasons. It’s also another sign of a slow Chinese economy. China remains one of the company’s biggest markets, but business there has grown harder after Beijing escalated a ban on foreign devices in state-backed firms and government agencies. Avoid (AAPL) until the turnaround.

Alphabet Earnings Beat Delivers Monster 10% Move, recovering a $2 trillion market cap. It also announced its first-ever dividend and a $70 billion share back, the second largest after Apple. Buy (GOOGL) on dips.

March New Home Sales Jump, by 8.1% when only 1.1% is expected, to 693,000. The median price of a home sold fell to $430,700 as builders pulled back on incentives like those cherry cabinets. It’s an uphill slog with those 7.0% mortgage rates.

CDC Birth Data Fall to Lowest Level Since the Great Depression, 1.1 births per 1,000 people. That is well below the Great Depression levels. Only 3,664,292 new Americans were born in 2021. It means there will be a shortage of consumers in 20 years so be out of stock by then. The good news is that Covid deaths have fallen from 4,000 per day to only 19 a day since January 2020.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, April 29, at 10:30 AM EST, the Dallas Fed Manufacturing Index is announced.

On Tuesday, April 30 at 9:00 AM, S&P Case Shiller National Home Price Index is released.

On Wednesday, May 1 at 2:00 PM, the ADP Private Employment Change report will be published

On Thursday, May 2 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, May 3 at 8:30 AM, the April Nonfarm Payroll Report is announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

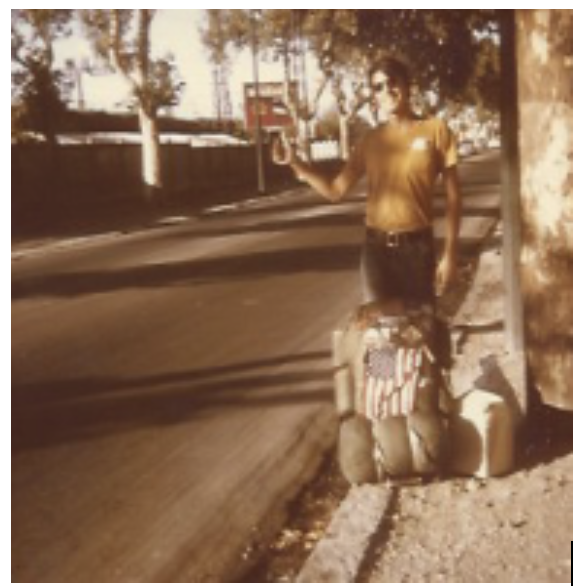

As for me, I have wanted to visit Cuba for decades. But relations with the US have run hot and cold over the years and whenever I had the time and money to go, the was a chill on, sometimes an extreme one.

So when I arrived in Key West and learned they were offering Cuba tour packages, I jumped at the chance. Unfortunately, you need to book three months in advance so that option was out.

Then I thought, “Why not fly there myself?” After payment of some hefty fees, commissions, and some outright bribes, I scored a Cuban visa and an aging Britten-Norman Islander twin built in the UK some 40 years ago. It was perhaps the smallest twin I have ever flown, with two minuscule 270 horsepower engines.

Although it was only 90 miles to Cuba, I had to load up with full tanks. Cuban aviation fuel is often contaminated with sludge or water and is unsafe to use. Losing both engines over shark-infested waters doesn’t fit in with my retirement plan. So I needed enough 100LL avgas to make the round drip, which meant skipping breakfast to stay within my weight limitations.

It was a clear and balmy morning when I received my clearance for takeoff, the sky dotted with fluffy white cumulus clouds. Of course, I had to skirt the Bermuda Triangle to get there, but no worries.

Amazingly Cuban air traffic control spoke English. Soon, the green hills of Cuba appeared on the horizon, and I received the words I will never forget: “N686KW you are cleared for landing in Havana.” I haven’t felt like that since I last landed in Moscow.

Much to my surprise, I found other US aircraft there as I was parked near jets from Southwest and American Airlines. I was greeted by an immigration officer who escorted me into the country, putting my Spanish skills to the test.

I had some concerns that I might be arrested in case Russia put me on a wanted list due to my recent work in Ukraine. But my fears proved unwarranted. You see, you get paranoid in your old age. A private car, a French Citroen van, a driver, and a government guide were waiting for me outside the airport.

Suddenly, I found myself in a strange new world. A darkly tanned people wore tired polyester clothes. Everyone was rail thin and the only obese people I saw were foreign tourists. There was an incredible variety of vehicles on the road, including ancient cars from Russia, China, Poland, and Japan. Apparently, Chevrolet had a great year in Cuba in 1956 because no American cars have entered the country since then and they are everywhere.

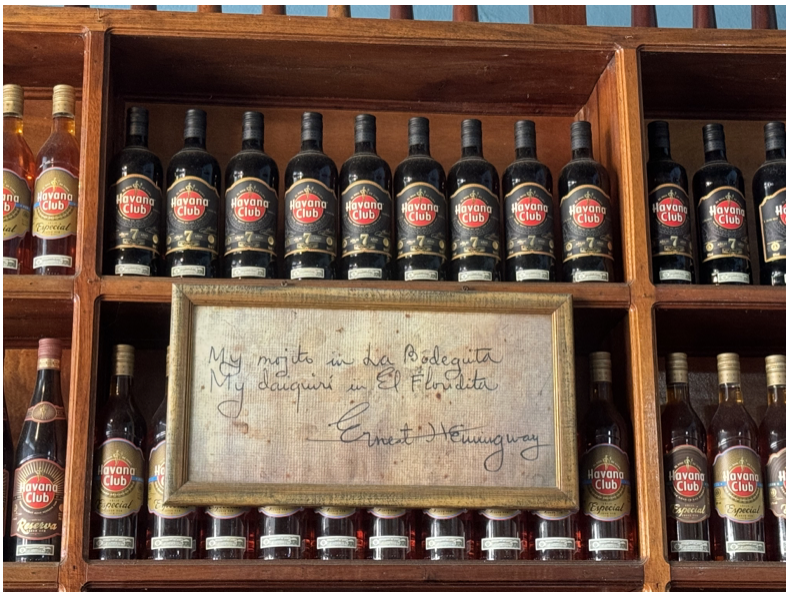

We headed straight for Earnest Hemingway’s Cuban home, known as Finca Vigia, or “Lookout Farm” built in 1886 on a hilltop overlooking Havana. The building was falling apart and showed large cracks, but going inside I was transported in time back to 1960, when Hemingway left the property ahead of the Cuban Revolution.

Finca Vigia has been untouched since. The walls are covered with an assortment of hunting trophies from Africa, including springboks, cape buffalo, lions, and leopards. They were collections of African spears and gun cases. Mounted on the walls were paintings of bullfights in Spain, cartoons about Hemingway, and family photos.

Magazine racks were stuffed with the 1960 issues of Life, Look, and The Saturday Evening Post. The National Geographic issues looked positively prehistoric. And there were thousands of books. Anyone who read his books would recognize all of this.

Hem, as his friends called him, bought the property in 1940 for $8,000, living there with wife three for five years, the famed war correspondent Martha Gellhorn, and wife four, Time magazine reporter Mary Welsch, who became his widow.

After passing on a Che Guevara T-shirt in the gift shop, I enjoyed a glass of freshly squeezed sugar cane juice. Then I headed into Havana, escorted by my guide, Eliar. The trip turned into a Hemingway bar crawl. I visited the well-known La Floridita, which made Hem’s favorite Daiquiri, La Bodegita, which mixed the best mojito and had lunch at his favorite roof terrace restaurant.

Cuba has long been one of the worst-managed countries in the world, second only to North Korea, and I learned why after grilling my guide all day about economic conditions. It’s 11.2 million people earn a per capita of $11,255, with 71% living below the poverty line. The real figure is a third of that as there are now 300 pesos to the US dollar, not the fictitious 120 that the government pretends.

When the Soviet Union collapsed in 1992, generous subsidies ended and Cuba quickly lost 33% of its GDP. With some of the richest farmland in the world, it imports 80% of its food and is currently suffering a food crisis. Even the bottled water I drank came from Panama.

Oil accounts for 100% of its energy supply which mostly comes from Russia and is paid for with raw sugar. Cuba’s largest exports are tobacco, nickel, and zinc most of which are exported to China. China also provided $11 billion in loans which Cuba promptly defaulted on.

The country would have been much better off if only Fidel Castro had accepted an offer from the Washington Senators to play US major league baseball in the early 1950s. Cuba is officially one of the last communist countries in the world, with Russia and China abandoning it years ago. After reforms in the 1990s, what they now practice is an odd mixture of communism and capitalism, with the government and the private sector competing side by side.

With thousands fleeing the country every year the real estate market has collapsed. You can buy a two-bedroom apartment in Havana for $30,000. Flying over the countryside at low altitude you fund vast expanses of agricultural land undeveloped for want of machinery and parts. There is unused labor everywhere. Cuba should be one of the richest countries in the world with all those beaches. The tourism possibilities are enormous. But with a 60-year trade and investment ban from the US, nothing can happen.

American credit cards and cell phones don’t work, so I brought in $200 in ones. You can’t bring back to the US the country’s only two worthy exports, rum and cigars. But there are buskers everywhere and by the end of the trip, I ended up giving it all away in tips. I did OK with the food, but only ate overcooked meals in high-end restaurants. Salads were out of the question but drink all the local beer and rum you can.

I ended my trip with a tour of the enormous Revolution Square where Fidel Castro used to give four-hour speeches to one million. One area the government did not skimp on spending was on the massive ministry buildings that surround the square. It seems the image of a strong government, especially the police, is essential in a workers’ socialist paradise.

Then it was back to the airport where surprisingly I obtained immediate clearance for takeoff. No passport stamps, as the government wanted to leave no evidence of my visit in an American passport. I returned to Key West just in time to catch a magnificent sunset over the Gulf of Mexico. US customs recognized my face and waved me right through.

Damn! Should have picked up some of those $5 bottles of rum.

It's all just another day in the life of John Thomas.

At Hemingway’s Cuban Home

A Look Back into 1960

Where Hem Wrote “Old Man and the Sea”, Standing

Hemingway’s Office

I passed on Che

Meeting an Old Friend for a Round at Floridita

Mixing it up with the Locals

One of Cuba’s Only Exports

Looks Like Chevy had a Great Year in 1956

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader