Mad Hedge Technology Letter

January 8, 2025

Fiat Lux

Featured Trade:

(BUY THE MICROSOFT DIP)

(MSFT)

Mad Hedge Technology Letter

January 8, 2025

Fiat Lux

Featured Trade:

(BUY THE MICROSOFT DIP)

(MSFT)

How will Microsoft grow their stock in 2025?

In short, MSFT are building what the market wants, and what the market wants are AI data centers.

The stock price should be rewarded if they can deliver these new AI data centers to the market.

The data center increase shows no signs of slowing down and I do believe this puts a floor under tech stocks.

To be honest, there has been a lot of bad energy surrounding the current tech business models because many of them are getting stale.

Why upgrade to the next iPhone when there isn’t much of an upgrade?

The refresh cycle data shows people are standing pat and using their own tech longer and that is bad news for tech software and hardware companies.

So instead of trying to squeeze the remaining juice out of a stale model, beefy balance sheet tech companies are driving full force into AI investment even though this investment doesn’t reciprocate with any sort of revenue stream.

It’s a little bit of a build it and it will come mentality which I do believe is quite risky and at some point, we are due for a heavy selloff.

That selloff could get triggered if the US 10-year interest rate blows past 5.5%, then all bets are off.

Microsoft says it plans to spend $80 billion on building AI data centers this year.

Microsoft has poured billions of dollars over the last two years into Anthropic, as well as Elon Musk’s startup xAI.

Advances by these firms would not have been possible without new partnerships founded on large-scale infrastructure investments that serve as the essential foundation of AI innovation and use.

The $80 billion would reflect a significant increase on the $53 billion capex spend Microsoft made in 2023.

Documents leaked last April revealed it had more than 5GW of capacity at its disposal, with plans to add an additional 1.5GW in the first half of 2025. It is possible this has since been revised upwards as it looks to provide compute power to OpenAI to run ChatGPT and its other AI services, as well as supporting its own Azure public cloud platform.

Part of this is definitely the management at OpenAI namely CEO Sam Altman. He is seen as the avant-garde of AI and the leader of the whole movement. He is demanding a massive build out and investors have largely taken him at this word. Nobody has really questioned him and that stems partly from no one really knows where this AI thing is headed in the future, but we are convinced that buckets of data space are needed for whatever comes next.

My issue is what if the thing that comes next is a cataclysmic letdown, then where do tech stocks head?

Most likely they would head for the gutter.

So we give the benefit of the doubt to this gargantuan AI infrastructure build-out and it feels like we are flying blind in a snowstorm, but that is what the market is telling us and the market is always right until it is not.

Sometimes tech does figure it out, and we are really hoping there is something of great value at the end of the build-out.

Buy the dip in MSFT until the AI infrastructure story is killed off.

Mad Hedge Technology Letter

October 28, 2024

Fiat Lux

Featured Trade:

(THE FUTURE OF TECH STOCKS)

(AI), (NVDA), (XLU), (XLE), (AAPL), (GOOGL), (AMZN), (META), (MSFT)

Through the vast whole spectrum of public markets, the U.S. stock market, and specifically technology stocks, are dominating versus their peers from other countries.

Heck, even Apple, just one company from a small suburb in California, is valued at a price that is greater than the entire German economy.

Does that speak to how bad the German economy is, or does it speak to the potency of public tech companies in America?

The truth is probably a bit of both.

Then, take a second and try to absorb the fact that Apple hasn’t even integrated AI into its own products yet.

The future is bright for many tech stocks, and the rally will broaden out to non-Magnificent 7 stocks.

More granularly, the US will continue to lead by market cap share as artificial intelligence benefits expand beyond a few large tech names that have dominated the market rally over the past year to companies in various industries.

Revenue production and margin improvement will be the critical levers of expansion.

The first will come from the money pouring into AI benefiting companies outside of Big Tech. This plays out as tech companies buy AI chips from the likes of Nvidia (NVDA), and as they need more power, these AI operators are forced to spend with companies in the Utilities (XLU) and Energy (XLE) sectors.

As AI makes companies more efficient and eliminates the simplest work, eventually cutting down costs, US corporates should get a boost to profit margins.

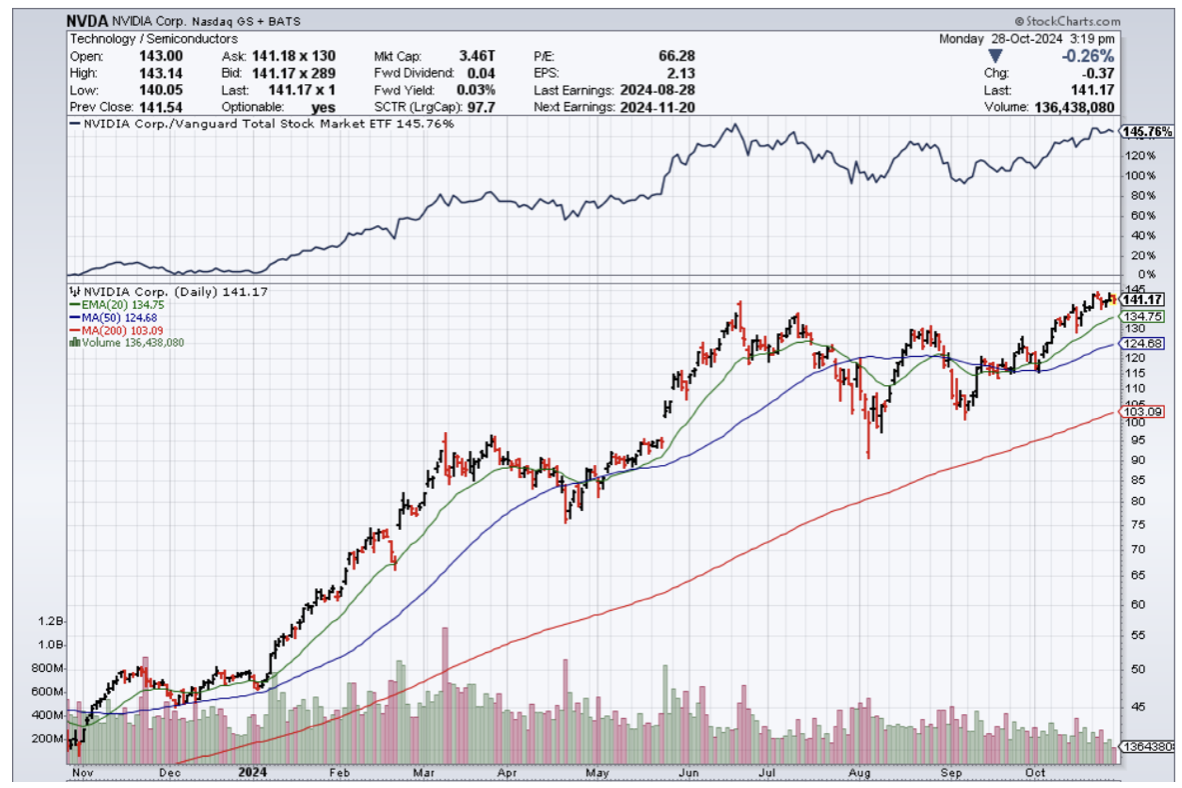

Global equity markets, including retirement allocations to equities, are basically leveraged to Nvidia.

A non-US tech company will rise over the next decade and unseat the large tech companies currently driving the US market share, like Apple (AAPL), Nvidia, Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Meta (META) are almost zero.

When we look at the revenue possibilities and understand that AI will directly cut expenses by creating efficiencies, it’s hard to see tech stocks do anything but go higher in the long term.

Even then, there will be some dips, and they should absolutely be characterized as buying opportunities.

Just look at a 3-month chart of Apple, and each month has presented a dip buying opportunity on August 6th, September 16th, and October 7th.

Apple stock is up 7.5% in the past 3 months.

When everyone complains that tech stocks are too expensive, well, they will get more expensive.

As long as leverage is able to be tapped, institutions will tap it and look for that asymmetric trade to the upside.

Tesla has also proved how hard it is to bet against tech and Elon Musk.

It usually is a terrible idea.

The setup to Tesla’s earnings meant a very low bar, and Musk jumped over it to the tune of a 22% pop in Tesla stock.

Tech is clearly in a secular bull trend, and trying to get artsy to squeeze in a microdip on the short side usually has meant a loss-taking event.

Why even try?

It’s my job to tell readers to bet on tech going to the upside, especially the quality companies that accelerate revenue by harnessing the superpowers of AI.

Global Market Comments

October 17, 2024

Fiat Lux

Featured Trade:

(FRIDAY OCTOBER 25 SALT LAKE CITY UTAH STRATEGY LUNCHEON)

(THIS IS NOT YOUR FATHER’S NUCLEAR POWER PLANT)

(SMR), (MSFT), (GOOGL), (AMZN)

A 35% move-up in one day certainly gets one’s attention. The move was prompted by Microsoft’s (MSFT), Google (GOOGL), and Amazon’s (AMZN) move into the nuclear industry to supply electricity for AI data centers over the past two weeks.

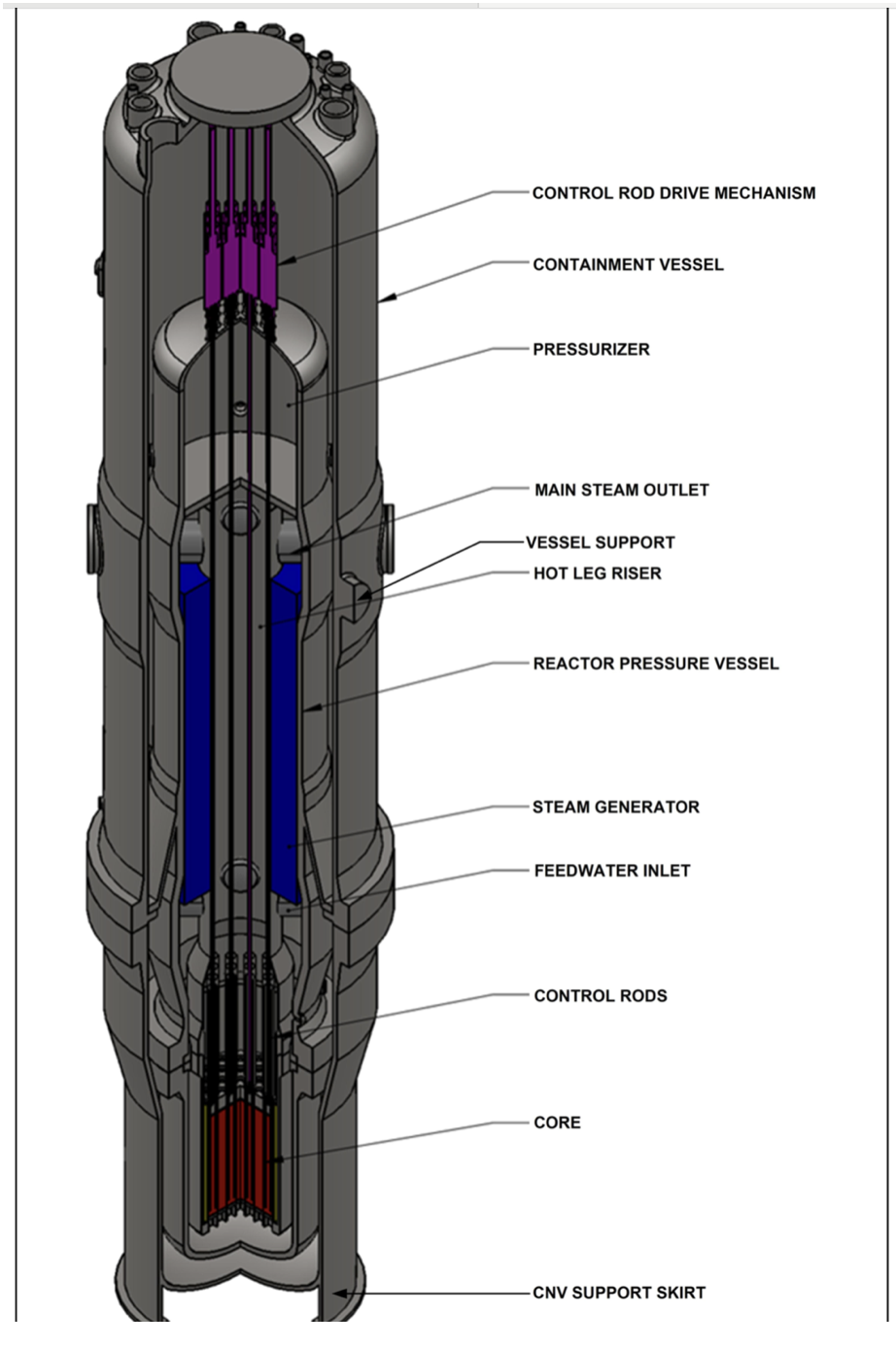

Building on my early career at the Atomic Energy Commission in the 1970’s, I have been covering this company since 2012, and it has been a long and windy road. In one shot, they have solved the dozen problems that held the industry back in the 1950’s.

But thanks to Three Mile Island, Chernobyl, and Fukushima, nuclear had the kiss of death on it, making it impossible for the company to raise capital. The Company finally went public in May 2022 at $10.55 with major backing from Bill Gates, with the ticker symbol of (SMR) for “small modular reactor.”

Then, it rallied 60% when it obtained its first order. It then crashed to $1.80 in 2023 when that single order was canceled. It has doubled since September 1, when the new nuclear movement gained traction.

Nuscale’s design eliminates the risk of a meltdown by refining uranium into small pellets and then encasing them with five layers of zirconium. The heat generated is enough to boil water but not go supercritical. The cost of huge billion-dollar containment structures is eliminated by putting the plants underground.

Below, find my original 2012 research piece.

“On my recent trip to Oregon, I met with venture capital investors in NuScale Power, which is trailblazing the brave new world of “new” nuclear. Their technology has been pioneered by Dr. Jose Reyes, dean of the School of Engineering at Oregon State University in Corvallis.

This is definitely not your father’s nuclear power plant. The company has applied for design certification with the Nuclear Regulatory Commission for a mini-light water reactor with a passive cooling system rated at 45 megawatts. The idea is to site a dozen of these together, which in aggregate can generate 540 Megawatts, little more than half the size of the old 1-gigawatt monsters.

Running a dozen small reactors instead of one big one makes for vastly easier operation and maintenance, as individual units can be brought on and offline as needed. Small size also eliminates the need for gargantuan, expensive containment structures.

This power source runs at night when solar and wind plants are offline. Modular design makes mass production of these units economical. Once certification, approval, permitting, and construction are complete, we can expect to see the NuScale plants running by 2018.

After all, if something similar works in nuclear-powered submarines and aircraft carriers, why not in industrial zones on the outskirts of town? For more on NuScale’s innovative efforts, visit their website by clicking here.”

While the stock has already had a great run from the bottom up tenfold, it's probably not too late to buy. This could be another Nvidia-type situation.

My Old Jeep

Global Market Comments

September 23, 2024

Fiat Lux

Featured Trade:

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE DOCTOR JEKYLL AND MR. HYDE MARKET),

(NVDA), (MSFT), (GLD), (NEM), (TSLA). (CCJ), (DHI), (TLT)

I have to tell you that every year I do this, calling the market gets easier and easier. That’s because when you go from year 62 to 63 in the market, you actually learn quite a lot.

What gets more frustrating every year is convincing people to execute my trades because they are increasingly out of consensus, as opposed to conventional wisdom, tradition-shattering, or downright Mad.

Nuclear stocks? Are you out of your mind? Haven’t you heard of Three Mile Island?

So, the Fed went with 50.

Initially, the stock reaction was “Oh my gosh, the free lunch is bigger than we thought!” By the close, this morphed to “Oh my gosh, the economy must be worse than we thought!” This opens the way to another possible 50 basis point rate cut in November, which happens to be the day after the presidential election. It only took 5 seconds for most investors to realize that they had way too much cash.

By acting so aggressively and out of character, Fed governor Jay Powell is admitting that he blundered, blew it, dropped the ball, and scored an own goal all at once by not lowering interest rates in July.

By doing his best impression of a deer frozen in the headlights in H1, all Powell got us were six more weeks of job losses, taking the headline Unemployment Rate up to 4.2%.

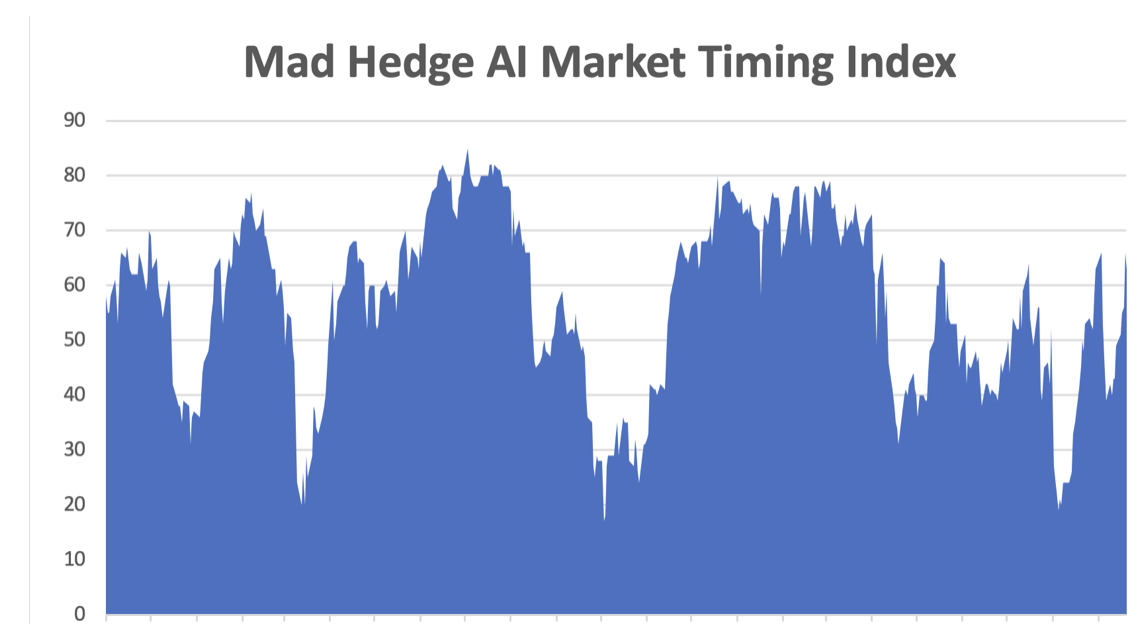

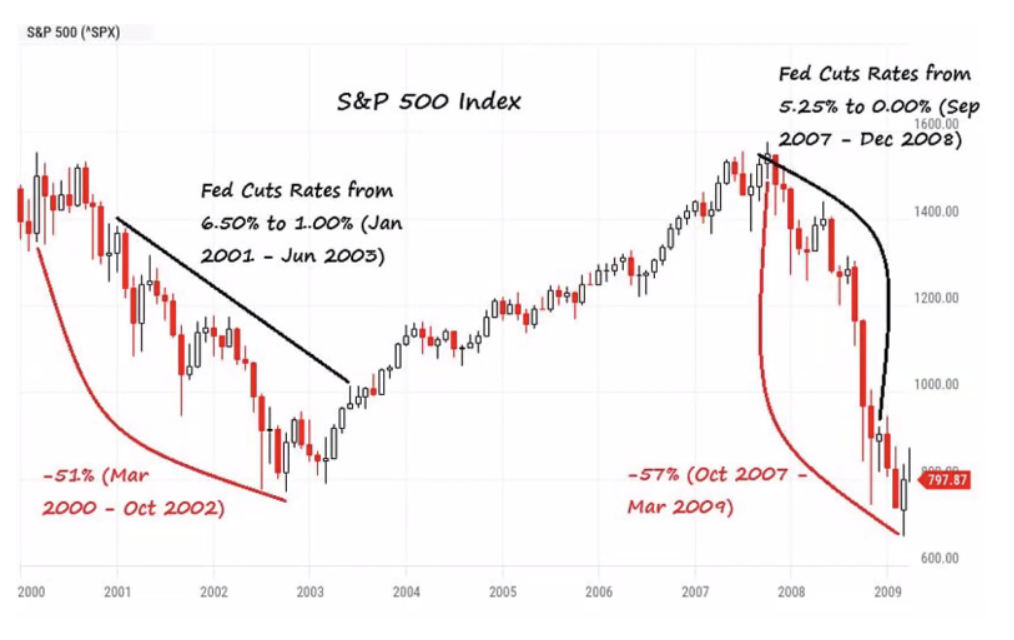

Don’t get too complacent though. Look at the chart below and you will see that when the Fed began an aggressive round of interest rate cuts in 2007, the market launched into a major crash of 57%.

Dow 42,000.

It may seem commonplace and ordinary for mere mortals to see this number. But for those of us who remember when it was only 600 back in 1982 (and predicted to immediately plunge to 300 by the late Joe Granville), we are now in the realm of science fiction.

However, in Q3 this year, the character of the bull market suddenly changed, from a Dr. Jekyll to a Mr. Hyde. The Magnificent Seven has shrunk to the Pitiful Seven, with long boring sideways-range trades. In the meantime, growth and interest rate-sensitive value stocks that I have been pounding the table about for six months have begun trading like red-hot must-own biotech IPOs.

The choice is very simple. Do I buy a stock that has a single-digit price-earnings multiple that is flying like a bat out of hell, or do I choose an incredibly expensive tech stock with a PE multiple of 27X or worse that is stagnating?

I know what I’m going to do with my money, which reached new all-time highs almost every day this month. I’ll go with the former all day long.

Don’t get me wrong. The Mag Seven aren’t going to stay out of favor for very long. It’s like holding a basketball underwater that keeps inflating. Their earnings are still growing at an explosive rate. Personally, I think Nvidia (NVDA) will hit $160 a share by early 2025.

If there is one common factor in all financial markets today, it is the vast underestimation of the potential of AI and the impact on stock prices, which keeps surreptitiously sneaking into our lives every day.

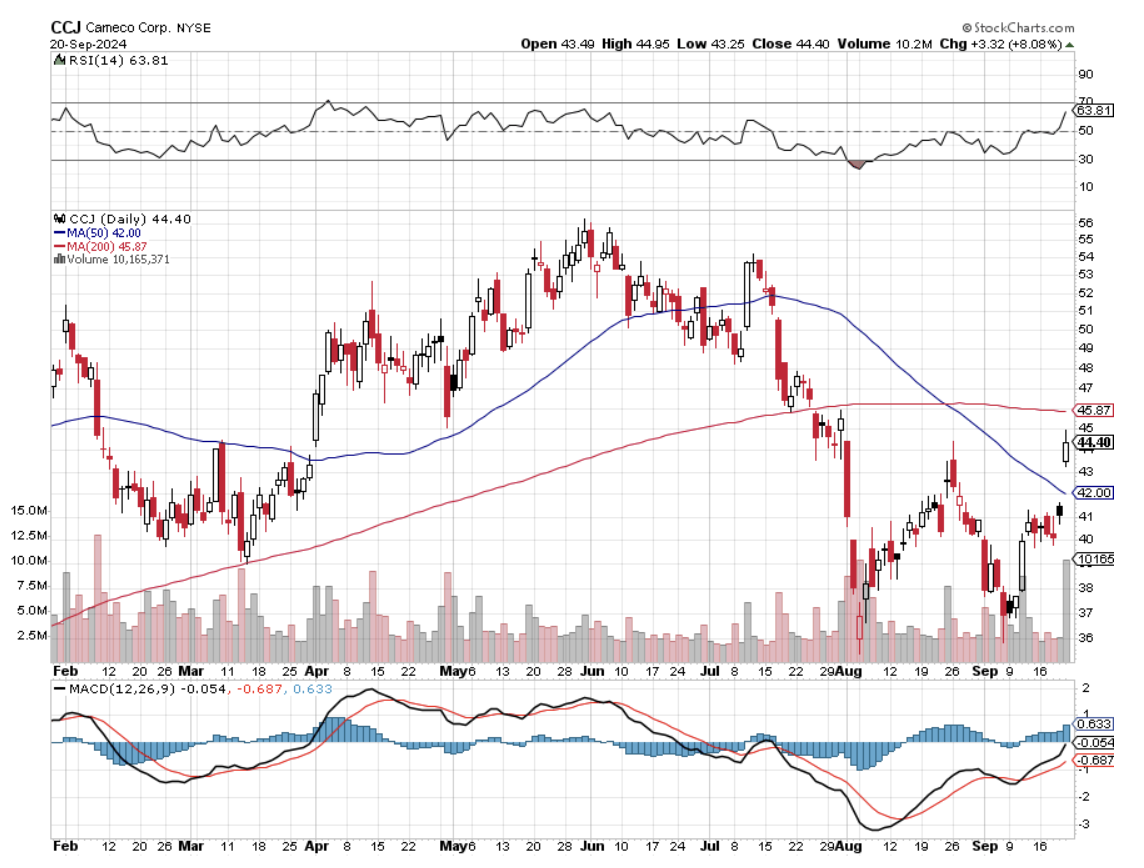

My Cameco (CCJ) trade alert came through in a week, immediately tacking on 10%. I have to tell you that reading my email, there is a lot of demand for positions that rise by 15% in a week. But that is better than the two-week wait for the Concierge clients who bought the 2026 $40-$42 LEAPS for only 75 cents. The consolation is that they will make a lot more money, potentially some 167% by expiration. The big money is always made with long-term trades.

I can honestly say that I put 54 years of work into this trade, dating back to when I started my work at the Atomic Energy Commission Nuclear Test Site in Nevada. While advanced nuclear power plant design and fuels (low enriched uranium oxide with an M5TM zirconium-based cladding) have been around for a long time, the industry had the kiss of death on it thanks to Three Mile Island (watch the movie China Syndrome), Chornobyl, and Fukushima.

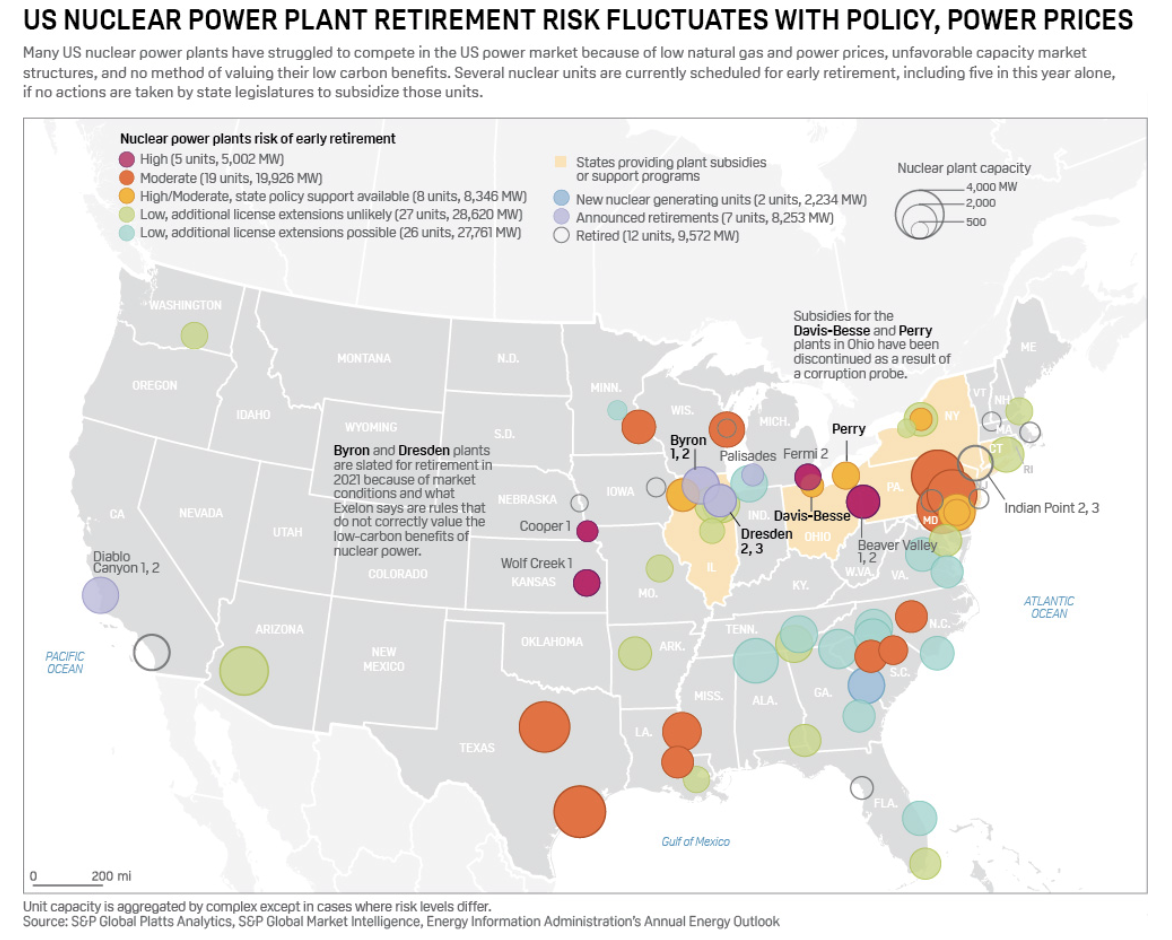

It was going to take someone bold with deep pockets to restart this industry. Then out of the blue Microsoft (MSFT) announced the reopening of Three Mile Island, the site of the worst nuclear accident in US history in 1979.

Constellation Energy announced Friday that its Unit 1 reactor, which closed five years ago, is expected to be revived in 2028, dependent on Nuclear Regulatory Commission approval. Microsoft will purchase the carbon-free energy produced from it to power its data centers to support artificial intelligence.

Twelve U.S. nuclear power reactors have permanently closed since 2012, with the most recent being Indian Point 3 on April 30, 2021. Another seven U.S. reactor retirements have been announced through 2025, with a total generating capacity of 7,109 MW (equal to roughly 7% of U.S. nuclear capacity).

I have a feeling that all of these will get reopened, which cost about $4 billion each to build and can be bought now for pennies on the dollar. In the meantime, the world’s largest uranium supplier, Kazakhstan, is cutting supplies. Buy all nuclear plays in dips.

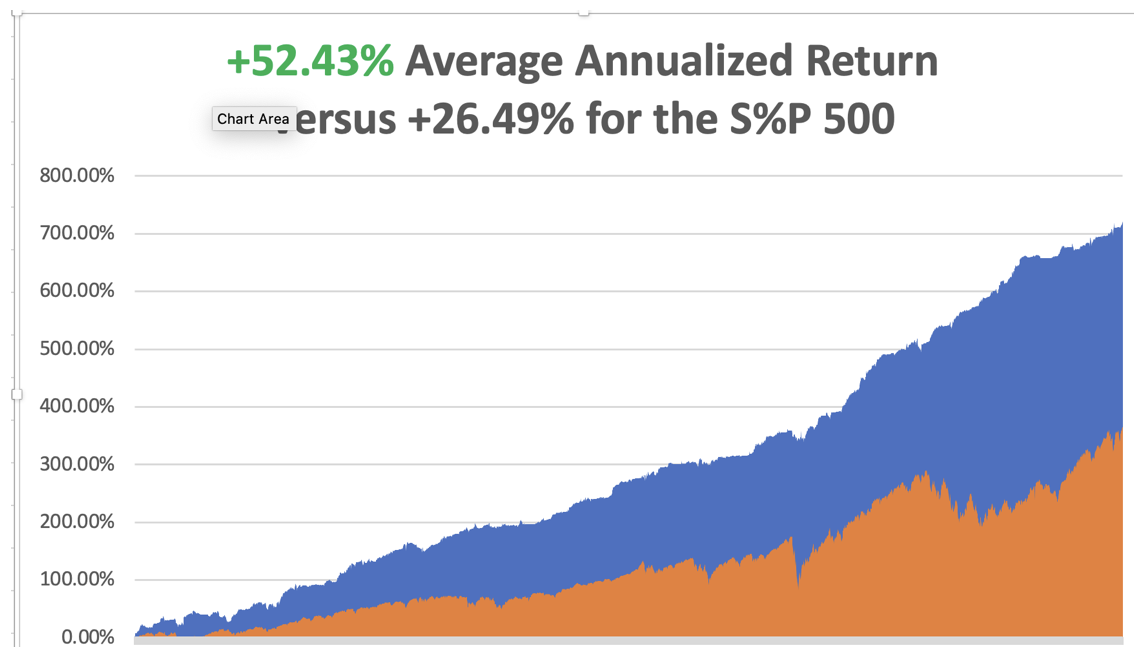

I have to tell you that this was one of those weeks that by making 6.74% it makes all the barbarically early mornings and exhausting late nights worth it. While all my friends are working on their golf swings or improving their bowling scores, I am scoring the Internet search for the next original investment theme. Every customer I have spoken to lately is having a great year.

So far in September, we are up by a spectacular +9.67%. My 2024 year-to-date performance is at +44.36%. The S&P 500 (SPY) is up +19.08% so far in 2024. My trailing one-year return reached +63.00%. That brings my 16-year total return to +720.99%. My average annualized return has recovered to +52.43%.

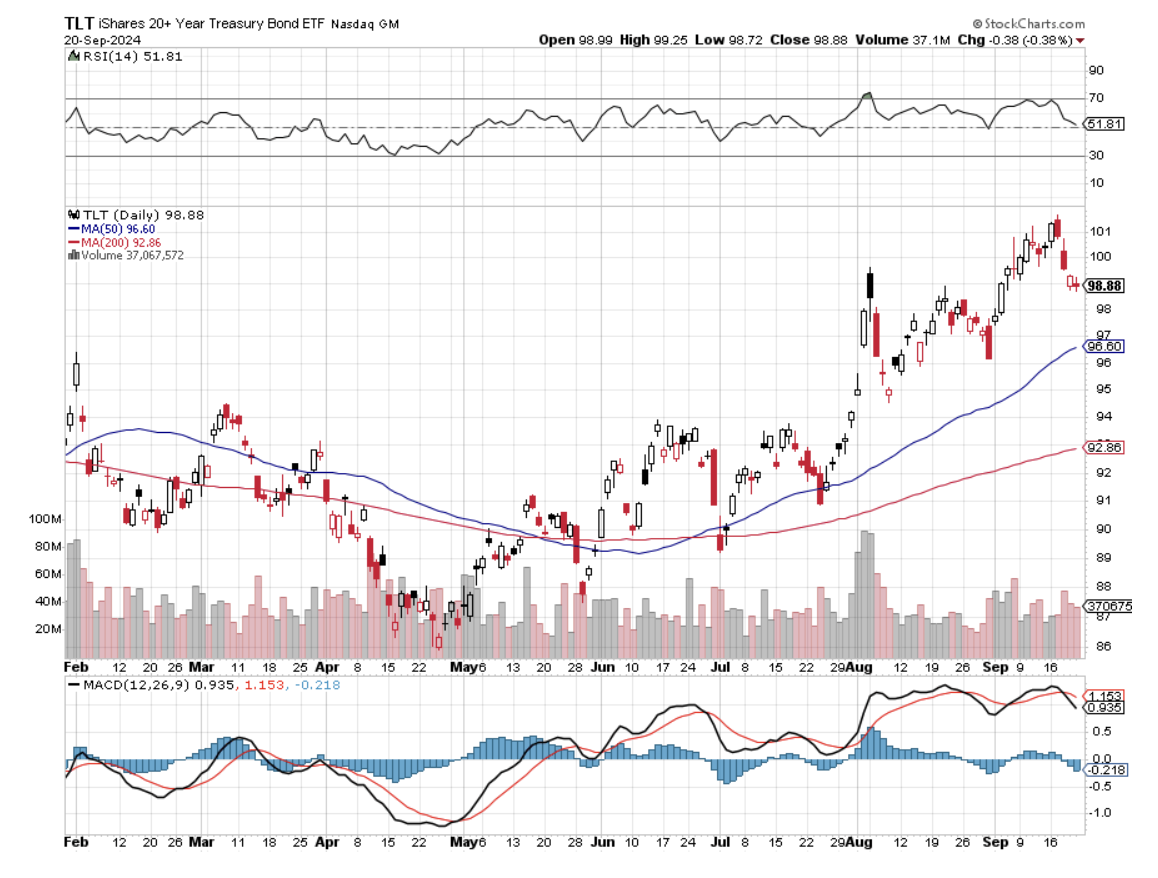

I front-ran the Fed move by adding positions in interest rate sensitives like (GLD), (NEM), and (TSLA). I added (CCJ) based on the arguments above. Once the Fed showed its hand, I added another interest rate sensitives with (DHI). I also added a short in (TLT).

My logic on (TLT) was very simple. I think it is safe to say that we won’t have any downside surprises in interest rates until the next Fed meeting on November 6. We don’t even get a Nonfarm Payroll Report until October 4.

In any case, the bond market has already fully priced in half of the 250 basis points worth of interest rate cuts now discounted by the June Fed futures markets. We have just witnessed a massive $20 rally off the (TLT) bottom. Upside surprises in prices from here should be nil.

If you couldn’t get into (TLT), you are not alone. As soon as the big hedge funds saw my trade alerts, they started hammering not only the options market but the underlying bond market as well with several large $100 million sales. That pushed the trade to near max profit almost immediately and made my trade alert impossible to execute.

At The Economist, they used to say that imitation is the sincerest form of flattery.

Some 63 of my 75 round trips, or 90%, were profitable in 2023. Some 57 of 75 trades have been profitable so far in 2024, and several of those losses were break-even. That is a success rate of +76%.

Try beating that anywhere.

FedEx Gets Crushed 10%, on disappointing earnings and guidance. Cost control is a big issue. Right now, investors are presented with the Dow Industrials at all-time highs and Transports barely positive for the year. Transports are up just 2.7% year to date, and a 13% drop in FedEx shares early Friday will likely drag it into the red for 2024. Buy (FDX) on dips, a great economic recovery play.

Existing Home Sales Drop 4.2%, in August to a seasonally adjusted annualized rate of 3.86 million units, according to the National Association of Realtors. There were 1.35 million units for sale at the end of August. That’s up 0.7% from July and up 22.7% year over year. median price of an existing home sold in August was $416,700, up 3.1% from August 2023, a new all-time high. Real estate should pick up once lower interest rates feed through.

Weekly Jobless Claims Hit 4 Month Low at 219,000. This flies in the face of yesterday’s 50 basis point rate cut by the Fed yesterday based on a weakening jobs market.

Alaska Airlines Takeover of Hawaiian Gets Approval, in a rare case of agreement from the government. The Feds have opposed the most concentration of industry. I think without the deal Hawaiian would have gone under. Expect prices to go and services to decline. Avoid the airlines.

Berkshire Hathaway Cash Approaches $300 Billion. Berkshire ended the second quarter with cash and equivalents (mostly Treasury bills) of $277 billion, up from $168 billion at year-end 2023, mostly due to heavy sales of Apple (AAPL). It highlights how much money is sitting on the sidelines waiting to come in on the next dip. It's also an indication that in the 75 years of Warren Buffet’s investing experience, stocks are expensive.

The Entire Energy Sector is About to Double, once the Chinese economy starts to recover. A recovering US economy powered by lower interest rates will also help. Everything from oil futures to master limited partnerships and stocks are on sale with the highest dividends in the market. It’s almost the only place Warren Buffet is buying.

Amazon Puts AI to Work, using it to plan new delivery routes which saves time and millions of gallons of gasoline. It’s a simple application with vast results. It all goes straight to the bottom line. AI is spreading throughout the economy far faster than most people realize. Buy (AMZN) on dips.

Foreign Direct Investment into China Collapses, down 31.5% in the first eight months of 2024 the Chinese Commerce Ministry said on Saturday. This could be a drag on the recovery of global commodity prices.

US Import Prices are in Free Fall, showing the biggest drop in eight months in August, driven by a broad decline in the costs of goods.

Ebbing price pressures give the Federal Reserve ample room to focus on the labor market which has slowed considerably from last year's robust job growth. Expectations of lower interest rates as well as slowing inflation results are making people feel better about the outlook for the economy.

Foreign Investors Pour $31 Billion into Emerging Markets in August. Fixed income funds ex-China accounted for $27.8 billion of inflows, with $1.4 billion funneled to Chinese debt, the data show. The net inflow to stocks stood at $1.7 billion despite a $1.5 billion outflow from Chinese equities. It’s all about falling US interest rates and a US dollar that is expected to be weak for years.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, September 23 at 8:30 AM EST, the S&P Global Flash PMI

is out

On Tuesday, September 24 at 6:00 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, September 25 at 7:30 AM, New Home Sales are printed.

On Thursday, September 26 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get the final read on Q2 GDP.

On Friday, September 27 at 8:30 AM, we learn the Fed’s favorite inflation indicator, the Core PCE Price Index. At 2:00 PM EST, the 2:00 PM the Baker Hughes Rig Count is printed.

As for me, when the Cold War ended in 1992, the United States judiciously stepped in and bought the collapsing Soviet Union’s entire uranium and plutonium supply.

For good measure, my client George Soros provided a $50 million grant to hire every Soviet nuclear engineer. The fear then was that starving scientists would go to work for Libya, North Korea, or Pakistan, which all had active nuclear programs. They ended up here instead.

That provided the fuel to run all US nuclear power plants and warships for 20 years. That fuel has now run out and chances of a resupply from Russia are zero. The Department of Defense attempted to reopen our last plutonium factory in Amarillo, Texas, a legacy of the Johnson administration.

But the facilities were deemed too old and out of date, and it is cheaper to build a new factory from scratch anyway. What better place to do so than Los Alamos, which has the greatest concentration of nuclear expertise in the world?

Los Alamos is a funny sort of place. It sits at 7,320 feet on a mesa on the edge of an ancient volcano so if things go wrong, they won’t blow up the rest of the state. The homes are mid-century modern built when defense budgets were essentially unlimited. As a prime target in a nuclear war, there are said to be miles of secret underground tunnels hacked out of solid rock.

You need to bring a Geiger counter to garage sales because sometimes interesting items are work castaways. A friend almost bought a cool coffee table which turned out to be part of an old cyclotron. And for a town designing the instruments to bring on the possible end of the world, it seems to have an abnormal number of churches. They’re everywhere.

I have hundreds of stories from the old nuclear days passed down from those who worked for J. Robert Oppenheimer and General Leslie Groves, who ran the Manhattan Project in the early 1940s. They were young mathematicians, physicists, and engineers at the time, in their 20’s and 30’s, who later became my university professors. The A-bomb was the most important event of their lives.

Unfortunately, I couldn’t relay this precious unwritten history to anyone without a security clearance. So, it stayed buried with me for a half century, until now.

Some 1,200 engineers will be hired for the first phase of the new plutonium plant, which I got a chance to see. That will create challenges for a town of 13,000 where existing housing shortages already force interns and graduate students to live in tents. It gets cold at night and dropped to 13 degrees F when I was there.

I was allowed to visit the Trinity site at the White Sands Missile Test Range, the first visitor to do so in many years. This is where the first atomic bomb was exploded on July 16, 1945. The 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Enormous targets hundreds of yards away were thrown about like toys (they are still there). Half the scientists thought the bomb might ignite the atmosphere and destroy the world but they went ahead anyway because so much money had been spent, 3% of US GDP for four years. Of the original 100-foot tower, only a tiny stump of concrete is left (picture below).

With the other visitors, there was a carnival atmosphere as people worked so hard to get there. My Army escort never left me out of their sight. Some 78 years after the explosion, the background radiation was ten times normal, so I couldn’t stay more than an hour.

Needless to say, that makes uranium plays like Cameco (CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) great long-term plays, as prices will almost certainly rise and all of which look cheap. US government demand for uranium and yellow cake, its commercial byproduct, is going to be huge. Uranium is also being touted as a carbon-free energy source needed to replace oil.

At Ground Zero in 1945

What’s Left of a Trinity Target 200 Yards Out

Playing With My Geiger Counter

Atomic Bomb No.3 Which was Never Used in Tokyo

What’s Left from the Original Test

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

September 4, 2024

Fiat Lux

Featured Trade:

(FEDS KNOCK THE WIND OUT OF TECH)

(AI), (NVDA), (MSFT), (META)

The U.S. Federal government just took the air out of the tech market rally in the short term.

Good thing the market usually has a short memory.

Mr. Market did not expect the US Justice Department to barge in and subpoena Nvidia (NVDA).

Nvidia is the gem of the tech industry and the leader of the cutting-edge generative artificial intelligence sub-sector.

To take out Nvidia and destroy it, the tech market would be valued at significantly less than it is today.

Not to mention we are just 2 months away from the U.S. election, this sounds and feels like a bold political move behind the scenes.

Why not wait until after the election?

As it stands, the timing is pretty terrible for tech stocks as the amount of catalysts to take us to new highs has disappeared.

The past earnings seasons were nothing stellar and many tech companies sold off on poor forward guidance.

It is no joke that we have been waiting for over 4 years for the recession that still hasn’t come.

However, it seriously looks like we won’t be able to kick the can down the road anymore and the job market is starting to fall apart to the point where we will need rate cuts.

The DOJ believes Nvidia is too dominant and appears to look like a monopoly and the government is inching closer to filing a formal complaint.

Antitrust officials are concerned that Nvidia is making it harder to switch to other suppliers and penalizes buyers that don’t exclusively use its artificial intelligence chips.

Nvidia has drawn regulatory scrutiny since becoming the world’s most valuable chipmaker and a key beneficiary of the AI spending boom. Sales have been more than doubling each quarter.

Regulators also are digging into whether Nvidia gives preferential supply and pricing to customers who use its technology exclusively or buy its complete systems.

Nvidia Chief Executive Officer Jensen Huang said he prioritizes customers who can make use of his products in ready-to-go data centers as soon as he provides them, a policy designed to prevent stockpiling and speed up the broader adoption of AI.

Microsoft (MSFT) and Meta (META) spend more than 40% of their budget on hardware on the chipmaker’s gear. During the peak of shortages of Nvidia’s H100 accelerator, individual components were retailing for as much as $90,000 each.

There also are broader regulatory questions about Nvidia’s practices. Access to AI capabilities has become a key focus for governments around the world, with the technology becoming increasingly vital to economic strength and national security.

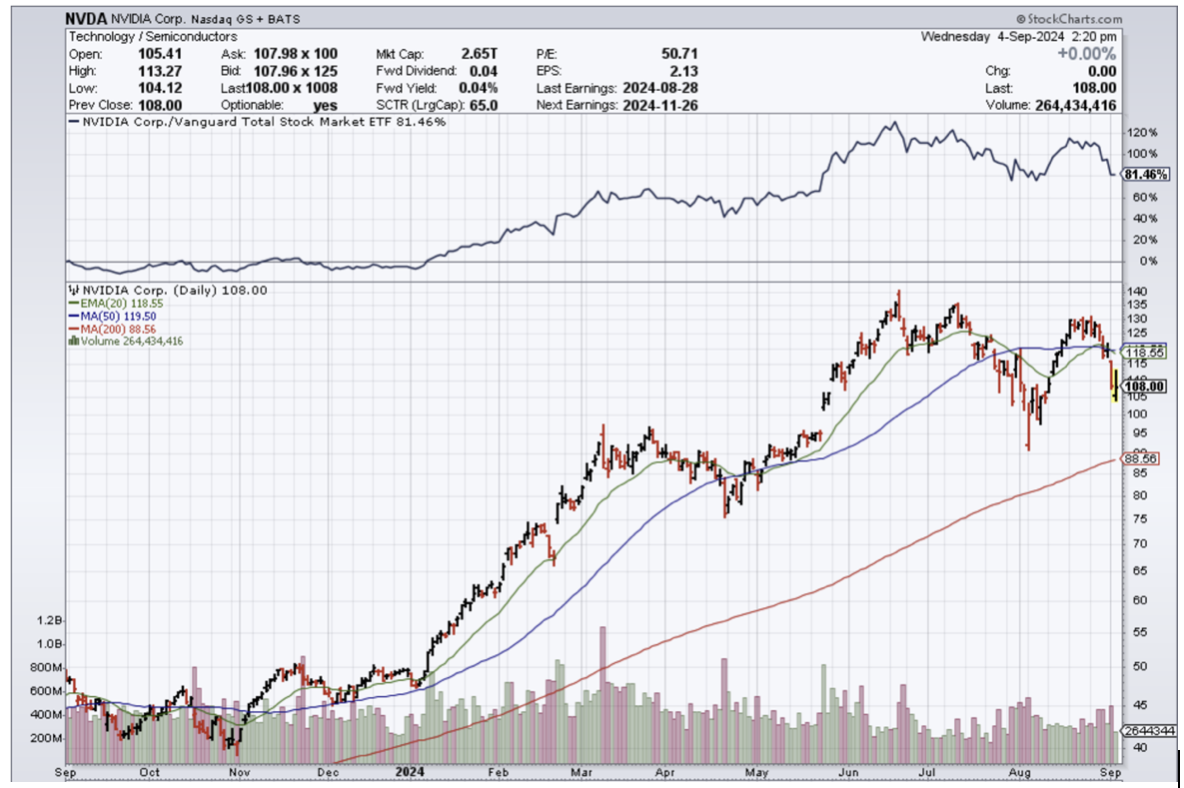

If NVDA shares drop to anything close to the $100 level, I do believe that is a great entry point to add to shares.

Much of the bad news has been priced in and at the end of the day, even if NVDA is broken up, it will happen 10 years later.

As for the larger tech story, September could be a weak month for tech stocks and it is a seasonably slow month.

However, the infrastructure build for AI data centers relentlessly continues, and from my channel checks, I see tech firms increasing their purchases of Nvidia AI chips.

This bodes well for the future and explains why sales keep doubling and doubling like it never ends.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.