Below please find subscribers’ Q&A for the Mad Hedge Fund Trader December 12 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader

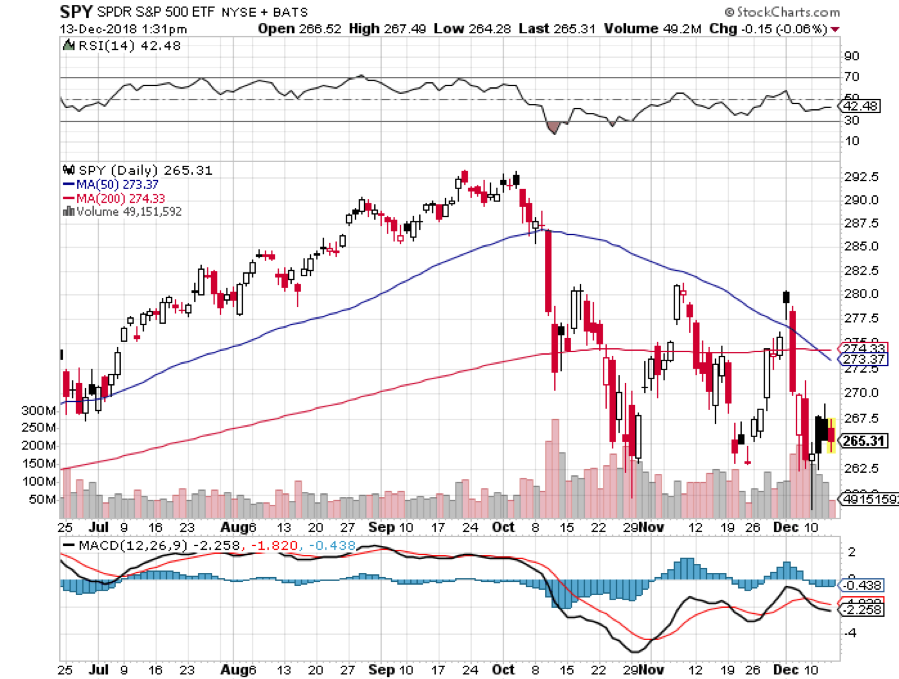

Q: Is the bottom in on the S&P 500 (SPX) or are we going to go on another retest?

A: It’s stuck right in the 2600-2800 range, and I think that’s probably where we bounce off of 2600 again. The question is whether or not we can clear the top of the range at 2800. If we can’t, I would fully expect a retest of this bottom in which case I could see it going down to 2500.

Q: You say you’ll go 100% cash by Dec 21st but also stated that the S&P 500 will go up 5% by the year's end. Should we stay in until we get the up 5% move?

A: Yes, all of our options positions expire by the 21st but if you’re just long in stocks, I would stay long, probably through the end of the year.

Q: Will the Chinese-U.S. dispute ruin the Tech industry?

A: No, I think the Trump Administration will have to do some kind of deal and call it a victory, otherwise the trade war will pull the U.S. into recession. If we go into the next presidential election with another recession—well, no one has ever survived that. Even with the China-U.S. dispute, the U.S. is still dominant in the Tech industry and will continue to do so for decades to come.

Q: China has managed to duplicate Micron Technology’s (MU) biggest selling chip, undercutting prices—thoughts?

A: True, Micron is the lowest value added of the major chip producers, therefore their stock has gotten hit the worst of any of the chip stocks down by about 46%, but I know Micron very well and they have a whole range of chips they’re currently upgrading, moving themselves up the value change to compete with this. So, that makes it a great company to own for the long term.

Q: I’m up 90% on my PayPal (PYPL) position—should I take a profit?

A: Yes! Absolutely! How many 90% profits have you had lately? You are hereby excused from this webinar to go execute this trade. And well-done Dr. Denis! And thank you for the offer of a free colonoscopy.

Q: What can you say about Spotify (SPOT)?

A: No, thank you—there’s lots of competition in the music streaming business. We are avoiding the entire space. The added value is not great, and many of these companies will have a short life. And with China’s Tencent growing like crazy, life for Spotify is about to become dull, mean, and brutish.

Q: What’s your view on currencies?

A: So you’re looking to make another fortune? Yes, I think the Euro (FXE) and the Yen (FXY) really are looking hard to rally, and the trigger could be dovish language in the next Fed meeting. Once the Fed slows its rate of interest rates rises, the currencies should take off like a scalded chimp.

Q: Will the banks (XLF) rally in the next 6 months for a better sell?

A: Many people are waiting for a rally in the banks so they can unload them and haven’t gotten it—they’re back to pre-election price levels. The issue here is structural, and you don’t get recoveries from major structural changes in an industry. It’s significant that this is the first bull market that had no net new employment in the banks whatsoever; the business is fading away. They are the new buggy whip makers. These gigantic national branch networks will all be gone in ten years because the banks can’t afford them.

Q: Would you enter the Microsoft (MSFT) trade today?

A: I actually think I would; Microsoft only pulled back 10% when everything else was dropping 30%, 40%, or 50%. That shows you how many people are trying to get into this name so if you could take a little short-term pain (like 5%), the stock outright is probably a screaming buy here. I think it’ll go to $200 one day, so here at $110-$111 it looks like a pretty good deal. The story here is that Microsoft is rapidly taking market share from Amazon (AMZN) in the cloud business and that’s going to continue.

Q: When will you be updating your long-term model portfolio?

A: I usually do it at the end of the year, and rarely make any big changes. I’ll still be selling short bonds and still like Tesla (TSLA) and Exxon (XOM).

Q: I just joined your service. What is the best way to get started?

A: I’ll give you the same advice that I gave every starting trader at Morgan Stanley (MS). Start trading on paper only. When you are making money reliably on paper, move up to using real money, but only with one contract per position. When that is successful, slowly increase your size to 2, 3, 5, 10, and 20 contracts. Pretty soon, you will be swinging around 1,000 contracts a lot like I do. The further you move down the learning curve the greater you can increase your size and your risk. If you never get past the paper stage at least it’s not costing you any money.

I hope this helps.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader