What a difference a vacation makes!

When I boarded the Queen Mary II in early July, big technology stocks (AAPL), (TSLA), (NVDA), (GOOGL) were on fire and knew no bounds, while bonds (TLT) were holding steady at a 3.40% yield. Energy stocks (OXY) were scraping the bottom.

One month later and big tech is in free fall while energy, commodities, and precious metals have taken over the lead. Bonds are probing for new lows at a 4.20% yield and may have another $5.00 of downside.

The Great Rotation of 2023 has begun!

The only question is how long it will last.

I happen to believe that we are into a traditional summer correction that could last until the usual September or October bottom. That is when I will be picking up long-term bull LEAPS with both hands. After that, it’s off to the races once again to new all-time highs once again.

Except that this time, everything will go up, both big tech, the domestics recovery plays, and bonds. That’s because they will be discounting the next great market mover, several successive cuts in interest rates by the Federal Reserve certain to take place in 2024.

We all know that markets discount market-moving developments six to nine months in advance. That means you should start buying about….September or October.

Perhaps the best question asked at my many strategy luncheons this summer came from a dear old friend in London. “Where is all the money coming from to pay for all this”? The answer is, well complicated. I’ll give you a list”

1) All of the Quantitative Easing money created since 2008, some $10 trillion worth, is still around. It is just sleeping in 90-day T-bills.

2) With inflation basically over, thanks to hyper-accelerating technology and collapsing energy prices, the case for the Fed to stop raising and start cutting interest rates is clear.

3) Falling interest rates trigger a collapse in the US dollar.

4) Earnings at big tech companies explode, which earn about half of their revenues from abroad.

5) The falling interest rate sectors are also set alike. These include energy, commodities, precious metals, and bonds.

6) A cheap greenback pours gasoline on the economy.

7) The $1 trillion in stimulus approved last year provides the match as most of it has yet to be spent.

8) China finally recovers and turbocharges all of the above trends.

9) 2024 is a presidential election year and the economy always seems to do mysteriously well going into such events.

10) All we are left to do is sit back and watch all our positions go up, figure out how we are going to spend all that money, and sing the praises of the Mad Hedge Fund Trader.

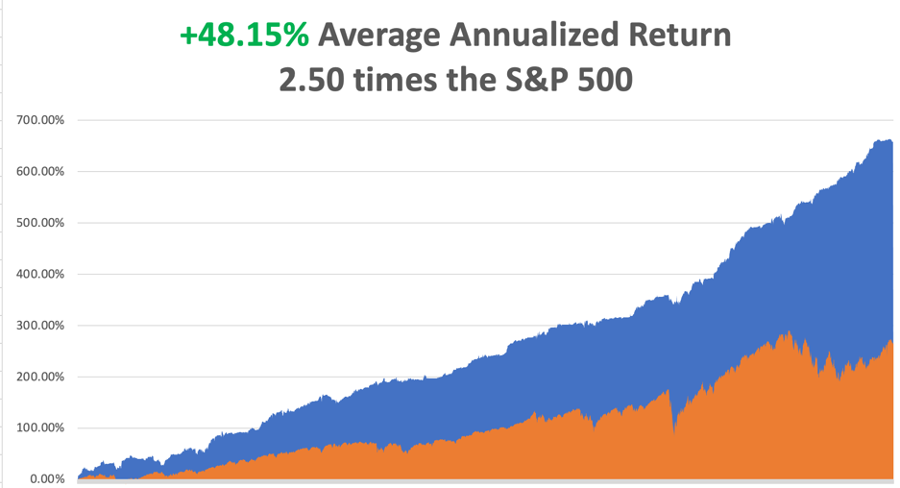

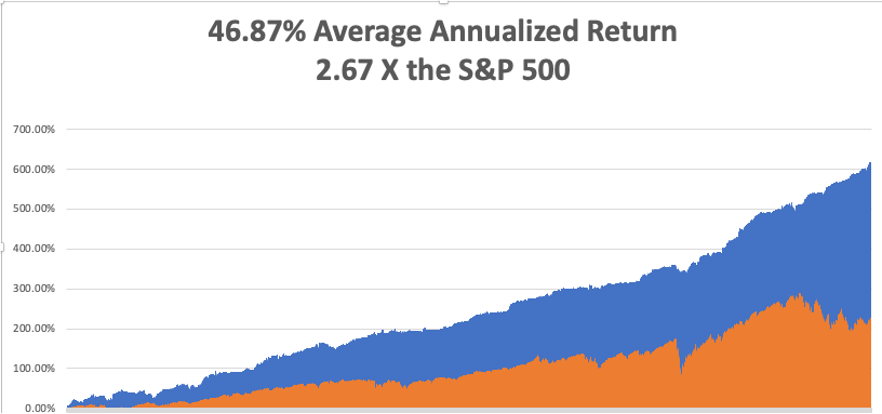

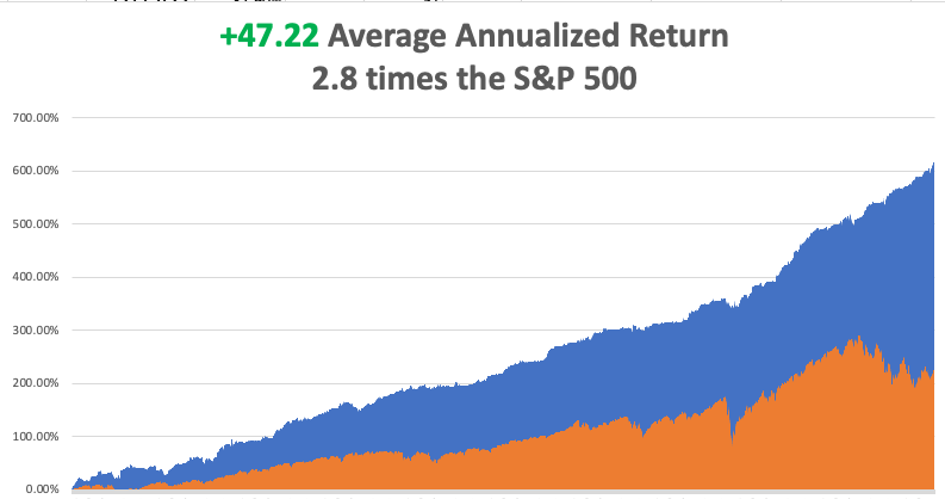

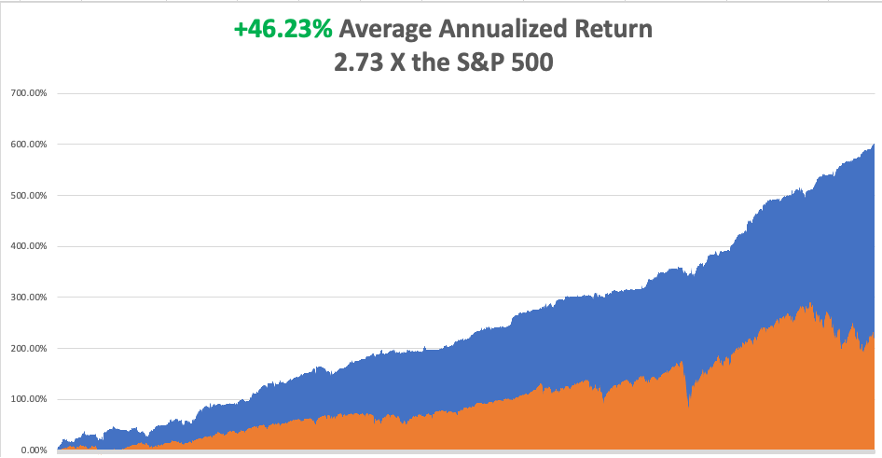

So far in August, we are down -4.70%. My 2023 year-to-date performance is still at an eye-popping +60.80%. The S&P 500 (SPY) is up +17.10% so far in 2023. My trailing one-year return reached +92.45% versus +8.45% for the S&P 500.

That brings my 15-year total return to +657.99%. My average annualized return has fallen back to +48.15%, some 2.50 times the S&P 500 over the same period.

Some 41 of my 46 trades this year have been profitable.

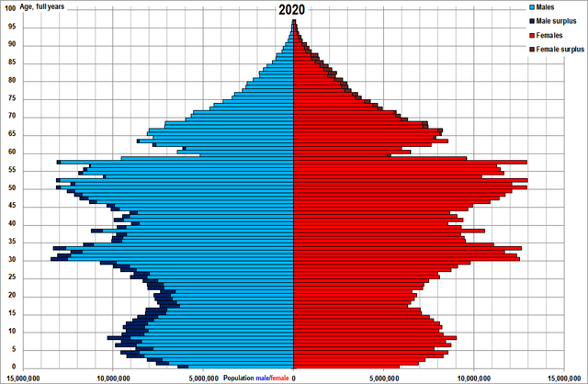

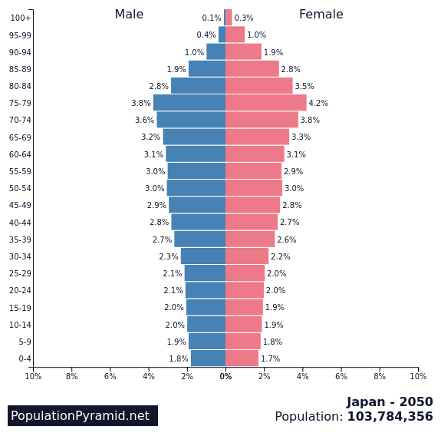

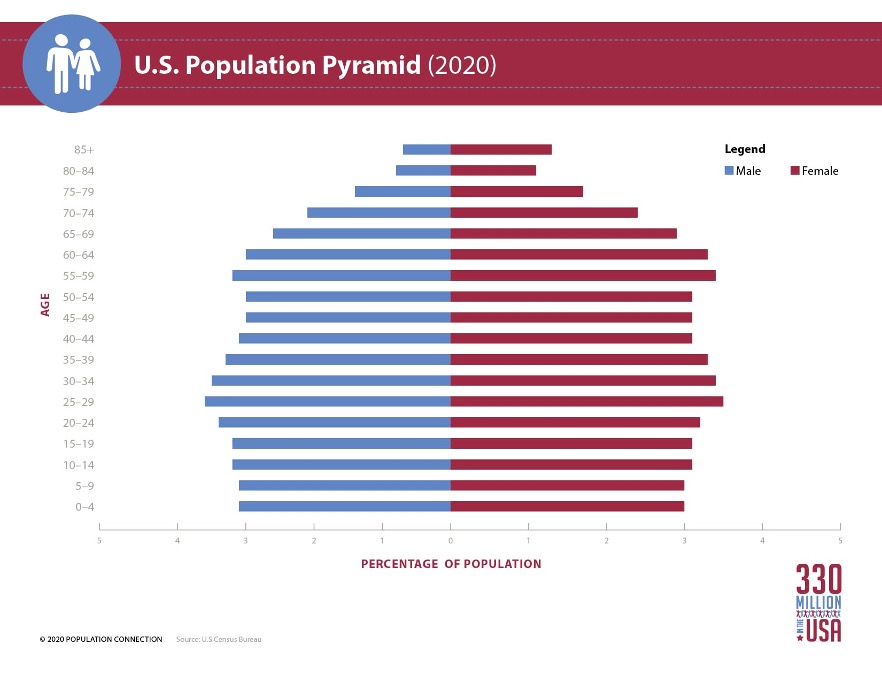

The Nonfarm Payroll drops to 187,000 in July, a one-year low, less than expectations. The Headline Unemployment Rate returned to 3.5%, a 50-year low. The soft-landing scenario lives! That’s supposed to be impossible in the face of 5.25% interest rates. Average hourly earnings grew at a restrained 3.6% annual rate. Half of the new jobs were in health care. At the rate we are aging, that is no surprise.

Rating Agencies Strike Again, with Moody’s threatened downgrade of a dozen regional banks. Stocks took it up on the nose giving up Monday’s 400-point gain. Higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate are among strains prompting the review, Moody’s said late Monday. The summer correction is finally here.

Berkshire Hathaway Post Record Profit, with profits up 38% and interest and other investment income growing sixfold as Warren Buffet’s trading vehicle goes from strength to strength to strength. Sky-high interest rates enabled its Geico insurance holding to really coin it this time. Buffet turns 93 this month. Keep buying (BRK/B) on dips. Our LEAPS are looking great, up 327% in 11 months.

Rivian Beats, losing only $1.08 a share versus an expected $1.41. The stock jumped 3% on the news. The gross profit per vehicle showed a dramatic improvement at $35,000. The production forecast edged up from 50,000 to 52,000 vehicles for 2023. Momentum is clearly improving making our LEAPS look better by the day. Buy (RIVN) on dips as the next (TSLA).

Deflation Hits China, as the post-Covid recovery continues to lag. Their Consumer Price Index fell 0.3% YOY. Imports and exports are falling dramatically as trade sanctions bite. Youth unemployment hit a new high as 11.6 million new college grads hit the market. Global commodities could get hit but so far the stocks aren’t seeing it. Avoid anything Chinese (FXI), even the food.

Inflation Jumps, 0.2% in July and 3.2% YOY. Rents, education, and insurance (climate change) were higher while used cars were down 1.3% and airfares plunged by 8.1%. Stocks rallied on the small increase preferring to focus on the smallest back-to-back increase in two years. Bonds (TLT) rallied big. The big question is what will the Fed do with this?

Weekly Jobless Claims came in at a strong 278,000, showing the Fed’s high-interest rate policy is having an effect on the jobs market. Stocks want to know how much longer it will last.

Natural Gas Soars to a new high and accomplished an upside breakout on all charts. European gas prices have just jumped 40%. An Australian strike shut down an LNG export facility. Energy traders are looking for higher highs. My (UNG) LEAPS, a Mad Hedge AI pick, are looking great, doubling off our cost in two months.

Biden Cracks Down on Technology Investment in China, especially on our most advanced tech which can be used in weapons development. Tech investment in the Middle Kingdom is already down 70% over the last two years. No point in selling China the rope with which to hang us.

Home Mortgage Rates Hit a 22-Year High, at 7.08%. But the existing home market is heating up and the new home market is absolutely on fire in anticipating of a coming rate fall. You can’t beat a gale-force demographic tailwind.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, August 14 at 8:00 AM EST, the US Consumer Inflation Expectations are out,

On Tuesday, August 15 at 8:30 AM, US Retail Sales are released.

On Wednesday, August 16 at 2:30 PM, the US Building Permits are published.

On Thursday, August 17 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, August 18 at 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, occasionally, I tell close friends that I hitchhiked across the Sahara Desert alone when I was 16 and I am met with looks that are amazed, befuddled, and disbelieving, but I actually did it in the summer of 1968.

I had spent two months hitchhiking from a hospital in Sweden all the way to my ancestral roots in Monreale, Sicily, the home of my Italian grandfather. My next goal was to visit my Uncle Charles who was stationed at the Torreon Air Force base outside of Madrid, Spain.

I looked at my Michelin map of the Mediterranean and quickly realized that it would be much quicker to cut across North Africa than hitching all the way back up the length of Italy, cutting across the Cote d’Azur, where no one ever picked up hitchhikers, then all the way down to Madrid, where the people were too poor to own cars.

So one fine morning found me taking deck passage on a ferry from Palermo to Tunis. From here on, my memory is hazy and I remember only a few flashbacks.

Ever the historian, even at age 16, I made straight for the Carthaginian ruins where the Romans allegedly salted the earth to prevent any recovery of a country they had just wasted. Some 2,000 years later it, worked as there was nothing left but an endless sea of scattered rocks.

At night, I laid out my sleeping bag to catch some shut-eye. But at 2:00 AM, someone tried to bash my head in with a rock. I scared them off but haven’t had a decent night of sleep since.

The next day, I made for the spectacular Roman ruins at Leptus Magna on the Libyan coast. But Muamar Khadafi pulled off a coup d’état earlier and closed the border to all Americans. My visa obtained in Rome from King Idris was useless.

I used to opportunity to hitchhike over Kasserine Pass into Algeria, where my uncle served under General Patton in WWII. US forces suffered an ignominious defeat until General Patton took over the army 1n 1943. Some 25 years later, the scenery was still littered with blown-up tanks, destroyed trucks, and crashed Messerschmitts.

Approaching the coastal road, I started jumping trains headed west. While officially the Algerian Civil War ended in 1962, in fact, it was still going on in 1968. We passed derailed trains and smashed bridges. The cattle were starving. There was no food anywhere.

At night, Arab families invited me to stay over in their mud brick homes as I always traveled with a big American Flag on my pack. Their hospitality was endless, and they shared what little food they had.

As a train pulled into Algiers, a conductor caught me without a ticket. So, the railway police arrested me and on arrival took me to the central Algiers prison, not a very nice place. After the police left, the head of the prison took me to a back door, opened it, smiled, and said “si vou plais”. That was all the French I ever needed to know. I quickly disappeared into the Algiers souk.

As we approached the Moroccan border, I saw trains of camels 1,000 animals long, rhythmically swaying back and forth with their cargoes of spices from central Africa. These don’t exist anymore, replaced by modern trucks.

Out in the middle of nowhere, bullets started flying through the passenger cars splintering wood. I poked my Kodak Instamatic out the window in between volleys of shots and snapped a few pictures.

The train juddered to a halt and robbers boarded. They shook down the passengers, seizing whatever silver jewelry and bolts of cloth they could find.

When they came to me, they just laughed and moved on. As a ragged backpacker, I had nothing of interest for them.

The train ended up in Marrakesh on the edge of the Sahara and the final destination of the camel trains. It was like visiting the Arabian Nights. The main Jemaa el-Fna square was amazing, with masses of crafts for sale, magicians, snake charmers, and men breathing fire.

Next stop was Tangiers, site of the oldest foreign American embassy, which is now open to tourists. For 50 cents a night, you could sleep on a rooftop under the stars and pass the pipe with fellow travelers which contained something called hashish.

One more ferry ride and I was at the British naval base at the Rock of Gibraltar and then on a train for Madrid. I made it to the Torreon base main gate where a very surprised master sergeant picked up a half-starved, rail-thin, filthy nephew and took me home. Later, Uncle Charles said I slept for three days straight. Since I had lice, Charles shaved my head when I was asleep. I fit right in with the other airmen.

I woke up with a fever, so Charles took me the base clinic. They never figured out what I had. Maybe it was exhaustion, maybe it was prolonged starvation. Perhaps it was something African. Possibly, it was all one long dream.

Afterwards, my uncle took for to the base commissary where I enjoyed my first cheeseburger, French fries, and chocolate shake in many months. It was the best meal of my life and the only cure I really needed.

I have pictures of all this which are sitting in a box somewhere in my basement. The Michelin map sits in a giant case of old, used maps that I have been collecting for 60 years.

Mediterranean in 1968

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader