Global Market Comments

June 7, 2022

Fiat Lux

Featured Trade:

(THE SECOND AMERICAN INDUSTRIAL REVOLUTION),

(INDU), (SPY), (QQQ), (GLD), (DBA),

(TSLA), (GOOGL), (XLK), (IBB), (XLE)

Global Market Comments

June 7, 2022

Fiat Lux

Featured Trade:

(THE SECOND AMERICAN INDUSTRIAL REVOLUTION),

(INDU), (SPY), (QQQ), (GLD), (DBA),

(TSLA), (GOOGL), (XLK), (IBB), (XLE)

Global Market Comments

May 20, 2022

Fiat Lux

Featured Trade:

(MAY 18 BIWEEKLY STRATEGY WEBINAR Q&A),

(C), (FXI), (BABA), (TSLA), (AAPL), (AMZN), (TGT), (FLR), (QQQ),

(FB), (ARKK), (TSLA), (WYNN), (UAL), (ALK), (DAL)

Below please find subscribers’ Q&A for the May 18 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: When do you see the banks returning to glory?

A: When recession fears go away, which should happen this summer. A recession will either have come and gone, or we will have confirmation by the end of summer that there is no recession in sight for the next few years at least. This will likely trigger a monster rally in the banks, which could all jump 50% from here. Obviously, Warren Buffet is putting his money where his mouth is by loading up on Citibank (C) yesterday. This would take us to new all-time highs by the end of the year. So, again, use these down-1000-point days to go cherry-picking among the generals who have been executed. If that’s not mixing metaphors, I don’t know what is!

Q: Should I listen to CNBC?

A: No, do not listen to the talking heads on TV. They are on TV because they don’t know how to make money. If they did know how to make money, they’d be locked up in a dark basement somewhere like me, grinding out millions for their firms. In fact, watching TV is the perfect money destruction machine because on down days, they bring out the uber bears, and on up days they bring up the hyper bulls. They are trying to egg you to get you to do the exact opposite of what you should be doing. They’re not interested in you making money; they’re interested in getting traffic on their websites and making money for themselves. CNBC can be highly dangerous to your financial health.

Q: Will we get stagflation?

A: No, because I think that once the year-on-year comparisons kick in—literally in a month or two—inflation will drop from the current 8.3% to down maybe 4% by the end of the year. That also is another factor in your monster second-half rally.

Q: Do you think the bounce in the market yesterday is the beginning of an upward trend or a dead cat bounce?

A: Definitely a dead cat bounce. I expect we’ll keep chopping around in the current range for the next 3, 4, and 5 months, and then we catapult into a monster year-end rally. That is a typical bottoming-type process.

Q: Is the wisdom “Go away in May” still alive or is your best bet that this year may prove different and the market goes up in the latter part of the year?

A: Actually, you should have gone away in November. That’s when all tech stocks peaked; only energy went up after that. If you’d gone away in November and said “come back in August” that would have been a good strategy because I think that’s when the year-end rally begins. If anything, May could be the bottom of the entire move.

Q: Is it time for LEAPS (Long Term Equity Anticipation Securities)?

A: Not yet—it’s too soon for LEAPS territory. You only want to do LEAPS when you are on a sustained long-term uptrend in a stock. We are nowhere near sustained anything, we are still in a bottoming phase, and could be there for months. At the end of those months is when we’ll be looking at LEAPS, where you can double your money every 6 months.

Q: Is it time to start nibbling on China stocks (FXI) now that COVID news is marginally better?

A: I’m going to avoid Chinese stocks because the American ones are so much better. You want to buy the quality at the discount, not the marginal, high-risk political footballs at a discount. And China will remain high-risk as long as they are abandoning capitalism. If you have to buy one Chinese stock, I would say Alibaba (BABA); you could get a double on that. But remember it is a high-risk trade—if the Chinese government wants to roll Jack Ma up in a carpet and kidnap him to Western Chinese re-education camp, the stock will get slaughtered. And that’s been happening increasingly with the heads of major companies in the Middle Kingdom.

Q: When this current route comes to an end, should we look to enter the market with 50% margin on stocks like Tesla (TSLA)?

A: It’s never sensible to go to 50% margin because if the stocks drop 50%, you are completely wiped out—you’ve lost everything. Plus, coming back from a loss is one thing; coming back from zero is impossible. So, I would not recommend that. You might do a safe stock like Apple (APPL), with a 2% dividend, and then at least you’re getting a double dividend. You only do the 50% margin on the safest, high dividend stocks.

Q: Amazon (AMZN) is on its way down. What is your expectation for the $3200/$3400 vertical bull call spread in January 2023?

A: I think you could make money on that. It may not be the full amount of the spread, but you’ll definitely get a big increase from current levels, because when we do get a second half rally, it will be tech-led, and Amazon has already had a horrific decline. What you might consider is rolling your strike down, taking the loss on the 3200/3400 and rolling down to like a $2,000/$2,200 in twice the size, and you’ll make your money back that way.

Q: For those of us thinking about LEAPS, how should we start to buy in—20, 30, 50% right now?

A: Well, first of all, you only do them on down days like today, when the market is down 800, and you scale in. 20% now, 20% higher or lower, and 20% again higher or lower. But you really want to be saving cash for days like this because You want to feel smarter than everybody else, and they absolutely will hit any bid on a down day, and that's where your LEAPS fills are really excellent, is on a down day like this.

Q: Can the Fed avoid another policy mistake? Because it seems that not only are they heading for high inflation, but layoffs are coming as well, and even with that I’m sure they will perform a soft landing of sorts.

A: For sure, when you take massive amounts of stimulus out of the economy, as we have in the last year, that is recessionary. In fact, the US government is close to running a balance budget right now because Biden can’t get anything through Congress other than money for Ukraine. Good for Ukraine economy, not for ours. And yes, they can do a soft landing, but has it ever been done before? No. Though this is the Fed that just keeps on surprising, so who knows. In the meantime, I'm willing to trade the ranges, and that may be all you get to do for a while.

Q: Target (TGT) shares are down 25%, as they cited higher costs that will result in rising prices for their customers. Would you buy the dip?

A: No, I generally don’t like retailers anyway. It’s a business that operates on a 2% profit margin. I like 40 or 50% profit margin businesses—those tend to be technology stocks.

Q: Would you buy retailers going into a recession?

A: No, that’s the worst thing in the world to own.

Q: Could Fluor Corp (FLR) be a Ukraine infrastructure stock?

A: Yes, once the war ends there will be a massive effort to rebuild Ukraine. Every company in the world will be involved, and Fluor and Bechtel will be the biggest, though Fluor is the only one where you can buy the stock. We already have the money to do this with all of the money that was seized from Russia. I predict discount sales on mega yachts.

Q: Why do you think all that money is going to Ukraine?

A: Because a weakened Russia is in the national interest of the United States, and it’s better that their soldiers are doing the dying than ours. I’ve done the latter and definitely prefer the former, using the other country's’soldiers as cannon fodder.

Q: On down days like today, should I be putting on one-month trades like the June options?

A: Yes, because the minimizes your risk and cuts the cost of mistakes. Waiting for the second half of the year when we get a prolonged uptrend to look at LEAPS—that is the correct way to do it.

Q: Over the next 12 months, do you think the S&P 500 will outperform Nasdaq?

A: No—for the next 3 months the S&P 500 will outperform NASDAQ. After that, NASDAQ will become an enormous outperformer for the rest of the decade. So, choose your entry points wisely.

Q: Do you think that housing is peaking out and will start to decline?

A: No, we still have a long-term structural shortage of 10 million homes in the US and I think we will flatline housing for years until we catch up with that shortfall.

Q: What are your thoughts on the Metaverse?

A: Too soon. Right now, the Metaverse involves spending only—no revenues. It could be years before you actually see any profits. So that’s why I'm avoiding Meta or Facebook (FB). But then, you could have made the same argument about the internet 25 years ago and semiconductors 50 years ago. If you waited long enough, however, you obviously made a fortune.

Q: China is hoarding 69% of their wheat reserves. Is this because they plan to invade Taiwan?

A: No, it’s because there’s a global food crisis going on. Many countries, like India, have banned exports of food to protect themselves. People miss this about China: China will never have a war or invade anybody, because the second they do, their food supplies get cut off by us, who are the world’s largest producer of food. Plus, their trade would get shut off to pay for it, so they can’t buy it from somewhere else, and that’s done with us also. So, they need to be in our good graces in order to eat. That's the bottom line and that’s why Taiwan will never get invaded. Russia’s economy can operate independently for a while, but China’s can’t.

Q: Is the baby food shortage further evidence of a food crisis?

A: No, the baby formula crisis is being caused by a monopoly of three companies that control 100% of the baby food market; and the largest of these companies, accounting for a 40% market share of the baby food making, is producing baby food that is poisonous. That's why they got shut down. This has been going on for years, and for some reason, they got a free pass on regulation and inspections by the previous administration, which is ending now, and all of a sudden we’re finding out that 40% of the country’s baby food is contaminated and is being pulled off the market. So, it really has nothing to do with the global food crisis. That’s more related to Climate change—surprise, surprise—as it’s not raining in the right places like California, the war in Ukraine, which removed 13% of the world’s calories practically overnight.

Q: Should I bet the farm here with the ARK Innovation Fund (ARKK)? I like Cathie Woods’ bet on innovation or five-year time horizon. It’s a great thing, don’t you think?

A: Not so great when you drop 70% in the last year. And it is a high-risk bet that of her ten largest holding companies, you only need one of them to work for the fund to bring in a decent return. Of course, you may have to write off nine other companies to do that. But yes, it’s a great thing to own on the way up, not so great on the way down. I know some people who started scaling into ARK in November and came to regret it. I would wait on it—this is your highest leverage technology play, and if you really want some punishment, there’s a hedge fund that’s bringing out a 2X long ARK fund in the next couple of months. Then it’s basically option money you’re throwing out. If you want to put some money in that, you could get a 10x on the 2x ETF if you’re playing a recovery in ARK. So watch it; don’t touch it now because ARK is having another heart attack today, but something to consider if you like gambling.

Q: I am full up with a thousand shares of PayPal (PYPL). It’s now down 76%. What should I do?

A: I recommend you learn the art of stop losses. I stopped out of this thing last fall, and it’s continued to go down virtually every day. Whenever you buy a new position, automatically enter into your spreadsheet your stop loss for that position. Because things can drop by 80 or 90% and you work too hard for your money to throw it away on these big losses.

Q: What do you think about Steve Wynn and Wynn Hotels?

A: I’d be buying down here down 62%; it was announced today that Steve Wynn has secretly been acting as an agent for the Chinese government where (WYNN) has a major part of its operations. Who knew? With all those high rollers being flown in on private jets from China, sitting at the tables in the closed rooms. So yes, this is a recovery play and it will do just as well as all other recovery plays, but remember it’s a China recovery play. And I think, in any case, his ex-wife owns a big part of the company anyway. So I don’t think Steve Wynn is that closely connected with Wynn hotels because of past transgressions with the female staff.

Q: Is it time to scale into Freeport-McMoRan (FCX)?

A: I’d say yes. On a longer-term view, I expect (FCX) to go to $100. And for those who have the May $32/$35 call spread that expires on Friday, my bet is that you get the max profit—but you may not sleep before then.

Q: What do you have to say about a post-Putin scenario and impact on the market?

A: The day Putin dies of a heart attack, you can count on the market being up 10%, if that happens right now—less if it happens at a later date. But it would be hugely bullish for the entire global stock market, and oil would also collapse, which is why I refuse to put on oil plays here. That is a risk. Putin can give up, have an accident, or get overthrown. When the Russian people see their standard of living decline by 90%, this is a country that has a long history of revolutions, putting their leaders in front of firing squads and throwing the bodies down wells. So, if I were Putin, I wouldn't be sleeping very well right now.

Q: What's the reason for air tickets (UAL), (ALK), (DAL) going up sharply?

A: 1. Shortage of airplanes 2. Soaring fuel costs 3. Labor shortages and strikes 4. It is all proof of an economy that is definitely NOT going into recession.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

With Lieutenant Uhuru

Global Market Comments

March 25, 2022

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(MARCH 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (TSLA), (BA), (DEER), (CAT),

(AAPL), (SLV), (FCX), (TLT), (TBT)

Below please find subscribers’ Q&A for the March 23 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: What is the best way to keep your money in cash?

A: That’s quite a complicated answer. If you leave cash in your brokerage account, they will give you nothing. If you move it to your bank account they will, again, give you nothing. But, if you keep the money in your brokerage account and then buy 2-year US Treasury bills, those are yielding 2.2% right now, and will probably be yielding over 3% in two years, so we’re actually being paid for cash for the first time in over ten years. And, as long as it’s in your brokerage account, you can then sell those Treasury bonds when you’re ready to go back into the market and buy your stock, same day, without having to perform any complicated wire transfers, which take a week to clear. Also, if your broker goes bankrupt and you hold Treasury bills, they are required by law to give you the Treasury bills. If you have your cash in a brokerage cash account, you lose all of it or at least the part above the SIPC-insured $250,000 per account. And believe me, I learned that the hard way when Bearings went bankrupt in the 1990s. People who had the Bearings securities lost everything, people who owned Treasury bills got their cashback in weeks.

Q: Is the pain over for growth stocks?

A: Probably yes, for the smaller ones; but they may flatline for a long time until a real earnings story returns for them. As for the banks, I think the pain is over and now it’s a question of just when we can get back in.

Q: Why did you initiate shorts on the Invesco QQQ Trust Series (QQQ) and SPDR S&P 500 ETF Trust (SPY) this week, instead of continuing with the iShares 20 Plus Year Treasury Bond ETF (TLT) shorts?

A: We are down 27 points in 10 weeks on the (TLT); that is the most in history. And every other country in the world is seeing the same thing. That is not shorting territory—you should have been shorting above $150 in the (TLT) when I was falling down on my knees and begging you to do so. Now it’s too late. If we get a 5-point rally, which we could get any time, that’s another story. It is so oversold that a bounce of some sort is inevitable. I’d rather be in cash going into that.

Q: Do you think Tesla (TSLA) has put in a bottom, or do you still see more downside? Is it time to buy?

A: The time to buy is not when it is up 50% in 3 weeks, which it has just done. The time to buy is when I sent out the last trade alert to buy it at $700. This was a complete layup as a long three weeks ago because I knew the German production was coming onstream very shortly; and that opens up a whole new continent, right when energy prices are going through the roof—the best-case scenario for Tesla. And the same is happening in the US—it’s a one-year wait now to get a new Model X in the US. In fact, I can sell my existing model X for the same price I paid for it 3 years ago, if I were happy to wait another year to get a replacement car.

Q: Will the Boeing (BA) crash in China damage the short-term prospects? And as a pilot, what do you think actually happened?

A: Boeing has been beat-up for so long that a mere crash in one of its safest planes isn’t going to do much. It could have been a maintenance issue in China, but the fact that there was no “mayday” call means only two or three possibilities. One is a bomb, which would explain there being no mayday call—the pilots were already dead when it went into freefall. Number two would be a complete structural failure, which is hard to believe because I’ve been flying Boeings my entire life, and these things are made out of steel girders—you can’t break them. And number three is a pilot suicide—there have been a couple of those over the years. The Malaysia flight that disappeared over the south Indian Ocean was almost certainly a pilot suicide, and there was another one in Germany and another in Japan about 20 years ago. So, if they come up with no answer, that's the answer. It’s not a Boeing issue, whatever it is.

Q: Is John Deer (DEER) or Caterpillar (CAT) a better trade right now?

A: It’s kind of six of one, half a dozen of the other. Caterpillar I’ve been following for 50 years, so I’m kind of partial to CAT, and Caterpillar has a much bigger international presence, but that could be a negative these days in a deglobalizing world.

Q: Apple (AAPL) has really caught fire past $170. Should I chase it here or wait until it’s too overbought?

A: I never liked chasing. Even a small dip, like we’re having today, is worth getting into. So always buy on the dips.

Q: Is Silver (SLV) still a good long-term play?

A: Yes, because we do expect EV production to ramp up as fast as they can possibly do it. Too bad the American companies don’t know how to make electric cars—they just haven’t been able to get their volumes up because of production problems that Tesla solved 12 years ago. So, long term, I think it will do better, but right now the risk-on move is definitely negative for the precious metals.

Q: How low will the iShares 20 Plus Year Treasury Bond ETF (TLT) go in April before the next Fed meeting?

A: I think we’re bottoming for the short term right around here. That’s why I had on that $127-$130 call spread in the (TLT) that I got stopped out of. And I may well end up being right, but with these call spreads, once you break your upper strike, the math goes against you dramatically. You go from like a 1-1 risk profile to like a 10-1 against you. So, you have to get out of those things when you break your upper strike, otherwise, you risk writing off the entire position with 100% loss. As long as Jay Powell keeps talking about successive half-point rate cuts, we will get lower lows, and my 2023 target for the TLT is $105, or about $20.00 points below here.

Q: Do you think we retest the bottoms?

A: Absolutely, yes; it just depends on where the test is successful—with a double bottom or with a retrace of half the recent moves. Keep in mind that stocks go up 80% of the time over the last 120 years, and that includes the Great Depression when they hardly went up at all for 10 years, so selling short is a professional’s game, and I wouldn’t attempt it unless you had somebody like me helping you. You're betting against the long-term trend with every short position. That said, if you’re quick you can make decent money. Most of the money we’ve made this year has been in short positions, both in stocks and in bonds.

Q: Where can we find this webinar?

A: The recording for this webinar will be posted on the website in about two hours. Just log into your account and you’ll find them all listed.

Q: When should I sell my tradable ProShares UltraShort 20+ Year Treasury ETF (TBT)?

A: You don’t have an options expiration to worry about, so I would just keep in until we hit $105 in the (TLT). If you do want to trade, I’d take a little bit off here and then try to re-buy it a couple of points lower, maybe 10% lower.

Q: What do you think of a Freeport McMoRan (FCX) $55-$60 vertical bull call spread?

A: The market has had such a massive move, that I’m reluctant to do out of the money call spreads from here unless we get a major dip. So, don’t reach for the marginal trade—that’s where you get your head handed to you.

Q: Will yield curve inversions matter this time and foretell a recession?

A: I think no, because corporate earnings are still growing, and by the summer, we probably will have a yield curve inversion.

Q: There seems to be some huge breakthrough in battery technology where batteries could be recharged within four minutes. I believe it’s the Chinese who have the tech, if so how will that impact on Tesla?

A: Every day of the year someone presents Tesla with a revolutionary new battery technology. It either doesn’t work, can’t be mass-produced, or is wildly uneconomical. So, I’ll confine my bet that Tesla will be able to eventually mass produce solid state batteries and get their 95% cost reduction that way.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

March 7, 2022

Fiat Lux

Featured Trade:

(SHORT TERM PAIN FOR SILICON VALLEY TECH)

(NFLX), (QQQ), (EPAM), (SNAP), (TDOC), (ARKK)

The American tech sector has largely been overshadowed by the events across the world.

Many would question why that would even matter.

What does that even have to do with an American smartphone or devices that permeate our society?

We deal with American tech stocks for this newsletter, and not with moral outrage or foreign policy matters.

So we stay in our lane and deal with various exogenous stocks that come our way as it relates to the Nasdaq (QQQ).

I don’t get to pick these shocks – they come in fits and starts and in different sizes.

The end of omicron was almost to the point of visualization, but we roll into yet another macro crisis of many groups’ makings.

Tech doesn’t operate in a vacuum, and politics, more often than I would like to admit, sometimes do overlap a great deal.

The world has changed dramatically in the past 14 days and the knock-on effects mean that American tech companies and their trillion dollars business models are pulling out of Russia, a country with a population close to 150 million, in droves.

It is what it is, and life moves on.

Netflix (NFLX) has been in operation in Russia since 2016 and the decision to vacate Russian business means they will lose around 1 million subscribers.

Most likely the worst tech company to work for right now in the world must be EPAM Systems (EPAM).

The internal chaos going on mainly stems from the 58,000 employees, with 14,000 of them in Ukraine and more than 18,000 staff in Belarus and Russia, according to company filings with the U.S. Securities and Exchange Commission.

EPAM’s stock is down 74% YTD in 2022 and is a stock that epitomizes the situation in Eastern Europe right now.

When workers refuse to work with each other, it’s hard to imagine that much gets done at all.

And this is just the tip of the iceberg.

The American tech withdrawals encompass all shapes and sizes.

Apple and Microsoft both said no bueno to selling products in Russia.

Game maker EA pulled the plug as well.

Google and Twitter have suspended advertising in Russia.

It’s a terrible time to monetize a YouTube channel in Russia because Google won’t pay you for it.

Likewise, Snap (SNAP) has pulled its marketing dollars from Russia too.

Another sonic boom hit Russian tech when Airbnb room-rental service suspended all operations in Russia and Belarus and has said its nonprofit subsidiary will offer free temporary housing to 100,000 Ukrainian refugees.

It's also waived host and guest fees for bookings in Ukraine, as people worldwide use Airbnb as a way to provide income directly to Ukrainians.

Adobe is halting sales of new Adobe products and services in Russia. In addition to making sure its products and services are not being used by sanctioned entities, Adobe is also cutting Russian government-controlled media outlets off from its cloud services.

What is emerging as quite black and white is that American technology companies hoping to apply their business model in autocratic states doesn’t integrate as well as first thought.

The weak rule of law along with all-powerful demagogue leaders make it hard to sustain any sort of business carve-out for the long term.

Eventually, many American companies are forced to abandon their ambitions in these marginal states.

The next question a tech investor must ask is will the American tech sector follow the lead from Russia and pull out from China.

Obviously, this has major implications for companies like Apple, Micron, and a handful of American tech companies that are entrenched in the Chinese economy and society.

Many people think this will blow over and tech will come back front and center, but short-term, this is highly negative for American tech stocks.

The more this situation drags out, the higher risk American tech is more involved in this mess from a different gateway.

The tech portfolio has been outright short recently and it was the perfect call to sell the dead cat bounce in growth tech like Teladoc (TDOC) and ARKK funds (ARKK).

Global Market Comments

March 4, 2022

Fiat Lux

Featured Trade:

(MARCH 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (TSLA), (FCX), (JPM), (BAC), (MS), (TLT),

(TBT),(BA), UPS (UPS), (CAT), (DIS), (DAL),

(GOLD), (VIX), (VXX), (CAT), (BA)

Below please find subscribers’ Q&A for the March 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: Do you think Vladimir Putin will give up?

A: He will either be forced to give up, run out of resources/money, or he will suddenly have an accident. When the people see their standard of living go from a per capita income of $10,000/year today to $1,000—back to where it was during the old Soviet Union—his lifespan will suddenly become very limited.

Q: Would you be buying Invesco Trusts (QQQs) on dips?

A: I think we have a few more horrible days—sudden $500- or $1,000-point declines—but we’re putting in a bottom of sorts here. It may take a month or two to finalize, but the second buying opportunity of the decade is setting up; of course, the other one was two years ago at the pandemic low. So, do your research, make your stock picks now, and once we get another absolute blow-up to the downside, that is your time to go in.

Q: Materials have gone up astronomically, are they still a buy?

A: Yes, on dips. I wouldn't chase 10% or 20% one-week moves up here—there are too many other better trades to do.

Q: Is it time to go long aggressively in Europe?

A: No, because Europe is going to experience a far greater impact economically than the US, which will have virtually none. In fact, all the impacts on the US are positive except for higher energy prices. So, I think Europe will have a much longer recovery in the stock market than the US.

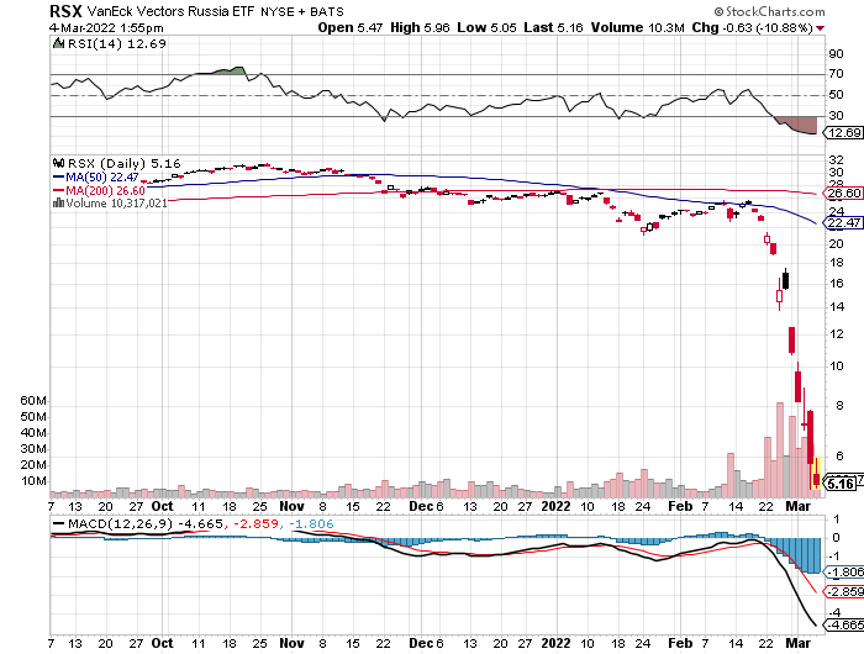

Q: Would you take a flier on a Russian ETF (RSX)?

A: No, most, if not all, of them are about to be delisted because they have been banned or the liquidity has completely disappeared. The (RSX) has just collapsed 85%, from $26 to $4. Virtually all of Russia is for sale, not only stocks, bonds, junk bonds, ETFs, but also joint ventures. ExxonMobil, Shell and BP are all dumping their ownership of Russian subsidiaries as we speak.

Q: Time for a Freeport-McMoRan (FCX) LEAP?

A: No, November was the time for an (FCX) LEAP—we’ve already had a massive run now, up 66% in five months, so wait for the next dip. The next LEAPS are probably going to be in technology stocks in a few months.

Q: My iShares 20 Plus Year Treasury Bond ETF (TLT) call $130 was assigned, What should I do?

A: Call your broker immediately and tell them to exercise your 127 to cover your short in the 130. They usually charge a few extra fees on that because they can get away with it, but you’ve just made the maximum profit on the position. If you haven’t been exercised yet, that 127/130 call spread will expire at max profit in 10 days.

Q: What if I get my short side called away on a position?

A: Use your long side calls to execute immediately to cover your short side. These call spreads are perfectly hedged positions, same name, same maturity, same size, just different strike prices. If your broker doesn’t hear from you at all, they will just exercise the short call and leave you long the long call, and that can lead to a margin call. So the second you get one of these calls, contact your broker immediately and get out of the position.

Q: Is it safe to put 100% of your money in Tesla (TSLA) for the long term?

A: Only if you can handle a 50% loss of your money at any time. Most people can't. It’s better to wait for Tesla to drop 50%, which it has almost done (it’s gotten down to $700), and then put in a large position. But you never bet all your money on one position under any circumstances. For example, what if Elon Musk died? What would Tesla’s stock do then? It would easily drop by half. So, I’ll leave the “bet the ranch trades” for the younger crowd, because they’re young enough to lose all their money, start all over again, and still earn enough for retirement. As for me, that is not the case, so I will pass on that trade. You should pas too.

Q: Do you foresee NASDAQ (QQQ) being up 5-10% or 10-20% by year-end?

A: I do actually, because business is booming across tech land, and the money-making stocks are hardly going down and will just rocket once the rotation goes back into that sector.

Q: We could see an awful earnings sequence in April, which could put in the final bottom on this whole move.

A: That is right. We need one more good capitulation to get a final bottom in, and then we’re in LEAP territory on probably much of the market. We know we’re having a weak quarter from all the anecdotal data; those companies will produce weak earnings and the year-on-year comparisons are going to be terrible. A lot of companies will probably show down turns in earnings or losses for the quarter, that's all the stuff good bottoms are made out of.

Q: What should we make of the Russian threats of WWIII going Nuclear?

A: I think if Putin gave the order, the generals would ignore it and refuse to fire, because they know it would mean suicide for the entire country. Mutual Assured Destruction (MAD) is still in place, and it still works. And by the way, it hasn’t been in the media, but I happen to know that American nuclear submarines with their massive salvos of MIRVed missiles, have moved much closer to Russian waters. So, you're looking at a war that would be over in 15 minutes. I think that would also be another scenario in which they replace Putin: if he gives such an order. This has actually happened in the past; people without top secret clearance don’t know this but Boris Yeltsen actually gave an order to launch nuclear missiles in the early 90s when he got mad at the US about something. The generals ignored it, because he was drunk. And something else you may not know is that 95% of the Russian nuclear missiles don’t work—they don’t have the GDP to maintain 7,000 nuclear weapons at full readiness. Plutonium is one of the world’s most corrosive substances and very expensive to maintain. Only a wealthy country like the US could maintain that many weapons because it’s so expensive. So no, you don’t need to dig bomb shelters yet, I think this stays conventional.

Q: Banks like (JPM), (BAC), AND (MS) are at a low—are they a buy?

A: Yes, but not yet; wait for more shocks to the system, more panic selling, and then the banks are absolutely going to be a screaming buy because they are on a long-term trend on interest rates, strong economy, lowering defaults—all the reasons we’ve been buying them for the last year.

Q: Should I short bonds or should I buy Freeport up 60%?

A: Short bonds. Next.

Q: Should I buy Europe or should I short bonds?

A: Short bonds. That should be your benchmark for any trade you’re considering right now.

Q: How much and how quickly will we see a collapse in defense stocks?

A: Well, you may not see a collapse in defense stocks, because even if Russia withdraws from Ukraine, they still are a newly heightened threat to the West, and these increases in defense spending are permanent. That’s why the stocks have gone absolutely ballistic. Yeah sure, you may give up some of these monster gains we’ve had in the last week, but this is a dip-buying sector now after being ignored for a long time. So yes, even if Russia gives up, the world is going to be spending a lot more on defense, probably for the rest of our lives.

Q: Just to confirm, LEAP candidates are Boeing (BA), UPS (UPS), Caterpillar (CAT), Disney (DIS), Delta Airlines (DAL)?

A: I would say yes. You may want to hold off, see if there’s one more meltdown to go; or you can buy half now and half on either the next meltdown or the melt-up and get yourself a good average position. And when I say LEAPS, I mean going out at least a year on a call spread in options on all of these things.

Q: Is $143 short safe on the (TLT)?

A: Definitely, probably. In these conditions, you have to allow for one day, out of the blue, supers pikes of $3 like we got last week, or $5 trins week, only to be reversed the next day. The trouble is even if it reverses the next day, you’re still stopped out of your position. So again, the message is, don’t be greedy, don’t over-leverage, don’t go too close to the money. There’s a lot of money to be made here, but not if you blow all your profits on one super aggressive trade. And take it from someone who’s learned the hard way; you want to be semi-conservative in these wild trading conditions. If you do that, you will make some really good money when everyone else is getting their head handed to them.

Q: Would you go in the money or out of the money for Boeing (BA) and Caterpillar (CAT)?

A: It just depends on your risk tolerance. The best thing here is to do several options combinations and then figure out what the worst-case scenario is. If you can handle that worst-case scenario without stopping out, do those strikes. These LEAPS are great, unless you have to stop out, and then they will absolutely kill you. And usually, you only do these with sustained uptrends in place; we don’t have that yet which is why I’m saying, watch these LEAPS. Don’t necessarily execute now, or if you do, just do it in small pieces and leg in. That is the smart answer to that.

Q: What’s the probability that the CBOE Volatility Index (VIX) makes a new high in the next 2 weeks?

A: I give it 50/50.

Q: Call options on the VIX?

A: No, that’s one of the super high-risk trades I have to pass on.

Q: How low can the VIX go down this month?

A: High ten’s is probably a worst-case scenario.

Q: LEAPS on Barrick Gold Corporation (GOLD)?

A: No, that was a 3-month-ago trade. Now it’s too late, never consider a LEAP at an all-time high or close to it.

Q: Time to short oil?

A: Not yet. We have some spike top going on in oil. It’s impossible to find the top on this because, while bottoms are always measurable with PE multiples and such, tops are impossible to measure because then you’re trying to quantify human greed, which can’t be done. So yeah, I would stand by; it’s something you want to sell on the way down. This is the inverse of catching a falling knife.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 18, 2022

Fiat Lux

Featured Trades:

(FEBRUARY 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(NVDA), (MSFT), (VIX), (ROM), (TSLA), (GOOGL), (TLT), (TBT), (IWM), (QQQ), (FCX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.