Below please find subscribers’ Q&A for the October 5 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: Is the final low in, or could we retest yet again (SPY)?

A: We could retest yet again, but it’s very important to notice that the marginal new lows are very small. The low we had on Friday, the last day of September and Q3, was only 800 points lower than the low we had in June—you had to work 4 months just to get a new low of only 800 points. So I think that's the way it's going to go. If we do get new lows, it’ll be incremental new lows—we’re not crashing to 3,000 or anything like that.

Q: What do you think Tesla (TSLA) will bottom at in the short term?

A: $200 or $210. The Tesla deal is a disaster for Elon Musk. It will amount to a huge diversion of management time; he’s going to be facing regulatory hurdles, and even though he said we’re going ahead for the deal, a lot of people still don’t believe it because the financing for the deal may have vaporized in the massive increase in interest rates that has occurred since February. So, there are still a lot of non-believers in this deal. I’d rather have him making solar panels, electric cars and launching rockets, not getting into the social media morass and taking over a broken company. The shareholders clearly don’t like it either, taking the shares down $30 in two days. By the way, if you look at the charts, you notice that people were front-running the Twitter deal by dumping Tesla stock the day before. So yes, it kind of peed on our Tesla parade for the short term; long term it keeps going up and the bad news is in the price.

Q: How do we get the concierge service?

A: Just contact customer support at support@madhedgefundtrader.com or call (347) 480-1034.

Q: Have you revised Tesla’s (TSLA) price target?

A: No, not the long-term ones, just the short-term ones.

Q: Is it possible that bonds are bottoming here, even if we expect further Fed rate rises?

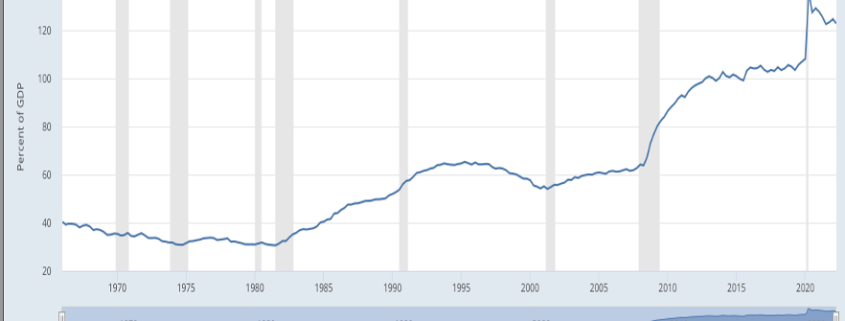

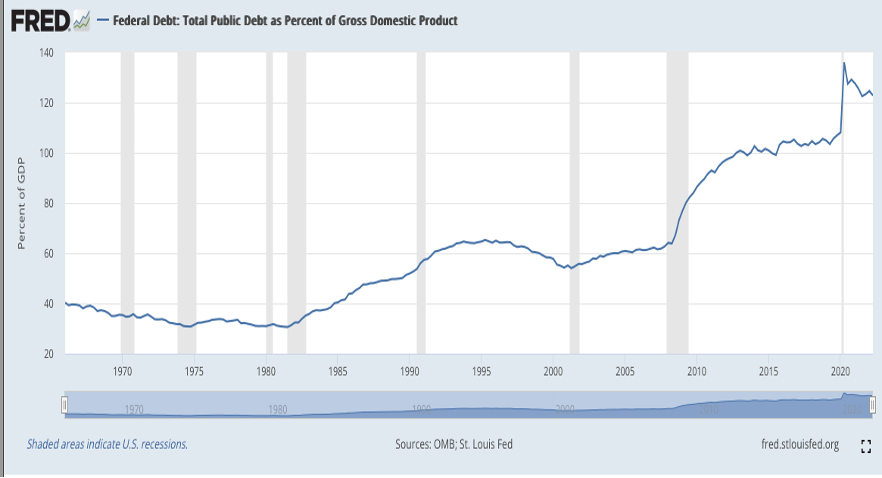

A: Yes, the Fed only has control of overnight rates, and those are rising. In fact, overnight rates are now higher than 10-year rates, and could go much higher still—that's called inversion of the yield curve. We’re almost certainly getting another 150-basis point rise in overnight rates. 10-year bonds or 20-year bonds could well stay around this level, or maybe just a little bit lower. So yes, the bond short is gone. It worked great for us for 2.5 years, we caught a 43% decline in the TLT, but it’s game over. Time to find other trades, like buying stocks.

Q: Does Elon Musk have to sell more Tesla to buy more Twitter?

A: That is the big question being asked today because he already sold $16 billion worth of stock in Tesla to cover the Twitter purchase this year. With the debt markets having fundamentally changed in the last 6 months, the question is: does he have to raise more equity (i.e. sell more Tesla), or can he bring in other equity investors? Hopefully, if he does have to sell more Tesla, it’s not very much—it’s a $44 billion deal and he’s already put $16 billion into it, so maybe he raises another $6 billion to get up to a 50% control level, which the market can easily handle in a day or two. He’s handled all of his past Tesla share sales fairly easily, and he tends to do these at market tops when demand for the shares is overwhelming. Longer term, the much greater demand for selling Tesla shares will come from the equity raises he will need to do to build another six Tesla factories around the world. That could be anywhere from $400 billion to $800 billion, so that will be the much larger cash call, but those are years off at best.

Q: With so many big techs breaking down, how should we play the (ROM) (ProShares Ultra Technology ETF)?

A: From the long side is how you play it. But you really need these capitulation days, especially if you’re involved in 2X ETFs. There is a spectacular play setting up for the (ROM) because it’ll go from $24 (or whatever the final bottom is) to $100 in the next upcycle, so that is a great leverage play that you really want to get involved in.

Q: If I don’t have time to babysit my portfolio, am I better in LEAPS or physical stocks?

A: Well the LEAPS I’m putting out now have a 2 years 4 months expiration date, so you can literally just buy them and forget about them. On the other hand, if we don’t get an economic recovery in 2 years and 4 months, you’re better off buying stocks outright on 2:1 margin. You make less profit, but if we don’t get a recovery for 3, 4, 5 years, then you have no expiration problem with stocks, as opposed to with LEAPS. Now, there are ways to trade around your LEAPS, like financing the long and by shorting puts and getting in for zero, but that requires smaller positions because you have to maintain the margin for the short put side. So, if you want to play it safe, buy the stocks. You can even handle a lost decade with stocks, especially if their dividend pays. With LEAPS, you need a fairly immediate economic recovery, which we should get, especially if the Fed lowers interest rates next year, which it should.

Q: What is your view on the US dollar (UUP)?

A: The dollar seems close to peaking right around here. It will peak on the last day that the Fed raises interest rates, which could be on December 14th. In fact, they may not even wait until then. Depending on the inflation rate, they could only do a quarter or a half-point rate rise in December, thus giving the market their signal that way. Or not do it at all, and the sudden selloff that we had in the dollar, and the stabilization of bonds we had last week is telling you that’s on the table as a possibility. So, we saw really important moves for long-term trend considerations in the markets since last week.

Q: Time for Palantir (PLTR)?

A: No, because the CEO doesn’t give a damn about his stock, and the stock reacts accordingly. I gave up on Palantir for that reason.

Q: How do you see the Ukraine/Russia situation developing?

A: It drags on for another year, Russia keeps losing and throwing men into the meat grinder until Putin gets removed, which should happen next year at which point oil prices collapse. That may be why he blew up the Nordstream One pipeline, to tie the hands of a future Russian government.

Q: Is it safe to buy 30-day Treasury bills in November going into the next F1C meeting?

A: Yes, because they essentially have no risk—that’s basically a cash type investment. And if your broker goes bust you can just force them to hand over your Treasury bonds and not get tied up in any three-year bankruptcy proceeding. It’s an asset, not cash.

Q: Will it be time to buy LEAPS on the next market selloff?

A: Absolutely, yes.

Q: Do you believe Putin would use nukes?

A: No I don’t, because the radioactive cloud would fall back on him immediately. There are very few people who are both stock market experts and nuclear weapons experts; I happen to be one of those—probably the only one in the world in fact—because of my time spent with the atomic energy commission at the Nuclear Test Site in Nevada. The problem with bombing your next-door neighbor with nukes is that the nuclear fallout comes right back on you the next day. Most of Russia’s nukes don’t even work, they only have a handful that actually does, and if he does use one, I bet it would be a tiny one just to demonstrate that he has a working nuke—like just a one-megaton one as opposed to Hiroshima which was 20 kilotons. Or he could drop it in the Black Sea or do an above-ground test at their old nuclear test site that wouldn’t kill anyone, just to show that he has working nukes. I don’t think he will, because we would react in kind in twice the size.

Q: Time to buy ARK Innovation ETF (ARKK)?

A: You might start with a small starter position, just to get it into your portfolio so you remember to buy it on the next dip. Cathy Woods’s leverage in this fund is tremendous. You really want to own it at a market bottom, but picking the actual bottom is going to be tough. One way to achieve this is to just go out and buy Tesla—that way you don’t have to pay the management fee—or buy the top 5 holdings in ARK directly, which includes Roku (ROKU) among others. So yes, I’m watching it; I prefer buying things on the way up and missing the first 10% than to catch a falling knife, and boy has this thing been a falling knife this year.

Q: Do you like biotech here?

A: Absolutely; please subscribe to the Mad Hedge Biotech Letter for biotech recommendations plus LEAPS on biotech plays by clicking here.

Q: Energy is still the best sector now?

A: Yes, but for how long? You don’t want to be left standing when the music stops playing, and that is imminent in the oil industry. It will be illegal to sell gasoline cars in California after 2035, and gas makes up half the oil use in the US.

Q: Did you know that oil reserves (USO) are the lowest since 1984?

A: Yes, I think you may have read that in my newsletter, and that’s because of Biden’s efforts to reduce US gasoline prices through a million barrel per day release from the strategic petroleum reserves in Texas and Louisiana. If we are a net energy producer, why do we even have reserves? It’s an out-of-date holdover from the Cold War.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Tokyo 1975