OK, I’ll give it to you straight.

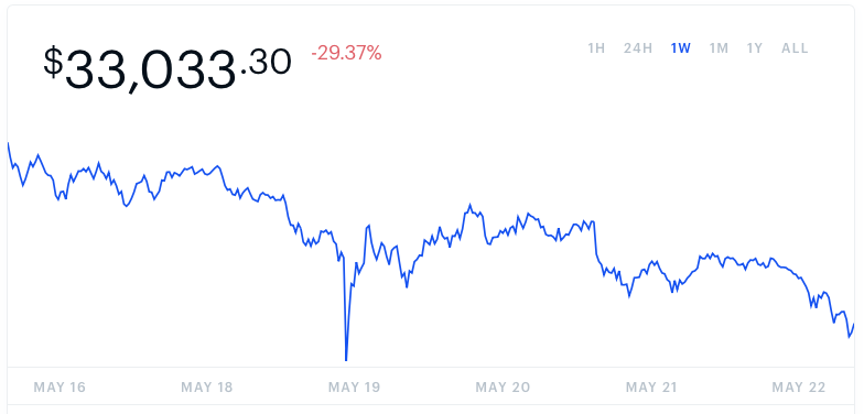

The market has just entered a correction that will take the Dow Average down precisely 7.81% from the recent 35,050 high down to 32,515. That just so happens to be the 150-day moving average.

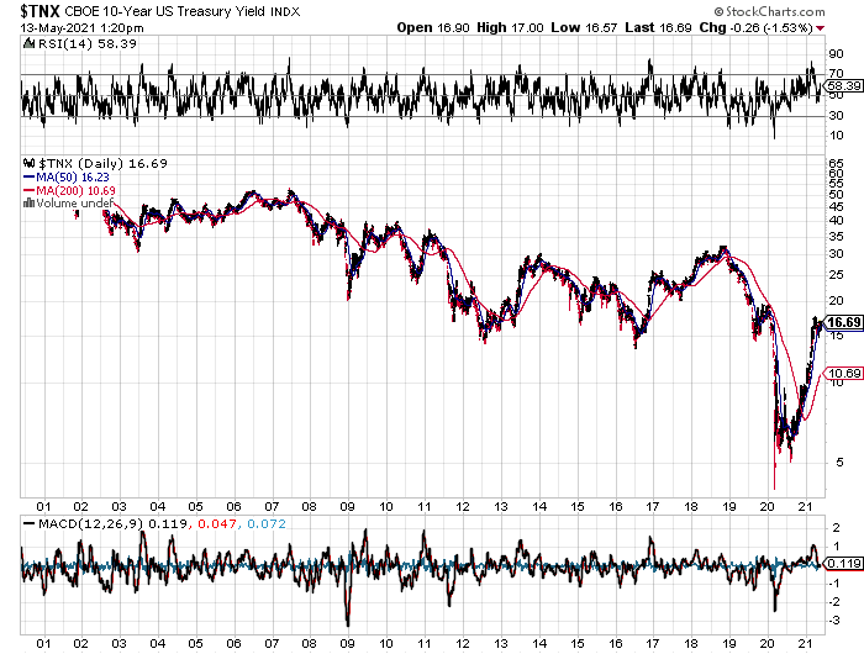

During this time, interest rates will rise, possibly taking the ten-year US Treasury bond yield to 1.30% and the United States Treasury Bond Fund (TLT) to $151.

Technology stocks will take the lead this summer. After not moving for nearly a year, Amazon (AMZN) will take the lead, discounting last year’s 44% growth in sales. NVIDIA (NVDA) and Adobe will follow.

Bank stocks and other financials like JP Morgan Chase (JPM) and Berkshire Hathaway (BRKB) will suffer, dropping 10% so far and 20% before the crying is all over.

In other words, we just flipped from one half of the barbell to the other in a heartbeat. That will last until late summer to the fall. After that, we shift to the other side of the barbell.

That means the best opportunity to buy financials and sell short bonds in a year is setting up in the coming weeks, if not months.

That takes us until the end of 2021 when I expect another liquidity surge to take everything up. Then we all walk together hand in hand into the sunset signing glory halleluiah. It doesn’t get any easier than that.

I saw all of this coming at the beginning of the year, which is why I raced to rack up a 68.60% profit in the first half of the year and went 100% cash with the June 18 option expiration. I succeeded right on the money.

As for 2022, that is a different story entirely.

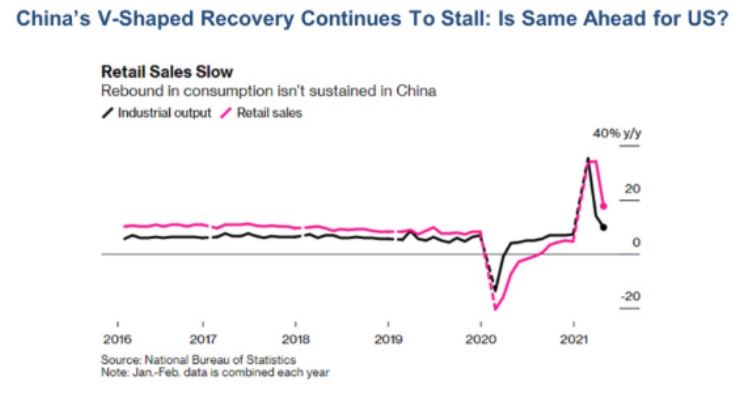

The big view here that the stock market is transitioning from an 80% gain to a 30% gain to a more normal average annualized 15% gain. The big game is how far in advance stocks will discount these smaller gains.

It will take a lot to get me off the bench and risk any of this hard-won profit. A Volatility Index (VIX) of over $35 would help (we closed at $20.70 on Friday). So would a Mad Hedge Market Timing Index under 20. So would JP Morgan under $127.

The Fed Takes a Turn, leaning towards more inflation. It is keeping interest rates unchanged at 0%-0.25% and continuing bond purchases at $120 billion a month. It is still sticking with the “transitory” argument on inflation but raised its full-year target from 2.4% to 3.4%, more than most expected. It went more specific on rate rises, predicting two 0.25% increases by the end of 2023. Bonds and technology stocks crashed, and inflation plays like banks, Bitcoin, and Berkshire Hathaway soared. The barbell strategy wins again!

The Big Rotation is On, with traders moving out of inflation plays and into big tech. That is the outcome of the shocking bond market spike that came out of last week’s 5% print for the Consumer Price Index. The Fed is telling the world that any inflation is temporary, and the world is believing them. It could give us a bond and tech rally that lasts a couple of months.

Commodities Crash, on a soaring US dollar and shrinking interest rates. The 15-month bull move is taking a summer vacation, unwinding 2X-10X moves racked up since the 2020 lows. Palladium took an 11% hit, with platinum off 7%, corn 6%, and copper 4%. Banks also sold off big as the whole inflation trade unwinds. Buy all of these on the next bottom for a rebound.

Shipping Costs are out of control for everything from everywhere to everywhere else. Transporting a 40-foot steel container of cargo by sea from Shanghai to Rotterdam now costs a record $10,522, up a whopping 547%. Tens of thousands of containers are on the wrong side of the Pacific. Shortages of truck drivers are extreme, with $50,000 signing bonuses rampant. It is one thing that could make continuing inflation pernicious.

If Copper sells off, it won’t be by much. Conventional internal combustion cars use 40 pounds of copper for wiring. EVs use 200 pounds for the heavy copper rotors in each wheel, in addition to two ounces of silver (SLV). EV production will rise from 700,000 units last year to 25 million by 2030. You do the math. There aren’t enough copper mines in the world to accommodate this demand and it takes five years to build a new one. Buy (FCX) on the next big dip. It’s going to $100 in five years.

Paul Tudor Jones says the Taper Tantrum is coming, despite last week’s perverse reaction by the bond market to the red hot 5% inflation rate. The Fed’s obsession with jobs only and not inflation will end in tears. My old client and legendary investor has 20% of his assets in inflation plays, including gold (GLD), Bitcoin, commodities, and short US Treasury bonds (TLT). When Paul is wrong, it’s usually not for very long.

Housing Starts up only 3.6% in May, to a seasonally adjusted 1.57 million units, with sky-high lumber and other materials prices a major drag. New Permits hit a seven-month low.

Weekly Jobless Claims jump to 412,000, the largest increase since March. Could the economy be slowing?

Tech Soars, getting a new lease on life with the collapse of interest rates last week. My favorite, Amazon (AMZN), picked up a healthy $80 yesterday on a 44% YOY gain in sales. Even Apple (AAPL) is coming back from the dead, up $2.00. I sent out long-term at-the-money LEAPS on these last week. It's hard to hold quality down for the long term.

Factory activity fell in June, for the second month in a row according to the Philly Fed, backing off from an all-time high in the spring. Parts and materials shortages are plaguing manufacturers everywhere as the economy struggles to escape from its pandemic torpor.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 0.71% gain so far in June on the heels of a spectacular 8.13% profit in May. That leaves me 100% in cash.

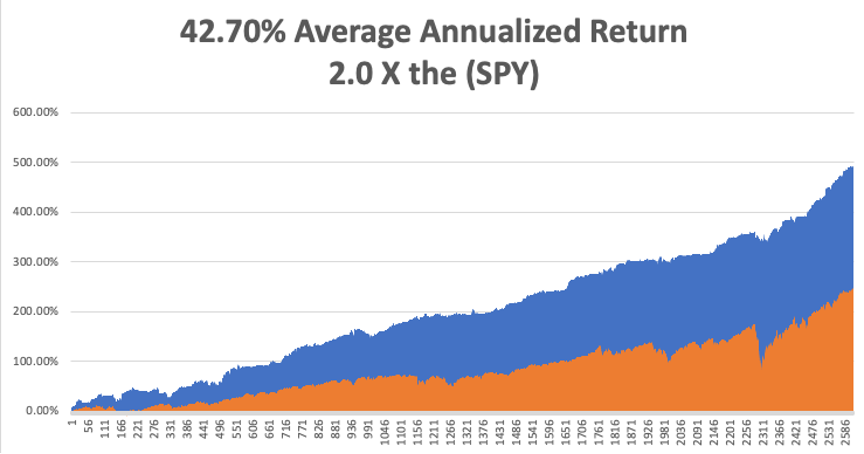

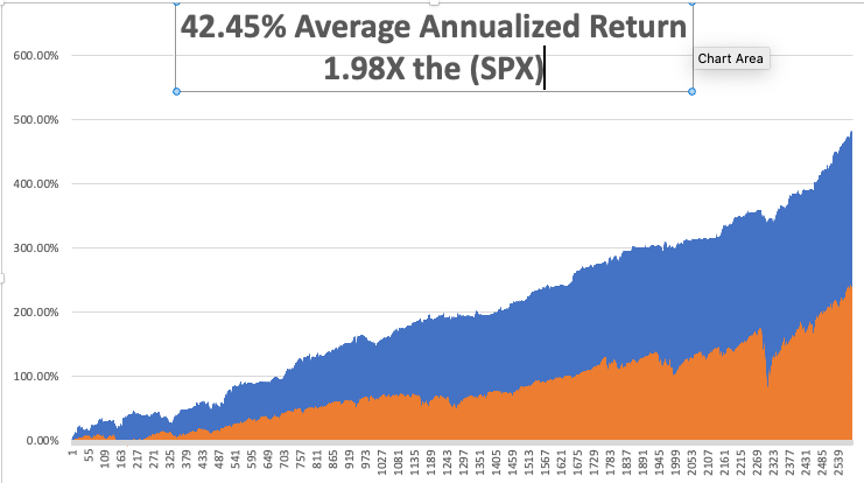

My 2021 year-to-date performance appreciated to 68.60%. The Dow Average is up 8.8% so far in 2021.

I spent the week taking profits on the 40% in remaining positions either by selling or running them into the Friday expiration. My goal was to go 100% before the market completely fell to pieces and I succeeded handily. It’s going to be a grim summer.

I rang the cash register on Berkshire Hathaway (BRKB) and the S&P 500 (SPY), and my short in the (SPY). Perhaps my best trade of the year was stopping out of my short in the (TLT) for an $800 loss when it topped $140.

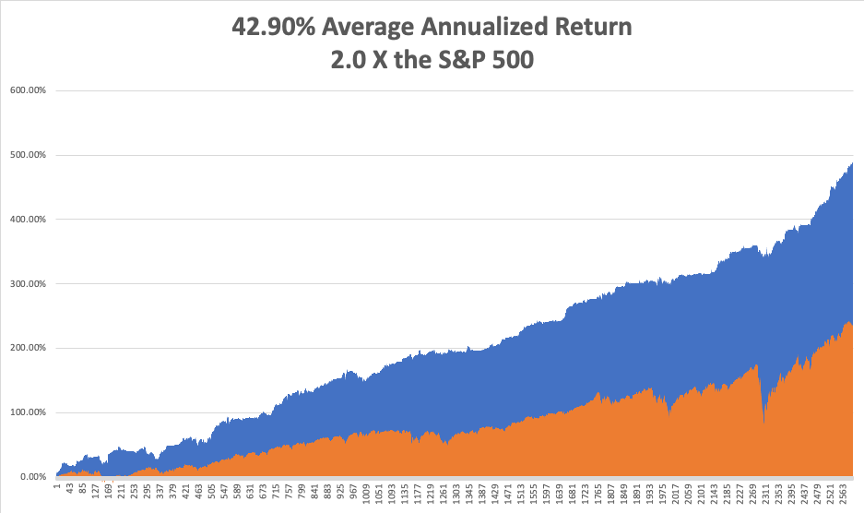

That brings my 11-year total return to 491.15%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.70%, easily the highest in the industry.

My trailing one-year return exploded to positively eye-popping 126.07%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 33.1 million and deaths topping 600,000, which you can find here. Some 33.1 million Americans have contracted Covid-19.

The coming week will be a weak one on the data front.

On Monday, June 21 at 8:30 AM, the Chicago Fed National Activity Index is out.

On Tuesday, June 22 at 10:00 AM, Existing Home Sales for May is released

On Wednesday, June 23 at 10:00 AM, New Home Sales for May is published.

On Thursday, June 24 at 8:30 AM, the Weekly Jobless Claims are published. We also get US Durable Goods Orders for May.

On Friday, June 25 at 8:30 AM, US Personal Income & Spending for May are disclosed. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, with all the recent violence in the Middle East, I am reminded of my own stint in that troubled part of the world. I have been emptying sand out of my pockets since 1968, when I hitchhiked across the Sahara Desert, from Tunisia to Morocco.

During the mid-1970s, I was invited to a press conference given by Yasser Arafat, founder of the Al Fatah terrorist organization and leader of the Palestine Liberation Organization, at the Foreign Correspondents Club of Japan. His organization then rampaging throughout Europe, attacking Jewish targets everywhere.

Japan recognized the PLO to secure their oil supplies from the Persian Gulf, on which they were utterly dependent.

It was a packed room on the 20th floor of the Yurakucho Denki Building, and much of the world’s major press were represented, as the PLO had few contacts with the west.

Many placed cassette recorders on Arafat’s table in case he said anything quotable. Then Arafat ranted and raved about Israel in broken English.

Mid-sentence, one machine started beeping. A journalist jumped up to turn his tape over. Suddenly, four bodyguards pulled out Uzi machine guns and pointed them directly at us.

The room froze.

Then a bodyguard deftly set his Uzi down on the table, flipped over the offending cassette, and the remaining men stowed their weapons. Everyone sighed in relief. I thought it was interesting that the PLO was using Israeli firearms.

The PLO was later kicked out of Jordan for undermining the government there. They fled Lebanon for Tunisia after an Israeli invasion. Arafat was always on the losing side, ever the martyr.

He later shared a Nobel Prize for cutting a deal with Israel engineered by Bill Clinton in 1993, recognizing its right to exist. He died in 2004.

Many speculated that he had been poisoned by the Israelis. My theory is that the Israelis deliberately kept Arafat alive because he was so incompetent. That is the only reason he made it until 75.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Middle East Does Have Some Advantages