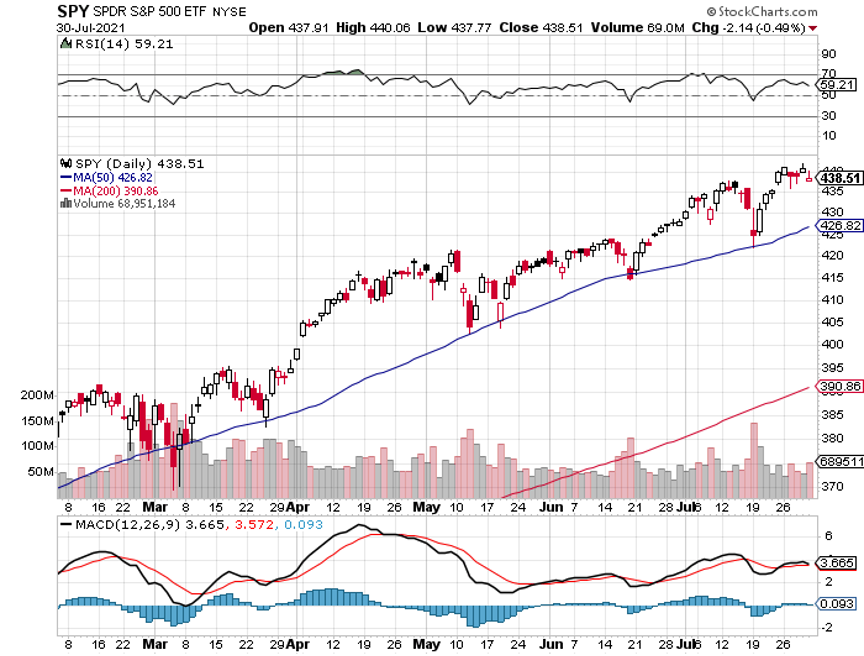

Friday saw the stock market’s lowest volume day of the year, and shares rose almost every day last week to new all-time highs.

The way this usually ends is that the slow grind explodes into a high-volume spike marking an interim market top. That makes new investment now extremely risky.

August usually markets the best buying opportunity of the year with a cataclysmic selloff. Remember the 2010 flash crash, down 1,100 points in two hours? So far, no cigar.

I have tons of people asking me what to buy right now. That is usually another market-topping indicator. I tell them to keep their cash. Cash is a position. A dollar at a market top is worth $10 at a market bottom.

Under an index that is making excruciatingly slow gains are constant sector rotations bring pretty dramatic moves. Play those dramatic moves.

May saw money suddenly shift into tech stocks, with the best, like NVIDIA (NVDA) leaping 56%.

The day the ten-year US Treasury yield (TLT) bottomed at 1.10%, tech went back to sleep. While big tech ground sideways, small tech brought more heart-rending downside moves, such as the 27% plunge in Roku (ROKU).

In the meantime, financials and commodities have moved to the fore. Goldman Sachs (GS) melted up 20% off of blockbuster earnings, while Freeport McMoRan popped 26%, thanks to a Chilean copper union strike.

Let me propose a revolutionary new investment strategy to you. It’s called “buy low, sell high.” Everybody talks about it but actually executes the opposite.

I employ this money-making ploy through my “barbell” strategy, with equal weightings in technology and domestic recovery stocks like financials, industrials, and commodities.

It's quite simple. You just sell whatever has just delivered the most recent spectacular upside gains and roll that money into what has recently become ignored, cheap, and out of favor.

It is a market approach that is really devoid of the thought process.

All eyes will be on Jackson Hole, Wyoming next week, the annual meeting of the world’s top central bankers. That is when we get the next hint about the intentions of the Federal Reserve as to, not "if", but "when" they reduce quantitative easing.

You would think that a 6.5% GDP growth rate and a 5.4% inflation rate would do it, but these days, nothing is certain. A hot jobs report in September would do it for sure.

We may have to wait until then before we see any serious move in stocks and a return of volatility (VIX). In the meantime, catch up on reading your research, pay your bills, and work on your golf swing.

Bitcoin staged a recovery for the ages, rallying 55% in two weeks. The “battle of $30,000” is over and the cryptocurrency won. It really is becoming too big to fail. I might have to do something about that.

July Inflation Read at a hot 5.4%, but core inflation showed a small decline. In June, used car prices accounted for a third of the total price increases, but last month, it was zero. So far, there is no move in rents, but it’s coming. All Fed eyes will remain laser-focused on this number.

Taper talk is back! With the ballistic increase in the July Nonfarm Payroll report and the 2 ½ point dive in the bond market. I think the top is in for finds and the bottom for long term rates. It means tech stocks will lag from now, while interest rate sensitives like banks, brokers, and fund managers will lead. Buy (JPM), (MS), (V), and (GS) on dips.

US Budget Deficit hits a record $302 Billion in July. Covid benefits are remaining high, while tax revenues are lagging YOY. Keep selling those (TLT) rallies. The generational crash may have just begun.

Fed’s Rosengren Says QE is not creating jobs, causing bonds to drop a full point in the after-market. No kidding. I have been arguing that our nation’s central bank has been pushing on a string all year. Atlanta Fed governor Bostic couldn’t agree more. Time for more action than words?

Gold Hits four-month low, breaking key support. Bitcoin is clearly stealing its thunder, which has risen by 50% in two weeks. If you’re considering gold, go take a long nap first.

Oil dives on delta surge, off $9, or 12% in a week, the lowest in three weeks. Delta is now rampaging throughout China, the world’s largest consumer of Texas tea., putting $63 in play.

Weekly Jobless Claims hit 375,000, down 12,000 on the week. Moving in the right direction but still incredibly high.

Berkshire Hathaway announces solid earnings, but scales back share buybacks at these elevated levels. Oracle of Omaha Warren Buffett bought back $6 billion of his own stock in Q2, leaving him with a staggering $144 billion in cash. Almost no stocks meet Buffett’s value standards in the current environment. Buy (BRKB) on dips. It’s a high-class problem to have.

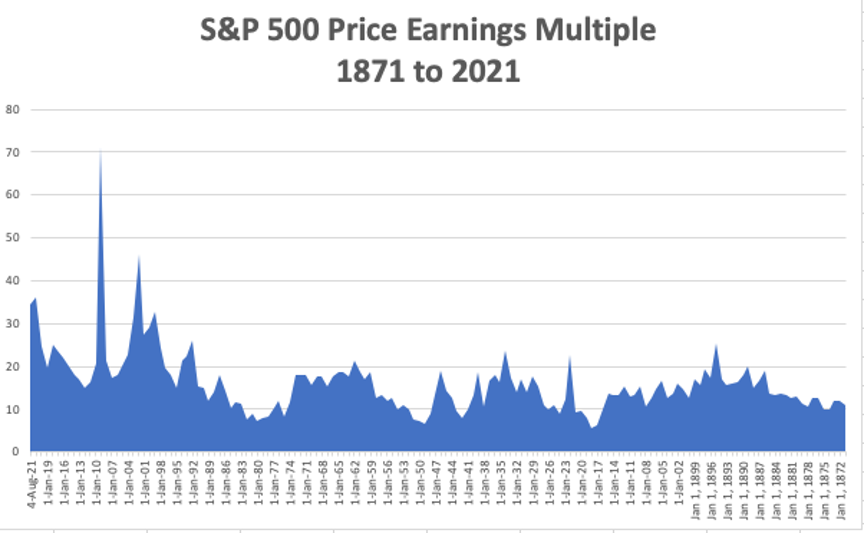

Ed Yardeni is bullish, along with David Kostin, and is the only manager who comes close to my own $475 target for the (SPY) by the end of the year. The U.S. economy will be in nominal terms around 8% higher this year than pre-pandemic 2019. Sales for the S&P 500 companies will be 15% higher and earnings will be 34% higher. That is a representation of the operating leverage that exists in so many companies. The Roaring Twenties lives!

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

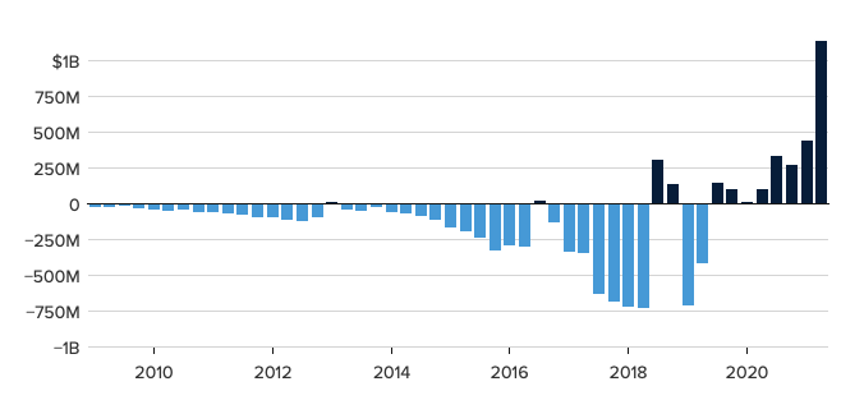

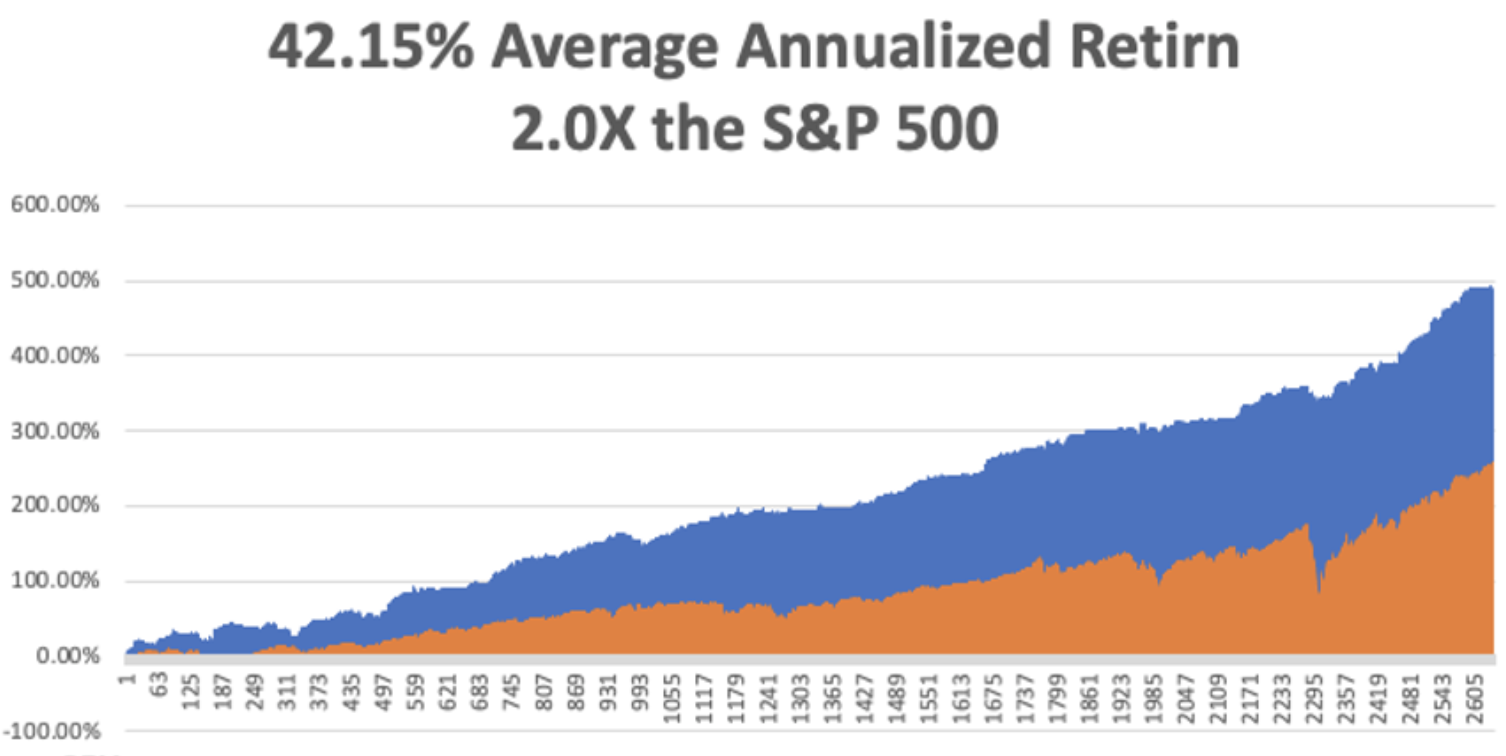

My Mad Hedge Global Trading Dispatch saw a modest +4.86% in July. My 2021 year-to-date performance appreciated to 74.07%. The Dow Average was up 16.00% so far in 2021.

I stuck with three positions, a long in (JPM) and a double short in the (TLT), all of which expire on Friday. My double short in the (SPY) punched me in the nose, forcing me to stop out for losses when I hit the lowest strike prices.

I then jumped into a very deep in-the-money call spread in Robinhood (HOOD) made possible only by the stock’s astronomically high volatility. Its 44% drop helped too. I also added a third short in the bond market.

That leaves me 30% in cash. I’m keeping positions small as long as we are at extreme overbought conditions.

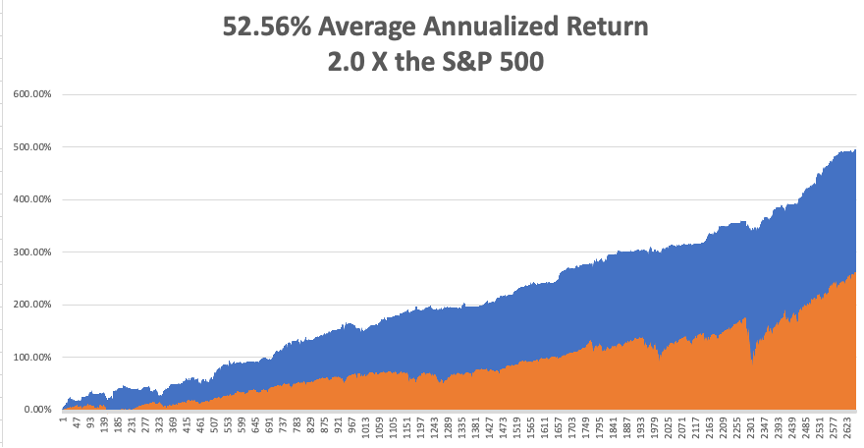

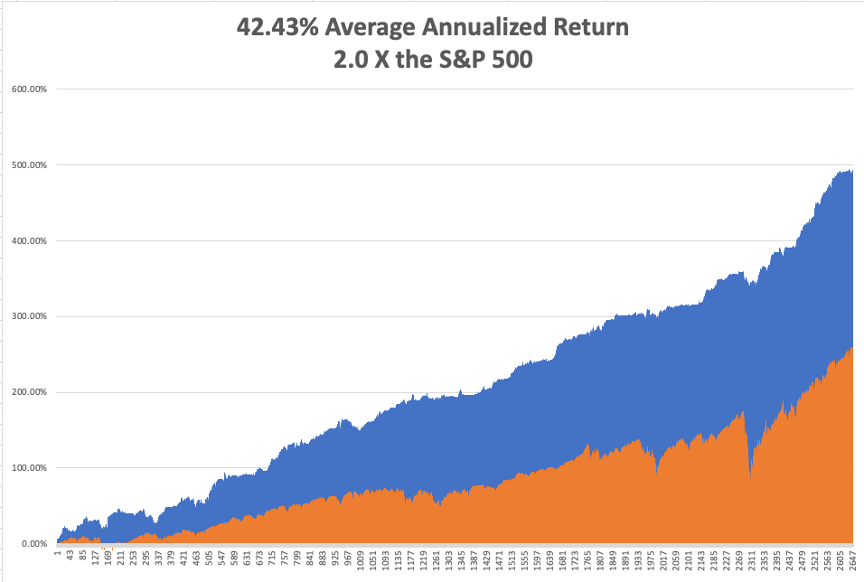

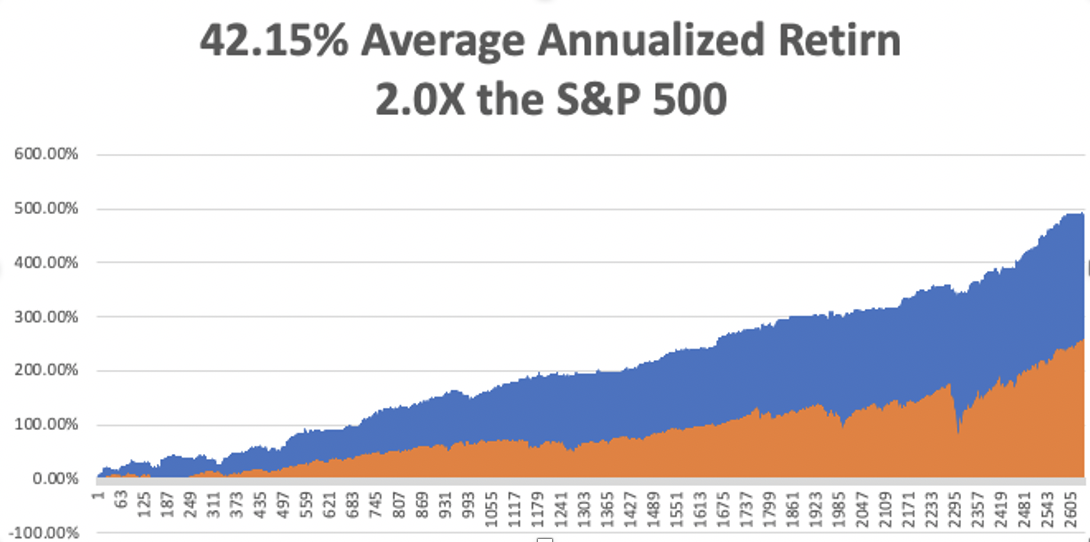

That brings my 11-year total return to 496.62%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 12.56%, easily the highest in the industry.

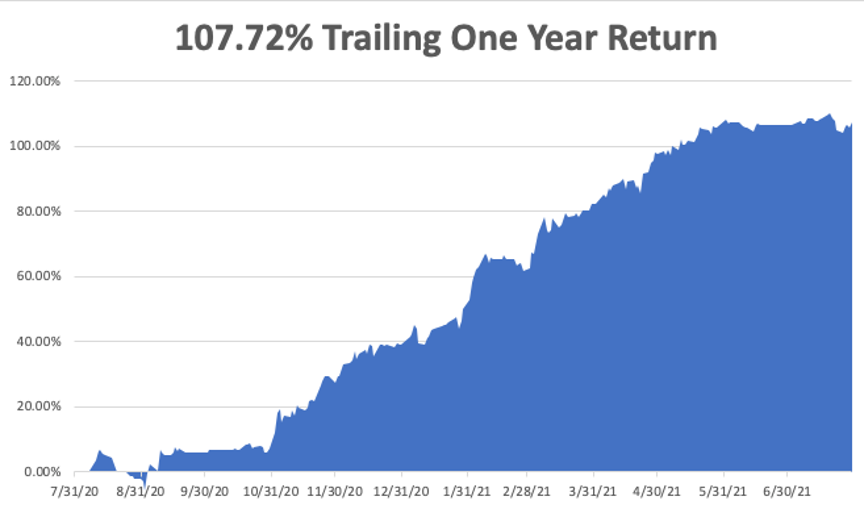

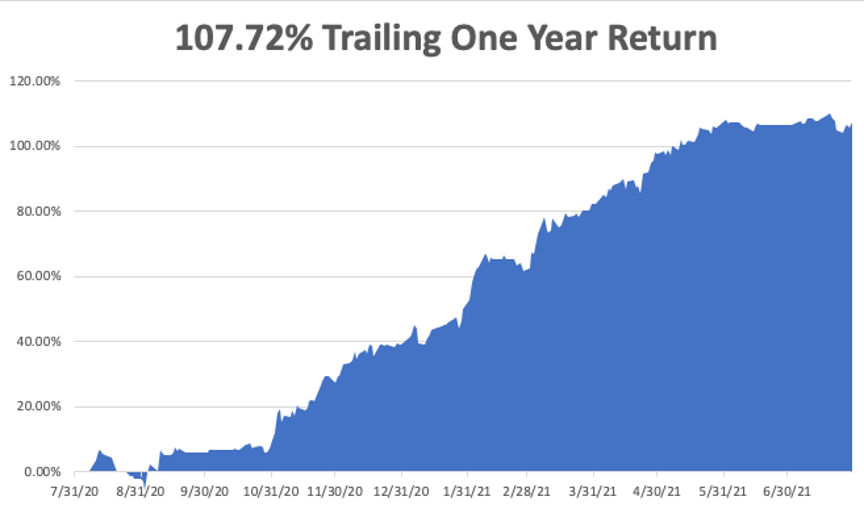

My trailing one-year return retreated to positively eye-popping 106.69%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 36.7 million and rising quickly and deaths topping 622,000, which you can find here at https://coronavirus.jhu.edu.

The coming week will bring our monthly blockbuster jobs reports on the data front.

On Monday, August 16 at 7:00 AM, the New York Empire State Manufacturing Index is out.

On Tuesday, August 17 at 7:30 AM, US Retail Sales for July are published.

On Wednesday, August 18 at 5:30 AM, the Housing Starts for July are printed. At 2:00 PM, the minutes from the last FOMC are released.

On Thursday, August 19 at 8:30 AM, Weekly Jobless Claims are announced. Square (SQ) reports.

On Friday, August 20 at 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, upon graduation from high school in 1970, I received a plethora of scholarships, one of which was for the then astronomical sum of $300 in cash from the Arc Foundation.

By age 18, I had hitchhiked in every country in Europe and North Africa, more than 50. The frozen wasteland of the North and the Land of Jack London beckoned.

After all, it was only 4,000 miles away. How hard could it be? Besides, oil had just been discovered on the North Slope and there were stories of abundant high-paying jobs.

I started hitching to the Northwest, using my grandfather’s 1892 30-40 Krag & Jorgenson rifle to prop up my pack and keeping a Smith & Wesson .38 revolver in my coat pocket. Hitchhikers with firearms were common in those days and they always got rides. Drivers wanted the extra protection.

No trouble crossing the Canadian border either. I was just another hunter.

The Alcan Highway started in Dawson Creek, British Columbia, and was built by an all-black construction crew during the summer of 1942 to prevent the Japanese from invading Alaska. It had not yet been paved and was considered the great driving challenge in North America.

The rain started almost immediately. The legendary size of the mosquitoes turned out to be true. Sometimes, it took a day to catch a ride. But the scenery was magnificent and pristine.

At one point, a Grizzley bear approached me. I let loose a shot over his head at 100 yards and he just turned around and lumbered away. It was too beautiful to kill.

I passed through historic Dawson City in the Yukon, the terminus of the 1898 Gold Rush. There, abandoned steamboats lie rotting away on the banks, being reclaimed by nature. The movie theater was closed but years later was found to have hundreds of rare turn-of-the-century nitrate movie prints frozen in the basement, a true gold mine.

Eventually, I got a ride with a family returning to Anchorage hauling a big RV. I started out in the back of the truck in the rain, but when I came down with pneumonia, they were kind enough to let me move inside. Their kids sang “Raindrops keep falling on my head” the entire way, driving me nuts. In Anchorage, they allowed me to camp out in their garage.

Once in Alaska, there were no jobs. The permits required to start the big pipeline project wouldn’t be granted for four more years. There were 10,000 unemployed.

The big event that year was the opening of the first McDonald’s in Alaska. To promote the event, the company said they would drop dollar bills from a helicopter. Thousands of homesick showed up and a riot broke out, causing the stand to burn down. It was rumored their burgers were made of moose meat anyway.

I made it all the way to Fairbanks to catch my first sighting of the wispy green contrails of the northern lights, impressive indeed. Then began the long trip back.

I lucked out catching an Alaska Airlines promotional truck headed for Seattle. That got me free ferry rides through the inside passage. The driver wanted the extra protection as well. The gaudy, polished tourist destinations of today were back then pretty rough ports inhabited by tough, deeply tanned commercial fishermen and loggers who were heavy drinkers always short of money. Alcohol features large in the history of Alaska.

From Seattle, it was just a quick 24-hour hop down to LA. I still treasure this trip. The Alaska of 1970 no longer exists, as it is now overrun with summer tourists. It now has more than one McDonald’s. And with runaway global warming, the climate is starting to resemble that of California than the polar experience it once was.

Good Luck and Good Trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Alcan Highway Midpoint

The Alaska-Yukon Border in 1970