Listening to the market commentary this week, the word “unbelievable” kept popping up.

It was “unbelievable” that the market crashed by 15% when Russia invaded Ukraine. It was equally “unbelievable” that it then melted up 7% over five trading days.

So has the market gone from discounting the outbreak of WWIII and complete Armageddon to a total victory by Ukraine, the resurgence of NATO, and the end of Russia….in a week?

Well, maybe they have done just that.

The only thing we can count on for sure is that volatility will continue for the indefinite future. The only certainty we have is that change will continue, and it is accelerating at a phenomenal rate.

Of course, it’s all amazing to me. I am a creature of the American 1950s who is now living 70 years in the future. Yes, even the Jetson-type flying cars have happened.

Let me update you on the war, since I know you’re all dying to know.

The Ukraine is winning. What once appeared to be a small, defenseless nation had in fact been preparing for a prolonged guerilla war for seven years, ever since Crimea was invaded.

Javelin and stinger missiles were stockpiled at every key intersection in the country. And the California National Guard has been training the army on how to use them for the last seven years. It was all a gigantic ambush in the making.

The Russian Army, which has seen no real combat experience for 30 years, believed their own propaganda and literally expected to be showered with roses on day one. As a result, they ran out of gasoline, food, and ammunition, and now precision weapons. Some 10% of the army has been killed and maybe 20% of their Air Force shot down. The war is essentially over, so Putin is desperately seeking a way to call it a victory and get out.

Putin himself is toast. At this point, he is the richest man in the world who can’t spend a single ruble of his money. What wealth he had overseas has been seized and will be used to finance the reconstruction of Ukraine. Putin can never leave Russia again without being arrested as a war criminal. But if he stays, he runs the constant risk of assassination. The guy has made a lot of enemies.

What about Putin’s nukes you may ask? Of the headline 7,000 such weapons mentioned in the SALT treaties, only 200 actually work. The rest are corroding empty shells. The math is very simple. Russia’s $1 trillion GDP can’t support any more of these wildly expensive weapons. By the way, China has the same number.

The logic of MAD (Mutually Assured Destruction) still applies, making nuclear weapons useless. If Putin fires off one nuke, his entire country vaporizes in 30 minutes. His generals know this. If ordered to use nukes, they would either ignore the order or depose him immediately.

As someone who has spent the last half-century contemplating the future of the universe, the consequences of this are absolutely mind-boggling.

Economic warfare has finally come into its own as a weapon more destructive than nuclear weapons. In a year, per capita income in Russia will have plunged from last year’s $10,000 to the Soviet-era $1,000. In weeks, Putin has written off 30 years of economic growth. A second Russian Revolution is a sure thing, but what form it will take should be interesting.

How did such a clever man as Putin end up in such a predicament? He surrounded himself with advisors who told him only what he wanted to hear. Such is the way of dictators who have been in power too long. A recent US president had the same problem, with similar results.

The US is the huge winner in all this. Biden announced on Friday that America will replace the missing Russian oil and gas, some 10% of the total world supply. This has already started a renaissance of the US energy industry, which only two years ago was on its heels and destinated to become the next buggy whip industry.

As I have been pointing out to the Joint Chiefs since all this started, strong support for Ukraine not only eliminates Russia as a threat, it puts the shackles on China with its own expansionist desires. You haven’t heard much about Taiwan lately. For America, it’s a twofer.

To say all of this is wildly positive for American stock markets is an understatement. It certainly keeps my $240,000 forecast for the Dow by 2030 on the table. How long it will take investors to figure all this out is anyone’s guess. But I think we are setting up for one hell of a second half.

You see all this in the behavior of a single stock. After NVIDIA (NVDA), the best stock in the world, plunged 40% on fears of deglobalization, it rocketed by 47% in the past week, suggesting that deglobalization is coming back stronger than ever. It reiterates my argument that you use this correction to pick up the Cadillacs at a discount, not Volkswagens.

Bonds Crashed, on comments from Fed governor Jay Powell that if he has to raise interest rates by 50 basis points next month, he will. It’s nothing new but it certainly set the cat among the pigeons with bond longs. The (TLT) broke $130, triggering a round of stop losses before it bounced back. The double short (TBT) popped to $21.33. The good news is that this is more than covered by the seven other bond trades we have closed in 2022 that made money. Those who have bond put LEAPS, which is almost all of you, are making a fortune. It looks like my yearend target of a $2.50% ten-year yield may be hit imminently. Keep selling rallies in the (TLT).

Will the Fed Raise Interest Rates by a Full 1% in April? Our central banks could make such a move at their April 28 confab as they are so far behind the curve, especially if inflation data continues hot. Such a move, or the fear of us, might give us a second shot at a double bottom in stocks at the (SPY) $410 level. Such a move would make your sizeable bond shorts look pretty good.

Recession is Unavoidable Without Russian Oil, says the Dallas Fed. There isn’t enough time to bring alternatives on to the market. The scenario is similar to the invasion of Kuwait in 1991 when we lost 1.5 million barrels a day overnight. This time, it’s 9 million b/d. It all augers for higher oil prices and slower economic growth….unless you drive a Tesla!

Weekly Jobless Claims Lowest Since 1969 at 187,000, down an eye-popping 28,000 on the week. No problems with the economy here. The drop in claims is consistent with a labor market in which employers are desperately trying to hang onto workers and attract new ones.

Berkshire Hathaway Buys Alleghany Insurance for $11.6 billion, taking (BRKB) to yet another new all-time high. Warren Buffet definitely loves the insurance industry, which he uses as a cash cow to fund all his other investments. Alleghany Insurance is in effect a mini-Berkshire, starting out in railroads and evolving into a general investment holding company. Keep buying (BRKB) on dips, a long time Mad Hedge favorite

Tesla Delivers First German Made Model Y, which will enable the company to reach its 1.5 million vehicle target for 2022, up 50%. With an energy crisis in Europe, Tesla will sell these as fast as they can make them. There is currently a one-year wait to get a Model X in the US, and I can sell mine for more than I paid for it three years ago.

Jeffries Raises Tesla Target from $1,250 to $1,400. It cites a dramatically changed geopolitical environment which sent oil prices through the roof, greatly benefiting all makers of electric vehicles, of which Tesla is far and away the largest. The company is firing on all cylinders, which it actually doesn’t make. Maybe in five years, they will get to my own $10,000 target for Tesla. Buy (TSLA) on dips.

Alibaba Announces Monster Share $25 billion Buy Back, taking the shares up 11%. Could this spell the end of the Chinese stock market crash, with many companies down 80%-90%?

New Home Sales Dive, down 2% to 772,000 in February. Inventories are still very light at 6 months compared to a scant 2-month supply for existing homes. Interest rates are starting to bite, and prices are still soaring, taking the median national price to a new high of $406,600, up 10.6% YOY.

The US to Replace Russian Gas for Germany, some two-thirds by year-end and completely by 2027. It is already on track to supply a record 22 billion cubic feet last year and 50 billion cubic feet by 2030. But the US is at maximum capacity and only major investments will increase supply. More specialized LNG carriers will need to be built and Golar LNG (GLNG) and Flex LTD (FLEX) are the plays there. Buy Chenier Energy (LNG), Tellurian Inc. (TELL), and Sempra (SRE) on dips.

Pending Homes Sales Sink, down 4.1% in February, the fourth straight month of declines. The share of disposable income taken by monthly mortgage payments rose by an incredible 8.3% last month, shutting out buyers. It explains why homebuilder stocks like Lennar (LEN) and KB (KBH) are getting slaughtered.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

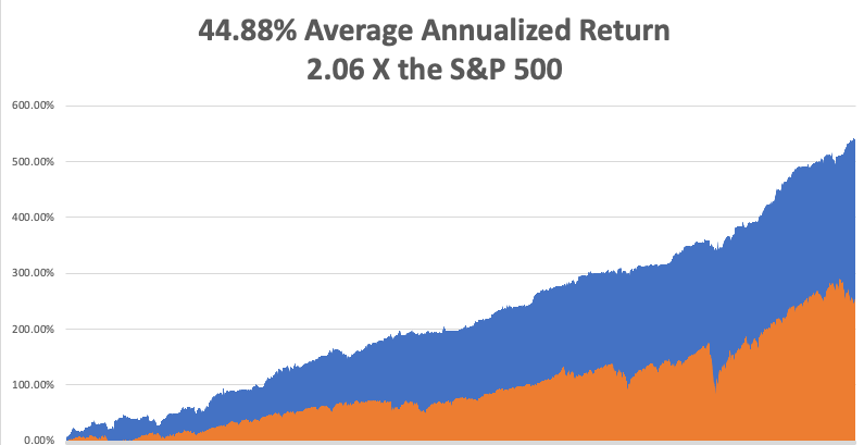

With near-record volatility, my March month-to-date performance retreated to a still blistering 12.60%. My 2022 year-to-date performance ended at a chest-beating 27.19%. The Dow Average is down -4.00% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding more long positions in technology.

That brings my 13-year total return to 539.75%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80 million and rising quickly and deaths topping 976,000 and have only increased by 7,000 in the past week. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 96% in a month.

On Monday, March 28 at 7:30 AM EST, the Dallas Fed Manufacturing Index is out.

On Tuesday, March 29 at 9:00 AM, The S&P Case Shiller National Home Price Index is published.

On Wednesday, March 30 at 8:15 AM, the ADP Private Employment Data is out.

On Thursday, March 31 at 7:30 AM, the Weekly Jobless Claims are printed.

On Friday, April 1 at 8:30 AM, the March Nonfarm Payroll Report is announced. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens, I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete works.

I visited his homes in Key West and Ketchum, Idaho. His Cuban residence is high on my list now that Castro is gone.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was still being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader