Global Market Comments

January 21, 2026

Fiat Lux

Featured Trade:

(FRIDAY, JANUARY 30 2026 BUENOS AIRES ARGENTINA STRATEGY LUNCHEON),

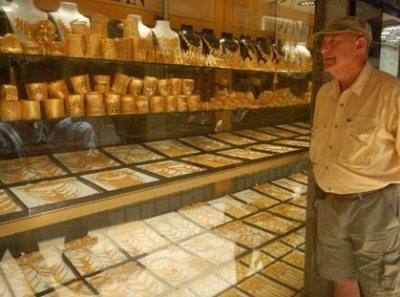

(THE ULTRA BULL CASE FOR GOLD)

(GLD), (UGL), (GOLD), (NEM)

Global Market Comments

January 21, 2026

Fiat Lux

Featured Trade:

(FRIDAY, JANUARY 30 2026 BUENOS AIRES ARGENTINA STRATEGY LUNCHEON),

(THE ULTRA BULL CASE FOR GOLD)

(GLD), (UGL), (GOLD), (NEM)

Global Market Comments

March 25, 2025

Fiat Lux

Featured Trade:

(THE ULTRA BULL CASE FOR GOLD)

(GLD), (UGL), (GOLD), (NEM)

Global Market Comments

August 3, 2023

Fiat Lux

SPECIAL PRECIOUS METALS ISSUE

Featured Trades:

(WHAT’S UP WITH GOLD?),

(GLD), (UGL), (PPLT), (PLAT), (WPM)

(THE ULTRA BULL CASE FOR GOLD)

CLICK HERE to download today's position sheet.

Global Market Comments

March 27, 2020

Fiat Lux

Featured Trade:

(MARCH 25 BIWEEKLY STRATEGY WEBINAR Q&A),

(ROM), (BA), (VIX), (UPRO), (SSO), (UBER), (LYFT), (MDT),

(GLD), (GOLD), (NEM), (GDX), (UGL)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 25 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Since we flipped the off button on the economy, I don’t see how we can simply flip the on button and have a V-shaped recovery. It seems much more unlikely that it will get back to pre-recession levels.

A: Actually, all we really need is confidence. Confident people can go outside and not get sick. Once we start seeing a dramatic decline in the number of new cases, the shelter-in-place orders may be cancelled, and we can go outside and go back to work. It’s really that simple. So, we will get an initial V-shaped recovery probably in the third quarter, and after that, it will be a slower return spread over several quarters to get back to normal. Everybody wants to get back to normal and let's face it, there's an enormous amount of deferred consumption going on. I have hardly spent any money myself other than what I’ve spent online. All of those purchases get deferred, so in the recovery, there's going to be a massive binge of entertainment, shopping, and travel that is all being pent up now—that will get unleashed once the airlines start flying again and the shelter-in-place orders are cancelled. We’re not losing so much of this growth, we’re just deferring it. Obviously, some of the growth is gone permanently; you can forget about any kind of vacation in the next couple of months. I would say, the great majority of consumption in the US—and thus growth and thus stock appreciation—is just being deferred, not cancelled outright.

Q: Other than the ProShares Ultra Technology ETF (ROM), do you have any other leveraged sectors coming into the recovery?

A: There is a 50/50 chance the Roaring 20s started 2 days ago, on Monday, March 23 at the afternoon lows. We may go back and test those lows one more time, which at this point is 3,700 points below here, but we are clocking 1,000 points a day. It doesn’t take much, like a bad non-farm payroll number, to go back and test those lows. The good news is out; they're not going to spend any more money other than the $10 trillion they're putting in now.

Q: Would you buy Boeing (BA) here? Is this the bottom?

A: The bottom was at $94 on Monday; we went up 100% in three days and now we’re at $180. Incredible moves, and a total lack of liquidity. One reason I haven't added any positions lately is that they have closed the New Yok Stock Exchange floor and its not clear that of I send out a trade alert, it could get done. We have gone totally online, so I just want to see what happens as a result of that. I don’t want to be putting out trade alerts that no one can get in or out of, heaven forbid.

Q: What do you mean by “The spike to $80 in the Volatility Index (VIX) was totally artificial?”

A: When you have a series of cascading shorts triggered by margin calls, that is artificial. I have seen this happen many times before, both on the upside and the downside. This happened twice in the (VIX) in the last two years. When you go from a (VIX) of $25 to $80 and back down to $39 in days, which is what we did, you know it was a one-time-only spike and we are not going to visit the $80 level again— at least not until the next financial crisis because those positions are gone and are never coming back. A (VIX) of $80 means we are going to have 1,000 point move in the Dow Average for the next 30 days.

Q: I bought some ProShares Ultra Pro ETF (UPRO) which is the 3x long the S&P 500 at $1,829. Do I take profits by selling calls or just hold longer?

A: I would just sell the whole position outright. The (UPRO) is so incredibly volatile that you are rewarded heavily for just coming out completely and then reopening fresh positions on these big meltdown days. We will probably be doing trade alerts on (UPRO) or its cousin, the 2x long ProShares Ultra S&P 500 (SSO) sometime in the near future.

Q: With 2-year LEAPs, would you go at the money or out of the money?

A: This is the golden opportunity to go way out of the money because the return goes from 100% to 500%, or even 1000% if you go, say, 30%-50% out of the money. A lot of these stocks are ripe for very quick 30% bouncebacks, especially the (ROM). So yes, you want to do out of the money 20% to 30%. It will easily recover those losses in weeks if you are picking the right stocks. Over a two-year view, a lot of these big tech stocks could double by the time your LEAP expires, and then you will get the full profit. The rule of thumb is: the farther out of the money you go, the bigger the profit is. But I wouldn’t go for more than a 1000% profit in 2 years; you don't want to get greedy, after all.

Q: You called the Dow to hit 15,000. Is that still possible? We got down to the 18 handle.

A: Yes, if the coronavirus data gets worse, which is certain, we could get another panic selloff. How will the market handle 100,000 US deaths, given the exponential rise in cases we are seeing? With cases doubling every three days that is entirely within range. So, I would say, there is a 50% chance we hit the bottom on Monday at 18,000, and 50% chance we go lower.

Q: Do you know anything about the coronavirus stocks like Regeneron (REGN)?

A: Actually, I do, it's covered by the Mad Hedge Biotech & Health Care Letter, click here for the link. If you get the Biotech Letter, you already know all about stocks like Regeneron. Regeneron literally has hundreds of drugs in testing right now to work as vaccines or antivirals, and some of them, like their arthritis drug, have already been proven to work. So, we just have to get through the accelerated trials and testing to unleash it on the market. But for anybody who has a drug, it's going to take a year to mass-produce enough to inoculate the entire country, let alone the world. So, don't make any big bets on getting a vaccine any time soon—it's a very long process. Even in normal times, some of these drugs take months to manufacture.

Q: Are there any ventilator stocks out there?

A: There are; a company called Medtronic (MDT), which the Mad Hedge Biotech & Healthcare Letter also covers. They are the largest ventilator company in the US. Their normal production is 100 machines a week. Now, they are increasing that to 500 a week as fast as they can, but it isn’t enough. We need about 100,000 ventilators. China is now selling ventilators to the US. Elon Musk from Tesla (TSLA) just bought 1,000 ventilators in China and had them shipped over to San Francisco at his own expense, and Virgin Atlantic just flew over a 747 full of ventilators and masks and other medical supplies from China. So yes, there are stocks out there to play these things, they have already had large moves. We liked them anyway, even before the pandemic, so those calls were quite good. And China thinks their epidemic is over, so they are happy to sell us all the medical supplies they can make.

Q: Why did 30-year mortgage rates just go up instead of down? I thought the Fed rate cuts were supposed to take them down; am I missing something?

A: In order to get 30-year mortgage rates down, you have to have buyers of 30-year loans, and right now there are buyers of nothing. The lending that is happening is from banks lending their own money, which is only a tiny percentage of the total loan market. When the Fed moves into the mortgage market, you will see those yields move to the 2% range. The other problem is how to get a loan if all the banks are closed. They are running skeletal staff now, and you can’t close on real estate deals because all the notaries and title offices are closed; so essentially the real estate industry is going to shut down right now and hopefully, we’ll finish that in a month.

Q: Do you think Uber (UBER) and Lyft (LYFT) will go bankrupt?

A: It is a possibility because one to one human contact inside a car is about the last situation you want to be in during a pandemic. Their traffic was down 25% according to a number I saw. It’s very heavily leveraged, very heavily indebted, and those are the companies that don’t survive long in this kind of crisis. So, I would say there is a chance they will go under. I never liked these companies anyway; they are under regulatory assault by everybody, depend on non-union drivers working for $5 an hour, and there are just too many other better things to do.

Q: Is this the end of corporate buybacks?

A: To some extent, yes. A future Congress may make it either illegal or highly tax corporate buybacks, in some fashion or another because twice in 12 years now, we have had companies load up on buying back their own stock, boosting CEO compensation to the hundreds of millions—if not billions—and then going broke and asking for government bailouts. Something will be done to address that. If you take buybacks out of the market (the last 10,000-point gain in the Dow were essentially all corporate buybacks), we may not see a 20X earnings multiple again for another generation. Individuals were net sellers of stock for those two years. We only reached those extreme highs because of buybacks, so you take those out of the equation and it's going to get a lot harder to get back to the super inflated share prices like we had in January.

Q: How long before an Italian bank collapses, and will they need a bailout?

A: I don’t think they will get a collapse; I think they will be bailed out inside Italy and won’t need all of Europe to do this. But the focus isn't on Europe right now, it's on the US.

Q: Do you think this virus is really subsiding in China based on their past history of dishonest reporting?

A: Yes, that is a risk, and that's why people aren’t betting the ranch right now—just because China is reporting a flattening of cases. And China could be hit with a second wave if they relax their quarantine too soon.

Q: What's your opinion on how the Fed is doing and Steve Mnuchin in this crisis?

A: I think the Fed is doing everything they possibly can. I agree with all of their moves—this is an all-hands-on-deck moment where you have to do everything you can to get the economy going. Notice it’s Steve Mnuchin doing all the negotiating, not the president, because nobody will talk to him. For a start, he may be a Corona carrier among other things, and you’re not seeing a lot of social distancing in these press conferences they are holding. About which 50% of the information they give out is incorrect, and that's the 50% coming from Donald Trump.

Q: What do you think about no debt and no pension liability?

A: That’s why Tech has been leading the upside for the last 10 years and will lead for the next 10. You can really narrow the market down to a dozen stocks and just focus on those and forget about everything else. They have no net debt or net pension fund liabilities.

Q: Why have we not heard from Warren Buffet?

A: I'm sure negotiations are going on all over the place regarding obtaining massive stakes in large trophy companies that he likes, such as airlines and banks. So that will be one of the market bottom indicators that I mentioned a couple of days ago in my letter on “Ten Signs of a Market is Bottoming.”

Q: What’s the outlook for gold?

A: Up. We just had to get the financial crisis element out of this before we could go back into gold, so I would be looking to buy SPDR Gold Shares ETF (GLD), the gold miners like Barrick Gold (GOLD) and Newmont Mining (NEM), the Van Eck Vectors Gold Miners ETF (GDX), and the 2X long ProShares Gold ETF (UGL).

Q: Does the Fed backstop give you any confidence in the bond market?

A: Yes, it does. I think we finally may be getting to the natural level of the market, which is around an 80-basis point yield. Let’s see how long we can go without any 50-point gyrations.

Q: Do you foresee a depression?

A: We are in a depression now. We could hit a 20% unemployment rate. The worst we saw during the Great Depression was 25%. But it will be a very short and sharp one, not a 12-year slog like we saw during the 1930s.

Good Luck and Good Trading and stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

December 18, 2018

Fiat Lux

Featured Trade:(THE CHRISTMAS RALLY GOT STOPPED AT THE BORDER)

(TLT), (TSLA), (AAPL)

(THE PASSIVE/AGGRESSIVE PORTFOLIO),

(ROM), (UYG), (UCC), (DIG), (BIB), (UGL), (UCD), (TBT)

What if you want to be a little more aggressive, say twice as aggressive?

What if markets don’t deliver any year on year change as they have done many times in the past?

Then you need a little more juice in your portfolio, and some extra leverage to earn your crust of bread and secure your retirement.

It turns out that I have just the solution for you.

This would be my “Passive/Aggressive Portfolio.”

I call it passive in that you just purchase these positions and leave them alone and not trade them.

I call it aggressive as it involves a basket of 2x leveraged ETFs issued by ProShares, based in Bethesda, MD (click here for their link).

The volatility of this portfolio will be higher. But the returns will be double what you would get with an index fund, and possibly much more. It is a “Do not open until 2035” kind of investment strategy.

Here is the makeup of the portfolio:

(ROM) –- ProShares Ultra Technology Fund - The three largest single-stock holdings are Apple (AAPL), Microsoft (MSFT), and Facebook (FB). For more details on the fund, please click here.

(UYG) – ProShares Ultra Financials Fund - The three largest single-stock holdings are Wells Fargo (WFC), Berkshire Hathaway (BRK.B), and JP Morgan Chase (JPM). For more details on the fund, please click here.

(UCC) – ProShares Ultra Consumer Services Fund - The three largest single-stock holdings are Amazon (AMZN), (Walt Disney), (DIS), and Home Depot (HD). For more details on the fund, please click here.

(DIG) -- ProShares Ultra Oil & Gas Fund - The three largest single-stock holdings are ExxonMobile (XOM), Chevron (CVX), and Schlumberger (SLB). For more details on the fund, please click here.

(BIB) – ProShares Ultra NASDAQ Biotechnology Fund – The three largest single-stock holdings are Amgen (AMGN), Regeneron (REGN), and Gilead Sciences (GILD). For more details on the fund, please click here.

You can play around with the sector mix at your own discretion. Just focus on the fastest growing sectors of the US economy which the Mad Hedge Fund Trader does on a daily basis.

It is tempting to add more leveraged ETFs for sectors that are completely bombed out, like gold (UGL) and commodities (UCD).

But it is likely that these despised ETF’s will move down before they move up, especially going into yearend.

There is also the 2X short Treasury bond fund (TBT) which I have been trading in and out of for years, a bet that long-term bonds will go down, interest rates rise.

There are a couple of provisos to mention here.

This is absolutely NOT a portfolio you want to own going into a recession. So you will need to exercise some kind of market timing, however occasional.

The good news is that I make more money in bear markets than I do in bull markets because the volatility is so high. However, to benefit from this skill set, you have to keep reading the Diary of a Mad Hedge Fund Trader.

There is also a problem with leveraged ETFs in that management and other fees can be high, dealing spreads wide, and tracking error huge.

This is why I am limiting the portfolio to 2X ETFs, and avoiding their much more costly and inefficient 3X cousins which are really only good for intraday trading. The 3X ETFs are really just a broker enrichment vehicle.

There are also going to be certain days when you might want to just go out and watch a long movie, like Gone With the Wind, with an all ETF portfolio, rather than monitor their performance, no matter how temporary it may be.

A good example was the August 24 flash crash when the complete absence of liquidity drove all of these funds to huge discounts to their asset values.

Check out the charts below, and you can see the damage that was wrought by high-frequency traders on that cataclysmic day, down -35% in the case of the (ROM). Notice that all of these discounts disappeared within hours. It was really just a function of the pricing mechanism being broken.

I have found the portfolio above quite useful when close friends and family members ask me for stock tips for their retirement funds.

It was perfect for my daughter who won’t be tapping her teacher’s pension accounts for another 45 years when I will be long gone. She mentions her blockbuster returns every time I see her, and she has only been in them for five years.

Imagine what technology, financial services, consumer discretionaries, biotechnology, and oil and gas will be worth then? It boggles the mind. My guess is up 100-fold from today’s levels.

You won’t want to put all of your money into a single portfolio like this. But it might be worth carving out 10% of your capital and just leaving it there.

That will certainly be a recommendation for financial advisors besieged with clients complaining about paying high fees for negative returns in a year that is unchanged, or up only 1%-2%. Virtually everyone has them right now.

Adding some spice, and a little leverage to their portfolios might be just the ticket for them.

What if you want to be a little more aggressive with your investment strategy, say twice as aggressive? What if markets don't deliver any year on year change?

Then you need a little more pizzazz in your portfolio, and some extra leverage to earn your crust of bread and secure your retirement.

It turns out that I have just the solution for you. This would be my "Passive/Aggressive Portfolio".

I call it passive in that you just purchase these positions and leave them alone and not trade them. I call it aggressive as it involves a basket of 2x leveraged ETF's issued by ProShares, based Bethesda, MD (click here for their link).

The volatility of this portfolio will be higher. But the returns will be double what you would get with an index fund, and possibly much more. It is a "Do not open until 2035" kind of investment strategy.

Here is the makeup of the portfolio:

(ROM) - ProShares Ultra Technology Fund - The three largest single stock holdings are Apple (AAPL), Microsoft (MSFT), and Facebook (FB). It was up 80.95% last year. For more details on the fund, please click here.

(UYG) - ProShares Ultra Financials Fund - The three largest single stock holdings are Wells Fargo (WFC), Berkshire Hathaway (BRK.B), and JP Morgan Chase (JPM). It was up 38.42% last year. For more details on the fund, please click here.

(UCC) - ProShares Ultra Consumer Services Fund - The three largest single stock holdings are Amazon (AMZN), Walt Disney (DIS), and Home Depot (HD). It was up 3.71% last year. For more details on the fund, please click here.

(DIG)- ProShares Ultra Oil & Gas Fund - The three largest single stock holdings are ExxonMobil (XOM), Chevron (CVX), and Schlumberger (SLB). It was DOWN 9.20% last year. For more details on the fund, please click here.

(BIB) - ProShares Ultra NASDAQ Biotechnology Fund - The three largest single stock holdings are Amgen (AMGN), Regeneron (REGN), and Gilead Sciences (GILD). It was up 40.49% last year, please click here.

You can play around with the sector mix at your own discretion. Just focus on the fastest growing sectors of the US economy, which the Mad Hedge Fund Trader does on a daily basis.

It is tempting to add more leveraged ETF's for sectors like gold (UGL), to act as an additional hedge.

There is also the 2X short Treasury bond fund (TBT), which I have been trading in and out of for years, a bet that long-term bonds will go down, interest rates rise.

There are a couple of provisos to mention here.

This is absolutely NOT a portfolio you want to own going into a recession. So, you will need to exercise some kind of market timing, however occasional.

The good news is that I make more money in bear markets than I do in bull markets because the volatility is so high. However, to benefit from this skill set, you have to keep reading the Diary of a Mad Hedge Fund Trader.

There is also a problem with leveraged ETF's in that management and other fees can be high, dealing spreads wide, and tracking error huge.

This is why I am limiting the portfolio to 2X ETF's, and avoiding their much more costly and inefficient 3X cousins, which are really only good for intraday trading. The 3X ETF's are really just a broker enrichment vehicle.

There are also going to be certain days when you might want to just go out and watch a long movie, like Gone With the Wind, with an all ETF portfolio, rather than monitor their performance, no matter how temporary it may be.

A good example was the flash crash, when the complete absence of liquidity drove all of these funds to huge discounts to their asset values.

Check out the long-term charts, and you can see the damage that was wrought by high frequency traders on that cataclysmic day, down -53% in the case of the (ROM). Notice that all of these discounts disappeared within hours. It was really just a function of the pricing mechanism being broken.

I have found the portfolio above quite useful when close friends and family members ask me for stock tips for their retirement funds.

It was perfect for my daughter, who won't be tapping her teacher's pension accounts for another 45 years, when I will be long gone. She mentions her blockbuster returns every time I see her, and she has only been in them for five years.

Imagine what technology, financial services, consumer discretionaries, biotechnology, and oil and gas will be worth then? It boggles the mind. My guess is up 100-fold from today's levels.

You won't want to put all of your money into a single portfolio like this. But it might be worth carving out 10% of your capital and just leaving it there.

That will certainly be a recommendation for financial advisors besieged with clients complaining about paying high fees for negative returns in a year that is unchanged, or up only 1%-2%. Virtually everyone has them right now.

Adding some spice, and a little leverage to their portfolios might be just the ticket for them.

I have long advocated my ?Buy and Forget? portfolio for those who are terrible at trading.

This is where you buy just six self hedging, counterbalancing exchange traded funds and then rebalance once a year (click here for the article).

But what if you want to be a little more aggressive, say twice as aggressive? What if markets don?t deliver any year on year change, as they have done this year?

Then you need a little more juice in your portfolio, and some extra leverage to earn your crust of bread and secure your retirement.

It turns out that I have just the solution for you. This would be my ?Passive/Aggressive Portfolio?.

I call it passive in that you just purchase these positions and leave them alone and not trade them. I call it aggressive as it involves a basket of 2x leveraged ETFs issued by ProShares, based in Bethesda, MD (click here for their site).

The volatility of this portfolio will be higher. But the returns will be double what you would get with an index fund, and possibly much more. It is a ?Do not open until 2035? kind of investment strategy.

Here is the makeup of the portfolio:

(ROM) ?- ProShares Ultra Technology Fund - The three largest single stock holdings are Apple (AAPL), Microsoft (MSFT), and Facebook (FB). It is up 13.7% so far this year. For more details on the fund, please click here: http://www.proshares.com/funds/rom_daily_holdings.html.

(UYG) ? ProShares Ultra Financials Fund - The three largest single stock holdings are Wells Fargo (WFC), Berkshire Hathaway (BRK.B), and JP Morgan Chase (JPM). It is up 6.2% so far this year. For more details on the fund, please click here: http://www.proshares.com/funds/uyg_index.html.

(UCC) ? ProShares Ultra Consumer Services Fund - The three largest single stock holdings are Amazon (AMZN), (Walt Disney), (DIS), and Home Depot (HD). It is up 18.3% so far this year. For more details on the fund, please click here: http://www.proshares.com/funds/ucc.html.

(DIG) -- ProShares Ultra Oil & Gas Fund - The three largest single stock holdings are ExxonMobil (XOM), Chevron (CVX), and Schlumberger (SLB). It is DOWN 38.2% so far this year. For more details on the fund, please click here: http://www.proshares.com/funds/dig.html.

(BIB) ? ProShares Ultra NASDAQ Biotechnology Fund ? The three largest single stock holdings are Amgen (AMGN), Regeneron (REGN), and Gilead Sciences (GILD). It is up 15% so far this year, but at one point (before the ?Sell in May and Go away? I widely advertised) it was up a positively stratospheric 64%. For more details on the fund, please click here; http://www.proshares.com/funds/bib.html.

You can play around with the sector mix at your own discretion. Just focus on the fastest growing sectors of the US economy, which the Mad Hedge Fund Trader does on a daily basis.

It is tempting to add more leveraged ETFs for sectors that are completely bombed out, like gold (UGL), which has pared 27% of its value in 2015, and commodities (UCD) which is off 15%.

But it is likely that these despised ETFs will move down before they move up, especially going into year end.

There is also the 2X short Treasury bond fund (TBT), which I have been trading in and out of for years, a bet that long-term bonds will go down, interest rates rise.

There are a couple of provisos to mention here.

This is absolutely NOT a portfolio you want to own going into a recession. So you will need to exercise some kind of market timing, however occasional.

The good news is that I make more money in bear markets than I do in bull markets because the volatility is higher. However, to benefit from this skill set, you have to keep reading the Diary of a Mad Hedge Fund Trader.

There is also a problem with leveraged ETFs in that management and other fees can be high, dealing spreads wide, and tracking errors huge.

This is why I am limiting the portfolio to 2X ETFs, and avoiding their much more costly and inefficient 3X cousins, which are really only good for intraday trading. The 3X ETFs are really just a broker enrichment vehicle.

There are also going to be certain days when you might want to just go out and watch a long movie, like Gone With the Wind, with an all ETF portfolio, rather than monitor their performance, no matter how temporary it may be.

A good example was the August 24 flash crash, when the complete absence of liquidity drove all of these funds to huge discounts to their asset values.

Check out the charts below, and you can see the damage that was wrought by high frequency traders on that cataclysmic day, down -53% in the case of the (ROM). Notice that all of these discounts disappeared within hours. It was really just a function of the pricing mechanism being broken.

I have found the portfolio above quite useful when close friends and family members ask me for stock tips for their retirement funds.

It was perfect for my daughter who won?t be tapping her teacher?s pension accounts for another 45 years, when I will be long gone. She mentions her blockbuster returns every time I see her, and she has only been in them for five years.

Imagine what technology, financial services, consumer discretionaries, biotechnology, and oil and gas will be worth then? It boggles the mind. My guess is up 100 fold from today?s levels.

You won?t want to put all of your money into a single portfolio like this. But it might be worth carving out 10% of your capital and just leaving it there.

That will certainly be a recommendation for financial advisors besieged with clients complaining about paying high fees for negative returns in a year that is unchanged, or up only 1%-2%. Virtually everyone has them right now.

Adding some spice, and a little leverage to their portfolios might be just the ticket for them.

It?s Time to Spice Up Your Portfolio

It?s Time to Spice Up Your PortfolioHave you ever held a basketball underwater in a swimming pool and let go? It flies to the upside and pops you in the nose. That is exactly what gold is doing now. After the barbarous relic peaked at $1,922 on August 24, it traded like an absolute pig, giving up 20% in a matter of weeks. I managed to coin it with a couple of quick in and out trades in (GLD) puts, some doubling over a weekend. So much for the ?safe asset? theory.

You can thank hedge fund titan, John Paulsen, for the action. John gained international notoriety when he earned a $4 billion bonus after making huge bets against subprime loans going into the housing crash.

Since then, his touch has grown somewhat icy. He started out 2011 with a huge, bullish bet on US banks, a play, I confess, I never really understood. This was back when Bank of America (BAC) was trading at a lofty $14/share. As a hedge, he backed up these gargantuan positions with big holdings in gold, which quickly made him the largest owner of the ETF (GLD).

John?s P&L held up reasonably well during the first part of the year. As the banks faded, gold went from strength to strength, limiting his damage. That all changed on April 29 when global financial markets flipped into ?RISK OFF? mode and gold melted along with everything else. Its hedging capability proved to be nil. By August, John?s losses approached a near death 50%.

Needless to say, his investors failed to see the humor in the situation, and rumors of cataclysmic redemptions started sweeping the street. By implication, this could only mean large scale liquidation of the yellow metal. This was happening when the rest of the hedge fund industry was catching daily margin calls, forcing them to dump even more gold into a downward spiral, their best performing holding for the year. When the sushi hits the fan, you sell what you can, not what you want to. By the time the carnage ended, gold was down $392.

When the crying was over, Paulson had reduced his ownership in the ETF (GLD) from 31.5 million shares to 20.3 million. That?s a haircut of $1.76 billion of the shiny stuff. In the end, Paulson says he only suffered redemptions of 10% of his somewhat reduced funds, much lower than expected.

Gold actually anticipated the new ?RISK ON? trade by a week, bottoming on September 26. Since then it has behaved like a paper asset, tracking the S&P 500 almost tick for tick, adding a quick 19.6%. So, what?s up with gold?

As we approach yearend, the downward pressure of this redemption selling is waning, hence my basketball analogy. New bull arguments have also come to the fore. The contagion in Europe has prompted massive buying of all precious metals by panicky individuals, including silver (SLV), platinum (PPLT), palladium (PALL), and even neglected rhodium, with a collapse of the Euro imminent. And how will the ECB eventually end the crisis? With a continental TARP and quantitative easing, which we here in the US already know is hugely positive for gold prices.

How far will the gold get this time? The gold bugs say we?re going to break the old high and power on through to the inflation adjusted high at $2,300. I?m not so sure. I am not willing to bet the ranch here on an asset class that could plunge $1,000 going into the next recession, which could be just around the corner.

But there may be a trade here in precious metals space for the nimble. My pick has been to buy lagging silver, which offers much more bang per buck if the sector starts to build a head of steam. The white metal will not get hit with IMF gold sales, which are also a rumored part of any European bailout package.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.