Global Market Comments

June 21, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or PREPARING FOR THE POST-RECESSION STOCK MARKET)

(NVDA), (SPY), (MSFT), (V), (TLT), (TSLA)

Global Market Comments

June 21, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or PREPARING FOR THE POST-RECESSION STOCK MARKET)

(NVDA), (SPY), (MSFT), (V), (TLT), (TSLA)

What if they gave a recession, and nobody came?

Better yet, what if we’re already in a recession that is about to end?

Q1 brought us a GDP growth of negative 1.5%. All we need is for the current quarter to bring in a negative number and we meet the textbook definition of a recession. That means an economic recovery could begin in as little as two weeks.

The way all asset classes traded worldwide last week confirms this view. What has really been impressive is how energy has gone from the most loved sector in the market to the most hated….in hours. Oil and energy stocks have seen the most extreme price reversals in their history, down some 20%.

If you truly believed that we were going into a recession, oil is the last thing in the world you want to own. It cost money to store and there is no storage. The Russians have locked up all they can get to place the oil that no one is buying because of the sanctions.

Tanker charters have disappeared as new buyers of Russian oil, like India and China, re-route crude from its traditional buyers in Europe.

And if you don’t sell maturing futures contracts, you have to take physical delivery of millions of barrels of oil. This is borne out by the futures market, which already has oil trading at a lowly $70 one year out. This is why the oil industry isn’t investing a dime in their own business. They’ve seen this movie before.

It isn’t just stocks and oil that are collapsing. It is everything, from copper to new home construction to retail sales. All of the loss in share prices this year, some 20%, is due to multiple compression, from 21 down to 17. Earnings are still rising. That shows there is no logic to the selling.

People just want out.

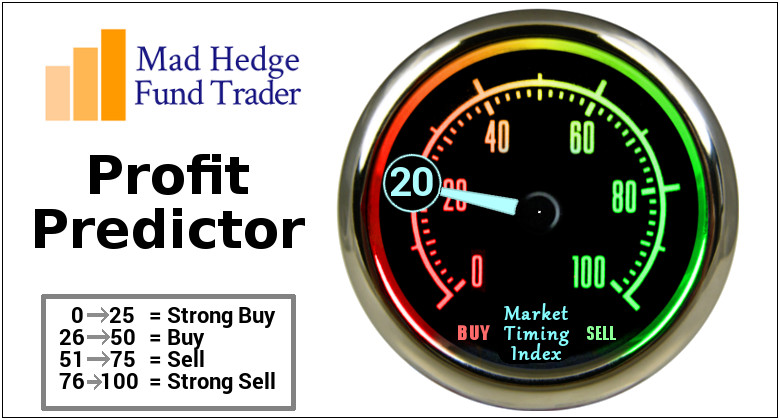

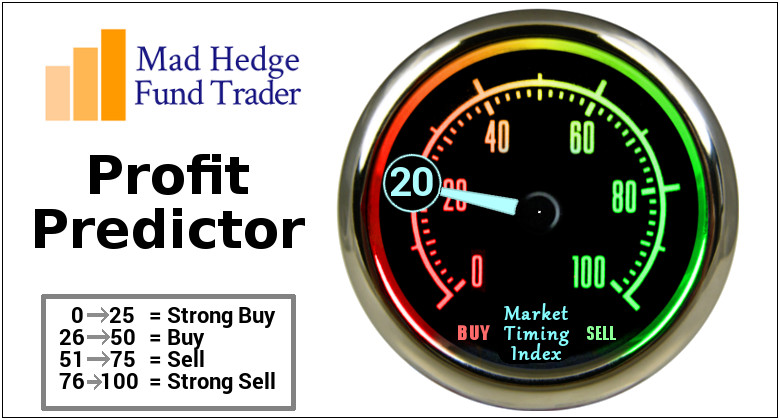

We have just about dotted all the “I”’s and crossed all their “T”’s to meet the requirements of a bear market bottom. Only 2% of stocks are now above their 50-day moving average. Equity put to call ratios are close to one. There has been massive selling of sectors that only recently started to plunge, like energy and utilities.

This has brought us a negative wealth effect that has sucked $13.1 trillion out of the real economy since November.

Watch for the trifecta of yields ($TNX), the US dollar (UUP), and oil (USO) rolling over. The “everything” bubble is over.

That makes the Bitcoin crash particularly compelling to watch, as it has become a great risk indicator for all asset classes. It broke $19,000 over the weekend. It turns out that 24/7 trading means it can go down a lot faster.

Crypto in general is having its “Lehman Brothers” moment. Crypto banks, NFTs, and brokers are dropping like flies as cascading margin calls wash through the system.

This was a field where there was margin on margin upon margin. Celsius, a crypto lender, has frozen $11 billion worth of deposits. As a long-time hedge fund manager, I can tell you that gating an asset class and preventing withdrawals brings certain death.

Some of these banks were guaranteeing 19% interest rates. It’s proof yet again that if it’s too good to be true, it usually isn’t.

All of this presages a crash in the inflation rate of epic proportions from the current 8.6%. We could be back to the Fed target of 2% by yearend if last week’s trends continue.

Since the Fed is so slow to act, the next two 0.75% rate hikes are in the bag. After that, even the Fed will release that it has a recession on its hands. All further rise hikes will cease, and they may even be back to cutting by 2023.

What happens if the above scenario plays out? It’s back to the Roaring Twenties once again and my new American Golden Age.

And while we are talking about the possibility of stocks going up once again, let me fill you in on a trade that looks particularly compelling.

Sell Short the July 15 Tesla $500 puts.

That closed at $12.25 on Friday with 18 days until expiration. At an 82.3% implied volatility, Tesla is one of the most volatile stocks in the market so they will pay you fortunes for the puts. For each put you sell short, you earn $1,225. The $500 strike price is down 58.3% from the $1,200 high seen in January. This is for a company that is seeing vehicle sales rise by 40% this year, and gross sales up 50% (they raised prices three times).

In this trade, you WANT the share to get sold to you at $500. Just take delivery of the shares. Then you can ride them up to my ten-year forecast of $10,000 and get a 20-fold return. If you don’t get triggered on the puts, just do the trade again for August and take in another $1,225 and every month until you are, or the trade goes away.

I know this trade works as I have done it several times with these results.

How do you think I got three Teslas?

Fed Raises Rates by 75 Basis Points, the most in 28 years, lifting a great weight from the shoulders of the market. Stocks rallied as well as bonds. It was one of the most confusing market responses I can recall. Two more 75 basis point hikes are in the can. The overnight rate could be at 2.75% by September. This may not be THE bottom, but it is A bottom. I’m adding risk here.

Dow Average Breaks 30,000, for the first time in a year, down 8,000 in less than six months, or 21%. Jay Powell has really taken a whip to this market. Suddenly, money costs money. I see another 5% of downside easy, then a strong rally.

Tesla is Raising Prices on its Cars, passing on rising commodity prices directly to customers because they can. There is still a one-year wait to get a new Model X. $7.00 gasoline is a dream come true for all EV makers, which are getting overwhelmed with demand. Ford quit taking orders for their all-electric F-150 at 200,000 because they can’t fill them. It might be smart to sell short the Tesla July $500 puts expiring in 20 trading days for a generous premium. If the stock falls that far, just take delivery of the shares and then ride them up to $10,000.

Tesla Proposes 3:1 Stock Split, its third since the company went public in 2010. Elon Musk is not above financial engineering to boost the share price. A cheaper share price would suck in more Millennial investors who love the company. Keep buying (TSLA) on dips like this one.

Soaring Interest Rates Demolish New Home Construction, down 14.42% in May. It’s only going to get worse. Avoid homebuilders like the plague.

Weekly Jobless Claims come in at 229,000, down 3,000. Watch this number climb as recession fears rise. The risk of a hard landing is growing exponentially.

Bitcoin is Still in Free Fall, down 10% on the day, and is just cents from breaking the crucial $20,000 support level. There are no buyers anywhere, and margin calls are running rampant. Several cryptos are not at risk of going under. This is when you find out who’s been swimming without a swimsuit. I am so glad I avoided crypto this year.

Ten-Year Treasuries Hit 11-Year High, at a 3.48% yield. This is the beginning of the end for the bear market in bonds, the worst in history.

30-Year Fixed Rate Mortgages Rocket to 6.28%, from 5.5%, effectively shutting down the market. Now you REALLY have to worry about real estate. That’s up from 2.8% in November. Avoid homebuilders like (LEN), (PHM), and (KBH) on pain of death.

FDA Approves Covid Shots for Kids, down to six months. Two mini shots are all that is needed. It will do a lot to bring working parents back into the workforce, and address worries of grandparents like me.

Producer Price Index Jumps 10.8% YOY, fanning the flames of inflation. The April print was up 0.8% compared to 0.4% a month earlier according to the Labor Department. Russia’s war in Ukraine continues to roil food and oil supplies globally, and China has started re-imposing Covid-19 restrictions just weeks after loosening them in major cities

Strong Dollar is Demolishing US Corporate Profits, and the worst is yet to come. Weaker foreign currencies like the Euro (FXE) and the yen (FXY) means international sales bring in less dough. Blame the Fed for a steady diet of interest rate rises which make the greenback the most attractive currency in the world.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility in market history, my June month-to-date performance exploded to +5.91%.

My 2022 year-to-date performance ballooned to 47.78%, a new high. The Dow Average is down -17.66% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 69.35%.

Last week, we made an absolute killing with the June option expiration day, running six position into their maximum profit into the close. Those were in (NVDA), a double short in (SPY), (MSFT), (V), and (TLT).

I also used the big down 1,000-point days to add new July longs in (MSFT), (NVDA), (BRKB), and (TSLA). Putting on front month call spreads with the Volatility Index over $30 is like shooting fish in a barrel.

That brings my 14-year total return to 560.34%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 44.23%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 86.3 million, up 300,000 in a week and deaths topping 1,014,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, June 20 markets are closed for the first-ever Juneteenth, the celebration of the freeing of the slaves.

On Tuesday, June 21 at 7:00 AM, Existing Home Sales for May are published.

On Wednesday, June 22 at 7:00 AM, MBA Mortgage Applications for the previous week are printed.

On Thursday, June 23 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, June 24 at 7:00 AM, New Home Sales for May are disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, since I hike ten miles with a 50-pound pack every evening, it is not unusual for me to wake up feeling like I was run over by a truck.

But one morning was different. I had no energy. So, I took a Covid test. It was negative. The next morning, I was still weak, so I took the test again. Still negative.

It was only on the third morning that I produced a positive test. I had Covid-19.

I don’t know how the heck I got this disease as I had been so careful for the past 2 ½ years with my background in virology. No UCLA degree helped here. That’s why they call this variant the “stealth omicron BA.2”.

The scary thing was that I tested negative for three days while I was potentially spreading the virus.

Thank goodness for the two vaccinations and two booster shots I received. They saved my life. They headed off a long hospital stay, a long covid disability, or even death. Thank you, Pfizer!

So I quarantined myself, donned a mask whenever I left my bedroom, and shoved cash under the door whenever the kids needed to eat.

I became a couch potato of the first order, binge-watching Killing Eve, Yellowstone, and every Star Trek ever made (there are hundreds).

Fortunately, I did not lose my sense of taste or smell, as do many others. But when you sleep 18 hours a day, you don’t eat. In two weeks, I lost 15 pounds. I guess every virus has a silver lining. But every day, I felt better and better.

Of course, I had to keep working. I sent out a dozen trade alerts while I had Covid, and the newsletters and Hot Tips kept pouring out every day.

One day, I had to give two webinars and I almost passed out during the second one. I had to excuse myself for a minute and place my head between my knees to keep from blacking out.

No rest for the wicked!

I’m completely over it now. I had to cut more loops in my belts because my pants kept falling off. I can get into clothes which haven’t fit for 40 years. Fortunately, men’s fashion never go out of style.

And here’s the really great news. I am totally immune to all covid variants for a year. The disease acts as a fifth super booster.

Looks like it’s time to top up that bucket list again. If nothing else, Covid reminded me of the shortness of life and the transitory nature of opportunity. The response of a lot of Covid survivors has been to trash the budget, throw caution to the wind, and go do those things you always wanted to do.

Why should I be any different? There is no tomorrow, next week, or next year, only now.

I’ll be hitting the road.

See you at Harry’s Bar in Venice!

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Oops, I Got Covid

A Negative Test at Last

Global Market Comments

May 31, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHY I LOVE INFLATION),

(SPY), (TLT), (TBT), (GOOGL),

(AAPL), (MSFT), (BRKB), (NVDA), (V)

I love inflation.

Thanks to the relentless increase in prices, the value of my home has risen by $4 million over the last ten years, and $2 million over the last three years alone.

And I’m not the only one.

Some 66% of Americans own their own homes and may have seen similar price increases or more.

So, what if the price of a gallon of milk goes up by $1? I’ll happily pay that if it means my largest personal investment appreciates at triple-digit rates. Besides, I’m lactose intolerant anyway, and all my kids have grown up.

I’ll tell you what else inflation does. It makes stocks really cheap. That’s because investors fear that the Fed will raise interest rates by too much, destroy company earnings, and trigger a recession.

This is counterintuitive because companies actually benefit from inflation because they can get away with faster price increases more often, boosting profits. I took my kids out to a graduation dinner yesterday and practically had to take out a second mortgage to do so.

Personally, I believe that such a stock market bottom is close. But while the last bottom was within 10%, or 200 S&P 500 (SPX) points in terms of price, it is only 50% in terms of time. That signals a great new bull market for stocks beginning sometime this summer. Then anything you touch will double in three years.

You will look like a genius….again!

You can see who agrees with me by looking at which stocks are already getting bought up. Coca-Cola (KO), Johnson & Johnson (JNJ), and Procter & Gamble (PG) are the kind of safe, dividend-paying, brand name stocks that very long-term investors like pension funds love to own. They tend to buy and hold….forever.

No meme stocks here.

It isn’t just the Fed that is raising interest rates, which can only control overnight rates. The US budget deficit is falling at the fastest rate since WWII, possibly taking us to a budget surplus by year-end. As a result, the money supply is shrinking at the fastest rate in 60 years.

QT, or quantitative tightening, will fan the flames when it starts on January 1, ultimately taking up to $9 trillion out of the financial system.

Remember all that liquidity from QE, near-zero rates, and massive government spending that saved the economy from Armageddon? Play for movie in reverse and you get the oppositive result, i.e. falling share prices….at least for a while.

The battle as to who is right about the direction of the economy continues unabated. Is it bonds or stocks? At the rates that stocks have been plunging, stocks are essentially anticipating another Great Depression.

Ten-year US Treasury yields that soared from 1.33% to 3.12% in a mere six months are proclaiming that happy days are here again and will last forever. Since January, the average monthly mortgage payment has jumped by $450 a month. If that isn’t recessionary, I don’t know what is.

As a 53-year veteran of these markets, I can tell you that the bond market is always right. That’s because the money spent on equity research has shrunk to a shadow of its former self in recent decades, while bond research is as strong as ever.

Always listen to the guy with the $10 million budget and ignore the one with the $500,000 budget, which means that in the coming months, equity prognosticators will realize the error of their ways and come over to my way of thinking once again.

The Fed Minutes were not so horrible, downplaying the risk of a full 1% rate rise, triggering a 1,000-point rally in the Dow. With five up days in a row, this is starting to look like THE bottom. Is this the light at the end of the tunnel?

Q1 GDP dives 1.5% in its final read. It’s the worst quarter since the pandemic began during Q2 2022. Weekly Jobless Claims dropped 8,000 to 210,000.

NVIDIA Rips, surprising to the upside on almost every front, sending the stock up $30, or 18.75%. Mad Hedge followers bought (NVDA) last week. This is one of the best-run companies in the world. I expect the shares to rise from the current $178.51 to $1,000 in five years. Buy (NVDA) on dips.

The Consumer will keep driving the economy, says Bank of America CEO Brian Moynihan. Betting against the American consumer has always been a fool’s errand. I’m with Brian. Cash levels this high were never followed by recessions.

Only 18% of Americans will increase stockholdings this year, which is usually what you get at market bottoms. It was closer to 100% at the December top. Yet another signal that we are approaching the bottom in price, if not time.

New Home Sales dive in April, down 16.6% on a signed contract basis, the weakest in two years. The macro is definitely conspiring against the market. It’s all about interest rates. The average monthly mortgage payment has rocketed by $450 a month since January. Inventories have also soared from 6 to 9 months.

Advertising is in free fall, especially the online version, a usual pre-recession indicator. It is the easiest and first expense companies cut when they expect flagging sales. Look no further than yesterday’s astonishing 43% collapse in Snap (SNAP). Notice that TV commercials are getting endlessly repeated as the number of advertisers and ad rates fall. If I see one more ad for Interactive Brokers, I’ll shoot myself.

The EV Shortage worsens, with wait times for a new Tesla extending beyond a year. I can sell my Model X for more than I paid for it three years ago. Gasoline at $6.00 is converting a lot of drivers, and gas lines this summer loom. Big three dealers are price gouging on the few EVs they have, charging well over list. Good luck finding a Rivian pick-up; that’s a two-year wait. Maybe that makes (TSLA) a “BUY” down here?

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my May month-to-date performance recovered to +8.80%.

My 2022 year-to-date performance exploded to 38.98%, a new high. The Dow Average is down -9.30% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 61.22%.

Last week was a quiet one, with me using the monster rally to add new shorts in Apple (AAPL) and the S&P 500 (SPY).

That brings my 14-year total return to 551.54%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 84 million, up 1.5million in a week, and deaths topping 1,004,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, May 30, markets are closed for Memorial Day.

On Tuesday, May 31 at 9:00 AM EST, the S&P Case Shiller National Home Price Index for March is released.

On Wednesday, June 1 at 10:00 AM, JOLTS Job Openings for April are published.

On Thursday, June 2 at 8:30 AM, Weekly Jobless Claims are out. We also learn the ADP Private Employment Report for May.

On Friday, June 3 at 8:30 AM, the big Nonfarm Payroll Report for May is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, as a lifetime oenophile, or wine lover, I long searched for the Holy Grail of the perfect bottle. I finally found my quarry in 1989.

During the 19th century, Russia was still an emerging country that sought to import advanced European technology. So, they sent agents to the top wine-growing regions of the continent to bring back grapevine cuttings to create a domestic wine industry. They succeeded beyond all expectations building a major wine industry in Crimea on the Black Sea.

Then the Russian Revolution broke out in 1918.

Czar Nicholas II and his family were executed, and eventually, the wine industry was taken over by the Soviet state. They kept it going because wine exports brought in valuable foreign exchange with which the government could use to industrialize the country.

Then the Germans invaded in 1941.

Not wanting the enemy to capture a 100-year stockpile of fine wine, the managers of the Massandra winery dug a 100-yard-deep cave, moved their bottles in, bricked up the entrance, and hid it with shrubs. Then everyone involved in storing the wine was killed in the war.

Some 45 years later, looking to expand the facility, some Massandra workers stumbled across the entrance to the cave. Inside, they found a million bottles dating back to the 1850s kept in perfect storage conditions. It was a sensation in the wine collecting world.

To cash in, they hired Sotheby’s in London to repackage and auction off the wine one case at a time. It was the auction event of the year. For years afterwards, you could buy glasses of 100-year-old ports and sherries from the Czar’s own private stock at your local neighborhood restaurant for $5, the deal of the century.

I attended the auction at Sotheby’s packed Bond Street offices. The superstars of the wine collecting world were there with open checkbooks. I sat there with my paddle number 138 but was outbid repeatedly and wondered if I would get anything. In the end, I managed to pick up some of the less popular cases, a 1915 Madeira, a 1936 white port, and a 1938 sherry for about $25 a bottle each.

For years, these were my special occasion wines. I opened one when I was appointed a director of Morgan Stanley. Others went to favored clients at Christmas. My 50th, 60th, and 70th birthdays ate into the inventory. So did the birth of children number four and five. Several high school fundraisers saw bottles earn $1,000 each.

One of the 1915’s met its end when I came home from the Gulf War in 1992. Hey, the last Czar didn’t drink it and looked what happened to him! Another one bit the dust when I sold my hedge fund at the absolute market top in 1999. So did capturing 6,000 new subscribers for the Mad Hedge Fund Trader in 2010.

It turns out that the empties were quite nice too, 100-year-old hand-blown green glass, each one is a sculpture in its own right.

I am now reaching the end of the road and only have a half dozen bottles left. I could always sell them on eBay where they now fetch up to $1,000 a bottle.

But you know what? I’d rather have six more celebrations than take in a few grand.

Any suggestions?

Stay Healthy,

John Thomas

CEO & Publisher

Mad Hedge Technology Letter

January 7, 2022

Fiat Lux

Featured Trade:

(THE DEATH OF VISA AND MASTERCARD)

(MA), (V), (SQ), (PYPL), (AFTPY), (AFRM), (AMZN)

Visa and Mastercard’s card networks are a relic of the past, not in terms of reach or footprint, but the technology of it.

This will cost their stock price and we are already seeing it play out in the market.

The canary in the coal mine was fintech players Square (SQ) and PayPal (PYPL) whose share prices were pummeled at the back end of last year.

PYPL is down 40% from its 2021 peak and SQ experienced a similar 42% drop.

This fierce competition and the crowded marketplace have investors paying less of a premium than ever before.

In a tightening rate environment, it’s clear the wolves are out for more flesh and the contagion will spread to those further up the food chain.

Fintech business models aren’t as robust or foundational as the bulwarks of MA and V, but questions must be asked if small businesses aren’t willing to pay an extra 2% on sales for outdated technology.

The fintech space has moved a long way in a short amount of time causing investors to be concerned about secular growth sustainability.

Among them are concerns that consumers are shifting to debit, away from higher-margin credit cards.

Consumers are also using more alternative payment methods that may bypass the card networks, including “buy now pay later” services offered by companies like Klarna, Afterpay (AFTPY), and Affirm (AFRM).

Visa has also come under pressure from a recent announcement by Amazon.com (AMZN) that next year it will stop accepting Visa-branded credit cards issued in the United Kingdom and this could be the beginning of a narrowing of Visas’ moat that could trigger a domino effect in other rich western countries.

The bulls would say that the stocks could undergo a reversal if the Omicron variant is not as bad as initially thought creating a tsunami of consumer spending massaging the bottom line for Visa and Mastercard.

But it’s looking more like V and MA are the victims of tightening travel restrictions around the globe and elevated positive cases that are immobilizing consumers.

The big card networks rely heavily on revenues related to cross-border travel as consumers and businesses use their cards for airfare, Airbnb’s, and Ubers, as well as duty-free gifts in foreign countries.

Multiples may need to come down if the Omicron variant puts the shackles on travel as countries reimpose bans or quarantine rules.

Investors had been counting on a recovery in cross-border travel to boost revenues for the card networks. This is definitely a kick in the nuts after initially seeing momentum as countries in general trended to loosening restrictions.

International transactions brought in $1.9 billion, or 21%, of Visa’s $8.9 billion in revenues for the 2021 fourth quarter.

The segment is highly profitable due to steep transaction and foreign-exchange fees. Cross-border margins come in around 69%, contributing significantly to Visa’s overall earnings per share.

The Christmas season has been confronted by a bevy of new restrictions as many places consider other measures to curb the spread of the Omicron variant.

Ultimately, even if MA and V can get positive reinforcement from increased short-term travel which seems unlikely, alternative business models are breathing down their neck as the technology of money has advanced.

The “buy now, pay later” phenomenon, although risky, is a rapid gut punch to the incumbents.

Then consider there is speculative technology like Bitcoin out there that bypasses these dinosaur networks altogether.

I believe 2022 is the year that MA and V get exposed as a luxury in a frugal world where small businesses can’t afford to give away 2% of revenue.

There’s too much money being invested into the technology of money for small businesses to reach for MA and V’s network.

Even open banking and digital networks can really dent the traditional payment networks.

Basically, I believe these companies have hit the high-water mark, and the likes of Zelle and Venmo will start to put pressure on these high fees.

Places like China don’t even use them by bypassing them through digital wallets like Wechat pay and Alipay.

Pie shrinkage and revenue decelerate — I believe this is one of the seminal trends we will see in fintech in 2022.

Global Market Comments

October 8, 2021

Fiat Lux

Featured Trade:

(OCTOBER 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(FCX), (TSLA), (BLK), (MS), (JPM), ($NATGAS), (UNG), (BIDU), (MRNA), (COIN), (ROM), ($BTCUSD), (ETHE), (FB), (DAL), (ALK), (LUV) (MSTR), (BLOK), (V), (NVDA), (SLV), (TLT), (TBT)

Below please find subscribers’ Q&A for the October 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: When will Freeport McMoRan (FCX) go up?

A: When the China real estate crisis ends, and they start buying copper again to build new apartment buildings.

Q: Do rising interest rates imply trouble for tech?

A: Yes, they do, but only for the short term. Long term, these things all double on a three-year view; and the next rise up in tech stocks will start when interest rates peak out, probably with 10-year yields at 1.76% or 2.00%. The great irony here is that all the big techs profit from higher rates because they have such enormous cash flows and balances. But that is just how markets work.

Q: I know you’ve been promoting Tesla (TSLA) for a very long time. What do you think about it here?

A: We’ve just gone from $550 to over $800. It actually has been one of the best performing stocks in the market for the past four months. Short term, you want to take profits; long term you want to hold it because it could go up 10 times from the current level. They just broke all their sales records and are the fastest growing car company in the US or Europe.

Q: If Blackrock (BLK) is reliant on interest rates, will the rise in interest rates hurt them?

A: No, it’s the opposite. Rising interest rates are positive for Blackrock because it improves the return on their investments, which they get a piece of; so rising interest rates mean more money and more fees. That's why I own it— it is a rising interest rate play, not a falling interest rate play.

Q: What do you think about Baidu (BIDU)?

A: Stay away from all China trades right now, it’s uninvestable. Not only do I not know what the Chinese are going to do next—they seem to be attacking a new industry every week—but the Chinese don’t even seem to know. This is all new to them; they had been embracing the capitalist model for the last 40 years and they now seem to be backtracking. There are better fish to fry, like Morgan Stanley (MS) and JP Morgan (JPM).

Q: Don’t you have a bear put spread on Baidu (BIDU)?

A: We did have a bear put spread on Baidu, but that's only a very short term, front month trade. It does look like it’s going to make money; but keep in mind those are high-risk trades.

Q: Could Natural Gas (UNG) trigger an economic crisis?

A: Not really. In the US, natgas is only a portion of our total energy needs, about 34%, and that’s mostly in the Midwest and California. The US has something like a 200-year supply with fracking. Plus, we’re on a price spike here—we’ve gone from $2 to $20/btu in Europe, entirely manipulated by Russia trying to get more money on their exports and more political control over Europe. So, it’s a short-term deal, and you can bet a lot of pros are out there shorting natgas like crazy right here. The real issue here is that no one wants to invest in carbon-based energy anymore and that is creating bottlenecks in the energy supply chain.

Q: How long will it take to provide EV infrastructure to mass gas station availability?

A: The EV infrastructure has in fact been in progress for 20 years, if you count the first generation of EV in the late 90s, which bombed. Tesla has been building power stations in the US for 10 years. They have 10,000 chargers now in 1,800 stations and their goal is 20,000 charging stations. In fact, most people already have the infrastructure for EV charging—you just charge them at home overnight, like I do. The only time I ever need a charge is when I go to Lake Tahoe. For gasoline engines, on the other hand, it took 20 years to build infrastructure from 1900 to 1920 to replace horses. Believe it or not, gasoline cars were the great environmental advance of the day, because it meant you could get rid of all the horses. New York City used to have 150,000 horses, and the city was constantly struggling through streets of two-foot-deep manure piles. So that was the big improvement. It only took 100 years to take the next step.

Q: The latest commodity with supply constraints I hear about is cotton. Is this all just a temporary thing and can we expect supply capacity to be back to normal next year? Is this just the failing of a just-in-time model that simply doesn’t work in the age of deglobalization?

A: We are losing possibly one third of our current economic growth due to part shortages, labor shortages, supply chain problems—those all go away next year, and that one third of economic growth just gets postponed into 2022 which means that the economic recovery is extended over a longer period of time, and so is the bull market in stocks, how about that! That’s why I’m loading the boat right here. It’s the first time I've been 100% invested since May.

Q: What do you think about the airlines here?

A: High risk, but high return play for the next year. Delta (DAL) is a play on business travel recovery. Alaska Airlines (ALK) and Southwest(LUV) are a play on a vacation travel return flying return, which has already started—we’re back to pre-pandemic TSA clearances at airports.

Q: Is Facebook (FB) a buy now?

A: No, I want to wait for the dust to settle before I go back in. I think it does recover and go to new highs eventually but will go to lower lows first. Regulation is certainly coming but we don’t know what.

Q: When will the chip shortage end?

A: Two years. My prediction is much longer than anybody else's because people are designing chips into new products like crazy. All predictions for the chip shortage to end in only a year don’t take that into account.

Q: When do we go into the (ROM) ProShares Ultra Technology long play?

A: When interest rates peak out sometime early next year. It’s probably a great entry point for tech; until then they go nowhere.

Q: Does the appetite for financials extend to Canada and their banks with higher dividends?

A: Yes, US and Canadian interest rates tend to move fairly closely so that rising rates here should be just as good for banks in Canada, and you might even be able to get them cheaper.

Q: Do you suggest we buy Altcoin?

A: No, not unless you're a Bitcoin professional like a miner, who can differentiate between all the different Altcoins. You can buy up to 100 different Altcoins on the main exchanges like Coinbase (COIN). In the crypto business, there is safety and size; that means Bitcoin ($BTCUSD) and Ethereum (ETHE), which between them account for about three quarters of all the crypto ever issued. A Lot of the smaller ones have a risk of going to zero overnight, and that has already happened many times. So go with the size—they’re less volatile but they’ll still go up in a rising market. And you should subscribe to our bitcoin letter just to get the details on how that market works.

Q: Target for Bitcoin by Christmas?

A: My conservative target is $66,000, but if we really go nuts, we could go as high as $100,000. That’s the “laser eyes” target for a lot of the early investors.

Q: Suggestions for a Crypto ETF?

A: It’s not out yet but will be shortly. I think that Crypto will run like crazy in anticipation of the Bitcoin ETF that we don’t have yet.

Q: Should I buy Moderna (MRNA) on this dip at 320 down from 400, or is this a COVID revenue flash in the pan that won’t come back?

A: It’ll come back because they’re taking their COVID technology and applying it to all other human diseases including cancer, which is why we got in this thing two years ago. But we may have to find a lower low first. So I would wait on all the drug/biotech plays which right now are getting hammered with the demise of the delta virus.

Q: What’s your favorite ETF right now?

A: Probably the (TBT) Double Short Treasury ETF. I’m looking for it to go up another 30% from here to 24 or 25 by sometime next year.

Q: EVs have been hot this year; Lordstown Motors is down to only $5 from $27 and just got downgraded by an analyst to $2. Should I buy, or is this a dangerous strategy?

A: I would say highly dangerous. This company has been signaling that it’s on its way to bankruptcy essentially all year, so don’t confuse “gone down a lot” with being “cheap” because that’s how you buy stuff on the way to zero.

Q: What about Anthony Scaramucci’s ETF?

A: We will have Anthony Scaramucci as a guest in our December summit. And the ETF is a basket of stocks as diverse as MicroStrategy (MSTR), Blok (BLOK), Visa (V), and Nvidia (NVDA), so you will only get a fraction of the Bitcoin volatility. That means if Bitcoin goes up 100% you might get a 40% or 50% move in the actual ETF.

Q: Do you have a Bitcoin book coming out soon?

A: I do, it should be out by the end of this month. That’s The Mad Hedge Guide to Trading Bitcoin, and it will have all the research I’ve accumulated on trading Bitcoin in the past year.

Q: Why have you only issued one trade alert in Bitcoin?

A: You don’t get a lot of entry points for Bitcoin. You buy the periodic bottoms and then you run them. Dollar cost averaging is very useful here because there are no traditional valuation measures to use, like price earnings multiples or price to book. When it comes time to sell, we'll let you know, but there aren’t a lot of Bitcoin plays outside the Bitcoin exchanges.

Q: Thoughts on silver (SLV)?

A: It’s horribly out of favor now and will continue to be so as long as Bitcoin gets the spotlight. Also, there’s a China problem with the precious metals.

Q: There are 8 or 10 good public Bitcoin and Ethereum ETFs in Canada.

A: That’s true, if you’re allowed to trade in Canada.

Q: Can the US ban Bitcoin like China did?

A: No, if they did, it would just move offshore to the Cayman Islands or some other place outside the world of regulation.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log on to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

September 24, 2021

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(SEPTEMBER 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (TBT), (V), (AXP), (MA), (FSLR), (SPWR), (USO), (UNG), (PFE), (JNJ), (MRNA), (MS), (JPM), (FCX), (X), (FDX), (GLD), (UPS), (SLV), (AAPL), (VIX), (VXX), (UAL), (DAL), (ALK), (BRK/B), (BABA), (BITCOIN), (ETHEREUM), (YELL)

Below please find subscribers’ Q&A for the September 22 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

Q: When’s the United States US Treasury bond fund (TLT) going to go down?

A: When J. Powell tapers, which will be either today or in 6 weeks. That's the time frame we’re looking at now, and people are positioning now for the taper—that's why financials are taking off like a rocket. Buy those financials and don't expect too much from your tech stocks for the next few months.

Q: What do you think of adding corporate or municipal bonds to my portfolio?

A: Don’t do that on pain of death please; you will lose money. Corporate bonds will get slaughtered the second interest rates turn because they have the most exposure from a credit point of view to any downgrades resulting from rising interest rates. Better to keep your money in cash than buy bonds here. It was a great idea 10 years ago, but a terrible idea today. Just buy cash or buy extremely deep-in-the-money LEAPS which will get you a 10-20% per year return.

Q: What are the chances that the government defaults?

A: Zero, because corporate profits this year will increase from $2 trillion to $10 trillion, spinning off massive tax revenues for the government. The deficit will come down substantially in the future as a result. Keep expecting upwards surprises in profits and taxable revenues. That may be why the (TLT) is staying so high.

Q: I need a customized LEAPS on a stock.

A: We do those for our concierge customers. If you’re interested, then email Filomena at customer support at support@madhedgefundtrader.com.

Q: What brand of shot did you get?

A: Pfizer (PFE).

Q: The Government is showing no sign of balancing a budget and the hole will only get deeper; what are your thoughts?

A: I agree, and that’s why I'm short the (TLT). All we need is a taper to really get some juice under that trade; we really don’t need that much. Ten-year US Treasury yields are now around 1.30% and we only need the yield to get up to about 1.70% for us to make a maximum profit on our positions. One taper hint and it could get us up to those levels.

Q: Why is Visa (V) dropping so much?

A: Fear of being replaced by Bitcoin. This is the big thing dragging all three credit card companies down, including American Express (AXP) and master Card (MA). That's why I have not added a Visa position among my financials in this go around.

Q: How can the Fed unwind their balance sheet and normalize interest rates to a historical average of 4-5%?

A: Quite easily: quit buying bonds. They’re still buying $120 billion/month worth. Technology has accelerated with the pandemic and we all know this is highly deflationary. I expect the next peak in interest rates to be only 3% or 3.5%, not the 6% we saw in the last peak in interest rates in the 2000s. So yeah, bonds are going to go down but not back to 2000’s level.

Q: Thoughts on the Johnson & Johnson (JNJ) shot?

A: No thank you. If you get to choose, Moderna (MRNA) is now producing the best immunity data on a year-to-date basis if you’re starting out from scratch. Some people are mixing, they start out with Pfizer and then get Moderna. They get a worse reaction because the Moderna initial reaction shot sees the Pfizer vaccine as a new virus, so you may get a small flu as a result of that.

Q: What is the put spread you’re recommending on the TLT?

A: The May 2022 $150-$155 vertical put spread. That is the sweet spot now on the short side on (TLT) LEAPS. You should earn a 115% profit in eight months on this trade if interest rates remain unchanged or fall.

Q: Do you expect the ProShares Ultra Short 20 year+ Treasury ETF (TBT) to make it to $20 this year?

A: Yes, I do; $16 to $20 isn’t that much of a move. Remember, the (TBT) is a two times short ETF.

Q: Are you recommending bank stocks?

A: Yes, Morgan Stanley (MS) and JP Morgan (JPM) are two of the best. They will lead the yearend rally starting from here.

Q: When do you expect the semiconductor shortage to end?

A: End of next year, or maybe even 2023, because what all the analysts keep underestimating is that the end of shortages is based on companies getting the chips they want today. The actual issue is that companies are designing billions of chips into their products at an exponential rate, and what they’ll need in a year from now is far higher than most people realize. The semiconductor shortage is much more structural than people realize—that's my theory. They don’t throw up a $2 billion fab overnight. So, this will keep going on for a while and be a drag on economic growth.

Q: Are you sure we won’t see $100 oil (USO)?

A: With oil, you're never sure about anything, although I highly doubt it. We’d have to have monster economic growth in China to get oil up to $100 a barrel. Right now, China is going the other way.

Q: What’s your view on the debt ceiling? Will it give us a good buying opportunity?

A: Probably not, our good buying opportunity was yesterday or Monday. These debt crises are always one minute before midnight solutions. They always get solved. Never underestimate the ability of Congressmen to spend money in their own district. So, I don’t think that would create a stock market crash like it might have done 20 years ago.

Q: What about Freeport McMoRan (FCX)?

A: It’s taking a dip here because of a possible real estate crash in China, and of course China is the world’s largest buyer of copper for apartment construction. I’m kind of taking a break here on Freeport McMoRan and US Steel (X) until we learn a little more about the China situation. They did move to start a bailout today. Let’s see if that continues.

Q: When will the airlines come back?

A: They’ll come back when business travel returns, which I think could be next year. If you eliminate the virus completely, these things double easily. That's the bet you’re making. Let’s see if the covid boosters work, the childhood shots work, and then you can take another look at Delta (DAL) and Alaska (ALK).

Q: If Bitcoin gains mass adoption, does that put banks out of business just like electric vehicles are making oil obsolete?

A: No, not if the banks go into the Bitcoin business. And the banks actually have the cash, resources, and infrastructure to take over the Bitcoin area once the technology matures. And the corollary to that is that the oil industry is that the majors have the infrastructure, the manpower, and the capital to take over the alternative energy business if they choose to do so and oil goes to zero, which it eventually will. The proof of that is the largest investor in all the Silicon Valley energy startups are Saudi Arabian venture capital funds. They’re huge investors in solar here. If Saudi Arabia has a lot of oil, they have even more solar. Believe me, I’ve been there.

Q: Will a lack of inventory and rising interest rates end the bidding wars on houses soon?

A: Only if you consider 10 years soon. That is how long it will take for the sizes of different generations to come into balance, the Millennials (85 million) versus the Gen Xers (45 million). That’s when the housing bubble will end, but that won’t be for another decade. We still have a structural shortage of new home construction (about 5 million units a year) because all the home builders who went bust in the financial crisis in 2008/2009 and never came back—all of that new construction is still missing. And the surviving ones haven’t increased production to meet that shortfall because they want to manage their risk. Eventually, they will and that probably will be the next top, but that’s really 2030 type business.

Q: What about Federal Express (FDX)?

A: Labor shortages. It's hitting (UPS), (FDX), the Post Office, and DHL too—all the couriers.

Q: When do you think gold (GLD) and silver (SLV) rise back to 2,000?

A: I am avoiding gold and silver as long as Bitcoin has buyers. The action in Bitcoin is 10x the movement you get in gold and that’s attracted all the speculative capital in the market, draining all interest from gold, which hit a new six-month low just last week.

Q: What’s your buy target for Apple (AAPL)?

A: I would say if you can get it at $135, that would be a gift. We did get close to $140 at the lows this week; that’s when you start nibbling, and then you double up again at $135. I doubt Apple is going down more than 10% in this cycle. There are too many people still trying to get into it. And they’re still the largest buyer of stock in the world. They only buy one stock, their own.

Q: I never got any IPath Series B S&P 500 VIX Short Term Futures ETN (VXX) alerts.

A: That's because we never sent any out. (VIX) has become an incredibly difficult game to play, accumulating positions for months and then trying to get out on a one-day spike that lasts a few minutes. The insiders have too much of a house advantage here, who only play from the short side. There are too many better fish to fry.

Q: What about the Apple electric vehicle?

A: I’ll believe it when I see it; I've been hearing about this for something like seven years. My guess is that Apple is more likely to supply consoles and parts to other EV makers and help them get into the game with software and so on. I think that will be Apple's role in all of this.

Q: How much has China Evergrande Group stock fallen?

A: It’s a really illiquid stock in China so we never got involved in it. I think it’s down more than half. Even the professional short-sellers like Jim Chanos and Kyle Bass, have been targeting that stock for 10 years are now screaming they’re vindicated. Of course, they lost fortunes in the meantime. So, I'll pass on that one.

Q: What about stop losses on LEAPS trades?

A: I don’t really run LEAPS portfolios or issue stop losses. The idea is to run these into expiration, and we’ve never had one expire out of the money, although I may break that record if TLT doesn’t turn around in the next three months.

Q: How would autonomous trucking impact rail transportation?

A: They’re two totally different things. Trucking companies like Yellow Corporation (YELL) carry smaller cargo for local deliveries or small long-distance deliveries. 7Some 70% of all railroad traffic is coal going to China, and the rest is bulk commodities like wood chips, iron ore, etc. Trucks don’t carry any of that, so they’re totally separate businesses. But, if we went totally autonomous on trucking, it would make all the main trucker companies massively profitable, as they get rid of their drivers. Right now, every trucking company in the US has a driver shortage.

Q: United Airlines (UAL) pilots are now ordered to get vaccinated.

A: I think within months to hold a job anywhere in the US, you will have to get vaccinated. They do not want you in the office without a vaccination. Jobs are not worth risking lives, and we hit 2,000 deaths again yesterday. The corporations are taking the lead, not the government. The exception will be the politically motivated companies, like the My Pillow Guy; I doubt they'll ever require vaccinations at My Pillow. And there are a few other companies such as Hobby Lobby that are also anti-vaxers. But all public transport companies, hospitals, etc., are going to say get vaccinated or get out—it’s very simple.

Q: Should I buy Berkshire (BRKB) here?

A: Yes, it’s a great entry point, even if you can't get my price. Go higher in the strikes or go farther out in maturity.

Q: Is copper metal (CPER) a buy here?

A: Probably long term, but short term will be subject to the whims of the Chinese real estate crisis if there is one.

Q: Won’t Natural Gas (UNG) outperform in the power grid since all EVs must be charged?

A: Not if the grid is 100% electric. Natural gas still has carbon in it, although only half as much as oil or gasoline. I think even natural gas eventually gets phased out because you can expect solar panels to improve by 80% over the next ten years. At that point, any other energy source won’t be able to compete—oil, natural gas, you name it. And that is why you don’t see any long-term money going into carbon energy sources.

Q: Iron ore has just gone from $200 to $100, why are you bullish?

A: Yes, Because it has just gone from $200 to $100. Eventually, China recovers, despite a short-term financial and housing crisis. Buy low, sell high—that’s my revolutionary new strategy.

Q: What are your thoughts on Bitcoin vs Ethereum?

A: I think Ethereum will outperform Bitcoin because it has a more modern technology. It’s only six years old, vs 12 years for Bitcoin. It’s also more efficient, using less energy in its production. In fact, we did get a double in Ethereum in August as opposed to only a 50% move in Bitcoin.

Q: Do you have any concerns on holding the financials through earnings in October?

A: No, I think the results will be fantastic, and I want to be long going into those.

Q: What does the current situation with China mean for Alibaba (BABA)?

A: Keep your stocks, you’ve already taken the hit—down 53%. The next surprise is that China quits beating up on capitalism and these things will all recover bigtime. However, any options you may have could expire before that happens. So, keep the stocks, get rid of the options, salvage whatever time value you can, and then wait for China to start doing the right thing.

Q: What are the best solar stocks?

A: First Solar (FSLR) and SunPower (SPWR), which have both done great.

Q: If bonds are a no-no, and governments are getting more indebted than ever, who will buy them?

A: Governments. The only buyers of bonds now are non-economic buyers. Those would be governments, central banks, and banks who are required by law to own certain amounts of bonds to meet regulatory capital requirements. No individual in their right mind is buying any bonds here at all, nor is any financial advisor recommending them.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.