Global Market Comments

September 6, 2018

Fiat Lux

Featured Trade:

(TUESDAY, OCTOBER 16, 2018, MIAMI, FL,

GLOBAL STRATEGY LUNCHEON),

(HOW THE RISK PARITY TRADERS ARE RUINING EVERYTHING!),

(VIX), (SPY), (TLT),

(TESTIMONIAL)

Tag Archive for: ($VIX)

Global Market Comments

August 24, 2018

Fiat Lux

Featured Trade:

(AUGUST 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(BIDU), (BABA), (VIX), (EEM), (SPY), (GLD), (GDX), (BITCOIN),

(SQM), (HD), (TBT), (JWN), (AMZN), (USO), (NFLX), (PIN),

(TAKING A BITE OUT OF STEALTH INFLATION)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader August 22 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: How do you think the trade talks will resolve?

A: There will be no resolution this next round of trade talks. China has sent only their most hawkish negotiators who believe that China has done nothing wrong, so don’t expect results any time soon.

Also, because of the arrests in Washington, China is more inclined to just wait out Donald Trump, whether that’s 6 months or 6 1/2 years. They believe they have the upper hand now, sensing weakness in Washington, and in any case, many of the American requests are ridiculous.

Trade talks will likely overhang the market for the rest of this year and you don’t want to go running back into those China Tech plays, like Alibaba (BABA) and Baidu (BIDU) too soon. However, they are offering fantastic value at these levels.

Q: Will the Washington political storm bring down the market?

A: No, it won’t. Even in the case of impeachment, all that will happen is the market will stall and go sideways for a while until it’s over. The market went straight up during the Clinton impeachment, but that was during the tail end of the Dotcom Boom.

Q: Is Alibaba oversold here at 177?

A: Absolutely, it is a great buy. There is a double in this stock over the long term. But, be prepared for more volatility until the trade wars end, especially with China, which could be quite some time.

Q: What would you do with the Volatility Index (VIX) now?

A: Buy at 11 and buy more at 10. It’s a great hedge against your existing long portfolio. It’s at $12 right now.

Q: Are the emerging markets (EEM) a place to be again right now or do you see more carnage?

A: I see more carnage. As long as the dollar is strong, U.S. interest rates are rising, and we have trade wars, the worst victims of all of that are emerging markets as you can see in the charts. Anything emerging market, whether you’re looking at the stocks, bonds or currency, has been a disaster.

Q: Is it time to go short or neutral in the S&P 500 (SPY)?

A: Keep a minimal long just so you have some participation if the slow-motion melt-up continues, but that is it. I’m keeping risks to a minimum now. I only really have one position to prove that I’m not dead or retired. If it were up to me I’d be 100% cash right now.

Q: Would you buy Bitcoin here around $6,500?

A: No, I would not. There still is a 50/50 chance that Bitcoin goes to zero. It’s looking more and more like a Ponzi scheme every day. If we do break the $6,000 level again, look for $4,000 very quickly. Overall, there are too many better fish to fry.

Q: Is it time to buy gold (GLD) and gold miners (GDX)?

A: No, as long as the U.S. is raising interest rates, you don’t want to go anywhere near the precious metals. No yield plays do well in the current environment, and gold is part of that.

Q: What do you think about Lithium?

A: Lithium has been dragged down all year, just like the rest of the commodities. You would think that with rising electric car production around the world, and with Tesla building a second Gigafactory in Nevada, there would be a high demand for Lithium.

But, it turns out Lithium is not that rare; it’s actually one of the most common elements in the world. What is rare is cheap labor and the lack of environmental controls in the processing.

However, it’s not a terrible idea to buy a position in Sociedad Química y Minera (SQM), the major Chilean Lithium producer, but only if you have a nice long-term view, like well into next year. (SQM) was an old favorite of mine during the last commodity boom, when we caught a few doubles. (Check our research data base).

Q: How can the U.S. debt be resolved? Or can we continue on indefinitely with this level of debt?

A: Actually, we can go on indefinitely with this level of debt; what we can’t do is keep adding a trillion dollars a year, which the current federal budget is guaranteed to deliver. At some point the government will crowd out private borrowers, including you and me, out of the market, which will eventually cause the next recession.

Q: Time to rotate out of stocks?

A: Not yet; all we have to do is rotate out of one kind of stock into another, i.e. out of technology and into consumer staple and value stocks. We will still get that performance, but remember we are 9.5 years into what is probably a 10-year bull market.

So, keep the positions small, rotate when the sector changes, and you’ll still make money. But, let's face it the S&P 500 isn’t 600 anymore, it’s 2,800 and the pickings are going to get a lot slimmer from here on out. Watch the movie but stay close to the exit to escape the coming flash fire.

Q: What kind of time frame does Amazon (AMZN) double?

A: The only question is whether it happens now or on the other side of the next recession. We can assume five years for sure.

Q: More upside to Home Depot (HD)?

A: Absolutely, yes. The high home prices lead to increases in home remodeling, and now that Orchard Hardware has gone out of business, all that business has gone to Home Depot. Home Depot just went over $204 a couple days ago.

Q: Do you still like India (PIN)?

A: If you want to pick an emerging market to enter, that’s the one. It’s a Hedge Fund favorite and has the largest potential for growth.

Q: What about oil stocks (USO)?

A: You don’t want to touch them at all; they look terrible. Wait for Texas tea to fall to $60 at the very least.

Q: What would you do with Netflix (NFLX)?

A: I would probably start scaling into buy right here. If you held a gun to my head, the one trade I would do now would be a deep in the money call spread in Netflix, now that they’ve had their $100 drop. And I can’t wait to see how the final season of House of Cards ends!

Q: If yields are going up, why are utilities doing so well?

A: Yields are going down right now, for the short term. We’ve backed off from 3.05% all the way to 2.81%; that’s why you’re getting this rally in the yield plays, but I think it will be a very short-lived event.

Q: Do you see retail stocks remaining strong from now through Christmas?

A: I don’t see this as part of the Christmas move going on right now; I think it’s a rotation into laggard plays, and it’s also very stock specific. Stocks like Nordstrom (JWN) and Target (TGT) are doing well, for instance, while others are getting slaughtered. I would be careful with which stocks you get into.

Good luck and good trading

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader

Global Market Comments

June 12, 2018

Fiat Lux

Featured Trade:

(THE LAST CHANCE TO ATTEND THE THURSDAY, JUNE 14, 2018, NEW YORK, NY, GLOBAL STRATEGY LUNCHEON)

(SHORT SELLING SCHOOL 101),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE),

Global Market Comments

May 25, 2018

Fiat Lux

Featured Trade:

(FRIDAY, AUGUST 3, 2018, AMSTERDAM, THE NETHERLANDS GLOBAL STRATEGY DINNER),

(MAY 23 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (SPY), (TSLA), (EEM), (USO), (NVDA),

(GILD), (GE), (PIN), (GLD), (XOM), (FCX), (VIX)

Below please find subscribers' Q&A for the Mad Hedge Fund Trader May 23 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Would you short Tesla here?

A: Tesla (TSLA) is on the verge of making the big leap to mass production, so they're in somewhat of an in-between time from a profit point of view, and the burden of proof is on them. Elon Musk is notorious for squeezing shorts. I would not want to bet him.

Musk has been successfully squeezing shorts for 10 years now, from the time the stock was at $16.50 all the way up to $392. So, I would not short Tesla. Buy the car but don't play in the stock; it's really a venture capital play that happens to have a stock listing because so many people are willing to back his vision of a carbon-free economy.

Q: What is your takeaway on the China trade war situation?

A: The Chinese said "no," and that is positive for economic growth. Anything that enhances international trade is good for growth and good for the stock market; anything that damages international trade is bad for corporate earnings and bad for the stock market. So, the China win in the trade war is essentially positive, but I don't think we'll see that reflected in stock prices until the end of the year.

Q: What do you think about Gilead Sciences?

A: I don't really want to touch Gilead (GILD), or the entire sector, for that matter. We shouldn't be seeing such a poor performance at this point in the market. Health care has been dead for a long time, and you would have expected a rally based purely on fundamentals; they are delivering good earnings, it's just not reflected in the price action of the stocks. I think with no new money going into the market, there's nothing to push up other sectors; it's really become a "technology on and off" market. Health care doesn't fit anywhere in that world.

Q: Do you still like Nvidia?

A: I love Nvidia (NVDA). The chip sector still has another year to go. Nvidia has the high value-added product, and I'm looking for $300 dollars a share sometime this year/next year. The reason the stock hasn't really been moving is that it's over-owned; too many people know about the Nvidia story, which continues to go "gangbusters," so to speak. The chairman has also put out negative comments on short-term inventories, which have been a drag.

Q: Treasuries (TLT) are over 3%. Will they go over 3.5% by then end of this year?

A: I would say yes. Since that is only 50 basis points away from the current market, I would say it's a pretty good bet. So, if you get any good entry points you can do LEAPS going out to next year, betting that Treasuries will not only be below $116 by the end of the year, but they'll probably be below 110. And that would give you a very good high return LEAP with a yield of 50% in the next, say 8 months. By the way, if the Treasury yield rises to 4% that takes the (TLT) down to $98!

Q: Any chance General Electric will be acquired this year?

A: Absolutely not. General Electric (GE) worth far more if you break it up into individual pieces and sell them. Some parts are very profitable like jet engines and Baker Hughes, while other parts, like their medical insurance exposure, are awful.

Q: What do you see about the India ETF?

A: The one I follow is the PowerShares India Portfolio ETF (PIN) and we love it long term. Short term, they can take some pain with the rest of the emerging markets.

Q: What should I do with my January 2019 Gold calls?

A: I would sell them. It's not worth hanging on to here with too many other better things to do in stocks.

Q: Would you continue to hold ExxonMobile?

A: I would not. If you were lucky enough to get in at the bottom on ExxonMobile (XOM). I would be taking profits here. I'm not sure how long this energy rally will last, especially if the global economic slowdown continues.

Q: Is Freeport-McMoRan (FCX) a buy?

A: Yes, but only buy the dip in the recent range, so you don't get stopped out when the price goes against you. Commodities are the best performing asset class this year and that should continue.

Q: How high is oil (USO) headed?

A: I think we're probably peaking out short of $80 a barrel currently unless we get a major geopolitical event. Then it could go up to $100 very quickly and trigger a recession.

Q: Are you looking to buy the Volatility Index here?

A: Buy the next dip, but the trick with (VIX) is buying after it sits on a bottom for about five days. You also want to buy it when stocks (SPY) are at the top of a range, like yesterday.

Q: How long do you think the market will be range-bound for?

A: My bet is at least three months, and possibly four or five. We should start to anticipate the outcome of the midterm congressional elections in September/October; that's when you get your upside breakout.

Q: Is Gold (GLD) not worth buying since Bitcoin has taken over market share from Gold buyers?

A: Essentially, yes. That's probably why you're not getting these big spikes in Gold like you're used to. Instead, you're getting them in Bitcoin. Bitcoin is clearly stealing Gold's thunder. That's a major reason why we haven't been chasing Gold this year.

Q: After the emerging market sell-off, is it a good time to go in?

A: No, I think the emerging market (EEM) sell-off is being created by rising interest rates and a strong dollar. I don't see that ending anytime soon. In a year let's take another look in emerging markets. By then overnight Fed funds should be at 2.50% to 2.75%.

Global Market Comments

April 24, 2018

Fiat Lux

Featured Trade:

(DON'T MISS THE APRIL 25 GLOBAL STRATEGY WEBINAR),

(MONDAY, JUNE 11, FORT WORTH, TEXAS, GLOBAL STRATEGY LUNCHEON)

(WHY INDEXERS ARE TOAST),

(VIX), (VXX), (SPY), (AAPL), (HACK),

Hardly a day goes by without some market expert predicting that it's only a matter of time before machines completely take over the stock market.

Humans are about to be tossed into the dustbin of history.

Recently, money management giant BlackRock, with a staggering $5.4 trillion in assets under management, announced that algorithms would take over a much larger share of the investment decision-making process.

Exchange Traded Funds (ETFs) are adding fuel to the fire.

By moving capital out of single stocks and into baskets, you are also sucking the volatility, and the vitality out of the market.

This is true whether money is moving into the $237 billion S&P 500 (SPY), or the miniscule $1 billion PureFunds ISE Cyber Security ETF (HACK), which holds only 30 individual names.

The problem is being greatly exacerbated by the recent explosive growth of the ETF industry.

In the past five years, the total amount of capital committed to ETFs has doubled to more than $3 trillion, while the number of ETFs has soared to well over 2,000.

In fact, there is now more money committed to ETFs than publicly listed single stocks!

While many individual investors say they are moving into ETFs to save on commissions and expenses, in fact, the opposite is true.

You just don't see them.

They are buried away in wide-dealing spreads and operating expenses buried deeply in prospectuses.

The net effect of the ETF industry is to greatly enhance Wall Street's take from their brokerage business, i.e., from YOU.

Every wonder why the shares of the big banks are REALLY trading at new multi-year highs?

I hate to say this, but I've seen this movie before.

Whenever a strategy becomes popular, it carries with it the seeds of its own destruction.

The most famous scare was the "Portfolio Insurance" of the 1980s, a proprietary formula sold to institutional investors that allegedly protected them by automatically selling in down markets.

Of course, once everyone was in the boat, the end result was the 1987 crash, which saw the Dow Average plunge 20% in one day.

The net effect was to maximize everyone's short positions at absolute market bottoms.

A lot of former portfolio managers started driving Yellow Cabs after that one!

I'll give you another example.

Until 2007, every computer model in the financial industry said that real estate prices only went up.

Trillions of dollars of derivative securities were sold based on this assumption.

However, all of these models relied on only 50 years' worth of data dating back to the immediate postwar era.

Hello subprime crisis!

If their data had gone back 70 years, it would have included the Great Depression.

The superior models would have added one extra proviso - that real estate can collapse by 90% at any time, without warning, and then stay down for a decade.

The derivate securities based on THIS more accurate assumption would have been priced much, much more expensively.

And here is the basic problem.

As soon as money enters a strategy, it changes the behavior of that strategy.

The more money that enters, the more that strategy changes, to the point where it produces the opposite of the promised outcome.

Strategies that attract only $10 million market-wide can make 50% a year returns or better.

But try and execute with $1 billion, and the identical strategies lose money. Guess what happens at $1 trillion?

This is why high frequency traders can't grow beyond their current small size on a capitalized basis, even though they account for 70% of all trading.

I speak from experience.

During the 1980s I used a strategy called "Japanese Equity Warrant Arbitrage," which generated a risk-free return of 30% a year or more.

This was back when overnight Japanese yen interest rates were at 6%, and you could buy Japanese equity warrants at parity with 5:1 leverage (5 X 6 = 30).

When there were only a tiny handful of us trading these arcane securities, we all made fortunes. Every other East End London kid was driving a new Ferrari (yes, David, that's you!).

At its peak in 1989, the strategy probably employed 10,000 people to execute and clear in London, Tokyo, and New York.

However, once the Japanese stock market crash began in earnest, liquidity in the necessary instruments vaporized, and the strategy became a huge loser.

The entire business shut down within two years. Enter several thousand new Yellow Cab drivers.

All of this means that the current indexing fad is setting up for a giant fall.

Except that this time, many managers are going to have to become Uber drivers instead.

Computers are great at purely quantitative analysis based on historical data.

Throw emotion in there anywhere, and the quants are toast.

And, at the end of the day, markets are made up of high emotional human beings who want to get rich, brag to their friends, and argue with their spouses.

In fact, the demise has already started.

Look no further than investment performance so far in 2018.

The (SPY) is up a scant 0% this year.

Amazon (AAPL), on the other hand, one of the most widely owned stocks in the world, is up an eye-popping 30%.

If you DON'T own Amazon, you basically don't HAVE any performance to report for 2017.

I'll tell you my conclusion to all of this.

Use a combination of algorithms AND personal judgment, and you will come out a winner, as I do. It also helps to have 50 years of trading experience.

You have to know when to tell your algorithm a firm "NO."

While your algo may be telling you to "BUY" ahead of a monthly Nonfarm Payroll Report or a presidential election, you may not sleep at night if you do so.

This is how I have been able to triple my own trading performance since 2015, taking my 2017 year-to-date to an enviable 20%.

It's not as good as being 30% invested in Amazon.

But it beats the pants off of any passive index all day long.

Yup, This is a Passive Investor

Global Market Comments

April 23, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES THE FOUR HORSEMEN OF THE APOCALYPSE),

(SPY), (GOOGL), (TLT), (GLD), (AAPL), (VIX), (VXX), (C), (JPM),

(HOW TO AVOID PONZI SCHEMES),

(TESTIMONIAL)

Have you liked 2018 so far?

Good.

Because if you are an index player, you get to do it all over again. For the major stock indexes are now unchanged on the year. In effect, it is January 1 once more.

Unless of course you are a follower of the Mad Hedge Fund Trader. In that case, you are up an eye-popping 19.75% so far in 2018. But more on that later.

Last week we caught the first glimpse in this cycle of the investment Four Housemen of the Apocalypse. Interest rates are rising, the yield on the 10-year Treasury bond (TLT) reaching a four-year high at 2.96%. When we hit 3.00%, expect all hell to break loose.

The economic data is rolling over bit by bit, although it is more like a death by a thousand cuts than a major swoon. The heavy hand of major tariff increases for steel and aluminum is making itself felt. Chinese investment in the US is falling like a rock.

The duty on newsprint imports from Canada is about to put what's left of the newspaper business out of business. Gee, how did this industry get targeted above all others?

The dollar is weak (UUP), thanks to endless talk about trade wars.

Anecdotal evidence of inflation is everywhere. By this I mean that the price is rising for everything you have to buy, like your home, health care, college education, and website upgrades, while everything you want to sell, such as your own labor, is seeing the price fall.

We're not in a recession yet. Call this a pre-recession, which is a long-leading indicator of a stock market top. The real thing shouldn't show until late 2019 or 2020.

There was a kerfuffle over the outlook for Apple (AAPL) last week, which temporarily demolished the entire technology sector. iPhone sales estimates have been cut, and the parts pipeline has been drying up.

If you're a short-term trader, you should have sold your position in April 13 when I did. If you are a long-term investor, ignore it. You always get this kind of price action in between product cycles. I still see $200 a share in 2018. This too will pass.

This month, I have been busier than a one-armed paper hanger, sending out Trade Alerts across all asset classes almost every day.

Last week, I bought the Volatility Index (VXX) at the low, took profits in longs in gold (GLD), JP Morgan (JPM), Alphabet (GOOGL), and shorts in the US Treasury bond market (TLT), the S&P 500 (SPY), and the Volatility Index (VXX).

It is amazing how well that "buy low, sell high" thing works when you actually execute it. As a result, profits have been raining on the heads of Mad Hedge Trade Alert followers.

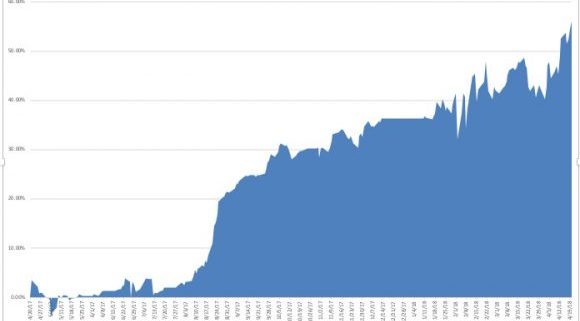

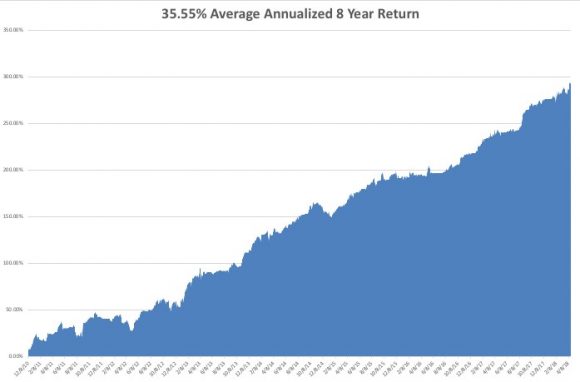

That brings April up to an amazing +12.99% profit, my 2018 year-to-date to +19.75%, my trailing one-year return to +56.09%, and my eight-year performance to a new all-time high of 296.22%. This brings my annualized return up to 35.55% since inception.

The last 14 consecutive Trade Alerts have been profitable. As for next week, I am going in with a net short position, with my stock longs in Alphabet (GOOGL) and Citigroup (C) fully hedged up.

And the best is yet to come!

I couldn't help but laugh when I heard that Republican House Speaker Paul Ryan announced his retirement in order to spend more time with his family. He must have the world's most unusual teenagers.

When I take my own teens out to lunch to visit with their friends, I have to sit on the opposite side of the restaurant, hide behind a newspaper, wear an oversized hat, and pretend I don't know them, even though the bill always mysteriously shows up on my table.

This will be FANG week on the earnings front, the most important of the quarter.

On Monday, April 23, at 10:00 AM, we get March Existing-Home Sales. Expect the Sohn Investment Conference in New York to suck up a lot of airtime. Alphabet (GOOGL) reports.

On Tuesday, April 24, at 8:30 AM EST, we receive the February S&P CoreLogic Case-Shiller Home Price Index, which may see prices accelerate from the last 6.3% annual rate. Caterpillar (CAT) and Coca Cola (KO) report.

On Wednesday, April 25, at 2:00 PM, the weekly EIA Petroleum Statistics are out. Facebook (FB), Advanced Micro Devices (AMD), and Boeing (BA) report.

Thursday, April 26, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 9,000 last week. At the same time, we get March Durable Goods Orders. American Airlines (AAL), Raytheon (RTN), and KB Homes (KBH) report.

On Friday, April 27, at 8:30 AM EST, we get an early read on US Q1 GDP.

We get the Baker Hughes Rig Count at 1:00 PM EST. Last week brought an increase of 8. Chevron (CVX) reports.

As for me, I am going to take advantage of good weather in San Francisco and bike my way across the San Francisco-Oakland Bay Bridge to Treasure Island.

Good Luck and Good Trading.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.