Hardly a day goes by without some market expert predicting that it's only a matter of time before machines completely take over the stock market.

Humans are about to be tossed into the dustbin of history.

Recently, money management giant BlackRock, with a staggering $5.4 trillion in assets under management, announced that algorithms would take over a much larger share of the investment decision-making process.

Exchange Traded Funds (ETFs) are adding fuel to the fire.

By moving capital out of single stocks and into baskets, you are also sucking the volatility, and the vitality out of the market.

This is true whether money is moving into the $237 billion S&P 500 (SPY), or the miniscule $1 billion PureFunds ISE Cyber Security ETF (HACK), which holds only 30 individual names.

The problem is being greatly exacerbated by the recent explosive growth of the ETF industry.

In the past five years, the total amount of capital committed to ETFs has doubled to more than $3 trillion, while the number of ETFs has soared to well over 2,000.

In fact, there is now more money committed to ETFs than publicly listed single stocks!

While many individual investors say they are moving into ETFs to save on commissions and expenses, in fact, the opposite is true.

You just don't see them.

They are buried away in wide-dealing spreads and operating expenses buried deeply in prospectuses.

The net effect of the ETF industry is to greatly enhance Wall Street's take from their brokerage business, i.e., from YOU.

Every wonder why the shares of the big banks are REALLY trading at new multi-year highs?

I hate to say this, but I've seen this movie before.

Whenever a strategy becomes popular, it carries with it the seeds of its own destruction.

The most famous scare was the "Portfolio Insurance" of the 1980s, a proprietary formula sold to institutional investors that allegedly protected them by automatically selling in down markets.

Of course, once everyone was in the boat, the end result was the 1987 crash, which saw the Dow Average plunge 20% in one day.

The net effect was to maximize everyone's short positions at absolute market bottoms.

A lot of former portfolio managers started driving Yellow Cabs after that one!

I'll give you another example.

Until 2007, every computer model in the financial industry said that real estate prices only went up.

Trillions of dollars of derivative securities were sold based on this assumption.

However, all of these models relied on only 50 years' worth of data dating back to the immediate postwar era.

Hello subprime crisis!

If their data had gone back 70 years, it would have included the Great Depression.

The superior models would have added one extra proviso - that real estate can collapse by 90% at any time, without warning, and then stay down for a decade.

The derivate securities based on THIS more accurate assumption would have been priced much, much more expensively.

And here is the basic problem.

As soon as money enters a strategy, it changes the behavior of that strategy.

The more money that enters, the more that strategy changes, to the point where it produces the opposite of the promised outcome.

Strategies that attract only $10 million market-wide can make 50% a year returns or better.

But try and execute with $1 billion, and the identical strategies lose money. Guess what happens at $1 trillion?

This is why high frequency traders can't grow beyond their current small size on a capitalized basis, even though they account for 70% of all trading.

I speak from experience.

During the 1980s I used a strategy called "Japanese Equity Warrant Arbitrage," which generated a risk-free return of 30% a year or more.

This was back when overnight Japanese yen interest rates were at 6%, and you could buy Japanese equity warrants at parity with 5:1 leverage (5 X 6 = 30).

When there were only a tiny handful of us trading these arcane securities, we all made fortunes. Every other East End London kid was driving a new Ferrari (yes, David, that's you!).

At its peak in 1989, the strategy probably employed 10,000 people to execute and clear in London, Tokyo, and New York.

However, once the Japanese stock market crash began in earnest, liquidity in the necessary instruments vaporized, and the strategy became a huge loser.

The entire business shut down within two years. Enter several thousand new Yellow Cab drivers.

All of this means that the current indexing fad is setting up for a giant fall.

Except that this time, many managers are going to have to become Uber drivers instead.

Computers are great at purely quantitative analysis based on historical data.

Throw emotion in there anywhere, and the quants are toast.

And, at the end of the day, markets are made up of high emotional human beings who want to get rich, brag to their friends, and argue with their spouses.

In fact, the demise has already started.

Look no further than investment performance so far in 2018.

The (SPY) is up a scant 0% this year.

Amazon (AAPL), on the other hand, one of the most widely owned stocks in the world, is up an eye-popping 30%.

If you DON'T own Amazon, you basically don't HAVE any performance to report for 2017.

I'll tell you my conclusion to all of this.

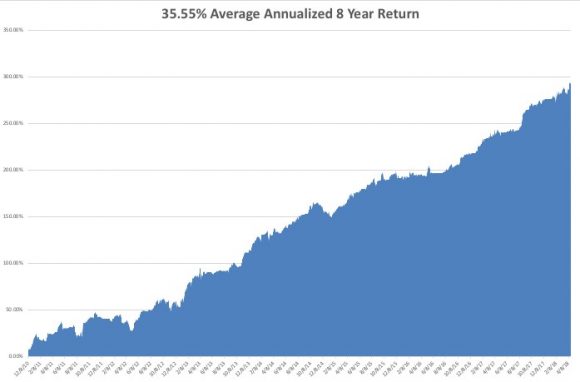

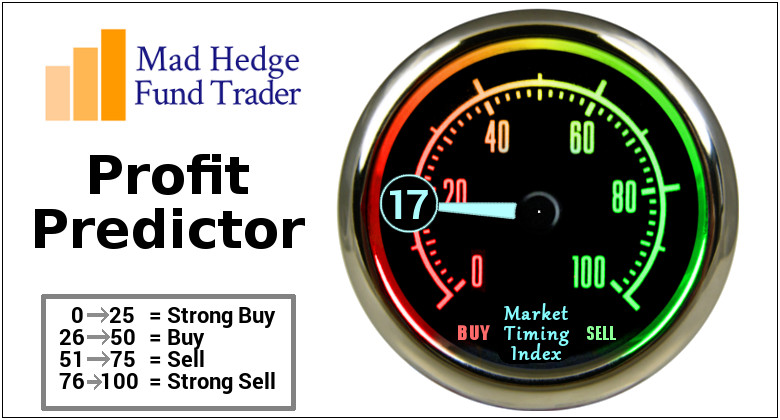

Use a combination of algorithms AND personal judgment, and you will come out a winner, as I do. It also helps to have 50 years of trading experience.

You have to know when to tell your algorithm a firm "NO."

While your algo may be telling you to "BUY" ahead of a monthly Nonfarm Payroll Report or a presidential election, you may not sleep at night if you do so.

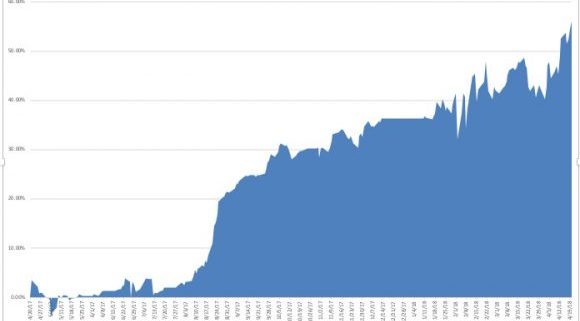

This is how I have been able to triple my own trading performance since 2015, taking my 2017 year-to-date to an enviable 20%.

It's not as good as being 30% invested in Amazon.

But it beats the pants off of any passive index all day long.

Yup, This is a Passive Investor