I am once again writing this report from a first-class sleeping cabin on Amtrak’s legendary California Zephyr.

By day, I have a comfortable seat next to a panoramic window. At night, they fold into two bunk beds, a single and a double. There is a shower, but only Houdini can navigate it.

I am anything but Houdini, so I foray downstairs to use the larger public hot showers. They are divine.

We are now pulling away from Chicago’s Union Station, leaving its hurried commuters, buskers, panhandlers, and majestic great halls behind. I love this building as a monument to American exceptionalism.

I am headed for Emeryville, California, just across the bay from San Francisco, some 2,121.6 miles away. That gives me only 56 hours to complete this report.

I tip my porter, Raymond, $100 in advance to ensure everything goes well during the long adventure and keep me up to date with the onboard gossip.

The rolling and pitching of the car is causing my fingers to dance all over the keyboard. Microsoft’s Spellchecker can catch most of the mistakes, but not all of them.

Chicago’s Union Station

As both broadband and cell phone coverage are unavailable along most of the route, I have to rely on frenzied Internet searches during stops at major stations along the way, like Omaha, Salt Lake City, and Reno, to Google obscure data points and download the latest charts.

You know those cool maps in the Verizon stores that show the vast coverage of their cell phone networks? They are complete BS.

Who knew that 95% of America is off the grid? That explains so much about our country today.

I have posted many of my better photos from the trip below, although there is only so much you can do from a moving train and an iPhone 15 Pro.

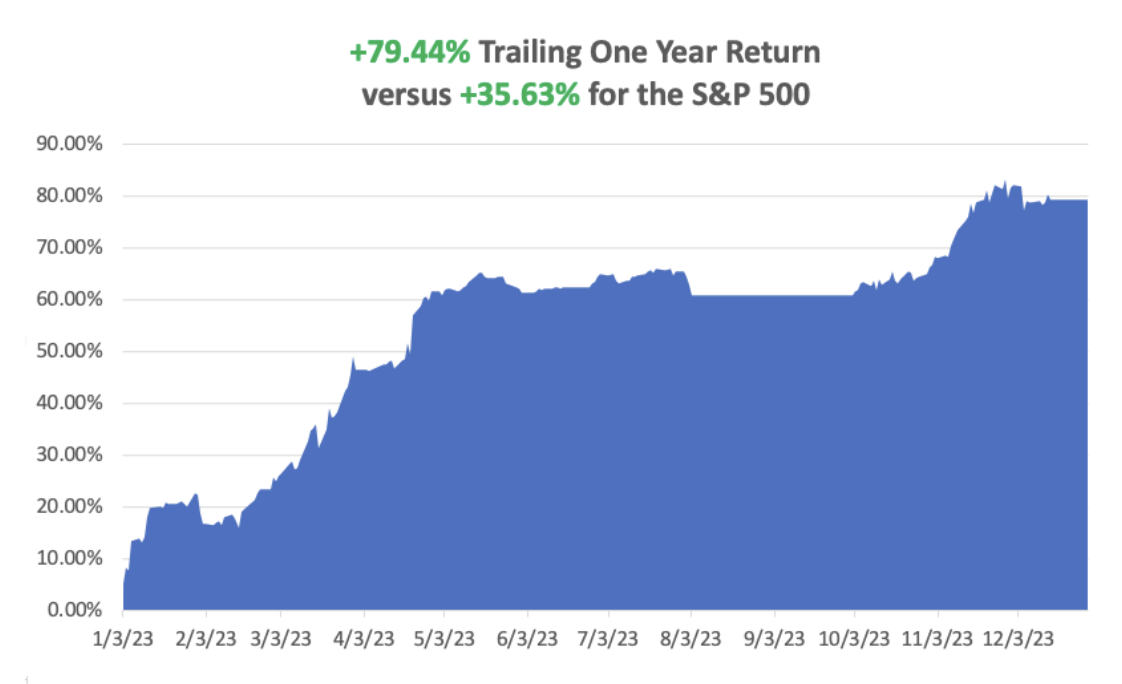

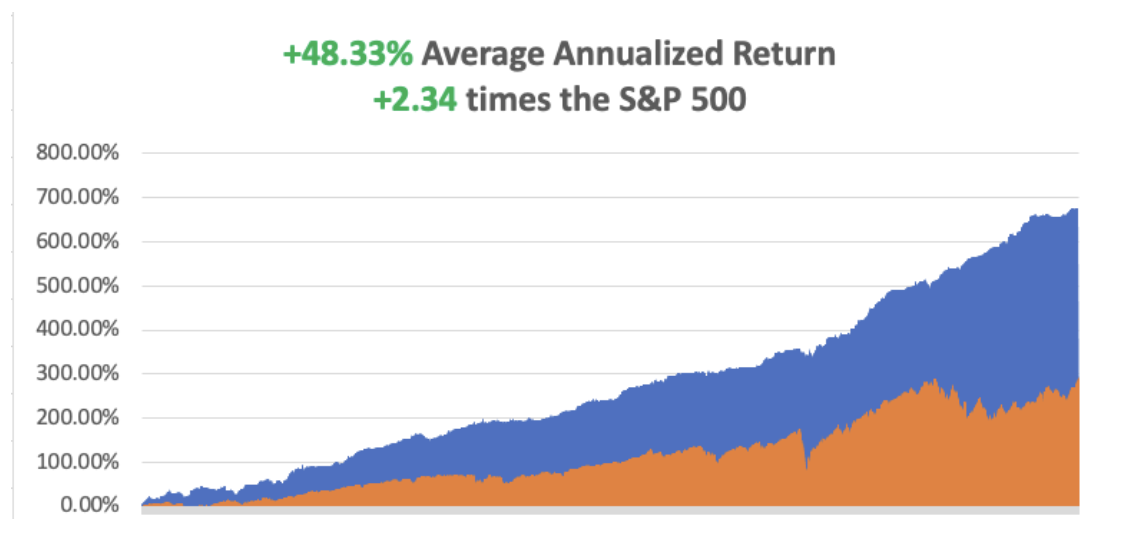

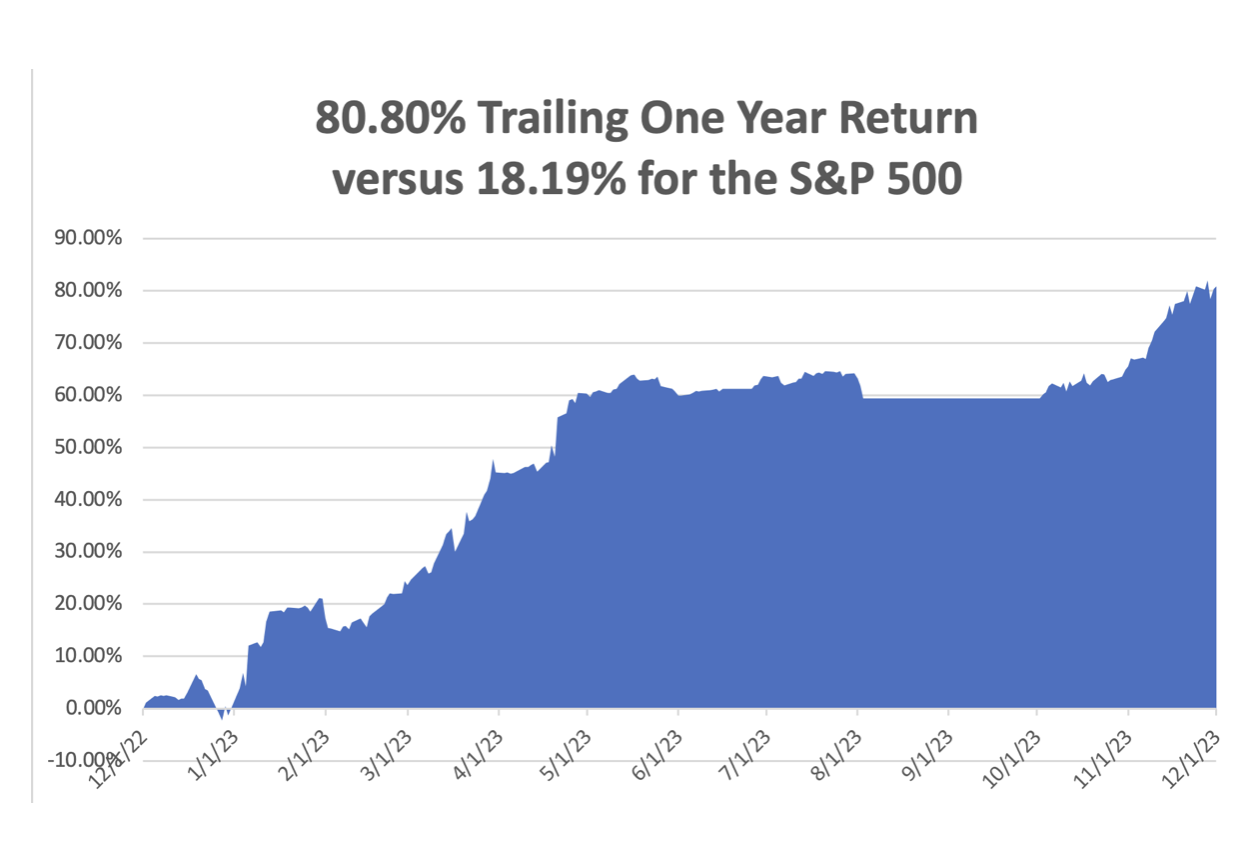

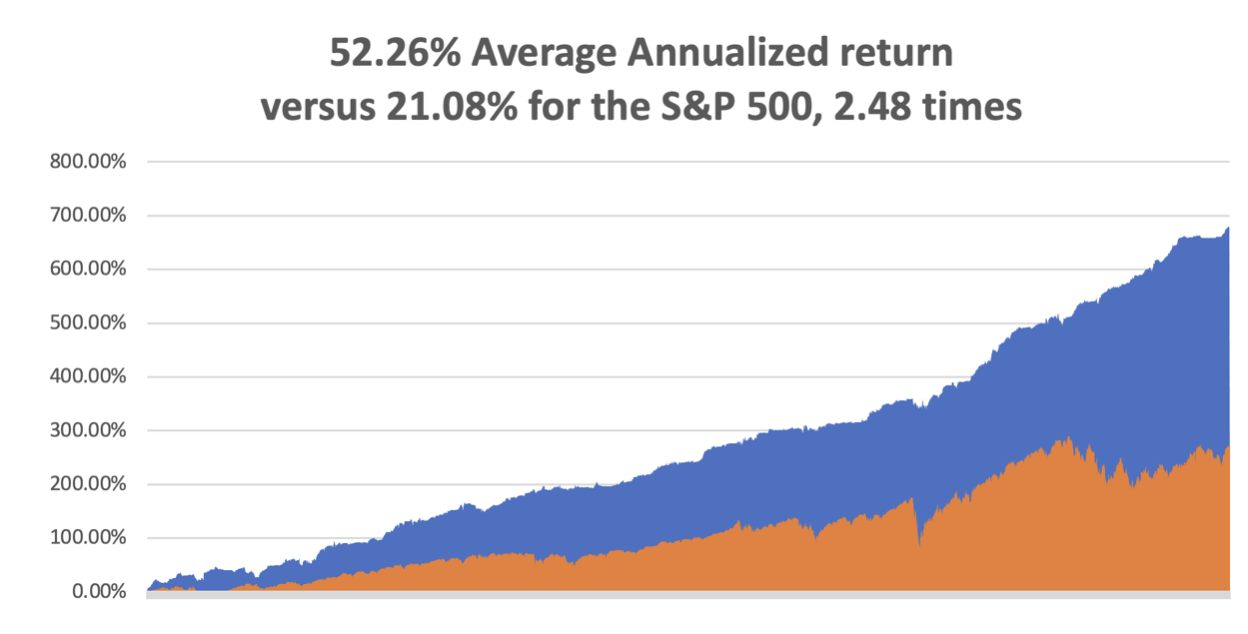

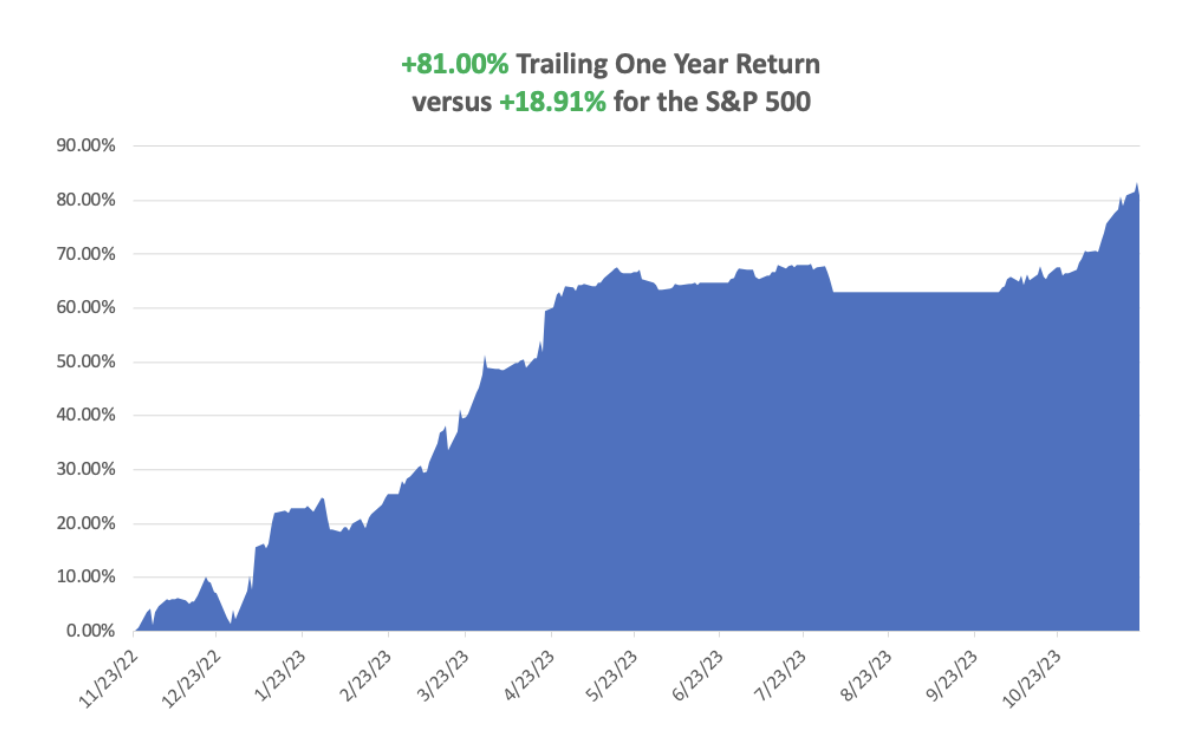

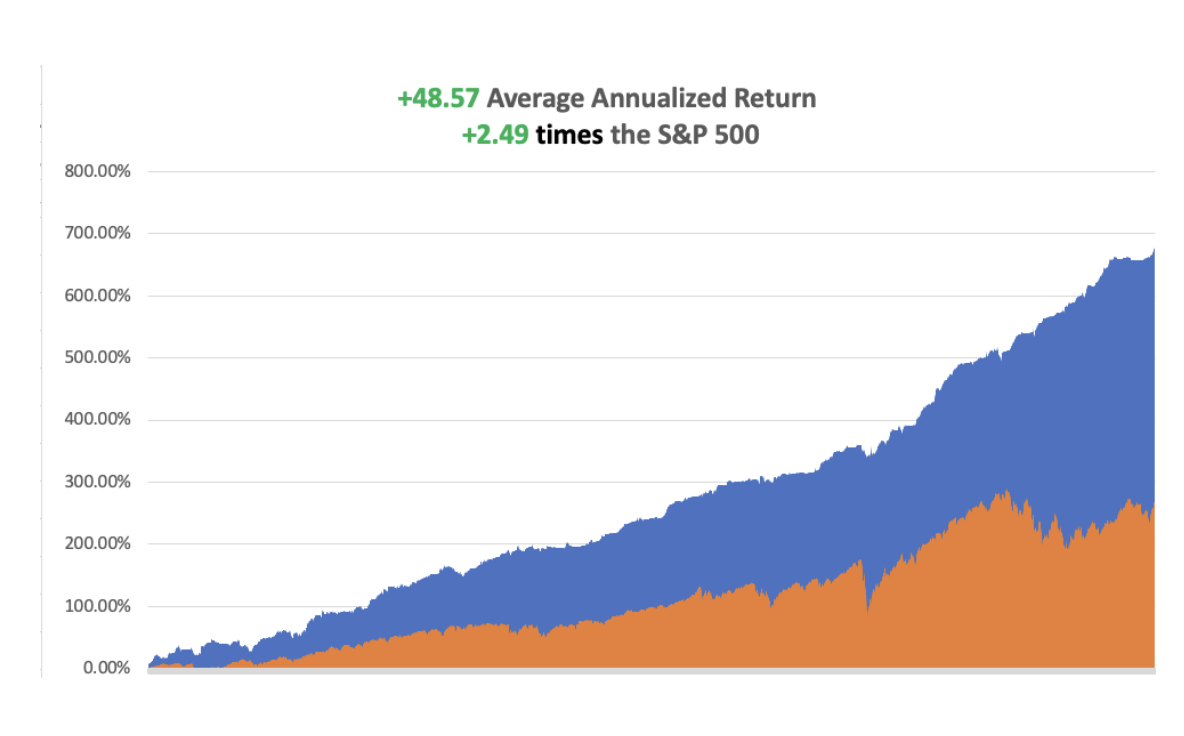

Here is the bottom line which I have been warning you about for months. In 2024 we will probably top the 70.44% we made last year, but you are going to have to navigate the reefs, shoals, hurricanes, and the odd banking crisis. Do it and you can laugh all the way to the bank. I will be there to assist you in navigating every step.

The first half of 2024 will be all about trading, making bets on when the Fed starts cutting interest rates. Technology will continue their meteoric melt-up. In the second half, I expect the cuts to actually take place and markets to go straight up. Domestic industrials, commodities, financials, energy foreign markets, and currencies will lead.

And here is my fundamental thesis for 2024. After the Fed kept rates too low for too long and then raised them too much, it will then panic and lower them again too fast to avoid a recession. In other words, a mistake-prone Jay Powell will keep making mistakes. That sounds like a good bet to me.

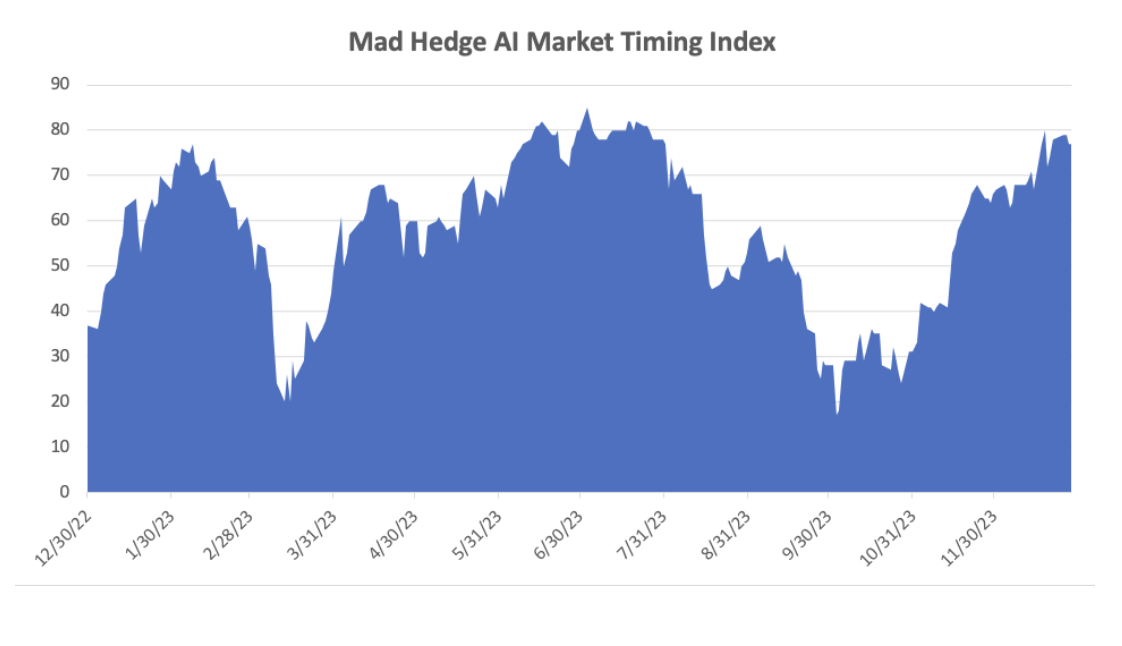

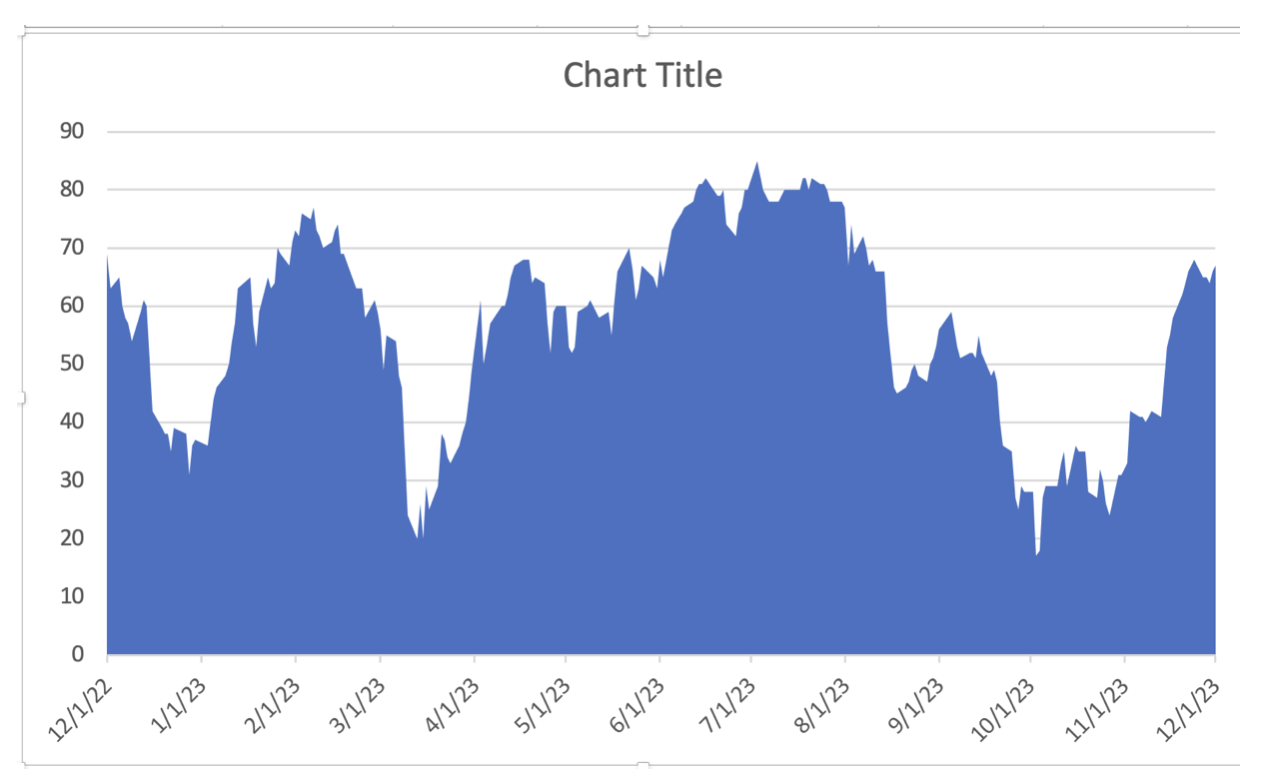

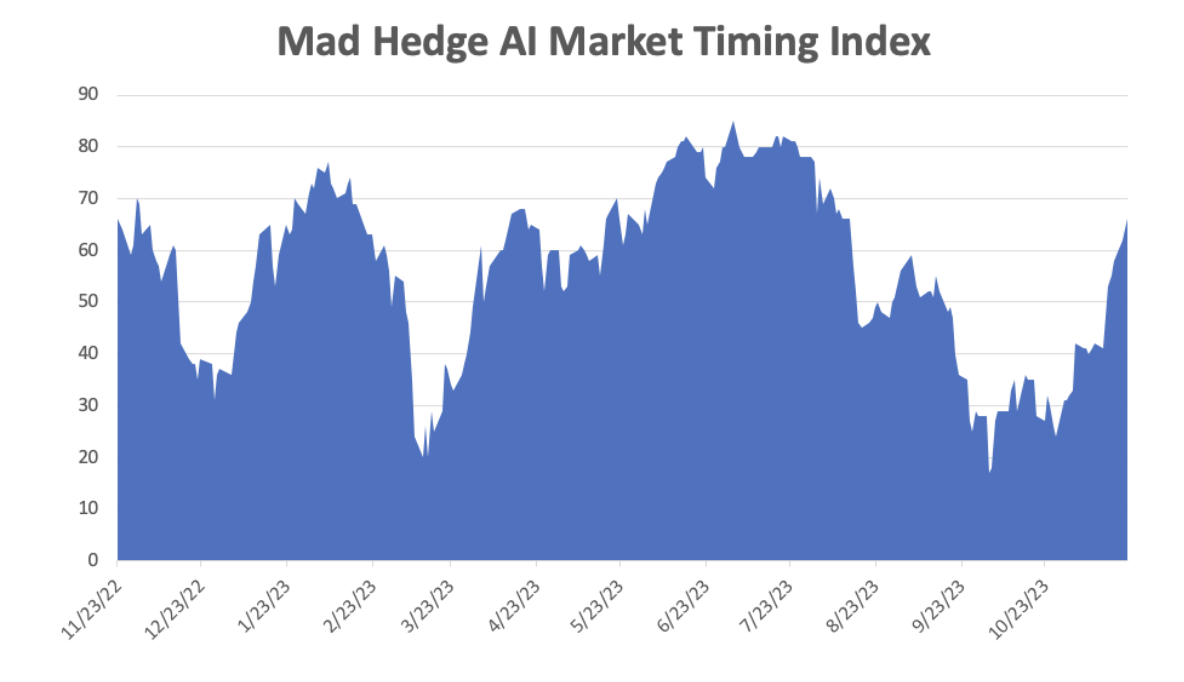

Keep in mind that the Mad Hedge AI Market Timing Index is at the absolute top end of its historic range the three-month likelihood of you making money on a trade is essentially zero. But adhere to the recommendations I make in this report today and you should be up about 30% in a year.

Let me give you a list of the challenges I see financial markets facing in the coming year:

The Ten Key Variables for 2024

1) When will the Fed pivot?

2) When will quantitative tightening end?

3) How soon will the Russians give up on Ukraine?

4) When will the rotation from technology to domestic value plays happen?

5)How much of falling interest rates will translate into higher gold prices?

6) When will the structural commodities boom get a second wind?

7) How fast will the US dollar fall?

8) How quickly will lower interest rates feed into a hotter real estate market?

9) How fast can the Chinese economy bounce back from Covid-19?

10) When does the next bull market in energy begin?

All the answers are below:

Somewhere in Iowa

The Thumbnail Portfolio

Equities – buy dips

Bonds – buy dips

Foreign Currencies – buy dips

Commodities – buy dips

Precious Metals – buy dips

Energy – buy dips

Real Estate – buy dips

1) The Economy – From Hot to Cool to Hot Again

2023 was a terrible year for economists who largely got it wrong. Many will be driving Uber cabs from January.

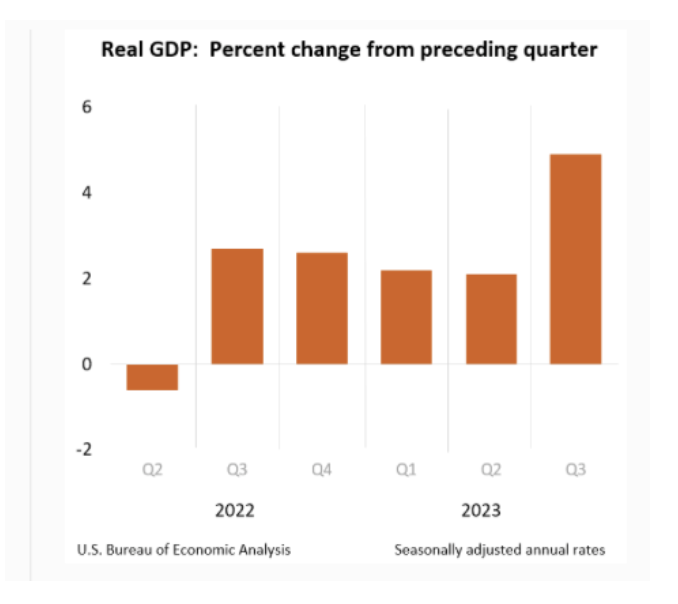

The economy is clearly slowing now from the red-hot 5.2% GDP growth rate we saw in Q3 to a much more modest 2.0% rate in Q4. We’ll get the first read on the end of January.

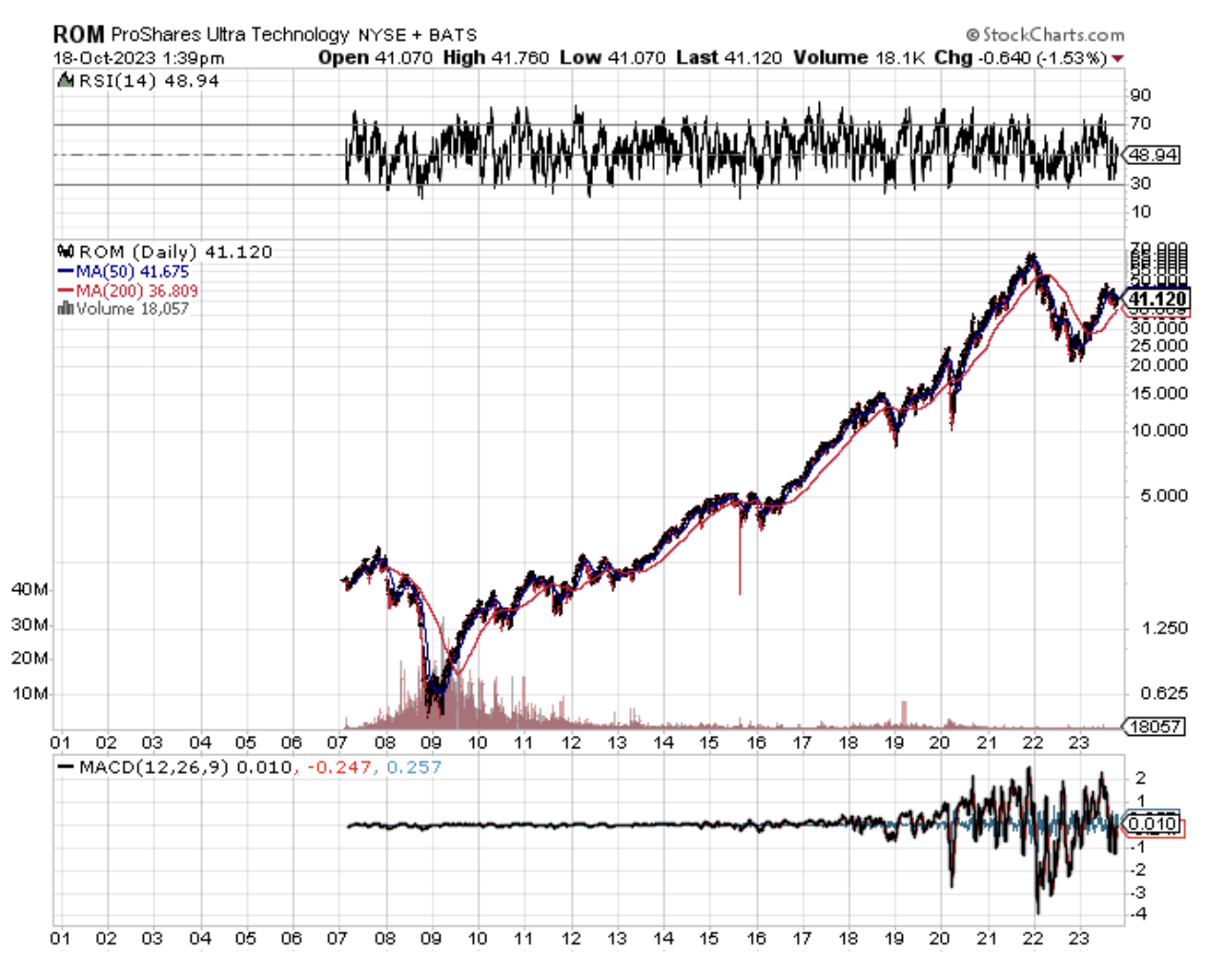

Any more than that and the Fed will panic and bring interest rate cuts dramatically forward to head off a recession. That is clearly what technology stocks were discounting with a melt-up of Biblical proportions, some 19% in the last two months, or $65 in the (QQQ)’s.

Anywhere you look, the data is softening, save for employment, which is holding up incredibly well at a 3.7% headline Unemployment Rate. The labor shortage may be the result of more workers dying from COVID-19 than we understand. Far more are working from home not showing up in the data. And many young people have just disappeared off the grid (they’re in the vans you see on the freeways).

The big picture view of what’s going on here is that after 15 years of turmoil caused by the 2008 financial crisis, pandemic, ultra-low interest rates, and excessive stimulus, we may finally be returning to normal. That means long-term average growth and inflation rates of 3.0% each.

I can’t wait.

A Rocky Mountain Moose Family

2) Equities (SPX), (QQQ), (IWM) (AAPL), (XLF), (BAC) (JPM), (C), (MS), (GS), (X), (CAT), (DE)

As I travel around the world speaking with investors, I notice that they all have one thing in common. They underestimate the impact of technology, the rate at which it is accelerating, its deflationary impact on the economy, and the positive influence they have on all stocks, not just tech ones. And the farther I get away from Silicon Valley the poorer the understanding.

Since my job is to make your life incredibly easy, I am going to simplify my equity strategy for 2024.

It's all about falling interest rates.

You should pay attention. In my January 4, 2023 Annual Asset Class Review (click here), I predicted the S&P 500 would hit $4,800 by year-end end. Here we are at $4,752.

I didn’t nail the market move because I am omniscient, possess a crystal ball, or know a secret Yaqui Indian chant. I have spent the last 30 years living in Silicon Valley and have a front-row seat to the hyper-accelerating technology here.

Since the time of the Roman Empire advancing technology has been highly deflationary (can I get you a deal on a chariot!). Now is no different, which meant that the Federal Reserve would have to stop raising interest rates in the first half of the year.

The predictions of a decade-long battle with rising prices like we saw in the seventies and eighties proved so much bunk, alarmism, and clickbait. In fact, the last 25 basis point rate rise took place on July 26, taking up from an overnight rate of 5.25% to 5.5%. That rendered the hard landing forecasts for the economy nonsense.

When interest rates are as high as they are now, you only look at trades and investments that can benefit from falling interest rates. All stocks actually benefit from cheaper money, but some much more than others.

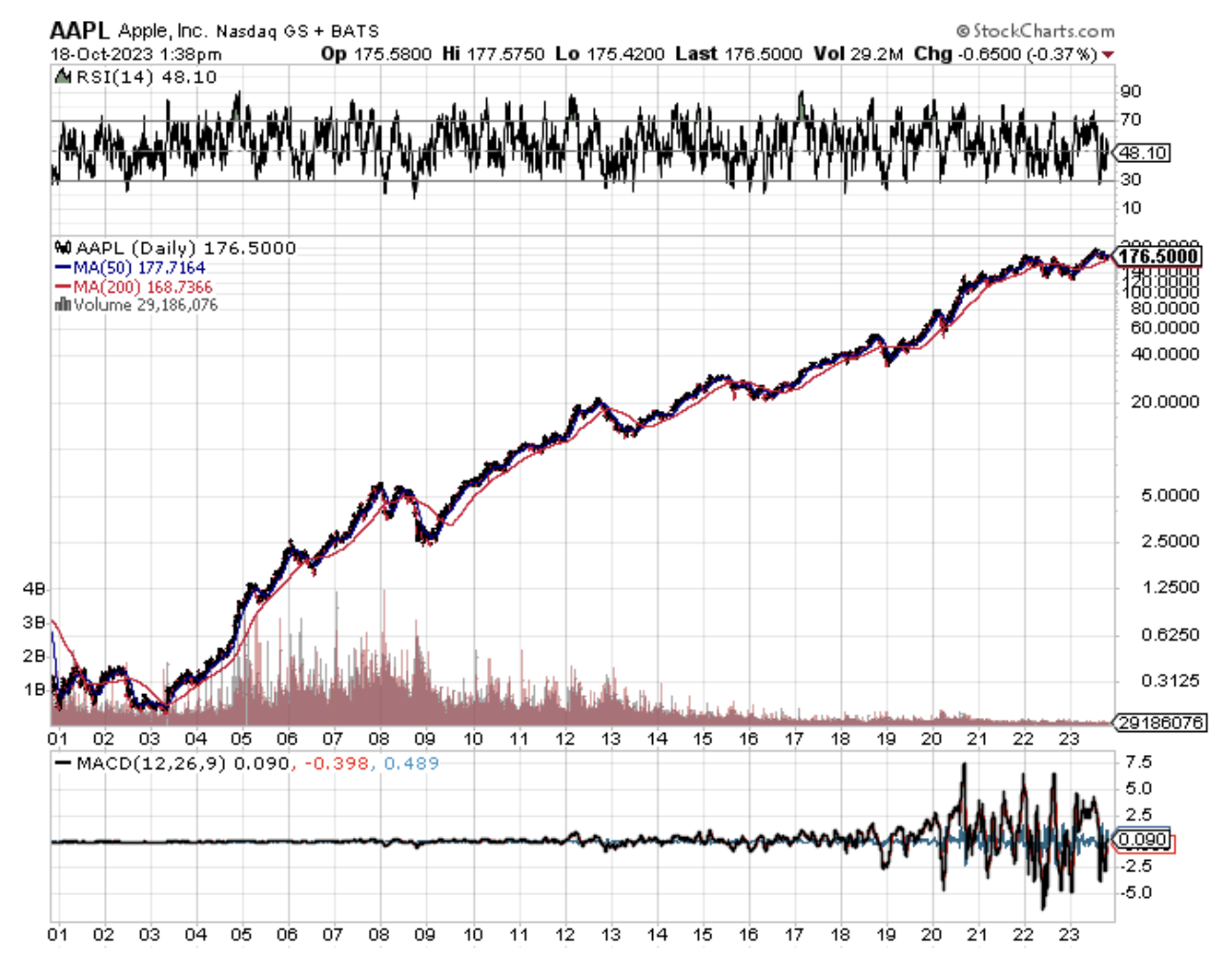

In the first half, that will be technology plays like Apple (AAPL), (Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and NVIDIA (NVDA). Much of this move was pulled forward into the end of 2023 so this sector may flatline for a while.

In the second half, value plays will take the leadership like banks, (JPM), (BAC), (C), financials (MS), (GS), homebuilders (KBH), (LEN), (PHM), industrials (X), capital goods (CAT), (DE), and commodities (FCX). Everything is going to new all-time highs. My Dow average of 120,000 by the end of the decade is only one more triple away and is now looking very conservative.

That means we now have at hand a generational opportunity to get into the fastest-growing sectors of the US economy at bargain prices. I’m talking Cadillacs at KIA prices. Corporate profits powered by accelerating technology, artificial intelligence, and capital spending will rise by large multiples. Every contemporary earnings forecast will come up short and have to be upgraded. 2024 will be a year of never-ending upgrades.

After crossing a long, hot desert small-cap stocks can finally see water. That’s because they are the most leveraged, undercapitalized, and at the mercy of interest rates and the economic cycle. They always deliver the most heart-rending declines going into recessions. Guess what happens now with the economy headed for a soft landing? They lead to the upside, with some forecasts for the Russell 2000 going as high as a ballistic 50%.

Another category of its own, Biotech & Health Care which is now despised, should do well on its own as technology and breakthroughs are bringing new discoveries. Artificial intelligence is discovering new drugs at an incredible pace and then telling you how to cheaply manufacture them. My top three picks there are Eli Lily (ELI), Abbvie (ABBV), and Merck (MRK).

There is another equity subclass that we haven’t visited in about a decade, and that would be emerging markets (EEM). After ten years of punishment from a strong dollar, (EEM) has been forgotten as an investment allocation. We are now in a position where the (EEM) is likely to outperform US markets in 2024, and perhaps for the rest of the decade. The drivers here are falling interest rates, a cheaper dollar, a reigniting global economy, and a new commodity boom.

Block out time on your calendars, because whenever the Volatility Index (VIX) tops $20, up from the current $12, I am going pedal to the metal, and full firewall forward (a pilot term), and your inboxes will be flooded with new trade alerts.

What is my yearend prediction for the S&P 500 for 2024. We should reach $5,500, a gain of 14.58%. You heard it here first.

Frozen Headwaters of the Colorado River

3) Bonds (TLT), (TBT), (JNK), (PHB), (HYG), (MUB), (LQD)

Amtrak needs to fill every seat in the dining car to get everyone fed on time, so you never know who you will share a table with for breakfast, lunch, and dinner.

There was the Vietnam Vet Phantom Jet Pilot who now refused to fly because he was treated so badly at airports. A young couple desperately eloping from Omaha could only afford seats as far as Salt Lake City. After they sat up all night, I paid for their breakfast.

A retired British couple was circumnavigating the entire US in a month on a “See America Pass.” Mennonites returning home by train because their religion forbade automobiles or airplanes.

The old bond trade is dead.

Long live the new bond trade!

After selling short bonds (TLT) from $180 all the way down to $82, I flipped to the long side on October 17. The next week, bonds saw their biggest rally in history, making instant millionaires out of several of my followers. The (TLT) has since rocketed from $82 to an eye-popping $100, a 22% gain.

In a heartbeat, we went from super bear to hyper bull.

I am looking for the Fed to cut interest rates by 1.00% in 2024 but won’t begin until the second half of the year. All of the first half bond gains were pulled forward into 2023 so I am looking for long periods of narrow trading ranges. By June, economic weakness will be so obvious that a dramatic Fed rate-cutting policy will ensue.

In addition, the Fed will end its quantitative tightening program by June, which is currently sucking $90 billion a month out of the economy. That’s a lot of bond-selling that suddenly ends.

I’m looking for $120 in the (TLT) sometime in 2024, with a possible stretch to $130. Use every five-point dip to load up on shares in the (TLT) ETF, calls, call spreads, and one-year LEAPS. This trade is going to work fast. It is the low-hanging fruit of 2024.

We are never going back to the 0.32% yields, and $165 prices we saw in the last bond peak. But you can still make a lot of money in a run-up from $82 to $120, as many happy bondholders are now discovering.

It isn’t just bonds that are going up. The entire interest rate space is doing well including junk bonds (JNK), municipal bonds (MUB), REITS (NLY), preferred stock, and convertible bonds.

A Visit to the 19th Century

4) Foreign Currencies (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

With a major yield advantage over the rest of the world for the last decade, the US dollar has been on an absolute tear. After all, the world’s strongest economy begets the world’s strongest currency.

That is about to end.

If your primary assumption is that US interest rates will see a sharp decline sometime in 2024, then the outlook for the greenback is terrible.

Currencies are driven by interest rate differentials and the buck is soon going to see the fastest shrinking yield premium in the forex markets.

That shines a great bright light on the foreign currency ETFs. You could do well buying the Australian Dollar (FXA), Euro (FXE), Japanese yen (FXE), and British Pound (FXB). I’d pass on the Chinese yuan (CYB) right now until their Covid shutdowns end.

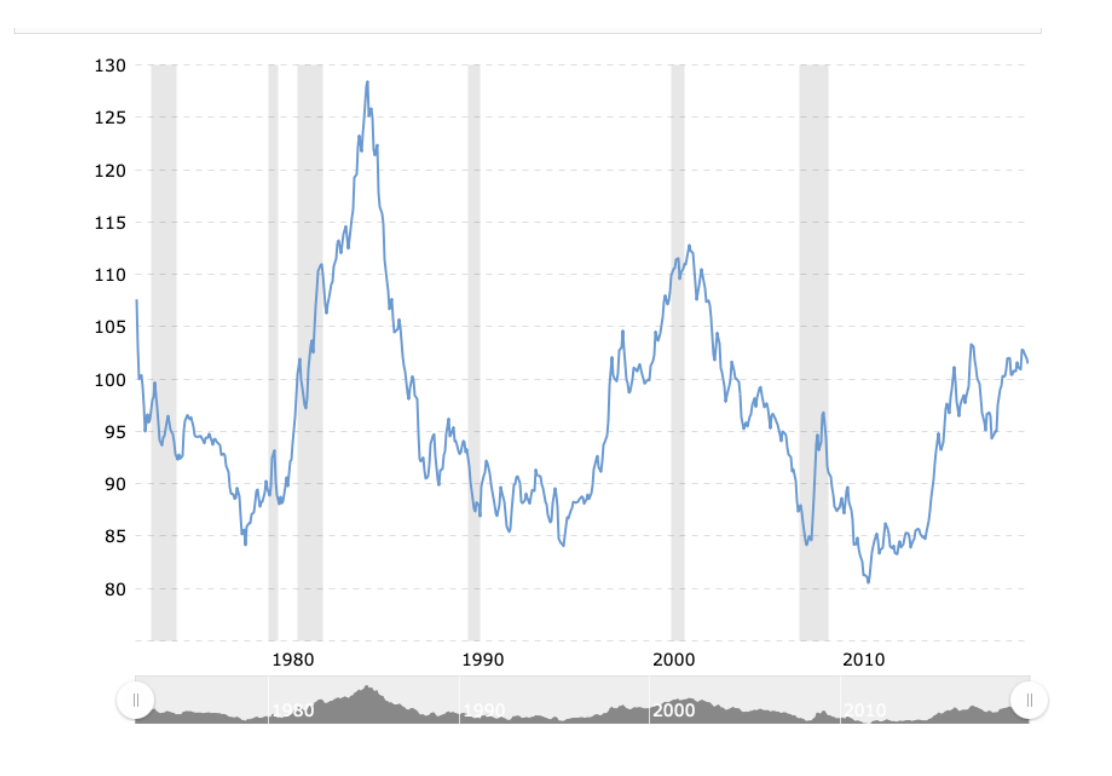

Look at the 50-year chart of the US dollar index below and you’ll see that a 13-year uptrend in the buck is rolling over and will lead to a 5-10-year down move. Draw your weapons.

5) Commodities (FCX), (VALE), (DBA)

Commodities are the high beta players in the financial markets. That’s because the cost of being wrong is so much higher. Get on the losing side of commodities and you will be bled dry by storage costs, interest expenses, contangos, and zero demand.

Commodities have one great attribute. They predict recessions and recoveries earlier than any other asset class. When they peaked in March of 2022, they were screaming loud and clear that a recession would hit in early 2023. By reversing on a dime on November 13, 2023, they also told us that a rip-roaring recovery would begin in 2024.

You saw this in every important play in the sector, including Broken Hill (BHP), Peabody Energy (BTU), and Freeport McMoRan (FCX). And who but me noticed that Alcoa Aluminum (AA) was up an incredible 50% in December? Maybe you can’t teach an old dog new tricks, but the old tricks work pretty darn well!

The heady days of the 2011 commodity bubble top are about to replay. Now that this sector is convinced of a substantially weaker US dollar and lower inflation, it is once more a favorite target of traders.

China will finally rejoin the global economy as a growth engine in 2024 but at only half its previous growth rate. It will be replaced by India, which is turning into the new China and is now the most populous country in the world.

And here’s another big new driver. Each electric vehicle requires 200 pounds of copper and production is expected to rise from 2 million units a year to 20 million by 2030. Annual copper production will have to increase three-fold in a decade to accommodate this increase, no easy task or prices will have to rise.

The great thing about commodities is that it takes a decade to bring new supply online, unlike stocks and bonds, which can merely be created by an entry in an Excel spreadsheet. As a result, they always run far higher than you can imagine.

Accumulate all commodities on dips.

Snow Angel on the Continental Divide

6) Energy (DIG), (RIG), (USO), (DUG), (UNG), (USO), (XLE), (AMLP)

Energy was the top-performing sector of 2023 until it wasn’t.

We got a nice boost to $90 a barrel from the Gaza War. But that faded rapidly as there was never an actual supply disruption, just the threats of one. Saudi production has been cut back so far, some 5 million barrels a day, that it risks budget shortfalls if it reduces any more. In the meantime, US fracking production has taken off like a rocket.

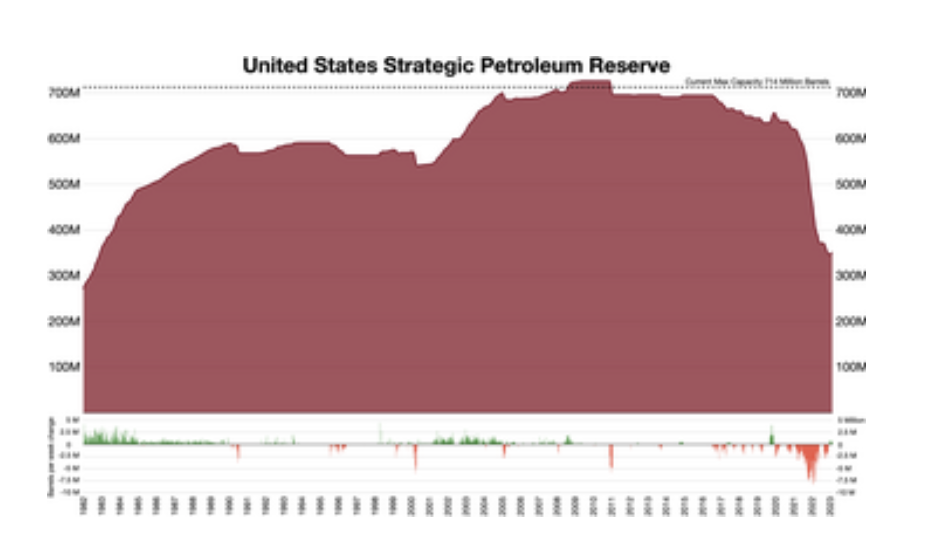

In the meantime, Joe Biden is sitting on the bid in an effort to refill the Strategic Petroleum Reserves that was drawn down from 723 to 350 million barrels during the last price spike.

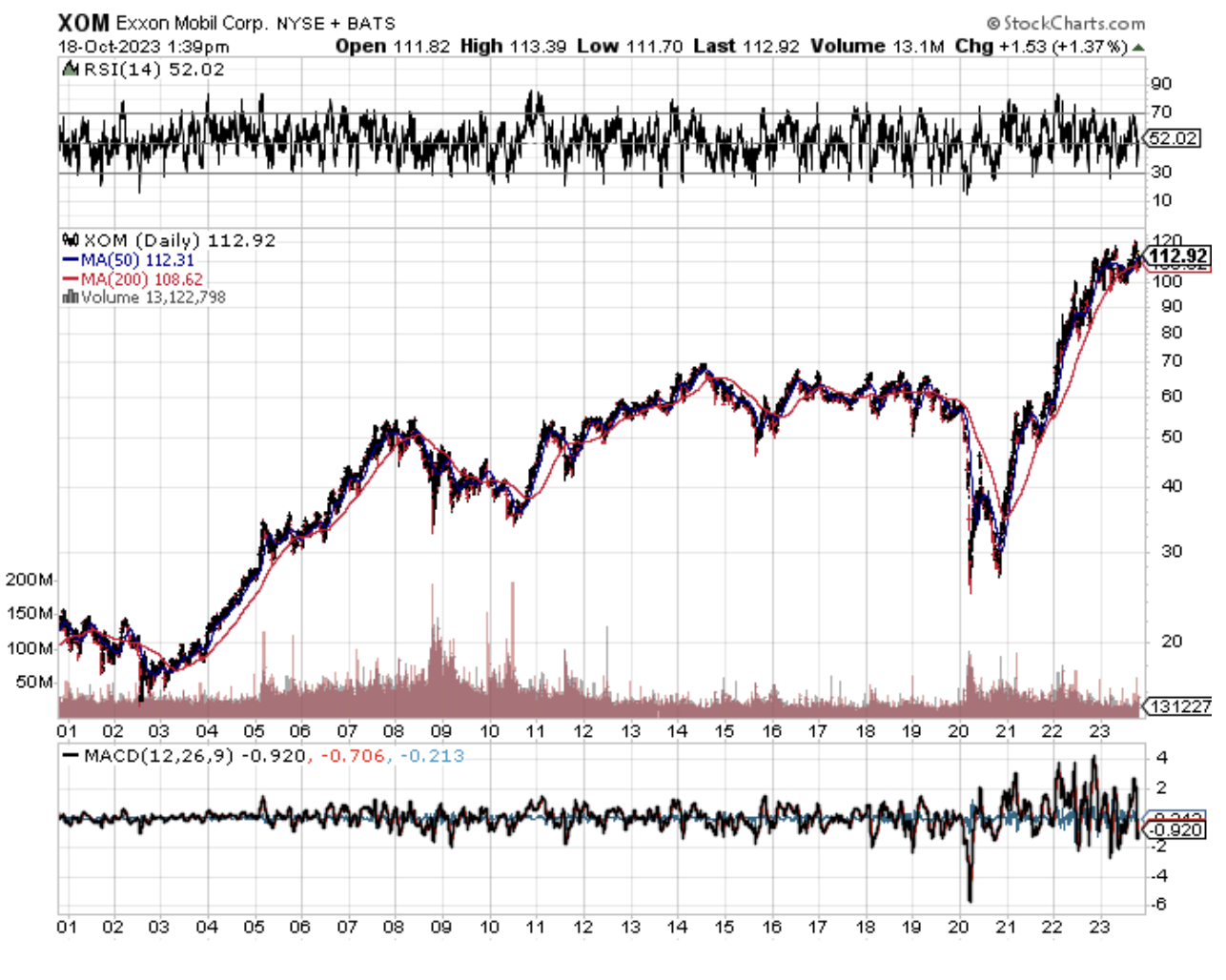

The trade here is to buy any energy plays when Texas tea approaches $70 and take profits at $95. Your first picks should be ExxonMobile (XOM), Occidental Petroleum (OXY) where Warren Buffet has a 27% stake, Diamondback Energy (FANG), and Devon Energy (DVN).

The really big energy play for 2024 will be in natural gas (UNG), which was slaughtered in 2023. The problem here was not a shortage of demand because China would take all we could deliver. It was in our ability to deliver, hobbled by the lack of gasification facilities needed to export. One even blew up.

In 2024 several new export facilities came online and the damaged one was repaired. That should send prices soaring. Natural gas prices now at a throw-away $2.00 per MM BTU could make it to $8.00 in the next 12 months. That takes the (UNG) from $5.00 to $15.00 (because of the contango).

Buy (UNG) LEAPS (Long Term Equity Anticipation Securities) right now.

Remember, you will be trading an asset class that is eventually on its way to zero sooner than you think. However, you could have several doublings on the way to zero. This is one of those times. And you also have a huge 35% contango headwind working against you all the time.

They call this commodity the “widow maker” for a good reason.

The real tell here is that energy companies are bailing on their own industry. Instead of reinvesting profits back into their future exploration and development, as they have for the last century, they are paying out more in dividends and share buybacks.

Take the money and run. Trade, don’t marry this asset class.

There is the additional challenge in that the bulk of US investors, especially environmentally friendly ESG funds, are now banned from investing in legacy carbon-based stocks. That means permanently cheap valuations and share prices for the energy industry.

Energy now counts for only 5% of the S&P 500. Twenty years ago, it boasted a 15% weighting.

The gradual shutdown of the industry makes the supply/demand situation infinitely more volatile.

To understand better how oil might behave in 2024, I’ll be studying US hay consumption from 1900-1920. That was when the horse population fell from 100 million to 6 million, all replaced by gasoline-powered cars and trucks.

The internal combustion engine is about to suffer the same fate.

7) Precious Metals (GLD), (DGP), (SLV), (PPTL), (PALL)

The train has added extra engines at Denver, so now we may begin the long laboring climb up the Eastern slope of the Rocky Mountains.

On a steep curve, we pass along an antiquated freight train of hopper cars filled with large boulders.

The porter tells me this train is welded to the tracks to create a windbreak. Once, a gust howled out of the pass so swiftly, that it blew a passenger train over on its side.

In the snow-filled canyons, we saw a family of three moose, a huge herd of elk, and another group of wild mustangs. The engineer informs us that a rare bald eagle is flying along the left side of the train. It’s a good omen for the coming year.

We also see countless abandoned 19th-century gold mines and broken-down wooden trestles leading to huge piles of tailings, and relics of previous precious metals booms. So, it is timely here to speak about the future of precious metals.

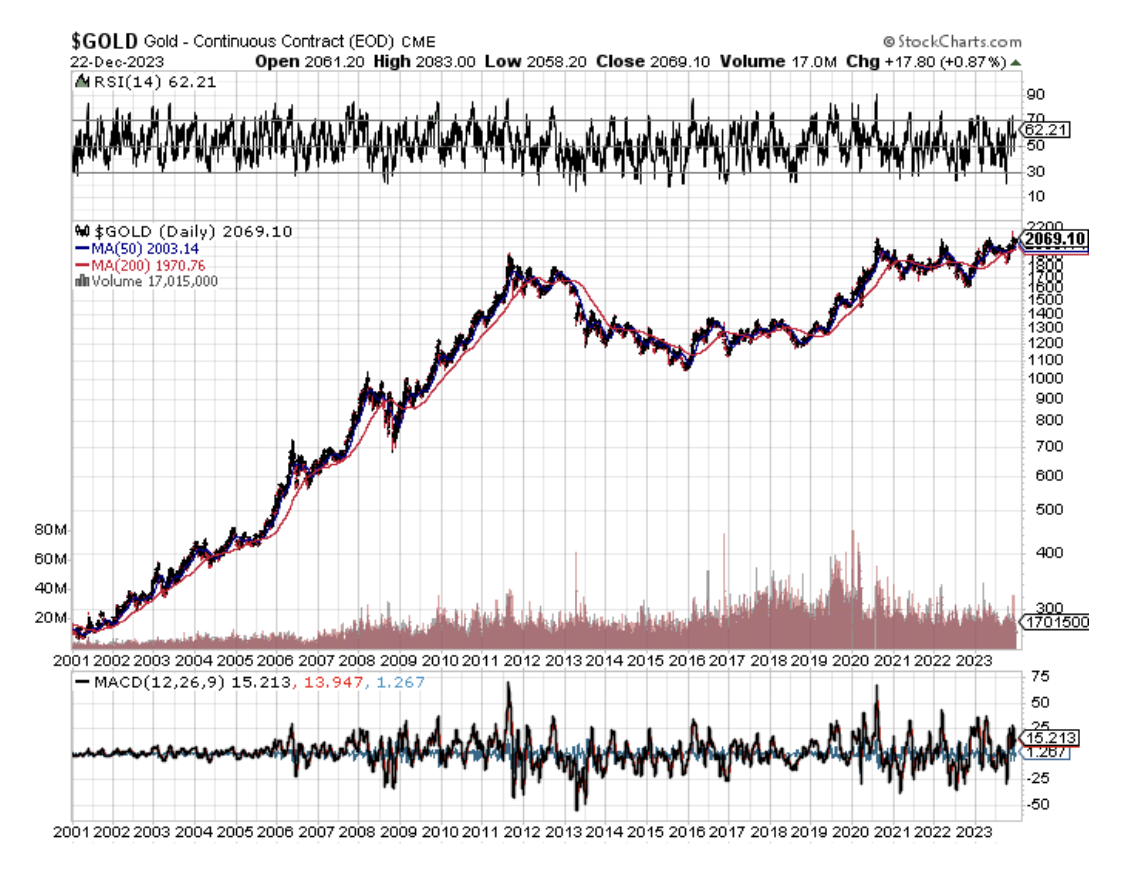

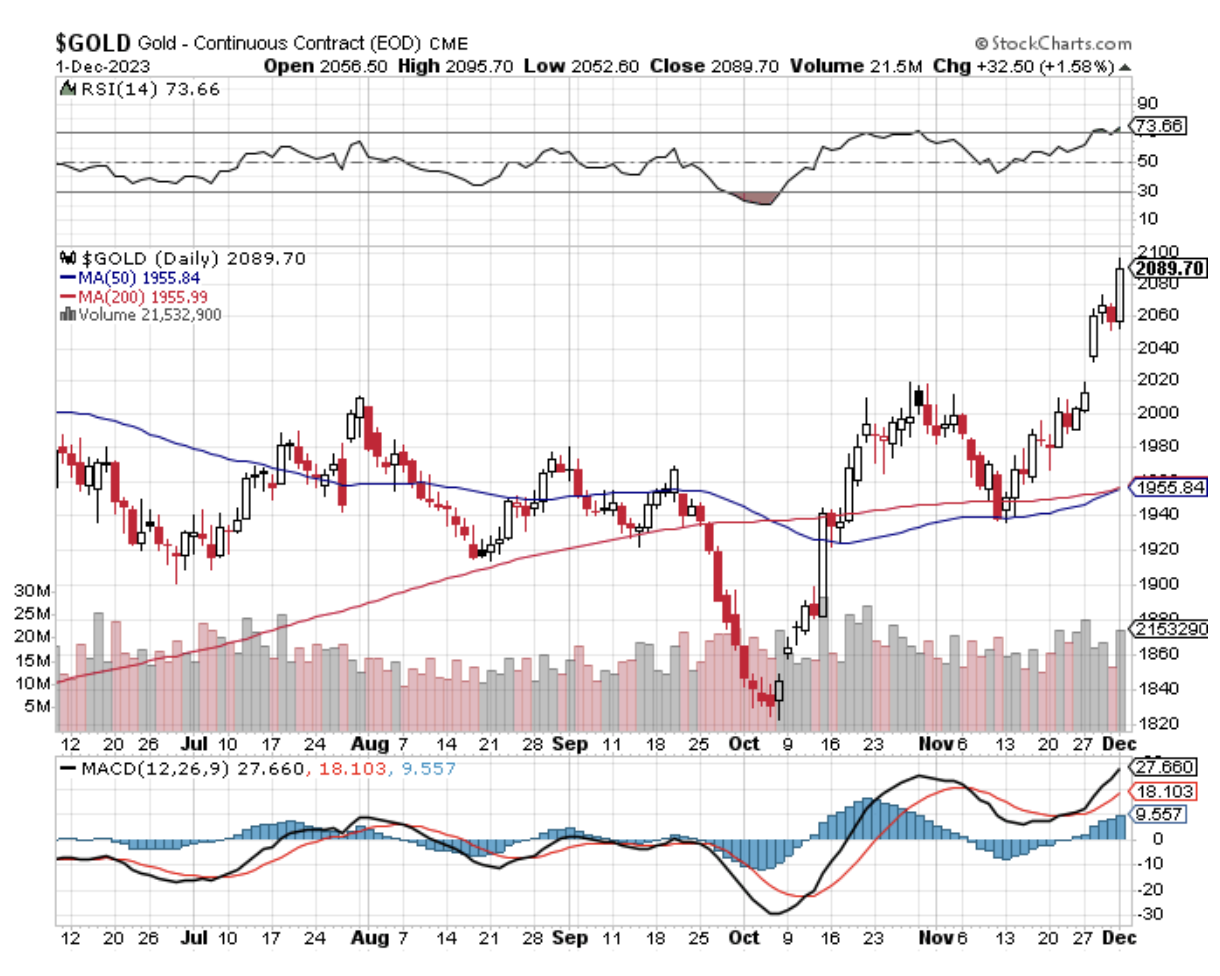

Here it’s important to look at the long view on gold. The barbarous relic tends to have good and bad decades. During the 2000’s the price of the yellow metal rose tenfold, from $200 to $2,000. The 2010s were very boring when gold was unchanged. Gold is doing well this decade, already up 40%, and a double or triple is in the cards.

2023 should have been a terrible year for precious metals. With inflation soaring, stocks volatile, and interest rates soaring, gold had every reason to collapse. Instead, it was up on the year, thanks to a heroic $325, 17.8%% rally in the last two months.

The reason is falling interest rates, which reduce the opportunity costs of owning gold. The yellow metal doesn’t pay a dividend, costs money to store and insure, and delivery is an expensive pain in the butt.

Chart formations are looking very encouraging with a massive upside breakout in place. So, buy gold on dips if you have a stick of courage on you, which you must if you read this newsletter.

Of course, the best investors never buy gold during a bull market. They Hoover up gold miners, which rise four times faster, like Barrack Gold (GOLD), Newmont Mining (NEM), and the basket play Van Eck Vectors Gold Miners ETF (GDX).

Higher beta silver (SLV) will be the better bet, as it already has been because it plays a major role in the decarbonization of America. There isn’t a solar panel or electric vehicle out there without some silver in them and the growth numbers are positively exponential. Keep buying (SLV), (SLH), and (WPM) on dips.

Crossing the Great Nevada Desert Near Area 51

8) Real Estate (ITB), (LEN), (KBH), (PHM)

The majestic snow-covered Rocky Mountains are behind me. There is now a paucity of scenery, with the endless ocean of sagebrush and salt flats of Northern Nevada outside my window, so there is nothing else to do but write.

My apologies in advance to readers in Wells, Elko, Battle Mountain, and Winnemucca, Nevada.

It is a route long traversed by roving bands of Indians, itinerant fur traders, the Pony Express, my own immigrant forebearers in wagon trains, the Transcontinental Railroad, the Lincoln Highway, and finally US Interstate 80, which was built for the 1960 Winter Olympics at Squaw Valley.

Passing by shantytowns and the forlorn communities of the high desert, I am prompted to comment on the state of the US real estate market.

Those tormented by the shrinking number of real estate transactions over the past two years take solace. The past excesses have been unwound and we are now on the launching pad for another decade-long bull market.

There is a generational structural shortage of supply with housing which won’t come back into balance until the 2030’s. You don’t have a real estate crash when we are short 10 million homes.

The reasons, of course, are demographic. There are only three numbers you need to know in the housing market for the next ten years: there are 80 million baby boomers, 65 million Generation Xers who follow them, and 86 million in the generation after that, the Millennials.

The 76 million baby boomers (between ages 62 and 79) have been unloading dwellings to the 72 million Gen Xers (between age 41 and 56) since prices peaked in 2007. But there are not enough of the latter, and three decades of falling real incomes mean that they only earn a fraction of what their parents made. That’s what caused the financial crisis. That has created the present shortage of housing, both for ownership and rentals.

There is a happy ending to this story.

The 72 million Millennials now aged 25-40 are now the dominant buyers in the market. They are transitioning from 30% to 70% of all new buyers of homes. They are also just entering the peak spending years of middle age, which is great for everyone. Hot on their heels are 68 million Gen Z, which are now 12 to 27 years old.

The Great Millennial Migration to the suburbs and Middle America has just begun. Thanks to the pandemic and Zoom, many are never returning to the cities. That has prompted massive numbers to move from the coasts to the American heartland.

That’s why Boise, Idaho was the top-performing real estate market in 2023, followed by Phoenix, Arizona. Personally, I like Reno, Nevada, where Apple, Google, Amazon, and Tesla are building factories as fast as they can, just a four-hour drive from Silicon Valley.

As a result, the price of single-family homes should continue to rise during the 2020s, as they did during the 1970s and the 1990s when identical demographic forces were at play.

This will happen in the context of a labor shortfall, rising wages, and improving standards of living.

Increasing rents are accelerating this trend. Renters now pay 35% of their gross income, compared to only 18% for owners, and less, when multiple deductions and tax subsidies are considered. Rents are now rising faster than home prices.

Remember, too, that the US will not have built any new houses in large numbers in 17 years. The 50% of small home builders that went under during the Financial Crisis never came back.

We are still operating at only half of the 2007 peak rate. Thanks to the Great Recession, the construction of five million new homes has gone missing in action.

There is a new factor at work. We are all now prisoners of the 2.75% 30-year fixed-rate mortgages we all obtained over the past five years. If we sell and try to move, a new mortgage will cost double today. If you borrow at a 2.75% 30-year fixed rate, and the long-term inflation rate is 3%, then, over time, you will get your house for free. That’s why nobody is selling, and prices have barely fallen.

This winds down in 2024 as the Fed realizes its many errors and sharply lowers interest rates. Home prices will explode…. again.

Quite honestly, of all the asset classes mentioned in this report, purchasing your abode is probably the single best investment you can make now after you throw in all the tax breaks. It’s also a great inflation play.

That means the major homebuilders like Lennar (LEN), Pulte Homes (PHM), and KB Homes (KBH) are a buy on the dip. But don’t forget to sell your home by the 2030s when the next demographic headwind resumes. That’s when you should unload your home to a Millennial or Gen Xer and move into a cheap rental.

A second-hand RV would be better.

Crossing the Bridge to Home Sweet Home

9) Postscript

We have pulled into the station at Truckee amid a howling blizzard.

My loyal staff have made the ten-mile trek from my estate at Incline Village to welcome me to California with a couple of hot breakfast burritos and a chilled bottle of Dom Perignon Champagne, which has been resting in a nearby snowbank. I am thankfully spared from taking my last meal with Amtrak.

After that, it was over legendary Donner Pass, and then all downhill from the Sierras, across the Central Valley, and into the Sacramento River Delta.

Well, that’s all for now. We’ve just passed what was left of the Pacific mothball fleet moored near the Benicia Bridge (2,000 ships down to six in 50 years). The pressure increase caused by a 7,200-foot descent from Donner Pass has crushed my plastic water bottle. Nice science experiment!

The Golden Gate Bridge and the soaring spire of Salesforce Tower are just coming into view across San Francisco Bay.

A storm has blown through, leaving the air crystal clear and the bay as flat as glass. It is time for me to unplug my MacBook Pro and iPhone 15 Pro, pick up my various adapters, and pack up.

We arrive in Emeryville 45 minutes early. With any luck, I can squeeze in a ten-mile night hike up Grizzly Peak and still get home in time to watch the ball drop in New York’s Times Square on TV.

I reach the ridge just in time to catch a spectacular pastel sunset over the Pacific Ocean. The omens are there. It is going to be another good year.

I’ll shoot you a Trade Alert whenever I see a window open at a sweet spot on any of the dozens of trades described above, which should be soon.

Good luck and good trading in 2024!

John Thomas

The Mad Hedge Fund Trader