Taking a Look at General Electric (GE) LEAPS

Long Term Equity Anticipation Securities, or LEAPS, are a great way to play the market when you expect a substantial move up in a security over a long period of time. Get these right and the returns over 18 months can amount to several hundred percent.

At market bottoms these are a dollar a dozen. At all-time highs they are as scarce as hen’s teeth. However, scouring all asset classes there are a few sweet ones to be had.

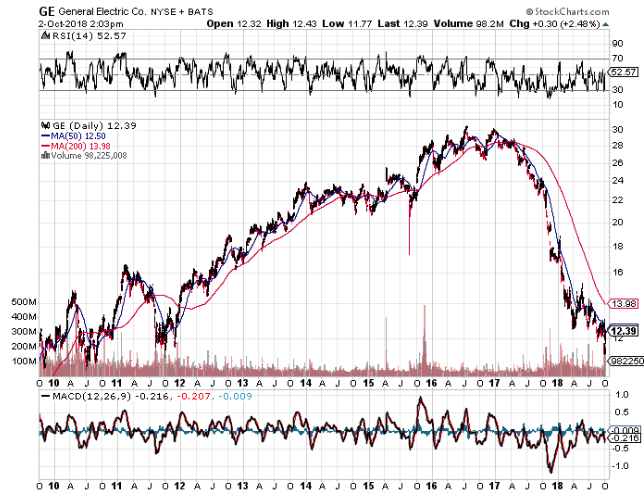

General Electric (GE) is a stock that has been taken out to the woodshed and beaten senseless. Management has made every possible mistake they could have over the past two decades.

During the 2000’s the company paid enormous premiums to get into the financial sector, thus causing the pros to dub it as the “hedge fund that made light bulbs.” They bailed out right at the market bottom after the 2008 crash for pennies on the dollar.

If it weren’t for Oracle of Omaha Warren Buffet’s generous move to buy their 10% yielding convertible bonds the company would have almost certainly gone under.

Another legacy dud dates back to former CEO Jack Welch’s entry into the insurance business. Although most of that business has been sold off, it still managed to lose $6.2 billion in the fourth quarter of 2017.

The result of this epic mismanagement has been to wipe out over $1 trillion in market capitalization. The shares have plunged some 66%, from $32 to $11.

At the urging of major shareholders a long-suffering board ousted GE’s latest CEO, John Flannery, after only a year in the job and replaced him with former Danaher (DHR) CEO Lawrence Culp. The move may have finally put a bottom in the stock.

It’s obvious what GE has to do here. It needs to liquidate the remaining money losing assets that have been such a huge drain on cash flow.

It could also sell a few other successful business lines at big premiums that are money makers, just as jet engines or its Baker Hughes oil subsidiary. These days investors are paying up for almost everything.

I don’t know how long it will take Culp to work his magic. However, I bet the stock market will start to sniff out a turnaround sometime in the next year and a half.

The GE January 17, 2020 $15-$18 vertical bull call spread (called a LEAP because it has a maturity of more than one year) is currently priced at 55 cents.

If the shares make it back up to $18, the price it traded at in January, the LEAP would be worth $3.00, delivering you a gain of 345%. It makes a very low risk, high return set up for investors tired of paying new all-time highs for everything else.

Whatever happened to Jack Welch, who originally created this disaster? Jack retired a billionaire and is now giving lectures on corporate managements. Go figure.

I’ll try to come up with another interested LEAP idea tomorrow. I know you’re all starved for them.