The real estate platform Zillow (Z) continues to underperform.

Readers should not buy the stock and I will tell you why.

Many of us, including me, want to overperform in business and we concoct all sorts of extreme strategies as the vehicle to take us to riches.

Zillow was not different.

They thought their business was too vanilla and wanted to snort that pixie dust to supercharge their business model.

That is why in 2018, Z launched a new initiative coined Zillow Offers, where it began purchasing homes of its own.

Fast forward about three years and a couple of billion dollars worth of home purchases later, and the company is now in the process of completely shutting down Zillow Offers.

The debacle wasn’t as bad as Bill Ackman’s 3 months pump and dump of Netflix, but it was of the same vein.

Exiting iBuying

The value of the homes Zillow acquired deviated big time. This hurt Zillow's profitability and increased the riskiness of its balance sheet, as the value of the homes could swing wildly.

Zillow Offers, however, was starting to weigh on their normal business of selling ads to people who look at real estate on their platform. Also, 90% of Zillow's offers on homes were rejected by sellers, suggesting that Zillow was hurting its reputation with many homeowners.

Next is where one might believe Zillow can wash its hands of past failures and move on.

Incorrect.

As the 30-year fixed mortgage rate has climbed to 5.20% at the time of this writing, that has turned off many potential buyers and visitors to the website by pricing them out of the market.

Potential buyers are the most ravenous consumers of Zillow’s platform because they hope to jump on a new listing after its listed and convert this info into a new house.

As the fixed mortgage becomes exorbitant, prices have not come down because of a dearth of inventory as builders stick to only building luxury dwellings.

These new record highs in American real estate prices have been achieved on scant volume which is bad news for Zillow’s platform.

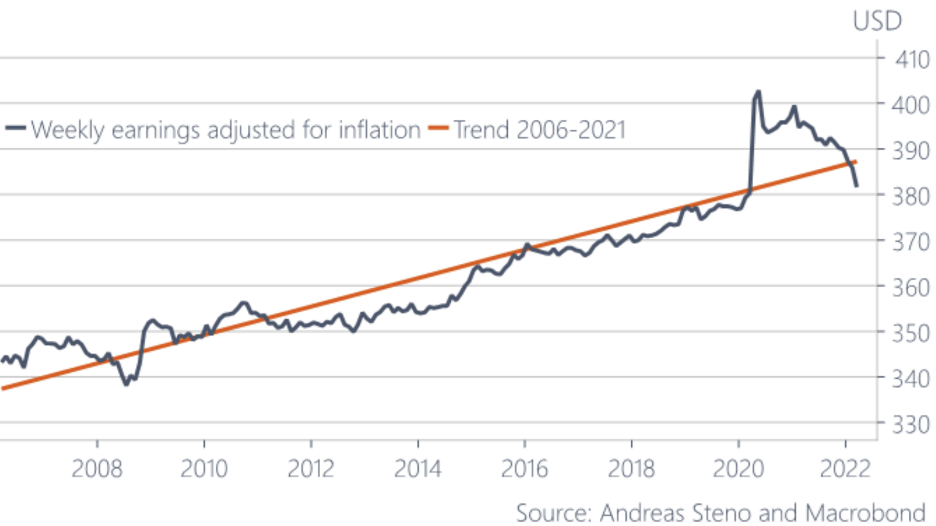

As the overarching economy exhibits more stagflation, potential buyers will allocate finite budgets to essentials like food and gas.

Downsizing or upsizing isn’t in the cards for many.

Especially families with children who will essentially need to leave their city if they sold their house and their 2.5% mortgage rate. The move to the sun belt from coastal areas has largely run its course.

The net net of everything is that everybody is staying in place, renters are extending leases even contacting their landlords 4.5 months before the end to lock another year in. People aren’t migrating to other cities as well.

Homeowners are stuck in their houses avoiding a scenario where they can’t find a rental or a new purchase if they sell their current house.

No traffic means no eyeballs for Zillow (Z) and their ad business will suffer.

This is why they were so desperate to supercharge the business model by grasping at straws that glamorously backfired.

Unfortunately, Zillow is still confined by the market we are in amid a backdrop of spiking rates and souring consumer sentiment.

Like the very consumers it services, Zillow, too, cannot upsize and upgrade its situation.

It’s not like they have $43 billion in secured funding to buy a social media company or anything like that.

Now is a time to pull back and sell any tech rallies because innovation at many levels in tech has become stale.

There are many mature models out there that need reinvention or risk becoming zombie companies.

Readers shouldn’t touch Zillow until mortgage rates become more reasonable for the median buyer.